Before hitting the short sell button, take a look at this OpenEden rating report

TechFlow Selected TechFlow Selected

Before hitting the short sell button, take a look at this OpenEden rating report

OpenEden is an infrastructure designed to connect traditional finance and DeFi.

Author: Stacy Muur

Translation: AididiaoJP, Foresight News

OpenEden is positioning itself as the gold standard for regulated RWA tokenization, bridging institutional-grade finance with DeFi-native composability.

With over $517 million in total value locked (TVL), Moody's "A" rating, S&P "AA+" rating, and partnerships with BNY Mellon and Binance, it has solved the regulation-innovation paradox that most RWA projects fail to address.

A brief overview of the RWA market:

-

The total tokenized RWA market size will reach $1.2 trillion by 2025 (up from $300 billion in 2024)

-

Projected compound annual growth rate of 80-100% by 2025

-

Market potential exceeding $2 trillion by end of 2025

-

Tokenized Treasuries: $150 billion market size (up from $1 billion in 2023)

Therefore, OpenEden’s potential market includes:

-

Treasuries: $26 trillion global market

-

Stablecoins: Over $17 billion market seeking yield

-

DeFi TVL: Over $100 billion seeking RWA exposure

-

Institutional RWA demand: Rapidly growing

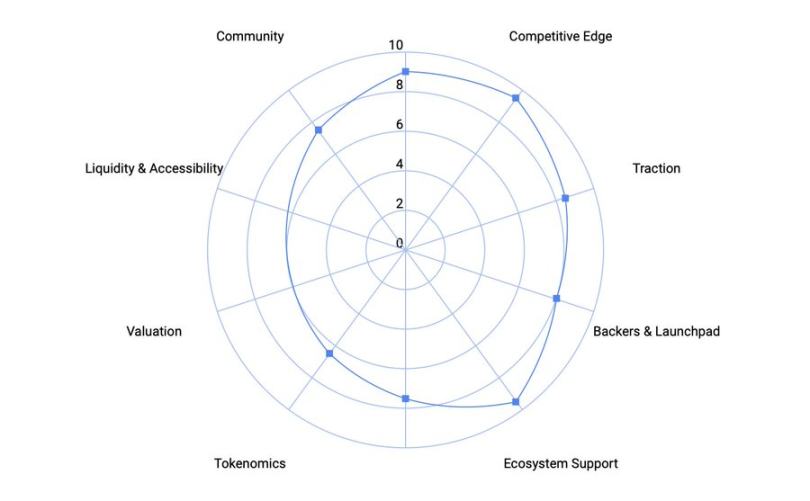

This investment potential analysis of OpenEden uses the Muur Score, my personal framework for evaluating protocols based on impact-weighted parameters.

Part 1: Product Evaluation

Product Maturity Score: 9/10

-

Stage: Mainnet live since 2022, with multiple functional products (TBILL, USDO, cUSDO).

-

Metrics: Over $517 million in combined product TVL, proven integrations within DeFi.

-

Maturity: Zero major security incidents over 3 years, audited infrastructure, consistent yield delivery.

Why 9/10? OpenEden is operating at scale with strong adoption. While not yet achieving Ondo’s billion-dollar dominance, its proven mainnet traction justifies a near-top score.

Competitive Advantage Score: 9.5/10

-

Unique innovation: First tokenized treasury fund to receive both Moody's "A" and S&P "AA+" ratings.

-

Trilemma solved: Regulation + Yield + DeFi Composability—typically impossible to achieve all three, but OpenEden delivers.

-

Moats: Institutional custody and asset management (BNY Mellon), regulatory first-mover advantage, and multi-chain presence.

Why 9.5/10? Clear first-mover advantage in regulated RWA space, backed by deep TradFi relationships and robust DeFi integration. Fast followers cannot easily replicate this.

Market Appeal Score: 8.5/10

-

TVL: TBILL ($260M) and USDO ($257M) totaling $517M.

-

Growth: TBILL up +135% YoY; USDO surging to new highs.

-

Adoption: Binance and Ceffu accept cUSDO as off-exchange collateral; Pendle vaults attract ultra-high APY demand.

-

Multi-chain: Ethereum, Ripple, Polygon, etc.

Why 8.5/10? Explosive growth, institutional adoption, and sustained usage. TVL not yet #1 vs Ondo, but momentum is strong.

Backer Score: 8/10

Backers: YZi Labs, plus strategic support from BNY Mellon and Binance.

Why 8/10? Institutional-grade partners, but no disclosed top-tier crypto-native VCs (e.g., Paradigm/a16z). YZi Labs has been actively investing recently, but not all investments delivered strong retail ROI.

Ecosystem Support Score: 9.5/10

-

DeFi Integrations: Pendle, Curve, Morpho, Euler, Balancer, Spectra.

-

TradFi Partners: BNY Mellon (custody & asset management), Moody's and S&P (ratings), Binance (collateral acceptance).

-

Yield: Active products and vaults are generating returns.

Why 9.5/10? Few RWA projects demonstrate such deep TradFi and DeFi synergy.

