Bybit incubates DEX Byreal as CEX intensifies decentralization competition

TechFlow Selected TechFlow Selected

Bybit incubates DEX Byreal as CEX intensifies decentralization competition

To seize the early-mover advantage in the on-chain market, CEXs have no choice but to accelerate their expansion and prevent DEXs from continuously eroding their market share.

By ChandlerZ, Foresight News

Recently, Bybit CEO Ben Zhou announced on X that "Byreal, the first chain-native DEX incubated by Bybit, will launch by the end of this month. Built from scratch within the Solana ecosystem."

He highlighted Byreal's unique features: 1/ CEX + DEX synergy. Byreal is not just "another DEX." It combines CEX-grade liquidity with DeFi-native transparency—this is true hybrid finance. More CEX + DEX projects are coming. 2/ Unified liquidity and speed via RFQ + CLMM routing design. Byreal will deliver ultra-fast swap transactions with low slippage and MEV protection.

According to official information, Byreal’s testnet will go live on June 30, with mainnet expected in Q3.

Bybit is not the first centralized exchange to enter the DEX space. As decentralized trading platforms continue growing, DEXs are progressively closing the gap with CEXs in terms of liquidity and user activity.

DEX Market Share Rises, Solana Emerges as a Top Choice

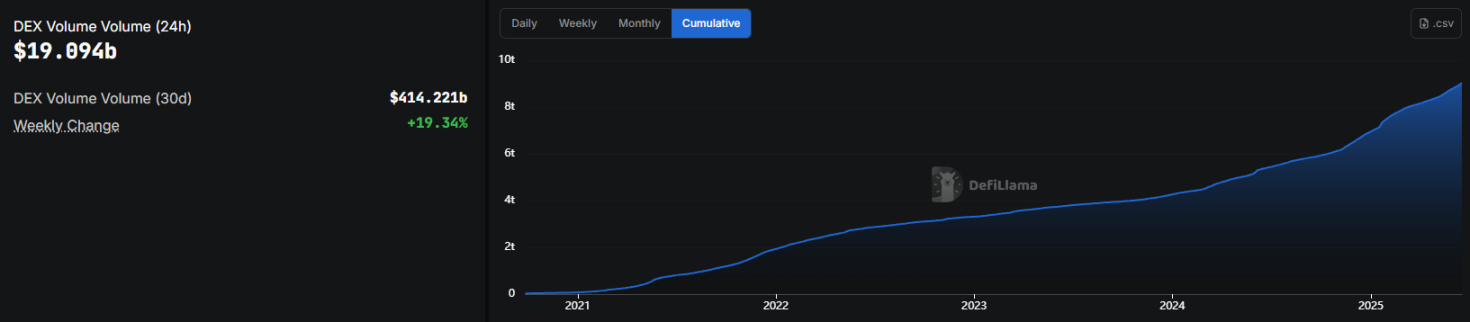

Data from DeFiLlama shows DEX trading volume maintaining steady growth. In May 2024, monthly DEX trading volume reached $405.3 billion, accounting for approximately 25% of global spot trading volume—a new record high. Meanwhile, total value locked (TVL) in DEXs surpassed $20 billion.

In terms of blockchain distribution, Ethereum remains dominant, with Solana ranking second, holding a TVL of around $3.3 billion—over half of which is concentrated in Raydium.

Bybit chose Solana as Byreal’s foundational infrastructure primarily due to its strong growth performance. In 2024, meme token trading on Solana and on-chain token issuance platforms like Pump.fun saw significant increases in activity, making DEXs the primary channel for new token launches. Major meme assets such as WIF, BOME, and BONK initially established liquidity on Solana-based DEXs like Raydium and Jupiter before being gradually listed on centralized exchanges.

