20 Cryptocurrency Market Truths People Are Unwilling to Believe Today

TechFlow Selected TechFlow Selected

20 Cryptocurrency Market Truths People Are Unwilling to Believe Today

A comprehensive altcoin season may never return, and Trump is not the "hope drug" for the crypto market.

Author: AlΞx Wacy

Translation: TechFlow

-

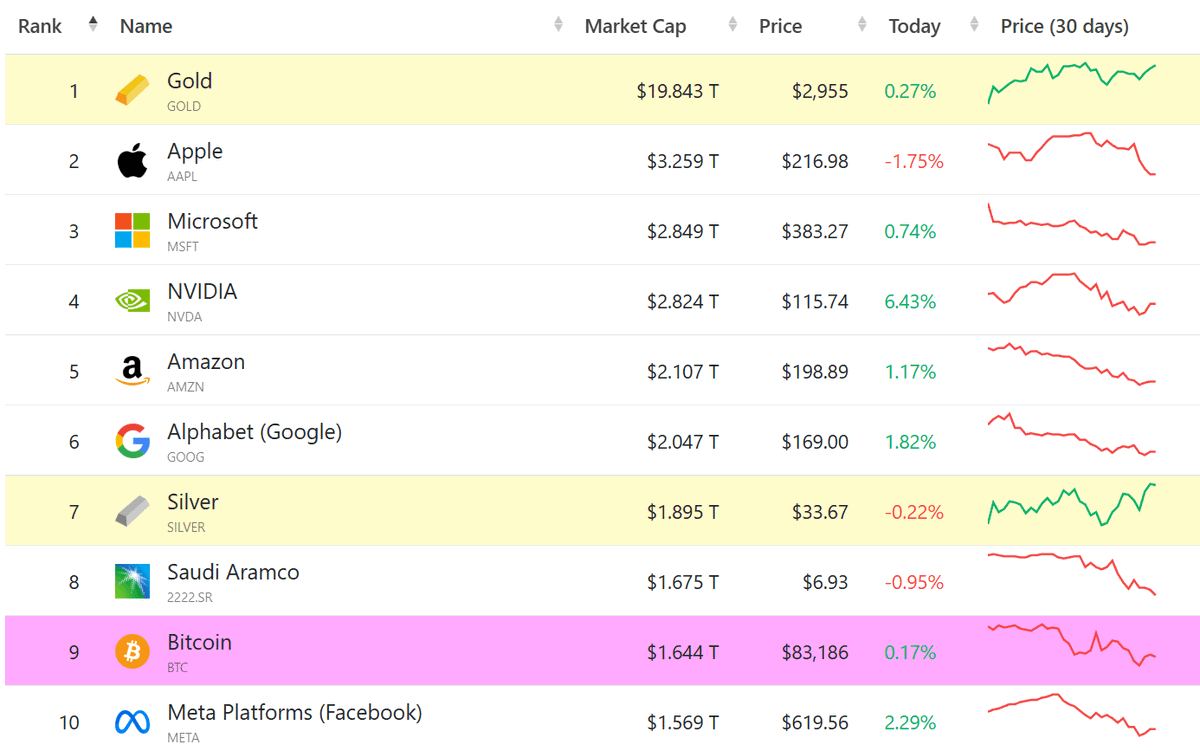

Bitcoin cannot replace gold. Gold has a market cap of about $19 trillion—under even the most optimistic scenarios, Bitcoin ($BTC) falls far short. Digital gold? Yes. Real gold? Forget it.

-

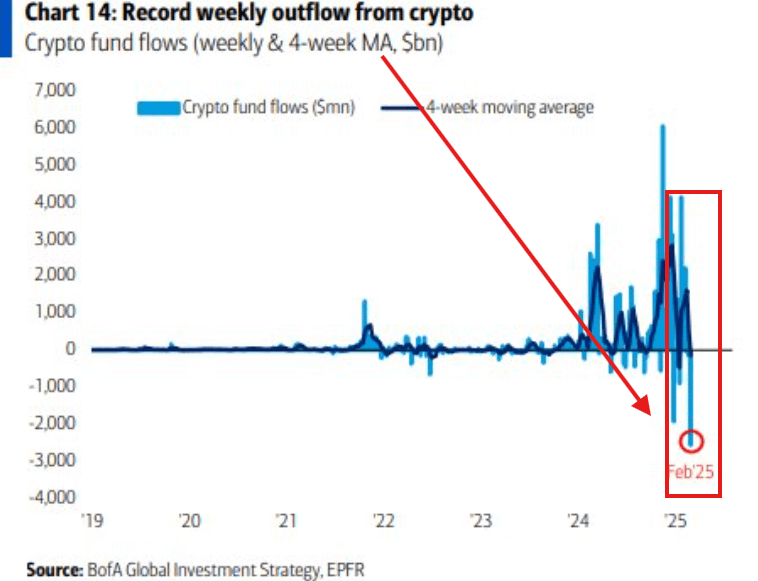

Liquidity is drying up. Spot ETFs have attracted institutional capital, but retail liquidity is vanishing. Market hype alone isn't enough to sustain the next phase of growth.

