Hotcoin Research | Crypto-Related Stocks Surge Collectively: A Comprehensive Insight into the Capital Bonanza Under the Crypto IPO Boom

TechFlow Selected TechFlow Selected

Hotcoin Research | Crypto-Related Stocks Surge Collectively: A Comprehensive Insight into the Capital Bonanza Under the Crypto IPO Boom

The "mutual embrace" between the stock market and the crypto circle shows that crypto enterprises are no longer confined to insular self-entertainment, but are truly knocking on the door of capital markets.

1. Introduction

Recently, crypto-related stocks have ignited an unprecedented frenzy across global capital markets. From Circle, the stablecoin giant whose share price surged nearly fourfold within a week of its IPO, to Tron’s reverse merger with a U.S. public company rapidly reigniting market enthusiasm, the cryptocurrency industry is entering the mainstream financial spotlight at an unprecedented pace and scale. Almost any company clearly tied to blockchain and possessing a defined regulatory-compliant path has seen explosive valuations in short order, becoming a focal point for capital market interest. With increasing numbers of crypto firms announcing or initiating IPO plans, 2025 may mark a record-breaking “year of crypto IPOs,” profoundly impacting both traditional capital markets and the broader crypto ecosystem.

This article provides an in-depth analysis of the key drivers behind the recent surge in crypto stocks, outlines the major publicly traded crypto-related companies currently on the market, and reviews high-profile crypto firms preparing for IPOs. It also explores the long-term implications of this IPO wave on market dynamics, offering valuable insights for investors and industry observers.

