Returns outperform airdrop farming—should you farm alpha instead of easy gains?

TechFlow Selected TechFlow Selected

Returns outperform airdrop farming—should you farm alpha instead of easy gains?

A heartfelt expression from studios and degens.

Adults, the times have changed—again, again, again.

After the tariff turmoil, the market briefly shifted from bearish to bullish. Beyond just price swings and scattered project hype, there’s now a central daily mission for crypto users: How many Binance Alpha points did you earn today?

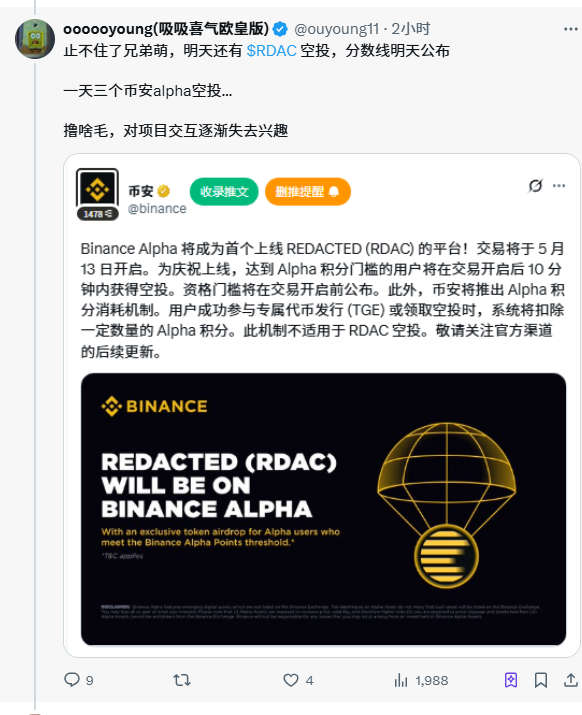

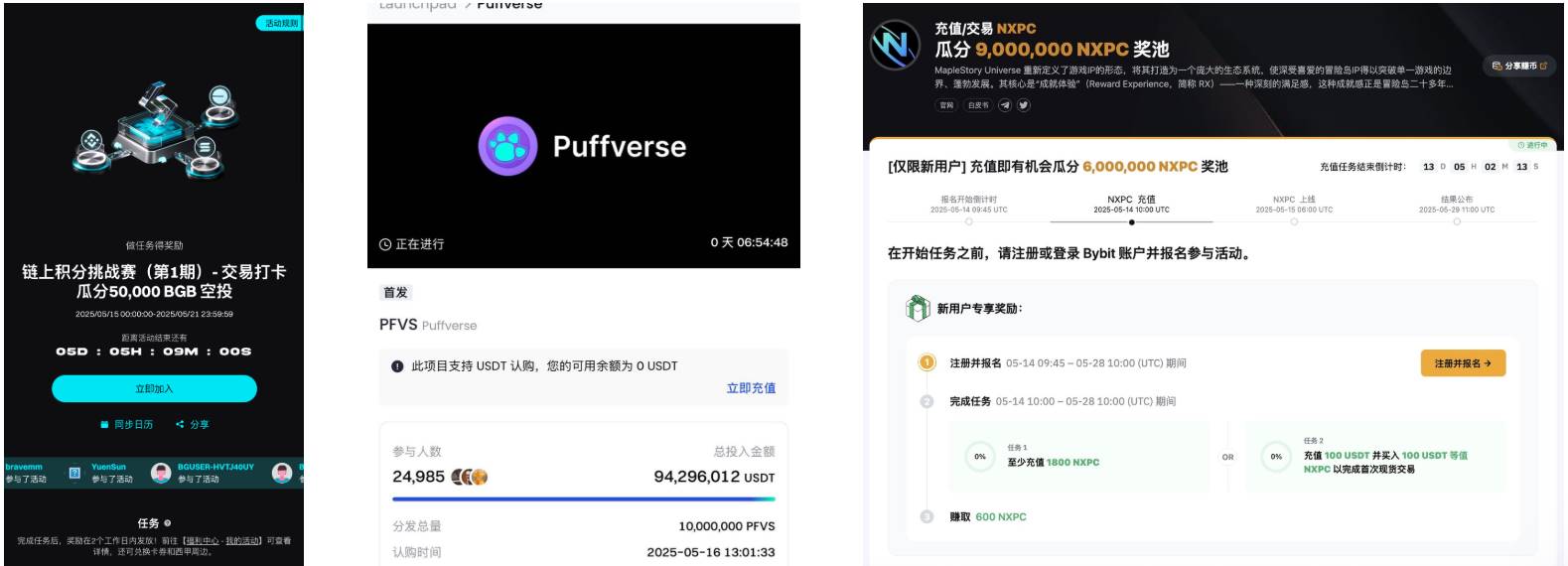

According to X user @btguagua, since the point system launched on April 25, Binance has conducted 15 "money-dropping" events via "airdrops + TGE activities" as of May 15. Yesterday's $NXPC airdrop reached a peak value of around $700 per account.