-

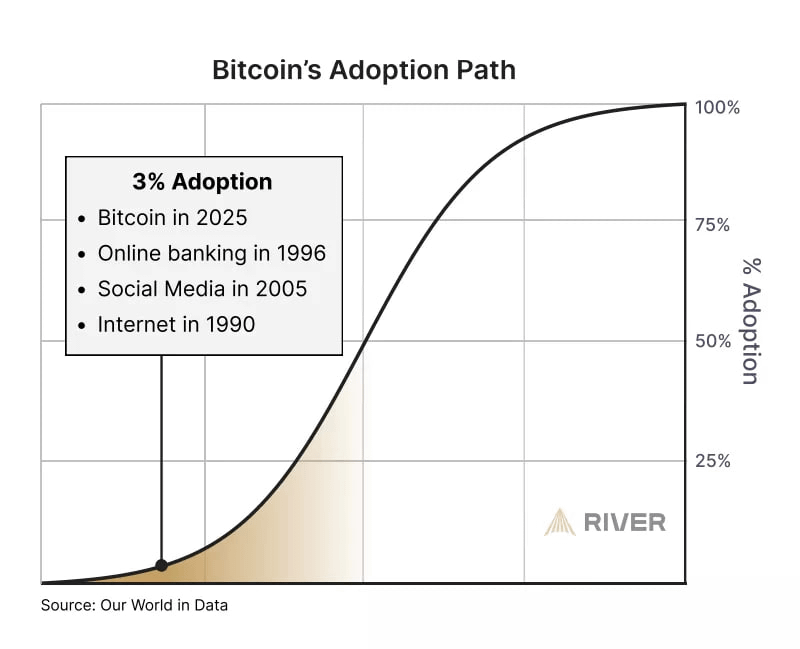

Mass adoption hasn’t started yet. Despite frequent media coverage, real-world applications remain limited. Crypto is still primarily a playground for speculators, not an everyday financial tool.

-

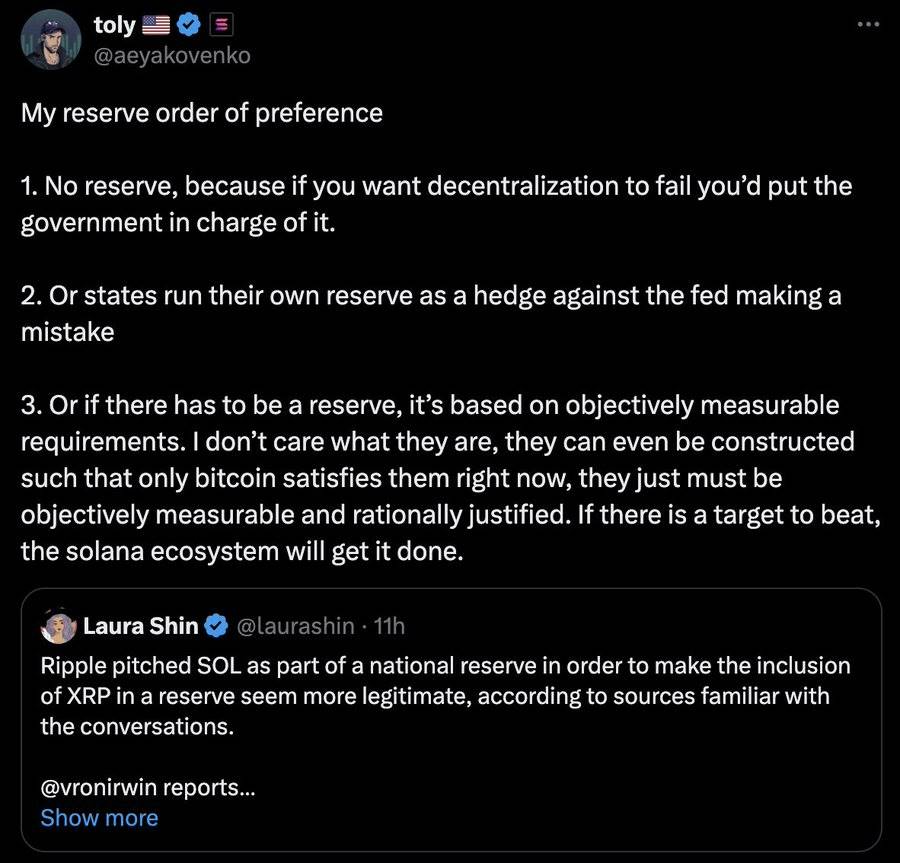

The dream of decentralization is dead. The vision of fully decentralized cryptocurrency is fading. Today, centralized exchanges, regulators, and large capital players dominate the landscape.

