CoinGecko Q1 2023 Report: Has the Industry Already Recovered?

TechFlow Selected TechFlow Selected

CoinGecko Q1 2023 Report: Has the Industry Already Recovered?

CoinGecko's Q1 2023 cryptocurrency industry report covers the crypto market landscape, analyzes Bitcoin and Ethereum, dives into DeFi and NFT ecosystems, and reviews the performance of CEXs and DEXs.

Author: CoinGecko

Compiled by: TechFlow

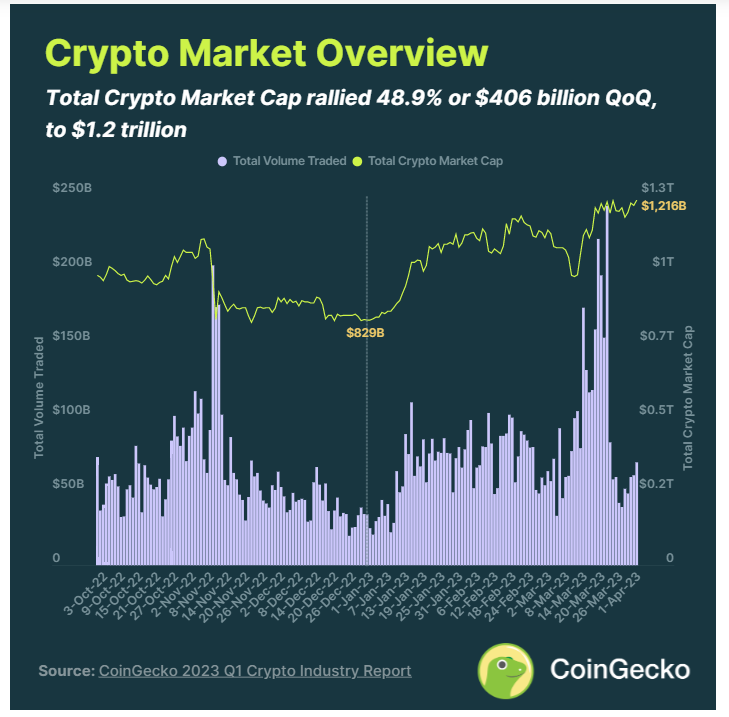

The new year brings a fresh start. As the cryptocurrency market awakens from its late-2022 slumber and emerges from the bear market, it has grown 48.9% from a total market capitalization of $831.8 billion on January 1, 2023, to $1.238 trillion by March 31, 2023.

Although this rally hasn't been entirely smooth, it has reversed losses caused by the FTX collapse and brought the market back to pre-Ethereum Merge highs. Bitcoin (BTC) and Ethereum (ETH) are now trading around $30,000 and $2,000 respectively, with BTC performing particularly well—up nearly 72% this quarter.

CoinGecko's Q1 2023 Crypto Industry Report covers the evolving crypto market landscape, analysis of Bitcoin and Ethereum, deep dives into decentralized finance (DeFi) and non-fungible token (NFT) ecosystems, and a review of centralized exchange (CEX) and decentralized exchange (DEX) performance.

1. Strong Start for Crypto Market: 48.9% Growth, Reaching $1.2 Trillion in Total Market Cap

The crypto market started strong in 2023, ending the first quarter with a total market cap of $1.2 trillion. This represents a 48.9% increase in absolute terms compared to $829 billion at the end of 2022, adding $406 billion in value.

Daily average trading volume also rebounded, rising 30% quarter-on-quarter from -33% in Q4 2022 to $77 billion in Q1 2023. Trading volume began recovering in January, temporarily spiking in early March due to increased volatility from banking crises, but gradually declined after Binance ended its zero-fee BTC trading incentives at the end of March.

