ArkStream Capital 2023 Outlook: Which Scenarios Will See the Explosion of Blockchain Applications for a Billion Users?

TechFlow Selected TechFlow Selected

ArkStream Capital 2023 Outlook: Which Scenarios Will See the Explosion of Blockchain Applications for a Billion Users?

How to position for 2023 across multiple sectors including DeFi and gaming?

Author: Warren, ArkStream Capital

In July 2018, Dr. Xiao Feng, Vice Chairman of Wanxiang Holding, mentioned in a speech that "the blockchain industry might produce companies with a market cap of $5 trillion." At that time, the total market capitalization of the entire crypto market was only around $200 billion, and after a full year of decline, it dropped to $100 billion.

From its peak of $830 billion on January 7, 2018, to its low of $100 billion on December 15, the crypto market fell by 88% over the course of one year—still 50 times smaller than the $5 trillion valuation Dr. Xiao Feng predicted.

At that time, despair and confusion filled nearly every crypto participant. Most people lost their direction, unsure whether the path they had chosen still held any future. Although Ethereum-based DApps were already taking shape and developers kept exploring how to move more transactions on-chain, almost no one could confidently predict that two summers later, in July 2020, the DeFi boom would ignite the crypto world, shifting the industry's narrative from invisible underlying infrastructure to applications generating real value.

Dr. Xiao Feng’s remarks in 2018

Over this cycle, we’ve witnessed large-scale explosions at both the application and protocol layers:

With multiple DeFi protocols starting to generate value, the debate over “fat protocols” versus “fat applications” entered mainstream discussion;

Public blockchains are no longer solely focused on breaking the “impossible triangle,” but instead prioritize ecosystem development. Improving developer ecosystems, establishing ecosystem funds to attract developer migration, and similar strategies have become essential for infrastructure advancement;

Blue-chip NFTs like CryptoPunks and BAYC successfully went mainstream, bringing Web3 into global public awareness.

In November 2021, after Bitcoin reached $69,000, the total market cap of the crypto market hit $3 trillion—less than double Dr. Xiao Feng’s forecast of $5 trillion. According to data from centralized exchanges like Binance, the number of global crypto users reached 100 million. Despite entering a prolonged bear market after November 2021, as the industry further clears out weak players, we have good reason to believe that the bottom of the bear market has formed, making 2023 a pivotal transitional year.

Rather than focusing on timing the market, we should ask: when user numbers grow tenfold—when global crypto users reach one billion and 15% of humanity begins entering Web3—which sectors will spawn trillion-dollar applications? How will these applications evolve in the next cycle? We’ll analyze sectors such as DeFi and gaming to discuss our strategic positioning for 2023.

Applications or Infrastructure?

For clarity, we crudely divide the industry using a binary framework: all products that directly interact with users are categorized as applications—including DeFi protocols, games, wallets, and exchanges—while components that support Web3 operations but remain invisible to users are considered infrastructure, including public chains, node service providers, data indexing, and developer tools.

We believe the next cycle is highly likely to see an explosion at the application layer—mirroring the development path of the internet.

When hardware and physical devices were difficult to普及, most developers focused on building infrastructure because there were few usable applications, or because infrastructure couldn’t support mass-scale apps. But once users gained the prerequisites to join the internet en masse, industry giants became those who developed dominant applications. After acquiring massive user bases, these developers gained control over “data”—the supreme power on the internet—and used it to dominate infrastructure during the cloud era.

Web3 follows the same trajectory. After multiple cycles of exploration, applications are gradually gaining influence. Capturing users first and then building dedicated blockchains has become a viable strategy—Binance’s launch of BSC and Polygon’s acquisitions exemplify this trend. Developers now recognize that infrastructure exists to serve applications, and whoever controls users and traffic gates holds sway over Web3. Therefore, even though current infrastructure cannot yet support a billion users, for application developers, this is the dawn of a moment to seize the high ground.

DeFi

After two cycles of experimentation, DeFi’s future may focus on two directions: attracting clients from centralized financial institutions within the space, and reaching unbanked users outside it—particularly in developing nations.

