Did the SEC's new innovation exemption policy change the game for U.S. crypto regulation?

TechFlow Selected TechFlow Selected

Did the SEC's new innovation exemption policy change the game for U.S. crypto regulation?

The door to exploration has just opened.

Author: San, TechFlow

On December 2, SEC Chair Paul Atkins announced during a speech at the New York Stock Exchange that new innovation exemption rules for cryptocurrency companies will officially take effect starting January 2026.

The new innovation exemption rule for crypto firms traces back to the Project Crypto initiative in July this year, but was temporarily shelved due to government shutdowns. Its recent revival and confirmation have sparked significant market attention and discussion.

However, can this highly anticipated policy truly bring springtime for the crypto industry?

Core Elements of the Innovation Exemption Rule

According to details released by the SEC, the innovation exemption primarily includes three key components.

First is the scope of exemption. Any entity developing or operating crypto-related businesses may apply, including trading platforms, DeFi protocols, stablecoin issuers, and even DAO organizations.

The innovation exemption period lasts 12–24 months, during which projects are required only to submit simplified disclosures instead of full S-1 registration filings.

Second is compliance requirements. While enjoying exemptions, projects must still meet basic compliance standards such as implementing KYC/AML procedures, submitting quarterly operational reports, and undergoing regular SEC reviews.

For projects involving retail investors, investor protection mechanisms must be established, including risk warnings and investment caps.

Lastly is the token classification framework. The SEC divides digital assets into four categories under this exemption: commodity-type (e.g., BTC), utility-type (functional tokens), collectible-type (NFT-like), and tokenized securities-type.

The first three types may exit the securities regulatory framework upon meeting conditions of “sufficient decentralization” or “full functionality.”

Critical Voices

The requirement that all participating projects implement “reasonable user verification procedures” directly conflicts with the decentralized ethos of the crypto industry and has triggered significant controversy within the DeFi community.

Under the new rules, DeFi protocols must divide their liquidity pools into two categories: permissioned pools for compliant investors and public pools open to all users.

Permissioned pools benefit from lighter regulation but require identity verification for every participant. Such demands effectively push crypto finance toward “traditionalization.”

Even more concerning may be technical modification requirements.

The SEC recommends DeFi projects adopt compliance token standards like ERC-3643, which embed identity verification and transfer restrictions directly into smart contracts.

If every transaction requires whitelist checks and tokens can be frozen by centralized entities, is it still DeFi as we understand it?

This also contradicts previous statements by Uniswap founder Hayden Adams opposing mandatory real-name identification.

Even if compliance requirements are accepted, significant uncertainty remains in implementation.

Regarding the policy allowing lighter regulation through sufficient decentralization, the SEC has not provided clear quantitative criteria—no one knows whether evaluation will be based on node count, token distribution, or other factors.

This ambiguity grants regulators substantial discretion and introduces uncertainty for project teams.

Another issue concerns arrangements after the exemption period ends.

At most 24 months later, exempted projects must either complete formal registration or prove they have achieved sufficient “decentralization.” But if the SEC then determines a project still fails to meet standards, could prior operations be retroactively penalized?

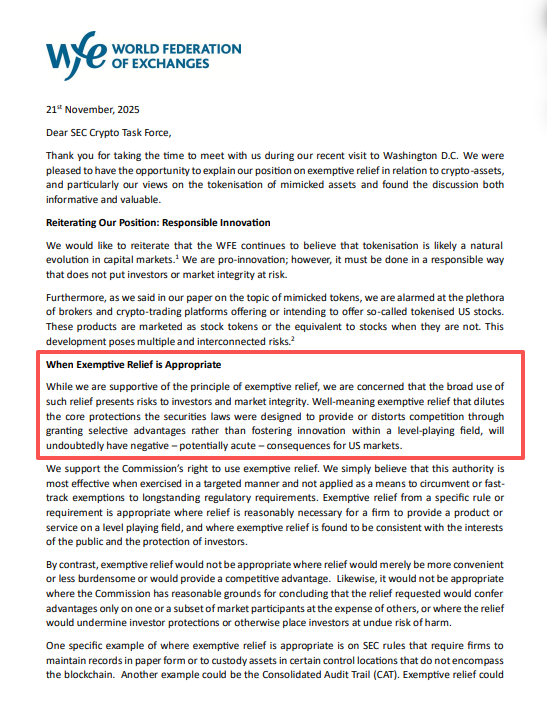

The World Federation of Exchanges (WFE) raises another concern: why should crypto assets receive special treatment? If every emerging industry demands regulatory exemptions, the fairness and consistency of the entire regulatory system would be challenged.

Image: WFE letter to SEC: 《Re: SEC Crypto Task Force》

Potential Positive Impacts

Despite numerous controversies, the innovation exemption policy has indeed brought some positive changes to the crypto industry, and the community widely views it as major good news.

Image: Post by @qinbafrank

In terms of policy, the most direct impact is reduced compliance costs.

In the past, a crypto project aiming for U.S. compliance faced over a million dollars in legal fees and more than a year of effort. Now, via the exemption mechanism, projects can launch operations first and gradually refine their compliance systems in practice—an enormous advantage for capital-constrained startup teams.

Beyond this, greater room for technological innovation is now available.

A series of new crypto concepts gain experimental opportunities under this new exemption framework, especially in this year’s hot stablecoin sector. With supporting legislation, higher regulatory standards may be established—of great significance to the broader payment system.

Compliance Survival Space for U.S.-Based Projects

In recent years, many crypto projects originally rooted in the U.S. have chosen to “leave.” Ripple relocated parts of its business to Singapore, Coinbase once considered overseas listing, and many early-stage teams registered from Day 1 in the Cayman Islands or BVI, deliberately avoiding the U.S. market.

The core reason behind this exodus wasn’t overly strict regulation, but rather excessive ambiguity. The SEC’s enforcement-driven regulatory model left project teams directionless—activities compliant today might trigger a Wells Notice tomorrow. Rather than gamble, it’s safer to simply leave.

The innovation exemption policy at least formally changes this: projects can now secure a 12–24 month “safe period” to operate within a clear framework, rather than living in constant fear within gray areas.

For teams genuinely interested in compliant operations and serving U.S. users, this significantly lowers the barrier.

But a reality check is needed: this is entirely different from “crypto talent returning to the U.S.”

Global talent drain from the crypto industry stems more from the sector’s own trust crisis. Conversely, if chaos prevails during the exemption period, it could accelerate further talent departure.

A more accurate interpretation is: this policy opens a window for “projects wanting to operate legally in the U.S.,” but it neither can nor intends to solve the crypto industry’s fundamental problems.

Conclusion

The SEC’s current innovation exemption marks a significant shift in U.S. crypto regulatory thinking. It attempts to find a middle path between “complete ban” and “laissez-faire”—a path imperfect, filled with compromise and contradiction, yet offering the industry a possibility to move forward.

The policy’s success depends on multiple factors, including the SEC’s enforcement approach, project team self-discipline, and technological progress. If all parties can find balance, 2026 may become a new starting point for crypto industry development.

Now, the door to exploration has just opened.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News