Frenzy, Trampling, and Restructuring: Reviewing the 2025 Crypto Market Amid Regulatory Easing and Institutional Entry, and Outlook for 2026

TechFlow Selected TechFlow Selected

Frenzy, Trampling, and Restructuring: Reviewing the 2025 Crypto Market Amid Regulatory Easing and Institutional Entry, and Outlook for 2026

This article will conduct an in-depth review of the 2025 crypto market from multiple perspectives, including macro environment, policy regulation, institutional participation, market performance, sector highlights, and on-chain data, and based on this analysis, provide outlook for development trends and investment opportunities in 2026.

Author: Hotcoin Research

Introduction

For the crypto market, 2025 was a dramatic year: early on, driven by improving macro conditions and favorable policies, Bitcoin and Ethereum prices surged to new all-time highs. Institutional capital rushed in, and a wave of Digital Asset Treasury (DAT) companies swept through capital markets. However, after a scorching summer, market sentiment took a sharp downturn. In mid-October, a "10·11 panic night" triggered a deleveraging stampede—Bitcoin plummeted, while altcoins suffered Waterloo-style crashes. The year unfolded as a rollercoaster with an initial surge followed by a steep decline.

This article provides a deep review of the 2025 crypto market from multiple angles—macro environment, policy regulation, institutional participation, market performance, trending sectors, and on-chain data—and uses this analysis to forecast trends and investment opportunities for 2026. It aims to summarize key events and data from 2025, distill the underlying logic of market evolution, and offer forward-looking insights for investors.

I. Macro Shifts and Policy Tailwinds: The “Tailwind” for Crypto

1. Global Macro Environment Warms Up

In 2025, the global economic environment improved relatively, with easing inflation prompting major central banks to shift toward looser monetary policies. The U.S. Federal Reserve ended its two-year rate-hiking cycle in the first half of the year and began a rate-cutting cycle by year-end. Its Quantitative Tightening (QT) program, launched in 2022, officially concluded on December 1, 2025.

Expectations of lower borrowing costs boosted investor appetite for risk assets. In 2025, U.S. equities entered a bull run fueled by the AI boom, led by tech stocks, with the S&P 500 repeatedly hitting record highs. However, the strength of equities also diverted attention and capital away from crypto, causing the crypto market’s overall performance to lag behind stocks in 2025.

In commodities, gold prices steadily climbed amid a weaker dollar and rising geopolitical risks, continuously setting new historical highs on safe-haven demand. Crude oil and other commodities saw modest gains due to mild global demand recovery.

Overall, the macro environment was relatively friendly to crypto during the first three quarters of 2025. A weakening dollar and peak interest rates were positive factors, with ample liquidity for risk assets. However, global market volatility intensified in Q4, as surging U.S. Treasury yields reignited risk-off sentiment, briefly impacting high-beta crypto assets.

2. U.S. Regulatory Easing

The 2024 U.S. presidential election concluded with Donald Trump, known for his pro-crypto stance, returning to the White House. Upon taking office in January 2025, he quickly delivered on campaign promises, sending unprecedented positive signals to the crypto industry and accelerating a "regulatory reversal": The passage of the "GENIUS Act" stablecoin bill provided a clear framework for reserve oversight and compliant operations of USD-backed stablecoins. Meanwhile, bipartisan lawmakers advanced a new digital asset market structure bill that clearly delineated regulatory boundaries between security tokens and commodity tokens, affirming the legal status of major cryptocurrencies like Bitcoin and Ethereum. These moves marked a shift from prior heavy-handed crackdowns to a more rational and inclusive regulatory posture, injecting a strong confidence boost into the crypto market.

On the enforcement front, both the SEC and CFTC adjusted their strategies, emphasizing greater collaboration with the industry and clearer guidance, supporting innovation while protecting consumers and financial stability. For example, the CFTC adopted an open stance toward prediction markets, treating them as event-based derivatives and allowing compliant platforms to offer such trading.

The significant improvement in the U.S. regulatory environment not only lifted domestic market confidence but also set a precedent for other jurisdictions globally. Europe formally implemented the MiCA framework in 2025, establishing unified regulations across issuance, trading, and custody. Hong Kong rolled out a comprehensive virtual asset exchange licensing regime and drafted stablecoin regulations, aiming to become a Web3 financial hub in Asia-Pacific. The Middle East and Singapore further optimized tax and compliance policies to attract crypto startups and capital. In contrast, mainland China maintained strict controls over crypto trading and reaffirmed its stance against speculation at the end of 2025, highlighting the divergence in global policy approaches.

Overall, the global crypto regulatory landscape improved significantly compared to previous years. U.S. regulatory easing enabled large-scale inflows of compliant capital and prompted other countries to explore regulatory frameworks suited to this new asset class, creating a dynamic of "competitive cooperation." This series of policy tailwinds laid the foundation for the crypto market’s prosperity in the first half of 2025.

