When traditional financial markets fail, will the crypto industry become a "pressure relief valve" for liquidity?

TechFlow Selected TechFlow Selected

When traditional financial markets fail, will the crypto industry become a "pressure relief valve" for liquidity?

As long as the system continues turning debt into asset bubbles, we won't achieve a real recovery, only slow stagnation masked by rising nominal figures.

Written by: arndxt

Translated by: AididiaoJP, Foresight News

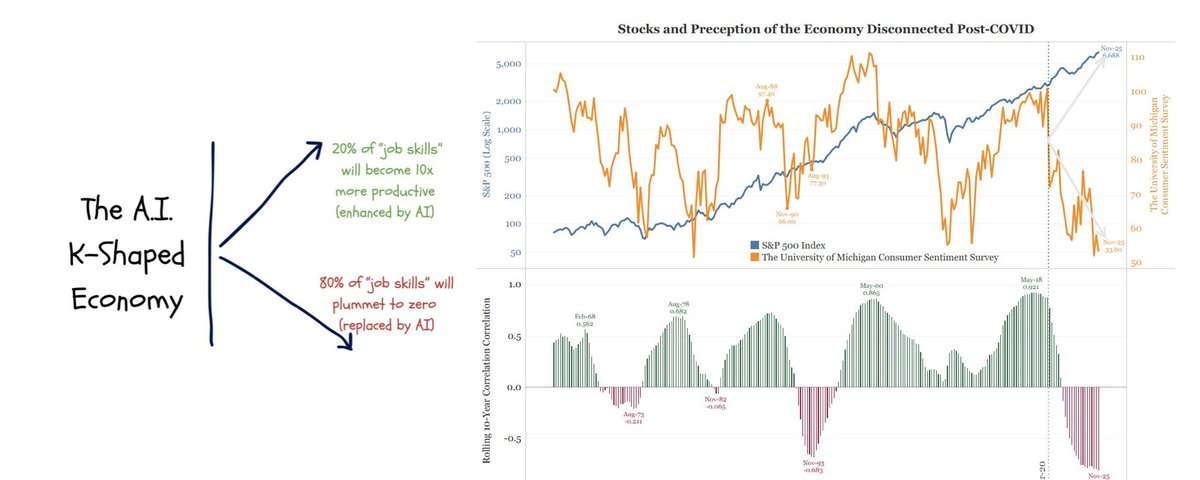

The U.S. economy has split into two worlds: one where financial markets are booming, and another where the real economy is陷入 a slow decline.

Manufacturing PMI has been contracting for over 18 consecutive months—the longest such streak since World War II—yet stock markets keep rising as profits become increasingly concentrated in tech giants and financial firms. (Note: "Manufacturing PMI" stands for "Manufacturing Purchasing Managers' Index," a key barometer of manufacturing health.)

This is essentially "balance sheet inflation."

Liquidity continuously inflates prices of similar assets, while wage growth, credit creation, and small business vitality remain stagnant.

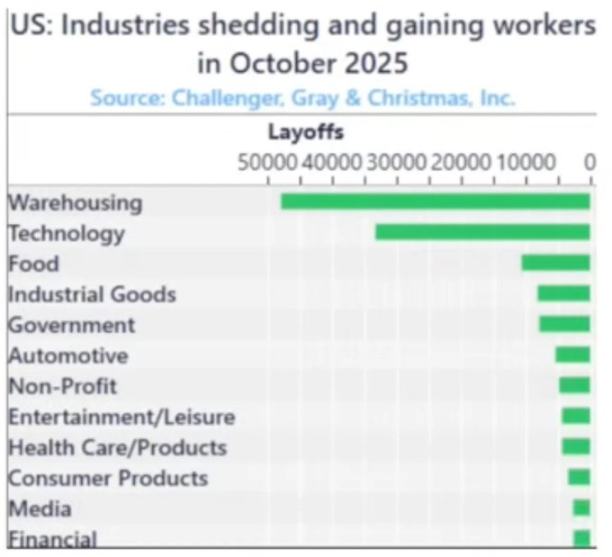

The result is economic bifurcation—during recoveries or business cycles, different sectors move in completely opposite directions:

One side: capital markets, asset holders, tech industry, and large corporations → rapid rise (profits, stock prices, wealth).

Other side: wage earners, small businesses, blue-collar industries → decline or stagnation.

Growth and hardship coexist.

Policy Failure

Monetary policy can no longer effectively benefit the real economy.

Fed rate cuts boost stock and bond prices but fail to generate new jobs or raise wages. Quantitative easing enables large corporations to borrow more easily, yet does little to support small businesses.

