When CZ Was Collectively Condemned

TechFlow Selected TechFlow Selected

When CZ Was Collectively Condemned

People need a villain, and CZ is that villain right now.

Author: TechFlow

In a bear market, someone always has to be blamed.

Over the past few days, that person was CZ.

Search his name on Twitter, and English-language timelines are flooded with terms like “fraud,” “send him back to prison,” and “a hundred times worse than SBF.” In comment sections, users even compiled an “Encryption Crime Ranking” chart—placing CZ’s profile picture at the top tier.

Scrolling further down, users posted charts showing the price trajectories of over 200 tokens launched by Binance last year—nearly every line trending downward, captioned simply: “Structural harvesting.”

Whether this wave stems from coordinated, premeditated smear campaigns—or merely represents a concentrated release of losses amid the crypto winter—CZ has become the most criticized figure on social media over the past few days.

Turning to Chinese-language communities, criticism is somewhat more restrained in wording—but the underlying sentiment remains largely identical.

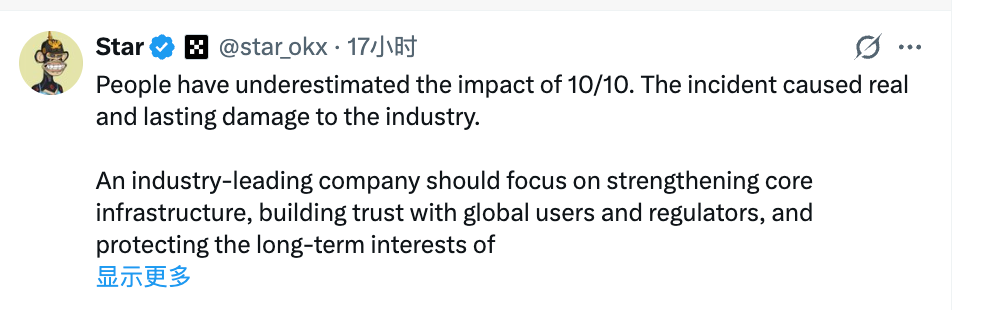

It’s not just retail investors doing the criticizing. On January 28, OKX founder Xu Mingxing posted a tweet stating that the incident on October 10 last year “caused real and lasting damage to the industry.”

Though unnamed, everyone knew who he meant. Comments from competitors at such moments often amplify emotional resonance.

Meanwhile, on the other side, Hyperliquid’s HIP-3 contract volume hit a new all-time high, and founder Jeff claimed liquidity depth for certain trading pairs had already surpassed Binance’s.

Challengers are quietly absorbing the users, capital, and attention flowing out of Binance.

Internal troubles remain unresolved—and external threats mount. This may be Binance’s toughest start to a year in recent memory.

Lighting the Fuse

This concentrated surge of sentiment in English-language communities traces back to a single statement.

On January 26, Cathie Wood—founder of ARK Invest and widely known as “Woodstock”—appeared on Fox Business. When asked why Bitcoin had been so weak recently, she replied:

“On October 10 last year, Binance experienced a software glitch that triggered massive automatic deleveraging, forcing liquidations totaling approximately $28 billion across the entire system.”

“Software glitch.” These four words, spoken by Woodstock, carried unusually heavy weight in English-language circles.

ARK Invest, which she leads, ranks among the world’s most aggressive tech-focused investment firms. She began betting on Bitcoin when it traded at just $200—and though she’s suffered significant losses alongside recent market downturns, her institutional influence endures.

As one of Wall Street’s most prominent Bitcoin bulls, her public criticism of Binance itself may well signal something deeper.

You might have missed this detail: In the same week she gave that interview, ARK purchased over $20 million worth of Coinbase stock. Coinbase—the largest regulated exchange in the U.S.—is also Binance’s most direct competitor in Western markets.

That brings to mind a saying: “Public statements serve to uphold positions and interests—not to express thoughts or insights.”

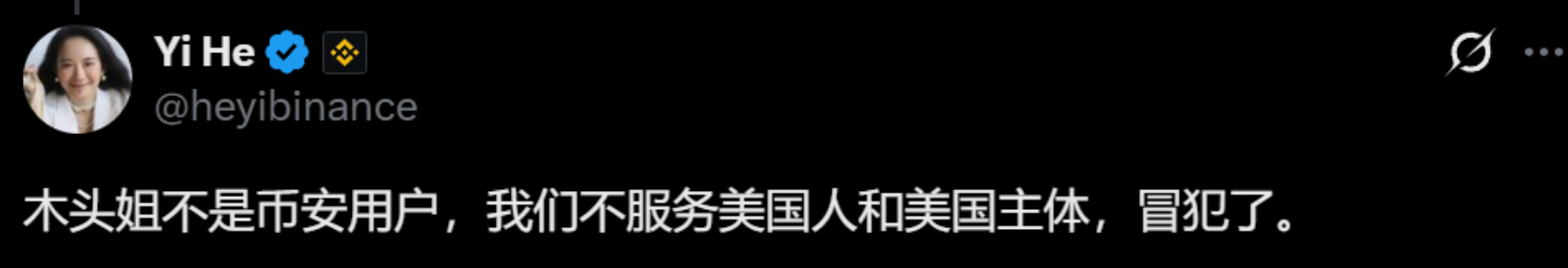

Meanwhile, He Yi quickly responded on Twitter: “Woodstock isn’t even a Binance user. Binance doesn’t serve Americans.”

