Crypto Exchange Liquidity Battle: Divergence Across Eight Major Exchanges, XRP Lags Behind SOL

TechFlow Selected TechFlow Selected

Crypto Exchange Liquidity Battle: Divergence Across Eight Major Exchanges, XRP Lags Behind SOL

Explore the trading depth of major centralized exchanges, focusing on narrow price ranges.

Author: Coingecko

Translation: Felix, PANews

Liquidity has become a key metric for measuring crypto assets, affecting not only trading convenience but also volatility, slippage, and institutional appeal. As exchanges raise their listing standards and market makers provide foundational depth, liquidity signals an asset’s maturity and readiness for large-scale capital.

This report examines trading depth across major centralized exchanges, focusing on narrow price bands to reveal the scale of capital required to move markets. It aims to provide ordinary traders with a clearer, more intuitive view of liquidity in today’s rapidly evolving crypto landscape.

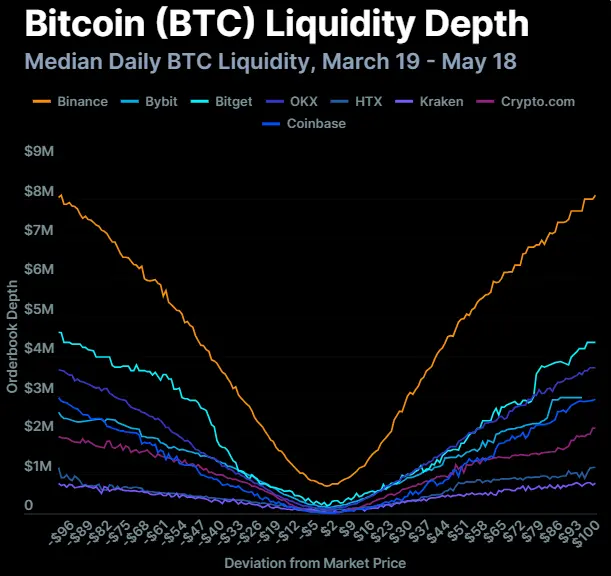

1. Binance leads in BTC liquidity at all depth levels, with two-way (bid and ask) depth of approximately $8 million each within a +/- $100 price band, ahead of Bitget and OKX.

During the study period, the median two-way order book depth across eight selected exchanges ranged between $20 million and $25 million within a +/- $100 band around the BTC market price. Liquidity across nearly all platforms showed steady growth, indicating robustness across various depth levels.

Binance accounted for about 32% of this liquidity, with both bid and ask depths near $8 million. Bitget followed with approximately $4.6 million, while OKX had around $3.7 million. Meanwhile, HTX and Kraken consistently ranked as the weakest in BTC liquidity.

Within the tighter +/- $10 range, only Binance maintained two-way liquidity exceeding $1 million. Bybit, Bitget, OKX, HTX, and Crypto.com posted liquidity between $100,000 and $500,000, while Kraken and Coinbase fell below or around $100,000.

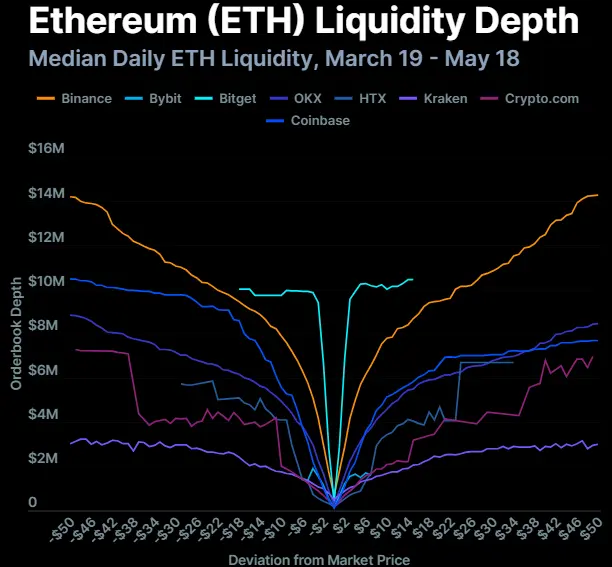

2. Within the +/- $15 range, Bitget surpasses Binance to become the leader in ETH liquidity, though Binance dominates in broader price ranges.

The median depth for ETH was $15–16 million within a +/- $2 range (approximately 0.1% of price). In the same 0.1% band (equivalent to +/- $100 for BTC), ETH liquidity amounted to roughly 60%–70% of BTC's.

Within the +/- $2 band, Bitget led in ETH liquidity, followed by Binance and OKX. However, beyond this narrow window, Bitget’s ETH liquidity declined significantly. Overall, liquidity across the eight exchanges remained healthy in this tight range—six platforms exceeded $1 million in depth, with even the lowest (HTX) reaching $430,000.

In wider bands such as +/- $50 (about 2%), Binance still provided the deepest liquidity, although its lead over peers was smaller compared to BTC. Binance held a 25% share of ETH liquidity, down from 32% for BTC.

