How did Zhao Changpeng and Binance secure Trump's pardon?

TechFlow Selected TechFlow Selected

How did Zhao Changpeng and Binance secure Trump's pardon?

Binance's lobbying expenses in 2025 have reached $860,000, and it has established a business relationship with the Trump family's cryptocurrency project through World Liberty Financial.

By Dong Jing, Wall Street Horizon

Just a year after serving time in prison, Binance founder Changpeng Zhao has now received a presidential pardon from U.S. President Donald Trump. This dramatic turn not only opens a new chapter for the entrepreneur convicted for allowing money launderers to use his cryptocurrency trading platform but also serves as the latest illustration of power dynamics in Trump’s Washington—so long as one can afford the right lobbyists.

As previously reported by Wall Street Horizon, Trump said last Thursday (October 23): "I don't believe I've ever met him, but many people told me he has tremendous support. They say what he did wasn't even a crime, that he was persecuted by the Biden administration, so at the request of many good people, I granted him clemency."

On October 25, U.S. media outlet Politico reported that key among these "good people" were Ches McDowell, hunting partner of Trump's eldest son, and cryptocurrency lawyer Teresa Goody Guillén, who had been considered by Trump for chairing the SEC.

For Zhao and Binance, this pardon represents a fresh start in Washington, symbolizing Trump’s friendly stance toward the crypto industry and his approach of light-touch regulation. For the lobbyists behind the pardon, it is a display of influence, reflecting a trend where K Street power—the symbolic center of U.S. lobbying—is shifting toward firms with direct ties to the White House.

The pardon marks the culmination of nearly a year of efforts by Zhao and Binance to align themselves closely with the Trump administration. Beyond lobbying, Binance has also established business ties with World Liberty Financial, a lucrative cryptocurrency venture linked to the Trump family.

High-Priced Lobbying: $450,000 in One Month

McDowell’s North Carolina-based lobbying firm, Checkmate Government Relations, has become one of the highest-earning lobbying outfits in Washington during Trump’s second term.

In just the past three months, the firm has pulled in $7.1 million—a staggering sum for a company that only set up its Washington office earlier this year.

Disclosure reports show that Binance hired McDowell in late September last year to lobby the White House and Treasury Department on financial policy matters and “executive clemency.”

Binance paid Checkmate $450,000 for just one month of work. Reports noted that photographers captured McDowell and Donald Trump Jr. speaking with the president at a White House event commemorating conservative activist Charlie Kirk last week.

(Photo source: AFP; left: Ches McDowell; right: Donald Trump Jr.)

But Zhao’s clemency campaign spanned far longer than a single month. In February this year—just three weeks after Trump took office—both Binance and Zhao personally hired Teresa Goody Guillén, a top cryptocurrency lawyer reportedly considered by Trump to lead the SEC during his second term.

Her firm has earned $290,000 from Binance and Zhao so far this year.

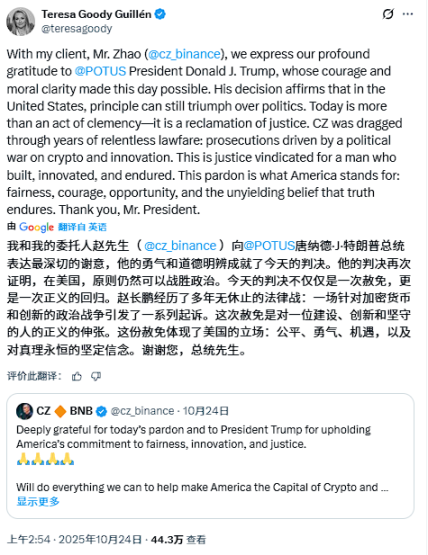

"My client Mr. Zhao and I express our deepest gratitude to President Donald J. Trump, whose courage and moral clarity made this day possible," she wrote on X following news of the pardon.

Lobbying Spending Rises and Falls with Legal Troubles

Binance’s lobbying history in Washington has closely tracked the company’s and its founder’s legal challenges.

Its U.S. subsidiary, Binance.US, first hired lobbyists at the end of 2021. In 2022, the company spent over $1 million on lobbying related to cryptocurrency issues. During the first nine months of 2023, as Zhao and Binance negotiated with federal prosecutors over their future, lobbying expenditures approached $1.2 million.

In the final months of 2023, after Zhao and Binance agreed to plead guilty to charges of willfully disregarding anti-money laundering laws and enabling criminals to use their platform to launder illicit crypto assets, spending dropped to zero.

As part of the plea deal, Zhao agreed to step down as CEO and pay a $50 million fine. He was later sentenced to four months in prison. The Binance entity was separately fined $4 billion and has since remained under compliance oversight by the Department of Justice and the Treasury Department.

A Strong Comeback in the Trump Era

Binance’s lobbying presence in Washington remained quiet through 2024 but made a strong comeback in the months following Trump’s return to power.

So far in 2025, the company has reported $860,000 in lobbying expenses, on track to meet or exceed previous highs. In July this year, Binance’s current CEO, Richard Teng, joined the advisory board of The Digital Chamber, a leading cryptocurrency industry association.

Beyond lobbying, Binance has also forged commercial ties with World Liberty Financial, a profitable cryptocurrency project linked to the Trump family, further strengthening its relationship with the president.

"President Trump and his administration are huge advocates for the crypto industry. The future looks bright," Teng posted on X earlier this year.

Analysts note that the pardon marks the peak of nearly a year of efforts by Binance and Zhao to cultivate a closer relationship with the president, demonstrating what can be achieved in Trump’s Washington with the right lobbyists.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News