So—is Woodstock playing favorites?

She didn’t answer that question—and perhaps didn’t need to. But her remark did act like a match, igniting emotions that had been simmering since October 11.

Perhaps, this truly reflects what many people have long held inside.

After October, no one knew whom to blame—or where to seek accountability. After three months of pent-up frustration, Woodstock’s comment tore open a crack.

Yet viewed differently, the $28 billion in forced liquidations also serves as an easy, ready-made target.

Simple. Intuitive. Requires no explanation—and inherently evokes emotion. Anyone looking to challenge Binance needs no fabricated narrative; the raw material is already there.

So whether what followed was a genuine outpouring of accumulated grievances—or a coordinated, opportunistic exploitation of the moment—remains unclear. What is certain is that once the opening appeared, both forces rushed in.

Silence and Resentment

Once that opening appeared, an overwhelming flood poured through.

If you examine those posts closely, you’ll find criticism centers almost entirely around two things: the flash crash of October 10, and token listings on Binance Alpha.

First, the October 11 crash.

What exactly happened that day? To date, no comprehensive investigation report has been released. Binance’s official stance cites “market factors,” claims its systems operated normally, and states it compensated affected users with $283 million.

But retail investors remember another number: $28 billion in forced liquidations.

$283 million was paid out—but that’s only 1% of $28 billion. What about the remaining 99%? Whose money was it? Where did it go? Why did it vanish within hours?

Some say market makers were at fault. Others point to exploited system vulnerabilities. Still others allege premeditated dumping. These theories circulated on Twitter for three months—but to date, official explanations remain scarce and unconvincing.

A common social-media reflex treats silence itself as a response. Retail investors may conclude: “If you won’t speak, it’s because you can’t explain.”

Then there’s Alpha listings.

Binance Alpha is Binance’s newly launched channel for early-stage project listings, promoted as a platform for early discovery.

Critics posted numerous statistical charts claiming most Alpha-listed projects follow a pattern: sharp initial gains followed by steep crashes. Exact figures vary depending on methodology—but the impression of “high-open, low-close” has taken root.

The broader market is in bear territory, and Alpha-listed tokens have fallen sharply—that’s unsurprising. Yet CZ previously remarked: “Good projects don’t need to beg exchanges for listings.”

Logically sound—but emotionally inflammatory under current conditions.

If Alpha were merely a gathering place for low-quality projects, users might accept it. Ten projects, nine dead—caveat emptor.

But if these are supposedly “curated” projects—and their crashes are dramatic enough to feed conspiracy theories and rumors of insider manipulation—then Binance’s role as a trust anchor begins to erode. And that shifts sentiment.

Individually, each issue could be dismissed as “market risk assumed.” But stacked together—pointing consistently at one platform and one individual—it ceases to be just about risk.

It becomes about lost trust.

The bear market amplifies this sentiment—but the sentiment itself didn’t appear out of thin air.

After CZ’s Return

On September 27, 2024, CZ was released from prison.

As part of his plea agreement, he stepped down as Binance CEO and pledged not to participate in the company’s day-to-day operations.

By late October, he appeared at Binance Blockchain Week in Dubai—receiving a standing ovation. Audience members shouted “The King is back!” and “The martyr!” He spoke briefly about prison life—unfun, but offering ample time for reflection.

Then came Giggle Academy’s education initiative and YZI Labs’ investment in Aster—widely interpreted as constructive responses to competitive pressure from Hyperliquid.

By January this year, he appeared at Davos. In a CNBC interview, he declared 2026 would mark Bitcoin’s “super cycle,” predicting upward momentum over the next 5–10 years.

All of this sounded genuinely positive.