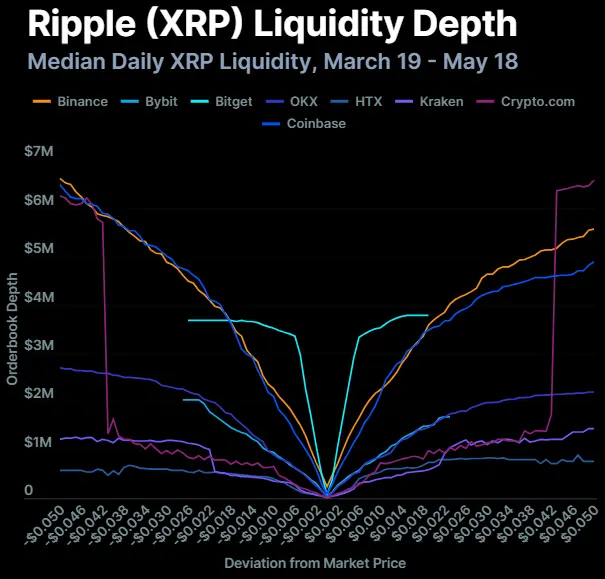

3. XRP liquidity is concentrated on Bitget, Binance, and Coinbase, which together control about 67% of the market; it lags behind SOL in both liquidity and trading volume.

Within a +/- $0.02 (approximately 1.0%) depth range, XRP’s single-sided liquidity across the eight exchanges totaled around $15 million.

Bitget dominated within the ultra-narrow +/- $0.006 (approx. 0.3%) range, but its advantage quickly faded. By the +/- $0.02 level, Binance and Coinbase had overtaken Bitget. These three exchanges collectively controlled nearly two-thirds (about 67%) of total liquidity within this band.

Despite XRP’s significantly higher market cap compared to SOL, its cumulative liquidity across the eight exchanges within a +/- 2% band was lower than SOL’s. This gap is mirrored in trading volume: during the study period, SOL’s volume was nearly double that of XRP.

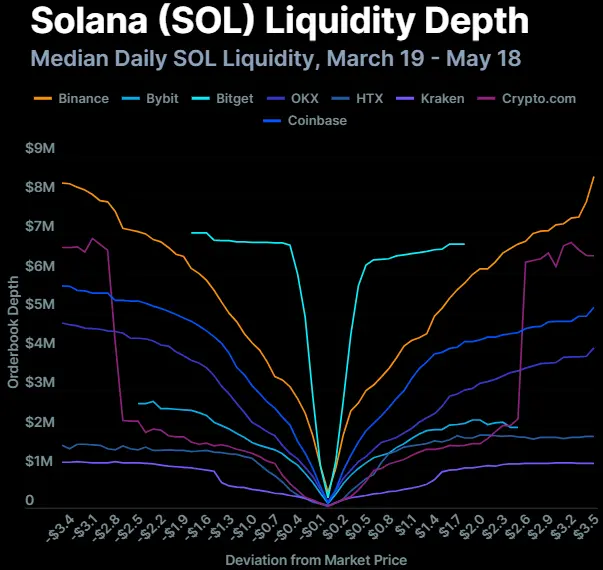

4. SOL holds about 60% of ETH’s liquidity within a +/- 2% depth range and shows strong depth in the narrow +/- $1 band.

Within a +/- $1 (approx. 0.6%) range, SOL exhibited around $20 million in liquidity per side across the eight exchanges, indicating solid overall market depth.

In this range, Bitget held about 32% of liquidity, followed by Binance at around 20%. Only Kraken fell short of $1 million in single-sided depth, recording just $480,000.

Beyond the +/- $1 band, Binance reasserted its dominance, with liquidity increasing steadily as the price deviation grew. At the +/- $2.5 (approx. 1.6%) level, Crypto.com saw a significant jump in depth. However, for a relatively smaller asset like SOL, liquidity so far from the market price offers limited utility to most traders. The other six exchanges generally saw declining depth beyond the +/- $1.5 level.

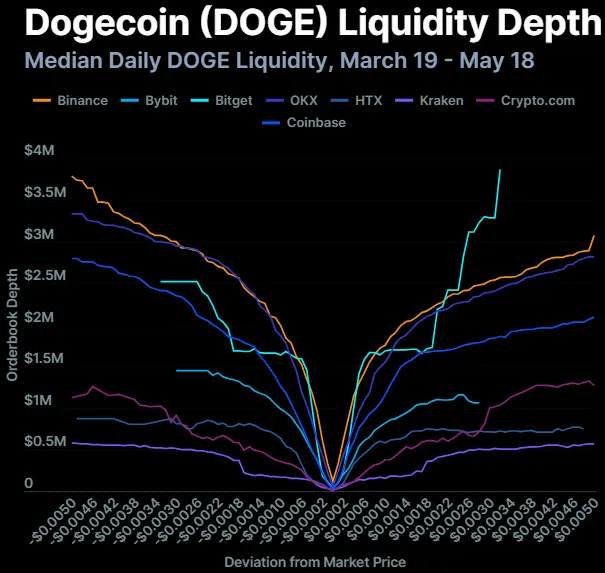

5. DOGE liquidity remains balanced and tightly clustered around the market price within the +/- 2% range.

DOGE’s liquidity profile differs markedly from other tokens—likely due to its status as a meme coin.

More exchanges show deeper liquidity close to the current market price. Bitget, Binance, OKX, and Coinbase have roughly comparable depth within the +/- $0.001 (approx. 0.5%) range, with single-sided liquidity between $1 million and $1.7 million.

DOGE’s liquidity curves on Binance, Coinbase, Bitget, and Crypto.com are relatively steep, suggesting consistent depth across levels. This may indicate active market making, but could also reflect speculative limit or stop orders placed by traders.

At the +/- 2% depth level, DOGE’s cumulative single-sided liquidity across all eight exchanges totals $10–12 million—roughly half of XRP’s depth at the same level. Given the relative market caps of XRP and DOGE, this represents a particularly healthy liquidity position.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News