In-depth analysis of the current market: resonance between large-scale fund theft triggering market concerns and liquidity migration amid great power rivalry

TechFlow Selected TechFlow Selected

In-depth analysis of the current market: resonance between large-scale fund theft triggering market concerns and liquidity migration amid great power rivalry

Intensifying geopolitical rivalry among major powers, DeepSeek's open-source week reshapes the competitive landscape of the AI sector, and Chinese risk assets enter a revaluation phase with liquidity migration under resonance.

Author: @Web3_Mario

Summary: The cryptocurrency market has recently undergone a significant correction. With chaotic information circulating and consecutive major hacking incidents in the crypto industry adding to bearish sentiment, understanding the short-term market trend has become challenging.

The author shares some views on this matter, believing that the current pullback in the crypto market is primarily driven by two factors:

First, from a micro perspective, repeated hacking incidents have triggered concerns among traditional capital, intensifying risk-averse sentiment.

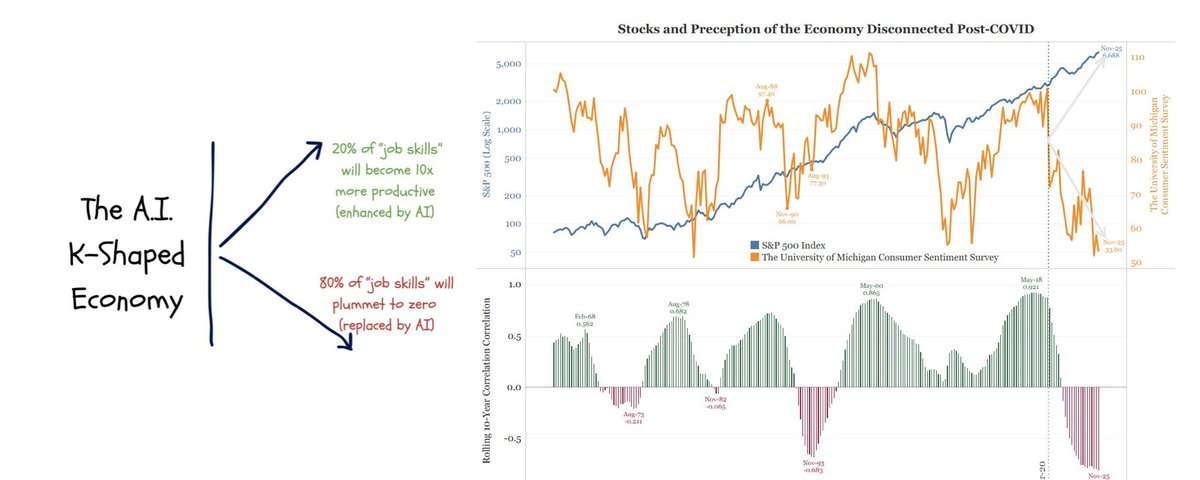

Second, from a macro standpoint, DeepSeek's open-source week further burst the U.S. AI bubble, combined with the actual policy direction of the Trump administration—on one hand fueling market worries over stagflation in the United States, and on the other hand triggering a repricing of Chinese risk assets.

Micro Level: Consecutive large-scale fund losses have raised traditional capital’s concerns about the short-term outlook of the cryptocurrency market, increasing risk-averse sentiment

Many readers likely still remember the recent hacks involving Bybit and Infini. There has already been extensive discussion on these events, so they won’t be elaborated upon here. Instead, let's briefly analyze the scale of the stolen funds relative to the impacted companies and the broader industry. For Bybit, although $1.5 billion represents roughly one year’s net profit based on its size, it is by no means a small amount for a company in an expansion phase. Typically, businesses maintain 3 to 12 months of cash reserves. Given that exchange operations are high-cash-flow businesses, their reserves are likely closer to the lower end. Looking at Coinbase’s 2024 financial report provides some initial insights: Coinbase’s annual revenue more than doubled year-on-year to $6.564 billion, with a net profit of $2.6 billion. Operating expenses totaled $4.3 billion in 2024.

