The Fed's "invisible easing" has begun, and a silent liquidity reversal is unfolding

TechFlow Selected TechFlow Selected

The Fed's "invisible easing" has begun, and a silent liquidity reversal is unfolding

Don't focus only on interest rate cuts!

Author: White55, Mars Finance

The Federal Reserve announced a 25-basis-point rate cut on October 29, lowering the target range for the federal funds rate to 3.75%–4.00%. This marks the Fed's fifth rate reduction since September 2024. However, more noteworthy than this market-expected decision is another move announced simultaneously: the Fed will end its balance sheet normalization program starting December 1. This policy, known as quantitative tightening (QT), launched in 2022, has reduced the Fed’s balance sheet from a pandemic-era peak of nearly $9 trillion to about $6.6 trillion. Its conclusion signals a quiet but profound shift in global liquidity conditions.

Policy Shift: From Implicit Drainage to Moderate Injections

Quantitative tightening works by allowing maturing bonds to roll off the balance sheet without reinvestment, effectively draining liquidity from the financial system. Initiated in June 2022 amid high inflation, QT was part of a broader strategy to tighten financial conditions. Over the past three years, QT and rate hikes worked in tandem—raising the cost of capital while reducing its supply. Since 2022, the Fed’s balance sheet has shrunk significantly through non-reinvestment of maturing securities. But conditions are shifting. In mid-October 2025, Powell warned at a conference in Philadelphia that signs of further cooling in the U.S. labor market were emerging. He also noted that with financial system liquidity conditions gradually tightening, the QT program may be nearing its end. The Fed has agreed internally to proceed with "extreme caution" to avoid a repeat of the money market stress seen in September 2019. Ending QT means the Fed will stop draining liquidity and instead reinvest proceeds from maturing securities, effectively returning funds to the market. While seemingly a technical adjustment, this shift carries profound implications for market liquidity.

Rationale: Preemptive Measures and Market Stability

Behind this decision lies a cautious assessment of the economic outlook and concerns over market stability. Powell’s October remarks—emphasizing that employment risks now outweigh inflation concerns—have become a key rationale for the policy pivot. Although inflation remains above the Fed’s 2% target, long-term inflation expectations remain well anchored. In contrast, signs of labor market softening are becoming more evident. Powell observed, “In this less active, somewhat weaker labor market, downside risks to employment appear to be rising.” Fed policymakers acknowledged that the nearly month-long federal government shutdown had constrained their decision-making process. The absence of official data made it difficult to accurately assess the economy, prompting a more cautious policy stance. The decision to end QT also reflects growing concern over market liquidity. In September, the New York Fed conducted large-scale repo operations to relieve liquidity pressures in money markets, signaling that bank system reserves may have approached a minimum comfortable level. Further balance sheet contraction could threaten financial stability.

