How Tim Draper, the "mentor" behind Pop Mart's angel investor Mai Gang and known as the father of Silicon Valley venture capital, is betting on Bitcoin and the next era?

TechFlow Selected TechFlow Selected

How Tim Draper, the "mentor" behind Pop Mart's angel investor Mai Gang and known as the father of Silicon Valley venture capital, is betting on Bitcoin and the next era?

Much of Mai Gang's "vision" stems from his early mentor during his time studying in the U.S.—renowned Silicon Valley venture capitalist Tim Draper.

Author: Weilin, PANews

The explosive popularity of Pop Mart, a trendy toy brand, has once again brought its first angel investor, Michael Mai, into the spotlight. In the summer of 2012, just five days after meeting Pop Mart's founder Wang Ning, Mai invested in the company. As Pop Mart’s first angel investor, Mai witnessed its journey from a modest residential apartment in Beijing to a listing on the Hong Kong Stock Exchange.

In fact, part of Mai’s “vision” stems from his early mentor during his studies in the United States—Tim Draper, a renowned Silicon Valley venture capitalist. Mai entered China’s venture capital industry in 1998, co-founding Pudong Venture Capital in Shanghai. Later, while studying at UCLA, he won first place in an entrepreneurship competition, which led him to connect with Tim Draper and enter the Silicon Valley venture ecosystem. In 2005, he co-founded VenturesLab with Tim Draper.

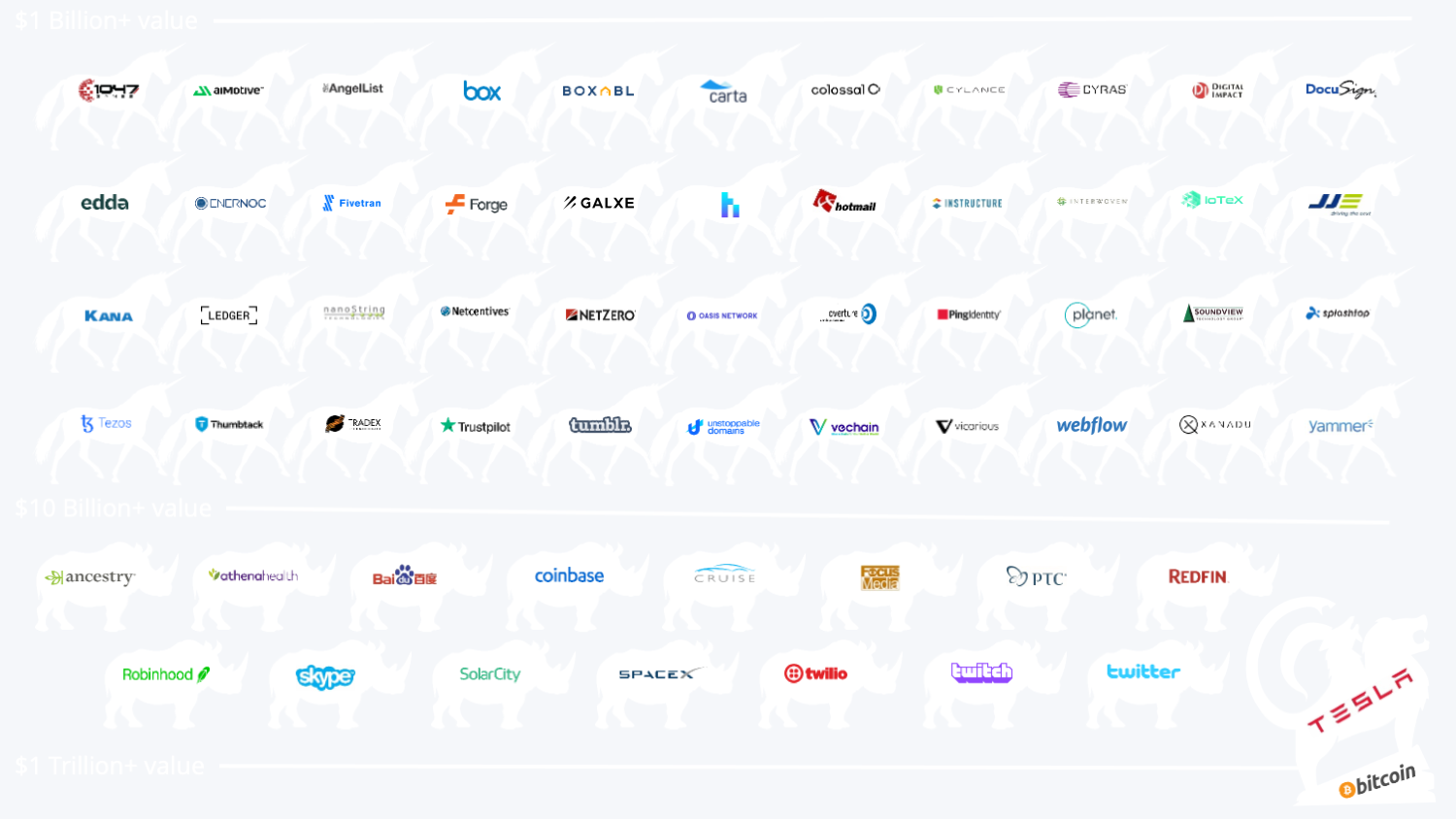

Tim Draper is hailed as a “father of venture capital,” having backed projects that have driven some of today’s most innovative advancements, including Skype, Baidu, Hotmail, and Tesla. He is also an early and staunch believer in Bitcoin.