If you’ve consistently participated in Alpha and maintained qualifying scores, your single-account earnings could approach $2,000 within twenty days when calculated at peak listing prices. Even after factoring in trading slippage costs, this remains a substantial return.

In less than a month, short-term gains from participating in Binance Alpha have already surpassed the current yield-farming sector, which is gradually losing market favor.

From Leftover to Hot Commodity

When "Binance Alpha 1.0" first launched, aside from an initial surge driven by the novelty of the “Binance Spot Candidate” concept—which briefly boosted tokens listed on Alpha—the overall positioning of the Alpha segment quickly became somewhat irrelevant. It either featured then-popular on-chain meme tokens or tokens tied to its own wallet TGE campaigns. Many meme traders and projects even treated Binance Alpha as a final stop for short-term liquidity absorption. Eventually, being listed on Binance Alpha ceased to be seen as a clear positive signal, trading volume rapidly declined, and it seemed to drift further away from Binance’s original goal of driving “growth.”

Although “Binance Alpha 2.0” integrated the Alpha interface directly into the exchange, data showed little impact from this move. The real game-changer was the long-debated “point-based access system.”

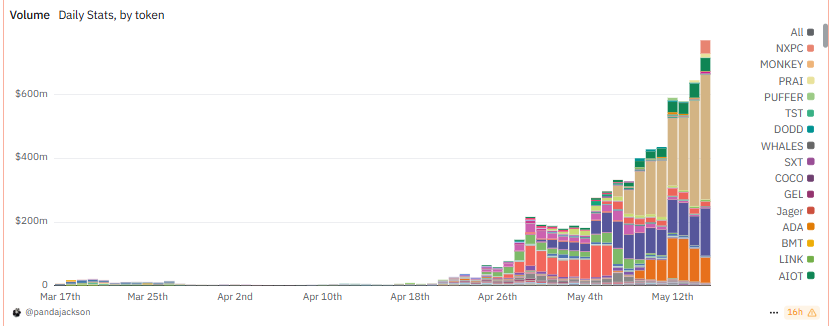

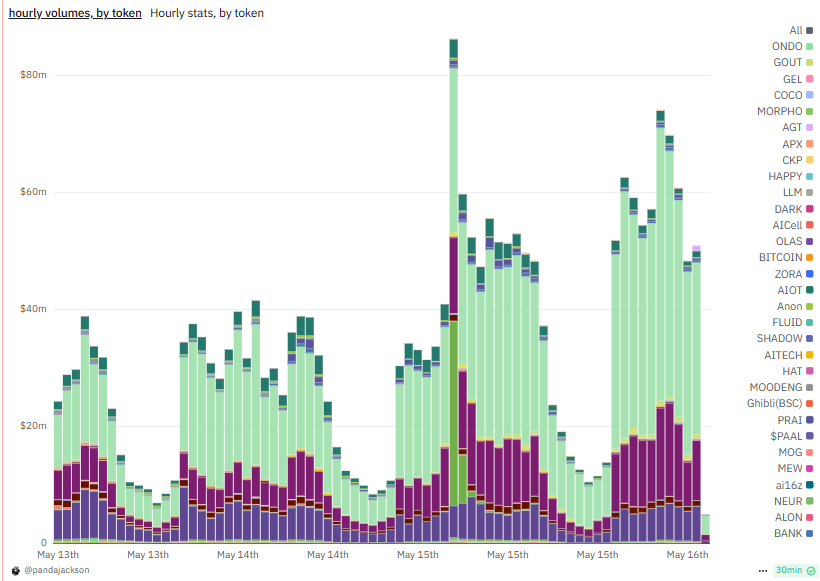

As shown in the data dashboard created by Dune user @pandajackson, after the introduction of the points system, Binance Alpha 2.0’s trading volume grew exponentially. As of May 15, Binance Alpha’s daily trading volume reached $771 million.

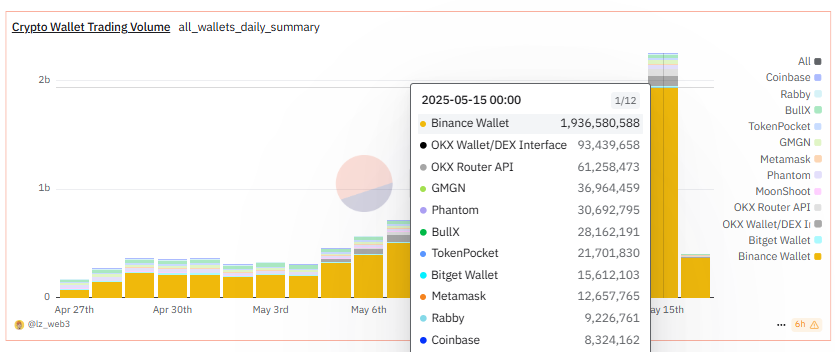

According to another dashboard by Dune user @lz_web3, Binance Wallet also dominates the entire wallet category in terms of short-term trading volume.