2. Rising Frenzy Around Crypto Stocks

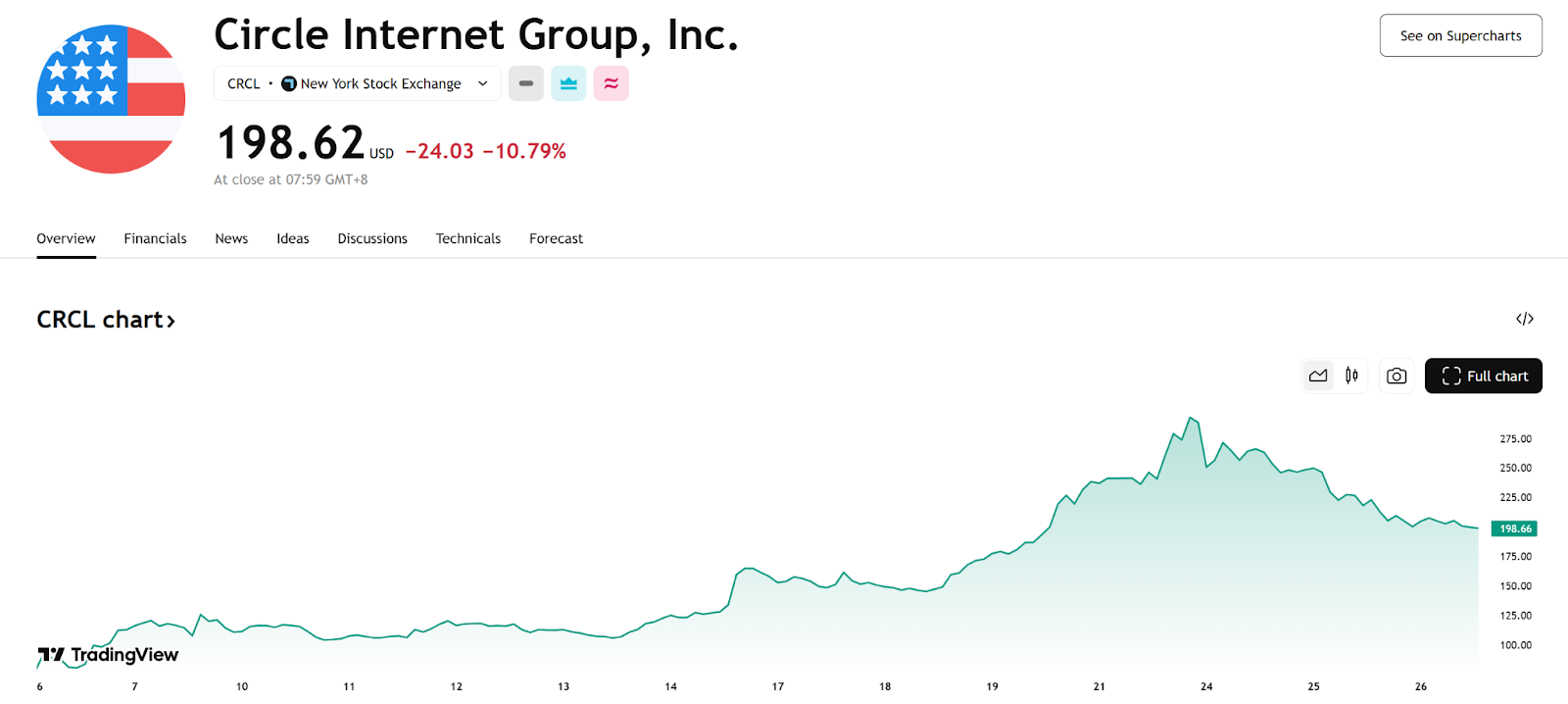

On June 5, stablecoin firm Circle listed on the New York Stock Exchange at an IPO price of $31, followed by consecutive days of soaring stock prices, closing around $115 in its first week. On June 23, Circle's stock hit an intraday high of $292.77—up over 844% from its IPO price—before pulling back slightly, though remaining highly popular.

Source: https://www.tradingview.com/symbols/NYSE-CRCL

SRM Entertainment (SRM) was trading below $1.50 per share in early June. After news emerged that Tron Foundation founder Justin Sun would inject capital into the company and use it as a vehicle for a reverse takeover, SRM’s stock skyrocketed more than fivefold on June 16 alone, with market cap leaping from tens of millions to approximately $158 million. The company announced a $100 million investment and a treasury strategy involving Tron’s TRX token, positioning itself as a "MicroStrategy for Tron."

Source: https://www.tradingview.com/symbols/NASDAQ-SRM

Beyond Circle and Tron-related stocks, other emerging companies are adopting “crypto asset treasury” strategies to attract investor attention:

- MicroStrategy (MSTR), the world’s largest corporate holder of Bitcoin, has made its stock a key barometer of Bitcoin’s price through its “digital gold reserve” strategy.

- SharpLink Gaming (SBET) announced it will spend approximately $463 million to acquire Ethereum (totaling 176,271 ETH) and implement a crypto treasury strategy.

- DeFi Development (DFDV) repositioned itself as a “Solana treasury,” holding over 600,000 SOL tokens as of May and securing up to $5 billion in equity financing to further accumulate Solana.

- Nano Labs unveiled a $500 million convertible bond program to fund large-scale BNB purchases, aiming to build a $1 billion BNB treasury targeting 10% of the coin’s circulating supply.

This unprecedented level of investor enthusiasm highlights the current fervor surrounding crypto stocks. The ignition point of the new bull market appears not to be within the crypto community itself, but on Wall Street. Traditional secondary market investors are channeling funds into “regulated crypto-asset proxy companies” at an accelerating pace. Any company tangentially linked to blockchain assets—with transparent disclosures and real business operations—often achieves significant valuation premiums in short periods.

3. Background and Forms of Crypto Companies Going Public

A confluence of favorable policies, bullish markets, funding needs, and flexible listing tools has driven the surge in crypto companies going public this year. Moving from the regulatory fringes into the mainstream, crypto firms are embracing Wall Street like never before.

1. Reasons Behind the Surge in Crypto IPOs

In recent months, an increasing number of crypto companies have either announced or begun preparations for public listings, with U.S. markets emerging as the preferred destination. This trend stems from both internal motivations and external catalysts.

- Regulatory environment turning favorable and clearer: Donald Trump, widely seen as “pro-crypto,” swiftly reshaped regulatory leadership upon returning to office, signaling greater openness from U.S. policymakers toward digital assets. On June 17, the U.S. Senate passed the GENIUS Act (Generative, Innovation, and Unified Security Act) by a decisive 63–30 vote, establishing a unified regulatory framework for stablecoins and other crypto assets—offering a clear path toward compliance for crypto businesses.

