2025 Q2 Asia Crypto Outlook: Regulation Stabilizes, Corporate Investment Rises

TechFlow Selected TechFlow Selected

2025 Q2 Asia Crypto Outlook: Regulation Stabilizes, Corporate Investment Rises

Asia's Web3 market entered a critical turning point in Q2 2025, shifting from the policy framework establishment in Q1 to substantive market activities and capital deployment, with countries exhibiting differentiated development paths.

Author: Tiger Research Reports

Translation: TechFlow

TL;DR

-

Regulation & Government: 1) Hong Kong will introduce stablecoin legislation in August, reinforcing its position as a digital finance hub. 2) Singapore implements strict licensing rules, banning unlicensed firms from operating overseas. 3) Thailand launches G-Tokens, becoming the first country to issue government-backed digital bonds.

-

Corporate Moves: 1) A wave of Japanese listed companies adopting Bitcoin investment strategies drives institutional capital inflows. 2) Chinese firms take a pragmatic approach, accumulating Bitcoin via Hong Kong licenses to bypass domestic restrictions.

-

Policy Shifts: 1) In South Korea, the emergence of KRW-pegged stablecoins as a post-election agenda is offset by ongoing regulatory fragmentation. 2) Vietnam achieves a historic shift from ban to full legalization. 3) The Philippines adopts a dual-track strategy combining strict oversight with sandbox frameworks.

1. Asia Web3 Market Q2: Regulation Stabilizes, Corporate Investment Rises

While the center of gravity in the Web3 market has clearly shifted toward the U.S., developments in major Asian markets remain noteworthy. Asia not only hosts the world’s largest cryptocurrency user base but also remains a core hub for blockchain innovation.

Hence, Tiger Research has maintained a quarterly review of key Web3 trends across Asia. In Q1 2025, regulators across Asia laid the groundwork—introducing new legislation, issuing licenses, and launching regulatory sandboxes. Efforts to strengthen cross-border cooperation also began gaining traction.

In Q2, this regulatory foundation enabled meaningful commercial activity and accelerated capital allocation. Policies introduced in Q1 were tested in the market, driving refinements and more concrete implementation.

Institutional and corporate engagement significantly increased. This report analyzes these developments country by country during Q2 and evaluates how policy changes across nations impact the broader global Web3 ecosystem.