Judging purely by trading data, Binance’s growth strategy has successfully turned itself into a magnet for market attention and capital.

Whole Market Participation: Who Wins, Who Loses?

Judging from market discussions and user feedback, Binance’s recent money-distribution campaign has largely satisfied participants, with multiple parties benefiting from the windfall. Users who meet the point thresholds are the most direct beneficiaries. Whether retail individuals or organized farming groups, many have ridden this artificial Binance-driven wave and captured early gains from this new asset issuance model.

For actively engaged individuals, checking, tracking, and earning Alpha points has become a daily routine. Watching steadily growing Alpha points gives a sense of security, like holding onto a guaranteed-yield asset.

For individual users, Binance Alpha offers short-term “stable happiness.” But for large-scale farming operations with the ability to manage multiple accounts, this appears to be a truly significant opportunity.

“Right now, we’ve cut manpower and funding across many other projects—we’re going all-in on Binance Alpha,” said Lü Ge (pseudonym), operator of a farming studio, told TechFlow. A net gain of nearly $2,000 per account over twenty days exceeds the returns of over 90% of crypto projects in both payback period and ROI. Compared to most crypto projects where farming typically takes “at least six months, no upper limit” with uncertain returns, Binance Alpha’s model of “instant feedback, one-and-done profitability” is exactly what farming studios dream of. Even upcoming “legendary-tier” projects pale in comparison under the current high-intensity reward environment.

And according to feedback from many yield-farming influencers, the consensus has temporarily shifted: farming Alpha beats farming regular projects...

For project teams, getting listed on Binance Alpha has once again become a prime opportunity for traffic exposure. It also serves as a “score-farming asset” to secure long-term liquidity, with trading volumes of popular assets like $ZKJ and $B² continuing to rise.

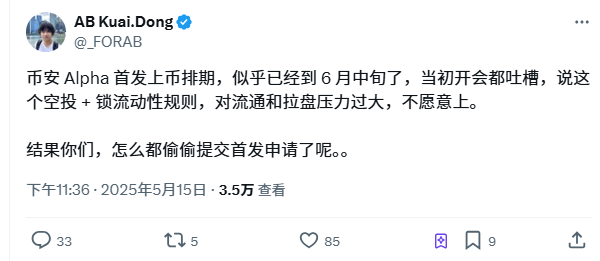

According to X user @_FORAB, the current Binance Alpha launch schedule is already booked through mid-June. Despite various restrictive requirements, project teams are still eager to capture this massive influx of traffic.

For competing exchanges, Binance’s series of cash-distribution tactics and its resulting growth metrics are highly enviable. Amid the Binance Alpha frenzy, rival platforms have launched their own versions of incentive programs to boost user growth.

Of course, even amid widespread celebration, some are still bearing losses.

The most direct losers are those who incurred trading slippage trying to earn points but failed to qualify for airdrops due to insufficient scores.