The collapse of Luna in 2022 triggered a chain reaction: Three Arrows’ implosion, FTX’s downfall, and cascading failures at institutions like DCG—all fueling skepticism about crypto, painting it as a lawless realm. Wall Street firms that drove the previous bull run became culprits due to excessive leverage.

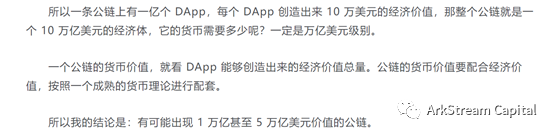

Yet data shows that DEX trading volume doubled within days of FTX’s collapse. Panic toward centralized entities transformed into trust in decentralized financial protocols. This industry isn’t rule-free—it operates under code-as-law. We don’t need to trust any central authority; open-source protocols and smart contracts offer true security. This is one of DeFi’s next narratives: replacing existing centralized financial institutions.

In 2020, thanks to incentives like transaction mining and liquidity mining, DEX trading volume briefly reached 15% of CEX levels. After two downturns depleted rich token rewards, we’re seeing DEX volumes rebound to ~15%, aligning with emerging tech adoption curves: as hype fades, more people use DEXs daily, replacing CEX functionality.

DEX vs. CEX Trading Volume Share (Spot) Source: The Block

Of course, CEXs still dominate. DEXs have significant room to grow. And this is just spot volume—if we look at derivatives, the share drops below 2%. Derivatives generate most profits for centralized exchanges, meaning far greater growth potential lies here for DeFi—but much work remains. Current decentralized derivative exchanges fall short of matching CEX experiences in speed, concurrency handling, depth, and convenience. While products like GMX show promise, they still lag behind CEXs. Thus, most users won’t currently choose DEXs for futures or options. Solving this is both a key challenge and a major growth opportunity for DeFi in the next cycle—capturing users from incumbent CEXs. This requires advances in L2 scaling, cross-chain asset solutions, account privacy, new liquidity models, and more.

Another frontier for DeFi is expanding into low-financialization countries in the Global South. Just as China leapfrogged credit cards and went straight to mobile payments, DeFi could help many African, Asian, and Latin American nations bypass traditional banking, credit cards, and third-party payment systems, moving directly to digital currency for everyday transactions. In parts of Africa and South America, merchants already accept BTC—even with its volatility, it’s often more stable than local fiat currencies. Without trusted banks, people lack savings habits, let alone access to lending-driven financialization. Yet DeFi can establish new financial order where centralized trust fails. Achieving this vision demands technological iteration to lower barriers—like AA wallets and smart contract wallets—as well as solving localization, grassroots outreach, user education, and community-building challenges.

For DeFi to achieve explosive growth across both fronts in the next cycle, relying on single protocols or liquidity models won’t suffice. It will depend heavily on progress across foundational infrastructure. Investors and developers must therefore pay equal attention to base-layer developments alongside protocol-level innovations.

X to Earn

In 2021, Axie Infinity brought Play-to-Earn into the spotlight. Classic ERC721 implementation, low-cost pet battle gameplay, and Ponzi-like tokenomics combined into a cultural phenomenon, becoming a national pastime in several Southeast Asian countries. People previously untouched by crypto earned substantial wealth, whole families joining the gold-farming economy. Early this year, StepN expanded the “Earn” concept to “X.” With refined numerical design and strong anti-cheat systems, millions joined the running craze. Then came a flood of X-to-Earn projects—mostly clones swapping shoes for other NFTs, or replacing running with eating, sleeping, or other daily activities. They never escaped StepN’s original framework. After StepN collapsed, debates intensified around tokenomics: What are the pros and cons of Ponzi designs? How do NFT pools reshape economic models? How should multi-chain token emissions balance interests between new and old players? Can every incentivized scenario adopt similar mechanics?

