If ETH reaches $5,000, how much can SBET increase?

TechFlow Selected TechFlow Selected

If ETH reaches $5,000, how much can SBET increase?

ETH rises, and these Ethereum strategic reserve stocks can capture more sentiment premium.

By: EeeVee

Over the past month, Ethereum (ETH) surged from $2,100 to $3,000. During this rally, U.S. listed companies and mining firms have announced purchases of ETH as part of their "strategic reserves," with some mining companies even selling all their BTC to buy ETH in cash.

According to statistics, Ethereum strategic reserve companies collectively purchased over 545,000 ETH in the past month, worth more than $1.6 billion.

SharpLink (SBET), the first company to adopt ETH as a strategic reserve, saw its stock price surge from $3 to over $100 after announcing its ETH purchase, then fall back into single digits amid market criticism. The stock is now trading above $20 again.

Recently, SBET aggressively bought nearly 50,000 ETH within just five days, bringing its total ETH holdings to surpass those of the Ethereum Foundation.

In addition, SBET has staked a portion of its ETH holdings on-chain to earn staking rewards. As of July 8, its staked positions have earned 322 ETH.

Currently, there are five main U.S.-listed companies holding ETH as a "strategic reserve":

-

SharpLink Gaming (SBET)

-

BitMine Immersion Technologies (BMNR)

-

Bit Digital (BTBT)

-

Blockchain Technology Consensus Solutions (BTCS)

-

GameSquare (GAME)

The ETH holdings of each company are as follows:

mNAV is the ratio of market capitalization to net asset value (NAV), calculated as:

The mNAV of ETH strategic reserve companies is primarily estimated by dividing their "total market capitalization" by the "total value of ETH held."

Is the Market FOMOing?

The mNAV metric reflects the disconnect between a company's market valuation and its underlying assets, indicating market sentiment premiums for certain concepts or stocks. A higher mNAV typically signals strong speculative sentiment, while a lower mNAV suggests investors are relatively rational about the concept or stock.

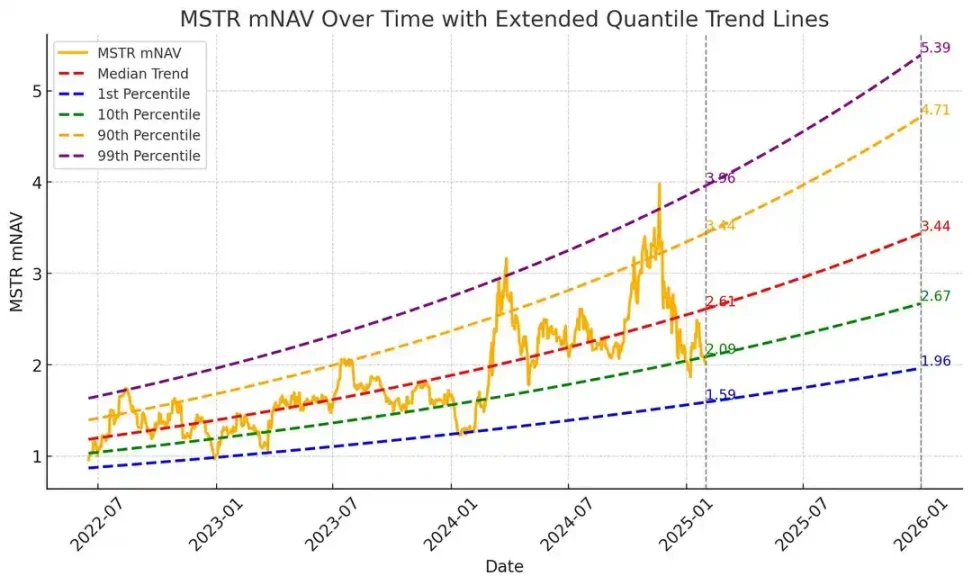

Looking at the premium levels of BTC strategic reserve companies, as of May 2025, MicroStrategy (MSTR) had a market cap approximately 1.78 times its Bitcoin net asset value (mNAV). Its mNAV fluctuated between 1x and 4.5x from August 2022 to August 2024.

MSTR's mNAV curve illustrates how crypto market sentiment drives the valuations of such companies.

Peaks, such as 4.5x, typically occurred during BTC bull markets and periods when MSTR aggressively accumulated Bitcoin, reflecting strong investor enthusiasm. Drops to 1x coincided with crypto bear and consolidation periods, showing investors' unwillingness to pay sentiment premiums.

An mNAV between 2x and 2.5x represents relatively neutral investor sentiment and premium levels.

Applying this benchmark to the five Ethereum strategic reserve companies: SBET and BTCS are currently within this range, while BMNR and BTBT appear slightly overvalued.

It should be noted that BMNR and BTBT were originally mining companies and may hold other assets beyond ETH, whose values have not been factored in.

Overall, these Ethereum strategic reserve stocks remain within a relatively rational valuation range, and market enthusiasm has not yet reached FOMO levels.

If Ethereum Reaches $5,000, How Many Times Could These Stocks Multiply?

If ETH continues rising to $5,000 in the coming months, assuming these companies maintain their current ETH holdings without issuing new shares or raising capital, and using a relatively rational premium estimate (mNAV = 2), the stock prices and potential gains would be:

Investors should note that mNAV = 2 represents a neutral premium level. If ETH does reach $5,000, the market might assign these ETH strategic reserve companies significantly higher sentiment premiums.

Additionally, during this period, staking rewards from their ETH holdings will further increase the amount of ETH these companies hold.

Ethereum Value Discovery? Why Suddenly So Popular Among Institutions

When these Ethereum strategic reserve companies explain why they chose ETH, the main reasons cited are:

-

The success of BTC reserve companies like MSTR

-

ETH staking yields

-

ETH's future potential in narratives around stablecoins and RWA (real-world assets)

Sam Tabar, CEO of Bit Digital, is highly optimistic about replicating MSTR's model with ETH and confident ETH could reach $10,000:

"(Building an Ethereum reserve) We're just getting started. This is merely warming up. Think about how Saylor repeatedly issued stock to acquire BTC, which kept rising, enabling him to repeat the cycle. That's exactly what we're doing."

Primitive Ventures emphasized the potential of ETH staking yield in its rationale for investing in SBET:

"ETH has inherent yield-generating capabilities through staking and the DeFi ecosystem, making it a truly productive asset, unlike Bitcoin which lacks such mechanisms. SBET has the potential to directly leverage on-chain compounding growth of ETH to deliver real, quantifiable returns to shareholders."

The CEO of BitMine Immersion Technologies is particularly bullish on ETH's potential in RWA and TradFi narratives, stating in an interview:

"To me, Ethereum is attractive because it's the primary blockchain layer for tokenizing real-world assets. As more things in finance and the real world become tokenized, institutions like Goldman Sachs, JPMorgan, Amazon, and Walmart—just as they did with stablecoins—will want to stake Ethereum itself. We're doing what these enterprises will do in the future."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News