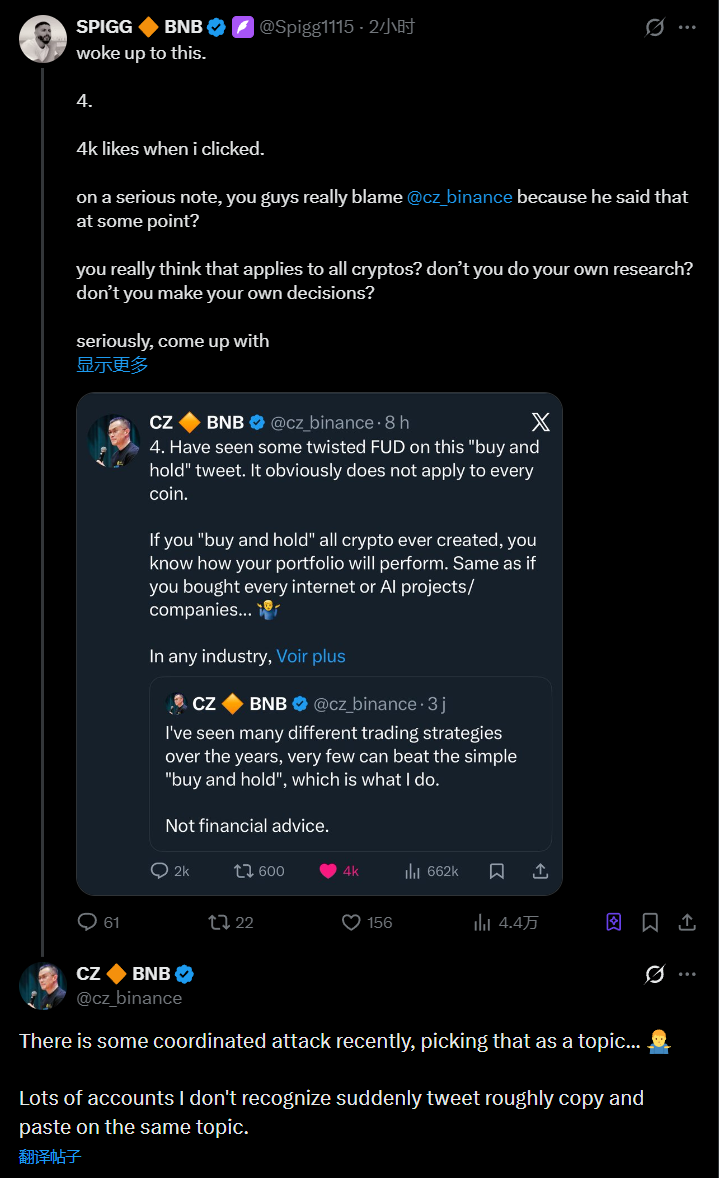

On January 28, CZ tweeted a response: “I’ve recently noticed many unfamiliar accounts suddenly emerging to spread FUD about my views—posting nearly identical content… This is an organized attack.”

Still, CZ remains Binance’s largest shareholder—raising an unavoidable question:

Has Binance improved over the past year?

All external reflections on this question inevitably project onto CZ. Likewise, industry-wide stagnation and introspection inevitably reflect upon him.

Why Now?

That said—CZ was released nearly a year and a half ago; Alpha launched over half a year ago; the October 11 crash occurred over three months ago. So why now—why this sudden eruption of criticism?

A glance at market charts tells the story.

Bitcoin has dropped nearly 20% from its August peak, hovering around the $90,000 resistance level. Meanwhile, gold broke above $5,000, silver hit record highs, and even copper surged. Traditional safe-haven assets soared—while crypto markets languished.

A flood of meme coins emerged on BNB Chain and Binance Alpha—some named after Chinese pinyin, others using emoji, some so obscure they’re literally unpronounceable.

Most tokens peaked immediately upon listing—halving in value within three days, and nearly vanishing within a week. The script never changes.

In such conditions, people break down.

You watch others profit from gold while frantically asking in group chats: “What’s next on Alpha?”—yet find no wealth effect.

Anger demands an outlet.

Whether triggered by Woodstock’s remarks or English-language crypto Twitter criticism, CZ stands right there—conveniently positioned to absorb the backlash. He’s the most famous, the wealthiest, and just declared Bitcoin’s super cycle.

Blaming him feels more effective than blaming the market—and far more comfortable than blaming oneself.

This isn’t to dismiss criticism as baseless. The October 11 incident does contain legitimate questions. Controversies around Alpha are real. And the erosion of trust is undeniable.

In bull markets, no one cares about these issues. When prices rise, exchanges are friends, comrades-in-arms, partners in profit. When prices fall, those same exchanges morph into manipulators, “scissors,” and the root of all evil.

Human nature—especially pronounced in crypto.

The community needs a villain. Right now, CZ is that villain.

So this controversy is less a trial of Binance—and more a collective catharsis of bear-market sentiment.

CZ isn’t the only target—just the biggest. Once the shouting ends, life goes on.

The industry needs a strong rally—to restore confidence. Let’s hope markets rebound soon—and that Binance improves.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News