3. Traditional Finance Embraces Crypto

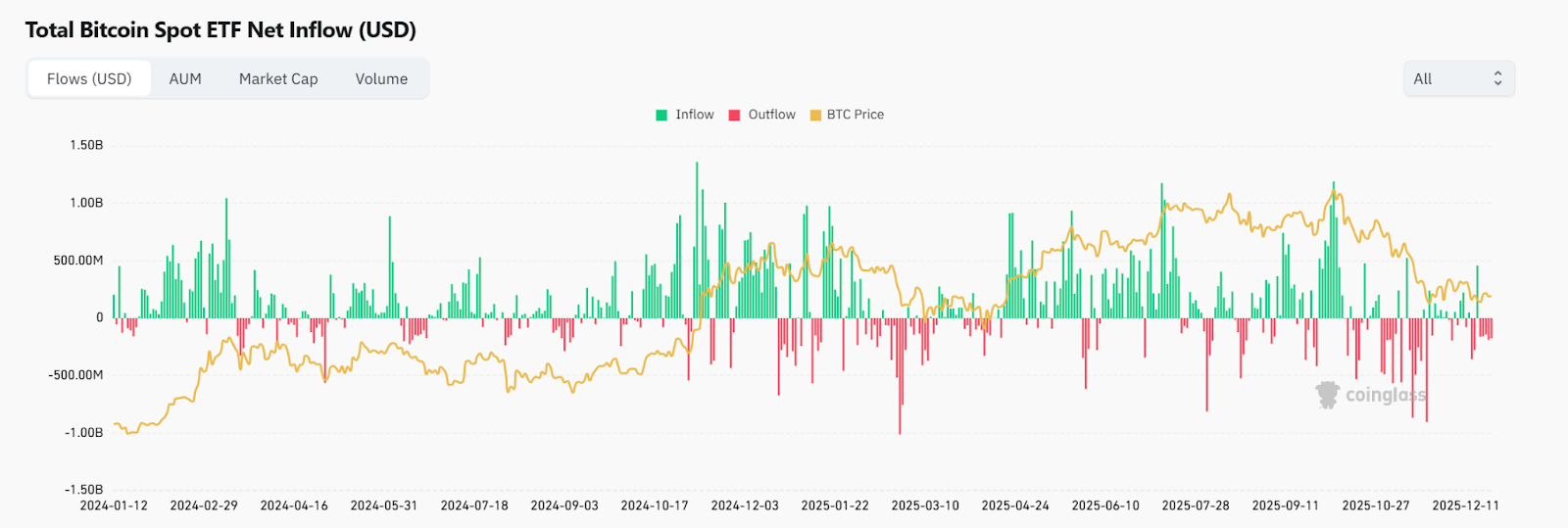

Alongside policy breakthroughs, traditional financial institutions made major moves into crypto in 2025, pushing the industry further into the mainstream. First, spot Bitcoin ETFs scaled up rapidly. Following the U.S. approval of the first spot Bitcoin ETF at the end of 2024, massive inflows occurred throughout 2025. As of December 25, 2025, the total AUM of U.S. spot Bitcoin ETFs reached approximately $117.3 billion, holding over 1.21 million BTC—about 6.13% of Bitcoin’s total supply. Ethereum ETFs had an AUM of around $17.1 billion, roughly one-tenth of Bitcoin ETFs. In the second half of 2025, an "Altcoin ETF boom" emerged, with approvals and listings for ETFs tied to major altcoins including XRP, SOL, LTC, DOGE, HBAR, LINK, and others.

Source: https://www.coinglass.com/bitcoin-etf

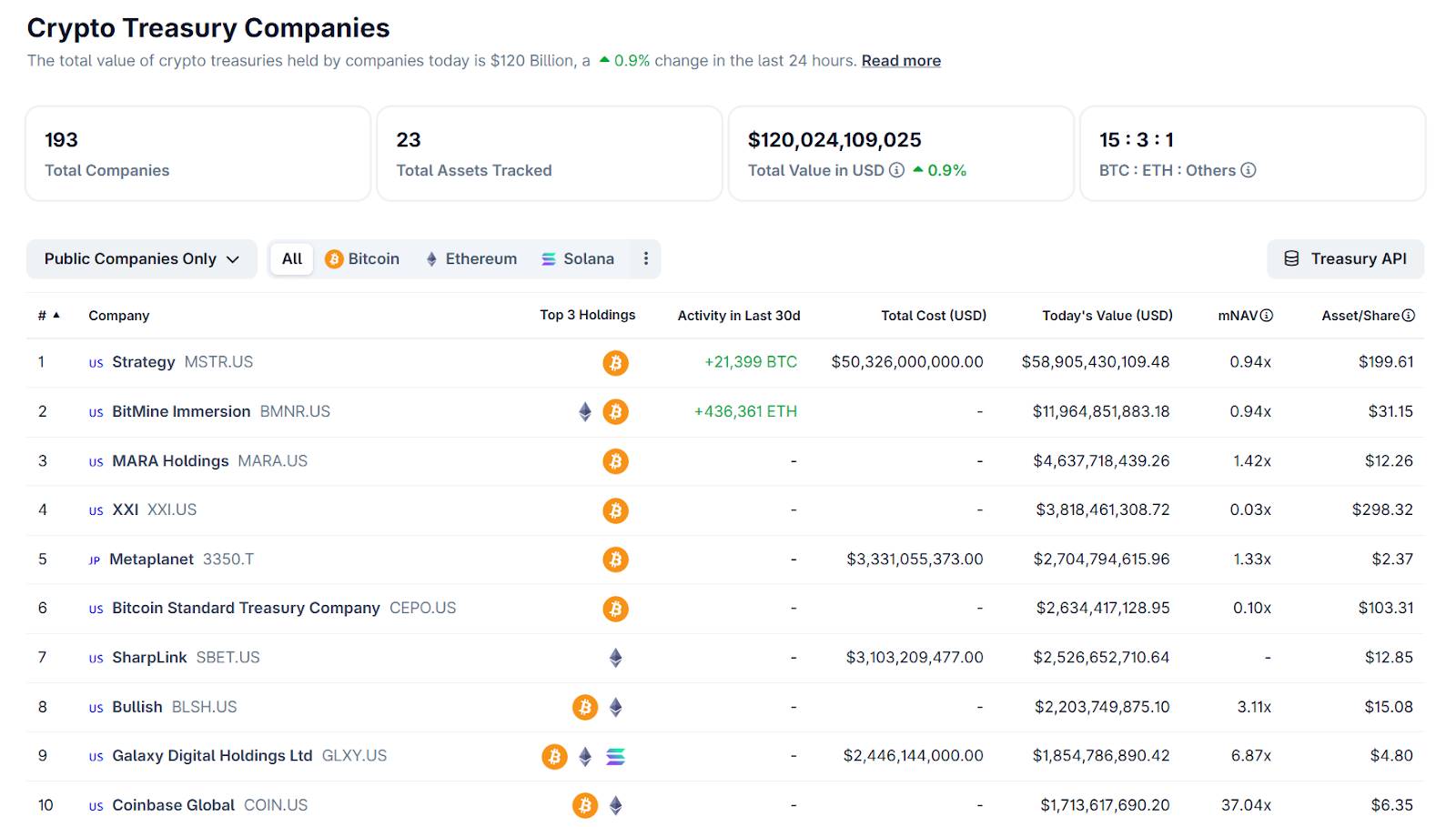

Benefiting from accounting rule reforms (allowing crypto assets to be measured at fair value) and shifts in venture investment preferences, numerous small- and mid-cap public companies announced they would follow MicroStrategy's lead by allocating part of their cash reserves to Bitcoin, Ethereum, and other crypto assets, transforming into "Digital Asset Treasury (DAT) companies." According to CoinGecko data, 193 listed firms have now disclosed crypto treasury plans, raising over $120 billion to purchase BTC, ETH, SOL, BNB, and other digital assets. Many traditional businesses sought to capture upside from the crypto bull market through these moves, and their stock prices often surged multiples upon announcements.

Source: https://www.coingecko.com/en/treasuries/companies

Among institutional investors, traditional hedge funds and sovereign wealth funds also warmed to crypto: Grayscale Trust products continued attracting incremental buying on secondary markets, and reports indicated some Middle Eastern and Asian sovereign funds quietly increased positions during Bitcoin’s October sell-off, establishing long-term holdings at lower levels. Additionally, the U.S. Department of Labor relaxed rules in 2025 on retirement plan investments in digital assets, allowing 401(k) and similar pension plans to allocate small percentages to approved crypto funds or ETFs—opening the door for potentially trillions of dollars in retirement capital to flow into crypto in the future.