Referencing Coinbase’s disclosed data and considering Bybit’s aggressive expansion phase—with even tighter cost controls—we can estimate Bybit’s cash reserves to be approximately between $700 million and $1 billion. A loss of $1.5 billion in user funds clearly cannot be covered solely by internal capital. This necessitates external financing through borrowing, equity fundraising, or shareholder injections to weather the crisis. Regardless of the method chosen, given underlying concerns about weak growth prospects for the crypto market in 2025, the resulting capital costs could be substantial, inevitably burdening future corporate expansion.

Today’s news suggests the core vulnerability lies within Safe, not Bybit itself, potentially allowing some recovery incentives. However, a major challenge facing the crypto industry remains the lack of a robust legal framework, meaning any litigation process will likely be lengthy and costly. Recovering lost funds may prove extremely difficult. As for Infini, a $50 million loss is certainly catastrophic for a startup, though the founder appears financially strong enough to inject capital and overcome the crisis—an uncommon scenario.

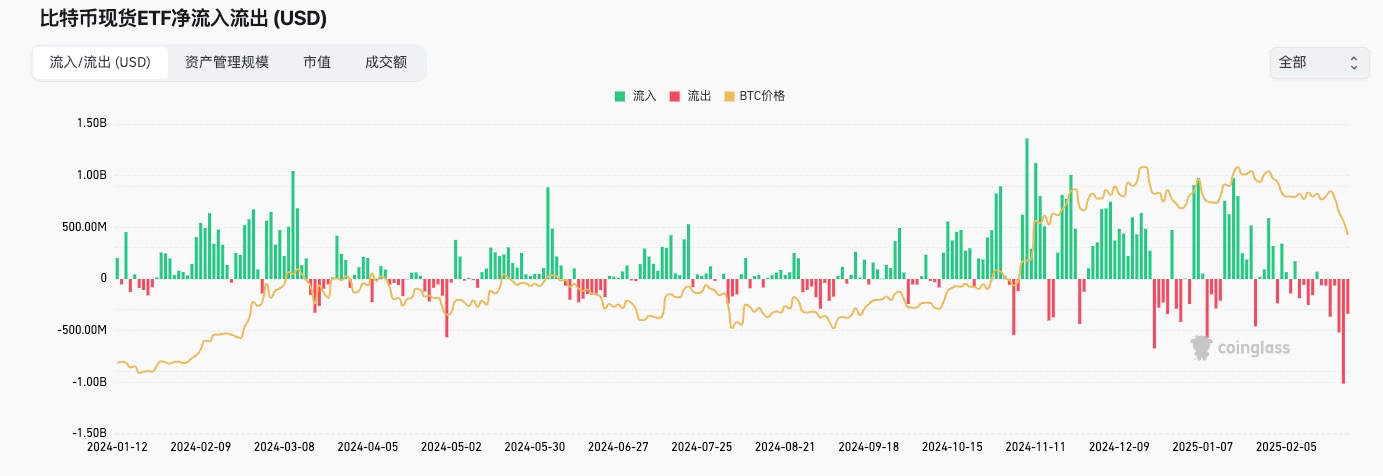

While such large consecutive losses might seem normal to crypto traders accustomed to high risks, they clearly shake the confidence of traditional capital. This is evident in BTC ETF flows: the attack on the 21st clearly triggered a significant outflow, indicating a negative impact on traditional investors. If such concerns center on whether this will hinder progress toward a regulatory-friendly legal framework, the implications are serious. Therefore, these theft incidents acted as the immediate catalyst for the current market correction at the micro level.