2. Key Developments Across Major Asian Markets

2.1. South Korea: Where Political Transition Meets Regulatory Adjustment

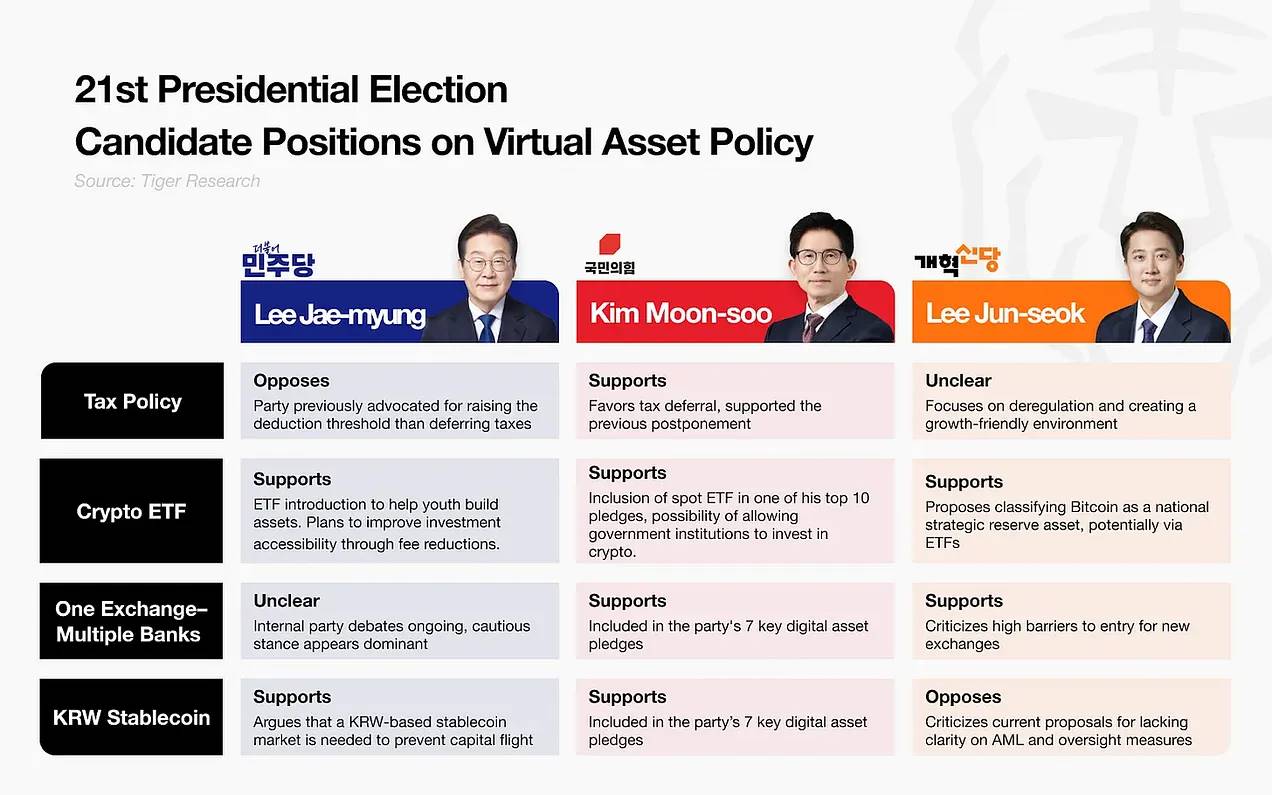

Source: Tiger Research

In Q2, crypto policy became a hot topic ahead of South Korea's June presidential election. Candidates actively shared Web3-related pledges, and with Lee Jae-myung’s victory, market expectations rose for significantpolicy shifts.

One central theme was the proposed launch of a KRW-pegged stablecoin. Related stocks, including Kakao Pay, surged, while traditional financial institutions began filing Web3-related trademarks to enter the market.

However, conflicts emerged in the policymaking process, most notably a jurisdictional dispute between the Bank of Korea and the Financial Services Commission (FSC). The central bank advocates early involvement in approval procedures, positioning stablecoins as part of a broader digital currency ecosystem alongside CBDCs.

In July, the Democratic Party announced a one-to-two-month delay in rolling out the Digital Asset Innovation Act. The lack of a clear lead policymaker appears to be a major bottleneck, with interdepartmental negotiations still fragmented. As a result, despite heightened focus on the KRW stablecoin, specific regulatory guidance remains absent.

Nonetheless, gradual institutional improvements continue. In June, new rules allowed non-profits and exchanges to sell donated crypto assets and immediately liquidate proceeds. The rule also requires such sales to minimize market impact.

Interest in the Korean market remained strong throughout Q2. Global exchanges showed sustained commitment: Crypto.com Korea completed Travel Rule integration with Upbit and Bithumb, while KuCoin expressed plans to re-enter Korea after meeting regulatory standards.

Offline activity rebounded significantly. Compared to last year, the number of meetups surged, with increasing international projects visiting Korea even outside major conferences. However, the rise of promotional events—focused more on giveaways than engagement—has begun to fatigue local builders.

