Anti-farming intensifies, yet smart farmers still earn tens of thousands monthly?

TechFlow Selected TechFlow Selected

Anti-farming intensifies, yet smart farmers still earn tens of thousands monthly?

Farming exchanges, subscribing to Hong Kong stocks, selling test coins, renting servers—the second spring of farming studios.

Author: Jaleel, Cookie

"Right now, farming projects isn't as profitable as targeting exchanges." Arez's farming operation has shifted 80% of its focus to exchange arbitrage this year.

Just before the May Day holiday, a rumor spreading wildly through chat groups—“Register Coinbase and get a 200U airdrop”—perfectly illustrated this shift in strategy.

This market cycle has been one where farmers themselves are being farmed. Most small farming studios have already shut down due to zero returns, and many farming KOLs have transitioned into other sectors. For instance, veteran farmer Icefrog has rebranded himself as a “project rights protection blogger.”

Against this backdrop, BlockBeats noticed that more agile studios have already redirected their efforts: some have moved to exchanges, precisely capitalizing on liquidity spillovers; others have returned to traditional IPO-style farming, turning the Hong Kong stock market into a new cash machine; while still others quietly started selling tools and infrastructure services, generating steadier revenue streams.

CEX: A New Hunting Ground Amid Liquidity Spillover

"Nowadays, project teams practically want to keep all tokens for themselves," Arez said with a bitter smile.

In the previous cycle, studios revolved around project teams—farming testnets, airdrops, and community events. But as overall market liquidity tightened, project teams—aiming to maintain control after launch and conserve limited budgets—have widely adopted strategies that reduce community allocations: airdrop rewards have shrunk dramatically, and the token share available to retail users keeps declining.

With testnet and airdrop criteria becoming increasingly opaque and rewards shrinking, it’s harder than ever for average farmers to profit. This shift has directly eliminated many small studios, accelerating internal competition within the farming ecosystem. Faced with dried-up farming channels from projects, studios have been forced to seek new battlefields.

"Launching projects used to be highly profitable, but not in this cycle," Arez lamented. "Now, many project teams are essentially working for exchanges and market makers. Where’s the meat left for outsiders?"

Exchanges still control the largest pools of capital and active users. As a result, they’ve become the new targets for farming operations.

To promote new listings, roll out products, and shape user behavior, exchanges continue to distribute large incentives. Whether it’s IDO participation, trading volume rewards, or volume manipulation arbitrage, the liquidity spillover from exchanges has created fresh opportunity zones—providing new hunting grounds for farming studios.

Wallet IDO Farming

"We can easily manage 200 accounts every time Binance Wallet launches an IDO," said Arez. If each account generates $30 to $50 in profit, the team’s earnings from a single IDO could match a white-collar worker’s half-year salary in China.

Arez isn’t alone—Lao Zhang’s studio has also found opportunities in exchange farming.

Lao Zhang had accumulated a pool of KYC resources during the Worldcoin era, which he’s now leveraging across various exchange activities.

Typically, studios collaborate with KYC providers and volume-boosting platforms, establishing a revenue-sharing model: supply chain partners provide identity resources, studios handle bulk operations, and profits from airdrops or new token arbitrage are split accordingly.