-

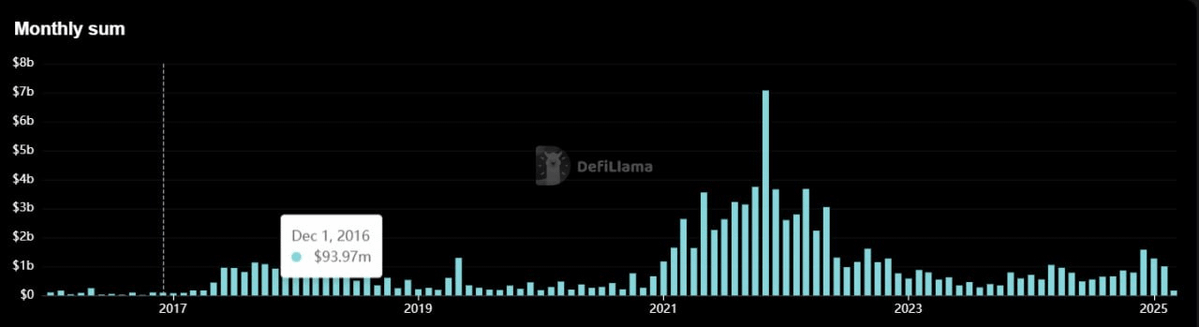

Investment is exiting crypto. Despite unprecedented government support and growing legitimacy, venture funding for crypto projects has dropped below 2017–2018 levels.

-

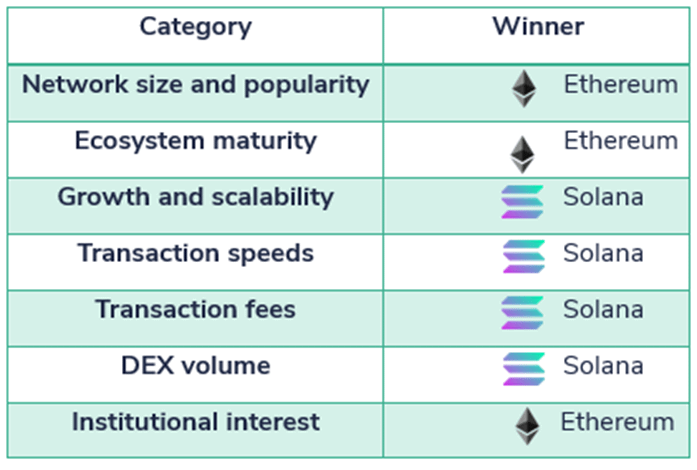

Solana will surpass Ethereum. Solana ($SOL) is faster, cheaper, and rapidly growing in NFTs, DeFi, and meme coins. Meanwhile, Ethereum ($ETH) struggles with high fees and internal disarray. It's not a matter of if, but when Solana overtakes it.

-

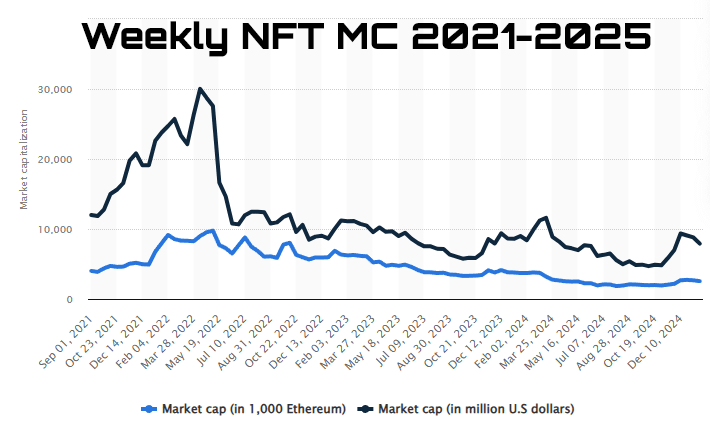

NFTs are dead. The PFP (profile picture NFT) craze is over. Without practical use cases, NFTs won't recover—unless new utility emerges.

