Business intensification, revenue pressure: CEXs racing on-chain for the future

TechFlow Selected TechFlow Selected

Business intensification, revenue pressure: CEXs racing on-chain for the future

When the "iron rice bowl" is shattered, CEXs launch the on-chain war.

By: BUBBLE

Centralized exchanges are undergoing a collective strategic shift. From Coinbase’s nearly $2.9 billion acquisition of derivatives platform Deribit and its partnership with Shopify to promote USDC adoption among physical merchants, to Binance launching its Alpha program to reshape primary market pricing mechanisms. Kraken has acquired NinjaTrader to expand into options markets and partnered with Backed to launch "U.S. stocks" services. Bybit has also opened trading for gold, stocks, forex, and even crude oil indices on its main platform.

Leading exchanges are actively diversifying their revenue streams, attempting multi-dimensional “replenishment” — from off-chain to on-chain, retail to institutional, major cryptocurrencies to altcoins. At the same time, these platforms are extending their reach into the on-chain ecosystem. For example, Coinbase has integrated DEX routing from the Base chain directly into its main platform, aiming to bridge liquidity barriers between CeFi and DeFi and reclaim trading volume siphoned off by on-chain protocols like Hyperliquid.

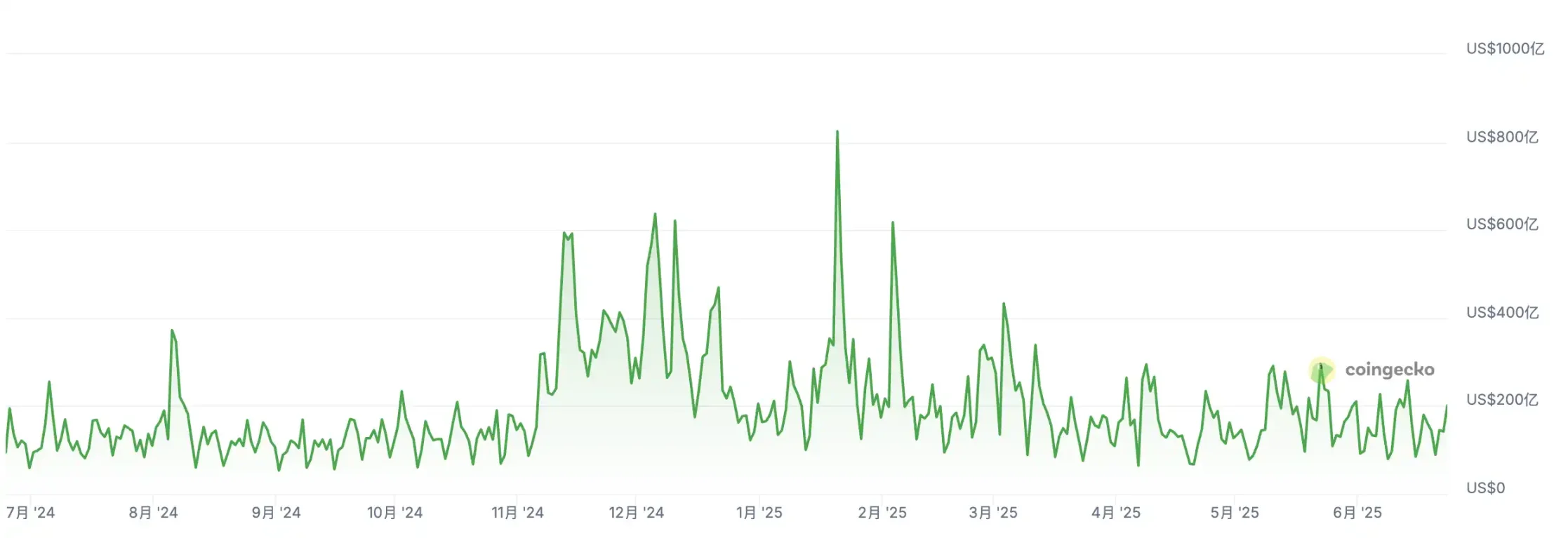

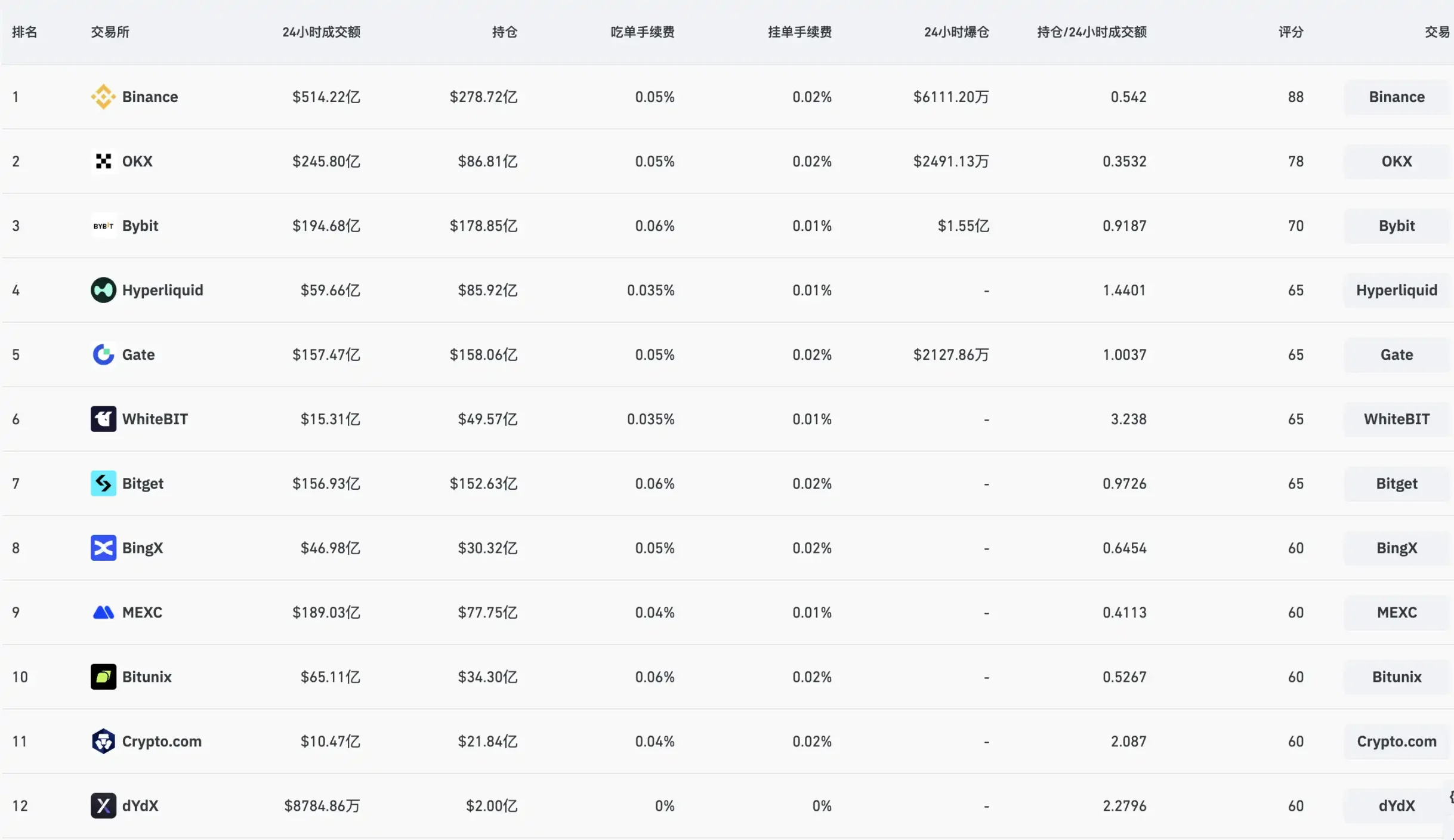

Yet behind these moves lies sustained pressure on actual revenue generation, as crypto exchanges face unprecedented development bottlenecks. Coinbase’s latest financial report shows its transaction fee income plummeted from $4.7 billion in 2024 to just $1.3 billion in Q1 2025, a 19% sequential decline. BTC and ETH trading volume dropped from 55% of total volume in 2023 to 36%, making revenues increasingly dependent on the more volatile altcoin segment. Meanwhile, operating costs remain high—$1.3 billion in Q1 2025 alone, nearly matching revenue. Binance faces similar challenges: according to TokenInsight, its average transaction fee revenue since late 2024 has hit a three-year low, despite maintaining leadership in market share.

