IOSG: Crypto vs. Stocks: Are SBET and BTCM Innovation or Bubble?

TechFlow Selected TechFlow Selected

IOSG: Crypto vs. Stocks: Are SBET and BTCM Innovation or Bubble?

Most reserve projects lack sustainable advantages, with long-term NAV premiums or relative quality advantages fading over time.

Author: Sam, IOSG

TL;DR

-

High concentration of holdings: MSTR accounts for 2.865% of total BTC held by public companies; holdings outside the Top 10 are relatively low

-

Severe project homogenization: Most reserve projects lack sustainable advantages; long-term NAV premiums may erode compared to higher-quality peers

-

Valuation bubbles emerging: NAV multiples generally >2× (only a few <1×), stock prices sensitive to announcements, and bear market risks can quickly erode premiums

-

Metaplanet raises capital via zero-coupon convertible bonds + SARs, profiting from the 20% dividend tax vs. 55% Bitcoin transaction tax differential

-

SPAC/PIPE/convertible bonds/physical commitments are mainstream; TwentyOne and ProCap achieve full funding immediately upon listing through multi-step mergers

-

SharpLink raises over $838 million in financing, nearly fully pledges ETH, Joseph Lubin joins the board, and completes an OTC transaction of 10,000 ETH with Ethereum Foundation.

-

BTCS innovatively borrows USDT from Aave to buy and stake ETH, making it sensitive to borrowing rates and on-chain liquidity

-

Crypto funds deploy strategic reserve stocks via PIPE and similar methods, establishing dedicated funds; industry veterans serve as strategic advisors, offering practical support and expertise.

Introduction

The frenzy around public companies adopting cryptocurrency reserve strategies shows no sign of slowing. Some view this as a last-ditch effort to save their business, others simply copy MicroStrategy’s playbook, while a few genuinely innovative projects stand out.

This article explores the leaders in the Bitcoin and Ethereum strategic reserve space—analyzing how they offer alternatives to spot ETFs, deploy complex financing structures, achieve tax optimization, generate staking yields, integrate with DeFi ecosystems, and leverage unique competitive advantages.

Bitcoin

Overview

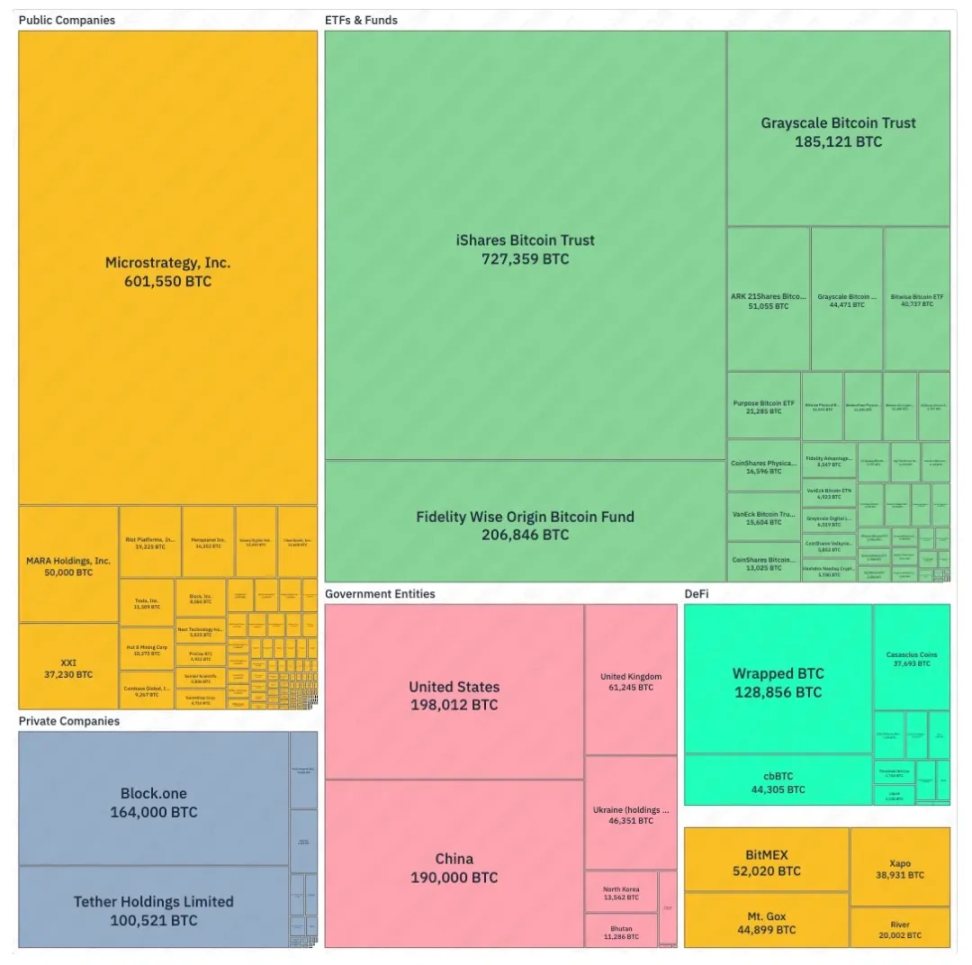

According to the treemap from BitcoinTreasuries.net, among entities publicly disclosing holdings, MicroStrategy has rapidly become the largest corporate holder—second only to iShares Bitcoin Trust—controlling nearly 2.865% of the 21 million total supply today alone.

▲ bitcointreasuries.net

Nonetheless, ETFs and trusts remain dominant, led by iShares, Fidelity, and Grayscale. At the sovereign level, the United States and China hold the most Bitcoin, with Ukraine also maintaining substantial reserves. Among private companies, Block.one and Tether Holdings rank at the top.

In all Bitcoin-holding entities, the U.S. and Canada lead, followed by the UK. Notably, Japan's Metaplanet (ranked 5th) and China's Next Technology Holding (ranked 12th) are also worth watching.

▲ bitcointreasuries.net

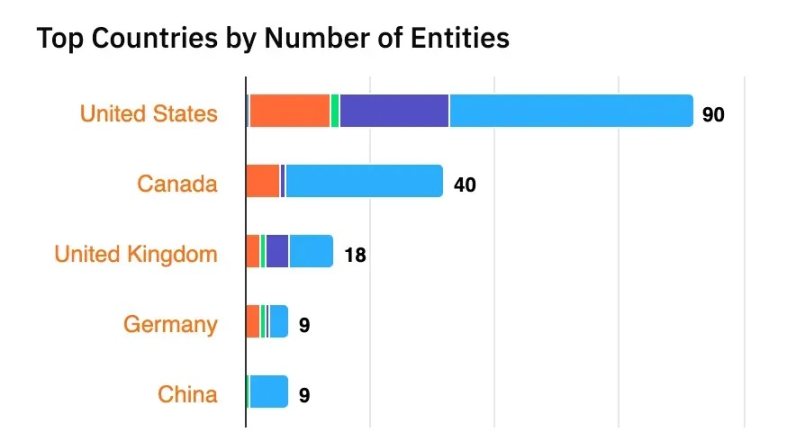

The following list shows the top 30 publicly traded companies holding Bitcoin, with MicroStrategy clearly leading.