-

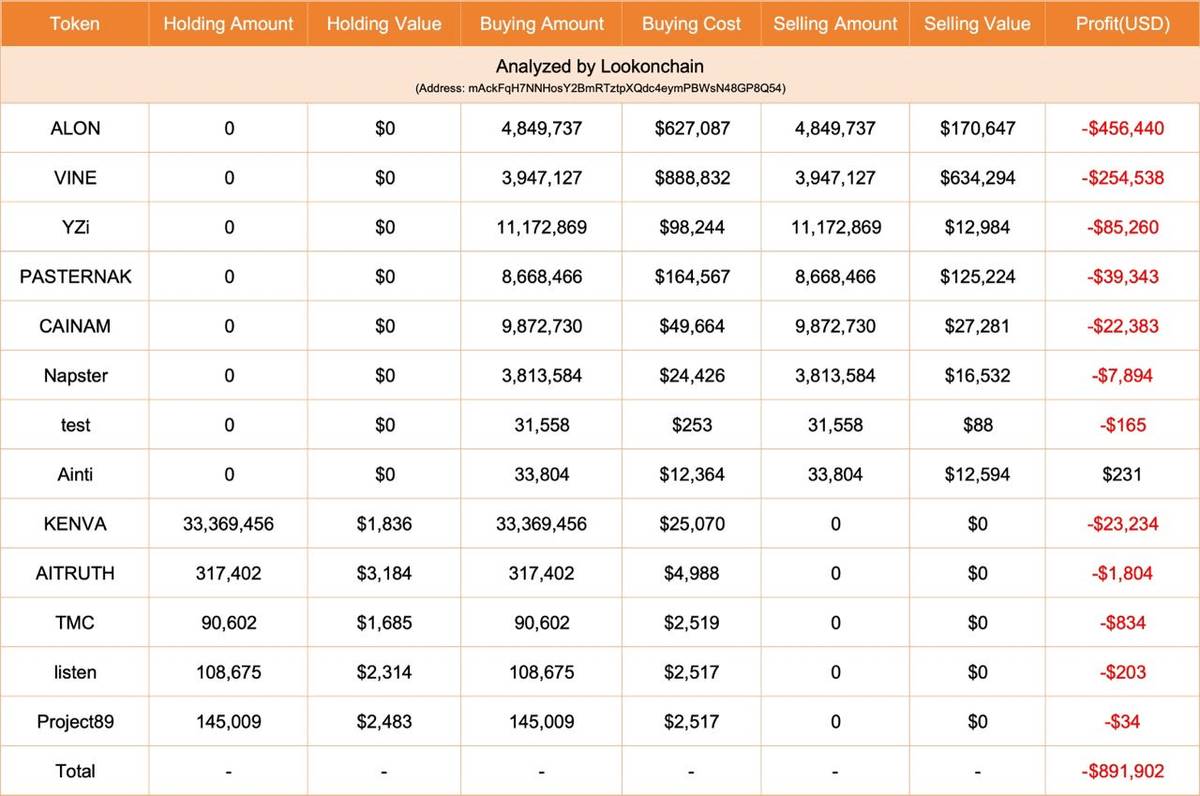

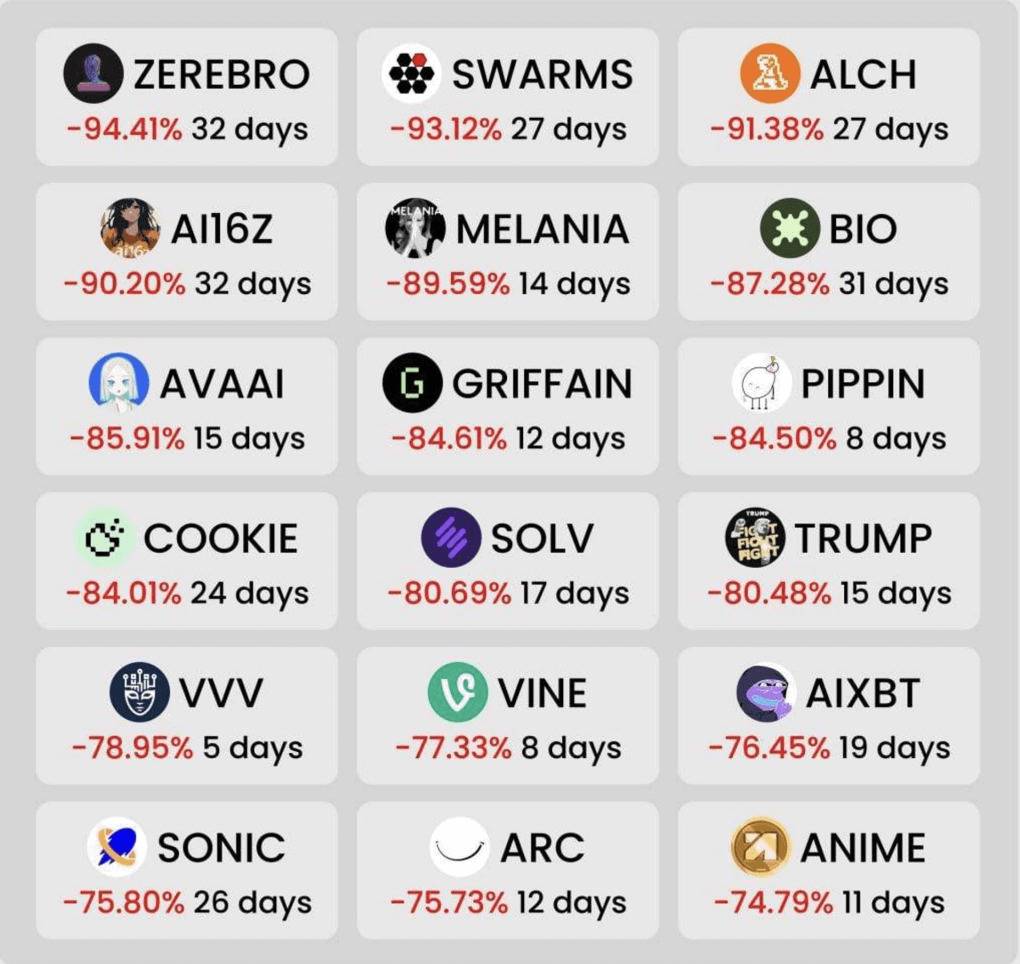

Retail investors are the "greater fools". Smart money enters early and sells at the top to retail. Most people end up losing.

-

If Solana lacks a new "spark," it may fail to reach new highs. Meme coins have been the biggest catalyst for $SOL. Without fresh momentum, market attention will fade.

-

The next wave of AI agents is coming. While the first wave was just chatbots, more advanced AI agents are on the horizon—and they’ll transform how we interact with crypto.

