Byreal Reset Episode 1: Can It Break Into the Mainstream Through Wealth Effect?

TechFlow Selected TechFlow Selected

Byreal Reset Episode 1: Can It Break Into the Mainstream Through Wealth Effect?

Byreal launches first round of new token offerings—how to participate?

Written by: Alex Liu, Foresight News

Byreal Launches Reset Launch

The on-chain DEX Byreal, incubated by Bybit, will launch its first Reset Launch today at 15:30. The inaugural project is Fragmetric, a Solana-native restaking protocol. This IDO adopts a capped but price-undetermined mechanism, with a total allocation of $360,000 accepted in bbSOL. The project's token FRAG will be directly tradable on the Byreal DEX upon listing. On the CEX (centralized exchange) front, exchanges such as Bitget and Gate have also officially announced their listings.

Byreal marks Bybit’s re-entry into the on-chain sector after announcing the shutdown of most of its Web3 wallet services, receiving strong promotion and resource support from Bybit. Binance Wallet was initially "lukewarm," but quickly broke through in late January by partnering with Creator.Bid for an exclusive launch—sparking a “wealth effect” that instantly went viral: users who invested $500 saw the value of BID tokens rise to $4,000–$5,000.

Will Byreal’s first project replicate this strategy, creating a wealth effect that captures immediate attention? How does the first Reset Launch work, and how can users participate?

Detailed Explanation of the Reset Launch Model

In simple terms, Reset Launch uses a tiered pricing mechanism for new token launches.

Byreal’s Reset Launch does not follow a first-come, first-served or rush-to-buy model. Instead, it features a “tiered pricing + proportional allocation” mechanism, with a subscription window lasting 23 hours. Users must prepare bbSOL in advance and use a whitelisted wallet (active bbSOL users, top 3,000 Fragmetric F Points holders, TOPU NFT, RateX, Solana Chinese, SoSoValue, etc.) to subscribe across different price tiers within the designated time frame.