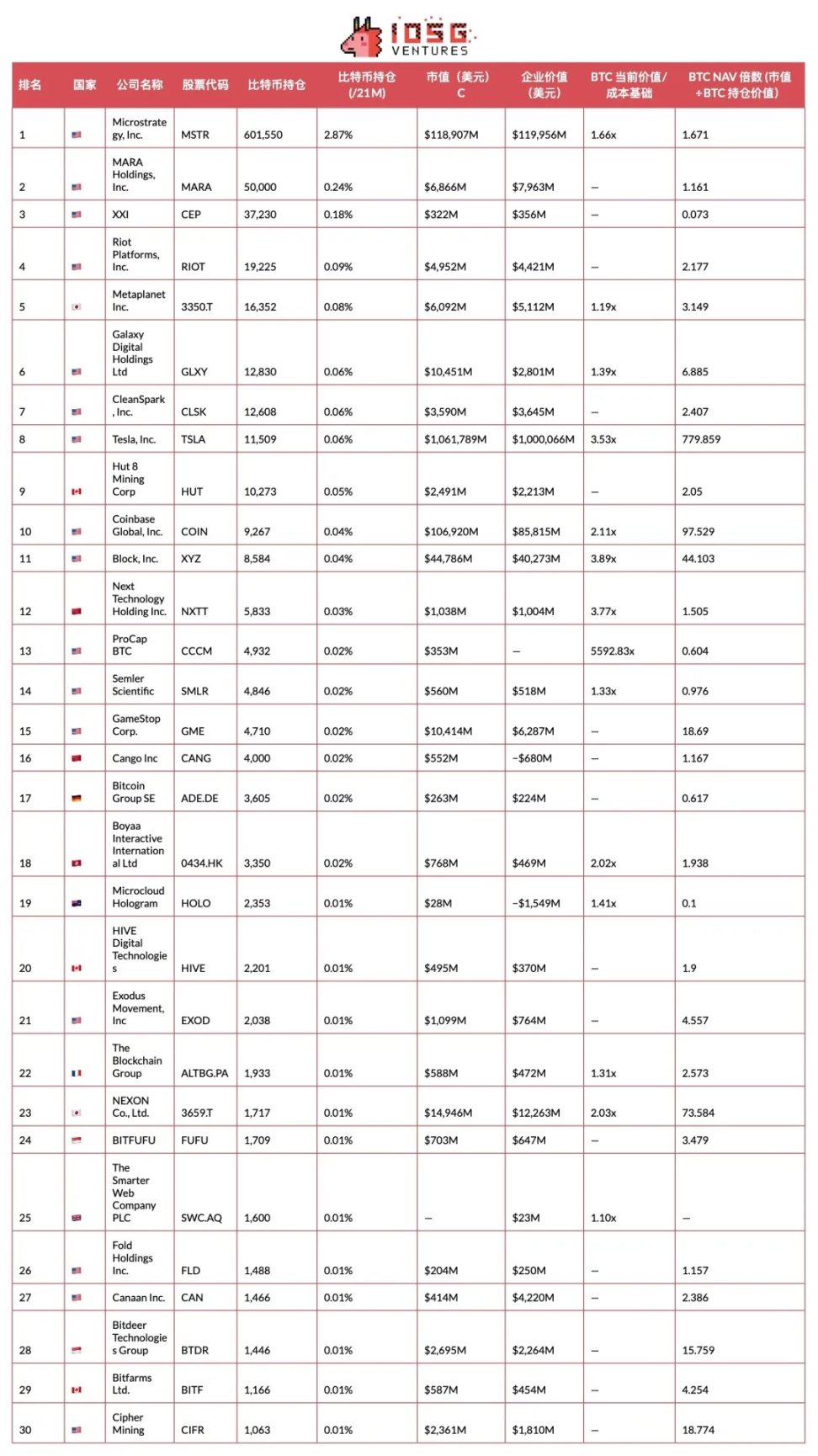

Even excluding MicroStrategy, MARA and Twenty One Capital still rank high, but holdings remain highly concentrated—most companies outside the top ten hold only moderate amounts relative to the leaders.

▲ bitcointreasuries.net, IOSG

Two metrics are particularly important when evaluating public companies’ Bitcoin reserves:

Market Value to Cost Ratio

Compares the current USD value of Bitcoin holdings against initial purchase cost. A higher ratio indicates significant unrealized gains—boosting returns and providing a buffer against market volatility.

Bitcoin Net Asset Value Multiple (BTC NAV Multiple)

mNAV is calculated by dividing a company’s market cap by the USD value of its Bitcoin reserves; some companies report mNAV using enterprise value (EV) instead of market cap.

This multiple reflects investor premium assigned to a company’s core business beyond its crypto assets.

-

When mNAV > 1, the market values the company above its Bitcoin holdings, indicating investors pay a premium per unit of "Bitcoin held."

-

Critically, mNAV > 1 enables anti-dilutive financing: when mNAV > 1, a company can issue new shares → buy Bitcoin → increase Bitcoin NAV → grow enterprise value (EV) while increasing Bitcoin per share.