Binance's trading volume has mostly remained depressed over the past year. Source: CoinGecko

Squeezed transaction fee margins, continuous fragmentation of on-chain liquidity, and traditional brokers re-entering with compliant frameworks—these converging forces are pushing CEXs to transform into “on-chain platforms.” Influential KOL ASH noted on X that as more DEXs refine their trading mechanisms, creating products with user experiences rivaling CEXs but offering greater transparency, CEXs have finally taken notice. They’re shifting strategic focus toward permissionless models, sparking a battle among multiple CEXs for dominance in the “on-chain CEX” arena.

OKX: Building Web3 Infrastructure

In OKX’s annual letter dated December 30, 2024, founder Star Xu expressed firm belief that “true decentralization will drive mass adoption of Web3,” committing to build a bridge between traditional finance and decentralized finance.

This vision is not mere rhetoric. Aside from Binance, OKX is one of the earliest and most systematic centralized exchanges investing in on-chain infrastructure. Rather than releasing isolated tools or wallets, it’s pursuing a “full-stack” approach to construct a Web3 operating system capable of replacing centralized use cases, forming a closed loop with CEX user assets.

In recent years, OKX has steadily advanced its strategic construction of on-chain infrastructure, aiming to evolve from a centralized exchange into a core participant in the Web3 ecosystem. A central pillar of this effort is OKX Wallet—a non-custodial wallet supporting over 70 public chains—integrated within its Web3 suite featuring Swap, NFTs, DApp browser, inscription tools, cross-chain bridges, and yield vaults.

OKX Wallet isn’t just a standalone product; it’s the cornerstone of OKX’s Web3 strategy. It connects users to on-chain assets while bridging centralized accounts with on-chain identities. Thanks to its comprehensive feature set, many newcomers who entered crypto around 2023 had their first on-chain experience through OKX Wallet.

On the foundational layer, OKX continues investing in network infrastructure and developer ecosystems. As early as 2020, it launched OKExChain (later renamed OKTC), an EVM-compatible Layer 1 blockchain. Though the chain didn’t gain significant market traction, OKX supported it with essential components including block explorers, developer portals, contract deployment tools, and faucet services, encouraging developers to build DeFi, GameFi, and NFT applications within its ecosystem.

Through ongoing hackathons and an ecosystem incentive fund, OKX is cultivating a fully闭环 on-chain environment. While OKX has never disclosed exact investment figures, given the scale of its wallet, chain, bridge, tooling, and incentive systems, industry estimates suggest its total investment in on-chain infrastructure exceeds $100 million.

Binance Alpha: Monetizing Reputation and Liquidity

In 2024, the crypto market experienced a bull run fueled by the approval of Bitcoin spot ETFs and meme coin mania. While liquidity appeared to rebound significantly, beneath the surface lay a growing breakdown in pricing mechanisms between primary and secondary markets. Project valuations became increasingly inflated during VC rounds, token launch cycles stretched longer, and ordinary users found participation harder than ever. When tokens finally listed on exchanges, they often served merely as exit ramps for project teams and early investors, leaving retail traders holding bags after “peak at listing” price collapses.

Against this backdrop, Binance launched Binance Alpha on December 17, 2024. Originally an experimental feature within Binance’s Web3 wallet for discovering promising early-stage projects, it quickly evolved into a key instrument for reshaping on-chain primary market pricing.

Binance co-founder He Yi publicly acknowledged during a Twitter Space addressing community concerns that Binance listings suffer from structural “peak at listing” issues, admitting that traditional listing models are no longer sustainable under current trading volumes and regulatory constraints. Past attempts—such as voting-based listings or Dutch auctions—to correct post-listing price imbalances yielded limited success.

The introduction of Binance Alpha represents a strategic alternative to the old listing model, operating within controlled parameters. Since launch, Alpha has onboarded over 190 projects across ecosystems including BNB Chain, Solana, Base, Sonic, and Sui, gradually forming a Binance-led platform for early project discovery and pre-launch marketing. This provides Binance with an experimental path to regain control over initial price discovery.