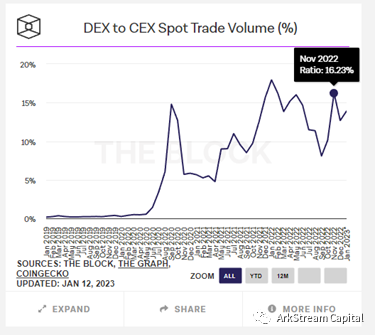

Ponzi schemes have long accompanied crypto, defined loosely or strictly. Looking back, we recall familiar examples. Many token economies are essentially Ponzi in nature—but criticizing them before collapse risks backlash from passionate communities. Conversely, after failure, we shouldn’t dismiss them entirely, but reflect on their exploratory role in tokenomic evolution. Fcoin’s failure is ancient history, yet its “trade-to-mine” model laid groundwork for DeFi Summer’s “liquidity mining” frenzy two years later.

Discussing X-to-Earn isn’t about labeling Ponzis—it’s about rethinking how tokenomics should tie into user behavior in future Web3 apps. Today, most decentralized apps face three common token models:

(1) Governance tokens: primarily granting voting rights, either directly proportional to holdings or weighted by staking duration. Token holders don’t receive direct revenue but may benefit indirectly via governance-controlled resources or anticipated future dividends.

(2) Dividend tokens: also called security tokens, distributing project revenues through dividends or buybacks, delivering direct returns to holders.

(3) Staking tokens: holding tokens increases future yield—either based on stake size or ownership of other ecosystem tokens/NFTs. We consider X-to-Earn models, which require owning NFTs and performing in-app actions to earn tokens, a variant of this category.

Unlike the last cycle, today most projects (except heavily compliant ones) blend multiple token types rather than relying on a single utility. Dual-token models—governance + dividend/staking—are increasingly common. Compared to the first two, staking tokens emphasize future output, demanding meticulous supply-demand modeling. Supply and demand directly affect price; higher issuance necessitates proportionally larger demand. If governance rights and profit-sharing fail to stimulate sufficient demand quickly, and native in-app demand falls short, teams often resort to Ponzi-style incentives as a last resort. This explains why many X-to-Earn projects default to Ponzi designs—a critical issue to resolve in the next cycle. The key question becomes: can pseudo-demand catalyze real demand? Can such models achieve soft landings despite lengthening breakeven periods and declining yields?

Source: The Block

We believe X-to-Earn emphasizes “X,” not “Earn.” Earn helps projects bootstrap early growth, solving customer acquisition. But projects cannot rely solely on Earn—they must swiftly transition away from Ponzi dynamics post-launch, diluting early adopters’ advantages. Because “X” is what sustains long-term operation. The app itself must generate genuine user demand. User retention should stem from meaningful in-app behaviors—not endless token farming. “Positive externality” is a term many developers now highlight: how external inflows sustain internal rewards, ensuring outside demand exceeds internal (token) supply. Lowering barriers and attracting off-chain traffic is the consensus for the next cycle—and essential for Web2-to-Web3 transition.

Ponzi projects will persist in the next cycle—some will shine brightly, collapsing later with massive market impact (as Luna’s crash deeply affected South Korea’s economy). Remember this:

(1) Nothing is too big to fail

(2) What elevates you can just as easily destroy you

Gaming and Metaverse

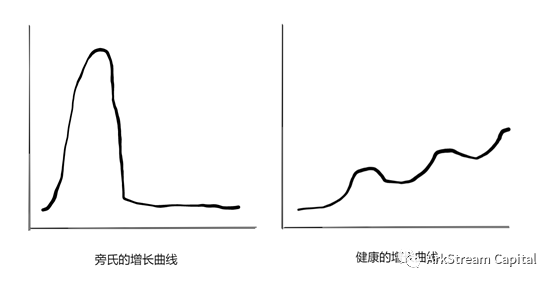

Axie Infinity popularized Play-to-Earn, but that’s not all gaming can be. According to Planet Daily’s 2022 funding report, “GameFi ran strong throughout 2022, raising $5.189 billion”—topping all categories, excluding “metaverse.” Similarly, in our fund’s primary market database, gaming projects number 796—about 20% of total entries, second only to DeFi.