Family Legacy and Silicon Valley DNA: The Third-Generation Investor

Draper comes from a family with deep roots in venture capital and politics, representing the third generation of this influential lineage. His father founded Draper & Johnson Investment Company and previously served as chairman and president of the U.S. Export-Import Bank. In 1994, Draper’s father returned to the investment world, co-founding Draper International—the first U.S. VC fund focused exclusively on Indian enterprises.

Draper’s grandfather, William Henry Draper Jr., established the venture capital firm Draper, Gaither and Anderson in 1958, laying down foundational principles still used in modern VC, such as management fees and profit-sharing upon exit. He also served as the first U.S. Ambassador to NATO.

Growing up in a family steeped in finance and diplomacy, Draper developed a unique perspective early on. He attended Phillips Academy Andover before enrolling at Stanford University, where he earned a bachelor’s degree in electrical engineering in 1980. In 1984, he completed his MBA at Harvard Business School.

In 1985, Tim Draper founded Draper Fisher Jurvetson (DFJ), later expanding into multiple entrepreneurial and educational platforms such as the Draper Venture Network and Draper University.

Among Draper’s most notable investments are Baidu, Hotmail, Skype, Tesla, SpaceX, AngelList, Twitter, Coinbase, Robinhood, and Twitch.

While foreign capital largely withdrew from China in the early 2000s, Draper chose to stay—and ultimately scored big with Baidu through DFJ. He was one of the earliest Silicon Valley figures to enter China’s venture capital scene. In 2005, he co-launched "VenturesLab" with Michael Mai and others, becoming a key player in China’s startup ecosystem. VenturesLab also became an early angel investor in OKX in the crypto space.

In 2018, Draper University, the well-known institution founded by Tim Draper, partnered with dCamp, a Chinese training program, to establish a base in Zhongguancun, Beijing, dedicated to cultivating blockchain talent and attracting numerous crypto OGs.

Draper has also invested in several early-stage crypto projects, including Ethereum, Coinbase, Ledger, Bancor, Arkham, Ark, Merzo, and Propy.

Betting on Bitcoin: From the Loss of 40,000 BTC to Unwavering Belief

Today, Tim Draper’s presence in the cryptocurrency world is ubiquitous. However, compared to the period between 2014 and 2020, Draper has made fewer direct investments in recent years, instead focusing primarily on promoting Bitcoin in public forums.

Draper’s interest in Bitcoin began in 2011, just two years after its inception. Through investor Joel Yarmon, he met Peter Vincennes, founder of CoinLab. CoinLab later became a pioneering Bitcoin company and miner, and was also the U.S. partner of Mt. Gox—the then-largest Bitcoin exchange. Though the concept seemed distant at the time, Draper was intrigued and made a small investment in the company. He then asked if they could purchase $250,000 worth of Bitcoin for him. At the time, Bitcoin was trading around $6 per coin. Peter bought some and stored them on Mt. Gox. He also planned to use part of the funds to buy ASIC mining chips from Butterfly Labs to mine Bitcoin at lower cost.

Two events subsequently caused the expected ~40,000 Bitcoins to “disappear.” First, the mining chips were significantly delayed. Butterfly Labs failed to deliver the chips to Peter as promised and instead used them to mine Bitcoin for several months themselves before shipping. During this time, more miners entered the market, drastically reducing mining profitability. By the time Peter finally received the chips, Draper and his partners had missed the optimal mining window. Worse, Peter stored the mined Bitcoin in wallets controlled by Mt. Gox, which later vanished when Mt. Gox was hacked. Peter thus became one of the largest creditors of the Mt. Gox collapse.

Rather than discouraging Draper, this loss strengthened his admiration for Bitcoin’s resilience—despite a major theft, Bitcoin dropped only about 20% and continued active trading.

Draper realized that demand for this new digital currency was so strong that even massive failures and fraud couldn’t stop its growth. Society wanted a frictionless, globally accessible monetary system so badly that people were willing to tolerate serious setbacks just to have it.

In 2014, after the U.S. Marshals Service seized Bitcoin from Silk Road, they auctioned off over 30,000 coins. Draper saw this as a chance to recover lost ground. A total of 31 bidders participated, each able to bid on nine blocks (each containing about 4,000 BTC). At the time, Bitcoin traded at $618 per coin. At the last moment, Draper placed a bid of $632—above market price—and won all nine blocks.

