Prediction market information overload, the aggregator赛道 becomes a new "traffic entry point"

TechFlow Selected TechFlow Selected

Prediction market information overload, the aggregator赛道 becomes a new "traffic entry point"

When a news story extends into multiple predictive topics flowing across different platforms, the aggregator赛道 is entering its moment in the spotlight.

Author: June, TechFlow

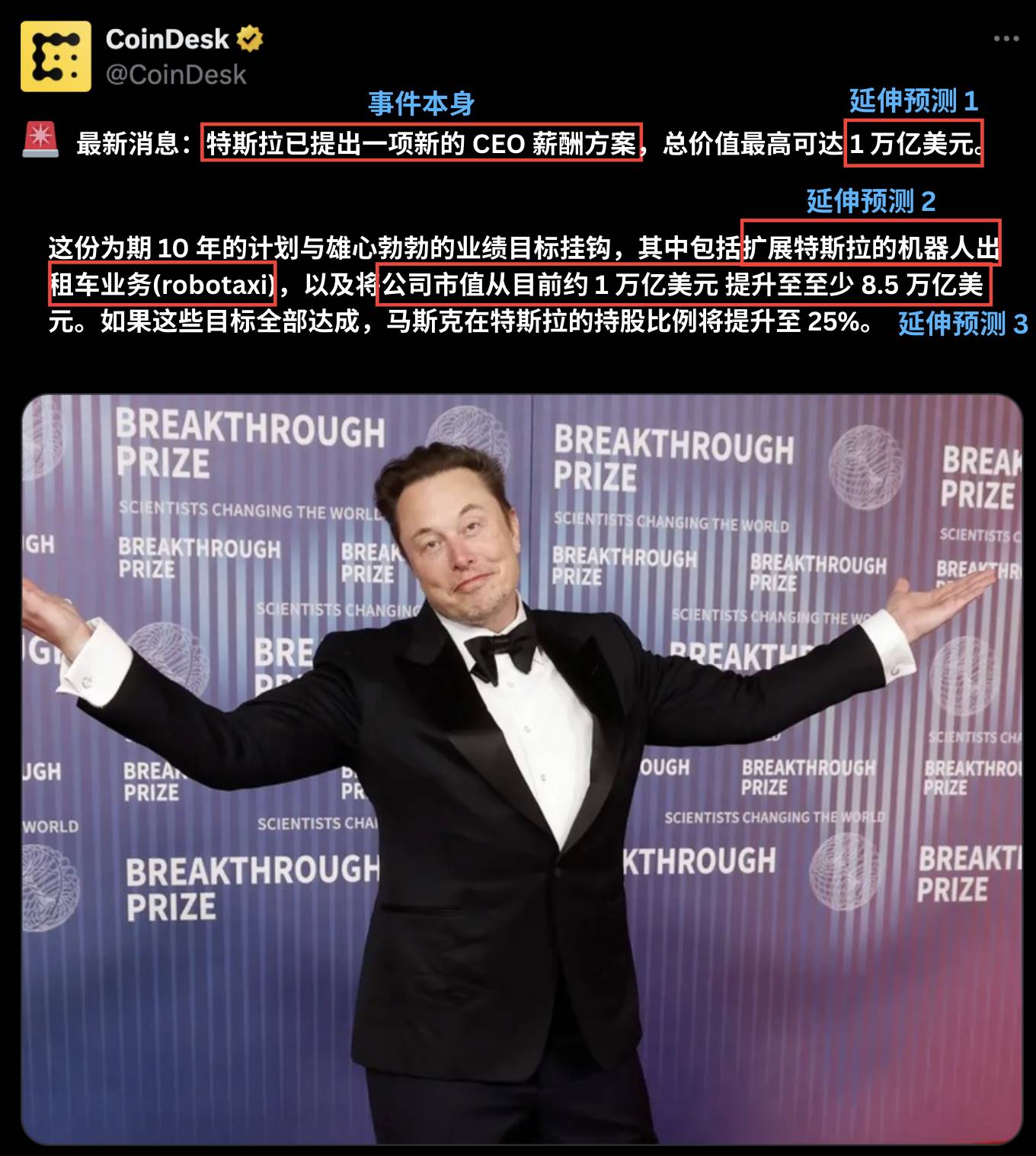

As soon as Musk's compensation plan was announced, traders' fingers were already flying across keyboards. But they weren't rushing to buy Tesla stock—they were searching for related questions on prediction markets.

