Unveiling Erebor: Peter Thiel's Crypto Bank and the Trump Donors' Grand Scheme

TechFlow Selected TechFlow Selected

Unveiling Erebor: Peter Thiel's Crypto Bank and the Trump Donors' Grand Scheme

Taking over Silicon Valley Bank's original market positioning to fill the gap in banking services for cryptocurrency.

By Azuma (@azuma_eth)

On July 3, multiple mainstream financial media outlets reported that several tech billionaires, including PayPal co-founder and Silicon Valley venture capital legend Peter Thiel, are jointly launching a new bank called Erebor. The initiative aims to fill the banking service gap left in the wake of Silicon Valley Bank’s collapse, specifically targeting the cryptocurrency industry.

According to the Financial Times, the billionaire founders of Erebor also include Palmer Luckey, co-founder of defense technology firm Anduril, and Joe Lonsdale, founder of big data analytics company Palantir (of which Peter Thiel is also a co-founder). Peter Thiel’s venture capital fund, Founders Fund, will directly invest in Erebor.

If the names Palmer Luckey and Joe Lonsdale don’t ring a bell for many readers, here’s another way to frame it: both, along with Peter Thiel, are major financial backers of Donald Trump in the 2024 U.S. presidential election.

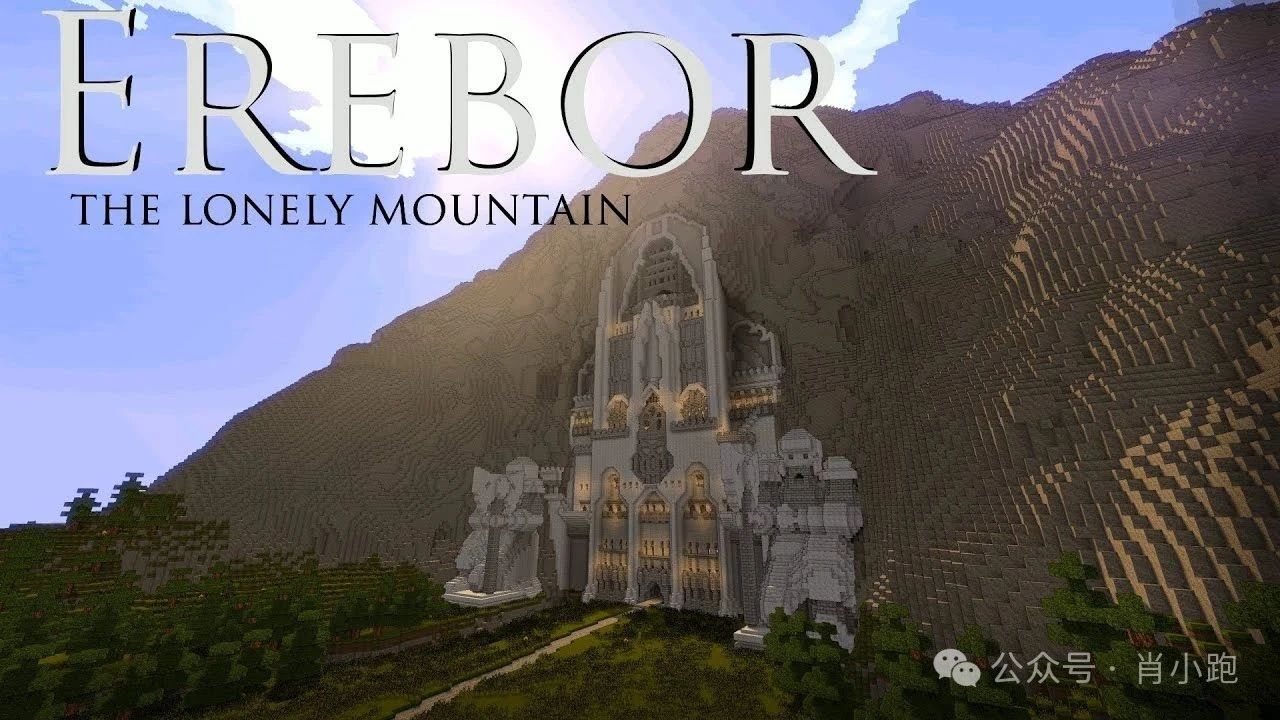

Notably, the name "Erebor" is drawn from the fantasy epic *The Hobbit*. In the story, it is the “Lonely Mountain” occupied by the dragon Smaug, beneath which lies an endless treasure hoard of the dwarves. Interestingly, both Anduril and Palantir derive their names from the same literary universe—Anduril meaning the legendary sword "Flame of the West," and Palantir referring to a mystical "crystal ball" capable of seeing across time and space.

Erebor has applied to the Office of the Comptroller of the Currency (OCC), the U.S. federal banking regulator, for a national bank charter, which would permit it to operate as a full-service bank. According to application documents made public this week, Erebor intends to “operate as a national bank… providing traditional banking products and virtual currency-related services” to businesses and individuals. Its target clients are innovative economy firms in the United States—particularly technology companies focused on cryptocurrency, artificial intelligence, defense, and manufacturing—as well as their employees and investors. The bank also plans to serve foreign enterprises seeking access to the U.S. banking system.

The Financial Times emphasized that Erebor aims to assume the market position once held by Silicon Valley Bank, offering banking services to high-risk ventures and crypto professionals who may be rejected by traditional banks.

In 2023, Silicon Valley Bank—boasting 40 years of history and having won Forbes’ “America’s Best Banks” award for five consecutive years—collapsed due to a liquidity crisis. At the time, numerous crypto-related projects and institutions, including BlockFi, Circle, and Avalanche, were SVB clients, leading to severe turmoil across the crypto sector. Amid the panic, BTC briefly dropped below $20,000.

Insiders revealed that discussions among Erebor’s co-founders about launching the bank began shortly after Silicon Valley Bank’s 2023 collapse. Although First Citizens BancShares acquired SVB’s assets and restarted operations, and some of its professionals moved to HSBC USA, investors and executives at tech startups continue to widely complain about difficulties accessing banking services—many firms no longer receive financing support at previous levels.

Erebor’s application documents highlight that stablecoin-related services will be a core focus. Stablecoins pegged to real-world assets like the U.S. dollar are expected to be central to its business, with the document stating its goal is to become “the most comprehensively regulated institution for stablecoin transactions.”

Odaily note: Banking services centered on stablecoins and cryptocurrencies have become a new competitive frontier. Circle recently submitted its own application for a banking license. For details, see “$60 Billion in Self-Custody: ‘First Stablecoin Stock’ Circle Applies for Federal Trust Bank Charter.”

Insiders say Palmer Luckey and Joe Lonsdale will not participate in Erebor’s day-to-day management. The bank’s co-CEOs will be Jacob Hirshman, formerly an advisor at Circle, and Owen Rapaport, co-founder and CEO of digital asset software firm Aer Compliance. The president will be a former senior executive vice president from Valley National Bank in New Jersey.

Erebor will base its headquarters in Columbus, Ohio, with an office in New York, but will offer only digital services. All products will be marketed through a smartphone app and website. Sections of the application related to shareholder composition, equity structure, and business plans remain confidential.

With the GENIUS Act successfully advancing through the Senate and the new SEC chair personally pledging to establish a reasonable regulatory framework for digital assets, investment and business activities related to cryptocurrencies are bound to grow. However, banking services in this domain still face notable gaps. Beyond Erebor, multiple players have already begun eyeing this opportunity.

In the foreseeable future, competition over these services is expected to intensify. For the cryptocurrency industry—long constrained by limited banking access—such competition may prove all the better the fiercer it becomes.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News