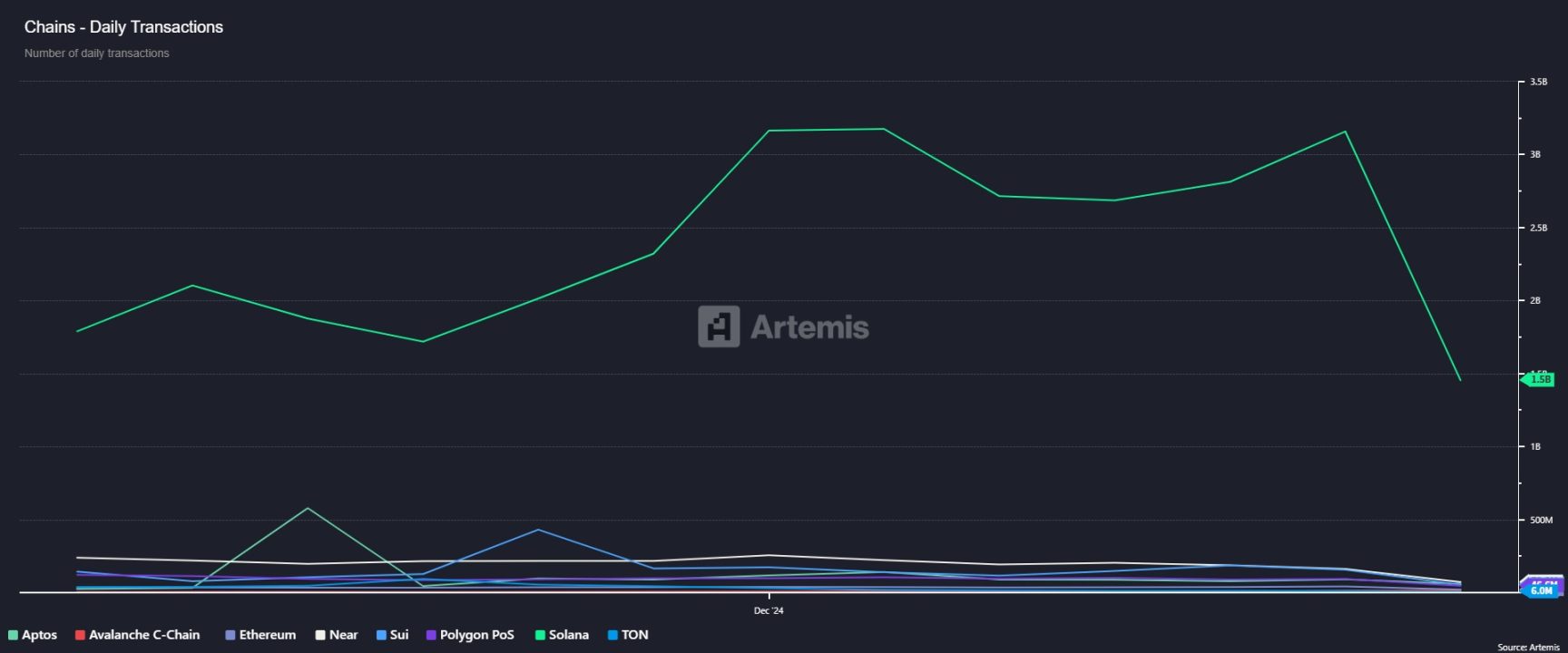

Solana has maintained high levels of activity and developer growth over the past year, emerging as one of the fastest-growing blockchains within the DEX ecosystem. Its daily transaction volume consistently averages around 80 million, with cumulative transactions exceeding 30 billion—ranking among the top public chains. In comparison, Base and Sui have daily transaction volumes of approximately 7 million and 6 million respectively. Though smaller in scale, both exhibit rapid growth and high engagement.

In terms of daily active addresses, Solana averages over 4 million, peaking at more than 9.4 million. For CEXs seeking to expand onto-chain, Solana offers a relatively mature high-performance execution environment and solid liquidity foundation.

The CEX Push Into Decentralization

When choosing on-chain trading products, users typically prioritize familiar platforms and superior user experience. This trend has driven leading centralized exchanges to launch their own decentralized offerings. There are already several precedents: Binance-backed PancakeSwap on BSC has long led the DEX market; OKX launched OKX DEX; and Coinbase supports Aerodrome, a DEX built on Base, which has rapidly grown in trading volume and now ranks among the top in market share.

Through building native on-chain platforms or strategic partnerships, these CEXs are gradually consolidating market liquidity and reaching both on-chain and off-chain user bases. At the product level, they are also actively exploring innovative features such as dark pools, cross-chain aggregation, and hybrid liquidity pools to enhance trading depth and execution efficiency, meeting increasingly diverse market demands.

In terms of competitive landscape, CEXs still hold advantages in overall trading volume and user scale. However, past CEX liquidity crises and risk incidents have heightened user interest in trustless, on-chain transparent, and lower-compliance-barrier DEXs, intensifying competition between the two models.

The data above shows that emerging trends favor convenient, low-compliance DEXs, with traffic shifting earlier toward on-chain products—leading some CEXs into an awkward position of “missing out on profits while barely getting scraps.” To seize early-mover advantage in the on-chain market, CEXs must accelerate their expansion to prevent continued erosion of market share and associated profit pressures.

Conclusion

Simon Kim, CEO of crypto venture firm Hashed, predicts that DEX trading volume could surpass CEX volume by 2028. Given increasing CEX investments in DEXs and the current development trajectory of the DEX ecosystem, this forecast is becoming increasingly plausible.

From an industry perspective, future exchange models may no longer be strictly divided into centralized or decentralized. Hybrid trading platforms could become a new direction. Ultimately, trader demand remains the key determinant of platform success. Platforms that deliver stable, secure, and user-centric products will be better positioned to gain a competitive edge in the market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News