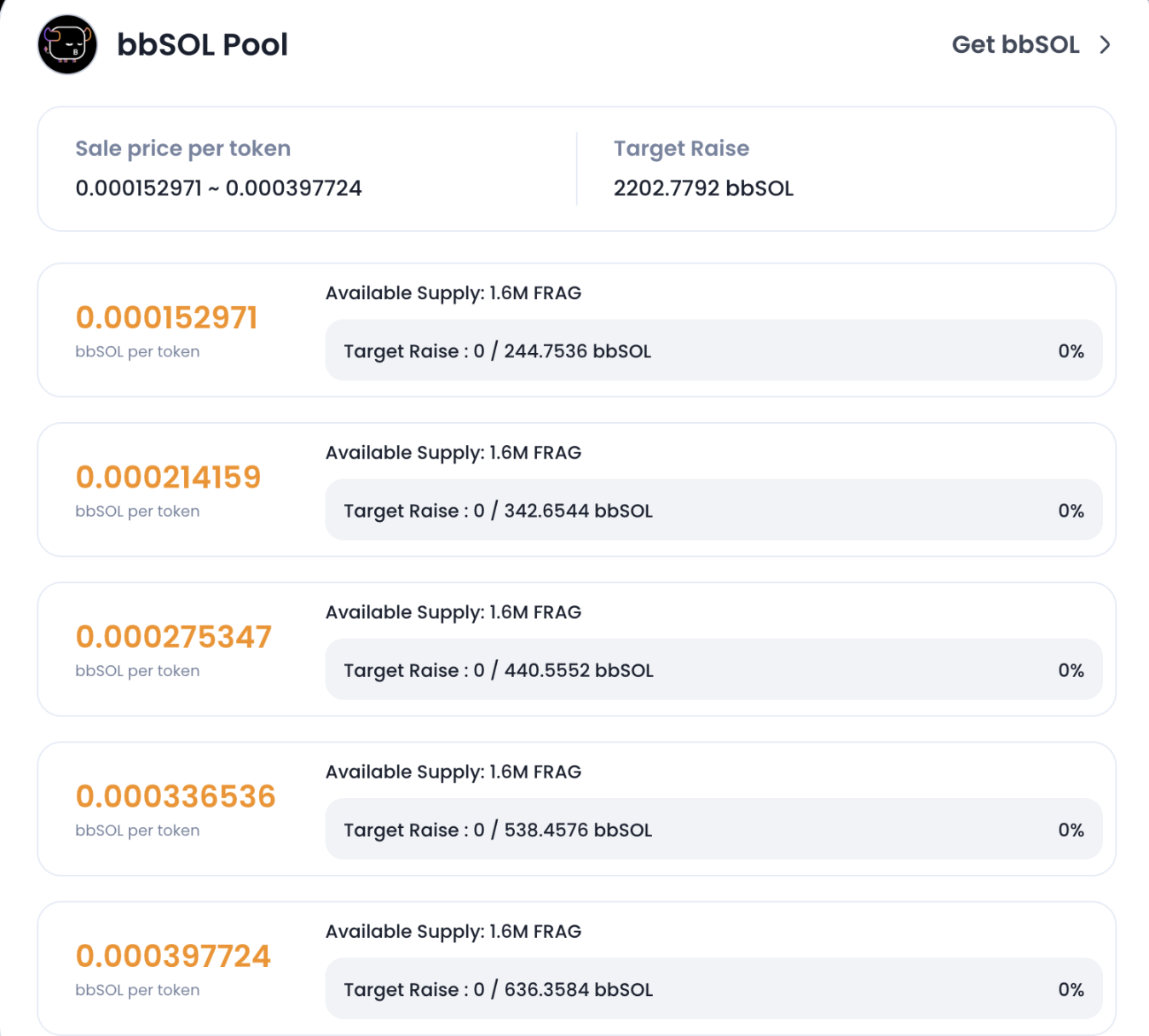

The five price tiers for this Reset Launch are:

-

$0.025 (1.6 million FRAG)

-

$0.035 (1.6 million FRAG)

-

$0.045 (1.6 million FRAG)

-

$0.055 (1.6 million FRAG)

-

$0.065 (1.6 million FRAG)

Each whitelisted wallet has a maximum total investment cap of 10 bbSOL. The system will allocate tokens proportionally based on total investments per tier. If a certain price tier is oversubscribed, tokens will be distributed proportionally according to contributions, and any remaining bbSOL will be automatically refunded.

Notably, Byreal states that there is no vesting period for tokens after the IDO concludes. Tokens will be immediately listed on the Byreal DEX with a FRAG/bbSOL trading pair, accompanied by high-APR liquidity incentive pools.

Participation Steps and Key Notes

Preparation Phase

-

Use a Solana-compatible wallet such as Phantom or Backpack, ensuring you have sufficient bbSOL (obtainable via exchange on Byreal, staking on Bybit, or swapping on DEXs like Jupiter) and a small amount of SOL for gas fees.

-

Verify that your wallet address is on the whitelist by checking the Byreal Reset page.

-

Familiarize yourself with the project details and launch rules, and decide on your participation tier and capital allocation strategy.

During Subscription Period

-

Between June 30 at 15:30 and July 1 at 14:30 (Beijing time), deposit bbSOL into your chosen price tiers.

-

Each wallet may invest up to 10 bbSOL, which can be spread across multiple tiers.

-

You cannot modify deposits already made to a tier, but you may continue adding funds until reaching the 10 bbSOL cap.

Settlement and Claiming

-

After the IDO ends, the system will automatically calculate proportional allocations. Users can then claim their allocated FRAG tokens and any unused bbSOL on the platform.

-

Tokens will be available for trading on Byreal DEX via the FRAG/bbSOL pool, with high APR liquidity incentives expected.

Strategy Tips: How to Maximize Value

Although the rules are clear, due to the proportional allocation mechanism, Reset Launch does not guarantee full allocation—especially in lower-priced tiers, which are likely to be oversubscribed, resulting in partial allocations for most users.