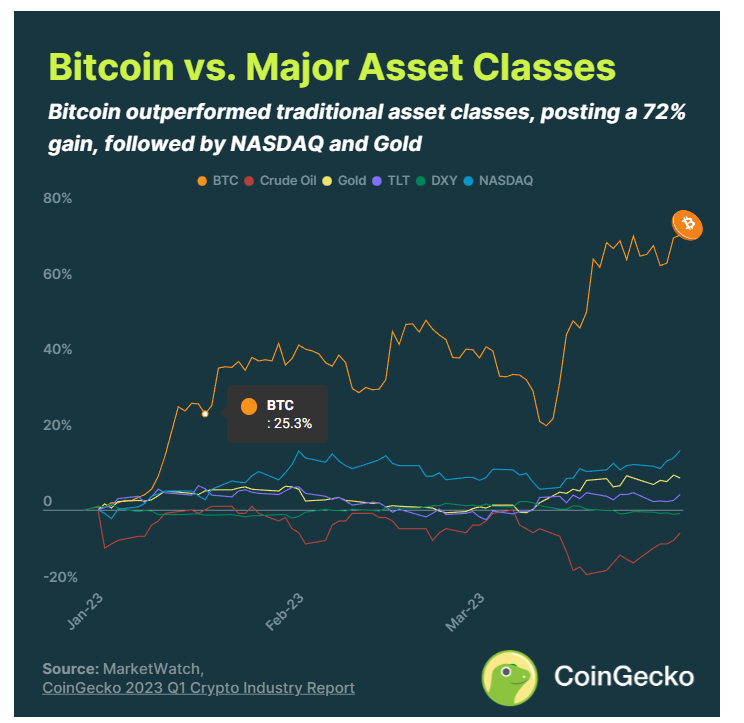

2. Bitcoin Outperforms Traditional Asset Classes, Up 72.4%

Bitcoin was the top-performing asset in Q1 2023, rising 72.4% quarter-on-quarter, followed by the Nasdaq Index (15.7%) and gold (8.4%).

All major asset classes ended the quarter in positive territory except crude oil, which fell 6.1%. This result is not surprising, as crude oil was one of only two assets that rose in 2022. Initially dropping to -17.2% due to falling oil demand cited in U.S. inflation reports and the impact of the U.S. banking crisis, crude oil managed to recover some losses by the end of March.

The U.S. Dollar Index (DXY) and other fiat currencies remained relatively stable during the same period, as inflation data came in below expectations.

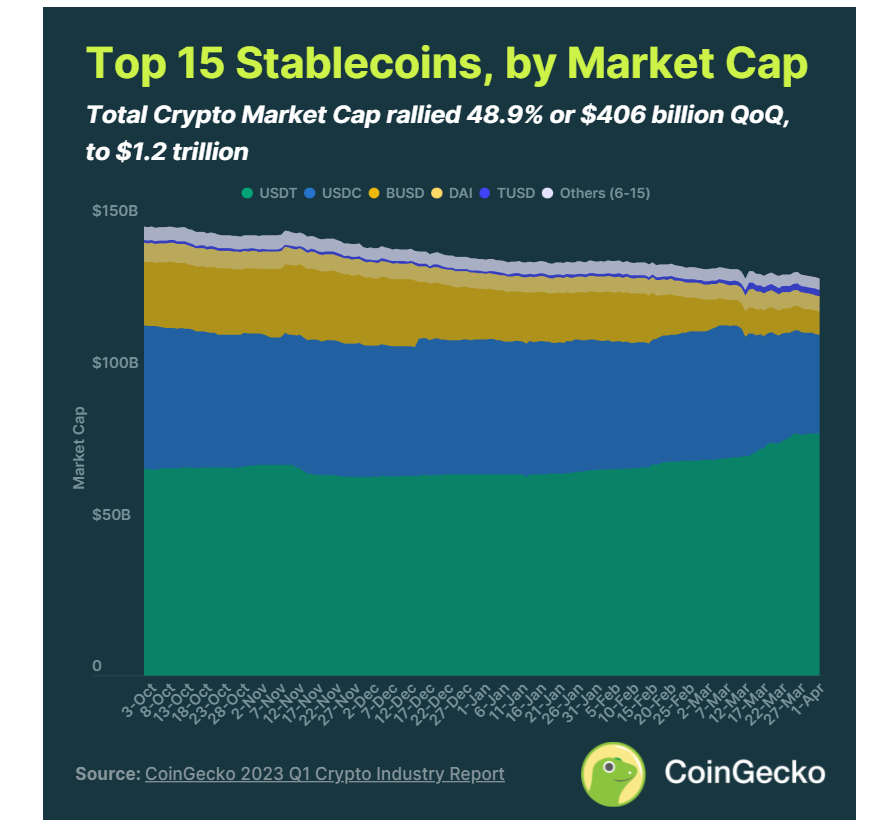

3. Stablecoins Lose $6.2 Billion, Down 4.5%, Led by Sharp Declines in USDC and BUSD

The combined market cap of the top 15 stablecoins dropped 4.5% ($6.2 billion), driven by Paxos' divestment from Binance USD (BUSD) and the depegging event of USD Coin (USDC) during the SVB collapse.

Tether (USDT), the largest stablecoin, further solidified its dominance, increasing its market cap by 20.5% ($13.6 billion). In contrast, USDC and BUSD lost 26.9% and 54.5% respectively, erasing all gains made in 2022.

Meanwhile, True USD (TUSD) entered the top 5, surpassing FRAX. Binance minted $130 million worth of TUSD, while Tron minted an additional $750 million, driving TUSD’s market cap up by 169.3%. Among stablecoins outside the top five, GUSD and USDP declined by 32.0% and 12.3% respectively.

