Erebor Bank: The Stablecoin Version of Silicon Valley Bank 2.0?

TechFlow Selected TechFlow Selected

Erebor Bank: The Stablecoin Version of Silicon Valley Bank 2.0?

Erebor aims to build a "hybrid banking model" that aligns with Web3 principles while meeting regulatory requirements.

By Xiao Xiaopao

For years, I’ve been grinding at my day job while casually writing a WeChat blog and hosting podcasts. Though I haven’t earned a penny from it, this habit has given me one clear advantage:

Whenever you see a new hype cycle spinning out of control—when GPUs are burning through cash—just search your old articles, past thoughts, or podcast episodes. I’ll bet you a Lambo that 90% of the time, you’ll find something relevant. There’s nothing new under the sun. You’ve probably already thought it through and have some framework in place (assuming you’ve kept up the casual grind for at least 5–8 full cycles).

Take stablecoins, which are hot again. As an old-timer, I can confidently say: I’ve seen this movie before. But it keeps coming back with new names, new branding. To be fair, things *are* different now—there’s definitely some progress. But just swap out a few terms, and suddenly every concept along the value chain gets a fresh coat of paint. The cost of re-understanding everything inevitably goes up. You burn more mental tokens only to realize 80–90% of it is stuff you’ve already considered.

Today, we’re talking about Erebor Bank.

Yesterday, Teacher Will sent me an article, excited to record a follow-up episode on stablecoins—because “Peter Thiel is launching a bank again—this time, a stablecoin bank.”

I briefly fell into people-pleasing mode and enthusiastically agreed. Then I zoned out: Yep, that familiar “wait, didn’t I live through this already?” old-timer feeling kicked in. Peter Thiel—the man widely believed to influence the current U.S. administration’s “new deep state,” the godfather of Silicon Valley, who last time around advised everyone to pull funds from Silicon Valley Bank (SVB), directly triggering its collapse—is starting another bank?

This time, he’s teaming up with Palmer Luckey, co-founder of Anduril (a defense tech company), to build a brand-new crypto bank called “Erebor.”

First, shake off the old-timer aura. No investigation, no right to speak. Time to dig into the research.

01 | The Erebor Parable

To be honest, the name is intriguing. As a Lord of the Rings fan, I’m already predisposed to like it.

Erebor—the “Lonely Mountain” in Tolkien’s universe, where the dragon Smaug sleeps. Smaug is a greedy, destructive beast who hoards gold and jewels stolen from dwarves, elves, and men, then burns them all alive. He lies atop a mountain of treasure in a vast underground lair.

Hmm, this IP image feels…off. Kind of a “slayer becomes the dragon” vibe. But whatever—maybe this branding actually resonates with the core clientele of crypto banks. After all, Silicon Valley naming conventions usually fall into three buckets: Greek mythology, Middle-earth lore, or Latin words spelled backward. At least Erebor has some literary flair.

Names aside, the real question is: Why is Silicon Valley launching a new bank just as stablecoins heat up again?

02 | The Fall of SVB: 48 Hours

Nearly every media outlet says: “To fill the massive void left by SVB’s collapse” + “to ride the stablecoin wave.”

Since SVB is mentioned, let me refresh everyone’s memory:

In March 2023, Silicon Valley Bank (SVB) set a record in financial history: going from “Forbes’ Best Bank of the Year” to “seized by regulators” in just 48 hours. I did two podcast episodes on it at the time (one from the old-timer lens, one from the grizzled vet perspective), calling it a “storm in a teacup.” SVB was the 16th largest bank in the U.S., nowhere near Lehman Brothers’ scale during the subprime crisis—so it didn’t shake global markets. But for the tech world? It was traumatic.

The trigger wasn’t even dramatic: On March 9, SVB announced it had sold $21 billion in securities at an $1.8 billion loss and needed to raise $2.25 billion to avoid a liquidity crunch. The next day, a bank run ensued—depositors tried to withdraw $42 billion, shares plunged over 60%. SVB’s held-to-maturity securities were marked down $15.9 billion, but its tangible common equity was only $11.5 billion. Result? Government bailed out all depositors, shareholders and bondholders lost everything, management was fired, and the stock went from over $200 to zero. A 40-year-old bank, still handing out year-end bonuses days earlier, collapsed overnight.

