IOSG | The New Degen Arena: Hyperliquid

TechFlow Selected TechFlow Selected

IOSG | The New Degen Arena: Hyperliquid

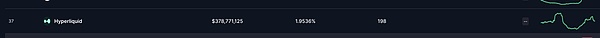

After the crisis, Hyperliquid quickly rebounded thanks to whale retention and ecosystem expansion, setting new highs in trading volume, open interest, and $HYPE price.

Author: Mario @IOSG

TL;DR

-

Hyperliquid is an ultra-fast on-chain perpetual DEX running on its own Layer 1, delivering centralized exchange-level performance while maintaining on-chain transparency.

-

Its native token $HYPE governs network decisions, reduces trading fees when staked, and captures value through listing auction buybacks.

-

The protocol's core liquidity source is the HLP Vault—a hybrid vault combining market-making and liquidation roles—accounting for over 90% of TVL.

-

In March 2025, Hyperliquid faced a severe black swan event—the $JELLYJELLY manipulation incident—that nearly triggered a system-wide cascade of liquidations.

-

The incident exposed centralization issues in validator governance: intervention by the Hyper Foundation prevented collapse but sparked controversy over decentralization.

-

Despite this, Hyperliquid rapidly rebounded post-crisis, driven by whale loyalty and ecosystem expansion, setting new highs in trading volume, open interest, and $HYPE price.

-

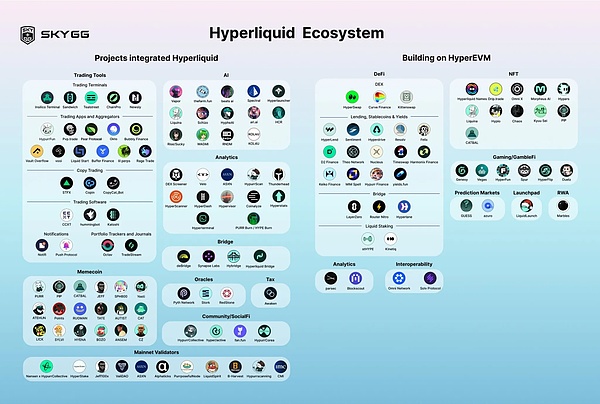

Today, the platform (including HyperEVM) hosts over 21 new dApps spanning NFTs, DeFi tools, and vault infrastructure, far surpassing a simple perpetual exchange.

Where do “Degen” whales trade?

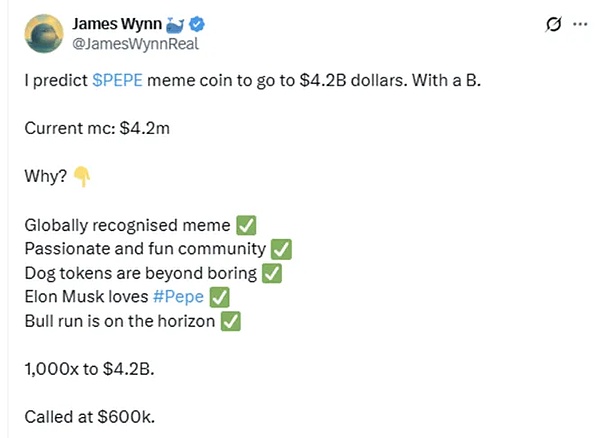

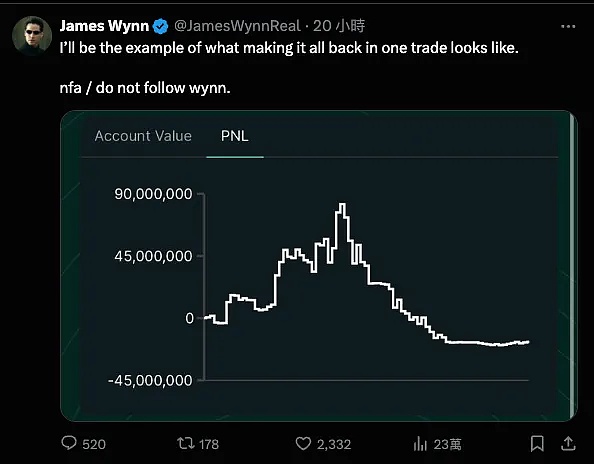

James Wynn is a well-known crypto degen—an anonymous whale who turned $210 into $80 million within three years. His most famous trade was multiplying $7,000 in $PEPE into $25 million, consistently taking nine-figure positions with 40x leverage. [1]

Wynn often publicly shares his entry points and reacts to market moves in real time, treating eight-figure blowups as routine. But more important than who Wynn is, is where he trades.

For Wynn and all high-leverage, high-position degens, Hyperliquid has become the new battleground. Anonymous whales (like "Insider Brother") now take large positions on Hyperliquid, and their positions are closely tracked by Chinese crypto media as live indicators of market sentiment and platform dominance.

So how did Hyperliquid get here? Why do high-risk traders choose it?

We break it down below.

What is Hyperliquid?

Hyperliquid is a decentralized exchange, but it doesn't use an AMM model like Uniswap.

Instead, it uses a fully on-chain order book mechanism—not pricing via liquidity pools, but matching orders directly on-chain—to deliver a CEX-like real-time trading experience. Limit orders, executions, cancellations, and liquidations all happen transparently on-chain and can settle within a single block.

Hyperliquid built its own dedicated Layer 1 blockchain, also named "Hyperliquid," designed specifically for high performance. This is precisely what enables it to execute trades at the speed and stability required by high-frequency traders.