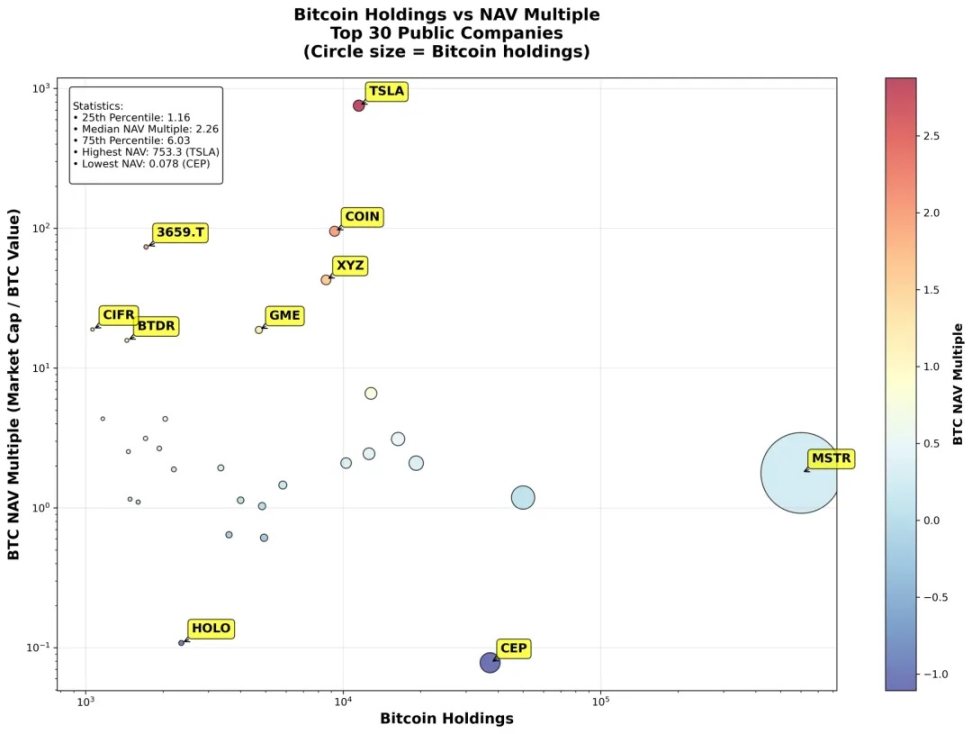

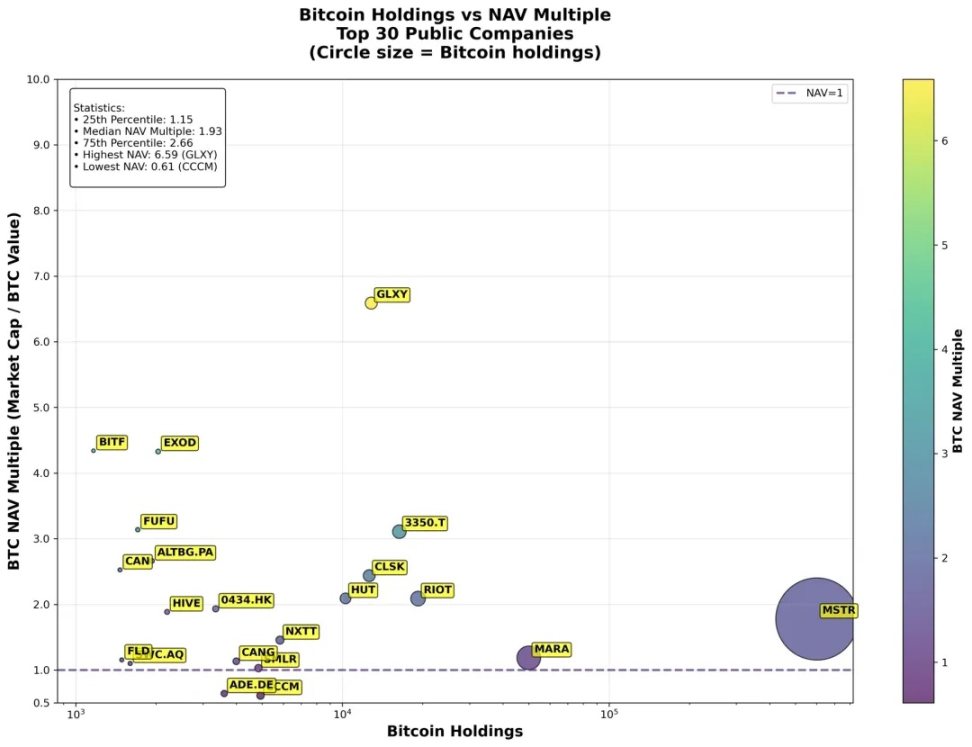

An analysis of NAV multiples among the top 30 companies reveals distinct clusters, such as Tesla (TSLA) and Coinbase (COIN). These companies are not primarily focused on Bitcoin reserves and have other core businesses, hence their higher NAV multiples.

▲ bitcointreasuries.net, IOSG

After removing non-Bitcoin-reserve companies, most actually trade at high NAV multiples—many exceeding 2×. Only four are below NAV = 1, and large holders like MSTR and MARA do not exhibit the extreme multiples seen in smaller firms.

▲ bitcointreasuries.net, IOSG

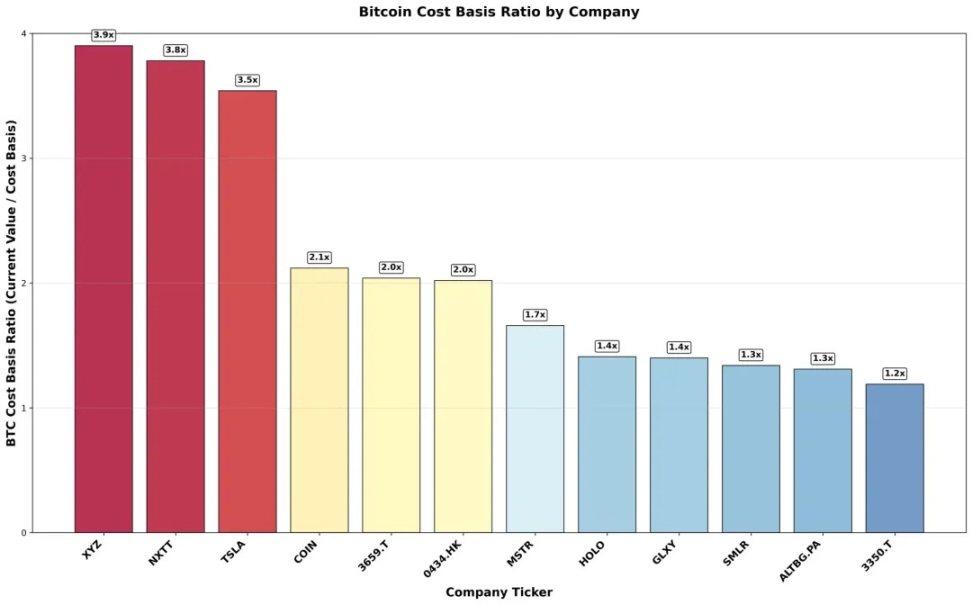

Data from BitcoinTreasuries.net shows that companies providing comprehensive public disclosures indeed show high cost basis ratios, reflecting substantial unrealized gains—likely because more profitable firms are inclined to disclose.

▲ bitcointreasuries.net, IOSG

Metaplanet Inc. (MPLAN)

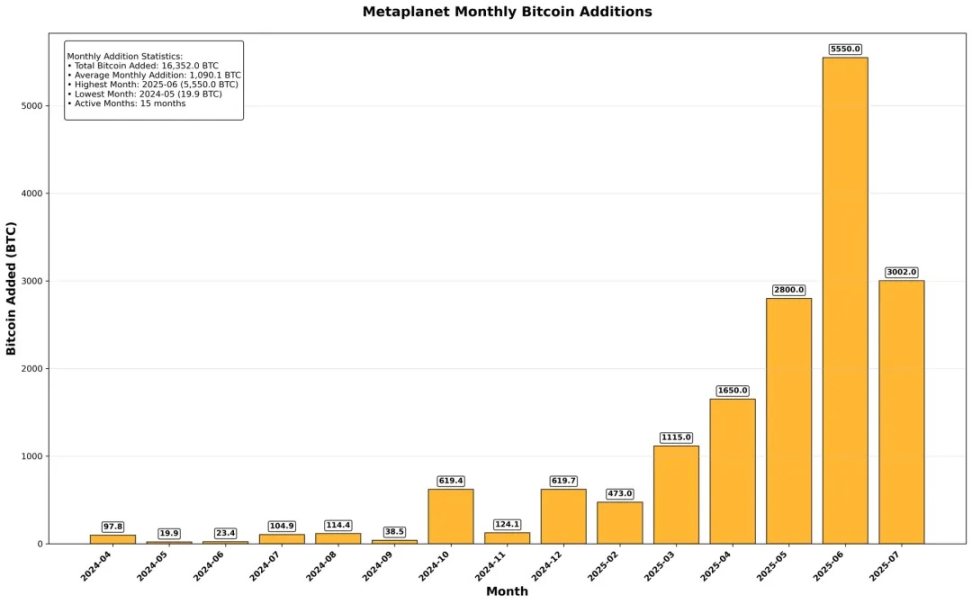

Among numerous public companies emulating MicroStrategy’s strategy, one Japanese firm stands out—Metaplanet. To date, it has accumulated 16,352 BTC, ranking among the top five publicly listed Bitcoin holders, significantly accelerating purchases over recent months.

