A&T Capital 2023 Trends Report: The market is adjusting, but innovation never stops

TechFlow Selected TechFlow Selected

A&T Capital 2023 Trends Report: The market is adjusting, but innovation never stops

A&T Capital's 6 predictions for innovation sectors and applications in 2023.

A&T Capital has released the "Web3 Trends Report 2023," making the following six predictions about this year's innovative sectors and applications:

► Keywords: New paradigm, ZK Layer 2, parallel computing, modular design, appchains, account abstraction wallets and externally owned accounts (EOA) wallets, MEV, decentralized exchanges.

1. Market and Innovation: Web3 is Building a New Paradigm

-

The total fund size of Web3.0 primary market funds reached $5 billion; the NFT market scale exceeded $2 billion, with over 3 million NFT holders.

-

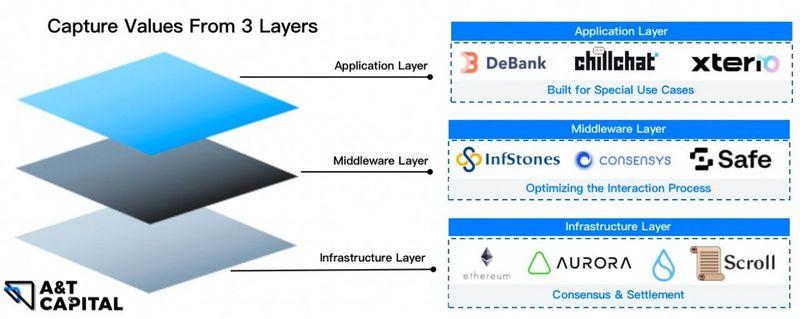

Innovations brought by Web3 can be seen across all technical layers—application layers creating dedicated user scenarios, middleware optimizing interaction processes, and infrastructure layers improving consensus and settlement mechanisms.

2. Zero-Knowledge Proofs: ZK-based Layer 2 Solutions Are the Long-Term Better Choice for Ethereum Scaling

-

ZK L2: Mainstream ZK L2s such as StarkNet, Scroll, and zkSync are highly likely to launch their mainnets within 2023, further accelerating Ethereum’s scalability. The market will see long-term coexistence of multiple solutions, benefiting from this diversity.

-

Beyond scaling: The value of ZKP technology across different segments of the blockchain industry is being increasingly recognized.

-

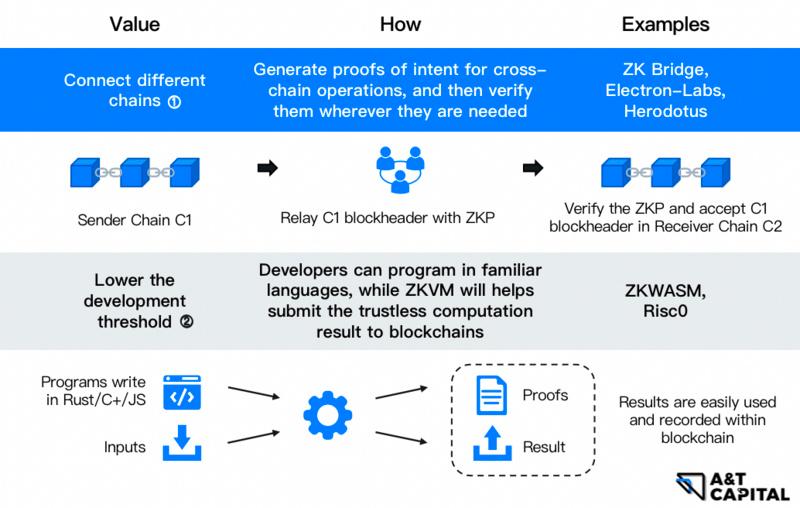

ZKP + Light Client designs have the potential to revolutionize cross-chain interoperability;

-

Virtual machines such as ZKWASM and Rust-based ZKVM will allow Web2 developers to enter Web3.0 with minimal changes to existing development practices;

-

Using ZKPs to verifiably transmit off-chain execution results on-chain applies to various use cases unsuitable for on-chain execution, offering another way to enhance overall blockchain efficiency beyond L2s.

3. Public Chain Keywords: Parallel Computing, Modular Design, Appchains

-

Parallel Computing: A widely adopted technique in traditional high-performance computing, parallel computing has recently entered mainstream blockchain awareness through projects like Sui, Aptos, and Fuel Network, and will push blockchain network computational capabilities to higher limits across more scenarios;

-

Modular Design: With the growing popularity of Ethereum+L2 combinations and Celestia’s persistent advocacy, modularity is gradually becoming a mainstream blockchain design philosophy—enabling flexible customization to meet diverse needs while shortening development cycles and improving quality by focusing on individual modules;

-

Appchains: Thanks to strong performance in customization, exclusive network capacity, and richer value capture, appchains will find clear application scenarios in 2023 and secure a portion of market share, taking diverse forms such as L1/L2/L3.