In 2025, several traditional financial institutions experimented with bringing stock trading onto blockchains, marking the dawn of on-chain equity trading. Nasdaq and others launched pilots to issue shares of public companies as tokens on permissioned chains, while xStocks, Ondo, and others introduced tokenized stocks integrated with major trading platforms. This signals accelerating convergence between traditional securities markets and crypto technology, suggesting that digital assets may soon represent not just new tokens but also tokenized forms of traditional assets.

In short, in 2025, traditional finance embraced crypto comprehensively—from regulation and product development to capital allocation. Crypto is rapidly integrating into mainstream portfolios, and the "liquidity handshake between Wall Street and crypto" has already begun.

II. Market Review: A Rollercoaster Ride from Bull to Bear

-

Overall Market Characteristics: Extreme Volatility

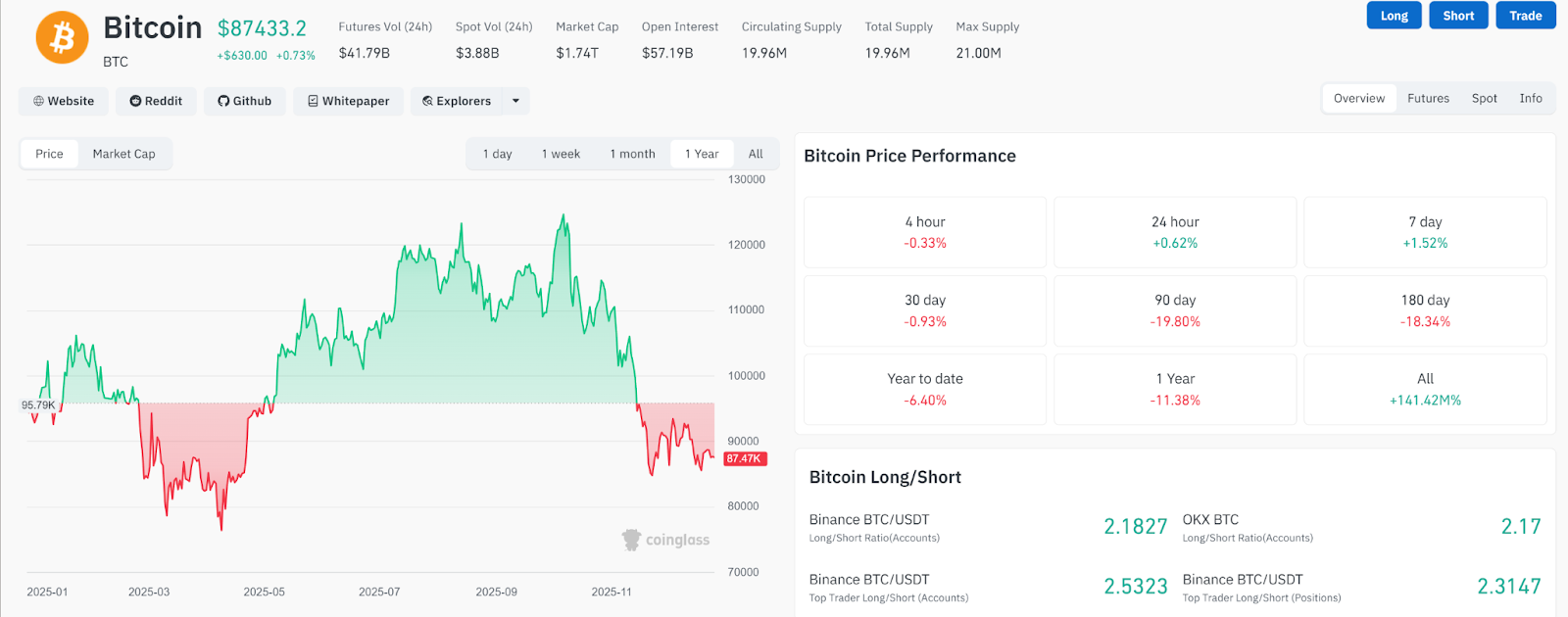

The 2025 crypto market experienced extreme volatility—a classic rollercoaster ride. The year started with momentum carried over from late 2024, as Bitcoin, Ethereum, and other major coins climbed steadily, reaching all-time highs around Q3. But in Q4, the market rapidly declined under leveraged liquidations and panic sentiment, resulting in a "high beginning, low ending" pattern for the year.

Source: https://www.coinglass.com/currencies/BTC

After Bitcoin broke $100,000 at the end of 2024, it continued climbing into early 2025. On January 2025, MicroStrategy announced another large BTC purchase, pushing the price close to $107,000. The market then entered a brief consolidation phase, with BTC staying above $80,000 in February and March, building momentum for the next leg up. With ongoing U.S. regulatory tailwinds, steady ETF inflows, and rumors that the Trump administration might designate Bitcoin as a strategic reserve asset, Bitcoin resumed its upward trajectory in Q2. From around $95,000 at the start of the year, BTC rose to about $120,000 by early Q3—nearly 7–8 times higher than the 2022 bear market bottom (~$16,000). Unlike previous bull runs, this rally was more orderly, without irrational vertical spikes, and new capital flowed primarily into BTC and a few top-tier assets.

Just when many investors thought the market would continue climbing toward year-end following the "four-year cycle," a sharp turning point occurred. In early October, Bitcoin spiked volume-wise to a new all-time high of ~$126,000 without obvious negative catalysts. But on October 11, market liquidity suddenly reversed, with multiple exchanges simultaneously seeing abnormal massive sell orders, triggering a chain reaction of cascading liquidations. Within days, Bitcoin broke through $120k, $100k, and $90k psychological levels, bottoming near $80,000—a nearly 37% drop from the peak. Major coins like Ethereum followed suit, with ETH falling from around $5,000 to ~$3,000. Mid- and small-cap tokens fared far worse—most altcoins dropped 80% to 99% from their yearly highs, with many minor tokens nearly collapsing to zero. This crash, comparable to the "5·19 crash" of 2021 and the "3·12 crash" of 2020, became known as the "10·11 panic night," marking the abrupt end of the bull market.

After the crash, the market entered a prolonged recovery. By mid-November, Bitcoin briefly tested near $80,000 before gradually stabilizing and rebounding. By end-December, BTC recovered to around $90,000. Ethereum ended the year slightly above $3,000, close to its starting level. Altcoins, however, were devastated—many second- and third-tier tokens fell over 50% for the year, and investor confidence hit rock bottom. Meanwhile, traditional risk assets like equities only saw mild pullbacks and remained near annual highs. This suggests that the 2025 crypto correction was more likely driven by internal leverage bubble bursts rather than broader macro deterioration.