Source: Planet Daily

This surge stems partly from Facebook’s rebrand to Meta, sparking metaverse investment fever, and partly from Axie Infinity’s successful fusion of NFTs and gaming. These forces made investors chase the next hundred-bagger blockbuster. However, grouping “gaming” and “metaverse” together doesn’t mean they’re identical. To non-gamers, they may seem like “virtual avatars,” but we see key differences: games emphasize competition or progression, while the “metaverse” focuses on mapping the real world into virtual spaces. Strictly speaking, most projects calling themselves “metaverse” are just MMORPGs, and many labeled “Web3 games” are merely old games resold with NFTs.

We believe neither represents gaming’s endgame. Let me share a story: when FTX collapsed, news surfaced that SBF was playing Storybook Brawl—a card game acquired by Alameda. Checking Steam reviews today, they’re all骂ing SBF, telling him not to bring his dirty crypto schemes into their beloved game—they just want to play. These comments predated FTX’s collapse and contradict mainstream crypto views because they come from real gamers. They reveal why games succeed: they make people happy. Whether pay-to-win MMOs or competitive MOBAs/FPS titles, the core goal is delivering joy—escape from real-world stress, not turning evenings into grind sessions for in-game gold. That’s not to say earning or tokenomics are wrong—only that games must first serve players. Happiness leads to spending and positive externalities; tokenomics follow afterward. Web3 can improve things—player data ownership, faster bootstrapping via tokens, verifiable scarcity of items via NFTs—but these aren’t fundamental. The fundamental challenge remains making games fun—then adding Web3 elements.

Returning to our initial question: how will gaming evolve in the next cycle? We believe most so-called “AAA” projects—adding tokenomics to boring games without refined design—will vanish in this bear market.

Games succeed based on fun. Immersion and real-world mapping (metaverse), plus Ponzi mechanics and economic gains from NFTs/tokens, only supplement gameplay. True strength lies in intrinsic “playability.” Next-cycle breakout Web3 games will build on solid Web2 foundations—already fun, engaging, and generating positive cash flow—then incorporate lightweight token models, using tokens as dividend rights rather than tightly coupling them to user actions. Tokens offer better liquidity than stocks and can reward player spending/behavior, but players and investors should be segmented: let dreamers live their hero fantasies uninterrupted, while return-seekers earn passively without forced gameplay. As for data ownership, 90% of players don’t care. When Blizzard exited China, returning data meant nothing—players just wanted to keep playing.

The gaming industry includes infrastructure, distribution platforms, and game content. While focusing on games, we also invest in infrastructure—closer to the “metaverse” vision, prioritizing novel interaction methods that expand human cognition into new dimensions. Over the past year, we’ve backed projects like Fragcolor (blockchain-native game engine), Anima (on-chain AR interactions), Matrix World and ChapterX (multi-chain metaverse solutions), and SecondLive (metaverse platform with hundreds of thousands of users). Decentraland and The Sandbox are little more than sandbox games under a metaverse label. Mere land-on-chain won’t win broad consensus—true world-changing products deliver imaginative, novel experiences. We know current tech is far from the VR/AR worlds depicted in *Ready Player One* or *Free Guy*, but Web3 deserves a seat at the table in future virtual worlds.

Compared to infrastructure and games, distribution platforms have clearer paths forward—proven blueprints exist. Whether testing countless low-cost games or leveraging one hit to retain users, Web2 offers precedents like 4399 or Steam. For Web3, it’s about integrating token economics into platform monetization or enabling cross-game data interoperability. Success hinges on similar principles as Web2. A platform might only need one hit as entry, but adding “metaverse” or Web3 concepts amplifies the narrative—potentially evolving into a chain, data center, or metaverse hub.

NFTFi

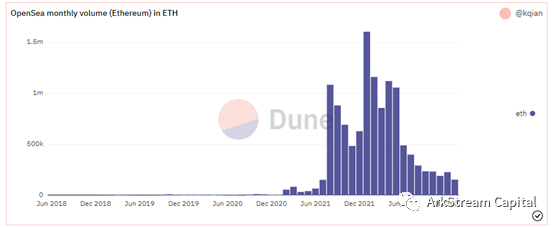

While DeFi and GameFi debated protocol viability and token models, NFTs carved an early cultural niche through PFPs. Identity and cultural expression via PFPs created massive global impact and strong in-community consensus. For two years, chatting with a BAYC/Punk avatar was akin to casually showing off a Rolex over coffee. But PFP summer ended. After OpenSea’s trading volume plummeted in June 2022, NFT markets revealed severe illiquidity. Once users realized non-blue-chip PFPs suffered drastic price drops due to poor liquidity in downturns, demand surged for AMM-DEX-like solutions addressing long-tail NFT liquidity. Though exploration continued throughout the cycle, OpenSea’s orderbook model still dominates.