- Favorable macroeconomic conditions create a window for listings: As Bitcoin breaks and holds above $100,000, the crypto sector re-enters a bull cycle, enabling related firms to command higher valuations and raise more capital. This presents an ideal window for crypto companies to enter public markets. Investor enthusiasm can now be converted into real fundraising and premium valuations, prompting many previously hesitant firms to accelerate their IPO timelines to capture these benefits.

- Internal growth imperatives: Launching an IPO during a bull market allows companies to raise capital at attractive valuations while boosting brand visibility and credibility. Leading players such as exchanges and custodians aim to solidify their market positions post-industry consolidation, gain regulatory legitimacy, and win trust for global expansion. For venture-backed unicorns, an IPO offers early investors an exit route and attracts new institutional backing. These practical considerations collectively fuel the rush toward public listings.

2. Diverse Listing Approaches Among Crypto Firms

Crypto companies are employing a range of methods to access public markets, leveraging various pathways to seize opportunities quickly:

- Traditional IPO: The most common route. Circle opted for a conventional IPO on the NYSE, which proved highly successful. Other examples include Israeli social trading platform eToro and restructured Galaxy Digital, both going public via IPO in early June. These offerings typically see strong first-day performance, reflecting robust investor demand.

- Direct Listing: Unlike IPOs, direct listings do not issue new shares but allow existing shareholders to trade their holdings directly. Coinbase pioneered this approach when it listed on Nasdaq in 2021, setting a precedent for crypto unicorns. Direct listings suit well-known, cash-rich firms. While fewer companies choose this path today, it remains a viable option offering flexibility.

- SPAC Merger: Special Purpose Acquisition Companies (SPACs) have become a popular alternative. For example, mining firm Bitdeer merged with a Blue Safari SPAC to list on Nasdaq in 2023. Twenty One Capital, backed by Tether and Bitfinex, completed a SPAC merger with Cantor’s vehicle in April 2025 and debuted on Nasdaq holding $3.6 billion worth of Bitcoin—becoming the third-largest Bitcoin holder among U.S. public companies. SPACs offer speed and flexibility, especially for established projects with institutional support. However, as traditional IPO markets recover, SPAC popularity has waned, with some firms switching to standard IPO routes.

- Reverse Takeover (Shell Listing): A notable trend in 2025, exemplified by Tron’s acquisition of SRM Entertainment. Although Tron already issues the TRX token, it used the small-cap U.S. shell SRM Entertainment—injecting $100 million and gaining control through new share issuance—then renamed the entity “Tron Inc.” to effectively bring the Tron ecosystem onto U.S. markets. Once confirmed, SRM’s stock surged over 500%, demonstrating strong market appetite for this “backdoor listing” model. Reverse mergers offer an alternative path for projects unable to pursue direct IPOs, though they come with complex compliance and disclosure challenges.

- Dual or Cross-Border Listings: Some major crypto firms seek listings in multiple jurisdictions to tap diverse capital pools. For instance, OKX is reportedly considering a U.S. IPO alongside potential spin-off listings, possibly including Hong Kong. Galaxy Digital was initially listed in Canada before restructuring to directly list on Nasdaq. Dual listings enhance global visibility, liquidity, and serve as a hedge against regional regulatory risks.

4. Overview of Popular Crypto Stocks

Crypto-related stocks now span global markets, with the U.S. serving as the primary hub, while Hong Kong, Singapore, and others host important players. Below is a breakdown of key listed crypto firms by sector, along with their performance and influence.

Crypto Financial Services & Investment Firms

- MicroStrategy (NASDAQ: MSTR, now Strategy): Originally a business intelligence software provider, MicroStrategy transformed into a “Bitcoin reserve company” after aggressively acquiring BTC as a core balance sheet asset. As of June 26, 2025, it held approximately 592,345 BTC—about 2.82% of the total supply. Its market cap briefly exceeded $100 billion following the strategic shift. In late 2024, MSTR was added to the Nasdaq-100 Index, marking a milestone in mainstream index inclusion of Bitcoin exposure. The stock closely tracks Bitcoin’s price and is viewed by many investors as a proxy for Bitcoin investment.