Draper quickly realized he could use these Bitcoins for meaningful impact—particularly in advancing Bitcoin adoption in developing countries. In many of these nations, people lack confidence in their local currencies due to government overprinting, leading to corruption and rampant inflation. Worse, low-income populations are often excluded from banking systems, deemed “unbankable.” These individuals represent roughly 3 billion “unbanked” people worldwide—and Bitcoin may offer them a solution.

Predicting Bitcoin at $250,000 by 2025: “Bitcoin Will Replace the Dollar”

To Tim Draper, Bitcoin’s advantages are clear:

1) It is a global, government-independent currency;

2) It enables value preservation without needing to store precious metals or art;

3) It is a frictionless currency that can automatically transfer based on smart contracts, without requiring lawyers or accountants.

He believes Bitcoin and its underlying blockchain technology are engines driving human progress. The U.S. wisely refrained from regulating the internet in its early days, allowing countless entrepreneurs to build there and ultimately fueling the rise of the internet economy. Today, adopting a similarly light-touch regulatory approach toward Bitcoin could continue attracting innovators to the U.S.

This May, within a few weeks, Tim Draper repeatedly stated that the dollar is rapidly losing value and advocated Bitcoin as the alternative. He reiterated this view in the most direct terms possible. “The dollar is going extinct,” he posted on social platform X, “As the dollar depreciates, people will rush to spend it.” In contrast, Draper believes people will turn to Bitcoin for financial security.

“Retailers will soon prefer Bitcoin,” he said, “And when that happens, people will start using Bitcoin for spending.” His latest comments respond to renewed debate sparked by Swan Bitcoin Financial Services over whether Bitcoin is primarily a store of value or a medium of exchange.

Draper believes Bitcoin’s widespread adoption as a payment method may come sooner than expected. In a May interview with CoinDesk, he predicted that within 10 years, Bitcoin will replace the U.S. dollar as the world’s reserve currency. At that point, he even forecasts Bitcoin will be “infinitely more valuable” than the dollar. In the near term, he expects Bitcoin to reach $250,000 by 2025.

One reason for Draper’s growing pessimism about the dollar is the poor performance of the U.S. Dollar Index (DXY) this year, reflecting declining market confidence. He attributes the DXY’s weakness to global concerns over former President Trump’s trade policies.

Investment Philosophy: 5–10 Year Horizon, Passion Over Data

As a venture capitalist, Draper has shared six core principles guiding his investment strategy:

Don’t invest too much in a single company early on: One of the biggest mistakes Draper has seen investors make is “putting too much money into the first few companies they back… Don’t invest as much as you think you want to, because you might run out of capital later.” He advises investing only one-half to one-sixth of what you initially intend, since startups often require multiple funding rounds. When a company succeeds, you want to have remaining capital to double down on your winners.

Set an investment horizon of 5 to 10 years: Some investments take a long time to mature, but Draper cautions against getting locked into overly distant timelines. His advice: “I don’t think too far ahead… You should focus on a 5 to 10-year timeframe.”

Don’t project your own entrepreneurial experience onto others: If you’re a successful founder turned investor, it’s easy to impose your personal traits and experiences on founders seeking funding. He warns: “You might think, ‘Hey, I did it, so others can too.’ You’ll start throwing money around, assuming everyone can make the same sacrifices you did. But reality doesn’t work that way. You need to step back and truly assess whether this person is genuinely willing to make the sacrifices required to succeed.”

Focus on mission, not money: In early-stage investing, never start with “How much money can I make?” Draper says: “If you’re getting into this thinking, ‘I can make money from this,’ maybe you shouldn’t do it at all. Invest for the mission. If you truly believe in the mission—if you say, ‘I love this vision, I love how it will change the world, I want to be part of it’—that kind of investment is far healthier.”

Invest based on “passion,” not “data”: During a pitch session, a founder once began showing Draper detailed financial models, leaving him visibly disinterested. The founder thought he was losing the deal. After a break, the team changed tactics, returning to speak sincerely about their frustrations with the current state of the industry and the transformative change they aimed to create. Reflecting on the experience later, Draper said: “You probably got it right. I’m looking for passion.”

Conclusion

To this day, while Bitcoin is still sometimes dismissed as a “bubble,” Tim Draper has already gone “all in.” While mainstream capital remains cautious about Web3, he is actively building talent pipelines, infrastructure, and backing visionary founders for the next era. He does not see himself as a speculator, but as a catalyst for transformation.

In the eyes of Pop Mart’s angel investor Michael Mai, Draper is not just a mentor, but someone who “ignites sparks even in the coldest winters of capital.”

His actions continue to ripple outward. Whether Bitcoin will truly replace the dollar remains uncertain—but one thing is clear: Tim Draper has bet his entire future on that possibility.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News