With the rollout of the Alpha Points mechanism, the platform became a hotspot for retail “airdrop farming.” Participation expanded beyond niche crypto circles into broader Web2 audiences, with attractive rewards prompting some users to mobilize entire families, offices, or even villages to join.

Despite increasing competition—and incidents such as ZKJ crashing after its Alpha listing raising compliance concerns—the community remains divided. Influential KOL thecryptoskanda praised Alpha highly, calling it Binance’s second-greatest innovation after IEO. Analyzing its role in the ecosystem, he stated: “The historical mission of Binance Alpha is to dismantle the primary market pricing power held by North American VCs like a16z and Paradigm—who can raise capital from TradFi at near-zero cost—and bring it back under Binance’s control. It crushes competing exchanges’ altcoin listing markets, preventing phenomena like Grass emerging on Bybit and diverting attention elsewhere. Most importantly, it consolidates capital flows from all chains into BSC, turning them into Binance’s own liquidity. So far, Alpha has successfully achieved all three goals.”

Coinbase Connects to DEX: Institutional Capital Feeds Base

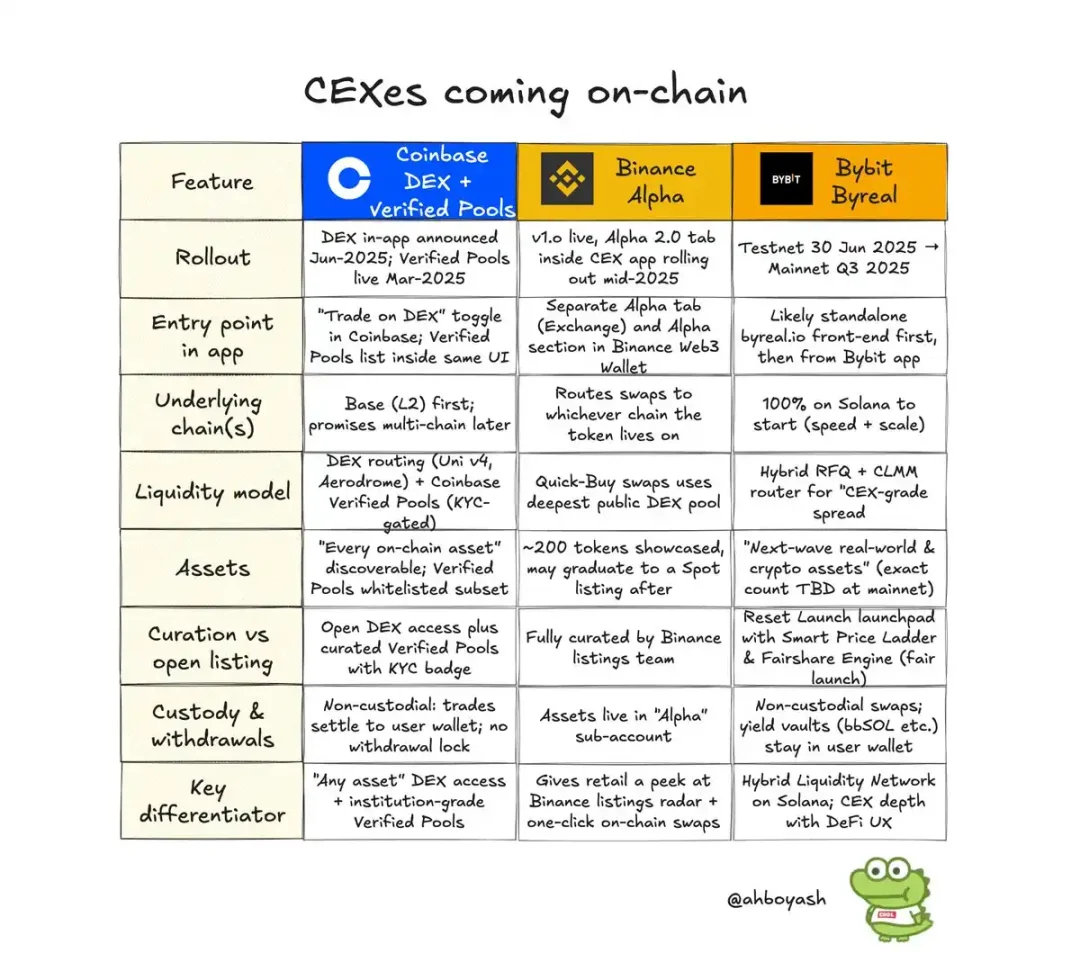

Following in the footsteps of Binance and OKX, Coinbase has begun integrating on-chain ecosystems into its platform. Its initial strategy involves incorporating DEX trading and verified liquidity pools. At the 2025 Cryptocurrency Conference, Max Branzburg, VP of Product Management at Coinbase, announced that DEX functionality from the Base chain would be embedded directly into the main Coinbase app, enabling native DEX transactions within the platform.