2. On-Chain Ecosystem Performance

Beneath the volatile market movements, on-chain data more accurately reflected changes in capital flows, user behavior, and ecosystem structure in 2025.

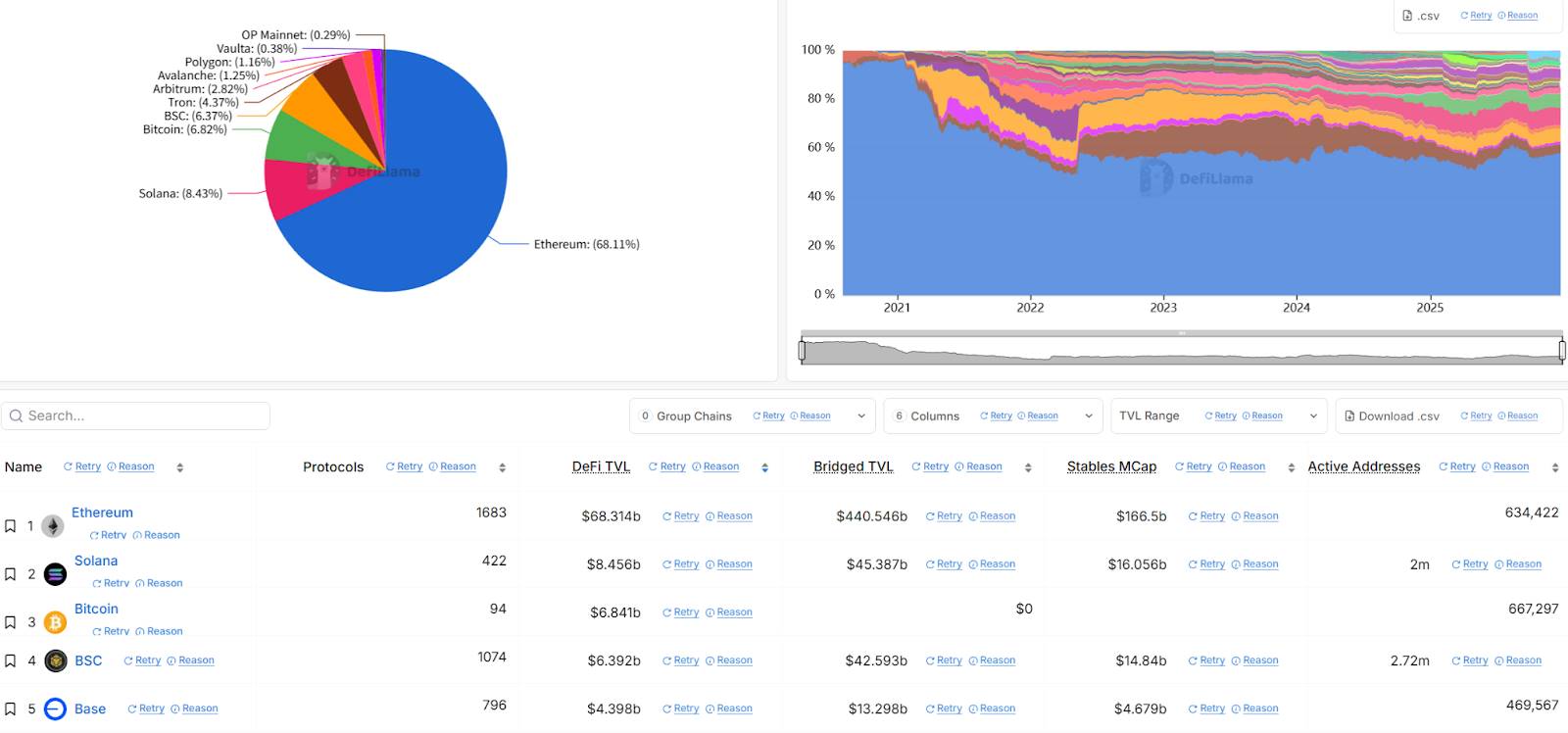

1) "Layer-1 Specialization" solidified further: Ethereum continued serving as the secure settlement layer and largest liquidity base, while Solana, BNB Chain, and Base functioned more as high-frequency transaction and consumer app "traffic chains." From a DeFi TVL perspective, Ethereum maintained its dominance in core asset deposits throughout the year, ending 2025 with an overwhelmingly leading position in on-chain stablecoin scale.

Source: https://defillama.com/chains

2) Structural migration in trading volume and user activity: In 2025, Solana frequently challenged Ethereum for the top weekly rankings, even briefly leading. BNB Chain captured substantial spot and liquidity demand through flagship apps like PancakeSwap, and its fee structure in 2025 saw "unit cost compression," enabling cheaper, higher-frequency transactions. Base’s rise was more "product-driven"—by year-end, its on-chain metrics showed typical characteristics of "high transaction count + high active addresses," becoming one of Ethereum’s strongest new traffic entry points.

3) Shifting trends in fees and revenue: In 2025, blockchain transaction fees were no longer driven solely by L1/L2 networks themselves—increasingly, applications contributed significantly. Trading platforms, wallets, and consumer apps are shifting the narrative of blockchains from "infrastructure" to "cash flow generators." This explains why, when Q4 risk events or macro tightening occurred, on-chain liquidity exhibited a "fast in, fast out" behavior.

4) Stablecoins and yield strategies as ecosystem glue: Ethereum remained the core hub for stablecoins and yield products. In 2025, yield-bearing stablecoins and strategy-based products expanded noticeably—Ethena’s USDe maintained a multi-billion-dollar scale by year-end, becoming a representative asset for "dollar-like yield" on-chain. Yield-splitting and yield market protocols like Pendle accumulated billions in TVL by mid-2025, with many strategy combinations built around yield-bearing stablecoins like sUSDe, accelerating deposit-yield-re-staking-re-cycling loops.

5) Staking and lending remain primary vehicles for large capital: Platforms like Lido on Ethereum and Jito on Solana drove the "financialization of staked assets." The lending sector focused more on efficiency competition between "stablecoins and blue-chip collateral": Top lending protocols kept absorbing collateral and borrowing demand, providing infrastructure for yield strategies and leveraged trading.

6) CEXs stepping into on-chain trading gateways: Take Binance Alpha as an example—its core selling point is integrating on-chain discovery and trading within the exchange, lowering wallet and gas barriers. Bybit Alpha similarly emphasized its "account-based on-chain trading" product path in 2025. Bitget promoted a unified multi-chain on-chain trading entrance, amplifying the hybrid model where "CEX handles users and risk control, while the chain handles assets and settlement." These products significantly boost the speed and frequency of on-chain asset circulation during bull markets, but during Q4’s sudden risk-off events, they also cause liquidity to exit more synchronously and intensely.