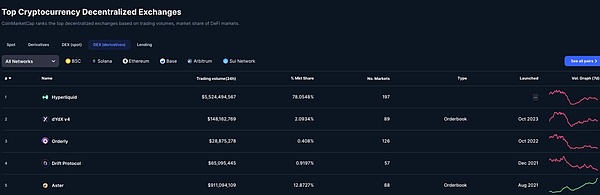

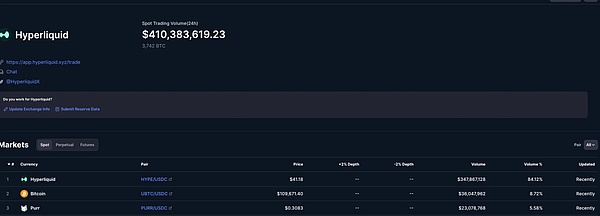

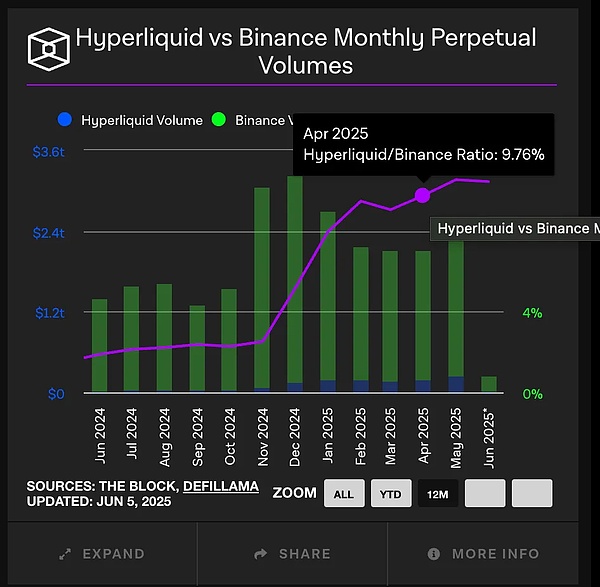

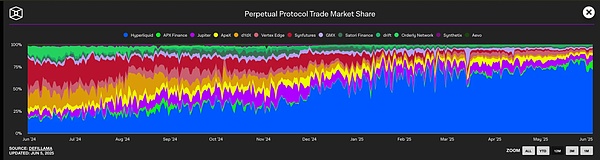

This performance isn't theoretical. By June 2025, Hyperliquid captured 78% of the on-chain derivatives market share, with daily trading volume exceeding $5.5 billion. [2]

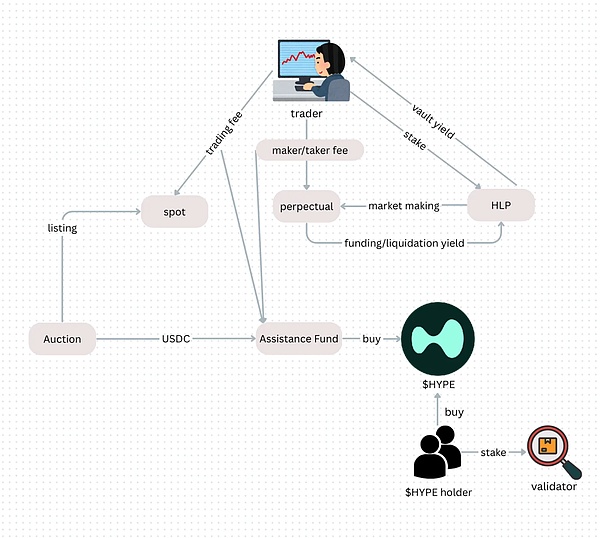

$HYPE

Hyperliquid isn't just a trading platform—it's a full-fledged on-chain financial system, with $HYPE at its core.

Tokenomics & Philosophy

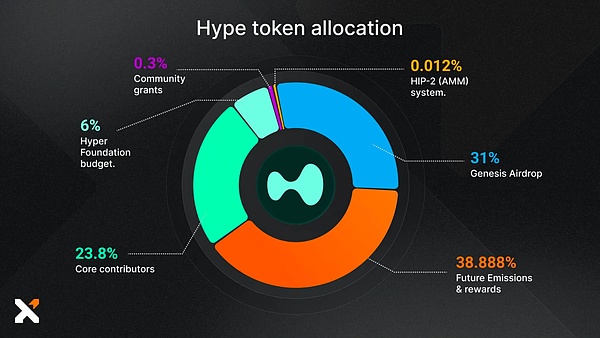

$HYPE has a total supply of 1 billion tokens. In November 2024, 310 million (31%) were distributed via a massive airdrop to approximately 94,000 users—one of the most genuinely user-distributed projects in recent years. [3]

A total of 70% was allocated to community airdrops, incentives, and contributors—no VC allocation. This reflects founder Jeffrey Yan’s clear philosophy. A Harvard math graduate and former high-frequency trader at Hudson River Trading, Yan stated publicly: “Letting VCs control the network would be a scar.” He aims to build a financial system “built by users, for users.” [4]

This “community-first + protocol performance” ethos is embedded in $HYPE’s design: it’s not just a governance token, but a utility-driven one.

Utility

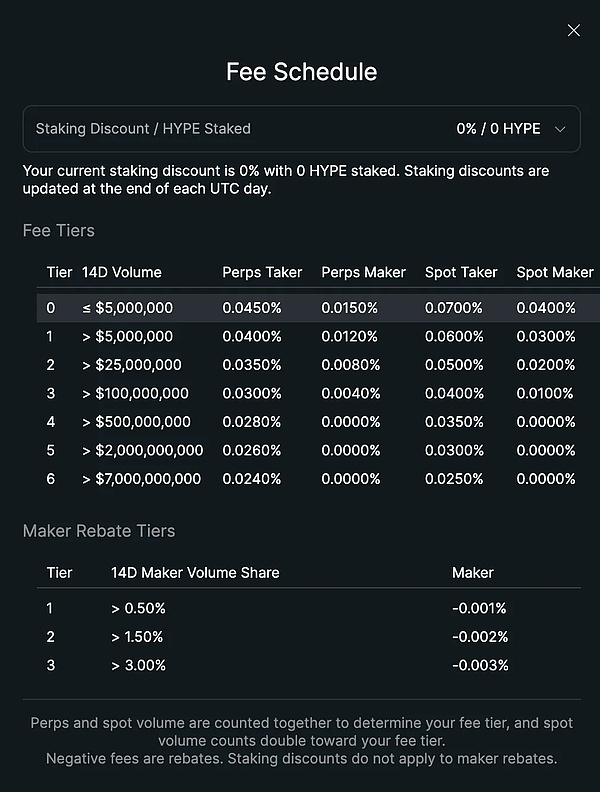

Beyond governance, $HYPE directly reduces trading fees. Users can stake $HYPE to earn fee discounts.

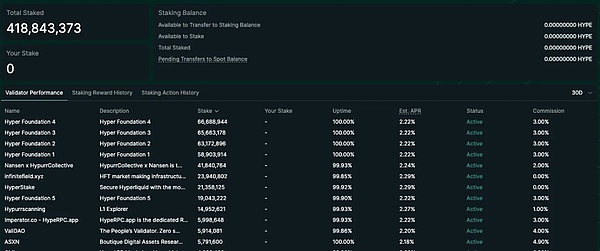

Additionally, $HYPE is central to network security. Hyperliquid runs on a Proof-of-Stake consensus, and staking $HYPE isn’t just about earning rewards or discounts—it’s foundational to block production.

To become a validator, one must meet these requirements: [5]

-

Stake at least 10,000 $HYPE

-

Pass KYC/KYB identity verification

-

Deploy high-availability infrastructure (including multiple non-validator nodes)

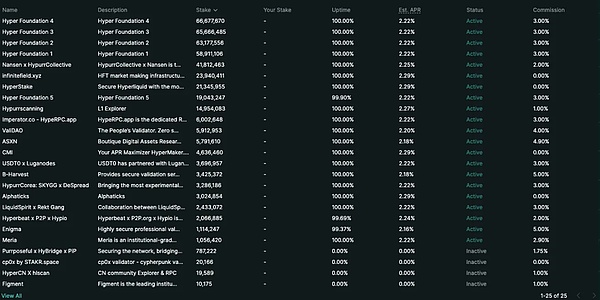

Validator performance is continuously monitored, with stake delegation managed through the Hyper Foundation’s delegation program.