▲ bitcointreasuries.net, IOSG

As described by itself: “raised $500 million in equity capital,” “Japan’s largest equity issuer in 2025,” “the largest zero-cost financing in history.”

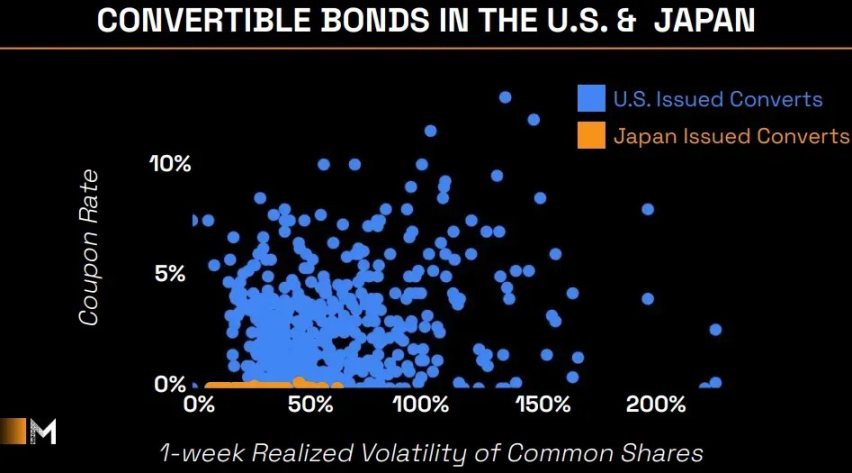

Japan has maintained low interest rates for years, only raising them to 0.25% in July 2024 and again to 0.5% in January 2025, where they currently remain. This interest rate gap is mirrored in the convertible bond market: as shown in Metaplanet’s chart, U.S.-issued convertibles typically carry higher coupons, while Japanese-issued ones have extremely low rates and lower volatility.

▲ Metaplanet Investor Deck

Despite Japan’s generally low market rates, Metaplanet’s “zero-interest financing” is not cost-free—the company balances costs by granting stock appreciation rights (SARs).

▲ Metaplanet Analytics

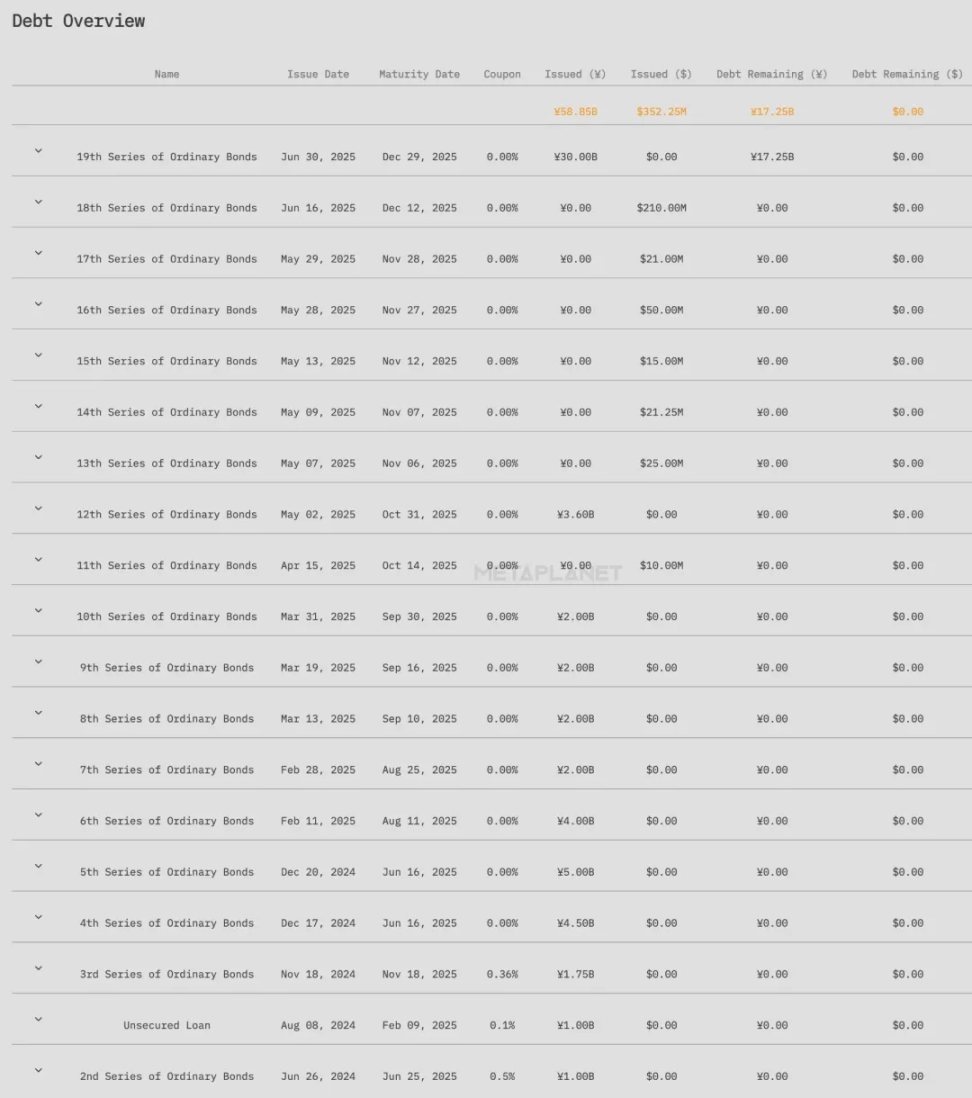

Metaplanet first raises cash by issuing six-month zero-coupon bonds at par. To ensure solvency, the company simultaneously grants an equivalent number of stock appreciation rights (SARs) to the EVO fund under the same board resolution.

The bond covenant stipulates that upon maturity, Metaplanet must use the cash received from EVO exercising these SARs at a floating strike price as the sole source to redeem the bonds.

Through this structure, Metaplanet avoids any periodic interest payments.

EVO Fund’s returns are secured through dual mechanisms:

-

Principal protection: full repayment in cash at maturity, eliminating downside risk from falling stock prices;

-

Upside gain: when Metaplanet’s stock price exceeds the floating strike price, EVO earns the difference between market price and strike price by exercising SARs.