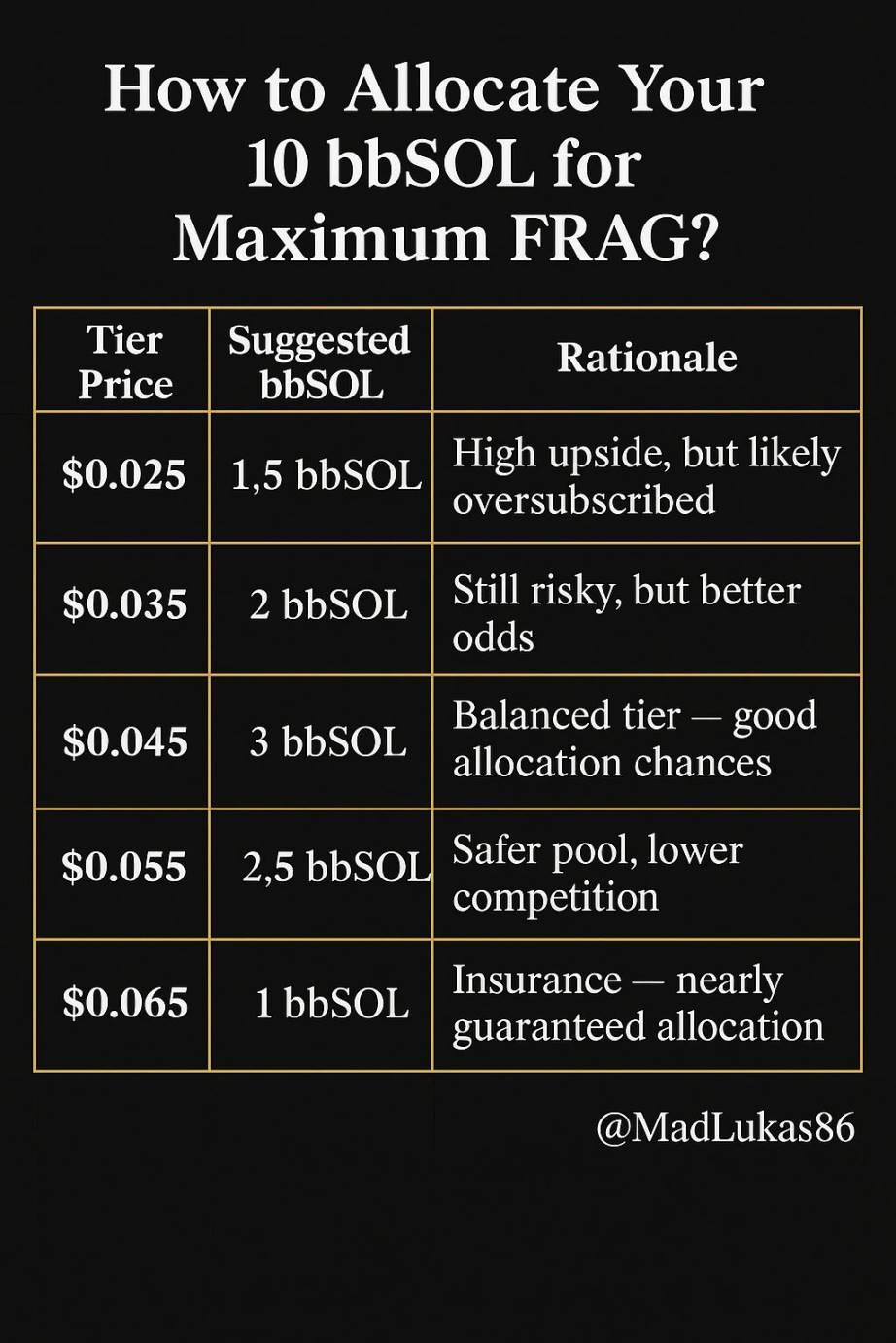

Community member @MadLukas86 proposed a “distributed betting” strategy to maximize both success rate and potential returns. His recommendations include:

Avoid putting all bbSOL into the lowest tier ($0.025): despite the attractive price, this tier is typically the most crowded and heavily diluted.

Distribute investments across multiple price tiers to diversify risk. A suggested allocation could be: 2 bbSOL at $0.025, 2 bbSOL at $0.035, 2 bbSOL at $0.045, 2 bbSOL at $0.055, and 2 bbSOL at $0.065.

Image source: as shown

Price outlook: if FRAG lists at $0.30 (based on pre-market pricing), even partial allocations in lower tiers could yield substantial unrealized gains.

Conclusion

The Byreal Reset Launch mechanism introduces notable innovation—preserving the engagement and excitement of new launches while enhancing fairness through tiered pricing and proportional distribution. The immediate trading availability, zero lock-up period, and liquidity provider incentives further support token liquidity and price performance.

However, participants should keep the following in mind:

-

Lower tiers may seem safe, but actual allocation ratios will fluctuate based on overall participation;

-

Investments should consider the project’s fundamentals, not just short-term profit potential;

The success or failure of Reset Launch will serve as a critical test for whether Byreal can sustainably attract capital for future IDOs. The debut performance of Fragmetric is not only a test of the project itself, but also a key battle to determine whether Byreal’s Reset model can ignite a wealth effect.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News