-

Investor Sentiment and Capital Flows: Two Opposite Extremes

In 2025, investor sentiment swung from extreme euphoria to extreme pessimism. In the first half, retail investors returned, crypto social media reactivated, and various narratives rotated rapidly—from AI to memes, with constant hot topics. But unlike past cycles, these narratives had much shorter lifespans—themes that once lasted months now faded within days, replaced by the next trend.

After the October crash, market sentiment turned sharply, with greed indices plunging into deep fear territory. By year-end, Bitcoin’s 30-day volatility had dropped to multi-year lows. Yet on-chain data showed that after the October selloff, the number of large Bitcoin addresses (holding over 10,000 BTC) began rising, indicating long-term players like sovereign funds were accumulating at lower prices. Looking ahead, 2026’s market is expected to be more rational and mature, with investment styles possibly shifting from chasing trends to long-term value allocation—laying fertile ground for steady growth.

III. 2025 Crypto Industry Highlights Review

Despite massive price swings, 2025 was not just about numbers going up and down. The year still witnessed many memorable technological breakthroughs, application innovations, and industry trends that laid the groundwork for future development.

1. Institutionalization and Compliance: Crypto Comes of Age

2025 was widely seen as crypto’s "coming-of-age moment," marking the transition from a retail-driven speculative phase to an infrastructure phase shaped by institutional participation. Institutions became marginal price setters in 2025—U.S. spot Bitcoin ETFs saw weekly inflows exceeding $3.5 billion in Q4, far surpassing retail net flows during the same period.

Institutional participation brought dual effects: On one hand, long-term capital with low risk tolerance and low turnover helped reduce market volatility and improve pricing efficiency. On the other hand, such capital is highly sensitive to macro interest rates, making crypto more tightly coupled with macro cycles—leading to stronger price pressure during liquidity tightening.

Compliance increasingly became a moat for crypto projects: Platforms with licenses, robust risk controls, and regulatory tech architecture gained institutional trust, growing in trading volume and market share. In contrast, non-compliant gray-zone platforms were marginalized or shut down. For example, Coinbase, a U.S.-regulated exchange, hit record highs in users and revenue, while a new wave of decentralized compliant financial infrastructure emerged, such as trustless custody solutions built on Ethereum.

2. Stablecoins: Legislation Passed and Use Cases Expanded

The U.S. stablecoin bill established that regulated issuers must hold high-quality short-term assets as reserves and undergo regular audits. This enhanced the credibility of mainstream stablecoins like USDC and USDT and encouraged more traditional financial institutions to participate in issuing or using stablecoins.

Total on-chain stablecoin transaction volume reached $46 trillion in 2025, making it arguably crypto’s "killer app." However, the year also saw risk incidents involving USDe, xUSD, deUSD, and USDX. For instance, the high-yield algorithmic stablecoin xUSD collapsed to $0.18 due to excessive reliance on endogenous leverage, causing nearly $93 million in user losses and leaving $285 million in protocol bad debt. These incidents served as warnings against overly complex stablecoin designs.

Yet overall, fiat-backed stablecoins strengthened their dominance. By end-2025, the circulating market cap of USD stablecoins continued growing steadily, with new use cases emerging: Companies used stablecoins for cross-border trade settlements to avoid SWIFT’s high costs and delays; consumers used third-party payments to spend stablecoins in daily purchases; residents in high-inflation countries like parts of Latin America and Africa treated USD stablecoins as digital piggy banks. Forbes projected that in 2026, stablecoins will become ubiquitous, further penetrating traditional financial transactions and corporate treasury management.

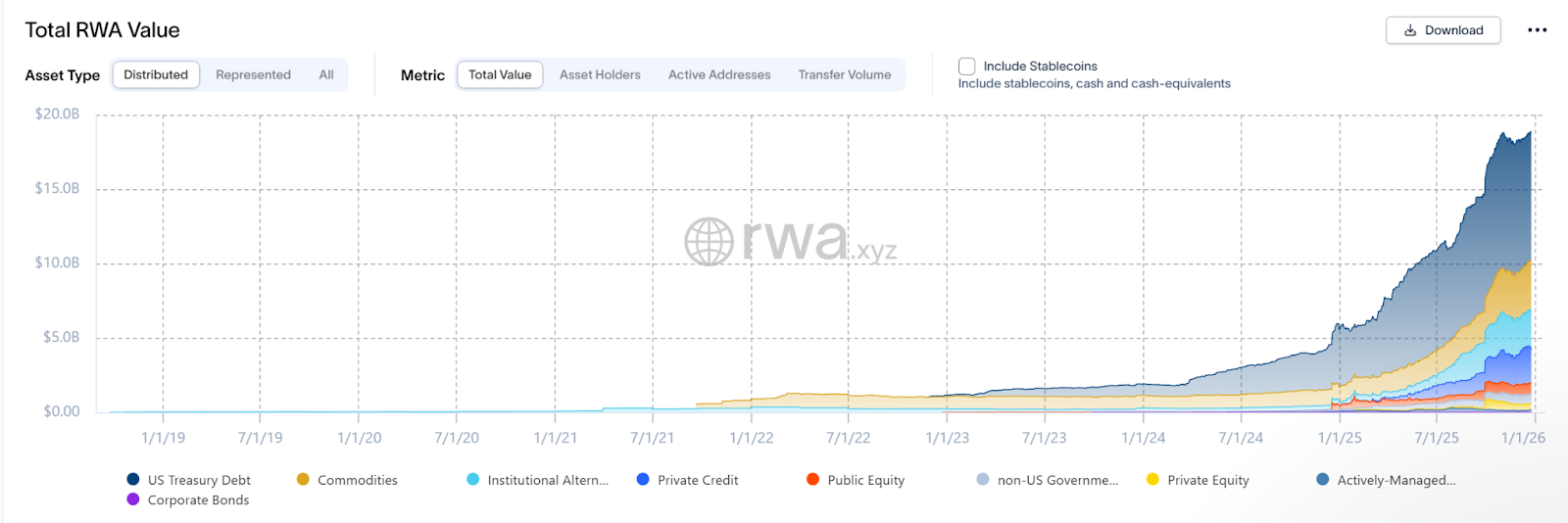

3. RWA: From Concept to Reality

2025 witnessed real-world asset tokenization (RWA) move from hype to scalable deployment, becoming a genuine component of the crypto capital market. As institutions sought traditional yield on-chain, U.S. Treasuries, real estate, and equities began appearing as tokenized assets. By end-2025, the total market cap of RWA tokens exceeded $19 billion, with about half coming from tokenized U.S. Treasuries and money market funds. BlackRock issued $500 million in tokenized U.S. Treasuries (ticker: BUIDL) via blockchain. Established Wall Street firms like JPMorgan and Goldman Sachs moved their RWA infrastructure from trials to production—JPM’s Onyx and GS DAP platforms began handling real transactions, tokenizing corporate loans and receivables.