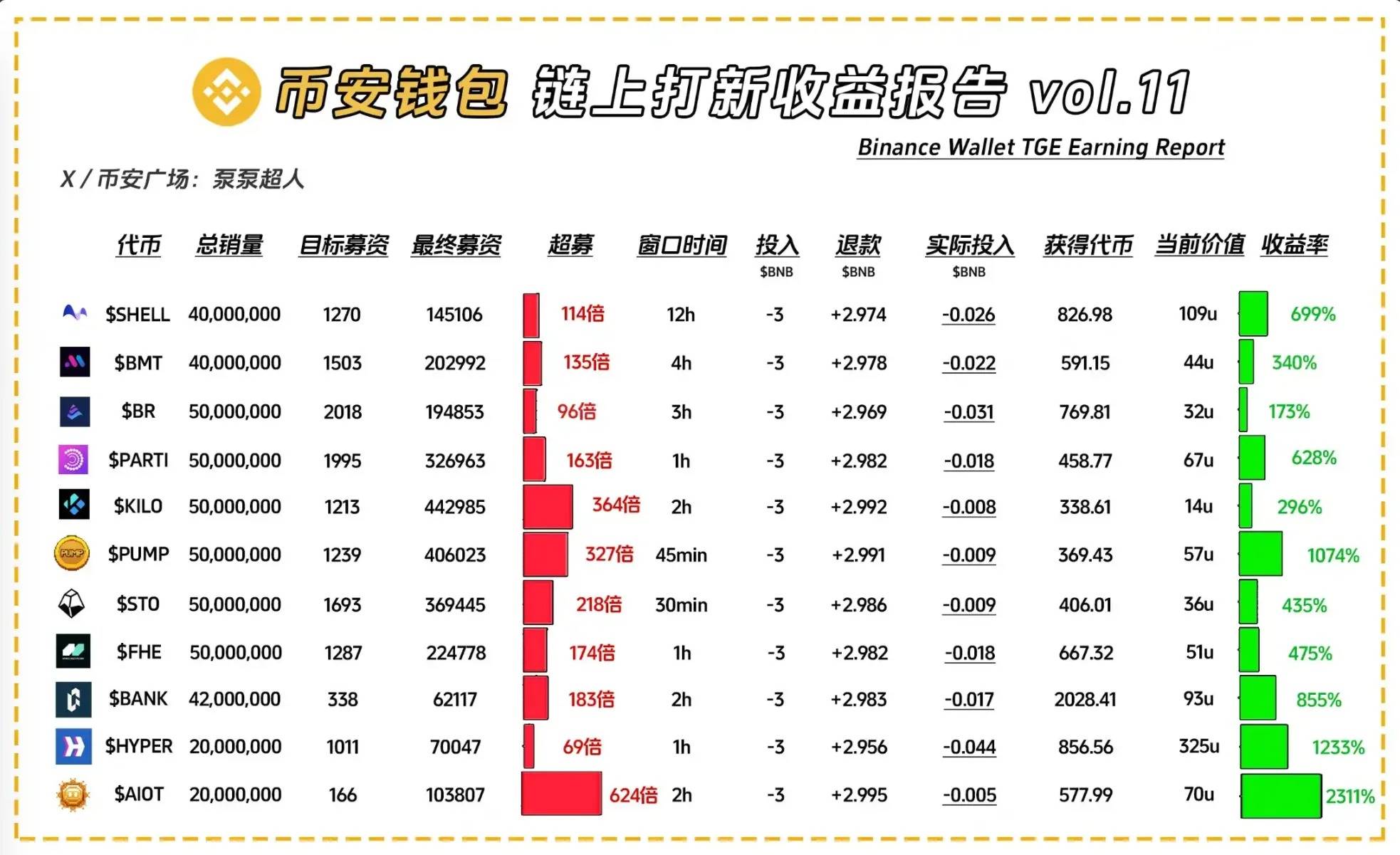

Take Binance Wallet Launchpool as an example—the early-stage rewards were extremely generous, with each account earning nearly $100 per event. But as participant numbers surged, platforms raised entry barriers: wallet trading volume requirements over the past month, introduction of KYC facial recognition, time-limited operations, Alpha points systems, etc.

Image source: BitErGua

"Initially, we mostly used KYC resources from Vietnam and the Philippines—they were cheaper," Lao Zhang recalled. But as Binance Wallet introduced complex facial verification and tight operational windows, overseas KYC resources became impractical for large-scale use.

"So now, we secure KYC resources ourselves—we no longer rely on third-party suppliers," Lao Zhang said.

Image source: PumpPump Superman

Still, even with more flexible resource allocation, Arez admitted that rising thresholds and skyrocketing oversubscription ratios have driven up both preparation workload and costs for each Launchpool event.

"It’s getting competitive now—too many players chasing too little reward. Profits shrink every round," he said. Consequently, studios are constantly seeking new opportunities beyond relying solely on IDO farming.