▲ Metaplanet Investor Deck

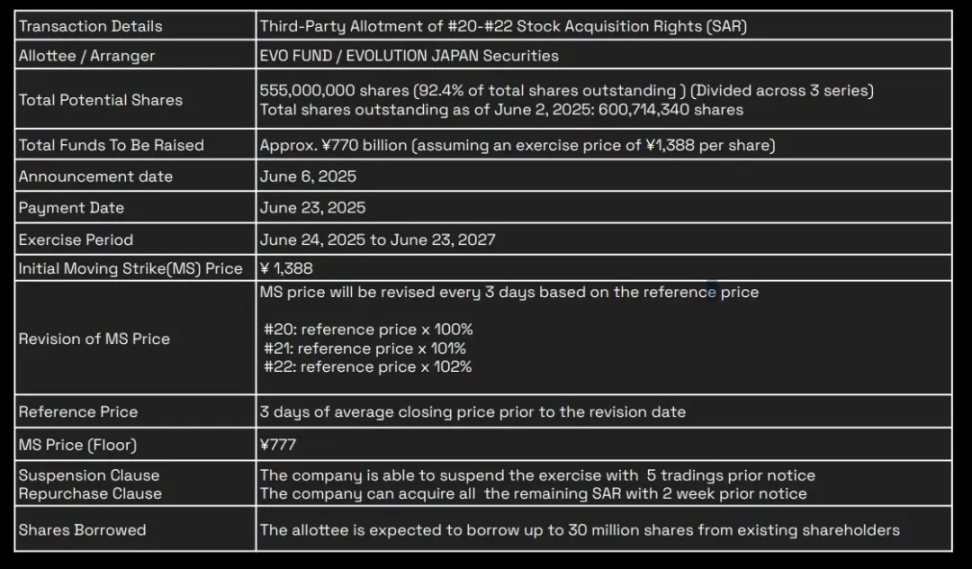

The “55.5 billion yen plan” launched on June 6, 2025 (SARs #20–#22) is Metaplanet’s largest single financing to date. It issued 555 million SARs—equivalent to 92.4% of the 600.7 million outstanding shares—with potential proceeds up to 770 billion yen upon full exercise. The initial floating strike price is set at ¥1,388 per share, reset every three trading days to 100%/101%/102% of the prior three-day average closing price, but never below a guaranteed floor of ¥777.

EVO Fund can exercise anytime between June 24, 2025, and June 23, 2027, triggering new share issuance and cash inflow to Metaplanet. To manage dilution and market impact, Metaplanet can suspend exercises with five trading days’ notice or repurchase unexercised portions with two weeks’ notice.

Tax advantages form another core value proposition: in Japan, capital gains and dividends are taxed at a flat ~20%, while Bitcoin trading profits are classified as miscellaneous income, subject to progressive national taxes of 5%-45%, plus a 10% local inhabitant tax (and applicable surcharges), resulting in a combined rate as high as 55%. For high-income investors seeking Bitcoin exposure, Metaplanet becomes a highly attractive alternative—especially since Japan has not yet approved spot Bitcoin ETFs.

▲ Metaplanet Investor Deck

Metaplanet has historically traded at high mNAV multiples—typically exceeding 5×, peaking at 20×—far above other major holders. While this premium reflects investor confidence in its financing structure, tax benefits, and optimized Bitcoin returns, it also brings higher risk and suggests potential stock overvaluation.

Other Bitcoin Reserve Companies: Riding the SPAC Wave

Multiple companies are racing to emulate MicroStrategy’s Bitcoin reserve strategy. Notably, SPACs like Twenty One Capital (ranked 3rd) and ProCap Financial (ranked 13th) have used complex fundraising architectures to instantly become top-tier holders post-merger.

Twenty One Capital, Inc.

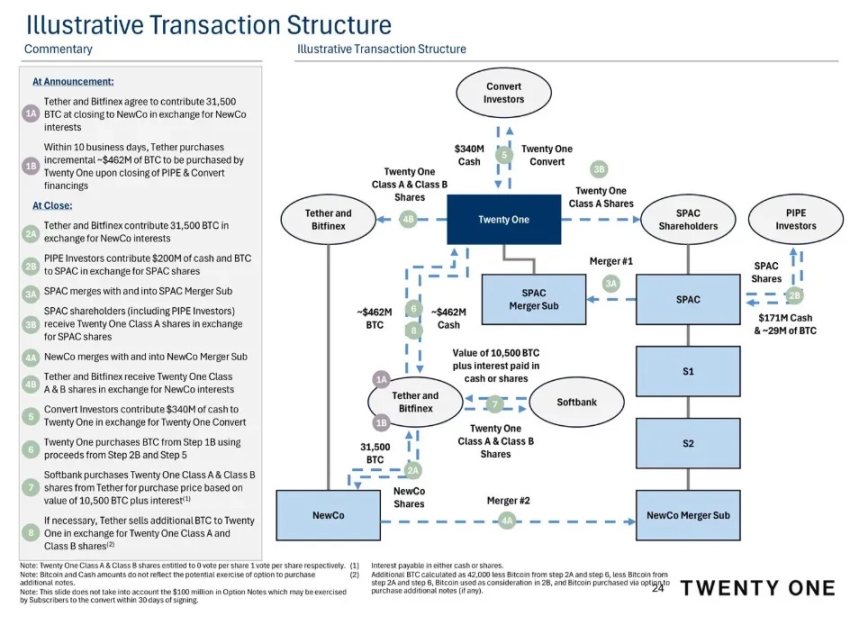

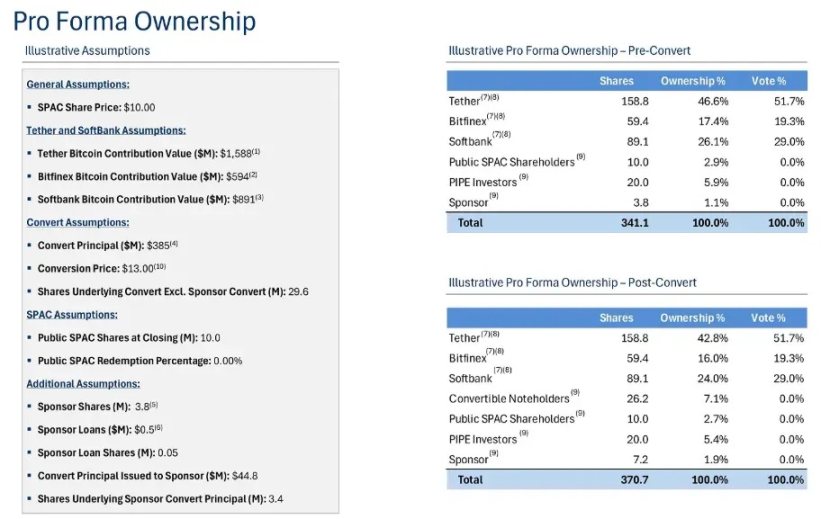

Co-founded by Strike CEO Jack Mallers. Twenty One’s SPAC path combines physical Bitcoin commitments, PIPE and convertible debt financing, and a two-step merger structure, enabling the company to launch on Nasdaq with a fully funded reserve of 42,000 BTC.

The deal began with Tether and Bitfinex committing 31,500 BTC to a private entity called NewCo, while Tether additionally spent $462 million buying Bitcoin. A $200 million PIPE funded the SPAC trust, which merged into its subsidiary and issued Class A shares to SPAC and PIPE investors.