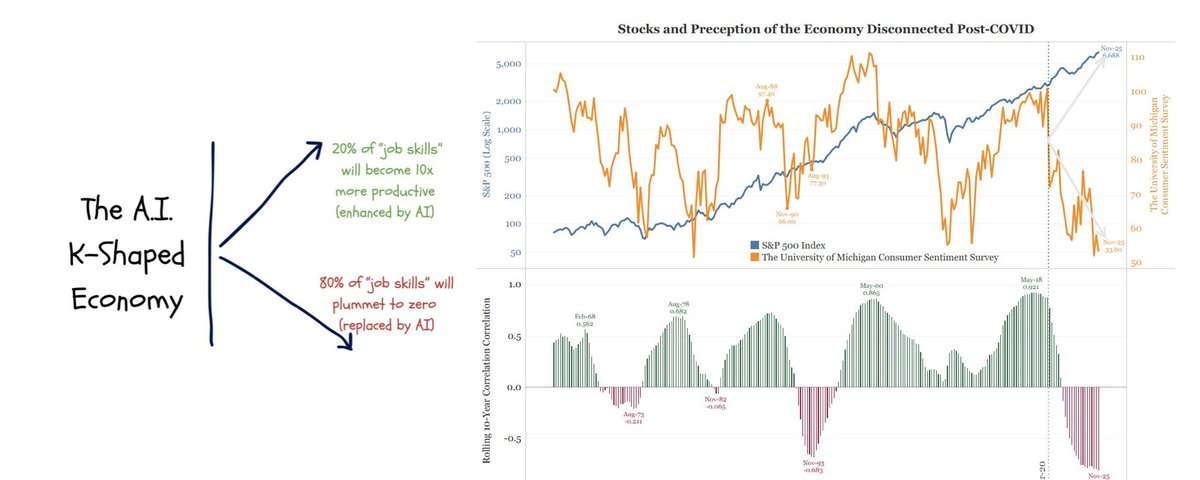

Market Impact: The Hidden Transfer of Liquidity

The end of QT will have complex and far-reaching effects across asset classes. According to Dong Zhongyun, chief economist at AVIC Securities, ending balance sheet reduction may bring three major impacts: first, U.S. market liquidity could improve, avoiding a repeat of the 2019 repo market crisis; second, halting the runoff means the Fed stops reducing bond holdings, easing selling pressure on the bond market and helping lower long-term yields; third, ending QT strengthens expectations of monetary easing, creating a synergistic effect with rate cuts. Despite the Fed’s October 29 rate cut, long-term Treasury yields continued to rise. This seemingly paradoxical phenomenon reveals divergent market views on the future policy path. Powell noted “significant disagreements” among policymakers regarding December actions, adding uncertainty to the outlook. However, the supportive impact of QT’s end on equities may be more direct. By reducing the pace at which liquidity is withdrawn from markets, it could bolster U.S. stocks, especially liquidity-sensitive growth and tech stocks. This view aligns with Bill Adams, chief economist at Comerica Bank, who believes QT’s end could “translate into greater financial market liquidity and more private investment flowing into risk assets over the coming period.” Subtle Shift: The “Stealth Rate Cut” Effect of QT Termination

Some analysts argue that even if the Fed pauses rate cuts in December, an early end to QT could produce effects similar to a rate cut. John Luke Tyner, portfolio manager at Aptus Capital Advisors in Alabama, even suggests that ending QT before 2026 could deliver benefits equivalent to a 25-basis-point rate cut for investors. This “stealth rate cut” operates through two channels: alleviating reserve pressure in the banking system and managing the supply and maturity structure of Treasury issuance. Ending QT means the Fed will absorb some Treasury supply that would otherwise fall on private markets, altering the supply-demand balance. However, not all analysts accept this direct comparison. Derek Tang, economist at Monetary Policy Analytics in Washington, argues that while QT termination amplifies the impact of any rate cut by boosting equity risk appetite, he sees the move more as a “gradual adjustment” in balance sheet policy. The decision to end QT is also closely tied to the U.S. Treasury’s debt issuance strategy. Will Compernolle, macro strategist at FHN Financial, notes that after QT ends, the Treasury gains greater flexibility in rebuilding its general account cash balances, while the Fed becomes a “voluntary buyer,” absorbing part of the Treasury demand.

Global Implications: Spillover Effects of Dollar Liquidity

The Fed’s policy shifts are never just domestic matters—their spillover effects profoundly influence global capital markets. Historical experience shows that Fed tightening often coincides with emerging market or global financial crises. However, the end of QT this time may benefit emerging markets. By halting quantitative tightening, the Fed reduces capital outflow pressures on emerging economies, improving their external financing environment. As pressure from tightening dollar liquidity eases, international capital may return to emerging markets in search of higher returns. The trajectory of the U.S. dollar index will also be affected. Narrowing interest rate differentials between the U.S. and other countries due to rate cuts will further weaken dollar appeal. Combined with growing “de-dollarization” sentiment fueled by global trade tensions, the dollar index faces increased downward pressure. This view aligns with Franklin Templeton Investments’ forecast, which expects inflation concerns to limit the Fed’s rate cuts below expectations, leaving the terminal policy rate possibly above 3.5%. Commodity markets may diverge. Gold could continue rising, supported by lower real rates and renewed safe-haven demand. Oil prices, however, remain driven by supply-demand fundamentals, with OPEC+ production cut compliance and Middle East geopolitical risks remaining key marginal drivers—rate cuts likely having limited impact. Outlook: Navigating the Fog of Policy Path

Even as QT draws to a close, the Fed’s future policy path remains uncertain. At the post-meeting press conference in October, Powell stated that officials held “clear differences” on how to proceed in December, making another rate cut at the upcoming meeting far from certain. The Fed’s official calendar shows one final 2025 rate meeting, with a new decision expected on December 11 Beijing time. This meeting will be particularly important, as it may offer more clues about the 2026 policy trajectory. Major institutions differ in their forecasts. Morgan Stanley predicts the Fed will continue cutting rates through January 2026, with two additional cuts in April and July 2026, ultimately bringing the federal funds rate target range down to 3.00%–3.25%. Meanwhile, a research report from CICC estimates that under “normal conditions,” the Fed still has room for three more rate cuts, corresponding to long-end yields of 3.8–4.0%. The firm also notes that while some easing space remains, the pace may slow, and overly optimistic expectations should be avoided. New uncertainties are emerging. CICC points out that the next Fed chair and the central bank’s independence represent the biggest variables for next year’s rate-cut path, potentially increasing policy uncertainty beyond Q2 2026. This suggests political factors could play a larger role in shaping future monetary policy.

Money market funds have reached a record $7.42 trillion in assets, reflecting both the market’s hunger for yield and its flight to safety. After QT ends, these dormant capital giants may reposition themselves, seeking new homes. The Fed will officially halt QT on December 1, but Powell has already made clear that another rate cut at the December meeting is not guaranteed. This very caution reflects the Fed’s delicate balancing act—walking a tightrope between inflation and growth, missing data and forward guidance. The curtain on the liquidity feast has slowly risen, but the duration and ultimate outcome of the banquet will depend on where the real economy finally lands.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News