"Whatever the platform pushes, we farm it"

"The fundamental logic behind exchange rewards is paying for data," Arez summarized.

Besides IDO farming, exchanges often run trading incentives or airdrop campaigns to promote new products. These usually occur shortly after product launches, requiring users to meet certain trading or deposit volume thresholds, offering rich and fast-distributed rewards.

"The principle is simple: wherever an exchange lacks trading volume, that’s where the biggest subsidies appear," Arez told BlockBeats. His team has dedicated personnel monitoring announcements across major exchanges, enabling them to quickly capture any new opportunity.

To precisely target high-value opportunities, Arez has spent considerable time analyzing the strategic styles of different exchanges. He likens the competitive landscape among exchanges to the Warring States period in ancient China.

"Each exchange is like a feudal state, with different conditions and tactics. Our job is to find our own opportunities amid these small wars," Arez said with a smile, citing a common saying within his team: "During Shang Yang’s reforms, someone offered ten gold coins to anyone who carried a log to the north gate. When no one stepped forward, the reward was raised repeatedly until it reached fifty gold coins—then someone did it and got paid."

In his view, Coinbase’s recent move to offer a 200U registration airdrop is aimed at boosting its derivatives trading segment to close a long-standing gap; Bybit is aggressively promoting its payment card feature with cashback campaigns; Gate is pushing new meme-related functions... "The logic is the same—today Qin State offers ten gold coins for reform, tomorrow Zhao State offers five. It’s all about spotting where the money flows."

"My goal is to be the first person to carry that log," Arez said. In this new round of exchange competition, he prefers to be the pioneer who tests the waters and gets the first bite: "Whatever the platform promotes, you farm it—follow the platform to eat meat."

As project airdrops turn into black-box games, exchanges have become the new "money printers" of this cycle: from Binance Launchpool IDOs, to Coinbase’s real-money push in derivatives, to Bybit’s traffic battle over payment cards—agile studios have already redirected their focus. Amid these exchanges’ liquidity spillovers, sharp-eyed farming teams have once again found their survival path.

Multiplying Returns: Low-Risk Arbitrage + Airdrop Farming

Beyond participating in events and IDO farming, some specialized studios have developed hybrid models combining arbitrage and airdrop farming. Backpack Exchange is a prime example.

We highly recommend Cookie’s interview article published last week—“Backpack + AI: Even Coding Beginners Can Script Low-Risk Profits.” The piece features CJ, an expert who uses arbitrage scripts on Backpack, sharing practical techniques and strategies that readers can apply directly:

For example, stacking multiple strategies: buying SOL spot, shorting SOL in the futures market, depositing the spot asset on-chain to earn fees via liquidity provision (LP Farming), while simultaneously positioning for potential airdrops across platforms—achieving multiplicative gains. Or using AI assistants (like Cursor) to iteratively refine and optimize logic, eventually building an automated system for trading and interaction, greatly improving efficiency in arbitrage and airdrop farming.

On exchanges with liquidity spillover, combining arbitrage with airdrop farming has become a key weapon for the new generation of studios. Platforms like Backpack—expected to launch a token and supporting multi-strategy arbitrage—are now fiercely contested battlegrounds for farming operations.

Hong Kong Stock "Mini Spring": Studios Return to Roots

Besides hunting for liquidity spillovers on crypto exchanges, some quicker-reacting farming studios have turned their attention to Hong Kong IPOs.

"If crypto is hard to farm, why not go to traditional markets for meat?" Arez told BlockBeats. This year, his studio established a dedicated Hong Kong IPO team focused entirely on applying for new stock offerings. Since the second half of 2024, Hong Kong IPOs have performed exceptionally well, entering a "mini spring" season and becoming a new cash flow source for many farming studios.

Among these new listings, Mixue Bingcheng and Mao Geping stood out: Mixue Bingcheng surged over 47% on its first trading day, netting nearly HK$10,000 per lucky applicant. Mao Geping, a well-known premium beauty brand, rose nearly 58% on debut. With only HK$2,880 required to apply for 10 shares, average account profits exceeded HK$16,000.