To them, this single news event spawns a wide array of prediction topics: Who will be the world's first trillionaire? When will Musk surpass a net worth of one trillion? Where is Tesla’s market cap headed this quarter? In which city will Robotaxi launch first?

This is the daily reality for prediction market traders today: behind every news story lie multiple themes and opportunities scattered across various prediction platforms.

Yet in practice, traders must search separately across platforms like Polymarket, Kalshi, and Limitless, compare odds, and monitor price movements.

This single event alone reveals the shortcomings of the current market.

If relevant prediction markets could be automatically matched to news content, trading efficiency would dramatically increase. Conversely, if traders could quickly identify key points after a news release and place precise bets, their win rates would also significantly improve.

The coexistence of multiple platforms presents unprecedented challenges: finding the best odds requires switching between platforms; capturing arbitrage opportunities means simultaneously monitoring price differences across platforms; obtaining comprehensive information demands constant tracking of the latest market news.

This fragmented information not only consumes time and energy but also hinders traders from making optimal decisions.

Trading volume catching up with Meme, but with more noise

Remember the Meme coin explosion earlier this year?

In 2024, the Pumpfun launchpad rose rapidly.

New coins emerged nonstop, launching at an overwhelming pace. Faced with such a vast and fast-growing market, traders were quickly overwhelmed—manually tracking each new project became extremely unrealistic. Amid this chaos, trading bots and aggregation platforms emerged. They helped users filter information, discover opportunities, and simplify complex trading processes.