Current annual staking yield for validators is around 2.5%, with a reward curve modeled after Ethereum.

Other Features of Hyperliquid

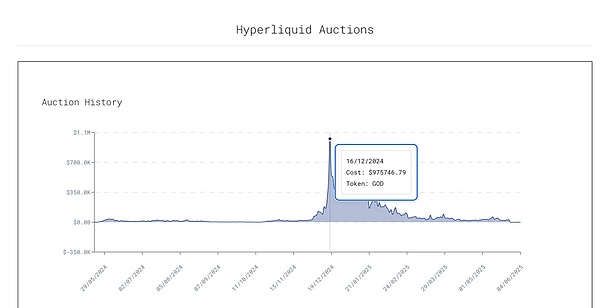

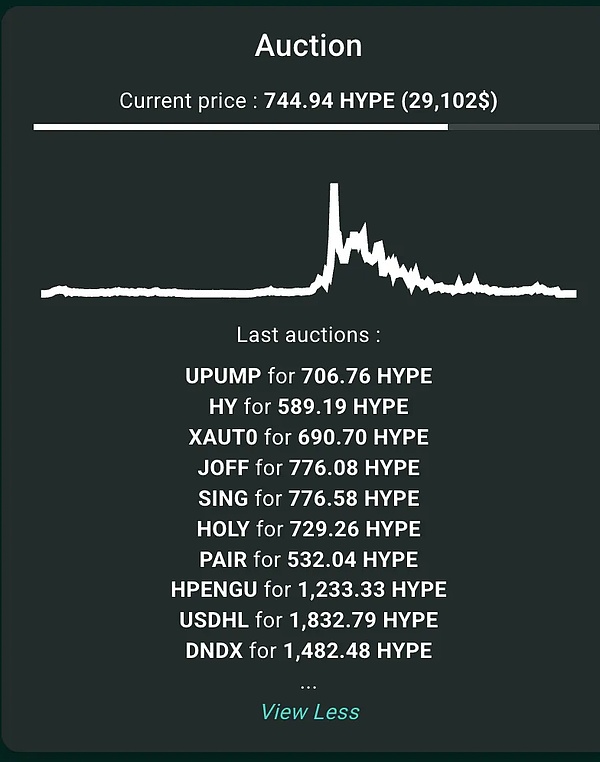

a. HIP-1 Auction Mechanism: Decentralized Token Listing

One of Hyperliquid’s most unique and often underappreciated mechanisms is its auction-based token listing system: HIP-1.

This mechanism uses an on-chain Dutch auction to determine listing rights:

-

Starting price is double the previous winning bid;

-

Price decreases linearly over 31 hours, down to a floor of 10,000 USDC;

-

The first wallet to accept the current price wins the right to create and list the token.

Unlike centralized exchanges (e.g., Binance and Coinbase), which operate opaquely and charge high listing fees, HIP-1 is fully transparent, requires no negotiation, and eliminates insider allocations.

For example, in late 2024, Moonrock Capital’s CEO alleged that Binance demanded 15% of a Tier 1 project’s tokens as a listing fee (worth ~$50–100 million). Coinbase has reportedly charged up to $300 million. [6]

Even Binance’s “Batch Vote to List” still faces opacity issues—voting for two listings but launching four.

In contrast, on Hyperliquid:

-

The entire auction process is on-chain and executed entirely by smart contracts;

-

All listing fees go 100% to the Assistance Fund, used to buy back and burn $HYPE;

-

No team cuts or reserved spots.

Compared to other protocols where teams and VCs pocket listing fees, Hyperliquid’s fee distribution logic is:

-

All fees go to the community: shared among HLP, the Assistance Fund, and spot publishers. [7]

However, despite its transparency, Hyperliquid’s spot market faces clear challenges:

-

Most auctions close near the floor price (e.g., 500 $HYPE), indicating limited market interest in spot listings;

-

Post-listing trading volumes are extremely low;

-

New listings aren't prominently displayed, leading to low visibility;

-

Spot market accounts for only 2% of DEX total spot volume, with 84% coming from the $HYPE/USDC pair.

If Hyperliquid wants to truly challenge CEXs on listings, it must improve UI visibility, activity, and secondary market integration.

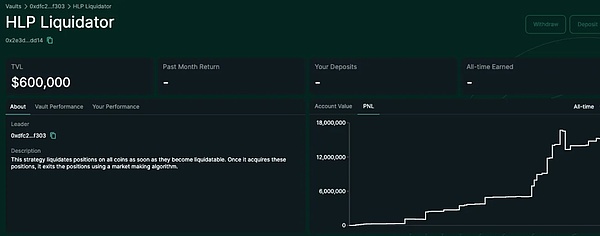

b. Vault System

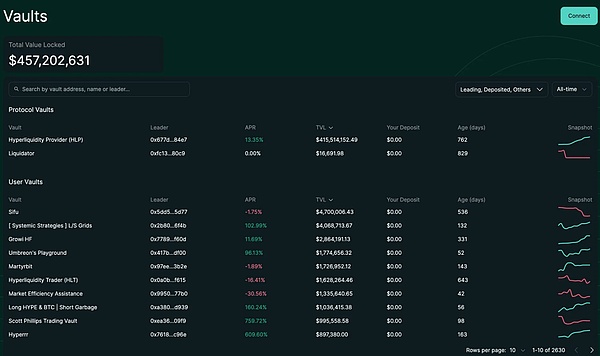

Hyperliquid serves not only active traders but also offers passive income through its vault system, enabling capital participation in algorithmic trading strategies.

There are currently two types of vaults:

-

User-Created Vaults: Anyone can launch a vault and trade using pooled funds. Investors share profits and losses proportionally, while vault managers collect 10% of profits as a management fee. To align interests, managers must personally stake at least 5% of the vault’s TVL (Total Value Locked). This mirrors CEX-style “copy trading.”

-

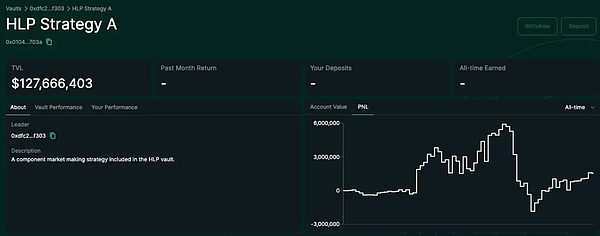

HLP (Hyperliquidity Provider): The HLP vault runs market-making strategies on Hyperliquid. Although strategy execution currently happens off-chain, holdings, order books, trade history, deposits, and withdrawals are all published on-chain in real time for public auditability. Anyone can provide liquidity to HLP and share profits and losses proportionally. HLP charges no management fees—all PnL is distributed strictly based on each provider’s share in the vault. [8]

HLP currently accounts for 91% of Hyperliquid’s total TVL. Its strategy has two components:

#

Market Making:

-

Continuously posting two-sided buy/sell quotes;

-

Earning the bid-ask spread.