2.2. Japan: Institutional Adoption Drives Expansion of Bitcoin Strategy

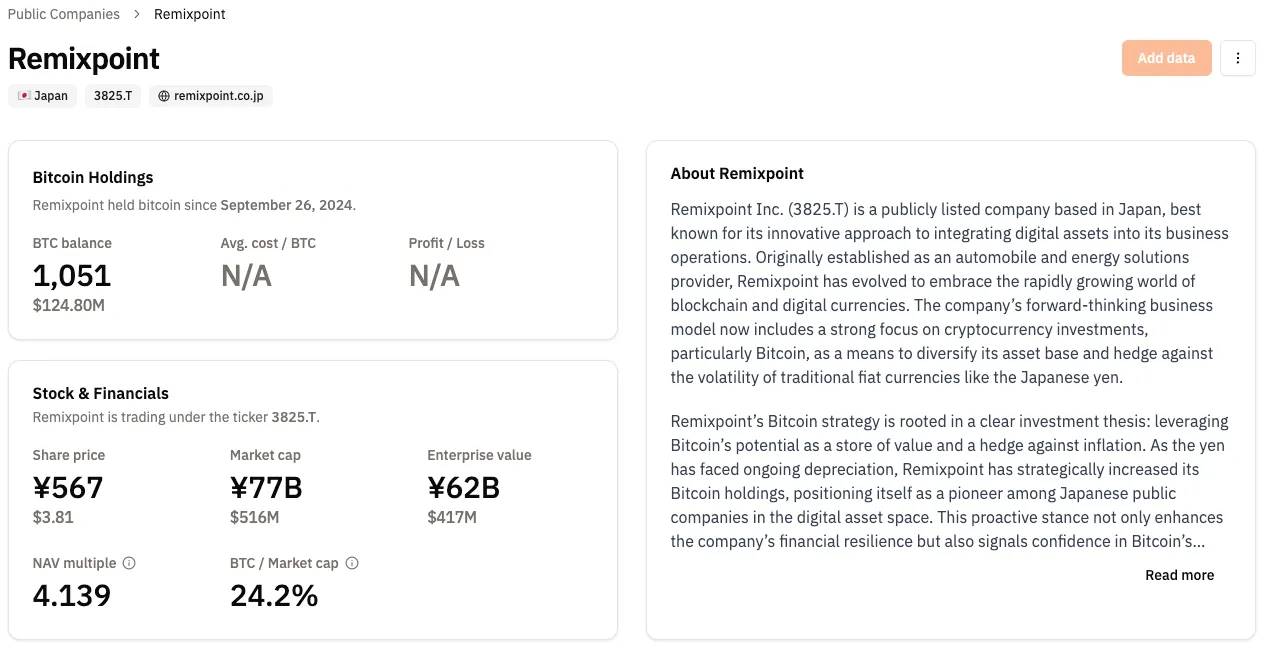

Source: Bitcoin Treasury

In Q2, Japanese publicly listed companies experienced a surge in Bitcoin adoption. Led initially by MetaPlanet, which achieved roughly 39x returns after its first Bitcoin purchase in April 2024, the company set a benchmark that prompted others like Remixpoint to follow suit with their own Bitcoin allocations.

Progress also advanced in stablecoin and payment infrastructure. Mitsubishi UFJ Financial Group has begun collaborating with Ava Labs and Fireblocks to prepare for stablecoin issuance. Additionally, Mercari’s crypto subsidiary Mercoin started supporting XRP trading, significantly improving crypto accessibility on a platform with over 20 million monthly active users.

As private-sector initiatives move forward, regulatory discussions continue. The Financial Services Agency (FSA) introduced a new classification system dividing crypto assets into two tiers: Tier 1, including tokens used for fundraising or business operations; and Tier 2, referring to general-purpose crypto assets. However, most of these regulatory updates remain in discussion, with limited concrete amendments so far.

Retail investor participation remains low. Traditionally conservative, Japanese retail investors remain cautious about crypto assets. Therefore, even with new market entrants, retail capital is unlikely to flow in immediately.

This contrasts sharply with markets like South Korea, where active retail participation directly boosts early liquidity for new projects. In Japan, the institution-led investment model offers greater stability but may limit short-term growth momentum.

2.3. Hong Kong: Regulated Stablecoins and Expansion of Digital Financial Services

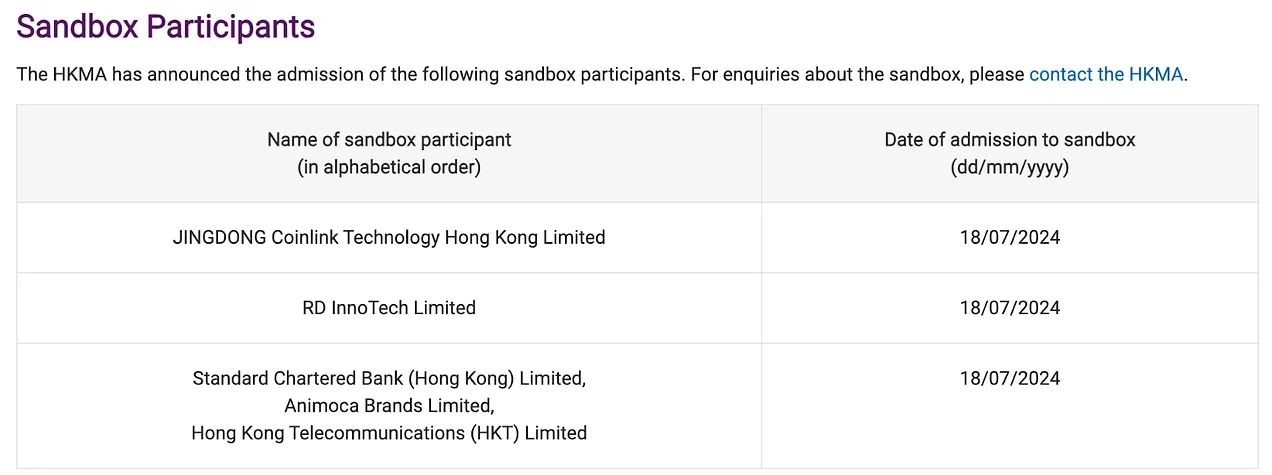

In Q2, Hong Kong refined its stablecoinregulatory framework, cementing its status as a leading Asian digital finance hub. The Hong Kong Monetary Authority (HKMA) announced that new stablecoin regulations will take effect on August 1. A licensing regime for stablecoin issuers is expected by year-end.