SVB’s failure exposed a fundamental mismatch between “traditional banking” and “innovation-driven economies.” SVB served over half of Silicon Valley startups, yet its business model was essentially 19th-century: take deposits, make loans, earn interest spreads.

The problem? Tech companies flush with VC cash don’t need loans. So SVB parked those funds in long-term bonds—and died from duration mismatch and interest rate risk.

Of course, all banks carry this risk. Maturity transformation is core to commercial banking—bank runs are always possible. But SVB’s collapse required a perfect storm: (1) extremely concentrated, homogeneous customer base; (2) catastrophically poor balance sheet management; and (3) precisely timing the reversal of a 40-year low-interest-rate cycle.

On (1):

SVB’s client base was abnormally narrow. If you attended any major VC or startup event in the U.S. in recent years, you’d see SVB reps stationed at the entrance—targeting freshly funded startups, no segmentation needed.

On (2):

During the Fed’s QE era (2020–21), startup fundraising boomed. SVB’s deposits surged from $61 billion in 2019 to $189 billion in 2021—tripling in three years. With rates near zero, these deposits were nearly free capital.

The issue? Deposit composition: $132.8 billion in demand and transaction accounts vs. just $6.7 billion in savings/time deposits—76.72% non-interest-bearing. That’s dangerously unstable liability structure. And its clients? All startups—no diversification, highly correlated.

Liabilities were risky enough. Assets were worse: These customers deposited but didn’t borrow. Startups lack fixed assets or steady cash flows—banks can’t lend. So SVB bought bonds—first short-term Treasuries, then longer-duration ones and (yes) agency mortgage-backed securities (MBS/ABS)—to boost yield.

Thus, the bank’s primary risk shifted from credit risk to interest rate risk.

Then came (3): Rate hikes.

Normally, rising rates benefit banks—higher loan yields offset higher deposit costs, widening net interest margins. But SVB had loaded up on long-term bonds (56% of assets—vs. 28% industry average). When rates rose, bond prices fell.

Double whammy: Asset values dropped, while funding costs spiked as cheap deposits dried up (sound familiar? Same script plays out at small/mid-sized banks domestically).

Add one final spark: Silicon Valley’s tech founders are all in the same WhatsApp groups. When Peter Thiel’s Founders Fund led the withdrawal, panic spread instantly. Nothing in the world is more herd-like than VCs—FOMO and FUD are baked into their culture.

03 | Fall Down Seven Times, Stand Up Eight

No big deal. Trends come back. This time, it’s stablecoins’ turn. The same players are stepping in to fix it themselves.