Liquidation:

-

When a user’s margin falls below maintenance level, the platform attempts limit-order liquidation;

-

If position value drops below 66% of maintenance margin, the system triggers the liquidation vault;

-

HLP attempts limit-order unwinding to minimize slippage and risk;

-

If risk becomes unmanageable, Auto-Deleveraging (ADL) is triggered to forcibly reduce positions.

In summary, HLP = Market Maker + Liquidator.

-

As a market maker, HLP continuously provides liquidity (two-sided quotes);

-

As a liquidator, HLP takes over and unwinds insolvent user positions.

Summary

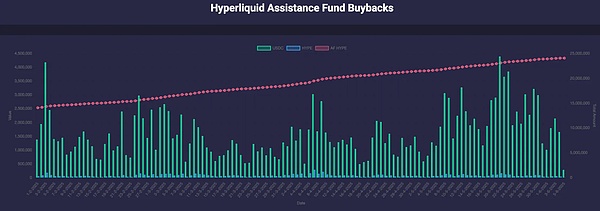

Here is Hyperliquid’s revenue structure:

-

Taker/Maker Fees: Distributed to HLP depositors;

-

Auction & Spot Trading Fees: 100% go to the Assistance Fund for $HYPE buyback and burn;

-

No team cut / treasury fee—unlike most DEXs.

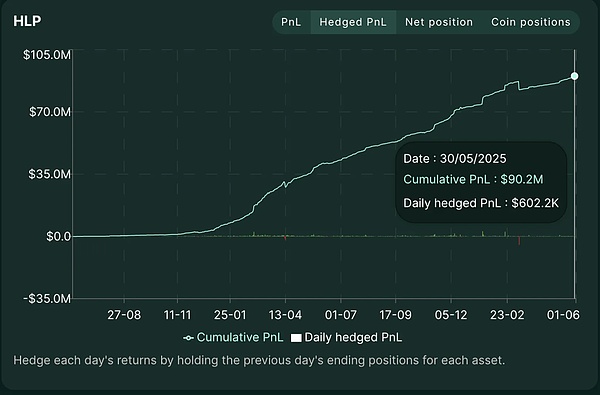

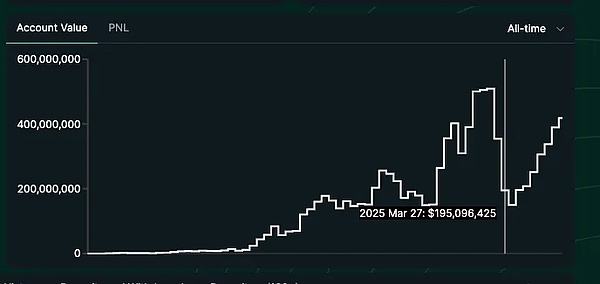

HLP Performance

We measure HLP’s actual protocol income using “hedged PnL,” which excludes unrealized gains/losses from market movements and includes only:

-

Taker/maker trading fees;

-

Funding rate income;

-

Liquidation fees, etc.

Thus, it reflects the protocol’s true “Alpha” capability.

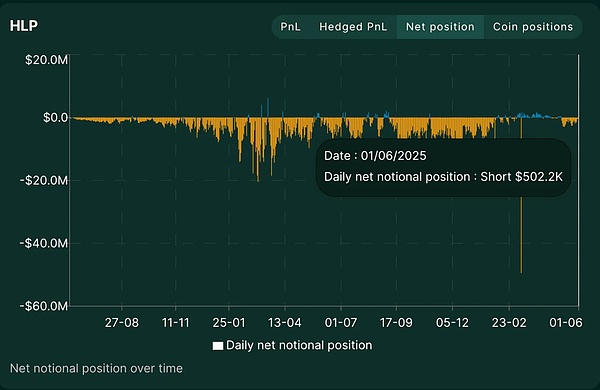

Data shows that during the 2025 bull run, HLP’s net position was typically negative, meaning it was mostly short the market. This happened because the platform posted many limit buy orders, causing HLP to passively absorb sell-side pressure, resulting in a net short exposure.

In March, we see a sharp spike where net nominal exposure approached -$50 million—this was the day of the $JELLYJELLY incident, when Hyperliquid nearly collapsed.

Hyperliquid’s Risk Exposure

HLP Concentration Risk

As noted, HLP holds over 90% of Hyperliquid’s TVL and serves as both primary liquidity provider and liquidator. Such high concentration creates systemic risk—if HLP fails, the entire platform could collapse.

We can see that HLP TVL accounts for around 75% of the entire Hyperliquid chain’s total TVL.

This vulnerability was starkly revealed in the $JELLYJELLY incident in March 2025—a sophisticated attack that nearly caused a systemic chain reaction of HLP vault liquidations.

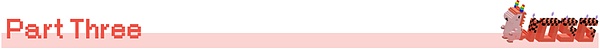

Brief timeline:

-

$JELLYJELLY is a meme + ICM project on Solana, once valued at $250 million, later dropped to $10 million, with very low liquidity;

-

An attacker deposited 3.5 million USDC as collateral on Hyperliquid;

-

Shorted $JELLYJELLY at $0.0095, with a position size of ~$4.08 million;

-

Bought large amounts of spot tokens, spiking the spot price;

-

Withdrew collateral, triggering forced liquidation—HLP took over the short;

-

No buyers existed in the market, leaving HLP stuck holding a massive short;

-

Unrealized loss reached $10 million; further price increases would have caused platform-wide cascading liquidations.

Eventually, Hyperliquid issued an emergency announcement citing “abnormal market behavior” and quickly coordinated validator votes to delist the JELLY contract and force liquidate the position.

But crucially: The liquidation price wasn’t the on-chain price, but an internal valuation of $0.0095—effectively manually marking $JELLYJELLY down by 80%.

While this allowed HLP to narrowly avoid disaster—and even profit slightly—it raised strong governance concerns:

-

Who has the power to manually override contract execution?

-

Can oracle pricing be trusted?

-

If contracts can be delisted arbitrarily, what does decentralization mean?

Is Validator Governance Just a Facade?

This event challenged not only HLP’s stability but also Hyperliquid’s claimed decentralization.

During the $JELLYJELLY liquidation, Hyperliquid validators acted swiftly:

-

Suspended contract trading;

-

Overrode oracle data;

-

Manually delisted the asset and force-closed positions.