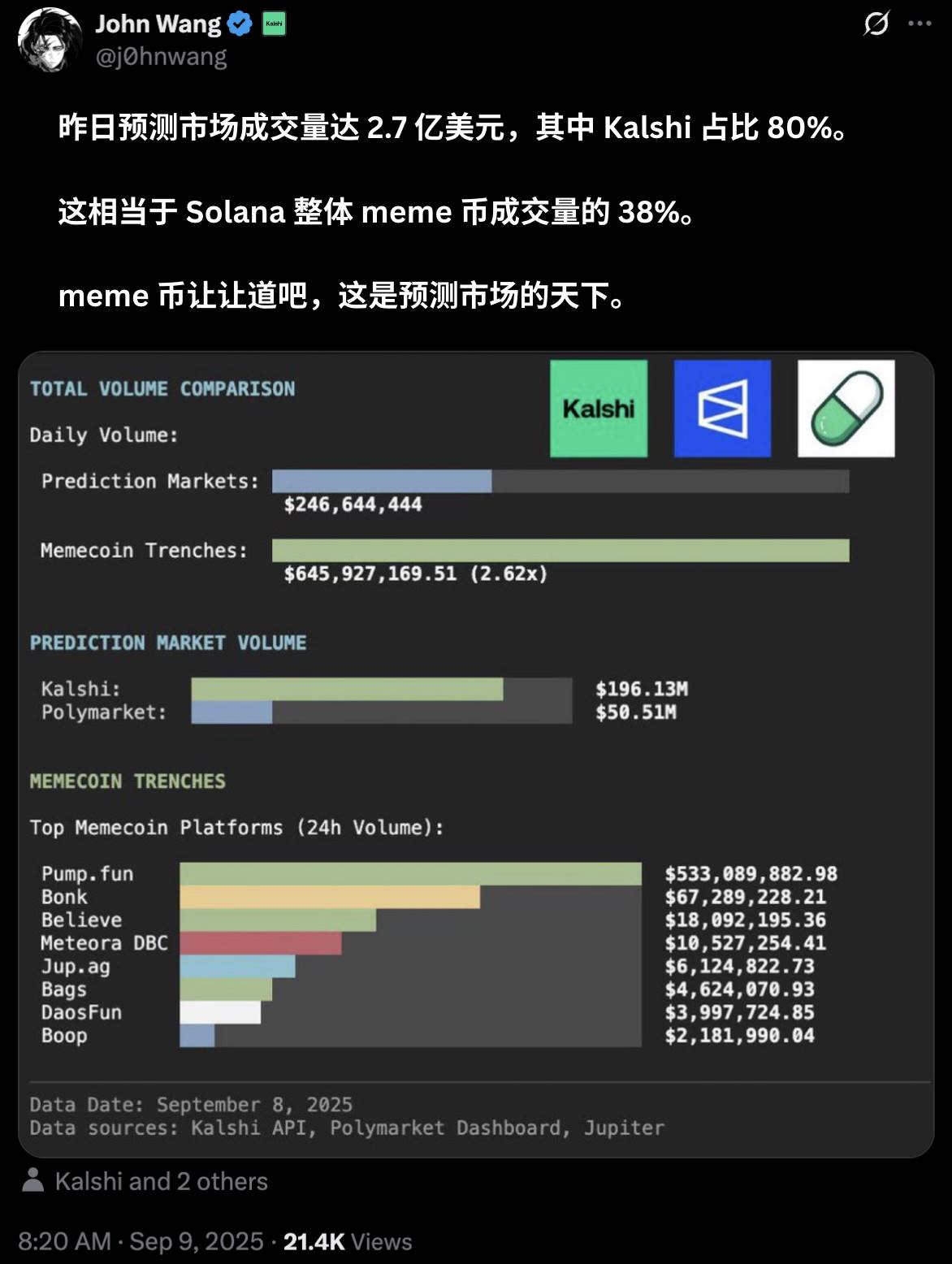

Today, the same scene is playing out in prediction markets. On September 8, daily trading volume in prediction markets reached $270 million, with Kalshi alone accounting for 80%, equivalent to 38% of Solana’s total Meme coin trading volume. Prediction markets are gaining momentum and beginning to challenge the Meme coin market.

As more prediction market platforms emerge, traders once again face the problem of information overload.

When supply exceeds human processing capacity, aggregation and automation tools become essential. This is a process all rapidly growing crypto ecosystems go through.

Right now, prediction markets stand at this inflection point.