Source: HKMA

Accordingly, the first regulated stablecoins are expected to launch in Q4, possibly as early as this summer. Firms previously involved in the HKMA’s regulatory sandbox are anticipated to lead the way, making their progress worth watching.

The scope of digital financial services has also expanded significantly. The Securities and Futures Commission (SFC) announced plans toallow professional investors to trade virtual asset derivatives. Meanwhile, licensed exchanges and funds are nowpermitted to offer staking services.

These developments reflect a clear regulatory intent to build a more comprehensive and institution-friendly digital asset ecosystem in Hong Kong.

2.4. Singapore: Regulatory Tightening Between Control and Protection

Source: MAS

In Q2, Singapore implemented notable tightening measures in crypto regulation. Most strikingly, the Monetary Authority of Singapore (MAS) banned unlicensed digital asset firms from offering services overseas—a firm stance against regulatory arbitrage.

The new rules apply to all entities providing digital asset services globally from Singapore, effectively mandating formal licensing. The environment has changed: simple business registration is no longer sufficient for operations.

This shift increases pressure on local Web3 firms, presenting a binary choice—either establish fully compliant operational entities or consider relocating to more lenient jurisdictions. While aimed at enhancing market integrity and consumer protection, there's no denying the measure limits early-stage and cross-border projects.

2.5. China: Digital Yuan Internationalization and Corporate Web3 Strategies

In Q2, China advanced its digital yuan internationalization efforts, with Shanghai at the core. The People’s Bank of China announced plans to establish an international operations center in Shanghai to support cross-border applications of digital currencies.

Yet, a gap persists between official policy and actual practice. Despite nationwide crypto bans, reports indicate some local governments (e.g., Jiangsu Province) have liquidated seized digital assets to cover fiscal shortfalls—revealing a pragmatic approach divergent from official positions.

Chinese enterprises similarly demonstrate pragmatism. Companies like logistics group AdanTex have begun following Japanese peers in increasing Bitcoin holdings. Others leverage Hong Kong licensing systems to bypass mainland restrictions and access the global Web3 market—effectively navigating regulatory boundaries to participate in the digital asset economy.

Interest in RMB-pegged stablecoins is also growing, especially in the latter half of the quarter. Rising concerns over dollar-pegged stablecoin dominance and RMB depreciation have fueled these discussions.

On June 18, PBOC Governor Pan Gongsheng publicly outlined a vision for a multipolar global monetary system, signaling openness to stablecoin issuance. In July, Shanghai’s SASAC initiated discussions on developing an RMB-pegged stablecoin project.

2.6. Vietnam: Crypto Legalization and Enhanced Digital Oversight

Vietnam officially legalized cryptocurrencies in Q2, marking a major policy shift. On June 14, Vietnam’s National Assembly passed the Law on the Digital Technology Industry, recognizing digital assets and outlining incentives for AI, semiconductors, and digital infrastructure.

This represents a historic reversal from Vietnam’s previous crypto ban, potentially catalyzing broad crypto adoption across Southeast Asia. Given its earlier restrictive stance, this move signals a significant regional shift in crypto policy.

