Zhao Changpeng rejects Hurun's claim of 190 billion net worth, Binance profits spark "bigger than Alibaba" controversy

TechFlow Selected TechFlow Selected

Zhao Changpeng rejects Hurun's claim of 190 billion net worth, Binance profits spark "bigger than Alibaba" controversy

Zhao Changpeng's wealth remains a mystery.

Author: Long Yue, Wall Street Insights

Amid the booming market for crypto assets, Zhao Changpeng has recently been frequently featured in news headlines.

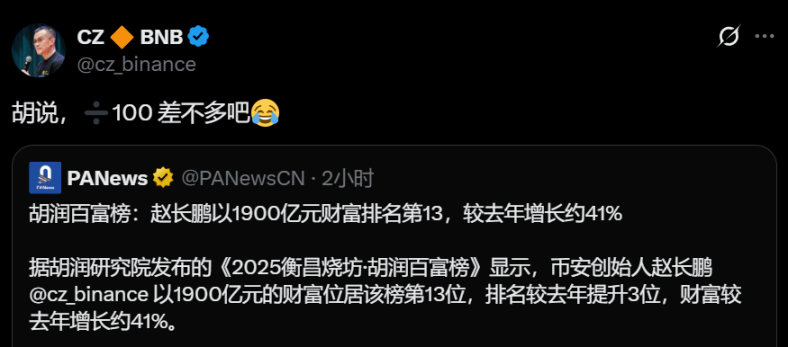

In the newly released "2025 Hurun Rich List," Zhao Changpeng, founder of the world's largest cryptocurrency exchange Binance, appears in a prominent position, ranked 13th on the list with a fortune of 190 billion yuan.

Despite his immediate objection stating, "Nonsense, divide by 100 and it'd be about right," speculation about his actual wealth continues unabated.

In stark contrast to Zhao’s low-key response, voices within the crypto community argue that his wealth is severely underestimated, even comparing Binance's profits to those of Alibaba.

Billion-Dollar Valuation Estimate and the Subject's Denial

The controversy originated from the publicly available data of the Hurun Rich List. According to the "2025 Hurun Rich List," Zhao Changpeng's wealth was estimated at 190 billion yuan. The Hurun Rich List typically bases its calculations on company market valuations or comparable public trading data. However, for massive private companies like Binance that are not publicly listed, valuation methods are more complex and less transparent.

Zhao Changpeng's response directly challenges the authority of this ranking. His claim of "dividing by 100" would completely overturn external perceptions of his wealth if true. This statement quickly spread across markets, sparking widespread debate over whether his wealth has been overstated or if he is intentionally downplaying it.

Community Debate: Binance Profits May Be Underestimated

On social platform X, crypto influencers have offered sharply contrasting views.

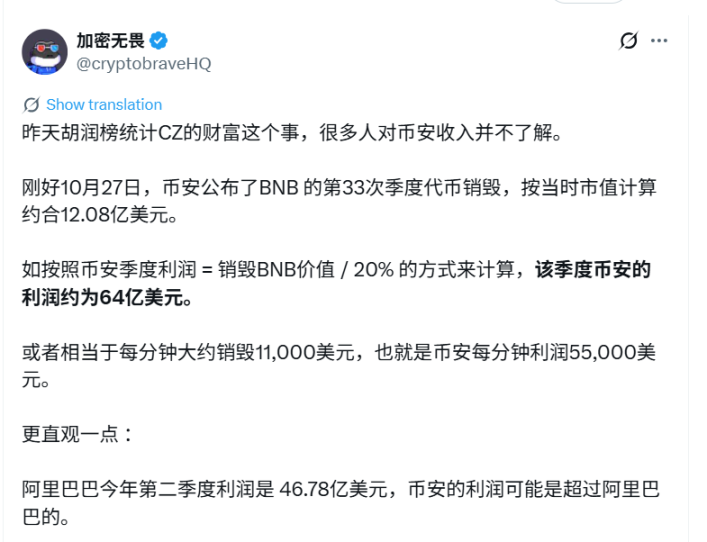

User @cryptobraveHQ argued that the Hurun valuation "is likely deliberately presented and does not accurately reflect CZ’s (Zhao Changpeng's) actual wealth."

The analysis noted that Zhao Changpeng's family office, YZi Labs, alone manages around $10 billion in assets, and there are public estimates suggesting Binance generated $16.8 billion in revenue in 2024. Zhao also holds significant amounts of BNB and BTC, among other cryptocurrencies.

An even more striking estimate stems from Binance's token burn mechanism. The analysis pointed out that on October 27, Binance completed its 33rd quarterly BNB burn, destroying tokens worth approximately $1.208 billion. Based on Binance’s original whitepaper, which stated that the value of burned BNB equals 20% of the company’s quarterly profit, one could infer that Binance’s quarterly profit was around $6.4 billion. For comparison, Alibaba’s profit in its second quarter this year was $4.678 billion.

Core of the Valuation Dispute: The BNB Burn Mechanism

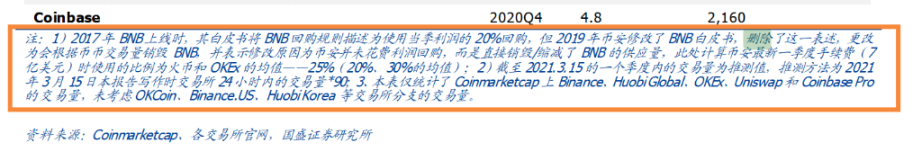

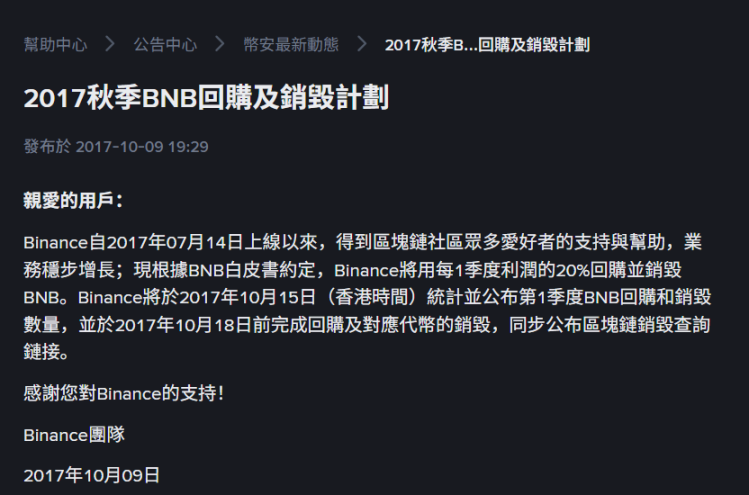

However, the foundation of this startling inference is not unshakable. The crux of the dispute lies in whether linking BNB burn value directly to profit remains valid.

Some suggest Binance may have already altered the rules regarding BNB burns outlined in its original whitepaper. The initial clear-cut ratio of "20% of profits" may have become ambiguous in subsequent updates, or possibly even decoupled from profits altogether. Therefore, attempting to precisely reverse-calculate Binance's current profits based on BNB burn volumes may lack solid grounding.

This technical ambiguity is precisely what makes it difficult for outsiders to grasp Binance’s true financial condition. Without audited financial statements, any estimation based on public operational data—such as token burns—remains speculative rather than factual.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News