Global liquidity cycle reshaping: Why is the 2025 crypto market so difficult?

TechFlow Selected TechFlow Selected

Global liquidity cycle reshaping: Why is the 2025 crypto market so difficult?

The increasingly clear direction remains: BTC and stablecoins.

Author: ODIG Invest

Since mid-2025, the crypto market as a whole has exhibited high volatility and downward pressure, with major asset prices continuously correcting, trading volumes shrinking, and investor confidence weakening. As of yesterday, the global crypto market cap was approximately $3.33 trillion, down about 20–30% from its peak at the beginning of the year. BTC dominance has remained stable around 55%, while volatility has surged to as high as 40%, far exceeding levels seen in 2024. Market sentiment is cautious.

On-chain data from CryptoQuant shows that exchange BTC reserves have declined by about 8% since early August, with USD value dropping from around $300 billion to $250 billion by November. This indicates investors are withdrawing funds from exchanges (shifting to self-custody or safe-haven assets), reinforcing sell-off signals.

Mainstream token prices briefly rebounded in the first half of 2025 but entered a correction phase starting in October, further declining in November. Prices of the top 50 tokens have nearly returned to levels seen after the FTX collapse in 2022.

In summary, the current state of the 2025 crypto market includes:

-

Mainstream tokens such as SOL, ETH, and BTC have reverted to their December 2024 price levels; the four-year cycle theory has failed, requiring industry participants to adjust and adapt.

-

Token supply explosion: Over the past four years, most tokens have followed a low-floating supply, high-FDV issuance model. After the meme wave, the number of tokens has grown rapidly; today, new projects launch daily, creating an oversupplied market. Capital has become increasingly cautious—unless new buyers keep entering, inflows are no longer sufficient to offset large-scale project token unlocks.

-

The market has entered a period of concept recycling: lack of innovation; proliferation of non-essential technologies;

-

Project implementation difficulties: poor incentive and adjustment effects from economic models; many projects have yet to achieve product-market fit (PMF);

-

Weak airdrops: airdropped tokens are immediately swapped for stablecoins by users;

-

Trading difficulty has significantly increased: any tradable asset with sufficient liquidity faces intense competition.

-

Tightening funding chains: VC investment has shrunk, with total fundraising amounting to only about half of 2024 levels, leaving project teams under financial strain.

-

Internal industry issues are frequent: the October 11 "black swan" event; frequent hacker attacks (losses exceeding $2 billion in the first half); Layer1 chain congestion incidents, etc.

-

Declining DeFi yields: compared to 2024, DeFi yields have dropped below 5%.

This resembles a structural adjustment, similar to 2018 but on a larger scale. It presents challenges for nearly every market participant—users, traders, meme enthusiasts, entrepreneurs, VCs, quant firms, and more.

Particularly after the October 11 Black Friday incident, many crypto traders and quant firms suffered losses, and concerns over institutional blowups persist. This event meant that speculators, professional traders, and retail investors alike faced capital drawdowns.

Traditional financial institutions’ involvement remains concentrated on BTC and payments, RWA, DAT strategies, etc., relatively isolated from the altcoin market. Spot Bitcoin ETFs performed strongly in October with a record net inflow of $3.4 billion, but saw massive outflows in early November, reflecting profit-taking behavior at higher price levels.

Currently, with expectations of the end of the government shutdown, official liquidity is expected to return. How will the crypto market perform in the final two months of 2025?

The increasingly clear direction remains: BTC and stablecoins.