Source: https://app.rwa.xyz/

Stablecoin issuers also rode the RWA wave: Companies behind USDT and USDC began adding short-term U.S. Treasuries to their reserves, enhancing transparency. Decentralized central bank MakerDAO added commercial paper and Treasuries to DAI’s collateral pool, backing stablecoin supply with real-world income. Treasury-backed stablecoins became digital dollar carriers. The biggest breakthrough in RWA in 2025 was a shift in investor mindset: People no longer settled for synthetic tokens pegged to gold or stocks—they wanted to directly own natively issued on-chain assets.

RWA’s rise also spawned dedicated platforms and protocols. A new wave of blockchain projects emerged to serve issuance, clearing, and trading of physical assets—some focused on real estate tokenization (splitting property shares into small tokens), others on NFTizing art and collectibles, and some offering full-stack compliant issuance and custody solutions. Oracles played a critical role in RWA, as reliable data feeds were needed to reflect off-chain asset values on-chain—spurring collaborations between oracle networks and traditional data providers. The direct benefit of the RWA wave was broadening DeFi’s collateral base: While DeFi lending previously accepted only crypto assets, some protocols now began accepting rigorously vetted RWA tokens as collateral—such as Treasury tokens used to mint stablecoins or borrow funds. This connected on-chain and off-chain capital markets and gave DeFi greater stability.

-

Artificial Intelligence × Blockchain: AI Economy Takes Root

In 2025, the convergence of AI and blockchain moved from proof-of-concept to initial real-world deployment. Notably, autonomous AI agents (AI Agents) began integrating with crypto economics. This year saw AI-powered DAOs, AI executing smart contract trades, and AI models acting as blockchain users in economic activities—emerging as new paradigms.

Driven by major players like Coinbase, Google, and Salesforce, X402 gained rapid popularity—it enables AI systems to automatically pay for web resources, facilitating low-cost, instant micro-payments perfectly suited to AI’s high-frequency, small-transaction needs. Numerous startups built around X402 emerged—for example, AI model training data markets where models autonomously purchase data, or IoT devices using X402 to auto-pay maintenance fees. X402 opened the door to autonomous AI economies, giving machines economic identities and self-trading capabilities.

Beyond payments, AI applications in blockchain governance and investing advanced in 2025. AI governance DAOs began appearing—projects introduced AI decision assistants to analyze proposals, detect contract vulnerabilities, and even automate operational decisions. AI trading bots attracted strong interest from quant investors. Some funds trained AI models to read on-chain sentiment and macro data, automatically executing arbitrage and hedging strategies. While AI trading still faces challenges around opacity and regulation, its advantages in speed and big data analysis are becoming evident.

The AI-blockchain fusion also gave rise to new token economic models. Some AI projects issued utility tokens granting access to AI services—for example, holding a token from an AI compute network grants computational power. Others used AI to generate content and sold it via NFTs on-chain, with buyers receiving rights to future appreciation as the AI model iterates. While many AI+crypto projects saw inflated valuations during the bull market and later halved in value, top-tier projects proved sustainable. For instance, AI security audit tools and AI risk management services saw strong B2B demand, generating real revenue and supporting intrinsic token value.