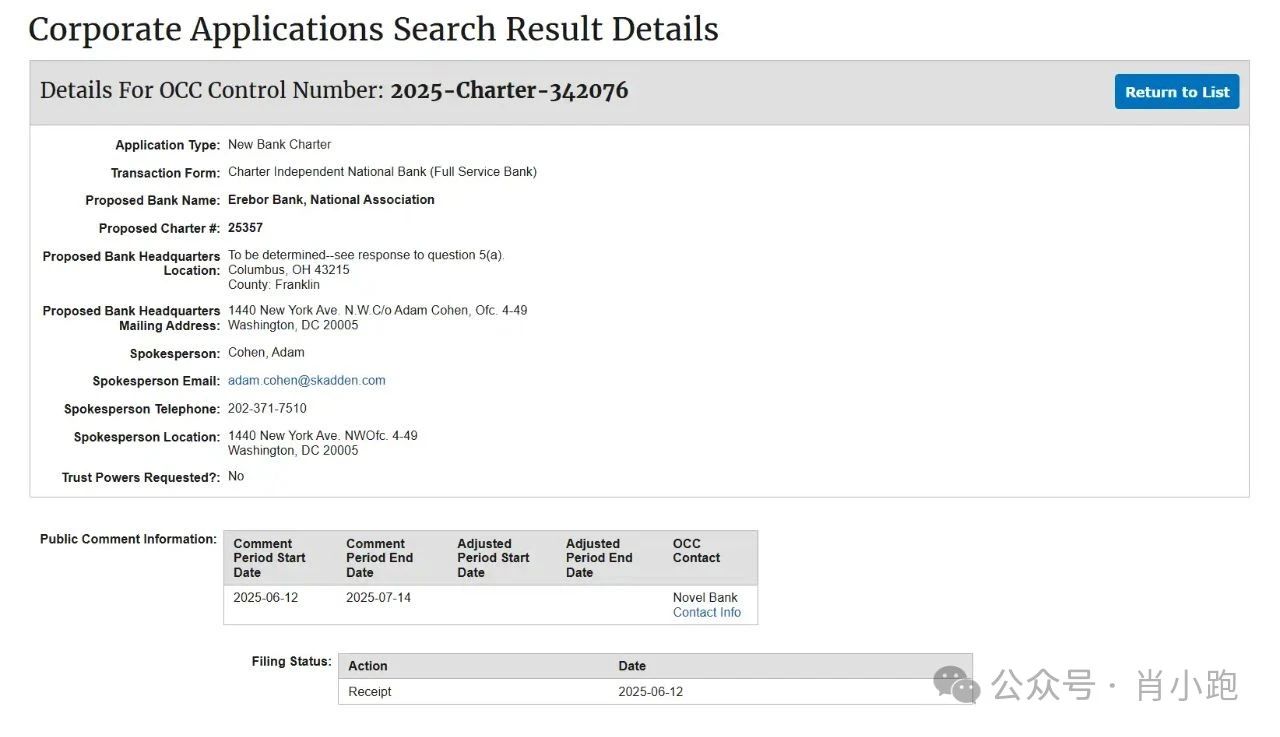

After digging, I found Erebor Bank’s application for a national bank charter filed with the Office of the Comptroller of the Currency (OCC): “Erebor Bank, NA, Columbus, OH (2025).”

The filing reads almost like an emotional manifesto—explicitly positioning itself as the “most regulated stablecoin trading platform,” vowing to “fully bring stablecoins into the regulatory framework.”

Perhaps learning from SVB, available info suggests Erebor’s risk controls are ultra-conservative: hold more cash, lend less, cap lending at half of deposits (1:1 reserve ratio, loan-to-deposit ratio ≤ 50%); maintain capital levels above regulatory minimums for three years; use only shareholder equity for initial funding—no debt, no dividends for three years.

Target clients are crystal clear: tech firms focused on cryptocurrency, AI, defense, and advanced manufacturing; high-net-worth individuals tied to these sectors (aka “new quality productive forces” dismissed by traditional banks as “no stable cash flow” or “too risky to understand”); and “international clients” (aka overseas firms wanting U.S. financial access but locked out—especially dollar-dependent businesses or those using stablecoins to reduce cross-border transaction risks/costs, i.e., some users of USDT and informal remittance channels). Erebor aims to become their “super interface” into the dollar system via correspondent banking relationships.

Business model is straightforward: offer deposits and loans—but collateral isn’t real estate or cars, it’s Bitcoin and Ethereum.

Stablecoin operations are key: helping enterprises “compliantly mint, redeem, and settle stablecoin transactions”; planning to hold minimal crypto on its balance sheet—purely for operational needs (e.g., gas fees), not speculation.

Red lines drawn clearly: No fiduciary trust activities requiring a trust license (i.e., only transfer/settlement, no asset custody).

Looks like Silicon Valley Bank 2.0. SVB’s logic: take deposits → make loans → earn spread. Erebor’s logic: build a bridge between fiat and stablecoin ecosystems, then take deposits → make loans → earn spread on top.

04 | This Time Is Different?

That’s all the info we have. Can’t draw conclusions—only speculate.

Start with the stablecoin operations.

No documents clarify whether deposits are in stablecoins or fiat. But since they aim to “help companies compliantly mint, redeem, and settle stablecoins,” let’s assume they accept fiat deposits—part of which will be used to issue stablecoins, part directly lent out. Essentially, adding standard commercial banking functions on top of Circle. In other words: creating credit.

If Erebor truly maintains such conservative loan-to-deposit ratios and capital adequacy, and fully isolates its stablecoin operations—only handling payments, not lending against them or providing custody—and only supports regulated USD-pegged stablecoins like USDC, then it might seem plausible. The rest—traditional fiat banking—can learn from SVB’s mistakes.

