Regulatory Crossroads: The United States, Europe, and the Future of Crypto Assets

TechFlow Selected TechFlow Selected

Regulatory Crossroads: The United States, Europe, and the Future of Crypto Assets

While the EU is busy binding itself with red tape, the US is actively planning how to "regulate" DeFi, moving toward a framework beneficial to multiple parties.

Author: TradFiHater

Translation: AididiaoJP, Foresight News

When Satoshi Nakamoto, the inventor of Bitcoin, released the whitepaper, mining was so simple that any gamer with an ordinary home computer could have accumulated wealth worth tens of millions of dollars in the future.

You could have built a vast family fortune on a home computer, freeing your descendants from hard labor, thanks to Bitcoin's potential return of up to 250,000 times the initial investment.

But at the time, most gamers were obsessed with playing Halo 3 on Xbox, while only a few young people used their home computers to earn fortunes surpassing those of modern tech giants. Napoleon built his legend by conquering Egypt and Europe, but all you needed was to click "Start Mining."

Over fifteen years, Bitcoin has become a global asset, and its mining has evolved into a large-scale industry requiring billions of dollars in capital, specialized hardware, and massive energy consumption. Today, mining one Bitcoin consumes an average of 900,000 kWh of electricity.

Bitcoin has created a new paradigm, fundamentally opposed to the financial world dominated by traditional institutions. It may be the first genuine rebellion against the elite since the failure of the "Occupy Wall Street" movement. Notably, Bitcoin emerged precisely after the "Great Financial Crisis" during Obama’s era—a crisis largely caused by tolerance for high-risk "casino-style" banking. The Sarbanes-Oxley Act introduced in 2002 aimed to prevent another internet bubble, yet ironically, the 2008 financial collapse was far worse than the earlier crash.

Whoever Satoshi Nakamoto is, his invention arrived at just the right moment—an intense yet deliberate rebellion against a powerful and omnipresent traditional financial system.

From Chaos to Regulation: The Cycle of History

Prior to 1933, the U.S. stock market operated largely without regulation, relying only on scattered state-level "Blue Sky Laws," leading to severe information asymmetry and rampant fraudulent trading.

The liquidity crisis of 1929 served as a "stress test" that broke this model, proving that decentralized self-regulation could not contain systemic risk. The U.S. government enacted a "forced reset" through the Securities Acts of 1933 and 1934: replacing the principle of "caveat emptor" (buyer beware) with a central enforcement agency (the SEC) and mandatory disclosure rules, establishing uniform legal standards for all public assets to restore market confidence in systemic solvency. Today, we are witnessing the exact same process unfolding in decentralized finance.

Until recently, cryptocurrencies operated as a permissionless "shadow banking" asset, functionally resembling the pre-1933 U.S. stock market—but far more dangerous due to the complete absence of oversight. Governance relied primarily on code and hype, failing to adequately assess the enormous risks posed by this "beast." A series of cascading collapses in 2022 became crypto’s "1929-style stress test," demonstrating that decentralization does not equal infinite returns or stable money; instead, it created a risk node capable of devouring multiple asset classes.

We are witnessing a forced shift in zeitgeist: the crypto world is transitioning from a libertarian, casino-like paradigm to a compliant asset class. Regulators are trying to force crypto into a U-turn: once legalized, funds, institutions, billionaires, and nations can hoard it just like any other asset, enabling taxation.

This article aims to dissect the origins of crypto’s "institutional rebirth," a transformation now inevitable. Our goal is to project the logical endpoint of this trend and attempt to depict the final form of the DeFi ecosystem.

Regulatory Rollout: Step by Step

Before DeFi entered its first true "dark age" in 2021, its early development was not driven by new legislation but by federal agencies progressively extending existing laws to cover digital assets.

The first major federal action came in 2013: the U.S. Financial Crimes Enforcement Network classified cryptocurrency "exchanges" and "administrators" as money services businesses, subjecting them to the Bank Secrecy Act and anti-money laundering regulations. 2013 could be seen as the year DeFi was first "recognized" by Wall Street—while simultaneously laying the groundwork for future regulation and suppression.