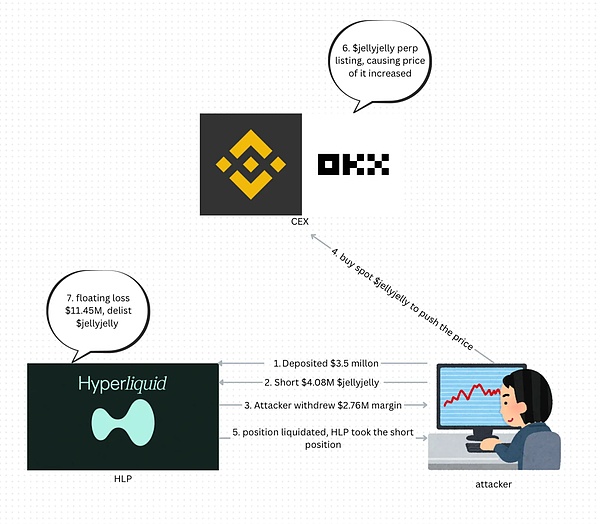

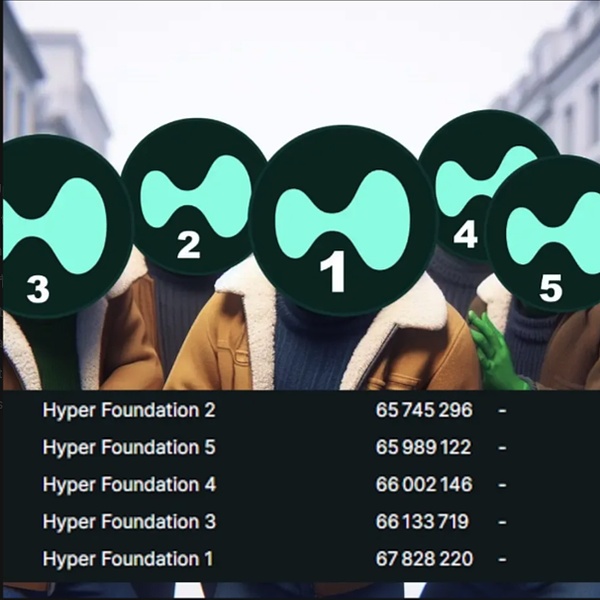

But there’s a critical reality: most validators have direct ties to the Hyper Foundation.

On-chain data shows that at the time of the incident:

-

The Hyper Foundation controlled 5 out of 16 validators;

-

Held 78.5% of total staked $HYPE; [10]

-

Even by June 2025, it still held around 65.3% of staked supply.

Thus, so-called validator governance functions more like an “internal emergency response” than genuine decentralization.

The community questioned: if assets can be forcibly delisted and prices changed, is Hyperliquid just “DEX architecture + CEX execution”?

Although this centralized governance prevented systemic collapse, users began questioning Hyperliquid’s long-term credibility. After the incident, HLP TVL declined noticeably as users withdrew funds.

How Did Hyperliquid Recover So Quickly From Crisis?

In crypto, being questioned isn’t fatal—but being replaced is.

After the $JELLYJELLY short squeeze in March 2025, Hyperliquid’s HLP vault was nearly wiped out, and its governance fell into controversy over centralization. Many believed it was doomed. On April 7, $HYPE dropped to $9, amid widespread FUD and fears over vault risk.

Yet just over a month later, $HYPE surged past $35, hitting an all-time high and re-entering the top 20 FDV crypto assets.

What enabled Hyperliquid’s comeback?

Whales Never Left

Even during the peak of the $JELLYJELLY crisis, Hyperliquid maintained about 9% of Binance’s perpetual trading volume—not just a number, but a signal:

Despite the trust crisis, institutional traders, whales, and KOLs continued using Hyperliquid.

Why? Because it meets the market’s core needs:

High-performance derivatives trading + No KYC + Extreme capital efficiency.

Unlike Binance or OKX:

-

Require identity verification;

-

Restrict access in certain regions;

-

Sometimes freeze user assets.

Hyperliquid offers freedom while retaining CEX-level matching speed and depth.

It’s highly attractive to:

-

Anonymous, leveraged whales;

-

Institutions needing programmatic trading (e.g., Hong Kong traders unable to obtain Type 7 API access from Binance);

-

KOLs relying on transparent trading records to build influence: creating a “capital + influence flywheel.”

Not only did these users stay—they became more active after the crisis. Meme coin rallies led by figures like James Wynn made Hyperliquid the epicenter of on-chain speculation.

In fact, the $JELLYJELLY incident proved one thing:

Hyperliquid is the only on-chain platform capable of “taking a hit” like a centralized exchange.

Even skeptical whales have nowhere else to go—only Hyperliquid has the depth to support their scale.

The Real Trade-off: Decentralization vs Control

Hyperliquid never claimed to be “pure DeFi.” Its goal is a user-centric, experience-focused DEX.

So it made a pragmatic trade-off: sacrificing some governance decentralization to achieve high throughput and low-latency execution.

Controversial? Yes. But clearly effective.

As Foresight News put it: [12]

“To survive a black swan, someone must hold the sword.”

Hyperliquid openly accepts the role of “sword-bearer,” choosing human coordination and top-down intervention to survive cascading crises.

This isn’t censorship—it’s operational resilience.

Take Sui Network: On May 22, 2025, Sui validators voted to recover $220 million stolen from DEX aggregator Cetus. The proposal allowed validators to overwrite wallet ownership and revoke hacker access to $160 million in frozen funds. Dubbed “hacking the hacker,” it sparked fierce debate.

This “hack-back” ignited controversy: one side condemned it as violating DeFi principles; the other praised it as necessary self-rescue.

Is Sui decentralized? Probably not.

But that’s the point: every high-performance blockchain must make trade-offs.

Speed, liquidity, UX, protocol security—cannot all be maximized simultaneously.

The key question is: Are these trade-offs transparent and effective?

Hyperliquid’s validators are majority-controlled by the Hyper Foundation, posing centralization risks. But this same structure enabled rapid response to the $JELLYJELLY crisis.

Users vote with their wallets: despite FUD, Hyperliquid set record highs in open interest, TVL, and fee revenue in May.

In true emergencies, most users don’t care if the system is “perfectly decentralized”—they only care: can this system save me?

More Than a DEX: An On-Chain Ecosystem

Despite governance centralization, Hyperliquid is no longer just a derivatives platform.

According to Cryptorank, over the past three months, 21 new projects have deployed on Hyperliquid, bringing the total ecosystem to over 80 projects across:

-

DeFi

-

GameFi

-

NFT

-

Dev tools

-

Analytics platforms

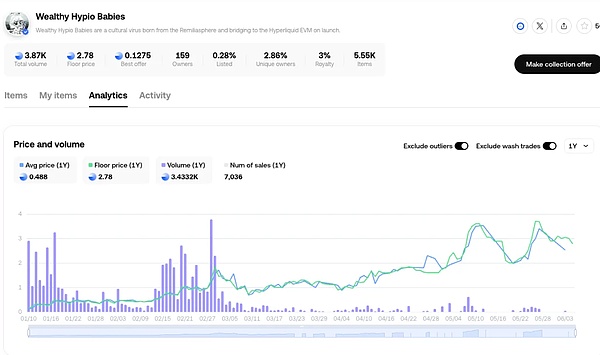

Milady-related NFT projects have launched on its chain, such as Wealthy Hypio Babies, whose floor price keeps rising—indicating strong native on-chain liquidity and organic community interest.