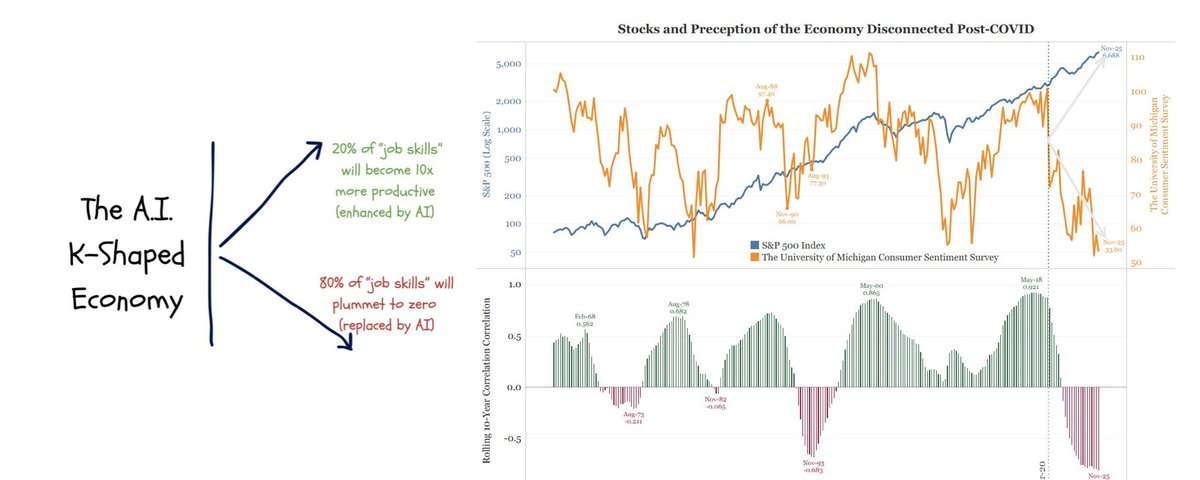

Fiscal policy is also nearing its limits.

Today, nearly one-quarter of government revenue goes solely toward paying interest on national debt.

Policymakers are thus trapped in a dilemma:

Tighten to fight inflation, and markets stall; loosen to stimulate growth, and prices surge again. The system has become self-referential: any attempt to deleverage or shrink balance sheets threatens the very asset values it depends on for stability.

Market Structure: Efficient Extraction

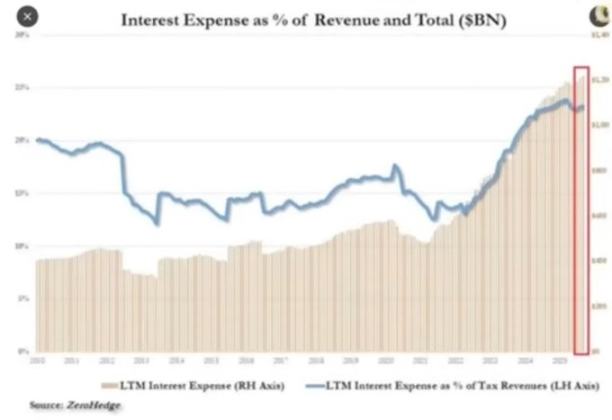

Passive fund flows and high-frequency data arbitrage have turned public markets into closed-loop liquidity machines.

Positioning and volatility supply now matter more than fundamentals. Retail investors are effectively playing against institutions. This explains why defensive sectors are abandoned and tech valuations soar—market structure rewards momentum, not value.

We’ve built a market with extremely high price efficiency but extremely low capital efficiency.

Public markets have become self-sustaining liquidity engines.

Capital flows automatically → through index funds, ETFs, and algorithmic trading → creating constant buying pressure regardless of fundamentals.

Price movements are driven by capital flows, not intrinsic value.

High-frequency trading and systematic funds dominate daily volume, leaving retail investors on the opposing side. Stock moves depend on positioning and volatility mechanics.

Hence, tech stocks keep expanding while defensive sectors lag.

Social Backlash: The Political Cost of Liquidity

Wealth creation in this cycle is concentrated at the top.

The wealthiest 10% hold over 90% of financial assets. The more stock markets rise, the wider the wealth gap grows. Policies that inflate asset prices simultaneously erode the purchasing power of the majority.

With no real wage gains and unaffordable housing, voters will eventually demand change—either through wealth redistribution or political upheaval. Both increase fiscal pressure and fuel inflation.

For policymakers, the strategy is clear: maintain excessive liquidity, push up markets, and declare economic recovery. Use superficial prosperity to avoid structural reform. The economy remains fragile, but at least the numbers can last until the next election.

Cryptocurrency as a Pressure Valve

Cryptocurrency is one of the few domains where value can be held and transferred without relying on banks or governments.

Traditional markets have become closed systems, where large capital captures most profits via private placements before IPOs. For younger generations, Bitcoin is no longer just speculation—it’s access. When the entire system appears rigged, at least here there’s still opportunity.

Though many retail investors have been burned by overvalued tokens and VC sell-offs, the core demand remains strong: people want an open, fair, and self-sovereign financial system.

Outlook

The U.S. economy cycles on "reflex mode": tighten → recession → policy panic → stimulus → inflation → repeat.

A new round of easing may arrive by 2026, driven by slowing growth and widening deficits. Stocks will rally briefly, but the real economy won’t truly improve unless capital shifts from asset support to productive investment.

Right now, we’re witnessing the late-stage form of a financialized economy:

-

Liquidity acts as GDP

-

Markets become policy tools

-

Bitcoin becomes a social pressure valve

As long as the system keeps recycling debt into asset bubbles, real recovery will remain out of reach—only slow stagnation masked by rising nominal figures.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News