In 2014, the IRS classified virtual currencies as "property" rather than "currency" for federal tax purposes, meaning every transaction could trigger capital gains taxes. Thus, Bitcoin received a legal classification—and became taxable—far removed from its original "rebellious" ethos!

At the state level, New York introduced the controversial BitLicense in 2015—the first regulatory framework requiring crypto companies to disclose information. Ultimately, the SEC concluded the party with its "DAO Investigation Report," confirming that many tokens qualify as unregistered securities under the Howey Test.

In 2020, the Office of the Comptroller of the Currency briefly allowed national banks to provide crypto custody services, though this move was later challenged by the Biden administration—a nearly routine operation across presidential administrations.

Old World Constraints: Europe's Path

Across the Atlantic in the "Old World," outdated customs similarly dominate crypto development. Influenced by rigid Roman law traditions—distinct from Anglo-American common law—a climate hostile to individual liberty prevails, limiting DeFi’s possibilities within a regressive civilization. One must remember that the American spirit is deeply shaped by Protestant ethics, a tradition of self-governance that forged America’s entrepreneurial culture, ideals of freedom, and pioneering drive.

In Europe, Catholic traditions, Roman law, and feudal remnants have produced a markedly different culture. Hence, it’s no surprise that established nations like France, Britain, and Germany have taken divergent paths. In a society that prefers obedience over risk-taking, cryptocurrencies were destined to face harsh suppression.

Europe’s early crypto era was defined not by a unified vision but by fragmented bureaucracies. The industry achieved its first legal victory in 2015 when the European Court ruled that Bitcoin transactions are exempt from VAT, effectively recognizing crypto’s "monetary" nature.

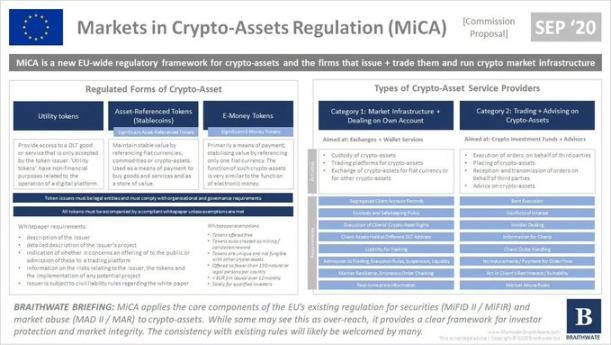

In the absence of EU-wide legislation, national regulators acted independently until the Markets in Crypto-Assets (MiCA) regulation emerged. France established a strict national framework via the PACTE Law, Germany introduced a crypto custodian licensing regime, while Malta and Switzerland competed to attract firms with favorable regulations.

In 2020, the Fifth Anti-Money Laundering Directive ended this chaotic period by mandating strict customer identification across the EU, effectively eliminating anonymous transactions. The European Commission finally realized that 27 conflicting rules were unsustainable and proposed MiCA at the end of 2020—marking the end of the "patchwork era" and the beginning of unified regulation.

American "Visionary" Model?

The evolution of the U.S. regulatory system isn’t true systemic reform but more driven by opinion leaders. The power shift in 2025 brought a new philosophy: mercantilism over moralism.

Trump’s launch of his controversial "meme coin" in December 2024 might have been a symbolic moment—indicating even the elite are willing to “Make Crypto Great Again.” Now, several "Crypto Popes" are leading the charge, advocating greater freedom and space for founders, developers, and retail investors.

Paul Atkins taking leadership of the SEC feels less like a personnel change and more like a "regime change." His predecessor, Gary Gensler, viewed the crypto industry with near-hostility, becoming the nemesis of a generation of crypto professionals. An Oxford paper even analyzed the pain caused by Gensler’s policies. Many believe his aggressive stance delayed DeFi development by years—regulators meant to guide the industry instead became completely detached from it.

