B2 Ventures Founder: Deep liquidity issues in traditional finance pose a potential structural risk to the crypto market

TechFlow Selected TechFlow Selected

B2 Ventures Founder: Deep liquidity issues in traditional finance pose a potential structural risk to the crypto market

Although the crypto market is growing rapidly, it faces the problem of fragmented and fragile liquidity.

Author: Arthur Azizov, Founder of B2 Ventures

Translation: Shan Obaba, Jinse Finance

Despite rapid growth and an ideal of decentralization, the crypto industry still suffers from fragmented and fragile liquidity—mirroring hidden risks in traditional finance and exposing the entire market to sudden shocks when sentiment shifts.

Although cryptocurrencies possess decentralized characteristics and promise innovation, at their core they remain a form of "money." And all money is ultimately subject to the realities of current market structures.

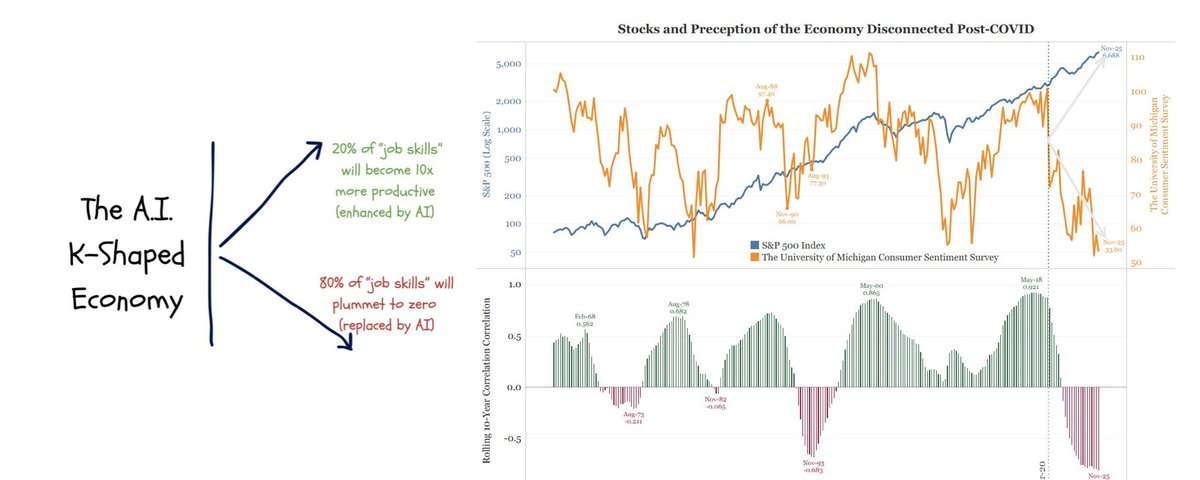

As the crypto market evolves, it increasingly resembles the lifecycle progression of traditional financial instruments. "The illusion of liquidity" has become one of the most pressing yet under-discussed issues—an inevitable byproduct of the market’s maturation process.

In 2024, the global cryptocurrency market was valued at $2.49 trillion, with projections indicating it will double to $5.73 trillion by 2033, representing a compound annual growth rate (CAGR) of 9.7% over the next decade.

Yet beneath this robust growth lies significant fragility. Just like foreign exchange and bond markets, the crypto market now faces what is known as the "phantom liquidity" problem: order books that appear liquid during calm periods can instantly dry up amid volatility.

The Illusion of Liquidity

The foreign exchange market, with over $7.5 trillion traded daily, has long been considered the most liquid market. Yet even this market is now beginning to show signs of fragility.

Some financial institutions and traders are increasingly wary of what they call the illusion of market depth. Even on the most liquid currency pairs such as EUR/USD, slippage has become frequent. After the 2008 financial crisis, no bank or market maker is willing to take on warehousing risk—the risk of holding volatile assets—during market sell-offs.

In 2018, Morgan Stanley highlighted a structural shift in liquidity risk: higher capital requirements post-crisis forced banks to exit the business of providing liquidity. The risk did not disappear—it simply shifted to asset managers, ETFs, and algorithmic trading systems.

Index funds and ETFs have proliferated rapidly. In 2007, index funds held just 4% of MSCI World free-float shares; by 2018, that figure had tripled to 12%, reaching as high as 25% for certain assets. This created a structural mismatch—liquid financial products built atop fundamentally illiquid underlying assets.

ETFs and passive funds promise easy entry and exit, but the assets they hold—particularly corporate bonds—often cannot be liquidated quickly during turbulent times. During sharp market swings, ETFs tend to be sold off more aggressively than their underlying holdings. Market makers widen bid-ask spreads or withdraw entirely, unwilling to step in during chaos.

This phenomenon, once confined to traditional finance, is now being skillfully replayed in the crypto market. On-chain activity, centralized exchange order books, and trading volumes may appear healthy—but when sentiment shifts, market depth often evaporates in an instant.

The Crypto Market’s 'Liquidity Illusion' Is Emerging

The illusion of liquidity in crypto is nothing new. During the 2022 market downturn, even major tokens experienced significant slippage and widening spreads on top-tier exchanges.

The recent plunge in Mantra's OM token serves as another warning—when market sentiment shifts sharply, buy-side demand vanishes overnight, and price support evaporates. Markets that appear deep during calm periods collapse rapidly under pressure.

The root cause lies in the fact that crypto market infrastructure remains highly fragmented. Unlike stock or forex markets, crypto asset liquidity is spread across multiple exchanges, each with its own order book and market-making framework.

This fragmentation is especially severe for "second-tier" tokens ranked beyond the top 20 by market cap. They are typically listed on multiple platforms but lack unified pricing mechanisms or coordinated market makers, relying instead on task-driven participants. There appears to be liquidity, but real depth and coordination are missing.

Worse still, some projects and market participants deliberately create artificial liquidity to attract attention or secure listings. Wash trading, fake volume, and spoof orders are particularly common on smaller and mid-sized exchanges.

These "fabricators" vanish at the first sign of volatility, leaving retail investors exposed to abrupt price drops. Liquidity isn't just "fragile"—sometimes it's outright "fake."

Solution: Unifying Liquidity at the Protocol Layer

To truly solve the problem of fragmented liquidity, deep integration must occur at the foundational protocol level. This means cross-chain bridging and routing functionality should be embedded directly into blockchain architecture—not added as afterthought patches.

Today, some Layer 1 blockchains are adopting this new architectural approach, treating asset transfer as a core function of the blockchain itself. This design helps consolidate liquidity pools, reduce fragmentation, and enable smoother capital flow across the entire market.

Meanwhile, underlying infrastructure has improved dramatically: orders that once took 200 milliseconds to execute now require only 10–20 milliseconds. Cloud ecosystems like Amazon and Google already support intra-chain transaction processing via peer-to-peer messaging between clusters.

This performance layer is no longer a bottleneck—it's an accelerator, enabling market makers and trading bots to operate in real time across the globe. Notably, automated trading systems currently account for 70%–90% of stablecoin trading volume in the crypto market.

However, high-performance "plumbing" is only the foundation. More importantly, it must be combined with protocol-level smart interoperability and unified liquidity routing mechanisms. Otherwise, it’s like building a high-speed rail on fractured land—fast, but heading in inconsistent directions.

Now, however, the necessary infrastructure is in place—ready to support a far larger financial system.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News