Giants battle, contenders rise

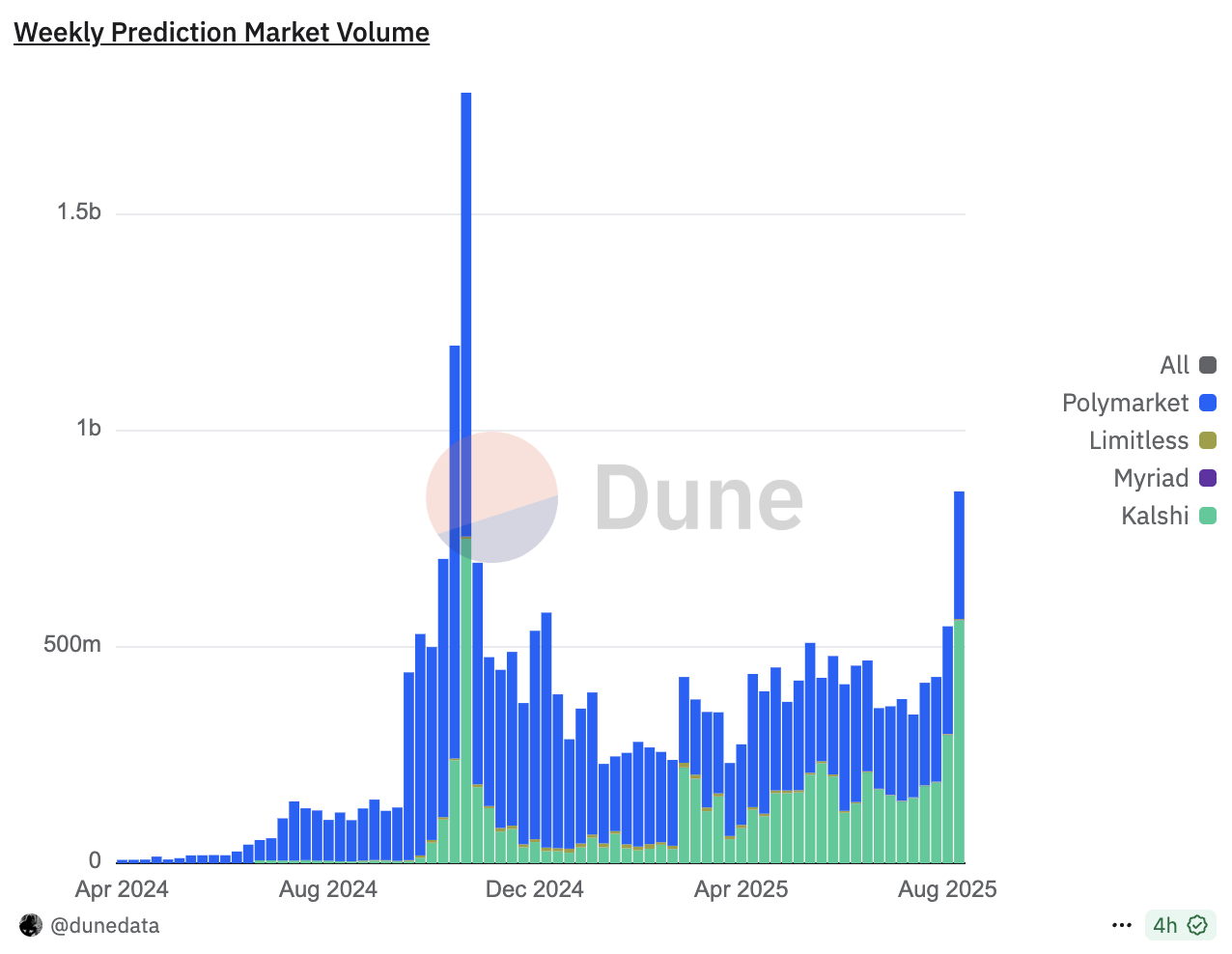

The surge in prediction markets has been evident for months.

In May this year, the U.S. Commodity Futures Trading Commission (CFTC) dropped its appeal against Kalshi. That same month, Kalshi began supporting cryptocurrency deposits—including USDC, RLUSD, SOL, BTC, WLD, and XRP—offering users financial options beyond traditional methods. In June, Kalshi raised $185 million in a Series C round led by Paradigm, reaching a $2 billion valuation and officially joining the unicorn ranks.

Meanwhile, Polymarket is reportedly raising around $200 million at a valuation exceeding $1 billion, drawing strong interest from capital. However, Polymarket’s journey in the U.S. has been rocky. In 2022, it was fined $1.4 million by the CFTC for operating an unregistered binary options market and was forced to restrict access for U.S. users.

Just as it gained fame for accurately predicting the outcome of the 2024 U.S. presidential election, the FBI suddenly showed up eight days later and seized founder Coplan’s computer and phone. The plot twisted during Trump’s administration. The judicial investigation abruptly ended, and Polymarket obtained a "ticket back to the U.S." by acquiring QCEX, receiving formal green light from the CFTC on September 4.

With regulatory easing and capital support reinforcing each other, ideal conditions have been created for the breakout of the prediction market sector.

At the same time, the competitive landscape is quietly shifting. After hiring well-known crypto KOL John Wang as Head of Crypto, Kalshi has performed impressively. Since August 25, its weekly trading volume has begun surpassing Polymarket’s, intensifying the rivalry between the two giants.

While giants battle, new competitors are already stirring: MyriadMarkets (founded by Farokh, creator of Rug Radio and Decrypt Media), Truemarkets, HedgehogMarket, DriftProtocol, and Limitless.

Prediction markets are rapidly reshaping, and these platforms all want a piece of the booming pie.

Just as the early “Meme chaos” gave rise to tools—from Bananabot to GMGN, then Axiom and others—the ongoing prediction market war is creating massive demand for aggregators.

Early forms of aggregators emerge

The pain points described at the beginning have given rise to a wave of innovative solutions. Though most are still in beta, they already show great potential.