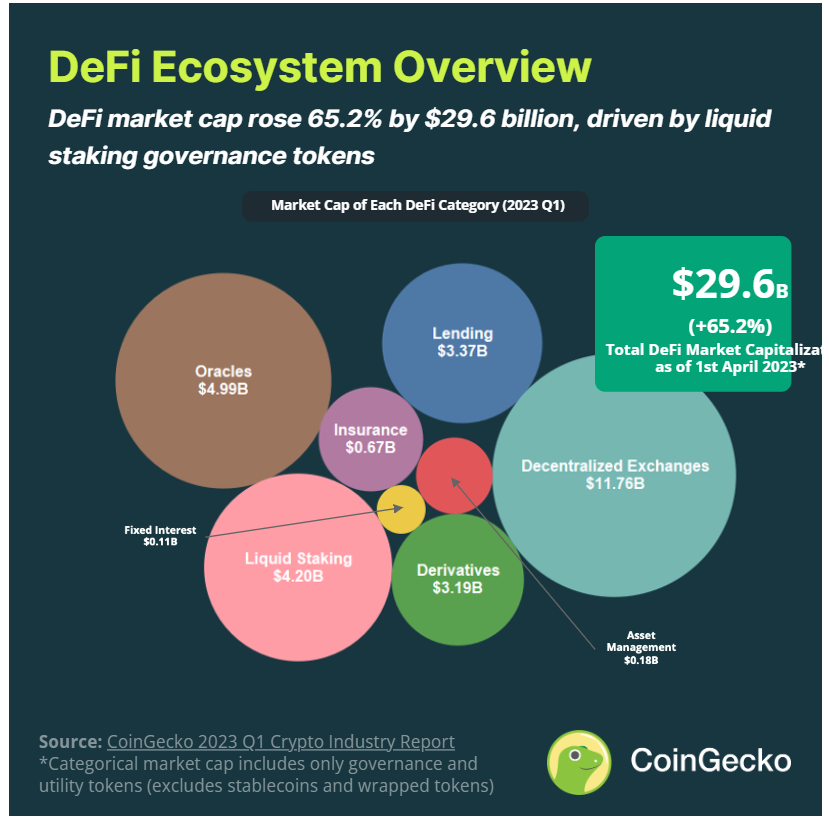

4. DeFi Ecosystem Grows 65.2% to $29.6 Billion, Liquid Staking Sector Surges 210.9%

The decentralized finance (DeFi) sector saw its market cap surge 65.2% in Q1 2023, reaching $29.6 billion—an increase of $11.8 billion—primarily driven by strong performance in liquid staking governance tokens.

Following the Ethereum Shapella upgrade, the market cap of liquid staking governance tokens grew 210.9% in the first quarter. It has now surpassed lending protocols to become the third-largest category within DeFi.

Despite a 44.3% market cap increase in Q1 2023, decentralized exchange (DEX) governance tokens continued losing market share, declining by -5% since January.