OpenSea Monthly Trading Volume in ETH (Source: Dune)

Yet ArkStream hasn’t lost faith in NFTs. Their unparalleled value in social money persists—BAYC and Punk avatars retain social appeal despite market declines. Mainstream Web2 platforms like Facebook, Twitter, and Instagram embrace NFTs, providing real-world utility. Over time, NFT trading volumes stabilized. Rather than a cliff, perhaps ultra-high prices for social money simply exceeded fair value—now returning to sustainable growth.

Throughout 2022’s crypto and NFT bear markets, developers never stopped exploring liquidity solutions.

A key difference between NFTFi and DeFi lies in mainstream NFTs (PFPs), which possess both fungibility and non-fungibility. Fungibility can be addressed via DeFi-style AMM DEXes or P2Pool lending. Non-fungibility, however, requires traditional orderbooks or P2P lending. This duality hampers rapid growth compared to early DeFi.

Regarding trading liquidity, three solution types exist: Marketplaces, AMM Protocols, and Aggregators. Early aggregators like Gem and Genie were acquired by OpenSea and Uniswap. More tool than true aggregator, they gained traction before strong OpenSea competitors emerged. With rivals rising, Blur emerged as a stronger aggregator—but functions mainly to drive traffic to its own marketplace. An aggregator unwilling to run a marketplace isn’t truly committed.

Marketplace competition is fierce. They split into art-focused and general NFT marketplaces.

2022 was a tough year for art NFTs—perhaps validating Beeple’s statement: “Honestly, I absolutely think this is a bubble.” Media reports indicate that after earning $53 million in ETH from a record-breaking NFT auction in March 2021, Beeple converted all ETH to USD.

Beeple: Everydays – The First 5000 Days

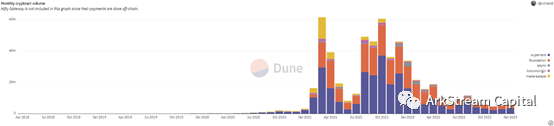

Monthly Art NFT Exchange Volume (Source: Dune)

Art NFT trading volume plummeted throughout 2022—declining faster and harder than PFP-centric platforms like OpenSea. SuperRare, Foundation, AsyncArt, KnownOrigin—we heard little from these players in 2022.

This makes sense—art NFTs are niche and illiquid. In the social media era, PFPs hold superior social money value.

General NFT marketplaces led by OpenSea (still mostly PFPs) weathered the speculative boom and now appear relatively healthy—but face growing competition.

Blur delivers a more professional trading experience, leading in batch operations with smoother UI and single authorization (vs. repeated approvals elsewhere).

Rarible, an early OpenSea challenger, struggles to keep pace.

X2Y2, a tier-two marketplace, shows strong metrics and launched P2P lending, growing rapidly thanks to exchange advantages.

LooksRare attracted massive attention at launch via trading mining, but appears average post-hype compared to peers.

Among AMM protocols, Sudoswap is best known, using multiple pools to price non-fungibles and front-end aggregation. In practice, fragmented liquidity limits effectiveness.

Key NFT lending players include P2P models (NFTfi, Arcade, X2Y2) and P2Pool models (BendDAO).

NFTfi leads in P2P lending, while X2Y2 grows fast by leveraging marketplace traffic.

We believe P2P lending will continue facing pressure from marketplaces.

BNPL (Buy Now Pay Later) and leasing, extensions of lending, haven’t gained traction in early NFTFi.