4. Wallets: Account Abstraction (AA) Wallets and Externally Owned Account (EOA) Wallets Will Achieve Lower Usage Barriers and Better User Experience Through Different Trade-offs

-

Wallets as Web3.0 traffic gateways currently suffer from poor user experience due to high security barriers and cumbersome interaction flows associated with commonly used mnemonic phrase wallets.

-

To address these pain points and pave the way for billions of new users entering Web3.0, account abstraction (AA) wallets can leverage on-chain smart contracts, while externally owned account (EOA) wallets can adopt off-chain MPC technology.

5. MEV: A Trustless, Censorship-Resistant, Permissionless MEV Extraction Market Will Replace Existing Solutions

-

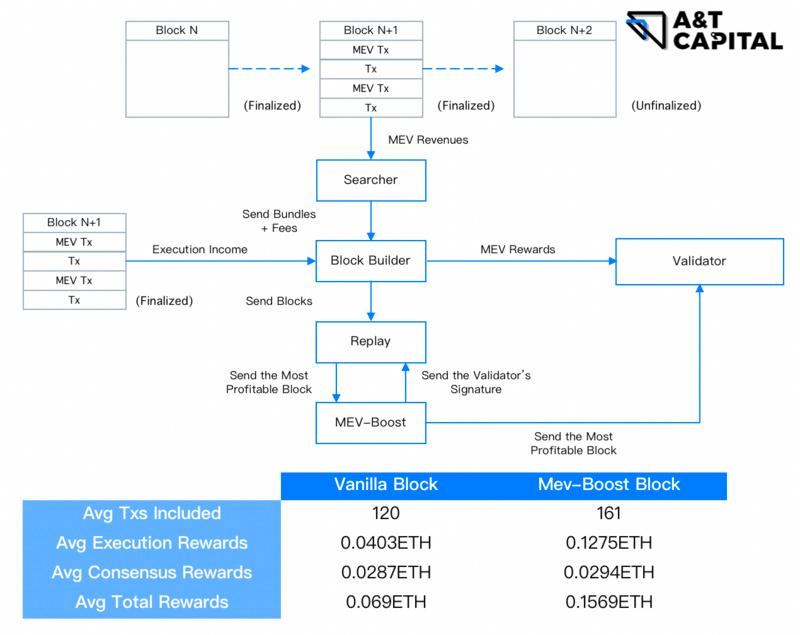

MEV-Boost is the current Ethereum MEV extraction solution. While using MEV-Boost increases validator revenue, it remains a trusted and censorable architecture.

-

Introducing “programmable privacy” into the communication network among MEV market participants will be the path toward achieving a more ideal MEV extraction market.

6. Exchanges: Separation of Custody, Trading, and Settlement Functions Is an Inevitable Trend

-

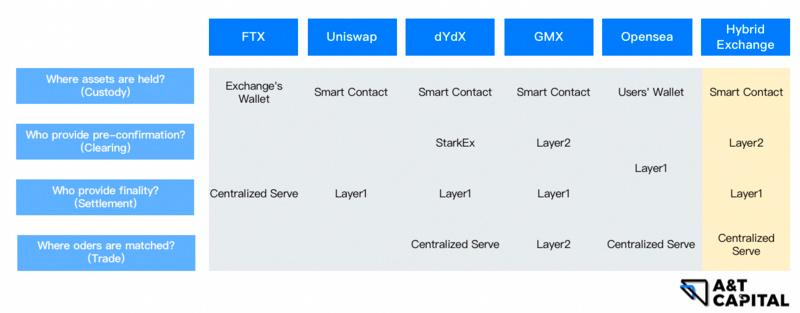

The FTX incident deeply shook the market, highlighting the high moral hazard posed by centralized exchanges that combine custody, trading, and settlement functions.

-

Proof of reserves published by exchanges is only a small step. To fundamentally solve this issue, exchanges must either embrace regulation, storing customer assets with trusted, compliant custodians, or choose decentralization, locking assets in on-chain smart contracts.

In 2022, the crypto industry experienced major events including the collapse of FTX and Luna, and the Ethereum Merge upgrade. The market is undergoing adjustments, yet the momentum of innovation continues unabated.

We look forward to Web3.0 reaching the broader public in a more innovative, secure, efficient, and user-friendly form.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News