Source: https://bitbo.io/treasuries/microstrategy/

- Circle Internet (NYSE: CRCL): Issuer of the USDC stablecoin, Circle successfully raised $1.1 billion in its June 5, 2025 IPO—the first IPO by a stablecoin issuer globally. In 2024, it generated $1.7 billion in revenue, with 99% derived from interest on USDC reserves—a low-volatility, stable cash flow model highly favored by investors. Its stock nearly doubled on the first day and continued to surge afterward. Circle’s success has energized the entire crypto IPO landscape.

- Galaxy Digital (NASDAQ/TSX: GLXY): Founded by Wall Street veteran Mike Novogratz, Galaxy represents the public-market entry of a full-service digital asset financial group. Listed on the Toronto Stock Exchange since 2018, it restructured and directly listed on Nasdaq on May 16, 2025. Galaxy offers trading, asset management, and investment banking services—earning comparisons to a “Goldman Sachs of crypto.”

- Amber Group (NASDAQ: AMBR): A leading Asian crypto financial services platform founded in 2017, offering trading, market-making, lending, and more. Backed by top-tier investors, Amber faced delays but ultimately went public on Nasdaq on March 13, 2025. Known for its technology-driven high-frequency and quantitative strategies, Amber stands as a flagship example of Singapore-based crypto globalization.

- Twenty One Capital (NASDAQ: XXI): Launched via SPAC merger in April 2025 with involvement from Tether and Bitfinex. Upon listing, it held $3.6 billion in Bitcoin—ranking third globally behind only MicroStrategy and Tesla. Functioning more like a Bitcoin ETF or dedicated investment vehicle, XXI reflects growing investor demand for equity-based Bitcoin exposure. Since listing, its stock has performed steadily, gaining further amid positive developments in stablecoin regulation.

Exchanges & Platforms

- Coinbase (NASDAQ: COIN): A leading global cryptocurrency exchange, founded in 2012 in the U.S., serving over 120 million users. It directly listed on Nasdaq in April 2021 as one of the first major crypto unicorns to go public. In May 2025, Coinbase was officially included in the S&P 500 Index—the first crypto-related stock ever to achieve this—sparking a 10% after-hours rally. Now valued at over $60 billion, its stable performance signals investor confidence in compliant platforms.

- eToro (NASDAQ: ETOR): An Israel-based social trading platform known for features like copy-trading, with over 30 million users worldwide. After a failed SPAC attempt, eToro successfully completed an IPO on Nasdaq on May 15, 2025, with shares rising over 40% on debut. As a hybrid platform supporting both crypto and traditional assets, eToro’s listing underscores investor optimism about cross-asset fintech models and sets a benchmark for European and Middle Eastern crypto firms.

- Robinhood (NASDAQ: HOOD): A well-known U.S. zero-commission brokerage that began offering crypto trading in 2018. Though not exclusively a crypto company, its support for Bitcoin and Ethereum earns it classification as a crypto stock. Listed in 2021, roughly 20% of its revenue now comes from crypto. Robinhood exemplifies how traditional financial tech giants are integrating crypto into their offerings.

- Block (NYSE: SQ): Formerly Square, this U.S. payments technology leader rebranded to “Block” in 2021 to reflect its commitment to blockchain innovation. Its Cash App enables Bitcoin buying and selling, and Block has invested in Bitcoin mining and hardware wallet development. While payment services remain dominant, the market treats it partly as a crypto player, with its stock showing correlation to Bitcoin’s movements.

- OSL (HKEX: 0863): A flagship crypto exchange stock in Asia. Operated by BC Technology Group, OSL was founded in Hong Kong in 2018 and holds a virtual asset trading license from the local SFC—one of the region’s first fully regulated digital asset platforms. It listed on the Hong Kong Stock Exchange in 2019 via reverse merger (BC Group previously operated media businesses). Today, OSL focuses on institutional and high-net-worth clients, providing brokerage and custody services with over $5 billion in AUM. Benefiting from Hong Kong’s proactive embrace of crypto—including new regulations allowing retail trading—OSL has seen its stock rise on policy tailwinds. Its presence shows Hong Kong is cultivating its own crypto stock ecosystem.