NFT Lending Protocol Transaction Volume (Source: Dune)

Non-fungibility also complicates pricing, with two main approaches: peer-based and AI-based. Upshot and Abacus pioneered peer pricing. Upshot later shifted to AI; Abacus added tokenomics atop peer pricing. Top AI pricers include NFTBank and Upshot. Peer pricing has inherent flaws—pricing needs arise mainly in lending, where P2P offers or actual trades already represent peer pricing, eliminating need for external mechanisms. P2Pool handles fungibles only, needing no pricing. Meanwhile, AI pricers struggle with value capture, typically operating as third-party services. To capture more value, they must evolve toward end-user products.

Fragmentation was once seen as a promising NFTFi direction, but faded as top project Fractional rebranded to Tessera, and NFTX, NFT20, Unicly declined in relevance. Most fragmentation schemes failed to answer: Why fragment? What does it add to liquidity? NFTX and NFT20 offered no better liquidity than direct NFT trading on Sudoswap. Unicly focused on trading fractional tokens rather than facilitating NFT trades—losing sight of NFTFi’s core purpose.

ArkStream mapped over 30 NFTFi sub-sectors—including derivatives like options/futures—which lacked favorable conditions in early stages and won’t be detailed here.

Overall, NFTFi remains extremely early. Liquidity solutions are still the priority—the foundational brick of the entire stack. We believe investors should focus on core areas: Marketplaces, AMM Protocols, and Lending Protocols. Given AMM Protocols’ inability to efficiently handle non-fungibility in the near term, Marketplaces will remain dominant, though order-flow processing will become more professional and convenient.

Wallets

When discussing how applications might explode, we often overestimate users’ learning ability. Just because we assume all Web3 users engage with DeFi doesn’t change the fact that CEXs still hold over 80% of trading volume. High user friction remains a major barrier preventing Web2 users from transitioning to Web3. As the primary gateway, wallets play an irreplaceable role in lowering this barrier. Early on, this wasn’t obvious—most early Web3 users were drawn by profit motives. Given massive wealth effects, memorizing long private keys, paying gas fees before transfers, or understanding macroeconomics seemed trivial. But when user goals shift to socializing, gaming—activities not tightly linked to earning—each hurdle becomes a dealbreaker, filtering out users in the growth funnel.

Amid recent app growth, wallet development split into two paths: smart contract wallets and MPC wallets. Led by Gnosis Safe, most major chains offer smart contract-based multisig solutions. MPC+TSS originated with Fireblocks in custodial wallets; after Web3Auth and Magic.link SDK-ified it, many apps adopted it, allowing users to manage wallets via email. But neither is final. Smart contract wallets suffer high gas costs and complexity, requiring EOA wallets and contract management. MPC+TSS compromises toward Web2, sacrificing full user control. Ultimately, wallet evolution may hinge on Vitalik’s account abstraction proposal. Features like gas sponsorship and social recovery, enabled by EIP-4337 deployment, could dramatically lower entry barriers.

Though the shift from EOA to AA wallets is inevitable, others won’t wait idly. MPC wallet development is booming. By the time EIP-4337 rolls out, the landscape may already be set—making now the golden window to capture market share. For wallets, two strategies stand out: one starting from applications, reverse-growing user bases into app-centric ecosystems; another targeting B2B services, offering SDKs for widespread integration to rapidly scale user numbers, then leveraging network effects to extract cluster value once scale is achieved. With technical implementations converging, the core competitive edge for new wallet teams lies in aggressive operations to expand user boundaries. The first path means any user touchpoint—exchanges, games, social platforms—can become someone’s “first wallet,” provided UX is seamless and frictionless. The second demands strong business development to quickly amplify influence and onboard partners, building wallet ecosystems. Like public chain ecosystem growth, wallet success may eventually converge with chain-level narratives, enabling grander visions and deeper user lock-in.

At its core, a wallet is a “private key management tool.” As long as we agree that Web3’s distinction from Web2 lies in users owning their data and assets, personal accounts built on public-private key cryptography remain the vessel for that data—and wallets are the gateways managing them. Everyone uses wallets, but not everyone intends to. Wallets are entrances, and every entrance can integrate wallets. Even if end-users never see private keys or complex mnemonics, as long as everything rests on blockchain networks, the wallet’s central role remains irreplaceable.