-

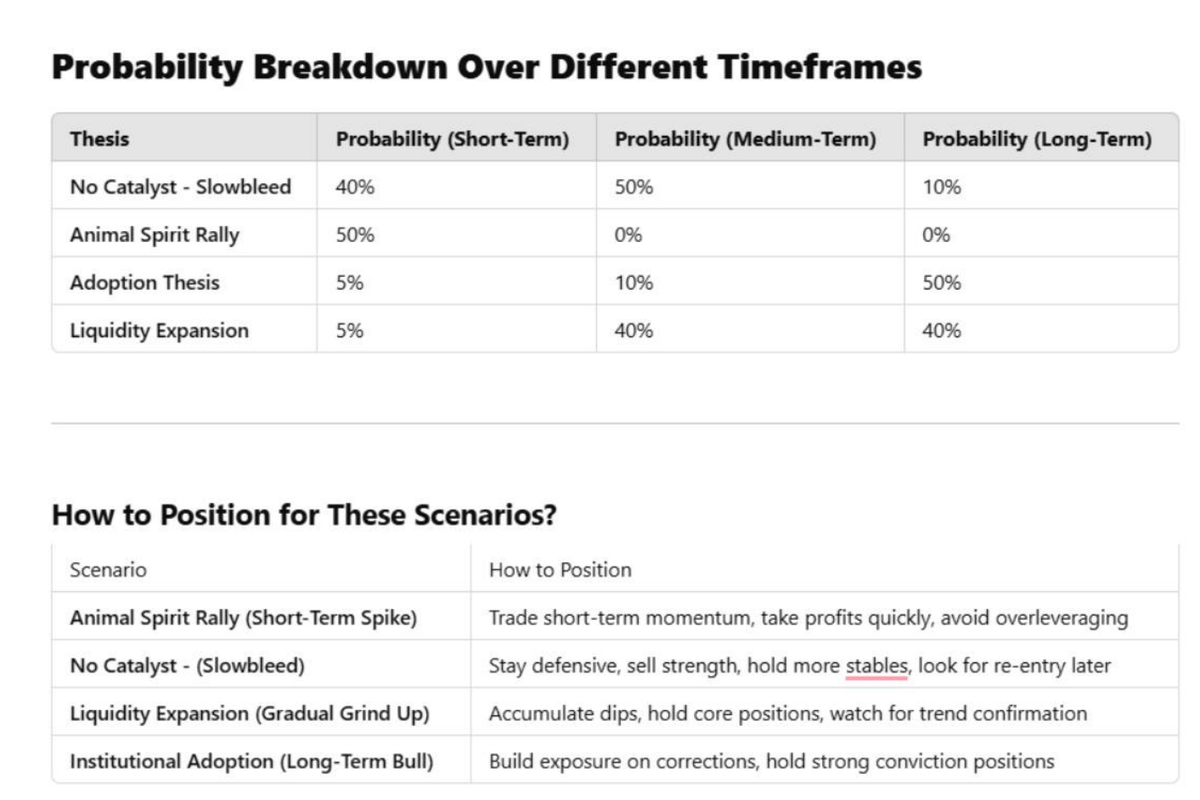

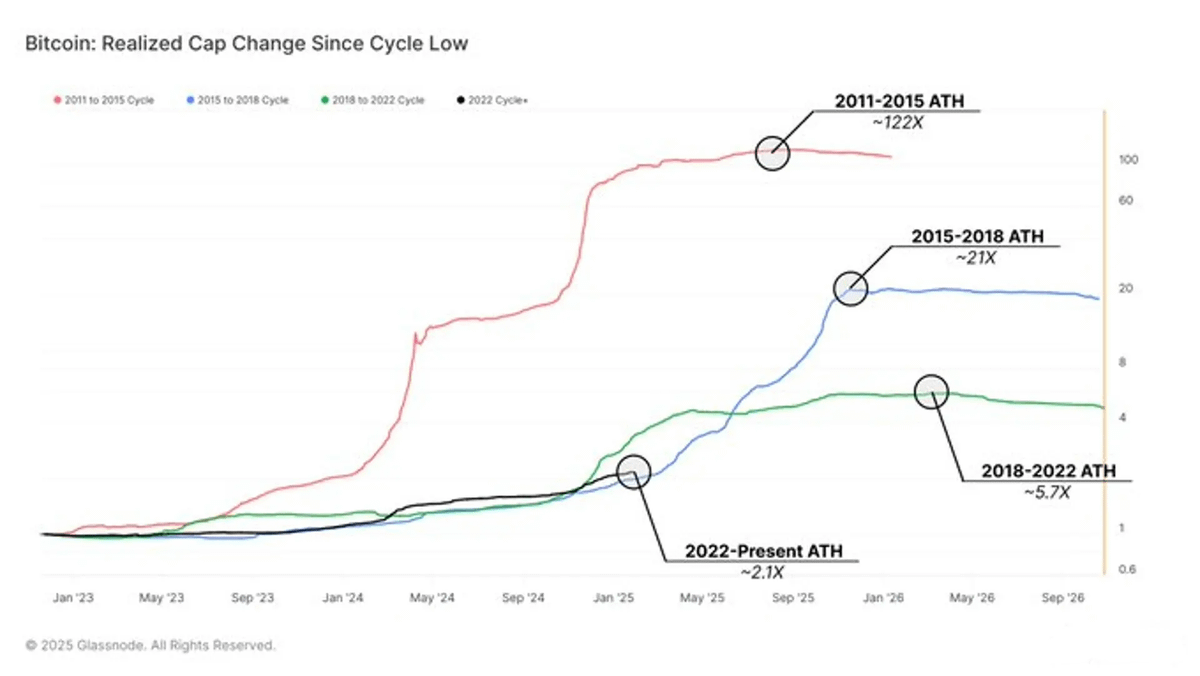

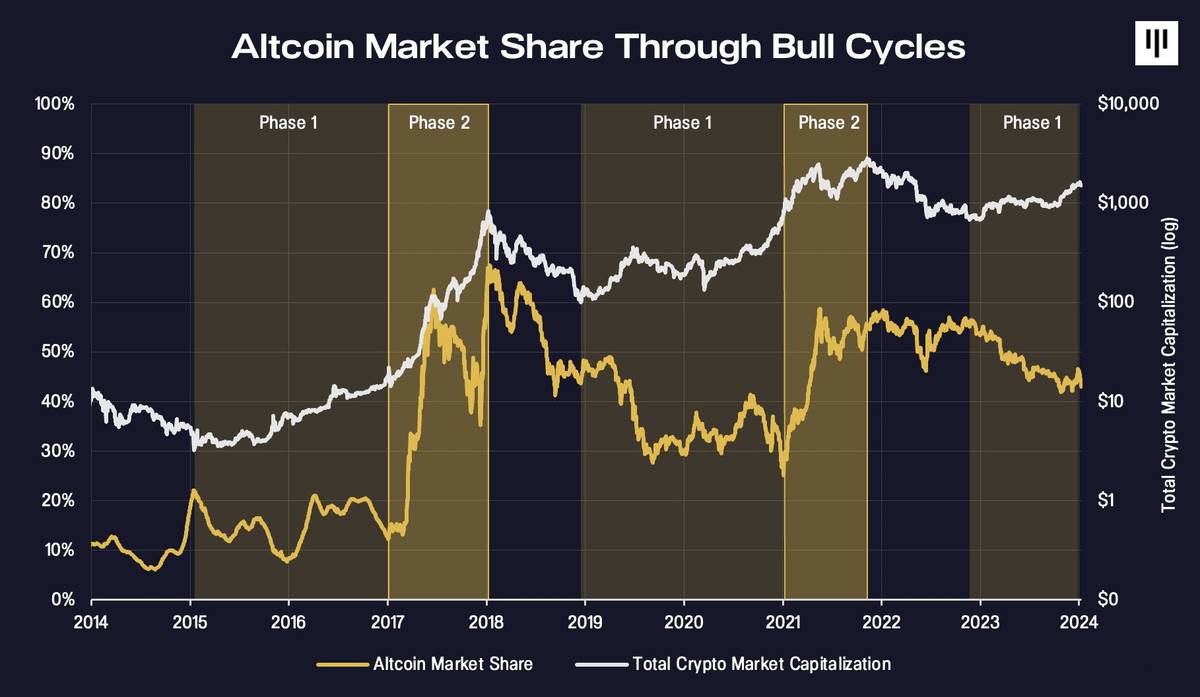

Market cycles and indicators no longer work. Traditional market cycles? Technical analysis (TA) patterns? Now, markets are driven more by liquidity games and macro events.