Simultaneously, NewCo merged with the same subsidiary via share exchange, swapping Class A and B shares. Concurrently, a $340 million convertible note financing was directly injected into Twenty One. Twenty One then used proceeds from PIPE and convertible notes to repurchase the committed Bitcoin from Tether and Bitfinex. SoftBank, as a strategic anchor, subscribed equity worth 10,500 BTC; if final reserves fall short of 42,000 BTC, Tether will cover the shortfall.

▲ Twenty One Investor Deck

Post-SPAC merger, Twenty One’s controlling stake will be primarily held by Tether and its affiliated exchange Bitfinex, with SoftBank Group holding a significant minority.

▲ Twenty One Investor Deck

Prior to the merger, Tether and Bitfinex each committed large amounts of Bitcoin in exchange for newly issued shares, ultimately holding controlling stakes (Tether 42.8%, Bitfinex 16.0%). SoftBank later purchased stock worth 10,500 BTC at the same price, securing a comparable ownership share (24.0%). In contrast, SPAC trust cash (~$100 million) and PIPE/convertible note holdings represent smaller stakes.

ProCap BTC (PCAP)

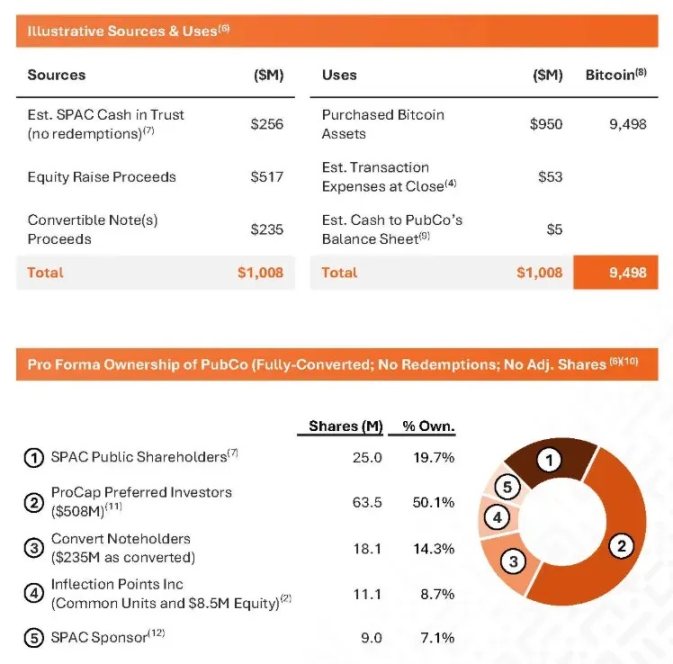

ProCap Financial raised $1.008 billion to launch its Bitcoin reserve platform—$256 million from SPAC trust (assuming minimal redemptions), $517 million from preferred share PIPE, and $235 million from zero-coupon, senior secured convertible notes. Nearly 95% of total proceeds ($950 million) were immediately deployed to acquire 9,498 BTC.

▲ ProCap BTC Investor Deck

Public SPAC shareholders exchanged $256 million in trust for 25 million shares (19.7%); $517 million preferred share PIPE led by Magnetar Capital, ParaFi, Blockchain.com Ventures, Arrington Capital, GSR, Primitive Ventures, etc., issued 63.5 million shares (50.1%); $235 million zero-coupon, senior secured convertible notes converted into 18.1 million shares (14.3%); Inflection Points Inc. exchanged existing shares and added $8.5 million in equity subscription for 11.1 million shares (8.7%); SPAC sponsors retained 9 million promote shares (7.1%).

Although SPACs generally underperform, Bitcoin reserve SPACs are recognized for transparency in holdings and cost basis. Their S-1/S-4 filings thoroughly disclose cash contributions, equity allocations, and in-kind Bitcoin valuations (e.g., Twenty One’s $200 million PIPE at $10/share warrant strike, $385 million zero-coupon convertible notes at $13/share conversion, with pre/post-conversion share counts clearly listed). Since these firms share a similar “buy and hold Bitcoin” business model, such disclosures provide reliable benchmarks for investors to assess dilution, cost basis, and reserve composition.

Compared to recent SPACs relying on complex structures, early adopters like Next Technology Holding built reserves through more direct equity-for-cash transactions.

Meanwhile, GameStop’s move stands out: on May 28, 2025, the retailer with $4.8 billion in cash announced it had acquired 4,710 BTC for approximately $513 million as part of its digital asset strategy.

Cash-Rich Crypto Platforms

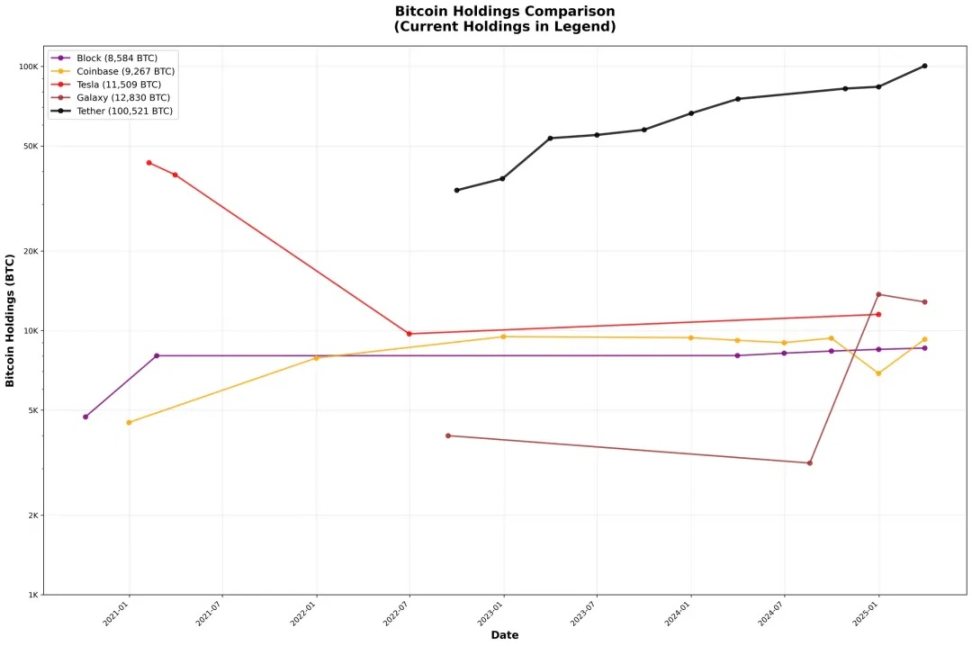

While many firms emulate MicroStrategy’s all-in Bitcoin approach, several native crypto platforms continue steadily investing in digital assets, occasionally joined by one-off large buyers like Tesla.

▲ bitcointreasuries.net, IOSG

Tether, issuer of USDT, has actively added Bitcoin to its reserves since late 2022, allocating up to 15% of quarterly net profits to direct market purchases and renewable-energy mining investments. As CTO Paolo Ardoino stated: “By holding Bitcoin, we add a long-term asset with upside potential to our reserves,” and noted the move “strengthens market confidence in USDT by diversifying reserves into digital asset stores of value.” Consequently, Tether’s Bitcoin holdings have grown quarterly since 2023—now doubling to over 100,000 BTC, accumulating ~$3.9 billion in unrealized gains.