Data Tools

With rapid growth of decentralized applications, the value of on-chain data continues to rise. Tools like Nansen and Dune Analytics have become daily essentials for analysts. Over the past year, numerous data products emerged—from on-chain indexing to airdrop claim trackers and mint calendars.

Tools fundamentally convert traffic into monetization, progressing in two phases: first dominating a niche, then rapidly expanding into adjacent fields to become traffic hubs. ByteDance’s core advantage isn’t TikTok, but its recommendation algorithms and traffic strategies—enabling replication of hundreds of similar products, dominating each vertical. Data tools follow suit—teams must identify core strengths: superior data mining or extensive on-chain labeling.

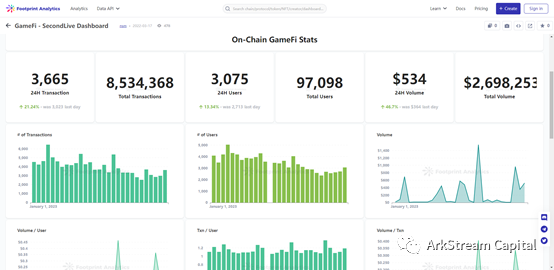

Our portfolio company Footprint Network initially focused on DeFi analytics, but after analyzing market needs and internal strengths, pivoted to GameFi—becoming the world’s leading Web3 gaming analytics platform. It provides real-time, comprehensive on-chain game data with customizable monitoring dashboards.

However, data tools face persistent business model challenges—evident in their short lifespans. ToB or ToC—that’s the question. Once deployed, protocols rarely change, but analytical tools require constant iteration and high server costs. Nansen pioneered premium consumer pricing, capitalizing on information arbitrage. But when bull markets end and users lose money—sometimes losing more than subscription fees—engagement plummets. Products like Massari and The Block combine media and analytics, using insights to gain industry influence and partner networks for resource monetization. They lean ToB, publishing reports to strengthen relationships. Advertising works too—but demands massive user volume and frequency. CoinMarketCap and Coingecko exemplify this. In the data tool space, we prefer small, elegant products solving one problem well—once they dominate that niche, expansion becomes possible. After a year mastering TVL display, DeFiLlama began moving into DEX aggregation. No one would be surprised if tomorrow they announced public chain initiatives.

Social

Social is a vast topic. To discuss it, we must first define: What is Web3 social? Modern social networks permeate life—instant messaging, opinion-sharing platforms, video sites showcasing daily moments—all constitute social activity. You might imagine all this happening on-chain, but current infrastructure can’t support it. Alternatively, what if we only change incentive structures—have existing Web2 platforms issue tokens? Would that make them Web3 social?

We won’t predefine Web3 social product forms, but examine three aspects: data ownership, scale of on-chain data, and value derived from data. Progressively addressing these marks the transition from Web2 to Web3.

Data ownership defines whether social activity occurs on Web3. If Twitter uses cryptocurrency (or DOGE) for tipping, or advertisers pay in crypto, we might call it digital transformation—but not Web3 social. All content still resides on centralized servers; moderators can suspend accounts without consent. So if we must define Web3 social, we argue social data must live on blockchain, with users having absolute control over their data and identities. This is part of social infrastructure—being built by leading teams today. Projects like Nostr (on Bitcoin Lightning), Farcaster (on Ethereum), and Lens Protocol (on Polygon) aim to rebuild data rules atop mature, decentralized, censorship-resistant blockchains. Content generated on these protocols is blockchain-native; data and identity belong to users. Frontends built by communities help users interact with these protocols. This, we believe, is the embryonic form of Web3 social.

Once data ownership is secured, Web3 social needs massive data accumulation to build moats. Recall Bitcoin’s journey—“consensus” has been its enduring strength, giving BTC an edge over functionally identical forks. After securing technical foundations, rapidly expanding users and broadening consensus is key. Tokens may help here—driving user incentives or improving business models. Frontend quality is also crucial. Try products built on Nostr or Lens Protocol—you’ll find them primitive compared to polished Web2 apps. This is temporary; we’re still in the infrastructure phase. Once competitive dynamics emerge, battles will shift to entry points. Games, exchanges, and wallets could all become social gateways. Thanks to protocol interoperability and user-owned accounts, switching between apps will be easy—intensifying competition. Apps failing to support multiple social protocols will be abandoned.