Tokenomics Evaluation

Valuation Score: N/A (pre-TGE)

FDV not disclosed; scoring deferred until TGE.

Tokenomics (35%) Score: 6.5/10

-

Unknowns: Allocation ratios, vesting periods, unlock schedules.

-

Positives: Community campaigns (Bills campaign) and token incentives (OpenSeason) suggest fair launch dynamics; institutional conservatism may ensure fairness.

Why 6.5/10? Limited tokenomics data pre-TGE; cautious mid-low score until disclosure.

Utility (30%) Score: 7.5/10

-

Expected utility: Governance, fee sharing from TBILL/USDO, staking, ecosystem incentives.

-

Strengths: Real income capture via fees.

-

Weaknesses: Regulatory constraints may limit utility breadth.

Liquidity & Accessibility (10%) N/A (pre-TGE)

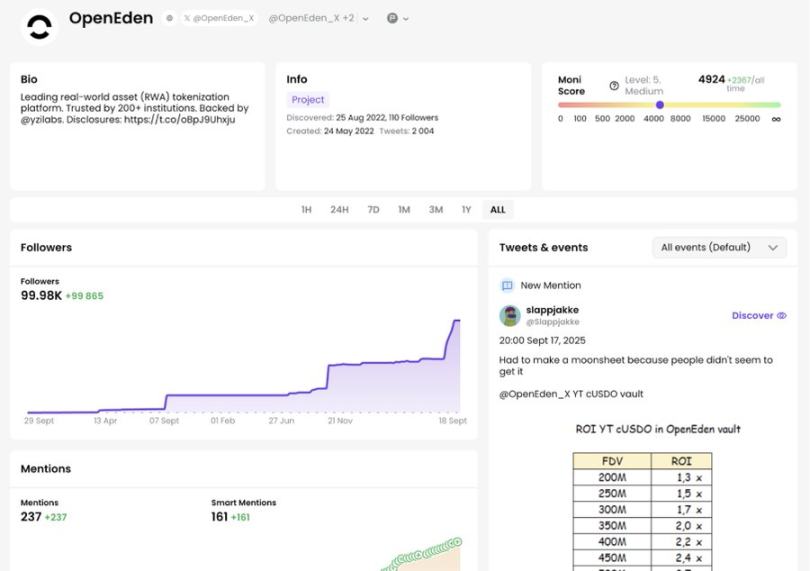

Community & Market Sentiment

Score: 7.5/10

Strong among institutional and DeFi-native users; weaker in retail or viral appeal. Campaigns like OpenSeason are boosting engagement pre-TGE.

Market Context

-

Narrative热度: RWA is one of the hottest narratives in 2025. (Final score +0.5)

-

Market sentiment: Market in "greed" zone, altseason underway. (Final score +0.5)

-

Competition: Intense competition for retail mindshare, especially in RWA category. (Final score -0.5)

Adjustment: Overall +0.5

Final OpenEden Score: 8.27

-

Product: 8.85/10

-

Tokenomics (pre-TGE): 6.96/10

-

Community: 7.5/10

-

Market Adjustment: +0.5

Risk Assessment

Bull Case (55% probability):

-

RWA market experiences sustained exponential growth, OpenEden captures significant market share.

-

Regulatory edge evolves into an insurmountable competitive moat.

-

Institutional adoption accelerates via strategic partnerships with BNY Mellon and Binance.

-

EDEN token appreciates due to increasing fee revenue.

Base Case (20% probability):

-

Adoption remains limited to specific institutional verticals.

-

Moderate growth observed, but token appreciation constrained.

-

Regulatory hurdles impede innovation.

Bear Case (25% probability):

-

Traditional financial institutions develop competing solutions.

-

Regulatory shifts favor larger, incumbent entities.

-

Value from DeFi integrations falls short of expectations.

-

Competition emerges from better-funded or more aggressive market entrants.

Key Risks to Monitor:

-

Regulatory changes impacting RWA tokenization.

-

Competition from traditional finance (e.g., BlackRock, JPMorgan entering the space).

-

Risks associated with integration into DeFi protocols.

-

Current interest rate environment affecting Treasury yields.

Specific Red Flags:

-

TVL concentrated among a few large depositors.

-

Regulatory compliance costs negatively impacting profitability.

-

Token utility limited due to regulatory restrictions.

-

Competition from protocol tokens offering superior yields.

Conclusion

OpenEden is positioned for the future of institutional-grade RWA tokenization, offering a fully regulated platform deeply integrated with DeFi and supported by partnerships with traditional financial entities.

The investment case for OpenEden is strong because:

-

Proven product-market fit: demonstrated by over $517 million in TVL.

-

Regulatory moat: a significant barrier to entry for competitors, nearly impossible to replicate.

-

Institutional partnerships: provide sustainable competitive advantages.

-

DeFi composability: enables yield optimization and broader adoption.

OpenEden is not a speculative project, but an infrastructure investment aimed at connecting traditional finance and DeFi. The upcoming EDEN TGE offers early access to a protocol that could become foundational in the multi-trillion dollar RWA market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News