TCG Year-End Review and Outlook: How to Drive Web3 User Base Expansion?

TechFlow Selected TechFlow Selected

TCG Year-End Review and Outlook: How to Drive Web3 User Base Expansion?

Tokens and NFTs will generate value, and these new financial mechanisms will continue to drive revenue in the cryptocurrency industry.

Original: TCG Crypto Team

Compiled by: TechFlow

A Year Comes to a Close

Dear TCG Crypto investors, partners, and friends.

As our fund passes its first year of operation, we’re excited to share this inaugural annual review letter focused on our portfolio and key areas of emphasis. In this letter, we outline our thinking around how we’ve invested over the past year, the domains where we’re building stronger convictions, and where we intend to spend our time in 2023.

By the Numbers

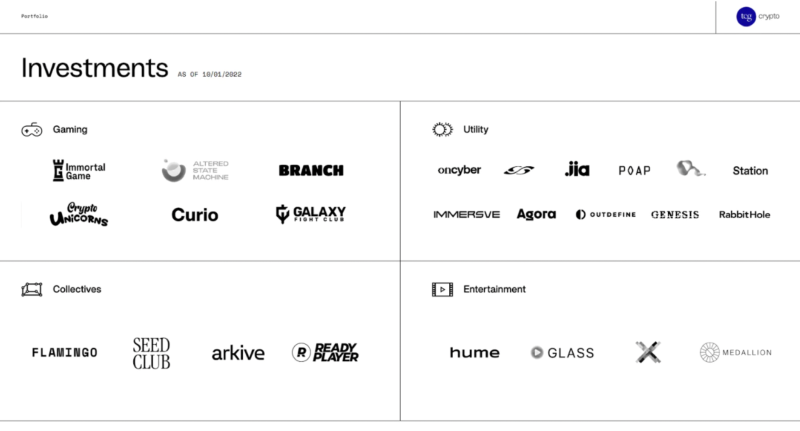

We closed TCG Crypto Fund I at $120 million earlier this year. We invested in 21 companies in 2022 (25 total including our initial cohort from 2021), and you can learn more about many of them here. We’re thrilled to continue working alongside these founders and teams.

Our team has grown to five people. This year, Dilveer Vahali, previously Deputy General Counsel at TCG, joined full-time as Managing Director and Chief Legal Officer, supporting us with legal and operational matters. More recently, we were fortunate to bring on Zion Thomas, who was previously an independent investor. We also welcomed Sophie Fujiwara from Stanford this past summer, who collaborated with us on our fund thesis (below) and helped develop more granular frameworks like this one.

Our Thesis

At TCG, we are obsessed with the idea of "how new technologies will change the way consumers spend their time online." Over the past year, our investment strategy has centered on the argument that in the Web3 era, the most enduring consumer businesses will be built around passion, and new forms of digital ownership will accelerate existing behaviors and create novel consumption experiences.

The first step in evaluating such businesses is identifying evidence of passion:

-

What drives people to behave this way?

-

Beyond market cycles, what sustains people’s interest and engagement?

-

What are the containers of interest or obsession online, and how do they evolve?

-

What are the real, applicable needs that improve people’s lives?

These businesses should exhibit high engagement, authentic origins, and a willingness from consumers to spend time and/or money. Once such passion is identified, we examine how crypto can accelerate or generate new net value within that domain of interest.

"What is now possible that previously felt unattainable, either personally or professionally?"