"For Hong Kong IPOs, I look for a few key factors: solid fundamentals, high market热度, large-cap stocks, low issuance valuations, and high subscription multiples. Win rates can exceed 70%," Arez said, adding that success probability and predictability here far surpass those in crypto projects.

In crypto, project airdrop criteria have become completely "black-boxed." Most projects no longer disclose any standards and some even manipulate recipient lists behind the scenes: self-allocated addresses take up a much larger share; criteria are vague, scoring systems are private—ordinary farmers have almost zero predictability. The chance of "getting soup after the feast" has plummeted. Some resource-backed studios leverage private relationships with projects: receiving direct allocation rules from project teams; mass-producing interaction addresses to meet data thresholds; then splitting airdrop proceeds afterward. But clearly, such opportunities are reserved for a select few with connections—most ordinary studios are excluded.

In contrast, Hong Kong IPOs seem much more transparent.

Meanwhile, just like exchanges competing in crypto, Hong Kong brokers are also aggressively acquiring new clients: Yao Cai, Futu, Tiger Brokers, and others are offering “zero commission” deals, free stock for account transfers—some give 100 shares of Tencent Holdings, others offer Warren Buffett’s favorite Western Oil.

Brokers are also offering higher leverage for IPO financing: "Previously, brokers offered 10x leverage; a few offered 20x or 30x. But since the second half of last year, 50x or even 100x leverage has become available," Arez noted.

(Note: 10x financing leverage means reducing the upfront cost per account to 1/10 of the original)

Selling 'Water', Renting Servers: Profiting from Farmers

Where there are many farming players, business opportunities emerge.

As projects impose stricter checks on IP sources and interaction environments, using saturated IPs (commonly known as “thousand-man-ridden IPs”) for farming is no longer viable. Mainland Chinese IPs are frequently blocked by projects, making overseas IPs a hard requirement for some interactions; multi-account operations demand numerous independent IPs to avoid association and bans; node-based or uptime-dependent projects (like Nillion, Grass, etc.) require high server stability and clean IPs.

Thus, professional server and IP providers have emerged.

A typical provider’s service includes: offering overseas cloud servers (such as BytePlus Volcano Engine, AWS, Hetzner, Tencent Cloud International); configuring stable, dedicated IPs; pre-installing essential interaction environments (OS, wallets, scripts, toolkits); and some premium services even offer customized solutions like node optimization, traffic distribution, and script deployment.

Byteplus.Pro operates exactly this business. After the Grass project launched, founder Miko spotted this niche trend and leveraged existing Web2 server, IP, and GPU resources to enter the Web3 space.

"We’re Web3 infrastructure providers," Miko explained. "We partner with big players like ByteDance and Tencent Cloud. We’re their overseas agents—even supplying official TikTok live streaming nodes."

For farming studios, purchasing ready-made packages saves time and increases success rates compared to setting up complex environments independently. "We’re like water, electricity, and gas in the farming industry. Every sector needs infrastructure providers like us to function," as founder Miko put it.