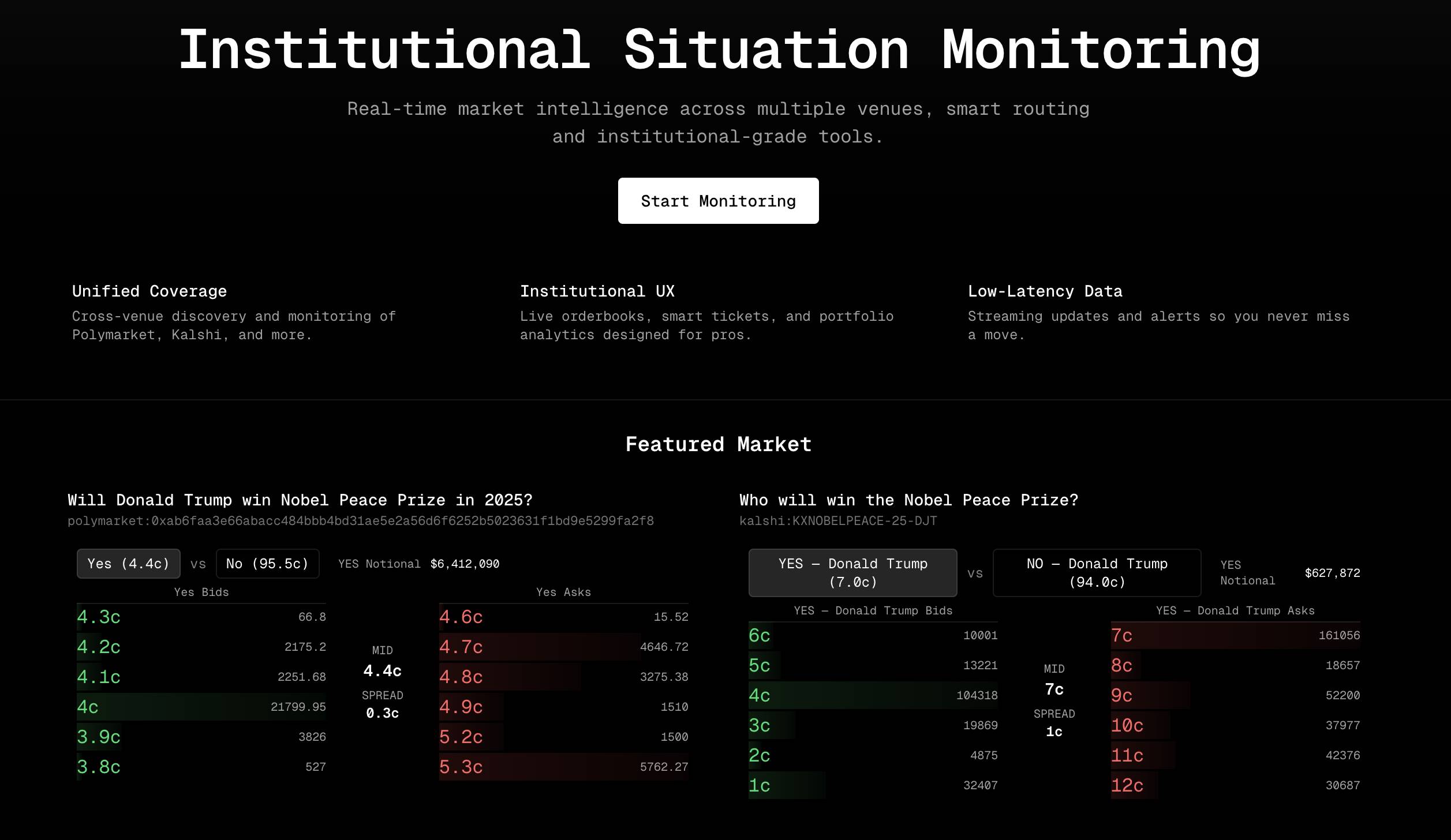

@rileyxcook's monitorthesituation.lol enables cross-platform real-time order book display and automatically matches similar markets across Kalshi, Limitless, and Polymarket, allowing traders to instantly spot price discrepancies.