Block (formerly Square) made its first “bet” in October 2020—buying 4,709 BTC for $50 million, about 1% of its assets at the time. In Q1 2021, it added $170 million (3,318 BTC), bringing reserves above 8,000 BTC. Since then, Block has maintained its Bitcoin position. In April 2024, Block launched a corporate dollar-cost averaging program, allocating 10% of monthly Bitcoin product gross profit to systematic OTC purchases executed at a two-hour weighted average price.

Coinbase formally established its corporate Bitcoin strategy in August 2021, with its board approving a one-time $500 million digital asset purchase and committing 10% of quarterly net income to a portfolio including Bitcoin.

In January 2021, Tesla’s board approved a $1.5 billion Bitcoin purchase, citing belief in digital assets as long-term investments and as alternatives to cash. Months later, CEO Elon Musk stated Tesla sold about 10% of its Bitcoin “to prove liquidity,” realizing $128 million in Q1 2021; in Q2 2022, Tesla sold ~75% of remaining holdings, with Musk explaining the move was to “maximize cash position amid production challenges in China due to pandemic,” while emphasizing “this should not be viewed as negative judgment on Bitcoin.”

Ethereum

Many companies have enthusiastically joined the Ethereum reserve movement, mirroring MicroStrategy’s Bitcoin strategy—driven by bullish ETH sentiment, staking rewards, and the fact that ETH ETFs cannot currently participate in staking. As Wintermute founder Evgeny Gaevoy noted on July 17: “Clearly, you can’t buy ETH at Wintermute’s OTC desk.”

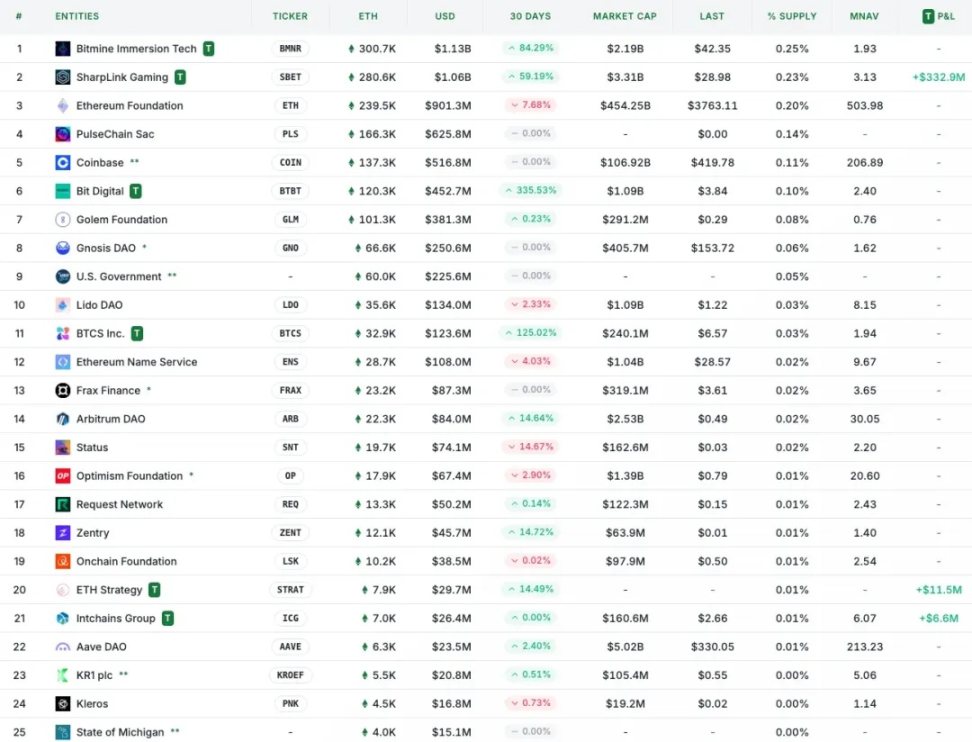

▲ strategicethreserve.xyz

Companies participating in Ethereum reserve strategies are marked with a “T.” Leaders include BitMine, SharpLink, Big Digital, and BTCS, all showing significant ETH accumulation in the past 30 days.

While BitMine and SharpLink now hold more ETH than the Ethereum Foundation, their individual positions remain modest compared to MicroStrategy’s near 2.865% of Bitcoin supply—accounting for approximately 0.25% and 0.23% of total ETH supply respectively. Moreover, most of these Ethereum reserve initiatives launched only between May and July this year, marking very recent developments.

SharpLink Gaming (Nasdaq: SBET)

SharpLink Gaming, a Nasdaq-listed iGaming affiliate company, announced in 2025 the launch of an Ethereum reserve strategy via a $425 million private placement.

SharpLink built this strategy around two financing channels: a large PIPE (Private Investment in Public Equity) and an ATM (at-the-market) equity offering mechanism. On May 27, 2025, SharpLink announced the completion of a $425 million PIPE (69.1 million shares at $6.15/share), led by Consensys (Joe Lubin’s firm) and major crypto VCs including ParaFi Capital, Electric Capital, Pantera Capital, Arrington Capital, GSR, and Primitive Ventures.

Following the PIPE, Lubin joined SharpLink’s board as chairman, guiding the strategic direction of the Ethereum reserve initiative.

▲ SharpLink Investor Deck

After completing the PIPE, SharpLink activated its ATM program, selling shares into the market based on demand. For example, it raised ~$64 million via ATM at the end of June 2025, and sold 24.57 million shares in early July 2025, raising ~$413 million.

Meanwhile, SharpLink committed to staking nearly 100% of its ETH holdings for yield. By mid-July 2025, approximately 99.7% of its Ethereum assets were staked.

On July 10, 2025, SharpLink reached a final agreement with the Ethereum Foundation to directly purchase 10,000 ETH for $25,723,680 (averaging $2,572.37 per ETH). This marks the first OTC transaction between the Ethereum Foundation and a public company.

SharpLink’s Ethereum reserve value proposition rests on four pillars: attractive staking yields, high Total Value Secured (TVS), operational efficiency, and broader network benefits. Staking rewards not only provide a stable income buffer for reserve deployment but also help offset acquisition costs. To date, Ethereum’s TVS reaches $0.8 trillion, with a security ratio of 5.9×—i.e., the total value of ETH, ERC-20 tokens, and NFTs secured on-chain ($0.8 trillion) divided by the value of staked ETH ($0.14 trillion). Beyond financial metrics, Ethereum offers superior energy efficiency versus proof-of-work networks, deep decentralization via thousands of independent validators, and a clear scalability roadmap through sharding and Layer 2 solutions.