-

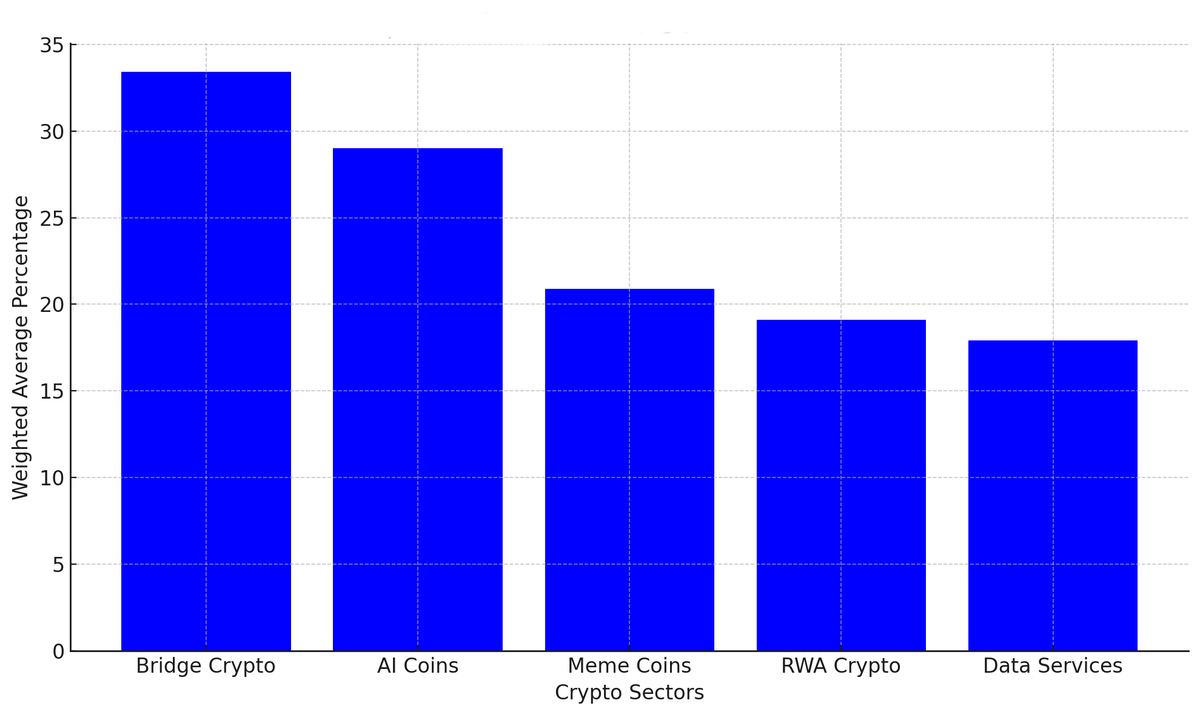

The fuel for altseason is gone. Capital is no longer flooding into altcoins like before. Without fresh inflows, a broad "altseason" may never return.

-

Bitcoin could drop to $40,000. Yes, such a deep correction is possible. Market structure and liquidity suggest a major pullback is brewing.