Users will be able to trade any on-chain token via Base-native routing, with trades routed through KYC-verified liquidity pools, enabling institutional participation. Coinbase currently boasts over 100 million registered users, 8 million monthly active traders, and holds $328 billion in customer assets, according to investor reports.

Retail trading accounts for only about 18% of activity on Coinbase. Since 2024, institutional trading volume has consistently increased—accounting for 82.05% of total volume ($256 billion) in Q1 2024. With Coinbase now integrating Base’s DEX, combining DeFi’s breadth with TradFi’s compliance standards could inject massive liquidity into tens of thousands of Base-based tokens. More importantly, numerous Base-native projects now gain access to a regulated gateway connecting them to the real-world financial system.

Aerodrome, Base’s leading native DEX, has recently become a focal point of discussion. As one of the first DEXs integrated into Coinbase’s main app, it surged 80% in the past week, adding nearly $400 million in market cap.

Community reactions are split. Prominent KOL thecryptoskanda criticized Coinbase’s move, arguing during discussions on Binance Alpha that Coinbase merely copying Binance’s model by allowing app purchases of Base assets amounts to superficial imitation. However, KOL 0xBeyondLee countered: “Alpha still has gatekeeping; not every token gets listed. Coinbase’s integration means *all* Base assets become tradable. It’s like being able to trade equity in your local fruit stand directly on Tonghuashun—it’s absurdly powerful. In terms of liquidity and attention, the boost to Base is unprecedented.”

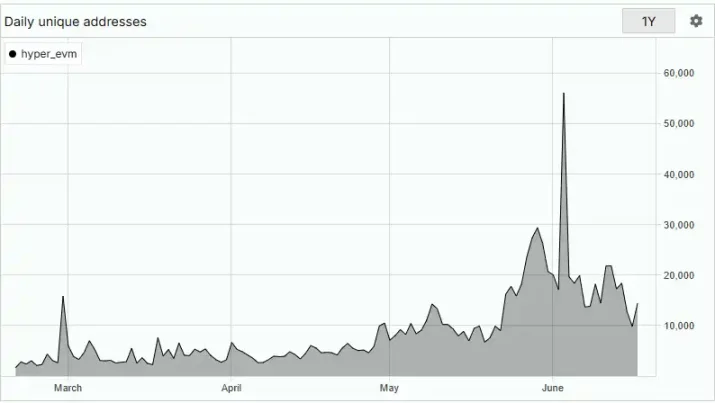

Coinbase’s push into on-chain liquidity doesn’t stop there. Influential KOL TheSmartApe (“the_smart_ape”) announced on social media that he plans to sell his $Hype holdings, which he’s held since TGE. He explained further: Hyperliquid currently has around 10,000 to 20,000 daily active users, with roughly 600,000 total users. Among them, 20,000 to 30,000 core users generate nearly $1 billion in revenue, much of it from U.S.-based traders.

However, most American traders use Hyperliquid simply because they lack better alternatives. Excluded from Binance and other major CEXs, they have no access to perpetual contracts. But now that both Coinbase and Robinhood have announced plans to roll out perpetual futures in the U.S., Hyperliquid faces a serious threat. A large portion of its core user base may migrate to Coinbase or Robinhood. A safer, simpler interface, without self-custody hassles or complex DeFi UX, backed fully by regulators like the SEC—Coinbase can attract the majority of traders who care less about decentralization and more about security and ease of use.

Byreal: Bybit’s On-Chain Twin

Compared to Binance and OKX, Bybit’s moves in the on-chain race are more “restrained”—no building its own chain or rollup. Instead, it focuses lightly on three areas: “user onboarding,” “on-chain trading,” and “fair issuance.”