-

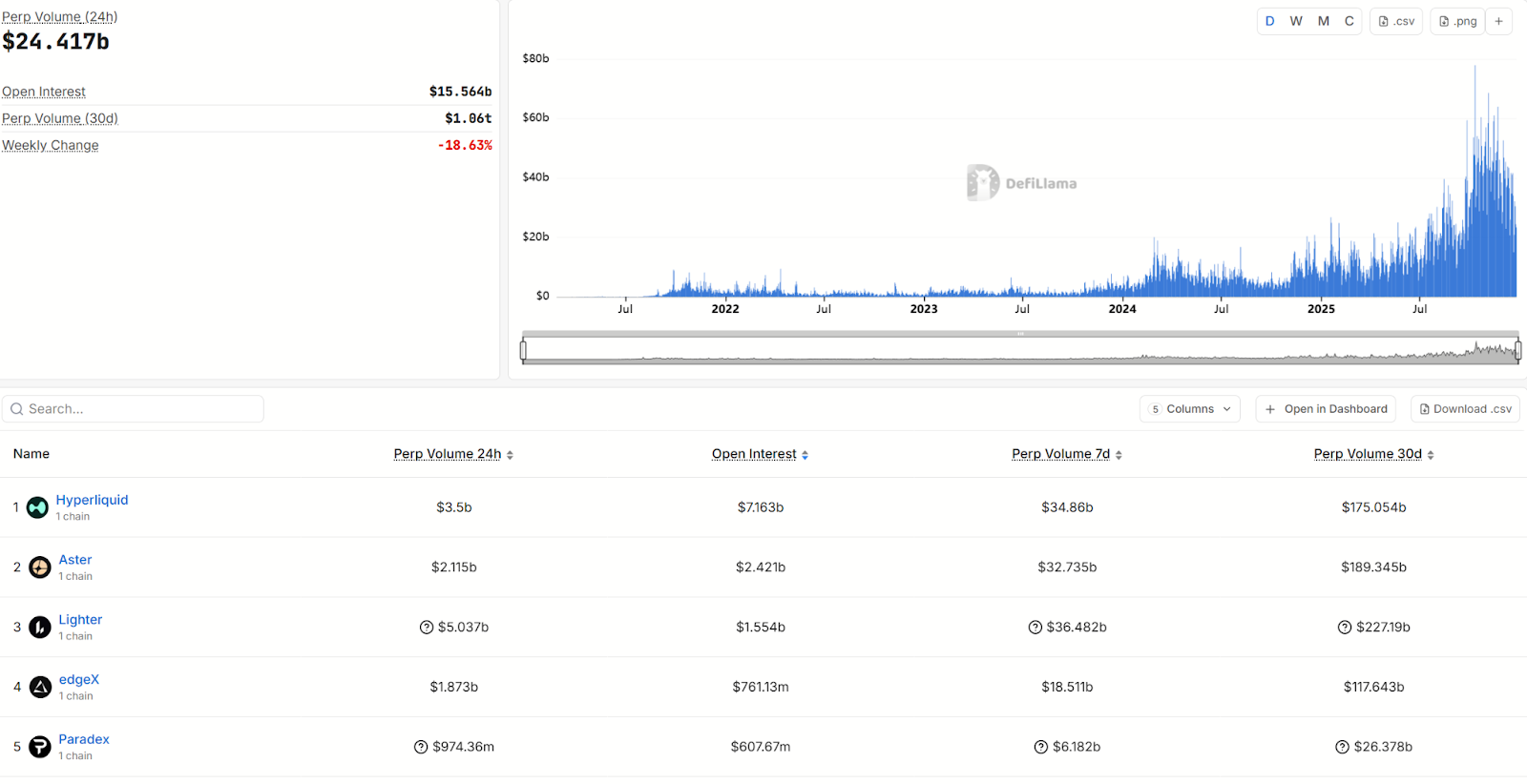

DeFi Ecosystem: Rise of Perp DEXs and Prediction Markets

Perpetual contract decentralized exchanges (Perp DEXs) became a force to reckon with in derivatives markets. Leading platforms like Hyperliquid and Aster achieved record-high trading volumes in 2025, attracting liquidity providers and market makers through trading mining and fee rebates. Data shows that 2025’s total volume of decentralized derivatives reached an all-time high, elevating DeFi derivatives from niche experiments to systemically important components of the market.

Source: https://defillama.com/perps

The rise of prediction markets was another highlight of 2025’s DeFi space. Thanks to the CFTC’s accommodating stance and surging user interest in event betting, platforms like Polymarket saw explosive growth in trading volume, becoming one of the fastest-growing verticals. Prediction markets effectively fulfilled some functions of traditional financial options and betting markets—not just for entertainment (political or sports bets), but also allowing enterprises to hedge performance risks and investors to manage uncertainty around macro events. This expanded DeFi’s application frontier.

Another notable DeFi trend in 2025 was the rise of yield and structured products. Traditional financial institutions began using DeFi lending protocols to improve capital utilization—e.g., participating in cross-border trade financing. To meet institutional demand for stable returns, a wave of structured DeFi products emerged—such as combining options and lending to create fixed-income and enhanced-yield token tranches, enabling yield curve segmentation. These innovations moved DeFi beyond simple high-yield chasing toward refined risk pricing.

However, 2025 still saw frequent hacking incidents—Balancer V2 lost about $128 million across mainnet and forks due to a contract vulnerability. Some complex "decentralized Lego" variants collapsed—over-leveraged yield aggregators and black-box algorithmic protocols faced bank runs when the bull market turned, driving token prices to zero. Some InfoFi projects also experienced wild swings—platforms claiming to reward users for contributing information boomed in early 2025 but quickly imploded as the model proved unsustainable, with user attention eroded by low-quality AI content and bot farming.

-

SociaFi and NFTs: New Experiments in Traffic and Content

In 2025, exploration in "Social + Finance" (SocialFi) continued, with new attempts such as creator-owned DAOs—NFTizing authors’ works and crowdfunding support, enabling transparent distribution of content revenue. Overall, however, SocialFi did not deliver revolutionary breakthroughs, and most users still accessed crypto content via centralized platforms.

The NFT space also matured in 2025. After the 2021 mania and the 2022–2023 downturn, the NFT market avoided a new broad bubble in 2025, but several niches stood out. First, high-end art and luxury NFTs developed steadily—top auction houses successfully held NFT auctions, renowned artists embraced blockchain creations, and NFT art gained gradual acceptance in traditional art circles, with blue-chip NFT prices remaining resilient in the bear market. Second, utility NFTs rose in prominence—music copyright NFTs, ticketing NFTs, etc., offered holders ongoing rights or services, providing a basis for value retention. Game NFTs also saw fresh experimentation—some games adopted a "free NFT + paid in-game items" model to lower entry barriers, then enhanced stickiness via cross-chain asset interoperability.

IV. Outlook for 2026: A New Chapter on the Horizon

After the wild swings of 2025, what lies ahead for the crypto market in 2026? Based on macro trends and structural shifts, here’s our forward look:

1. Macro Environment: Liquidity Rebuilding Opportunities

Expectations of the Fed entering a rate-cutting cycle will continue materializing in 2026. If the U.S. economy slows significantly, rate cuts could exceed current expectations. Looser monetary conditions will provide "fresh water" for risk assets including Bitcoin, potentially reigniting global liquidity expansion.

Meanwhile, geopolitical and trade environments remain uncertain, but fiscal stimulus is expected to ramp up, keeping global risk appetite high. However, caution is warranted—the 2025 gains in traditional markets like equities were substantial, and some sectors (e.g., AI stocks) may harbor bubble risks. If traditional assets correct in 2026, crypto could face short-term spillover drag.

Thus, macro impacts on crypto will be twofold: Loose liquidity and rising inflation favor store-of-value narratives, but if equity bubbles burst and risk-off sentiment rises, crypto won’t be immune. Overall, 2026’s macro backdrop is more positive than 2025’s, though cross-market risk transmission must be closely monitored.

2. Policy and Regulation: Deepening Global Competition and Cooperation

The U.S. will continue setting the tone for crypto policy in 2026. The Trump administration is expected to maintain its 2025-friendly stance, possibly advancing bolder moves—like considering Bitcoin inclusion in national reserves—or Congress reaching consensus on defining security tokens and clarifying SEC/CFTC jurisdiction, legitimizing many "gray-area" projects.

The EU may initiate discussions on MiCA 2.0, covering new rules for DeFi and NFTs. Hong Kong and Singapore will compete to attract Web3 firms with more attractive tax and licensing terms. Japan or South Korea might loosen listing restrictions on certain tokens to revitalize their local crypto industries. International regulatory cooperation will strengthen, especially in anti-money laundering and cross-border stablecoin oversight. We can expect 2026 to see efforts toward common stablecoin standards and frameworks for coexistence between CBDCs and private stablecoins. More broadly, the systemic importance of crypto markets may enter the agenda—as market cap and ties to traditional finance grow, regulators may bring crypto into macroprudential oversight, preparing contingency plans for extreme scenarios.

In short, 2026’s regulatory tone may be one of "calm normalization"—no longer feared nor blindly hyped, but treated as part of the financial system to be managed rationally. This is undoubtedly positive for long-term industry health. That said, localized setbacks or tightening may still occur—if major fraud or money laundering cases emerge, short-term regulatory reactions could be harsh.