Despite governance controversies and major liquidation crises, developers and users continue betting on Hyperliquid as a high-performance, promising Layer 1.

Hyperliquid’s True Growth Drivers

Why a DEX?

CEXs keep collapsing, eroding user trust and accelerating migration to DEXs.

-

FTX’s 2022 collapse showed even top-tier exchanges can vanish overnight, freezing user assets;

-

In the past decade, CEXs suffered 118 hacks, losing over $11 billion—far exceeding on-chain losses;

-

Every withdrawal pause or asset freeze reminds users: custodial platforms carry inherent third-party risk.

With improved payment infrastructure, many may no longer need fiat off-ramps.

In 2024, self-custody wallet users surged 47%, with over 400 million active addresses. In January 2025, DEX volume hit an all-time high. Users are voting with their feet—moving toward self-custody and on-chain trading.

The original vision of blockchain: decentralization, self-sovereign assets, no trust in intermediaries. Yet many ignored “not your keys, not your coins” for convenience, treating CEXs as wallets.

Now, that mindset is shifting. As infrastructure matures and on-chain opportunities grow, self-custody isn’t just safer—it’s the gateway to early access and high returns, e.g., airdrops, meme coins.

For example: $TRUMP traded above $20 on CEXs at listing, but on-chain users bought much cheaper.

This trend shows: convenience often means missing out—control means opportunity.

The shift from centralized to on-chain isn’t ideological anymore—it’s a choice of yield and efficiency.

Why Hyperliquid?

Despite the $JELLYJELLY crisis, users stayed. DEXs like dYdX and GMX didn’t siphon them away.

Hyperliquid got three things right:

Genuinely Community-Oriented Token Model

Hyperliquid is one of the few DeFi projects launched without VC funding.

-

No early allocations, no private rounds;

-

Over 70% of $HYPE went to the community, including 31% airdropped to 94,000 addresses (~$45,000 avg per wallet).

This created three effects:

-

Built a sticky user base via Season 1/2 point farming;

-

Launched with stable buybacks (unlike dydx);

-

No VC dump pressure (vs. dYdX >50% internal allocation, GMX >30%).

In short: users aren’t just users—they’re owners.

CEX-Level Experience Without CEX Risks

Hyperliquid delivers: Binance speed, on-chain deployment.

-

GMX suffers from AMM inefficiency;

-

dYdX v3 uses off-chain matching;

-

UI/UX feels laggy.

This attracts whales (e.g., James Wynn with multi-billion positions), market makers, and HFT traders.

Even post-crisis, Hyperliquid leads in depth and slippage control (slippage ~0.05%).

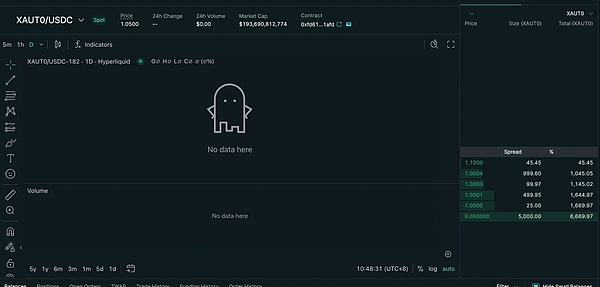

Product Depth: Beyond Perpetuals

In early 2025, Hyperliquid launched several new modules:

-

Spot market launch;

-

HyperEVM release for DeFi developers;

-

HLP vault and copy trading system;

-

Meme coin standard (HIP-1), supporting spot+perp integrated trading;

-

Risk fund with real-time fee support (for $HYPE buyback and burn).

Together, these form an “all-in-one DeFi trading platform”:

-

Trade BTC spot, ETH perps, meme coins—all in one UI;

-

Participate in HLP or copy top traders;

-

One wallet for everything—fast, cheap, gas-free.

In contrast, dYdX and GMX feel like “single-function protocols,” while Hyperliquid has evolved into a multifunctional ecosystem.

Deep Dive: HyperEVM Ecosystem

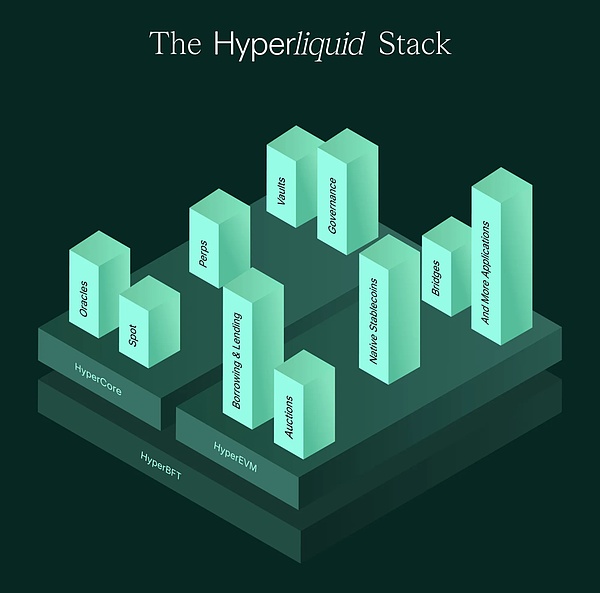

HyperEVM is Hyperliquid’s smart contract layer, enabling EVM-compatible dApp development. Together with HyperCore (trading engine) and HyperBFT (consensus), it forms a three-layer architecture:

-

HyperCore: Core asset and matching engine. All assets enter here first—like “exchange balances.”

-

HyperEVM: Smart contract execution layer for DeFi, NFTs, GameFi, etc.

-

HyperBFT: BFT consensus based on HotStuff, optimized for low latency and high throughput.

Assets must be manually transferred from HyperCore to HyperEVM to interact with smart contracts. Gas fees are paid in $HYPE.