(1) BTC: Macro liquidity cycle replaces halving narrative

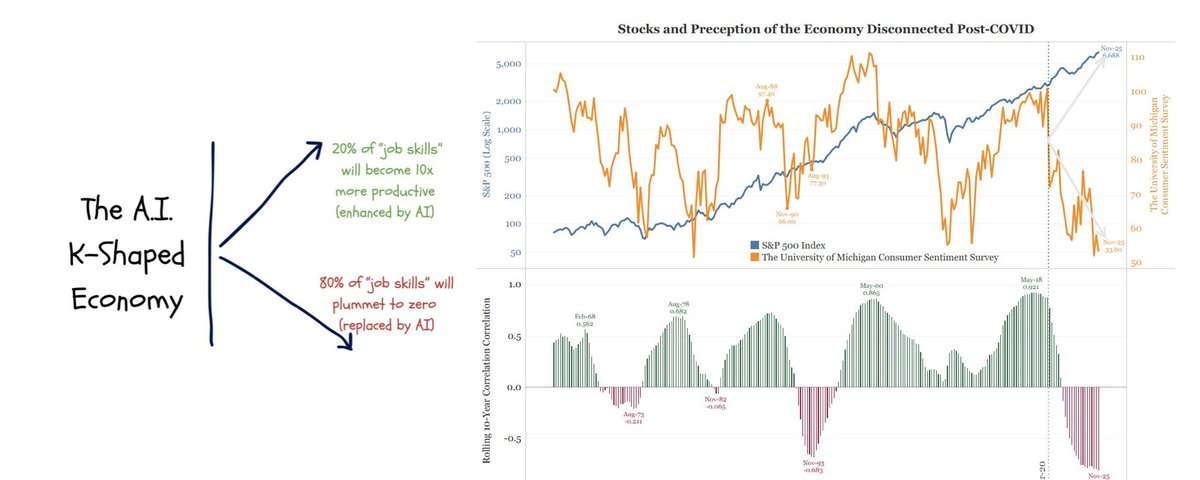

As market consensus shifts, analysts believe the global liquidity cycle—not merely the Bitcoin halving—is the core driver behind bull and bear transitions.

Arthur Hayes recently emphasized his key view: "The four-year cycle is dead; the liquidity cycle lives on." He argues that the past three bull-bear cycles closely aligned with periods of massive balance sheet expansion by the U.S. and China, along with low interest rates and credit easing. Currently, U.S. Treasury debt is growing exponentially. To dilute this debt, the Standing Repo Facility (SRF) will become the government’s primary tool. Growth in SRF balances implies synchronized expansion of global fiat money supply. Under this "stealth QE," the upward trend for BTC will not reverse.

The belief is that the Standing Repo Facility (SRF) will become the government's main instrument. With current monetary conditions persisting and Treasury debt piling up exponentially, SRF balances—as the lender of last resort—will keep rising. Growth in SRF balances means synchronized expansion of global fiat money supply, which could reignite a Bitcoin bull run.

Raoul Pal’s cycle theory similarly points out that each crypto cycle ends due to monetary tightening. Data shows global debt has reached about $300 trillion, with roughly $10 trillion (mainly U.S. Treasuries and corporate bonds) maturing soon. To prevent yield spikes, massive liquidity injections will be required. According to his model, every additional $1 trillion in liquidity may correlate with 5–10% gains in risk assets (stocks, cryptocurrencies). A $10 trillion refinancing need could inject $2–3 trillion in fresh capital into risk assets, strongly driving BTC higher.

All these views place the global central bank liquidity cycle at the center, providing a macro environment conducive to long-term appreciation of scarce assets like BTC.

(2) Stablecoins: Evolving into financial infrastructure

Another key theme in 2025 is stablecoins, whose value lies not in "speculative narratives" but in "real-world adoption."

Recent policy tailwinds have emerged: the U.S. Congress is pushing to grant CFTC (Commodity Futures Trading Commission) greater authority over the cryptocurrency spot market. The CFTC is expected to introduce a policy early next year that may allow stablecoins to serve as tokenized collateral in derivatives markets. This would initially be piloted at U.S. clearinghouses, accompanied by stricter regulation, opening the door for stablecoins to enter core traditional finance domains.

Stablecoin scale is expanding rapidly, far exceeding market expectations. Major U.S. institutions have already moved ahead, building new payment networks centered on stablecoins.

Facing an explosion of real-world use cases, the value of stablecoins lies in reliably functioning across cross-border transfers, exchange rate risk hedging, corporate settlements, and fund reallocation.

Over the past year, stablecoins have achieved a balance among speed, cost, and compliance, forming an initial global payment channel that is compliant, low-cost, and traceable. They are gradually becoming a usable financial settlement layer in the real world. As infrastructure, stablecoins are solidifying their status through both regulation and practical application, serving as stable lifeblood for the entire crypto economy.

This offers insights for entrepreneurs: startup teams should consider making their business processes "stablecoin-native," target markets toward "stablecoin-using populations," and build genuine product-market fit (PMF) on this foundation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News