Mining & Hardware Companies

- Marathon Digital (NASDAQ: MARA): One of the largest U.S.-based Bitcoin miners, publicly listed since 2012 and operating major mining facilities across North America. As of June 26, 2025, it held 49,179 BTC. The rebound in Bitcoin prices from 2023 to 2025 drove a sharp recovery in its stock, attracting sustained institutional interest. MARA acts as a “magnifying glass” for Bitcoin sentiment and serves as a key instrument for Wall Street speculation on BTC.

- Riot Platforms (NASDAQ: RIOT): Another long-standing Bitcoin miner, listed since 2003, focused on North American operations. Similar to Marathon, Riot’s stock rose 20–30% from early 2024 as Bitcoin recovered and capital flowed back into the sector, cementing its status as a core mining asset.

- Bitdeer (NASDAQ: BTDR): Founded by Wu Jihan, former chairman of Bitmain, Bitdeer specializes in mining operations and hash rate leasing. It went public on Nasdaq in April 2023 via merger with Blue Safari SPAC, drawing investor interest due to its infrastructure and scarcity value. Operating sites in the U.S. and Norway, Bitdeer reported steady revenue growth in 2024–2025 and plans to expand into AI cloud services using its data centers. As an overseas offshoot of Chinese mining hardware leaders, Bitdeer’s listing marks a form of indirect U.S. market entry for China’s mining capital.

- Canaan (NASDAQ: CAN): One of China’s first publicly listed Bitcoin mining machine manufacturers, Canaan conducted its IPO on Nasdaq in 2019, known for its Avalon series. It performed strongly during the 2021 bull run but later declined due to market downturns and competition. Since the 2023 mining revival, Canaan has regained momentum with improved performance and renewed orders. It remains a key representative of blockchain hardware in public markets, signaling the resurgence of the industry cycle.

Other Ecosystem-Linked Companies

- Tron Inc (planned listing): Tron’s reverse takeover of SRM is underway. If completed, it would mark the first time a major public blockchain project enters the U.S. stock market. This could pioneer a new capitalization model for crypto-native projects and inspire others to follow. However, questions remain about regulatory compliance, particularly given ongoing TRX trading and past SEC litigation. A successful listing would significantly raise expectations for the securitization of native blockchain projects.

- DeFi Development (NASDAQ: DFDV): Originally a proptech company, DFDV pivoted to become a Solana-focused treasury firm—an experiment in DeFi company tokenomics securitization. Its stock surged 28-fold after the pivot, illustrating how even small companies can attract massive speculation by aligning with popular ecosystems and announcing bold token-holding strategies.

- Other Asian Market Listings: Beyond OSL, Hong Kong hosts firms like Hashkey Technology (formerly Tongcheng Holdings, HKEX: 1611), active in crypto asset management and brokerage. In Singapore, besides Amber Group, companies like Osmosis—a mining equipment distributor—are exploring local listings. Though smaller in scale compared to the U.S., these markets are developing under their respective regulatory frameworks. For example, Hong Kong’s government is actively promoting itself as a crypto hub, suggesting more Asian crypto firms may choose to list locally, potentially giving rise to a “Hong Kong version of Coinbase.”

Overall, the global landscape of listed crypto companies now spans the entire industry chain—from upstream miners and hardware makers to midstream exchanges and wallets, downstream payment and investment services, and even public blockchain ecosystems. This expanding map reflects the broader transformation of blockchain from the margins to the mainstream. Public markets provide crypto firms with a powerful new stage to showcase value, while enabling traditional investors to participate in the blockchain revolution.

5. Crypto Companies Preparing for IPO

Several blockchain-related firms are actively preparing for public listings. Over the next 1–2 years, the crypto sector is expected to welcome a wave of heavyweight entrants—including exchanges, miners, infrastructure providers, and Web3 content platforms.