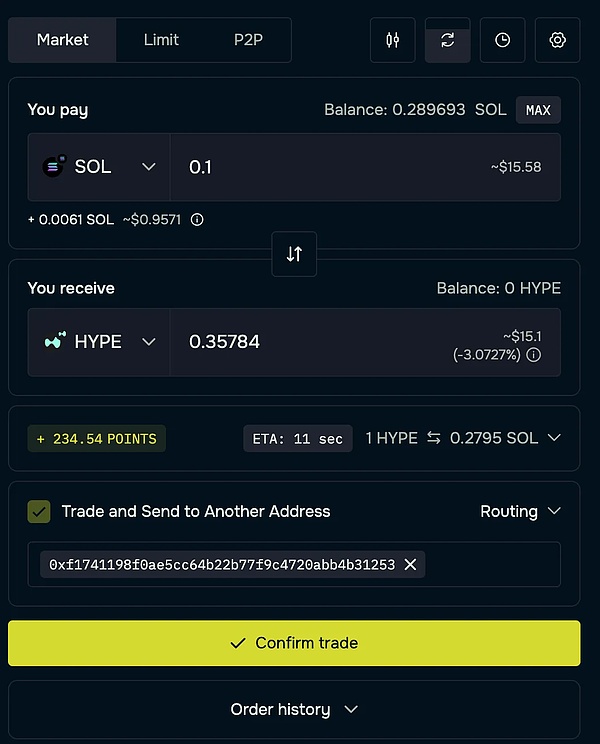

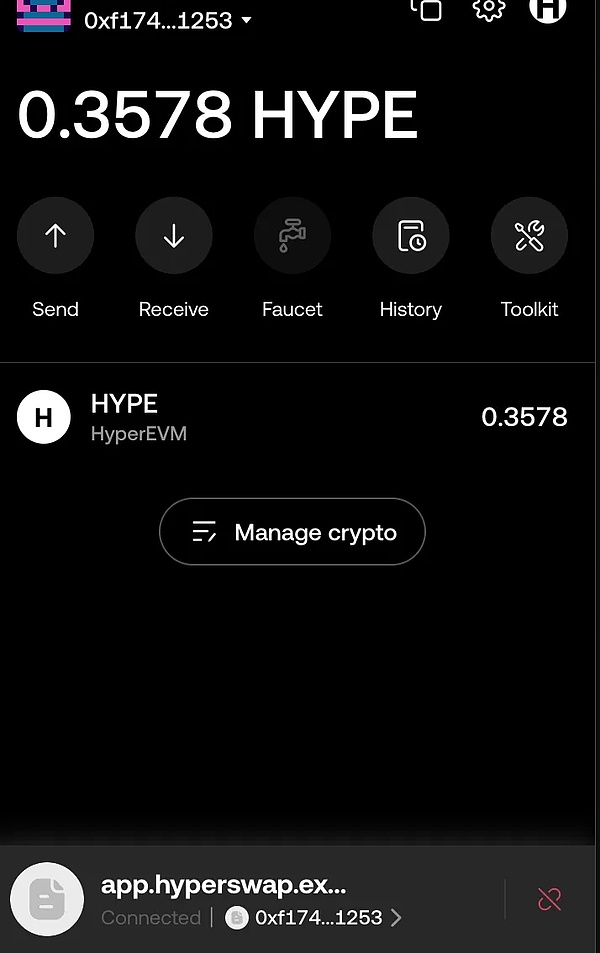

How to Enter the HyperEVM Ecosystem?

External Chain → HyperCore → HyperEVM

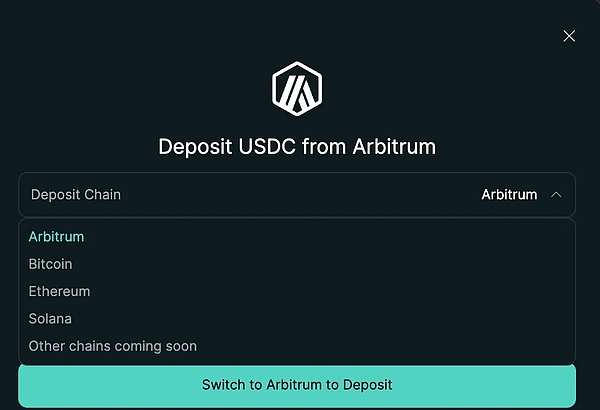

a. External Chain → HyperCore

Supported chains include Ethereum, Arbitrum, Solana, Bitcoin. Supported assets: USDC, ETH, BTC, SOL, etc.

b. HyperCore → HyperEVM

External Chain → Direct to HyperEVM (e.g., via deBridge)

Popular Projects on HyperEVM

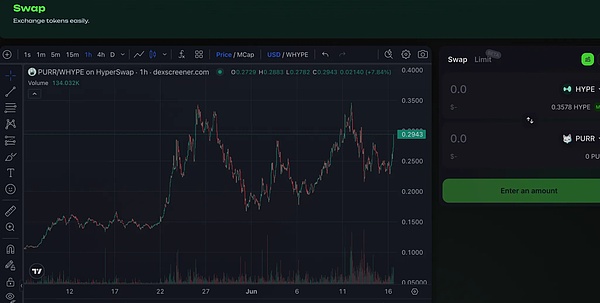

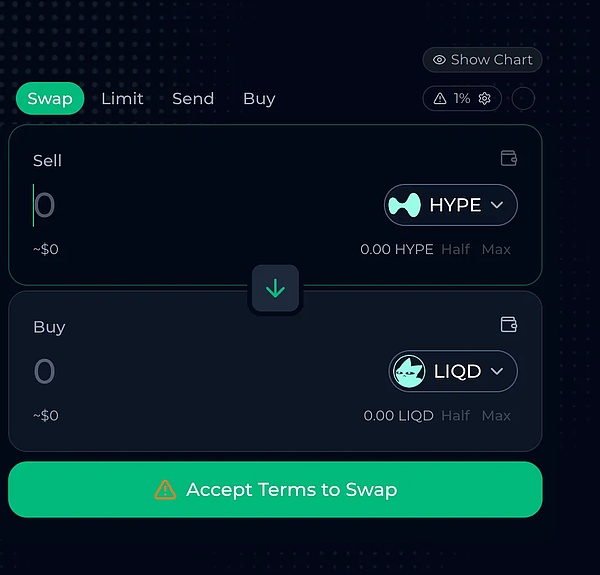

DEX (Non-Perpetual)