-

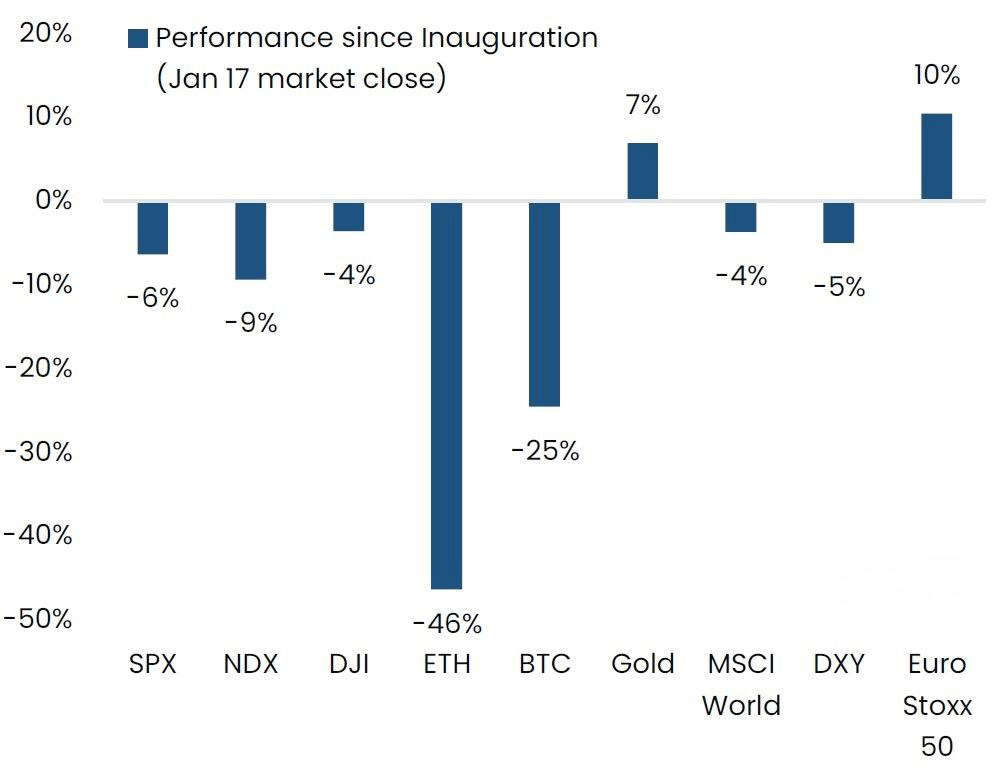

Trump is not a "magic pill" for crypto. Markets performed better under Biden. Trump’s policies may favor institutions over retail.

-

GameFi will see a revival. Web3 gaming is maturing. If GTA 6 integrates blockchain, it could revolutionize the gaming industry.

-

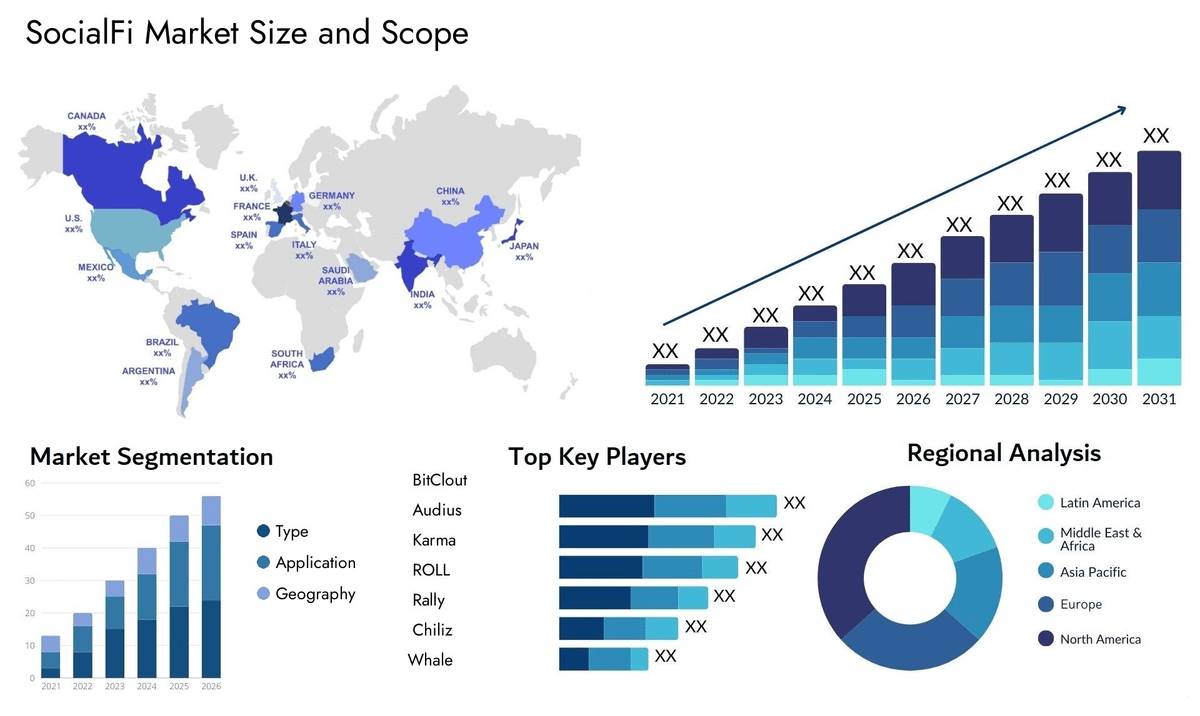

SocialFi will be the next trend. Tokenized communities, engagement rewards, and content monetization are inevitable developments.

-

Complex tech isn’t hot this cycle. Simpler projects win. AI, DePIN, and RWA are easy to grasp; modular blockchains are not.

-

New listings on Binance no longer mean pumps. Most tokens newly listed on Binance eventually decline. The market's hype cycle has changed.

-

A full-scale altseason may never return. Sure, some altcoins might 10x or even 100x—but a massive rally across all altcoins? Almost impossible.

-

Crypto markets never behave as expected. If you think you’ve figured it out, the market will prove you wrong. Adapt or get left behind.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News