Atkins didn’t just halt numerous lawsuits—he essentially apologized for prior policy. His "Crypto Project" exemplifies bureaucratic agility. It aims to create an extremely dry, standardized, comprehensive disclosure regime, allowing Wall Street to trade crypto assets like oil. According to Allen & Overy, the plan’s core includes:

-

Establishing a clear regulatory framework for U.S. crypto asset issuance.

-

Ensuring freedom in choosing custodians and trading venues.

-

Encouraging market competition and fostering "super apps."

-

Supporting on-chain innovation and decentralized finance.

-

Creating innovation exemptions to ensure commercial viability.

The most crucial shift may be at the Treasury. Former Treasury Secretary Janet Yellen saw stablecoins as systemic risks. But current Secretary Scott Bessent, a hedge fund-minded official, sees the truth: stablecoin issuers are the "only net new buyers" of U.S. Treasuries.

Bessent understands the severity of America’s deficit. With central banks worldwide slowing Treasury purchases, the insatiable demand from stablecoin issuers for short-term debt is a major win for the new Treasury chief. He sees USDC and USDT not as competitors to the dollar, but as its "vanguards," extending dollar dominance into countries where fiat currencies are collapsing and citizens prefer holding stablecoins.

Another classic "short-to-long" turnaround is Jamie Dimon, CEO of JPMorgan Chase. He once threatened to fire any employee trading Bitcoin, yet now he’s completed what may be the most profitable "180-degree turn" in financial history. JPMorgan’s 2025 launch of crypto-backed lending is seen as "raising the white flag." As The Block reported:

JPMorgan plans to allow institutional clients to use Bitcoin and Ethereum as loan collateral, marking deeper Wall Street integration into crypto.

Bloomberg, citing insiders, said the program will be global and rely on third-party custodians to hold collateral.

When Goldman Sachs and BlackRock began eroding JPMorgan’s custody fee revenue, the "war" quietly ended—banks won by choosing not to fight.

Last, Senator Cynthia Lummis, once seen as a "lone crypto warrior," is now among the staunchest supporters of America’s new collateral system. Her proposal for a "Strategic Bitcoin Reserve" has moved from fringe online forums to serious congressional hearings. While her advocacy hasn’t directly boosted Bitcoin prices, her efforts are sincere.

The 2025 legal landscape consists of both "settled" and "pending" elements. The current government’s enthusiasm for crypto is so great that top law firms have launched real-time policy tracking services. For example, Latham & Watkins’ "U.S. Crypto Policy Tracker" monitors moves by agencies aggressively crafting new DeFi rules. Yet we remain in an "exploratory phase."

Currently, two bills dominate U.S. debate:

-

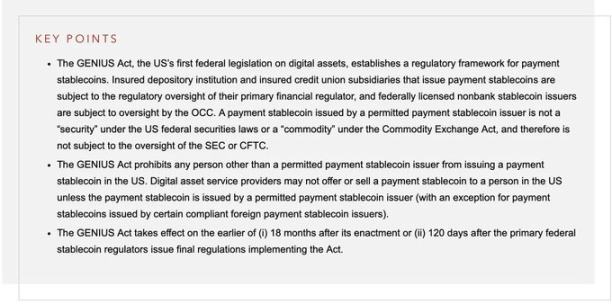

GENIUS Act: Passed in July 2025. This marks Washington finally regulating stablecoins—the most important crypto asset class after Bitcoin. It mandates 1:1 backing by U.S. Treasuries, transforming stablecoins from systemic risks into geopolitical tools akin to gold or oil. The bill effectively authorizes private issuers like Circle and Tether as "officially recognized buyers" of U.S. Treasuries—a win-win.

-

CLARITY Act: This market structure bill, designed to clarify distinctions between securities and commodities and resolve jurisdictional conflicts between the SEC and CFTC, remains stuck in the House Financial Services Committee. Until passed, exchanges operate in a comfortable but fragile "gray zone," relying on temporary guidance rather than solid statutory law.

Currently, the bill has become a political battleground between Republicans and Democrats, seemingly used by both sides as a weapon.