-

Hyperswap: Supports new token listings with liquidity mining incentives

-

Liquidswap: Aggregated DEX routing across multiple pools

DeFi Protocols

-

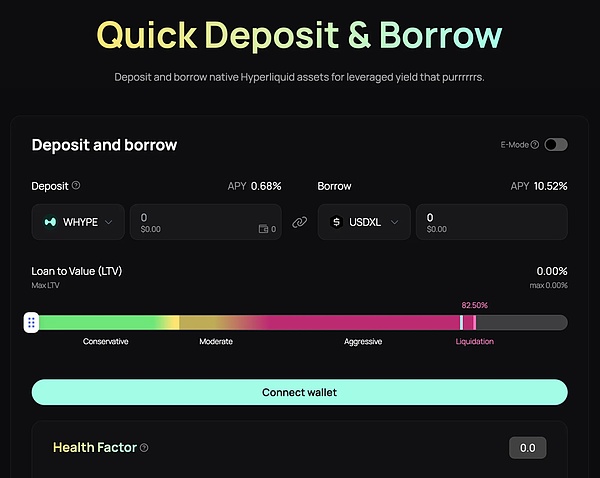

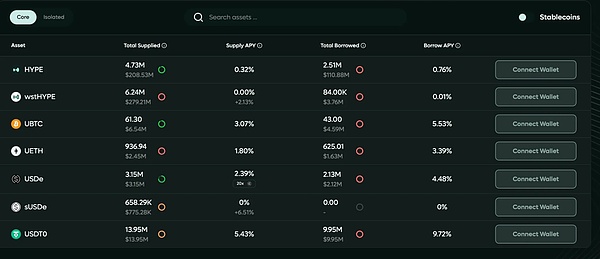

Hyperlend / Felix / Hypurr.fi: Support lending, LP, and complex yield strategies

#

Launchpad

-

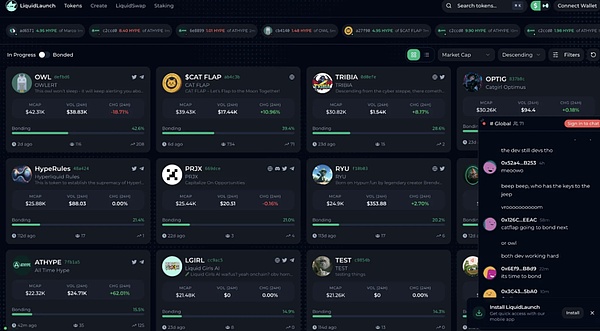

Liquidlaunch: Early project launchpad

Why HyperEVM Matters?

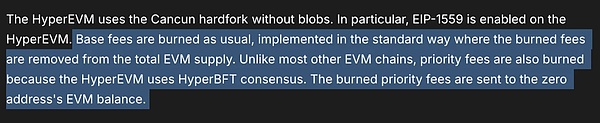

As DeFi, stablecoins, NFTs, and other protocols deploy on HyperEVM, on-chain activity grows—increasing demand for $HYPE as gas, creating deflationary pressure. All gas fees (base + priority) are burned.

Additionally, future airdrops may factor in EVM activity, further incentivizing user and developer migration.

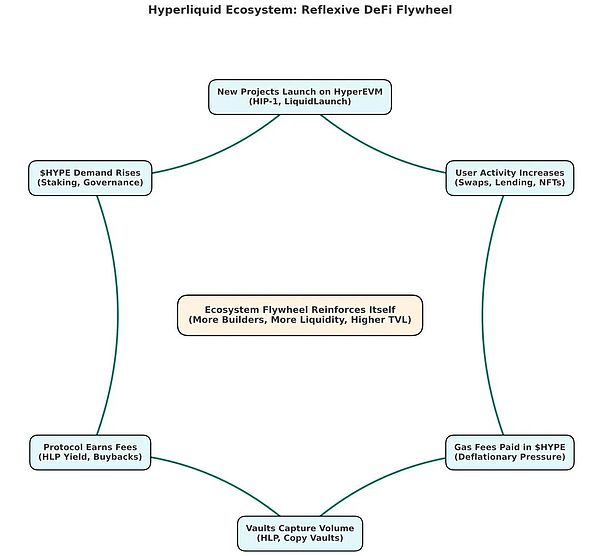

This means HyperEVM isn’t just feature expansion—it enables real network effects and narrative flywheels:

New projects → More gas consumption → Supports $HYPE value → Attracts more users → More developers → Repeat

Potential High-Beta Plays: Ecosystem Tokens

While $HYPE remains the core asset capturing Hyperliquid’s system value, emerging tokens on HyperEVM (e.g., $LIQD, LiquidSwap’s governance and incentive token, distributing $HYPE to stakers) offer higher beta exposure to ecosystem growth. These tokens typically represent:

-

Localized revenue-sharing models

-

DeFi base assets

-

Early liquidity opportunities

As $HYPE appreciates, these tokens may benefit from:

-

Increased trading volume and user inflows, boosting utility and fee capture;

-

Higher APY denominated in $HYPE, as seen with $LIQD staking;

-

Speculative upside as traders rotate into smaller-cap ecosystem projects;

-

Airdrops or governance incentives tied to early usage.

In a compounding ecosystem like HyperEVM, such “pick-and-shovel” tokens (driven by $HYPE gas demand but structurally less correlated) may outperform $HYPE itself in early cycles.

Example: If $HYPE doubles, a $LIQD with FDV < $100M could potentially quadruple if paired with deepening adoption.

These tokens aren’t just parasites—they’re amplifiers of ecosystem growth: more usage → more gas → more $HYPE burned.

Creating a positive flywheel.

Conclusion

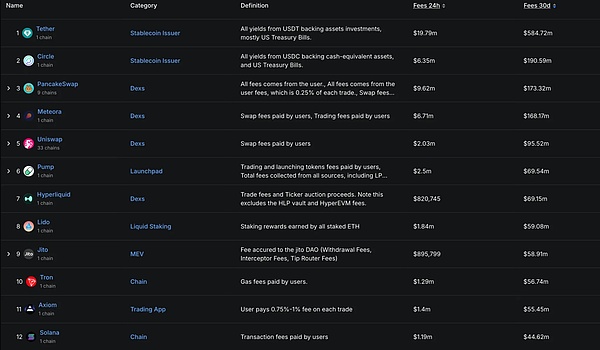

Though many view Hyperliquid as “just another DEX” or “a new L1,” fee data tells a different story:

Hyperliquid ranks 7th among all protocols in 30-day fees ($69.15 million), surpassing Tron, Solana, and even staking leader Lido.

And this doesn’t include HLP Vault or HyperEVM revenues—meaning its income potential is still untapped.

From a valuation standpoint, Hyperliquid’s fundamentals rival mainstream L1s. But its true potential lies in becoming the first DeFi-native trading platform to match CEXs in user experience, fees, and execution.

Most DEXs still rely on swap models with poor liquidity. Hyperliquid built a real orderbook + HLP2 mechanism, keeping cross-chain slippage under 0.3%, all without constant wallet switching.

We believe Hyperliquid is evolving into the one-stop on-chain trading platform—from spot to perps to full ecosystem.

In a way, it’s not trying to beat Uniswap—it’s aiming straight at Binance. [16]

Why Another Hyperliquid Can’t Be Replicated?

Even if you want to bet everything on the next “exploding perpetual DEX,” I believe the DEX boom is over.

Four reasons:

-

Dominant Market Share

Controls 80% of on-chain perpetual volume, weekly turnover >$60 billion—creating a liquidity → user → liquidity flywheel. New entrants must catch up with tens of billions in daily volume—near impossible.

-

Irreplicable Economic Model

No VC, self-funded launch—not a meme, but built real trust and long-term alignment. New DEXs need fundraising, token launches, reserved allocations, due diligence disclosures, incentive programs… completely different user dynamics.

-

Elite Founding Team

Founders from HRT, MIT, Caltech—high-frequency background enabled CEX-grade infrastructure design. Founder “Jeff” revealed his network consists of veteran traders who became early users and feedback sources—this “moat” is hard to replicate.

-

Mature Product Ecosystem

Hyperliquid isn’t just a DEX—it’s a complete high-performance L1 with self-consistent architecture, user base, and governance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News