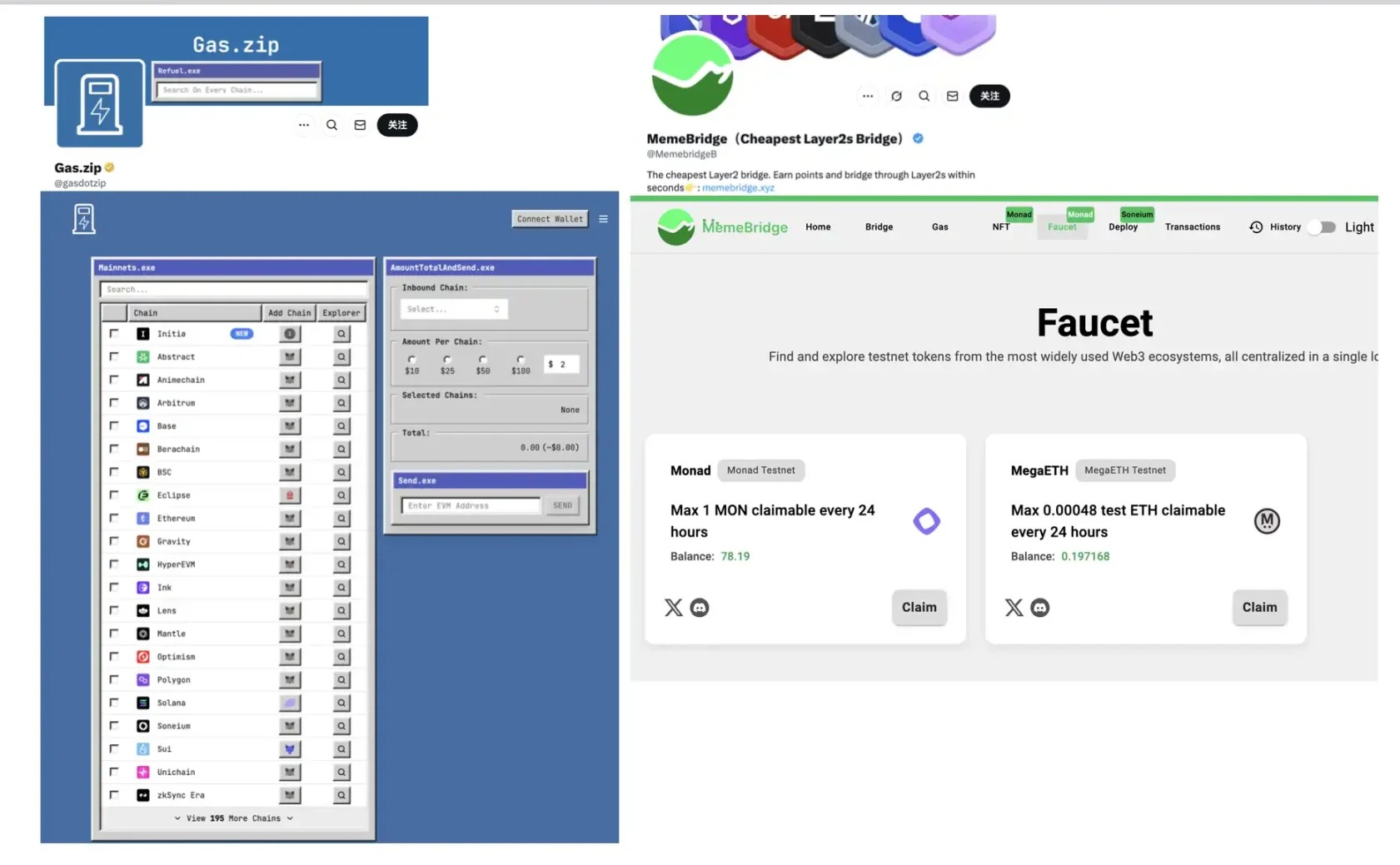

The sharpest minds in this space have even gone deeper—"selling water" (testnet tokens) is another direct example.

Historically, testnet tokens were freely distributed by projects for testing purposes. Today, however, this process has become highly commercialized and formalized, with mature products dominating the "water-selling" market.

Servicers like gasdotzip and memebridgeb now offer one-stop solutions for purchasing testnet tokens and cross-chain bridging, with refined operations and complete systems.

Beyond these established services, searching Twitter for popular farming projects often reveals individual posts selling testnet tokens, and similar messages frequently appear in WeChat groups. Testnet tokens were meant to be part of blockchain testing, but today it’s sometimes hard to distinguish between mainnet and testnet.