BTCS Inc. (Nasdaq: BTCS)

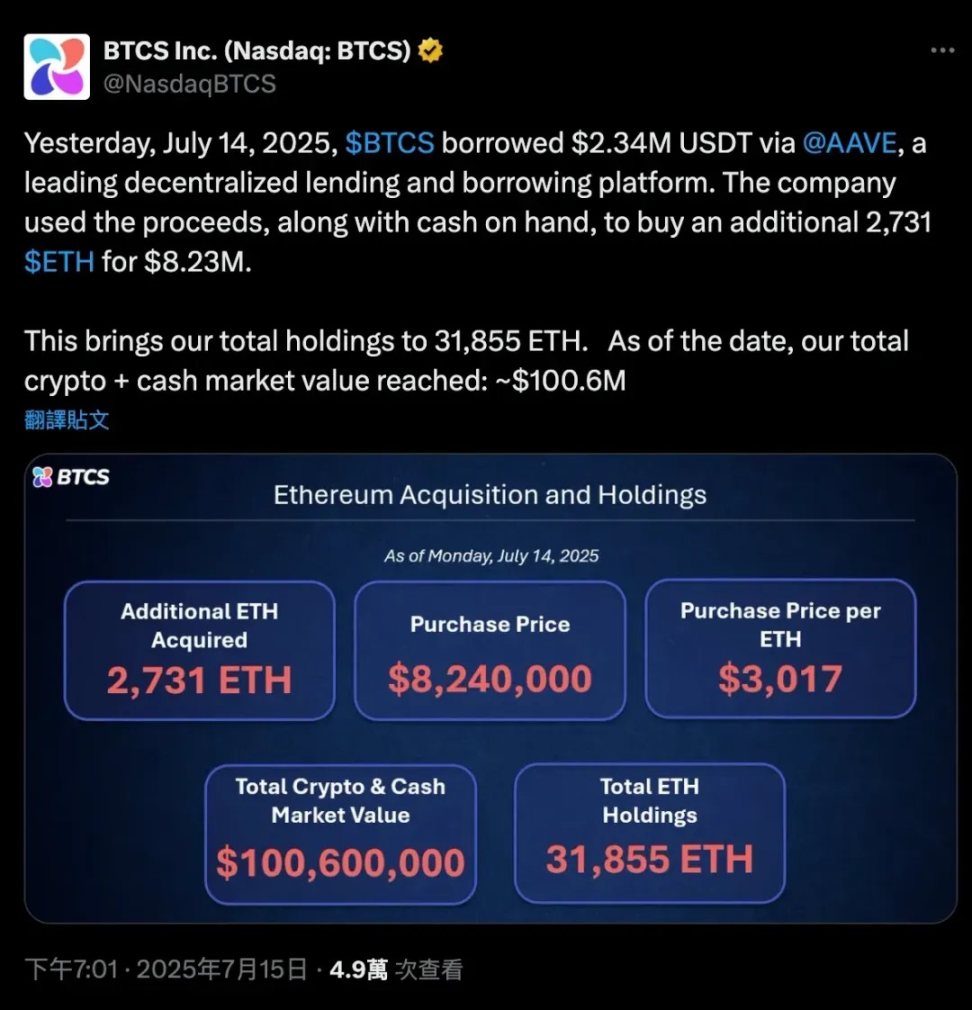

On July 8, 2025, BTCS (Blockchain Technology & Consensus Solutions) announced plans to raise $100 million in 2025 for Ethereum reserve acquisitions.

BTCS devised a hybrid funding model combining traditional finance with decentralized finance: using ATM equity sales, convertible note issuances, and on-chain DeFi lending via Aave to fund continuous ETH accumulation.

For the on-chain component, BTCS centers its strategy on Aave: the company borrows USDT on Aave using ETH as collateral, then uses the proceeds to buy additional ETH. Subsequently, BTCS stakes these ETH through its NodeOps validator network to earn rewards. CEO Charles Allen emphasized this low-dilution, steady approach—“slow and steady wins the race”—aimed at increasing ETH per share at minimal cost.

For example, in June 2025, BTCS borrowed an additional $2.5 million USDT on Aave (increasing its total Aave debt to $4 million), using ~3,900 ETH as collateral. In July 2025, it borrowed $2.34 million USDT (total Aave debt ~$17.8 million), with ~16,232 ETH as collateral.

Most newly acquired ETH is staked. BTCS connects these ETH to its NodeOps validator network, operating both standalone validators and RocketPool nodes.

BTCS’s on-chain strategy is innovative—integrating DeFi into strategic reserve planning. However, its cost advantage depends on Aave’s interest rate environment, and leveraged positions carry inherent risks. Meanwhile, rising ETH demand from other reserve-focused firms may reduce on-chain liquidity. As a potentially amplifying on-chain leveraged buyer, BTCS may support prices in the short term, but long-term impacts require close monitoring—especially if its positions grow large enough to influence Aave markets.

Other Companies

BitMine Immersion Technologies (NYSE American: BMNR)

July 8, 2025 (initial funding). Cryptomining firm BitMine launched a “light-asset” Ethereum reserve strategy in July 2025, completing a $250 million PIPE to buy ETH on day one. Within a week, BitMine acquired approximately 300,657 ETH. The company publicly states its long-term goal is to “acquire and stake 5% of all ETH.”

Bit Digital (NASDAQ: BTBT)

July 7, 2025. Formerly focused on Bitcoin mining, Bit Digital announced its transition to an Ethereum reserve strategy. According to its press release, Bit Digital raised ~$172 million through a public stock offering and liquidated 280 BTC on its balance sheet, reinvesting proceeds into Ethereum. As a result, its total ETH holdings reached approximately 100,603 (accumulated continuously through staking operations since 2022).

GameSquare Holdings (NASDAQ: GAME)

July 10, 2025. Digital media/gaming company GameSquare launched a $100 million Ethereum reserve program. In its announcement, GameSquare confirmed an initial purchase of $5 million, acquiring ~1,818 ETH at ~$2,749 per coin. The company initially raised $9.2 million in a July public stock offering, then announced a follow-on offering of $70 million (expandable to $80.5 million with greenshoe), to further expand its ETH reserves.

Conclusion

The corporate crypto reserve trend extends far beyond Bitcoin and Ethereum—many companies are expanding reserves into SOL, BNB, XRP, HYPE, and others to gain early-mover advantage.

However, most projects suffer from severe homogenization and lack sustainable competitive edges; their NAV premiums are likely to erode over time as strategically advantaged competitors emerge.

Truly advantaged firms often possess stronger financing structures and strategic partnerships. For instance, Metaplanet benefits from Japan’s favorable stock tax treatment and absence of spot BTC ETFs; Twenty One employs complex financing to leverage all available channels to acquire Bitcoin—and formed strategic partnerships with Tether, Bitfinex, and SoftBank to instantly become the third-largest holder, maximizing scale advantages. Meanwhile, SharpLink is backed by Consensys and leading crypto VCs, with Joseph Lubin joining its board, while BTCS integrates with Ethereum’s DeFi ecosystem.

For public investors, caution is essential: beneath massive hype, many companies still trade at elevated NAV multiples, with stock prices often volatile around announcements—while investors frequently lack transparent, real-time data to assess changes. Additionally, broader market risks, especially in bear markets, could rapidly erase any premium generated by these strategies.

In the institutional space, more crypto funds are allocating to crypto reserve stocks, even launching dedicated funds. Meanwhile, seasoned industry experts are stepping in as strategic advisors.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News