Starting in 2023, Bybit began separating its Web3 brand identity by launching the Bybit Web3 Wallet, embedding core on-chain features such as Swap, NFTs, inscriptions, and GameFi. The wallet integrates a DApp browser, airdrop campaign pages, and cross-chain aggregation trading, supporting both EVM chains and Solana. Its goal is to serve as a lightweight bridge for CeFi users transitioning to on-chain environments. However, amid fierce wallet competition, the initiative failed to gain significant momentum.

Bybit then shifted focus to on-chain trading and issuance platforms, launching Byreal on Solana. Byreal aims to replicate the centralized exchange “matching experience” using a hybrid RFQ (Request for Quote) + CLMM (Concentrated Liquidity Market Making) model to achieve low-slippage trades. It also incorporates mechanisms like fair launches (Reset Launch) and yield vaults (Revive Vault). The testnet is scheduled to go live on June 30, with mainnet launch expected in Q3 2025.

Meanwhile, Bybit launched Mega Drop on its main site, completing four rounds so far. The model allows users to automatically earn token airdrops through staking. Estimated returns suggest staking $5,000 yields about $50 per round, though results vary based on project quality.

Overall, Bybit’s strategy in the on-chain war emphasizes “low development cost and leveraging existing public chain infrastructure” to connect CeFi users with DeFi scenarios, enhancing its on-chain discovery and issuance capabilities through components like Byreal.

The decentralized derivatives wave ignited by Hyperliquid has evolved from a technological breakthrough into a fundamental reshaping of competitive dynamics among exchanges. The boundary between CEX and DEX is blurring: centralized platforms are proactively going on-chain, while on-chain protocols are mimicking centralized matching experiences. From Binance Alpha reclaiming primary market pricing power, to OKX building full-stack Web3 infrastructure, to Coinbase leveraging compliance to tap into the Base ecosystem, and even Bybit constructing its own on-chain twin via Byreal—this “on-chain war” is far more than a technical race. It’s a battle for user sovereignty and liquidity dominance.

Ultimately, whoever captures the future of on-chain finance won’t be determined solely by performance, experience, or innovation—but by who builds the strongest capital flow networks and deepest channels of user trust. We may be standing at the tipping point of deep CeFi-DeFi convergence. The winner of the next cycle may not be the most “decentralized,” but rather the one who best understands on-chain users.

Hype! Hype! Hype!