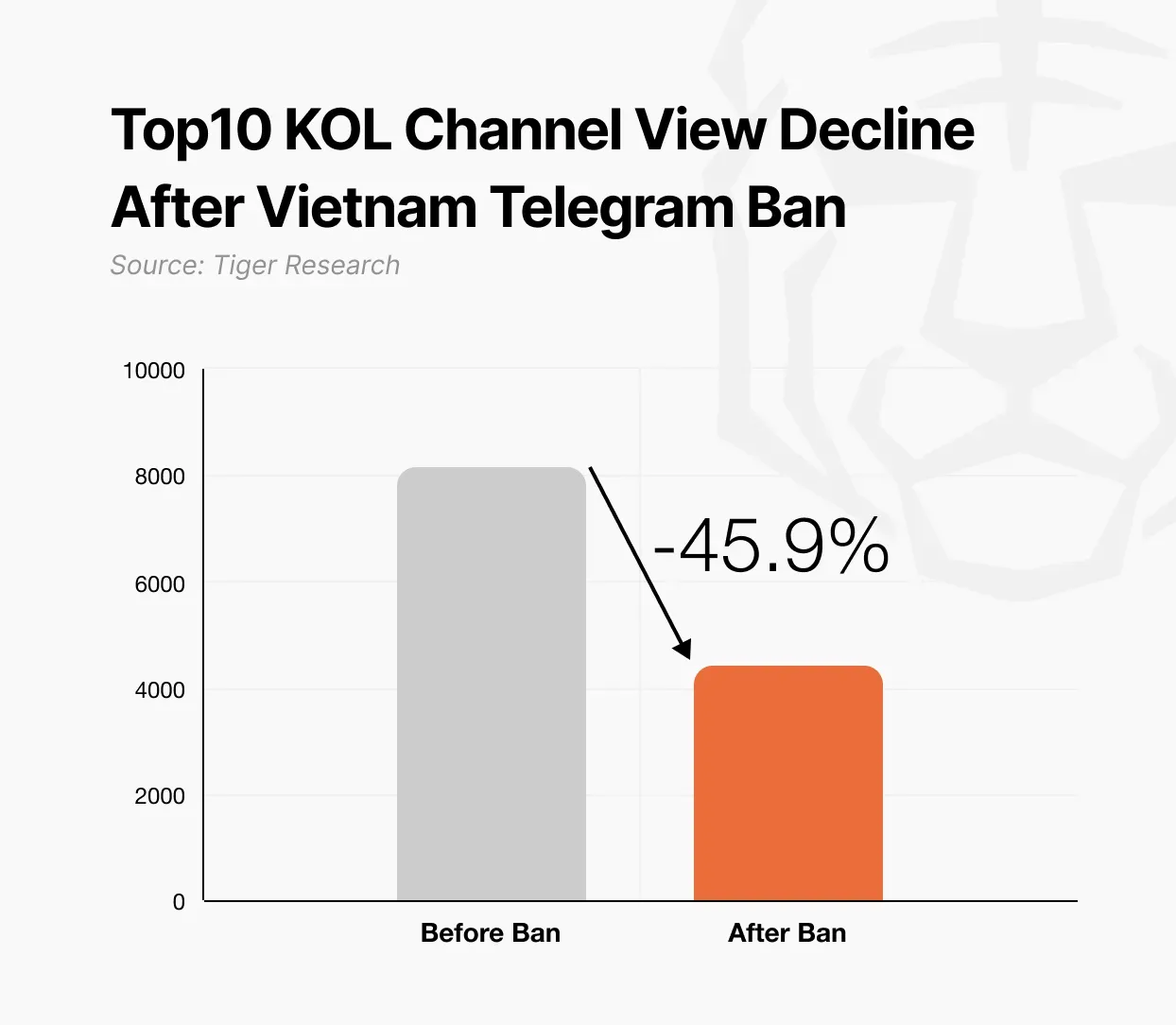

At the same time, the government tightened control over digital platforms. Authorities ordered telecom providers to block Telegram, citing its alleged use in fraud, drug trafficking, and terrorism. A police report found 68% of the app’s 9,600 active channels were linked to illegal activities.

This dual approach—legalizing crypto while cracking down on digital abuse—reflects Vietnam’s intent to allow innovation within tightly controlled boundaries. While digital assets now have legal recognition, their use in illicit activities faces harsher enforcement.

2.7. Thailand: State-Led Innovation in Digital Assets

In Q2, Thailand advanced state-driven initiatives in the digital asset space. The Securities and Exchange Commission (SEC) Thailand announced it is reviewing a proposal allowing exchanges to list their own utility tokens—a departure from prior strict listing rules that could enhance platform flexibility.

More notably, the Thai government unveiled plans to issue national digitalbonds. On July 25, Thailand will issue “G-Tokens” via an approved ICO platform, with a total issuance of $150 million. These tokens will not be usable for payments or speculative trading.

This initiative is a rare example of direct government participation in digital asset issuance. Globally, Thailand’s approach stands as an early model of public-sector-led tokenized financial innovation.

2.8. Philippines: Dual-Track Approach Combining Strict Regulation with Innovation Sandbox

In Q2, the Philippines adopted a dual-track strategy, combining tighter regulation with support for innovation in the crypto sector. The government imposed stricter controls on token listings, with regulatory authority shared between the central bank and the SEC. Registration and AML compliance requirements for Virtual Asset Service Providers (VASPs) were also significantly tightened.

A particularly notable move was the introduction of influencer regulations. Content creators promoting crypto assets must now register with relevant authorities. Violations could lead to penalties of up to five years in prison—one of the region’s strictest enforcement regimes.

Beyond these measures, the government launched a framework to foster innovation. The SEC began accepting applications for “ StratBox ”, a sandbox program designed to support crypto service providers under controlled regulatory conditions.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News