Additionally, repealing Accounting Standards Update No. 2023-01 carries major significance. This rule previously required banks to list custodied crypto assets as liabilities on their balance sheets, effectively preventing banks from holding crypto. Its repeal is like opening a floodgate, signaling institutional capital can now enter crypto markets without fear of regulatory retaliation. Meanwhile, life insurance products priced in Bitcoin have begun to emerge—suggesting a bright future ahead.

Old World: Innate Risk Aversion

Just as the Church once burned scientists at the stake, today’s European authorities craft complex, obscure laws whose main effect may simply be scaring away entrepreneurs. The gap between the vibrant, rebellious youth spirit of America and the rigid, conservative, stumbling pace of Europe has never been wider. When Brussels had the chance to break free from its usual rigidity, it chose stagnation.

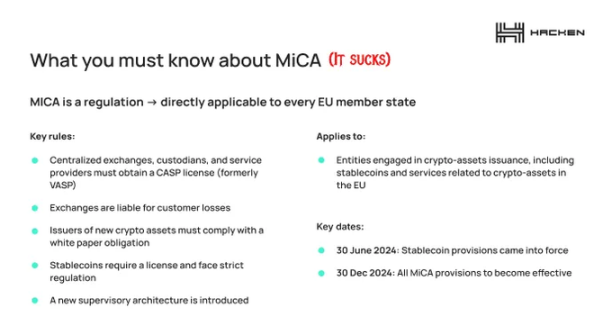

MiCA, fully implemented by the end of 2025, is a "masterpiece" of bureaucratic intent and an "apocalypse" for innovation.

MiCA is marketed as a "comprehensive framework," but in Brussels-speak, that often means "comprehensive torture." It does offer clarity—but clarity so oppressive it makes people want to flee.

MiCA’s fundamental flaw is a "category error": it regulates crypto founders as if they were sovereign banks. Compliance costs are so high they doom most crypto startups from the start.

A memo by Norton Rose Fulbright objectively analyzes the regulation:

Structurally, MiCA is an "exclusion mechanism." It forces digital assets into heavily regulated categories and imposes a compliance burden on crypto service providers comparable to MiFID II—designed for financial giants, not startups.

Under its Titles III and IV, the regulation imposes strict 1:1 liquidity reserve requirements on stablecoin issuers, effectively banning algorithmic stablecoins by legally assuming insolvency from day one. This could itself trigger new systemic risks—imagine being declared "illegal" overnight by Brussels?

Moreover, issuers of "significant" tokens face enhanced supervision by the European Banking Authority, including capital requirements so high they deter startups. Today, launching a crypto business in Europe is nearly impossible without a top-tier legal team and capital rivaling traditional financial giants.

For intermediaries, Title V completely eliminates offshore, cloud-based exchange models. Service providers must establish physical offices in EU member states, appoint resident directors who pass "fit and proper" tests, and implement strict asset segregation and custody. The "white paper" requirement turns technical documents into legally binding prospectuses—any material misstatement or omission triggers strict civil liability, shattering the cherished anonymity of corporate "veils." At that point, you might as well just open a digital bank.

Although MiCA introduces a "passporting right" allowing approval in one member state to apply across the EEA, this "harmonization" comes at a steep cost.

It erects a regulatory "moat"—only institutions with immense capital can afford the heavy costs of AML integration, market abuse monitoring, and prudential reporting.

MiCA doesn’t just regulate Europe’s crypto market—it actively blocks entrepreneurs lacking legal and financial resources from entering, which describes the majority of crypto founders.

Beyond EU law, Germany’s BaFin has devolved into a mediocre "compliance paperwork machine," efficient only in processing applications for an increasingly stagnant industry. France’s ambition to become Europe’s "Web3 hub" has crashed into walls of its own making. French startups aren’t coding—they’re "voting with their feet." Unable to compete with U.S. speed or Asian innovation, talent is flooding to Dubai, Thailand, and Zurich.