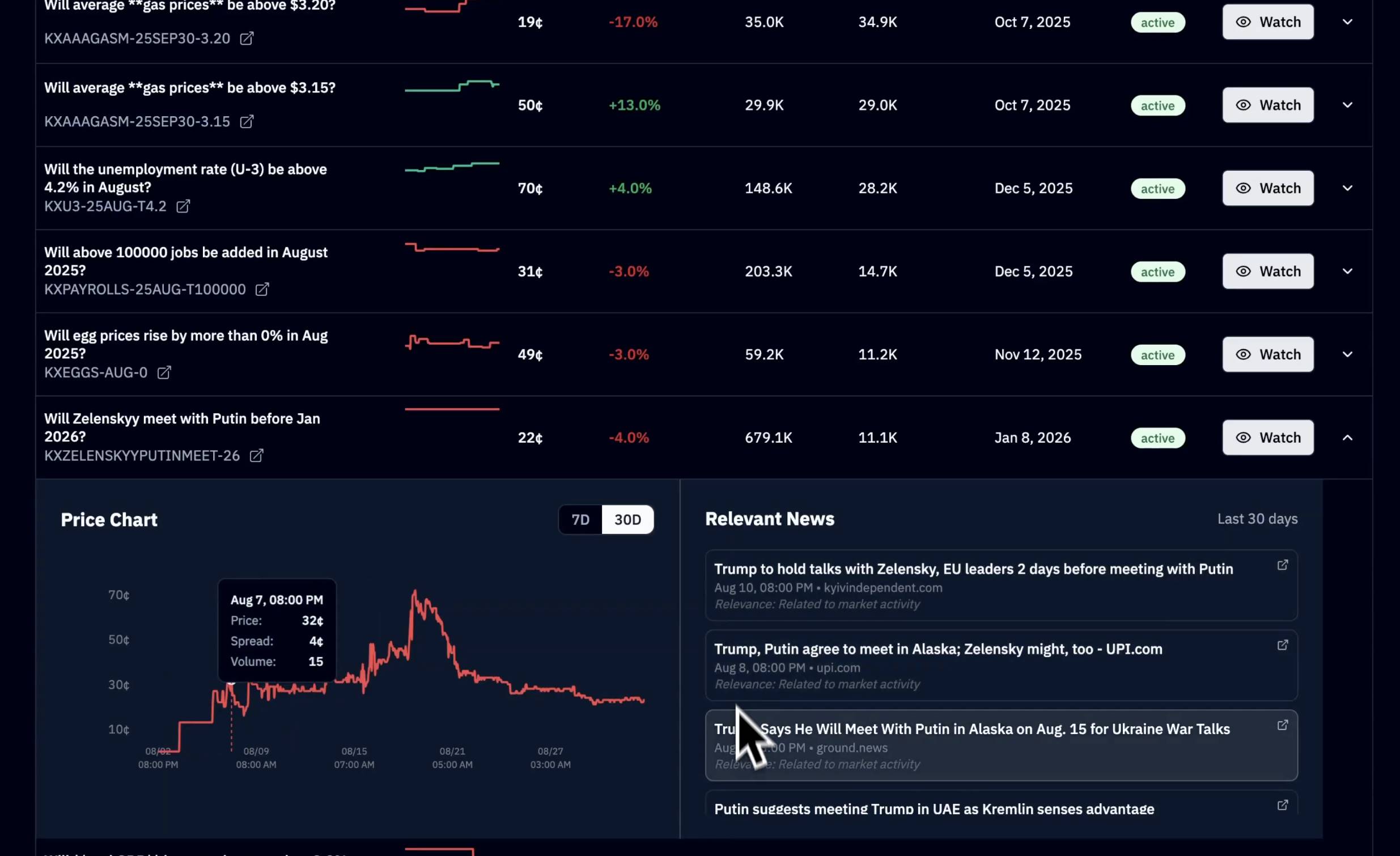

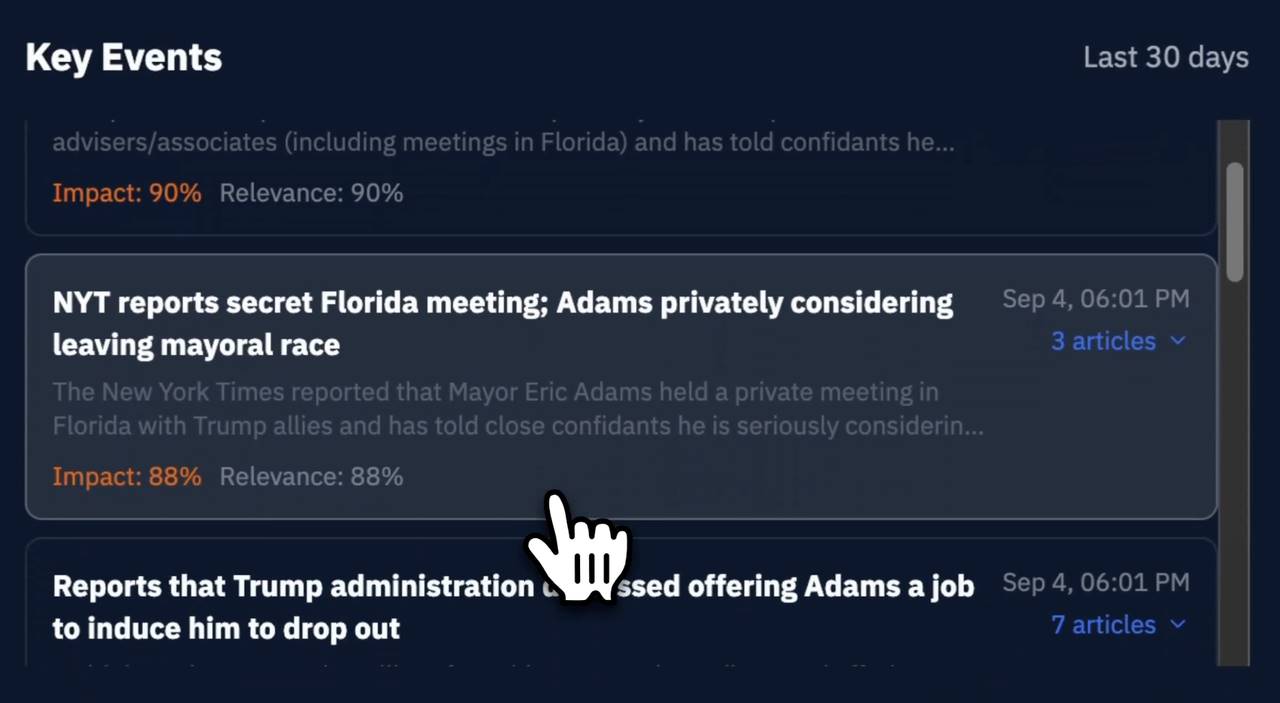

Verso Trading has built a smarter news engine that consolidates repetitive headlines into single events and provides impact and relevance scores. This lets users see which news truly affects Kalshi contract prices. The platform is also about to launch low-latency real-time alerts, notifying users immediately when news or tweets might influence the market.