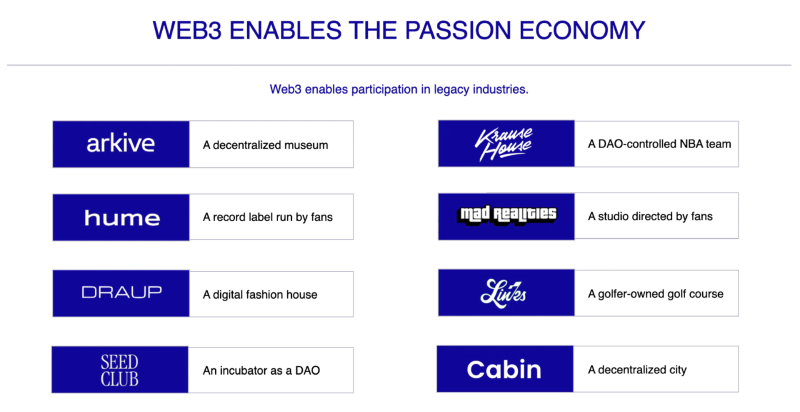

This passion doesn’t necessarily need to represent new net value. Consumer crypto businesses don’t have to revolve around entirely new markets (though they can—see here for thoughts). They can unlock new experiences within existing markets, expanding the ways consumers can participate.

This thesis largely reflects TCG’s early thinking around internet content businesses (e.g., Goldin Auctions, Barstool Sports, Food52, and Epic Gardening), where the most successful companies are rooted in audiences with intense passions. Peter Chernin elaborated on this during his interview with Patrick O'Shaugnessy on Invest Like the Best (2022):

“You can look at what’s happened in the world over the past 20 or 30 years. Broadcast networks survived in the 70s and 80s on what I call ‘the middle’—things that were inoffensive to most people. Today, the middle of everything has disappeared, vanished, gone forever. The world has split into two things: these massive events—Marvel movies, the Super Bowl, the Grammys, the Beatles documentary—and technology makes those events possible, greatly amplifying them, enabling you to deliver them to people globally.

“The second thing that’s happened is technology has enabled niche passions. If you think of yourself as a consumer of entertainment—or anything—you tend toward these two extremes: you want to be part of that big event—you want to watch the Super Bowl, see the new Marvel movie, go see Hamilton from New York. You want to indulge your deepest passions… And the last thing you want to do is spend time on something that feels mediocre, safely in the middle. Because you don’t have to anymore.”

We believe the fundamentals of Web3 further unleash this concept of passion, empowering audiences and communities to dive deeper and actively participate in the things they love most. This is evident in platforms no longer driven solely by individuals observing and following, but by contributing through ownership of the experience itself. You can see this unfolding in portfolio companies like Arkive and Hume, as well as in companies we admire from afar such as Krause House, Mad Realities, LinksDAO, and Cabin.

What We’ve Learned

Over the past year, we’ve learned a great deal and have worked to build stronger frameworks and deepen our views in several areas. Here are some highlights:

The Path to Consumer "Scale" Has Changed

A year ago, we placed significant emphasis on “onboarding”—how to get new users into the crypto ecosystem for the first time. While we remain excited about new consumers entering the space and continue to look for products that improve access to crypto-native offerings, we now believe growth will stem less from pushing new users into existing market landscapes and more from better leveraging the utility of existing bases, making experiences more meaningful for current crypto users. We see the path to meaningful value as vertical rather than horizontal—driven by depth within existing domains.

Another useful framework we’ve worked to implement is prioritizing convenience. Take MetaMask: due to surging interest during “DeFi Summer,” its MAU grew from 545k in July 2020 to over 10 million by August 2021. Yield farming became a consumer magnet, driving exponential growth. At the time, using MetaMask to capture DeFi yields was obvious because it had broader support than any competitor. Today, despite newer (and often higher-quality) wallets emerging, MetaMask maintains scale because it remains the most convenient option—it launched first, giving it distribution advantages (often listed first or exclusively on WalletConnect) and enabling natural “onboarding,” perpetuating the flywheel.

That said, we’re not unexcited about new wallets entering the space—in fact, quite the opposite. But we aren’t looking for “high-quality” solutions with marginal UX improvements; we seek wallets that are significantly more usable and accessible for Web3 participants. That’s why we’re excited to work with companies like Genesis, which is building a new system for exploring Web3, starting with a fresh take on mobile wallets—designed for identity, navigation, personalization, and media.