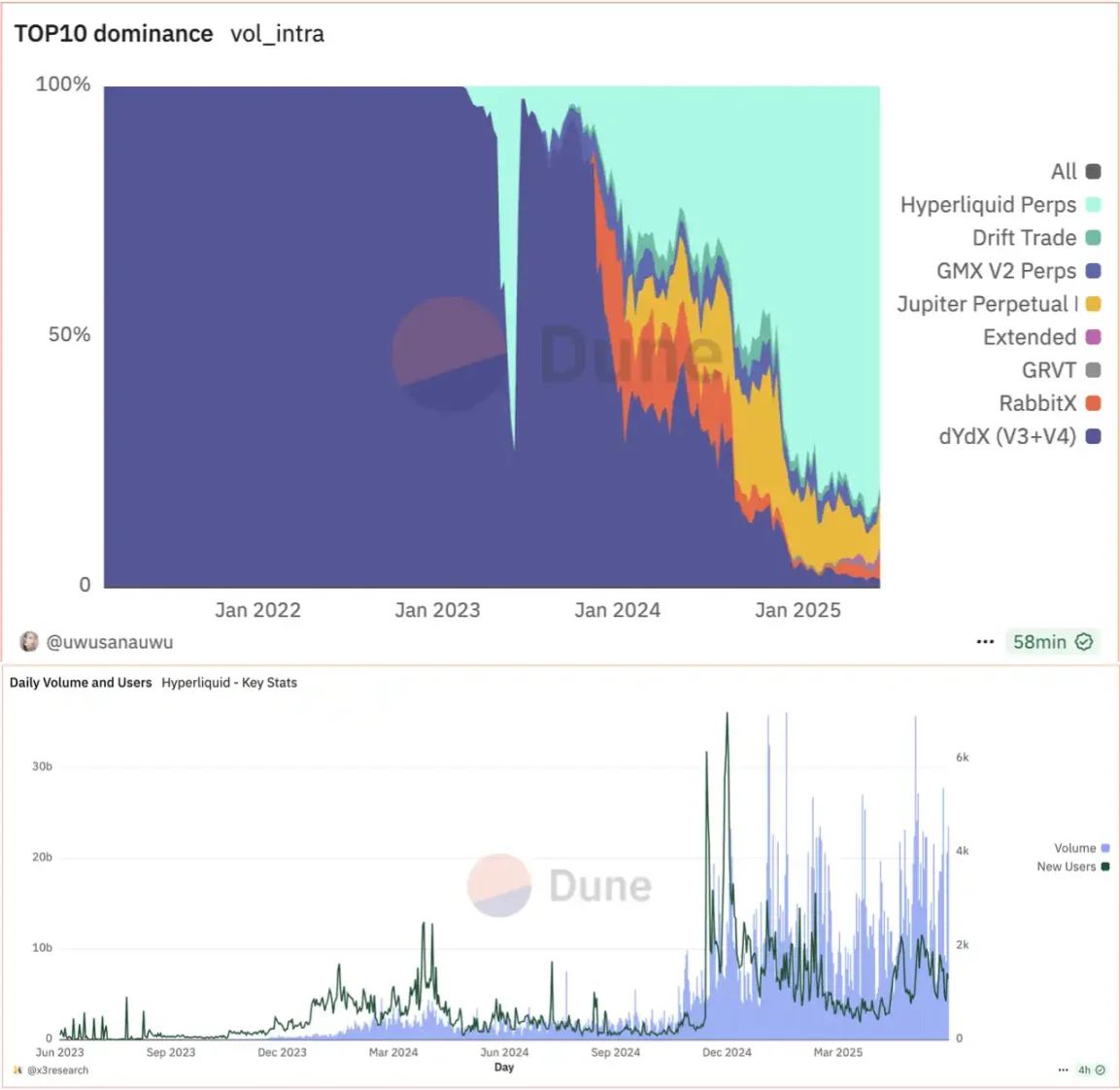

In April 2020, dYdX launched the first decentralized perpetual contract for BTC-USDC, marking the beginning of DEXs entering the derivatives space. After five years of evolution, Hyperliquid emerged and unlocked the true potential of this domain. To date, Hyperliquid has accumulated over $3 trillion in trading volume, with daily volume approaching $7 billion.

As Hyperliquid breaks into mainstream awareness, decentralized exchanges have become a force centralized platforms can no longer ignore. With overall growth stagnating and users increasingly diverted to DEXs led by Hyperliquid, CEXs urgently seek new “growth anchors.” Beyond expanding stablecoin or payment-based “revenue expansion” strategies, the top priority is a “leak-stopping” strategy—recapturing derivative traders flowing onto chains. From Binance to Coinbase, major CEXs are integrating their on-chain resources. Meanwhile, the community’s attitude toward blockchain has shifted—from fixating on “decentralization” to prioritizing “permissionless access” and “fund security.” The line between decentralized and centralized exchanges is fading.

In previous years, DEXs symbolized resistance against CEX monopoly. But over time, DEXs have progressively adopted—and even replicated—the core techniques once exclusive to the “dragons.” From UI design to order-matching engines, liquidity architecture, and pricing models, DEXs have reinvented themselves by learning from CEXs—and in some cases, surpassing them.

Now that DEXs can match most CEX functionalities, even suppression by CEXs cannot dampen market enthusiasm for their future. They now represent more than just “decentralization”; they embody a transformation in financial paradigms and underlying asset issuance models.

CEXs appear to be fighting back—not only by expanding business lines but also by binding on-chain liquidity tightly into their own ecosystems, compensating for declining trading volumes and user counts siphoned off by DEXs.

Markets are most creative and vibrant when filled with diverse competition. The rivalry between DEXs and CEXs reflects an ongoing negotiation between innovation and reality. This “on-chain war” for liquidity dominance and user attention has long transcended technology itself. It’s about how platforms redefine their roles, capture next-generation user needs, and find new equilibrium between decentralization and compliance. As the boundaries blur, the future belongs to those builders who chart the optimal path across “experience, security, and permissionless access.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News