But the true "death knell" is the stablecoin ban. Under the guise of "protecting monetary sovereignty," the EU effectively prohibits non-euro stablecoins like USDT—strangling the most reliable sector of the DeFi ecosystem. The global crypto economy runs on stablecoins. Forcing European traders to use illiquid, euro-only stablecoins ignored outside the Eurozone, Brussels has dug itself into a "liquidity trap."

The ECB and the European Systemic Risk Board have urged the EU to ban the "multi-issuance" model—where global stablecoin firms treat EU and non-EU issued tokens as interchangeable. The ESRB, led by ECB President Lagarde, warns that non-EU holders redeeming EU-issued tokens could "amplify financial risks within the EU."

Meanwhile, the UK considers capping individual stablecoin holdings at £20,000, while doing little to regulate higher-risk "shitcoins." Europe’s risk-averse strategy desperately needs reform—or the regulation itself may trigger systemic collapse.

The reason may be simple: Europe wants its citizens bound to the euro, unable to escape its stagnation or decline by participating in the U.S. economy. As Reuters quoted the ECB warning:

Stablecoins could drain valuable retail deposits from eurozone banks, and any run on stablecoins could have wide-ranging effects on global financial stability.

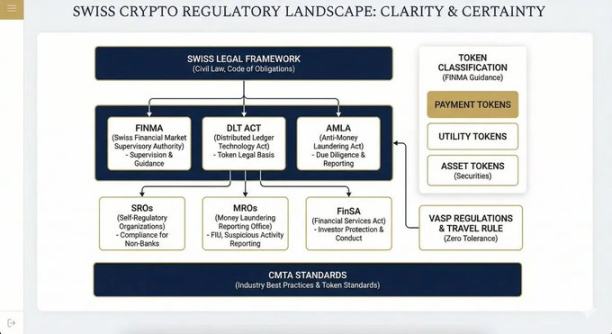

Ideal Model: The Swiss Approach

Some countries, freed from partisan battles, foolish decisions, and outdated laws, have successfully avoided the binary trap of "over-regulation" versus "under-regulation," finding inclusive paths forward. Switzerland is such a model.

Its regulatory landscape is diverse, effective, and friendly—beloved by practitioners and users alike:

-

Financial Market Supervision Act: Enacted in 2007, consolidates banking, insurance, and AML supervisory bodies, establishing the independent, unified Swiss Financial Market Supervisory Authority (FINMA).

-

Financial Services Act: Focuses on investor protection, creating a level playing field for all financial service providers through strict conduct rules, client categorization, and disclosure requirements.

-

Anti-Money Laundering Act: Core framework combating financial crime, applicable to all financial intermediaries—including crypto service providers.

-

Distributed Ledger Technology Act: Passed in 2021, amends ten federal laws, formally recognizing the legal status of crypto assets.

-

Ordinance on Virtual Asset Service Providers: Strictly enforces FATF rules with a "zero-tolerance" approach.

-

Article 305bis of the Swiss Penal Code: Explicitly criminalizes money laundering.

-

Industry Standards: Issued by the Association for Financial Markets and Technology, widely adopted despite being non-binding.

-

Regulatory Structure: Parliament passes laws, FINMA issues detailed rules, self-regulatory organizations handle daily oversight, and the Money Laundering Reporting Office reviews suspicious reports and forwards them for prosecution—clear structure, defined responsibilities.

Hence, the Zug Valley has become a "holy land" for crypto entrepreneurs. Its coherent framework not only allows innovation but provides a clear legal safety net—giving users peace of mind and encouraging banks willing to take controlled risks to collaborate.

American Embrace and Exploitation

The New World’s acceptance of crypto isn’t purely driven by innovation (France still hasn’t sent a human to the moon), but more by fiscal pragmatism. After losing Web2 internet dominance to Silicon Valley in the 1980s, Europe seems to view Web3 as another "tax base" to harvest, rather than an industry to nurture.