Bitmain / Antalpha

Bitmain attempted a Hong Kong IPO in 2018 without success and currently has no plans for a direct listing. However, its mining finance subsidiary Antalpha filed an F-1 registration statement with the SEC in April 2025, planning to list on Nasdaq. It intends to issue about 3.85 million shares to raise ~$50 million, with proceeds allocated to asset management in Bitcoin and other “digital gold” assets. Antalpha operates in mining supply chain finance and has signed an MOU with Bitmain as its primary funding partner—an arrangement seen by the industry as a “backdoor listing” for Bitmain.

BitGo (Digital Asset Custodian)

Veteran custodian BitGo is actively preparing for an IPO. Multiple financial outlets including Bloomberg report that the firm is working with investment banks and aims to list on Nasdaq or NYSE in the second half of 2025. Its custodied assets surpassed $100 billion in H1 2025. BitGo has also expanded into OTC trading to diversify revenue streams.

Kraken (U.S.-Based Veteran Exchange)

Kraken has repeatedly signaled IPO intentions at the end of 2024 and beginning of 2025. In 2025, it initiated preparatory steps including a $100 million debt financing round. Market sources suggest the company is targeting a Q1 2026 listing, focusing on compliance readiness and capital structure optimization. While co-CEOs emphasize that any IPO must benefit customers and build trust, favorable regulation could enable steady progress.

Gemini (Winklevoss-Founded, U.S.-Compliant Exchange)

Gemini confidentially submitted its S-1 form to the SEC on June 6, 2025, officially launching its IPO process. Previously delayed by industry downturns and issues involving partner Genesis, Gemini resolved investigations by the CFTC and SEC earlier this year, clearing major hurdles for its listing.

OKX (Established Offshore Exchange)

OKX is preparing for a U.S. IPO through its American subsidiary on Nasdaq. The company has settled with the U.S. Department of Justice and Treasury Department and resumed U.S. operations. Final approval from the SEC and adjustments to its Asian licensing structure remain pending. Reports suggest OKX could leverage the improving regulatory climate to proceed with its listing.

Bithumb (South Korea’s Leading Crypto Exchange)

Bithumb plans to split its business in late 2025, focusing on its core exchange operations, and prepare for a KOSDAQ listing in South Korea. It has appointed Samsung Securities as lead underwriter and separated its trading and investment divisions. The domestic listing aims to raise $1 billion, with a future U.S. IPO considered for later stages.

Bitkub (Thailand’s Largest Crypto Exchange)

Bitkub Capital Group is preparing for an IPO on the Stock Exchange of Thailand (SET) in 2025. The CEO indicated a target valuation of 6 billion THB (~$165 million). The company is expanding its team and has hired financial advisors to accelerate the process, viewing the IPO as a strategic inflection point for growth.

FalconX (Institutional-Focused Crypto Brokerage Platform)

FalconX is actively preparing for an IPO, potentially as early as 2025 on the NYSE. Providing OTC and derivatives services to institutions, the firm is leveraging the current market upswing and investment banking support to finalize its public listing.

Ripple (Operator of RippleNet Network)

Following gradual resolution of its legal battle with the SEC, Ripple executives have reiterated that an IPO is not imminent. CEO Brad Garlinghouse stated that Ripple remains well-funded and is prioritizing M&A over fundraising. An IPO is explicitly labeled a “non-priority for now.” While “definitely possible” in the future, Ripple prefers to wait until regulatory clarity is fully achieved.

6. Impact and Outlook of the Crypto IPO Boom

With numerous crypto firms rushing toward IPOs, 2025 has become a defining “year of crypto IPOs.” This concentrated wave of listings is having profound effects on both crypto and traditional financial markets, introducing new variables for future trends.

Impact of the Crypto IPO Surge

First, the influx of crypto companies into public markets signifies deeper acceptance by traditional capital. When stocks like Circle, Coinbase, and MicroStrategy are included in authoritative indices such as the S&P 500 and Nasdaq-100, global passive funds and institutional investors gain indirect exposure to crypto—either passively or actively. This strengthens the linkage between crypto and traditional finance. On one hand, crypto assets are no longer confined to tokens but are now integrated into mainstream portfolios via equities. On the other, volatility and capital flows in traditional markets can now influence these crypto stocks—and indirectly affect sentiment in the broader crypto market.