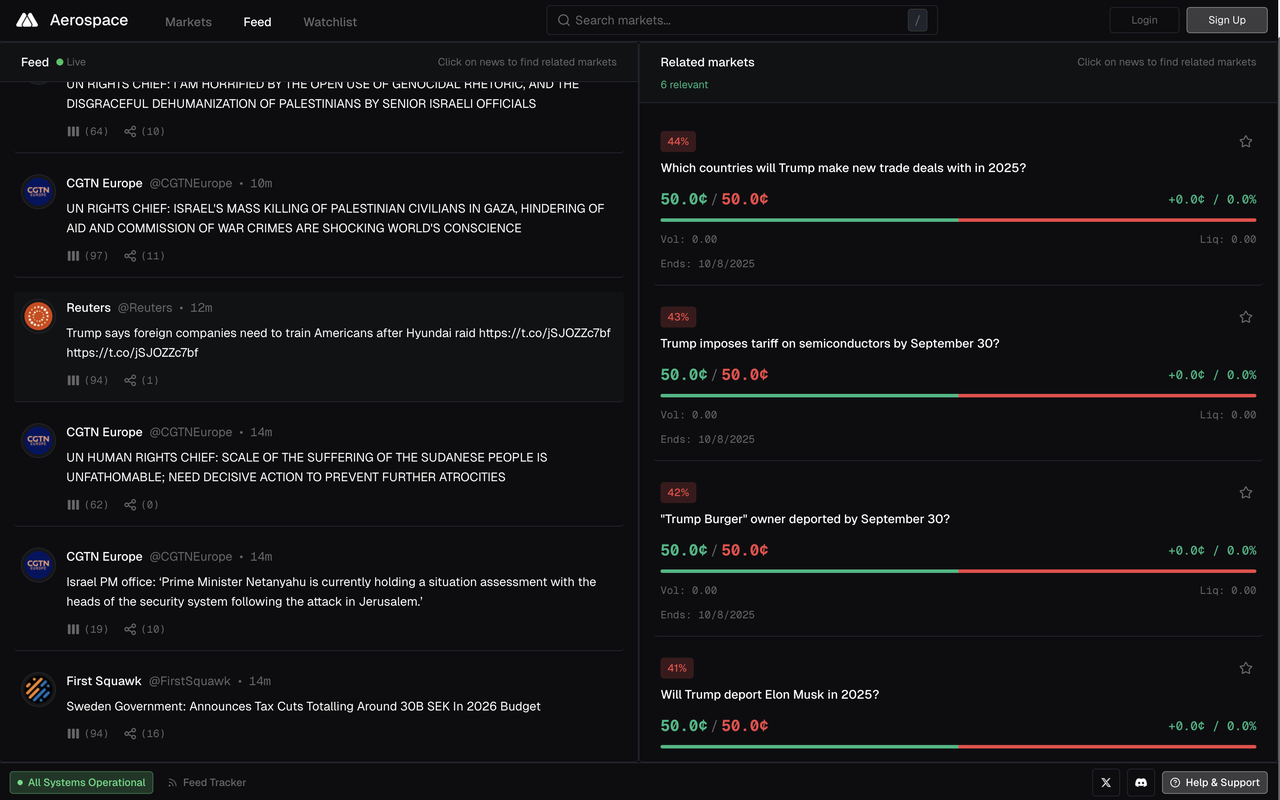

16-year-old engineer @agpkeleta built Aerospace, a prediction market trading terminal with real-time news feeds that precisely matches alpha information to relevant markets. This allows traders to quickly seize market opportunities based on confirmed outcomes before a market resolves to "yes." Currently, the site supports only Polymarket, with Kalshi support coming soon.

All these tools address the same core issue: integrating news with relevant prediction markets on a unified platform to facilitate complex trading. While still in early stages, these beta versions have already demonstrated the value proposition of aggregators.

Outlook: Greater opportunities ahead

Where there’s a market gap, opportunity follows.

The rise of prediction market aggregators is no accident—it’s an inevitable outcome of a thriving ecosystem.

A flourishing ecosystem requires diversified infrastructure, a pattern we’ve seen before during the Meme coin boom. As core asset classes mature, tools, analytics platforms, and automation solutions spring up around them, eventually forming a complete ecological loop.

Prediction markets may now be approaching the same tipping point.

With more platforms emerging and user bases expanding, the demand for specialized tools will only grow stronger.

Aggregators might just be the beginning.

We’re likely to see more innovations—cross-platform arbitrage bots, AI-driven market analysis tools, institutional-grade risk management systems, and more. Prediction markets are no longer just simple "bets"; they’re evolving into a complex trading ecosystem requiring professional tools and deep analysis. Projects that provide core infrastructure during this transition are likely to become the most important components of this emerging ecosystem.

Bonus: Since this is a prediction market, why not let AI make a prediction too? The author asked AI to boldly envision the future of this space. Here’s what it said.

Short-term (6–12 months):

-

The aggregator battle begins

-

Polymarket vs Kalshi escalation: both will launch more similar markets, directly competing head-to-head, leading users to see fierce price wars on the same events across platforms

-

New platforms will “copy homework”: frantically replicating popular markets, causing severe homogenization

Mid-term (1–2 years):

-

API integration becomes standard: successful aggregators will force platforms to offer better APIs, or risk losing traffic

-

Institutional players enter: hedge funds and quant teams will begin large-scale arbitrage in prediction markets, reducing retail advantages

-

Vertical specialization emerges: dedicated sports, politics, and crypto prediction markets will rise, causing general-purpose platforms to fragment

Long-term (3–5 years):

-

Platform consolidation: only 2–3 major platforms will remain; others will either be acquired or fail

-

Aggregators become “super entrances”: top aggregators may launch their own markets, becoming both channel and platform

-

AI-driven prediction goes mainstream: AI analyzes news and social media data to place automated bets, turning manual prediction into a niche hobby

Bold prediction: Future prediction market aggregators will resemble today’s brokerages—not just displaying prices, but offering leverage, options, portfolio investing, and other financial tools. At that point, prediction markets will truly become a mature financial category.

Which of these predictions do you think is most likely to come true?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News