Macro Level: Escalating geopolitical competition between major powers, DeepSeek’s open-source week reshaping AI sector dynamics, and liquidity shifts amid revaluation of Chinese risk assets

Now let’s examine the macro-level impacts, which are clearly unfavorable for the crypto market in the short term. After careful observation, the policy direction of the Trump administration has become relatively clear: achieving internal consolidation and industrial restructuring through strategic contraction—trading space for time—to enable U.S. reindustrialization. Technology and production capacity are ultimately the most critical elements in great power competition. The most essential factor in achieving this goal is “money,” reflected specifically in the U.S. fiscal situation, financing capacity, and the real purchasing power of the dollar. These three aspects reinforce each other, making it difficult to track changes. Yet, by carefully analyzing the details, we can identify several core concerns:

1. U.S. fiscal deficit issues;

2. Risks of U.S. stagflation;

3. Strength or weakness of the U.S. dollar;

First, regarding the U.S. fiscal deficit, this issue has been extensively analyzed in previous articles. In short, the root cause traces back to the Biden administration’s extraordinary economic stimulus packages during the pandemic, along with Treasury Secretary Yellen’s strategy of adjusting U.S. debt structure—issuing excessive short-term debt, causing yield curve inversion and enabling global wealth extraction. Over-issuance of short-term debt depresses their prices on the supply side, thereby raising short-term yields. Higher short-term yields naturally attract dollar repatriation, offering risk-free excess returns without time cost—a highly attractive proposition. This explains why capital represented by Warren Buffett chose to sell off risky assets and increase cash holdings in the previous cycle. In the short term, this placed immense pressure on other countries’ exchange rates. To prevent excessive depreciation, central banks were forced to sell short-term bonds at a discount, turning unrealized losses into realized ones to retrieve dollar liquidity and stabilize their currencies. Overall, this was a global wealth extraction strategy, particularly targeting emerging economies and trade surplus nations. However, a key downside is that this debt structure dramatically increases the U.S.’s short-term repayment burden, as short-term debts require principal and interest repayment upon maturity—this is the origin of the current U.S. debt crisis stemming from fiscal deficits, essentially a mine left behind by the Democrats for Trump.

The biggest impact of a debt crisis is damage to U.S. creditworthiness, weakening its financing ability. In other words, the U.S. government must offer higher interest rates to borrow via Treasuries, which raises the neutral interest rate across American society—a rate unaffected by Fed monetary policy. Elevated neutral rates place heavy burdens on businesses, leading to stagnant economic growth. This stagnation then transmits through the labor market to ordinary citizens, resulting in reduced investment and consumption—a negative feedback loop that triggers recession.

The focus of monitoring this trajectory centers on how the Trump administration will restore fiscal discipline and resolve the deficit issue. Key policies include the DOGE efficiency department led by Musk, tasked with cutting government spending and downsizing bureaucracy, along with assessing the economic impact of these measures. Currently, the intensity of Trump’s internal consolidation is very high, with reforms entering deep waters. While tracking specific progress is beyond the scope here, the author shares some analytical logic:

1. Monitor the aggressiveness of efficiency department policies—excessive cuts will inevitably raise near-term economic concerns, typically negative for risk assets.