Second, the IPO boom may indirectly impact crypto asset prices. Some listed companies hold substantial crypto reserves. Their ability to raise capital and increase stock value enhances their capacity to buy more crypto. For example, Semler Scientific announced plans to raise funds to purchase up to 100,000 BTC—effectively channeling equity market capital into the crypto ecosystem. Similarly, companies pursuing “treasury strategies” may feel greater incentive to accumulate relevant tokens when their stock performs well, thereby supporting underlying token prices. Additionally, strong performance of crypto stocks can heighten investor interest in the native assets themselves.

Potential Risks and Challenges

However, not every listed crypto company can replicate Circle’s success. Investor euphoria often contains speculative excess, and a correction may follow: Only those with solid fundamentals and proven business models will sustain high valuations, while concept-driven stocks lacking substance will eventually revert to fair value. For example, SharpLink Gaming (SBET) more than halved after its initial spike. This serves as a reminder that once the hype fades, fundamentals will prevail. While the current IPO wave brings capital and attention, long-term sustainability depends on whether companies deliver growth and whether the regulatory environment remains supportive.

Regulatory risk remains a key uncertainty. Despite current pro-crypto momentum in the U.S., political shifts and changes in regulatory leadership could alter the landscape. For example, if the GENIUS Act stalls in the House or other areas face tighter rules, market sentiment could suffer. Nevertheless, there is reason for optimism: Major U.S. indices now include several crypto stocks, tying the interests of millions of traditional investors to the crypto market. This creates political pressure for balanced, thoughtful regulation rather than abrupt crackdowns. In this sense, public market entry increases the industry’s “political weight,” helping secure a more rational regulatory framework.

Outlook on Future Trends

Looking ahead, integration between crypto and traditional finance will deepen further. Over the next 18 months, industry forecasts suggest additional listings: Kraken is reportedly preparing for a 2026 debut; BitGo may go public as early as this year; and high-value unicorns such as Consensys (Ethereum infrastructure), Ledger (hardware wallets), Fireblocks (institutional custody), and Chainalysis (on-chain analytics)—each valued in the billions—also appear poised for IPOs. Moreover, Chinese-origin firms are increasingly active: OKX has established a U.S. headquarters and is eyeing an IPO; Tron is aggressively pursuing a U.S. listing via reverse merger. If the crypto market maintains its strength, these pipeline projects could materialize in succession, triggering the largest wave of crypto IPOs in history. As a result, crypto stocks will likely become even more visible to the general public, with sector market cap and influence continuing to grow.

Conclusion

The recent surge in crypto stocks across global capital markets represents a concentrated victory for the industry’s journey into the mainstream. The mutual embrace between Wall Street and the blockchain world demonstrates that crypto companies are no longer confined to niche circles but are now knocking decisively on the doors of institutional finance. From shifting macro policies and surging investor interest to soaring stock prices and fundraising records, the crypto sector is gaining increasing recognition from traditional investors. For investors, it is crucial to recognize both the opportunities and risks: High-quality crypto stocks offer potential participation in rapid industry growth, yet the inherent volatility of the sector persists—even if now expressed through a different vehicle. Looking forward, the wave of crypto IPOs is likely to continue building momentum, deepening the convergence between crypto and traditional finance, and jointly shaping the next chapter of innovation and value creation.

About Us

Hotcoin Research, the core research and analytics hub of the Hotcoin ecosystem, is dedicated to delivering professional, in-depth analysis and forward-looking insights for global crypto investors. We have built a three-pillar service system combining “trend analysis + value discovery + real-time tracking.” Through deep dives into industry trends, multi-dimensional evaluation of emerging projects, and round-the-clock market monitoring—complemented by our bi-weekly《Top Coin Selection》strategy livestreams and daily《Blockchain Headlines》news briefings—we provide precise market interpretations and actionable strategies for investors at all levels. Leveraging cutting-edge data models and an extensive industry network, we empower novice investors to build analytical frameworks and help institutional players capture alpha, together seizing value-growth opportunities in the Web3 era.

Risk Warning

The cryptocurrency market is highly volatile and inherently risky. We strongly advise investors to fully understand these risks and conduct investments strictly within a sound risk management framework to ensure capital safety.

Website:https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail:labs@hotcoin.com

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News