This suppression is structural and cultural. Amid aging populations and pension systems under strain, the EU cannot tolerate the rise of an uncontrollable financial industry. It recalls feudal lords imprisoning or killing local nobles to eliminate threats. Europe exhibits a tragic "self-destructive tendency," sacrificing citizen potential to block uncontrolled change. This is alien to America, where culture celebrates competition, ambition, and a Faustian will to power.

MiCA isn’t a "development" framework—it’s a "death sentence." It ensures that if European citizens engage in crypto trading, it must occur within a state surveillance grid, guaranteeing the government gets its cut—like an obese monarch squeezing farmers dry. Europe is positioning itself as the world’s "luxury consumer colony" and "eternal museum," for astonished Americans to visit and mourn a past that cannot revive.

In contrast, Switzerland, the UAE, and others have escaped historical and structural flaws. They lack the imperial burden of defending a global reserve currency and the bureaucratic inertia of a 27-nation bloc. By exporting "trust" through laws like the DLT Act, they’ve attracted foundations behind Ethereum, Solana, Cardano, and other IP-rich projects. The UAE follows closely—no wonder more and more French citizens are "invading" Dubai.

We are entering an era of "radical jurisdictional arbitrage."

The crypto industry will geographically split: consumers will remain in the U.S. and Europe, subject to full KYC, high taxes, and integration with traditional banks; while core protocol layers will migrate entirely to rational jurisdictions like Switzerland, Singapore, and the UAE.

Users will be global, but founders, VCs, protocols, and developers will have to consider leaving their home markets to build elsewhere.

Europe’s fate may be reduced to a "financial museum." It is building a shiny yet useless—and even deadly to actual users—legal system for its citizens. One must ask: Have Brussels technocrats ever bought Bitcoin or transferred stablecoins cross-chain?

Crypto becoming a macro asset is inevitable. The U.S. will retain its position as the global financial center. Bitcoin-denominated insurance, crypto-collateralized loans, crypto reserves, unlimited VC funding, and a vibrant developer ecosystem—America is building the future.

Worrisome Conclusion

In sum, the "brave new world" Brussels is constructing resembles less a coherent digital framework and more a clumsy patchwork—forcibly grafting 20th-century banking compliance onto 21st-century decentralized protocols, designed by engineers mostly ignorant of ECB politics.

We must actively advocate for an alternative system—one that prioritizes real-world needs over administrative control. Otherwise, we will utterly suffocate Europe’s already anemic economy.

Unfortunately, crypto is not the only victim of this "risk paranoia." It’s merely the latest target of a well-paid, complacent bureaucracy. These officials wander lifeless postmodern corridors in capitals, wielding heavy-handed regulation that reveals their lack of real experience. They’ve never endured the hassle of account verification, passport renewals, or business license applications. Thus, despite Brussels’ abundance of so-called "technocrats," native crypto founders and users must contend with a group mired in incompetence, producing only harmful legislation.

Europe Must Pivot—Now

While the EU busies itself binding with red tape, the U.S. is actively planning how to "standardize" DeFi, moving toward a framework beneficial to all parties. A degree of "re-centralization" through regulation is now inevitable—the collapse of FTX already wrote the warning on the wall.

Investors who suffered heavy losses crave justice; we need to break free from the current cycle of meme coin mania, bridge vulnerabilities, and regulatory chaos—the "Wild West." We need a structure that allows safe entry for traditional capital (Sequoia, Bain, BlackRock, Citigroup—all already moving in) while protecting end users from predatory capital.

Rome wasn’t built in a day, but the crypto experiment has lasted fifteen years—yet its institutional foundation remains stuck in the mud. The window to build a functional crypto industry is rapidly closing; hesitation and half-measures in war lose everything. Both sides of the Atlantic need swift, decisive, comprehensive regulation.

If this cycle is truly ending, now is the best time to salvage the industry’s reputation and compensate serious investors harmed for years by bad actors.

Tired traders from 2017, 2021, and 2025 demand a thorough reckoning and a final answer to the crypto question—and above all, to let our world’s favorite assets reach the historic highs they so richly deserve.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News