As we continue rethinking scale, we find ourselves spending less time on products built atop new, experimental markets and behaviors. Instead, we focus first on existing domains of passion—either within established spaces like gaming or music, or in emerging areas that channel existing interests, such as Nouns and Proof Collective’s crypto-native communities. Along these lines, we’re grateful to partner with companies like Arkive, Hume, Medallion, and Immortal Game, providing experiences and solutions for individuals deeply passionate about these verticals.

Projects Will Go Direct-to-Consumer via New Tools

In the last cycle, crypto was largely pay-to-play. We saw the rise of NFTs and tokens as financial mechanisms that enabled ownership and speculation. But as tools evolve, we’re seeing vertical industries compete on offering free consumer experiences powered by on-chain data, rather than on-chain finance. Of course, DeFi remains a major component, but crypto is moving beyond finance.

For example, narratives around NFTs initially centered on returning royalties to creators, but with platforms like LooksRare and SudoSwap, royalty fees are no longer competitive, leading to royalty-free NFTs and projects needing more creative monetization strategies. Similarly, social products on-chain never made sense when every post required payment, since off-chain communication was far more convenient. Now, protocols like Lens Protocol are reducing the cost of building on-chain, aiming instead to generate more on-chain data for the network.

As crypto matures, technology becomes commoditized, and liquidity is no longer a moat for consumer businesses. We see this in the rise of vertical NFT marketplaces and liquidity aggregators like Reservoir, FirstMate, Snag Solutions, and others. These platforms offer greater flexibility and convenience than ever before—consumers no longer need to cross-marketplace shop for the best price, while NFT project creators can now spin up their own verticalized marketplace while leveraging aggregated liquidity. Previously, NFT projects spent significant time and capital building a beautiful minting site for primary sales, only to immediately push customers to third-party platforms for secondary trading. With better tooling and the erosion of liquidity as a moat, projects are increasingly owning more of the vertical, focusing on brand and user experience. Examples include Pudding (a vertical marketplace built specifically for the Proof ecosystem), Sound Market, and Truth Labs’ new Goblintown marketplace.

Free-to-Own Business Models

In consumer businesses, we’ve noticed NFTs shifting from direct revenue streams to serving as levers for distribution. Throughout the cycle, countless companies and NFT projects primarily profited from secondary sales. This model quickly falters, generating one-off revenue, encouraging churn, and limiting long-term business predictability. If retention matters, relying solely on secondary income isn’t sustainable.

We believe tokens and NFTs will still generate value, and these financial mechanisms will continue driving revenue for crypto businesses. However, we expect NFTs to shift from being direct revenue sources to becoming tools for distribution. If the initial action (e.g., minting an NFT) is the goal, consumers lack incentive to stay afterward—in fact, exiting often benefits them more than staying. But if minting becomes free, consumers may stick around to explore the NFT’s utility and novelty. We’ve already seen this free-to-own model pioneered by companies like Starbucks and Reddit, as well as Web3-native players like Limit Break and Branch in our portfolio. Other verticals are innovating too: Mirror and Paragraph use free NFTs for newsletter subscriptions; Arpeggi and Blocktones (partnering with Hume) encourage on-chain collaboration and co-creation among artists.

We also observed some of last year’s most successful and innovative NFT projects launching as Free Mints, including Potatoz (ranking among OpenSea’s top 150 collections three months post-launch) and Rainbow Zorbs (unlocking a special Rainbow wallet app icon upon mint, processing over 125,000 mints in three days). They follow in the footsteps of CryptoPunks (launched via Free Mint in June 2017)—an omission would be a disservice!

The point is, we believe NFTs can foster stronger relationships than email-based ones, and we expect this technology to become a native feature across many internet use cases today. The focus has shifted from monetizing first interactions with consumers to building richer, tighter experiences between sellers and buyers. It’s enabling direct-to-consumer everything.