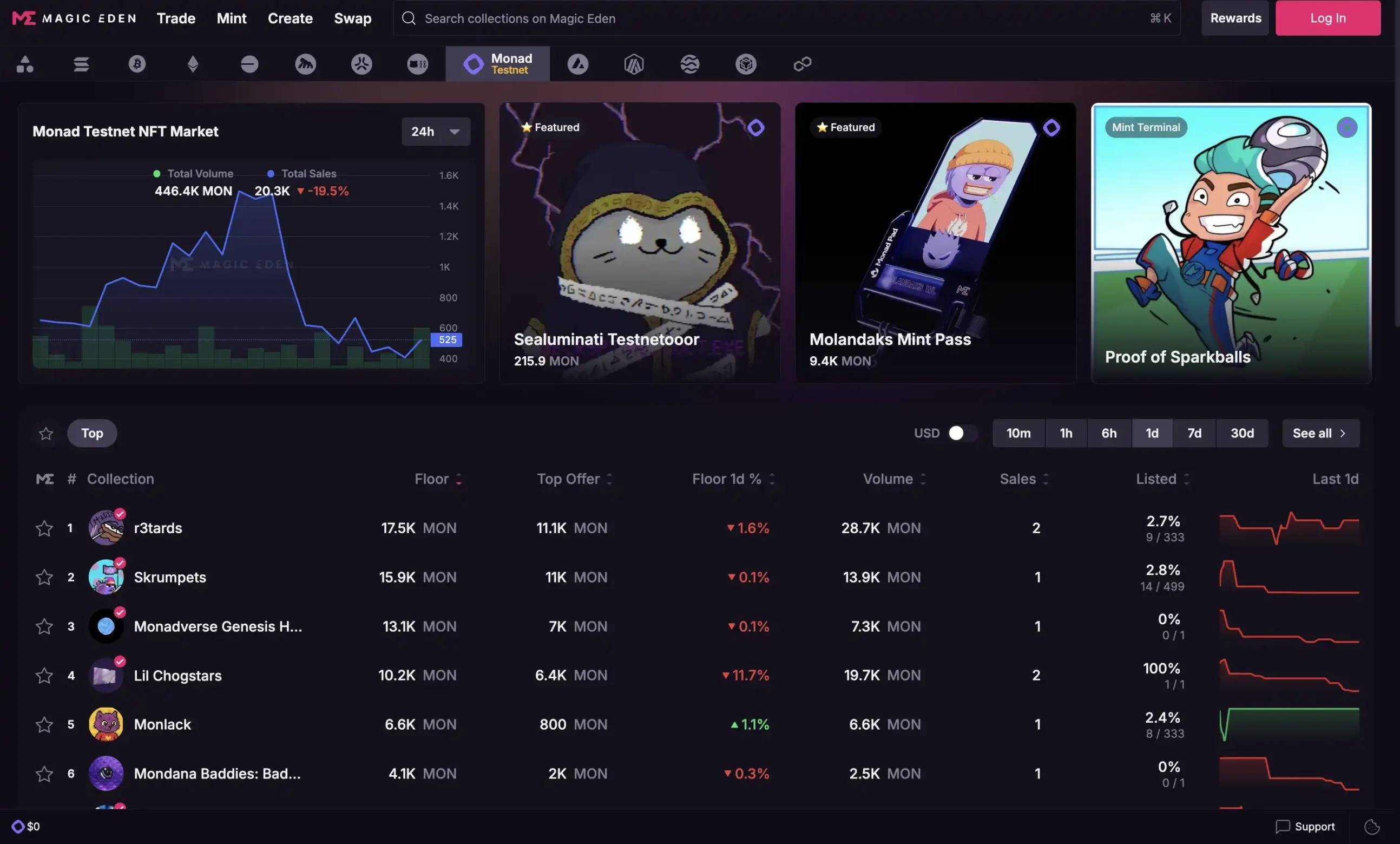

The most striking example is Monad—despite its mainnet not launching yet, its testnet already hosts numerous NFT assets, actively traded on Magic Eden, appearing no different from real mainnet assets.

Testnet tokens, seemingly "worthless" at first glance, have become arbitrage opportunities—proof that chances exist everywhere in crypto.

This is a new cycle, new hunting grounds, and new survival rules.

The farming world never lacks smart people. The real difference lies not in good or bad conditions, but in who can adapt fastest to change.

In this market shift, projects have tightened airdrop distributions, liquidity has flowed to exchanges, and traditional farming paths are shrinking. The era when burning gas and spamming interactions guaranteed airdrop profits is gone. In this new cycle, survival doesn’t belong to the fastest, but to those who best understand the landscape and proactively adapt.

After all, in crypto, survival and evolution remain the highest capabilities.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News