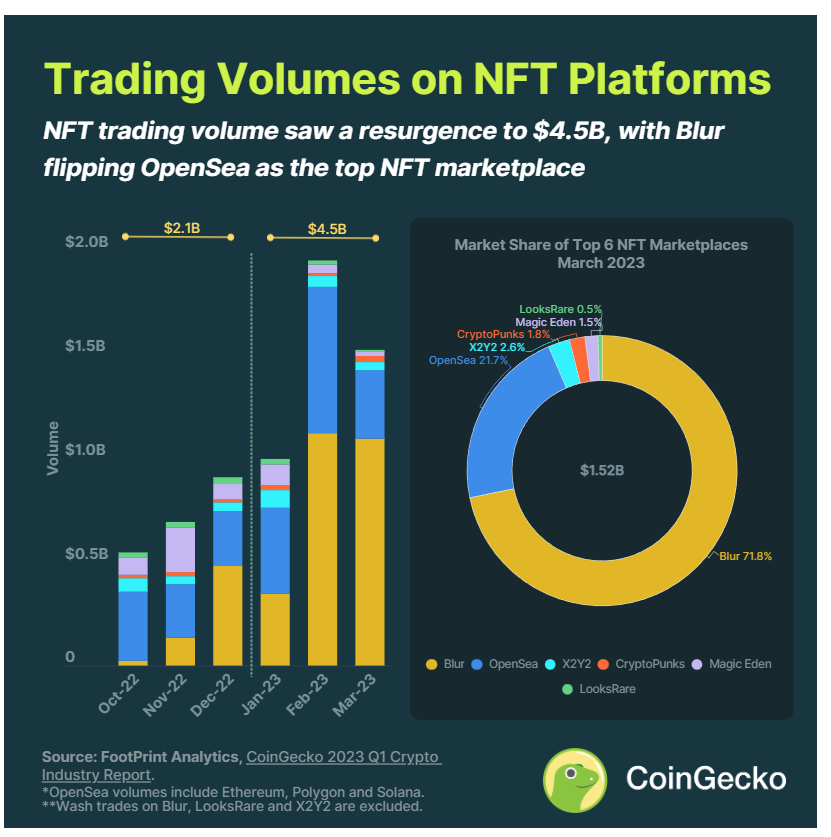

5. NFT Trading Volume Rebounds to $4.5 Billion; Blur Overtakes OpenSea as Top NFT Marketplace

Non-fungible token (NFT) trading volume surged, rising 68% from $2.1 billion in Q4 2022 to $4.5 billion in Q1 2023.

Most of this NFT trading volume came from Blur, a new NFT platform launched in October 2022. Within six months, it has overtaken former market leader OpenSea, growing its market share from 52.8% in December 2022 to 71.8% in March 2023 across the top six NFT marketplaces. Over the same period, OpenSea’s market share shrank from 29.3% to 21.7%.

While most blockchains saw increased trading volume in Q1, Solana’s ecosystem continued to decline. Magic Eden, the chain’s largest marketplace, saw its trading volume drop from $73.9 million in December 2022 to $23.6 million in March 2023—a 67.9% decrease. High-profile NFTs like y00ts and DeGods have also migrated to other chains, further weakening Solana.

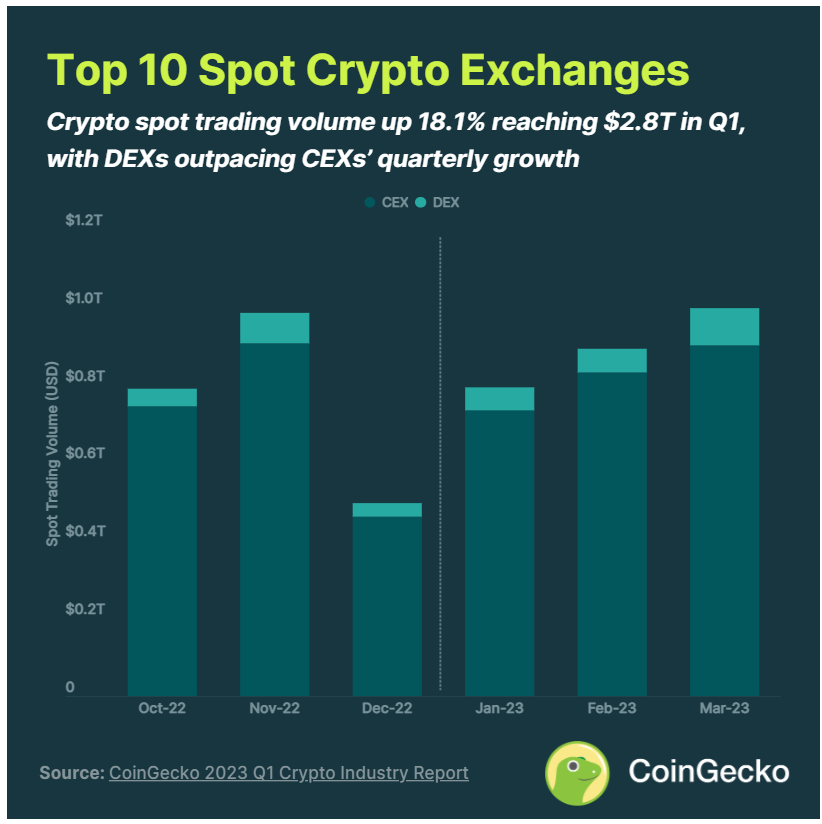

6. Q1 Spot Crypto Trading Volume Rises 18.1% to $2.8 Trillion; DEX Growth Outpaces CEX

In Q1 2023, the top ten cryptocurrency exchanges recorded a combined spot trading volume of $2.8 trillion, an 18.1% increase from Q4 2022. Monthly trading volume has been on an upward trend since hitting a low of $500 billion in December 2022. However, monthly volume has yet to return to the average $1 trillion level last seen in the first half of 2022.

Amid increased regulatory scrutiny on centralized exchanges (CEX), decentralized exchanges (DEX) grew nearly twice as fast as their centralized counterparts. In Q1 2023, DEX volume rose 33.4% compared to 16.9% for CEX. Nevertheless, the CEX-to-DEX trading volume ratio remained above 90% during the same period.

Additionally, CoinGecko offers a comprehensive 44-page full report for interested readers who wish to explore further.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News