Outlook for 2023

Here are a few areas that excite us most:

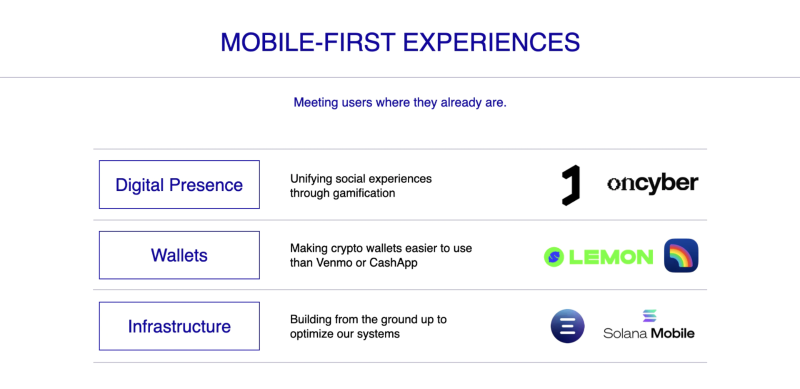

Mobile-First Experiences

Today, crypto applications are almost entirely web-native, with nearly no widely adopted mobile-native Web3 apps. For Web3 to achieve true consumer scale, we’ll need mobile-native Web3 applications that cater to casual users.

So, what kinds of mobile-native Web3 experiences might emerge?

Here are a few predictions:

-

Location-based NFTs (e.g., Mirage or Superlocal);

-

Augmented reality Web3 games (e.g., Jadu);

-

AR digital art (e.g., Anima);

-

Web3 social wallets (e.g., Genesis, in our portfolio);

-

Immersive galleries for digital assets (e.g., Cyber, in our portfolio).

Smartphones are our primary gateway to the internet, accounting for 60% of global traffic. In emerging markets, many people are mobile-only. Rainbow has dominated as the go-to mobile wallet in crypto-native communities, but in countries like Argentina, all top wallets are mobile-first—such as LemonCash, Buenbit, and Belo. Within our own portfolio, we’re proud to partner with Jia, an emerging market DeFi lending company, where founders Zach and Cheng are applying lessons from Tala to bring blockchain-based financing to small businesses via mobile-first interfaces.

The biggest hurdle for Web3 mobile apps will be incumbent platforms continuing to extract rent from any in-app transactions occurring on mobile-native platforms. Beyond simply complying with existing platform rules, solutions here form a spectrum:

-

On one end, we’re excited about rebuilding crypto-first mobile experiences from the ground up, such as ethOS (a native mobile OS for Ethereum) or Solana Mobile;

-

On the other, we see Web3 companies bypassing these barriers entirely by building mobile web apps (see: Primitives) instead of iOS apps.

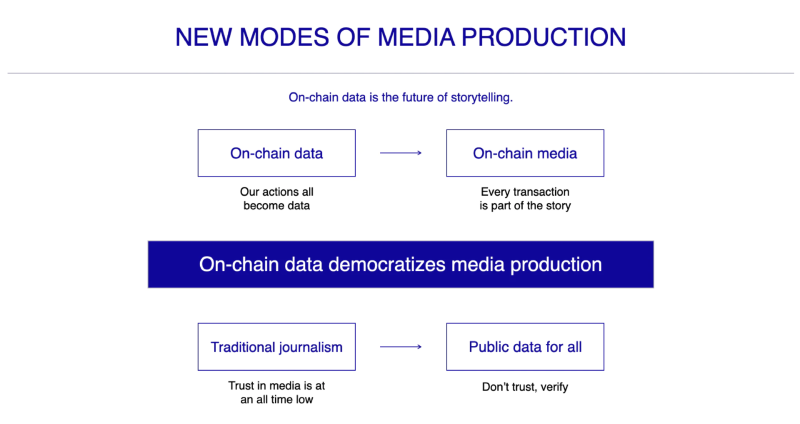

Entirely New Models for Media Content Creation

Interfaces like block explorers and analytics platforms aren’t just technical crypto products—they’re storytelling tools. In a world of public on-chain data, every company is a media company. You can see this in accounts like Zachxbt and Nansen Intern, who produce investigative, market-driven journalism using Etherscan and similar tools, effectively serving as public goods for the entire crypto ecosystem.