3. Institutional Deepening: Mainstream Adoption Advances Further

In 2026, we expect even more diverse institutional participation. First, 401(k) and other retirement giants may officially launch Bitcoin/Ethereum investment options for retirement accounts under new rules, ushering in an era of long-term systematic investing. Estimates suggest that even 1% of U.S. pension capital flowing into crypto could amount to hundreds of billions of dollars, becoming a key driver of the next long-term bull market. Second, sovereign wealth funds and commercial banks worldwide are likely to increase digital asset trials. Some national reserve funds may follow Singapore and UAE in directly investing in Bitcoin ETFs or launching domestic digital currencies. Major Western banks may roll out digital asset custody and brokerage services under compliance frameworks, incorporating crypto into standard wealth management offerings.

In 2026, we expect continuous improvements on both product innovation and compliance systems: More structured products (e.g., volatility ETFs, tokenized yield notes) will emerge to meet varied risk profiles. Exchanges and custodians will enhance transparency and capital requirements to prevent repeat stampedes. Institutional involvement will reshape market ecology—large OTC and ETF trades will dominate, volatility will fall, and Bitcoin’s safe-haven and macro-asset traits will become more pronounced. As Forbes noted, as the market becomes broader and more institutionalized, the four-year cycle of wild swings may fade, replaced by sustained, gradual growth. For investors, this may mean fewer get-rich-quick stories, but also a more mature, reliable asset class that traditional investors can embrace at scale.

4. Technology and Applications: Six Structural Forces Paving the Way

Six major structural forces could drive the next phase of crypto market evolution in 2026:

1) Value Storage and Financialization: Bitcoin, Ethereum, and others will become further financialized, with mature derivatives and lending markets making them behave more like traditional assets such as gold. As volatility declines, they’ll attract more conservative capital, boosting global adoption. Grayscale forecasts predict BTC will hit new highs in 2026, targeting $250,000. The magic of the halving cycle may fade, but Bitcoin’s status as digital gold will be firmly cemented.

2) Stablecoin Surge: Stablecoins may explode in 2026—big tech companies might build their own stablecoin ecosystems, and more countries may allow banks to hold stablecoins for settlement. Mainstream payment networks like Visa/Mastercard could integrate stablecoins into clearing, enabling seamless on-off-chain payments. At the same time, market consolidation will occur—smaller, less competitive stablecoin projects will be eliminated, concentrating dominance among leaders like USDT, USDC, USD1, and PYUSD. Businesses and individuals could bypass banks for instant global transfers, opening new cross-border capital channels.

3) Asset Tokenization: The trend of moving real-world assets on-chain will accelerate. Major exchanges might partner with blockchain platforms to launch 24/7 tokenized securities trading, serving global investors. Financial product granularity will deepen further, with innovative ETFs and funds (e.g., composite ETFs blending Bitcoin futures and tech stocks) entering the market, offering investors more choices.

4) DeFi-TradFi Convergence: Bank-DeFi integration will become the norm. We may see the first bank-issued DeFi loan product, or Visa launching an enterprise-level payment smart contract platform on Ethereum. DeFi features like dynamic yield and prediction markets will embed into traditional finance. For example, insurers could use decentralized oracles and on-chain data to automate claims—showcasing how traditional finance goes "on-chain." On-chain governance and compliance DAO concepts might pilot internally in corporations, improving efficiency and transparency.

5) AI-Crypto Deep Integration: As discussed, the AI economy is taking shape—2026 could see widespread economic participation by AI agents. The X402 protocol might become an industry standard, widely used in IoT and Web service payments. AI-powered on-chain investment advisors and risk models will mature—perhaps by 2026, some funds openly advertise using AI algorithms for investment decisions. In the next cycle, AI narratives won’t just be stories—they’ll be backed by real applications and profitable models.

6) Privacy and Security Infrastructure: With institutions and mainstream users prioritizing privacy, 2026 may see breakthroughs in privacy tech. Zero-knowledge proofs and multi-party computation projects may achieve commercial viability, offering compliant solutions for private transactions and data sharing. Regulators might allow privacy-preserving exchanges or stablecoins under specific frameworks, serving compliant users needing anonymity (e.g., corporate confidential deals). On security, 2026 is likely calm—but ongoing vigilance is needed regarding cryptographic upgrades under quantum computing threats, and progress in social engineering defense and on-chain monitoring.

V. Outlook and Conclusion

Market Outlook: Bull, Bear, or Transformation?

Views on 2026’s market outlook are divided. Some believe the top was already reached in October 2025, that the four-year cycle remains intact, and 2026 will be a long bear market—predicting Bitcoin could fall back to $50k–$60k to find a bottom. These views are based on lagging macro effects and market inertia, assuming institutions will also follow cyclical patterns. Conversely, institutional and long-term asset managers believe the cycle isn’t over and may even extend—they argue sustained institutional buying could stretch the cycle to 4.5 or 5 years, viewing the 30% pullback as a normal bull-market correction, expecting the bull run to continue through 2026 and push BTC to new highs.

We judge that 2026 is likely to see a "low-volatility, long bull" paradigm—no longer simply repeating past boom-bust rhythms, but experiencing several moderate swings within a rising trend, delivering positive annual returns. In other words, unless there’s a severe global recession or black swan event, Bitcoin, Ethereum, and others will likely end 2026 higher than they began. Mainstream firms like BlackRock support this view—their reports suggest that with lower volatility, crypto will gradually integrate into traditional asset allocation logic. Even without explosive rallies, 2026 will be a year of ongoing ecosystem reconstruction. Of course, investors should remain alert to potential risks—including regulatory shifts (election-year politics), technical flaws, and unpredictable macro events.

Conclusion

Looking back at 2025, the crypto market swung violently between frenzy and despair—we witnessed historic highs and sudden collapses; we saw greed and fear alternate in dominance, yet also observed innovation and transformation quietly gathering strength. Whether it was regulatory shifts, institutional entry, or the rise of new narratives like RWA, AI, and prediction markets, all signs point to the crypto industry steadily maturing. As we step into 2026, we may no longer see the extreme euphoria and despair of past cycles, but instead progress steadily through reason and construction. For investors, this is not necessarily a bad thing: Fewer get-rich-quick myths, more long-term value; fewer illusions, more tangible progress. When the froth clears, truly outstanding projects and assets will stand out even more. Let us approach with cautious optimism the next iteration of the crypto market. In 2026, a new and exciting chapter awaits us all to write together.

About Us

Hotcoin Research, as the core research arm of Hotcoin Exchange, is committed to turning professional analysis into your practical edge. Through our "Weekly Insights" and "Deep Dive Reports," we unpack market dynamics. With our exclusive column "Top Picks" (powered by AI + expert screening), we help you identify promising assets and reduce trial-and-error costs. Every week, our analysts go live to discuss hot topics and forecast trends. We believe that warm, hands-on guidance and professional insights can help more investors navigate market cycles and seize Web3’s value opportunities.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News