With abundant data, unlocking its value becomes the post-Web3 era’s biggest question. Web2’s data value centers on targeted ads. Predicting Web3’s data value is hard today, but undoubtedly, it will spawn multiple trillion-dollar products.

Returning to our opening question: What is Web3 social? Today, we can only describe its traits blindly, like touching an elephant. Precise definition eludes us. But we can say clearly: Web3 social remains in infrastructure-building phase—investing in infrastructure offers far better odds than randomly hunting client products.

AI

ChatGPT’s explosion brought AI + crypto back into discourse. Most current AI+blockchain projects focus on using AI to solve blockchain privacy and security issues—not application-layer products.

Future convergence of AI and crypto is unpredictable, but some potential use cases are emerging.

One area where AI and crypto may intersect is DeFi and financial trading. AI algorithms can analyze market trends and execute trades, potentially increasing efficiency and profitability. Additionally, AI can detect fraud in DeFi systems, enhancing security in decentralized networks.

Another potential use case is creating decentralized autonomous organizations (DAOs). DAOs are organizations managed by blockchain-coded programs. AI could optimize and manage these entities, making decision-making and governance more efficient.

Interesting developments are also occurring in privacy and data security. AI models are trained on vast datasets, sometimes containing sensitive personal information. Blockchain technology can protect such data, ensuring it’s used only for intended purposes—especially important in healthcare and finance, where privacy is paramount.

Several projects are already exploring AI-crypto integration. For example, Ocean Protocol is a blockchain-powered data exchange platform designed to provide secure, trustworthy environments for sharing valuable data and supporting AI model development and deployment.

Advancements in AI and crypto are also driving smart contract evolution. AI algorithms can help develop and execute smart contracts, ensuring secure and reliable operations.

In summary, integrating AI and crypto could unlock new applications and create more effective, secure, and trustworthy financial systems. As both technologies evolve, more exciting innovations will emerge.

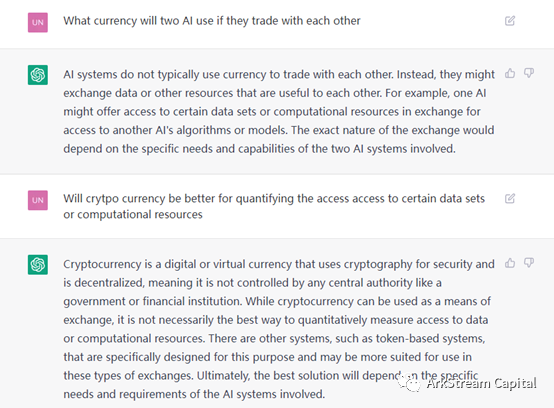

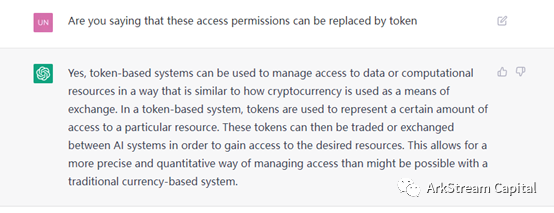

If AIs trade with each other, will they use fiat or digital currencies? I asked ChatGPT this question. It replied that using tokens to quantify data access rights is a better solution than traditional money.

This suggests the AI-crypto convergence might be simpler: cryptocurrencies serving purely as settlement units for AI-to-AI interactions, helping AIGC products better reach users.

Conclusion

Surveying various sectors, we’ve outlined potential scenarios for massive user growth in the next cycle. Returning to our initial discussion, during the next bull market, applications may no longer be subordinate to public chain ecosystems. Instead, giant applications may emerge independently, challenging Web2 monopolies. Unlike closed Web2 giants, Web3’s emphasis on interoperability and composability will finally shine. We eagerly anticipate a world where users own their data, switch freely between apps at minimal cost, engage in open socializing, enjoy immersive gaming, and operate without worrying about high barriers, fees, or asset security. Such a Web3 will fulfill deeper

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News