I know what you’re thinking: Why can’t stablecoin deposits be lent out?

Because “one dollar in stablecoin” and “one dollar in bank deposit” are fundamentally different. Their economic roles diverge completely. Let’s revisit the money multiplier:

If a company deposits $10 million in a bank, the bank keeps 20% as reserves and lends out $8 million. When another firm borrows that $8 million and deposits $6 million back in the same bank, total deposits rise to $16 million. This cycle repeats.

This is the banking system’s “alchemy”—via the money multiplier effect, $10 million in deposits can generate far more liquidity.

Stablecoins don’t do alchemy. In the stablecoin world, one dollar equals one dollar—it must be backed 1:1 by real dollars. No expansion allowed. That’s literally the definition. No exceptions—even if you think you’re a genius. Congress made it law.

This is the price of being a “stablecoin bank”: You give up the most profitable part of banking—lending. Embracing “stability” means sacrificing the banking system’s credit creation power.

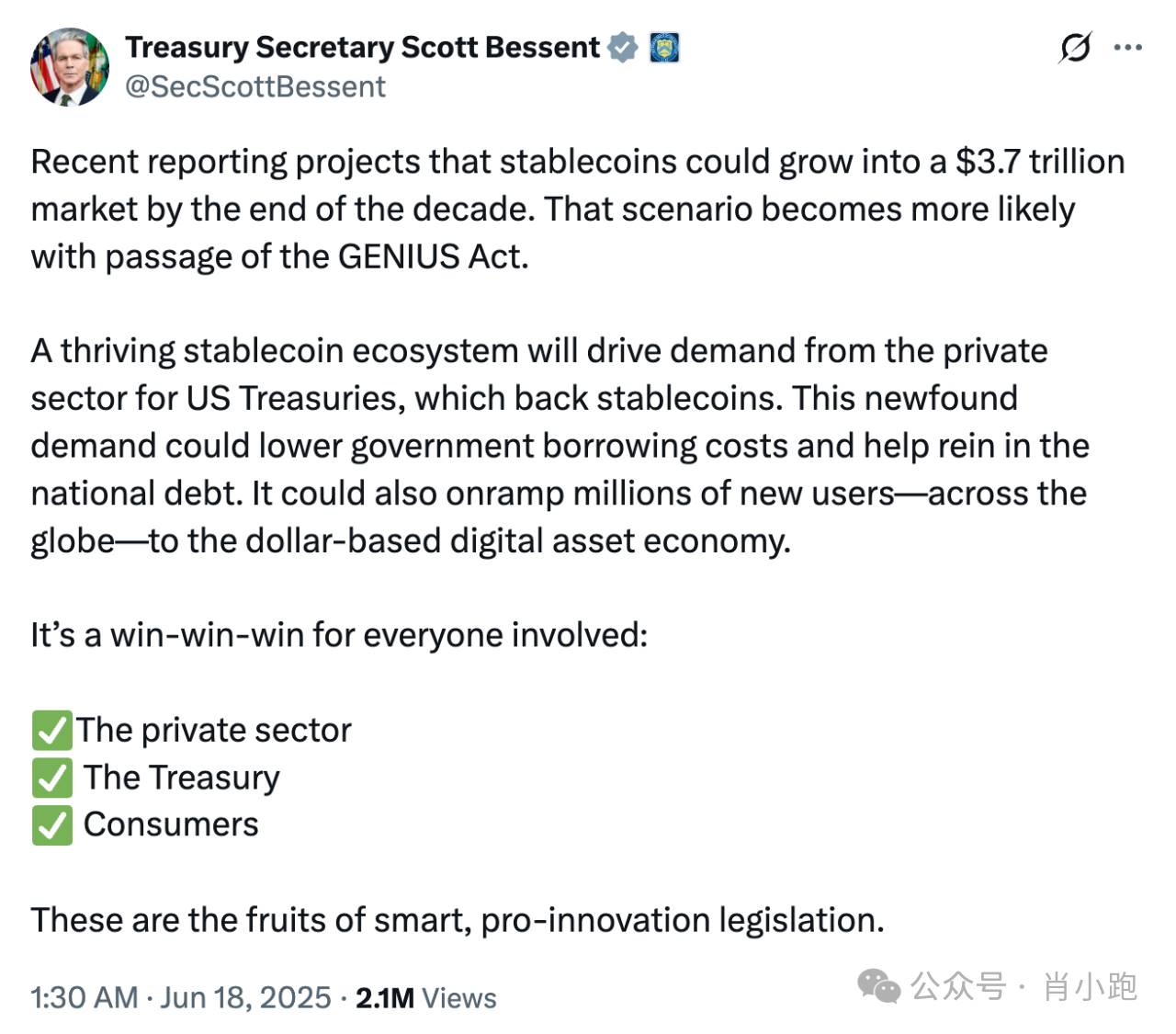

This reminds me of Bessent’s post on X: Stablecoins could absorb up to $3.7 trillion in U.S. Treasuries.

If half comes from demand/savings accounts, that’s ~10% of total U.S. bank deposits. Following the logic above, this presents a major trade-off:

-

Upside:

New massive demand source for U.S. Treasuries (boosting public credit).

-

Downside:

Weakened credit creation capacity in the traditional banking system (undermining private credit).

When people move money from banks to stablecoins, the banking system’s ability to create credit via the “money multiplier” shrinks. This is essentially a consequence of long-term government fiscal deficits (historical precedent? Review how money market funds disrupted banks in the 1970s).

05 | Liquidity: Where Ghost Stories Begin

We’ve only scratched the surface on deposits—haven’t even reached the liquidity horror stories yet.

If stablecoins dominate Erebor’s balance sheet, despite being pegged to real assets, today’s stablecoins lack FDIC insurance and have no access to the Fed’s discount window for off-chain liquidity support.

If a stablecoin suddenly depegs and drops in value, and Erebor holds significant reserves or exposure to it, the bank faces a “on-chain bank run.” Depositors don’t queue—they just click “withdraw” en masse. No FDIC takeover, no central bank bailout. Can Erebor survive?