It’s worth noting that trust in media today is arguably at an all-time low (see: Axios’ July report, The Twitter Files, Bari Weiss’s The Free Press, among others).

There are several reasons on-chain media is becoming relevant:

-

First, because it democratizes the ability for any individual to discover important activity and information from day one. In traditional media, we relied on flagship brands for news or truth; today, we can collectively piece together insights through our own discovery. We’re excited to support tools enabling this new behavior.

-

Another exciting aspect of on-chain media is the ability to sign information to authenticate its origin, as Fred Wilson articulates well here. Signed messages confirm the signer’s address actually authored the message, and in many cases (e.g., on Web3 publishing platform Mirror), the content is fully stored on-chain (e.g., on Arweave), so it exists independently of any third-party platform. As Fred wrote, “We will need tools to manage our identity and our humanity.” Signing information on-chain is a powerful step in that direction.

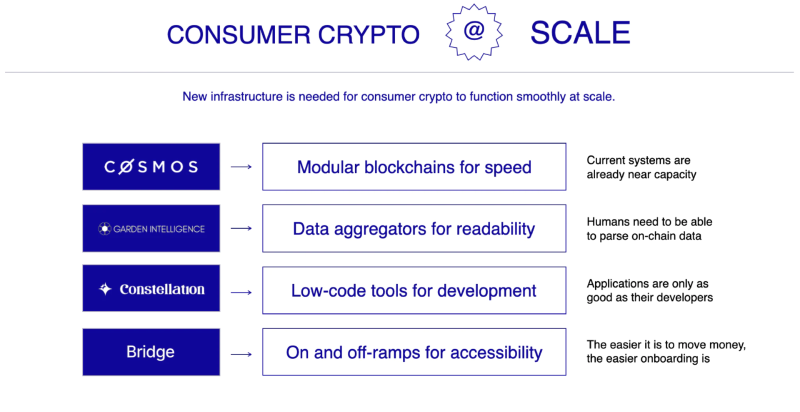

Infrastructure Powering Scalable Ecosystems

As markets cool, infrastructure takes center stage. We’re seeing modular blockchain theory gain traction:

-

Innovations like application-specific chains in the Cosmos ecosystem, along with Ethereum L2s gaining significant traction as execution layers, are increasing focus on vertical scaling.

-

Next-generation blockchains like Celestia focus entirely on one layer of the stack (in this case, data availability and consensus), while other teams build systems compatible with modular architectures like OP Stack, Polygon Supernets, and AVAX Subnets.

As we enhance crypto’s capacity to process transactions more efficiently, we dramatically increase the potential number of consumer applications. We hope these technological advances usher in a renewed emphasis on equitable participation in crypto—no longer gating access through gas fees or limited allocations that drip-feed user experiences.

Moreover, as this new infrastructure enables more data to be stored on-chain, we anticipate growing demand to interpret and analyze it, evidenced by human-readable block explorers and data aggregators like Ora, Breadcrumbs, and Once Upon. These tools reflect a broader trend of turning technically complex tasks—like migrating app chains or integrating NFTs into games—into low-code or no-code processes via tools like Constellation or Stardust. Other areas exciting us within this trend include fiat on/off ramps (e.g., Bridge) and customer intelligence (CI) and communication solutions (e.g., Plex, Garden, Dispatch).

Conclusion

We hope this piece clarifies where we plan to spend our time and collaborate in the coming year. If you’re building or investing in any of the areas above, we’d love to hear from you.

Additionally, if you’re working outside this scope or believe there’s an area we should be spending more time on, we’d be grateful to connect and learn from you.

Of all things, the most important is who you do it with. We’re deeply grateful for our founders’ partnership and thankful to all of you—investors, partners, and friends—for being in our corner. We look forward to spending more time with you in 2023, and if you’d like to chat further or dive deeper into any part of this letter, please reach out.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News