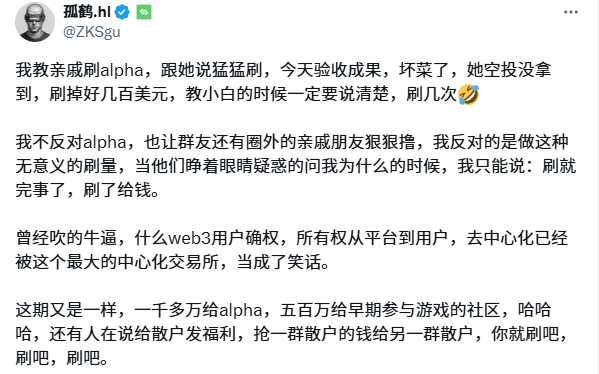

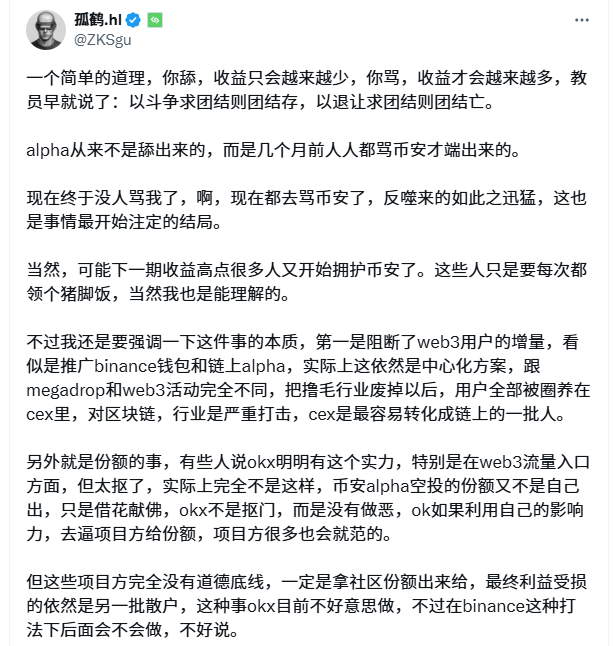

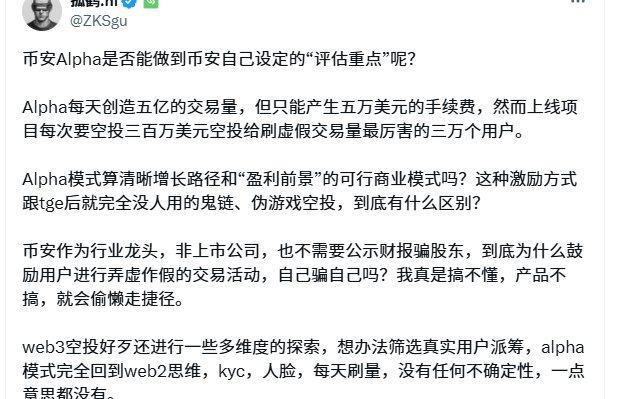

As reported by X user Gu He.hl (@ZKSgu), under the pressure of the Alpha points mechanism, many users resort to reckless trading to farm points. Without careful asset selection and slippage settings, they may suffer significant losses. Moreover, the difficulty of earning points increases exponentially—hundreds of thousands in trading volume versus a few thousand might only differ by a few points, yet the former could incur hundreds or even thousands of dollars more in slippage.

Beyond these direct financial losses, many genuine yield farmers—who participate in projects for actual airdrops—also face a form of “invisible loss” under the shadow of Binance Alpha: To ensure rewards for Alpha participants, projects launching via Binance Alpha must allocate substantial token portions and lock liquidity. To cover these “Alpha listing fees,” some project teams deduct portions originally reserved for their community and redirect them to Binance Alpha for distribution. In this transfer, funds that would have gone to “project community members” end up in the pockets of “Binance Alpha users.” This practice effectively halts organic Web3 user growth, instead centrally corralling native users within the exchange ecosystem.

How Long Can This Intensity Last?

Not long ago, people criticized project airdrop point systems for dangling time, effort, money, and expectations in front of users, fueling endless internal competition—an approach generally considered unfair. Yet perhaps because the positive feedback here is fast and tangible, criticism toward Binance Alpha’s points system has been muted, replaced by praise for its payouts.

On the positive side, Binance Alpha has, to some extent, channeled market enthusiasm in an environment lacking a dominant narrative, broadly benefiting ordinary users through its cash drops. Additionally, its assembly-line listing model has helped demystify the previously revered act of “getting listed on Binance.”

On the negative side, the primary way to earn Alpha points remains mechanical point farming, which—aside from inflating wallet and project metrics—holds little intrinsic value. Many users spend money and endure high on-chain slippage, only to receive no return amid fierce competition.

Given current trends, the point threshold required to qualify for future Alpha rewards will likely keep rising. As competition intensifies, Alpha activities will become increasingly actuarial and dense—missing by just one point could mean losing eligibility, and participation difficulty for small retail users will grow exponentially.

Summary

Binance Alpha’s overwhelming dominance recalls the Qin state in the *Records of the Grand Historian*—“sweeping across the六合, capturing feudal lords, dividing the world, and swallowing the eight wastelands”—ruthless, rapid, and massively scalable.

Yet this expansion may be too fast. As the saying goes: “A wildfire may blaze brightly, but not necessarily endure.” Any model that burns through market expectations too quickly faces sustainability challenges. Today’s high short-term returns resemble Binance paying tuition for user education—so long as it captures users’ time, money, attention, and focus now, long-term planning can wait.

The difficulty of earning rewards has indeed increased. The current point deduction system already tests participants’ research and judgment skills. The era of passively farming points and collecting free airdrops is over. Moving forward, those who can accurately assess projects may be the ones to reap meaningful rewards.

From a user perspective, opportunities with such high positive expected value (EV) are rare even across full bull-bear cycles. Capturing this红利window is critical. How long will this last? Could Binance Alpha eventually harm the broader market? “When it gets too intense and the红利vanishes, just move on to the next opportunity. No one knows what comes after, but whenever there’s a chance, you’ve got to take it.” So said Lü Ge from the farming studio during our interview.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News