Now look at the lending side: Instead of buying Treasuries, they’re offering crypto-collateralized loans. But this math isn’t hard:

-

Loan-to-deposit ratio: 50%

-

Bitcoin loan-to-value ratio: likely 60–70%

-

Bitcoin daily volatility: often >10%, spikes to 20–30%

Question: How to avoid a death spiral?

Now combine both sides: Right side = stablecoins; Left side = crypto-backed loans (liabilities: stablecoins + assets: crypto loans). Wow—that combo sounds intense.

Run a stress test:

-

A macro event (e.g., Trump stirs chaos) triggers crypto market panic

-

Bitcoin crashes 30%—Erebor’s collateral loans face massive defaults

-

Market starts doubting stablecoin stability—depeg begins

-

Erebor’s stablecoin reserves lose value, loan losses mount

-

Deposit withdrawals go into overdrive

-

Erebor forced to dump assets at rock-bottom prices to meet redemptions

In one sentence: It’s basically SVB’s duration mismatch, plus leverage, plus a 24/7 on-chain bank run accelerator.

Once this scenario kicks in, none of traditional banking’s safety buffers exist:

-

No deposit insurance to calm nerves

-

No central bank liquidity lifeline

-

No interbank lending market to spread risk

-

Digital 24/7 trading means runs can’t be paused

This does feel a bit like a “regulated version of Terra.”

06 | Stay Optimistic

I couldn’t help but channel my inner old-timer again. But seriously, crypto and digital assets are here to stay. Only three countries globally still ban crypto outright. Whether I like it or not, (USD) stablecoins will grow explosively in the foreseeable future.

Erebor wants to build a “hybrid banking model” that fits web3 logic while meeting regulatory standards—enjoying the stability of traditional reserves while unlocking the efficiency and convenience of on-chain systems.

From this angle, Erebor represents an inevitable trend: regardless of who leads, traditional finance and digital asset ecosystems will converge.

The real question: Who should lead this fusion?

Back to the name Erebor. In Tolkien’s tale, Smaug is eventually slain, and the treasure of the Lonely Mountain returns to dwarves, elves, and men.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News