2. Watch macroeconomic indicators’ responses to these policies, such as employment and GDP data.

3. Track the progress of tax reduction initiatives.

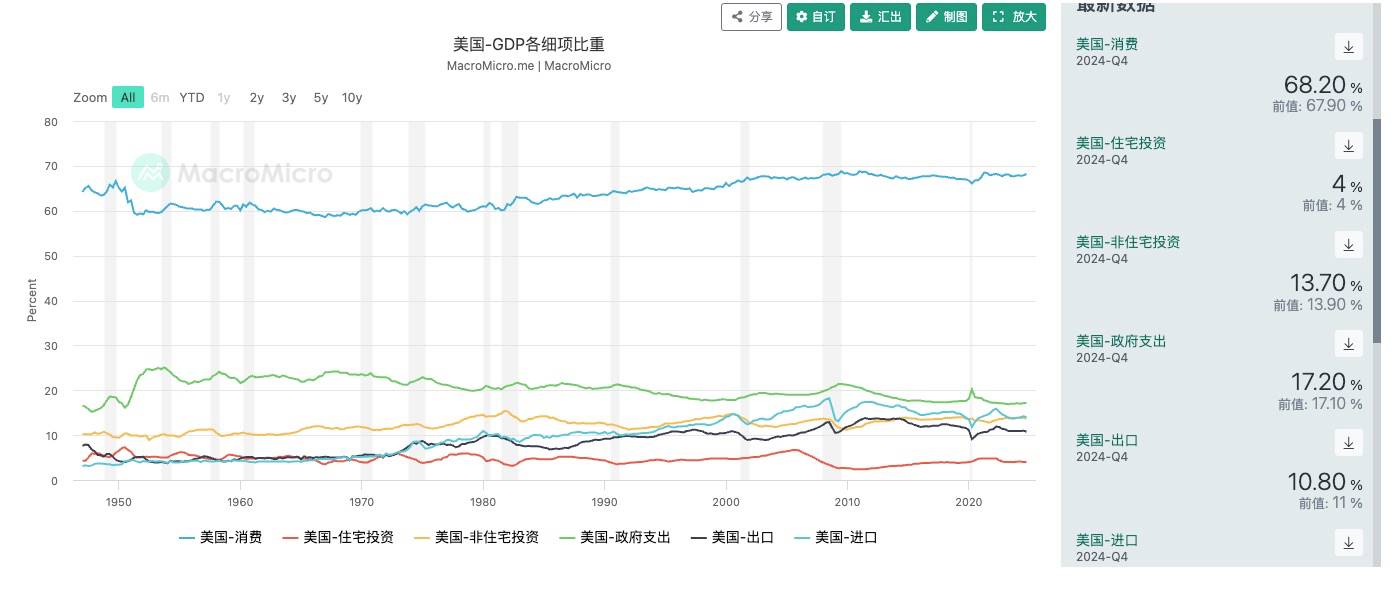

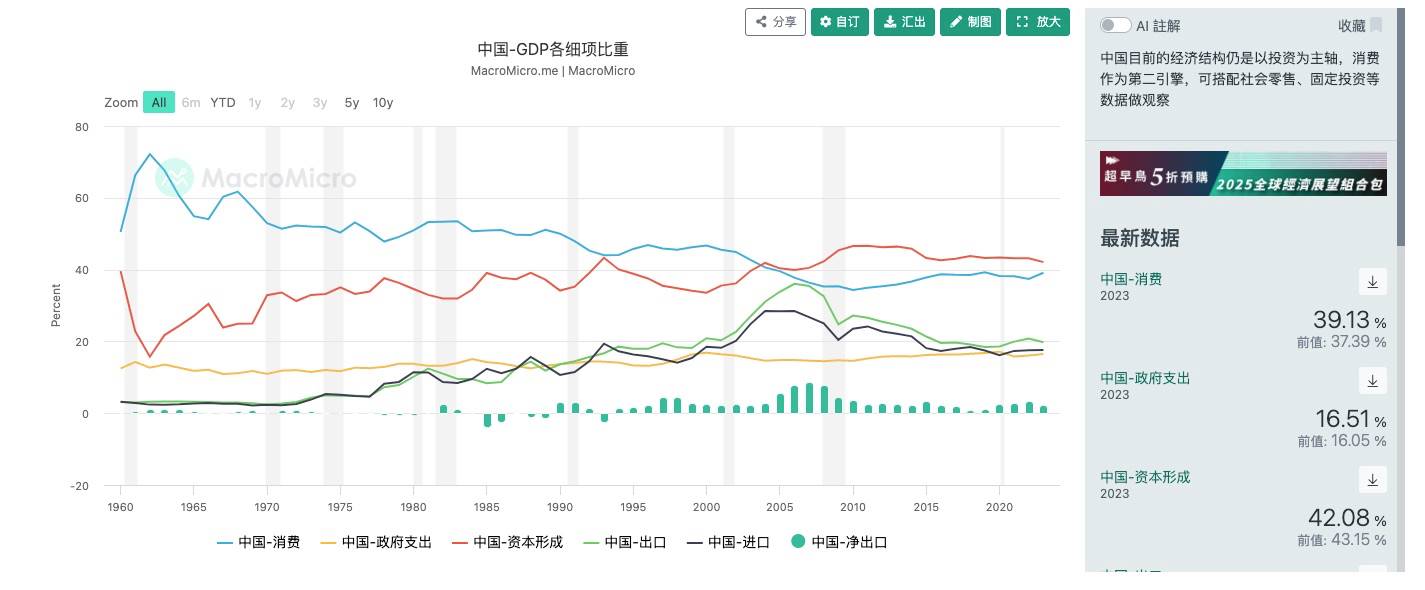

We must not underestimate the impact of government spending and public employment on the U.S. economy. It’s commonly assumed that China’s government expenditure ratio is higher than the U.S., but this is actually a misconception. U.S. government spending accounts for 17.2% of GDP, compared to China’s 16.51%. Government spending usually multiplies through supply chains into the broader economy. Structural differences mainly lie in the U.S. having a much higher consumption share in GDP, while China’s GDP relies more on imports and exports. This reflects two different economic stimulus approaches: for the U.S., boosting external demand and exports drives growth; for China, domestic demand still holds significant untapped potential.

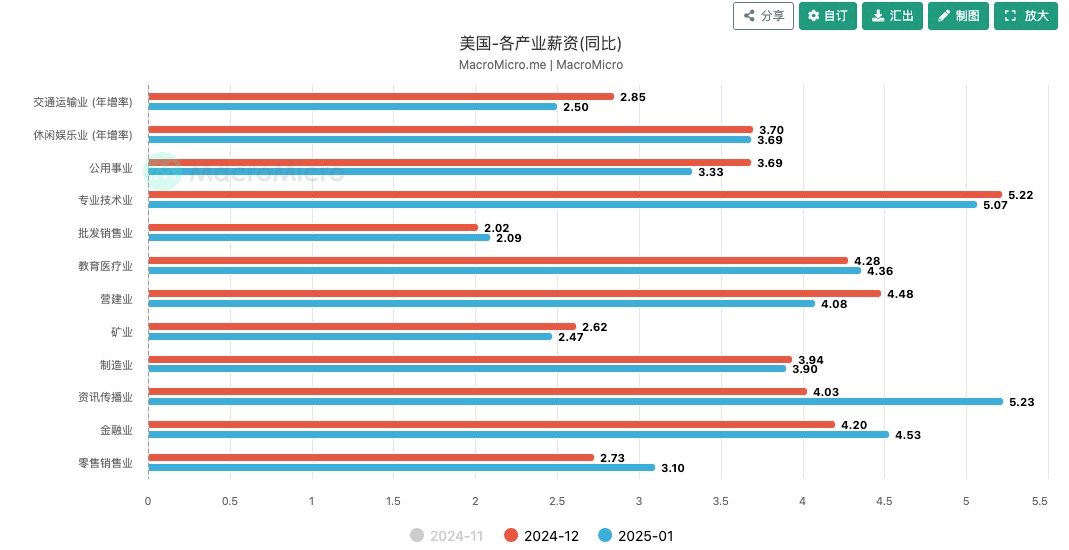

Consumption patterns follow the same logic. As shown in this chart, government employee salaries are not low across the entire industrial chain. Cutting redundant public jobs dampens U.S. economic growth on the consumption side. Thus, overly aggressive policy implementation will inevitably trigger fears of recession. Some matters require gradual handling. Still, coordination with the overall pace of the Trump administration’s agenda is essential. Regarding tax cuts, Trump’s current focus does not appear to be on this front, so concerns over short-term revenue decline remain muted—but vigilance is warranted.

Next is concern over U.S. stagflation—the combination of stagnant growth and rising inflation, a painful scenario socially unacceptable. Beyond the previously mentioned impact of reduced government spending on economic growth, several other key points deserve attention:

1. How DeepSeek will further disrupt the AI sector.

2. Progress on U.S. sovereign wealth fund development.

3. Impact of tariff policies and geopolitical conflicts on inflation.

The author believes the most significant short-term impact comes from the first point. Tech enthusiasts may know that DeepSeek’s open-source week delivered stunning results—all pointing toward drastically reduced AI computational demands. Previously, despite high interest rates, U.S. equities remained stable due to the compelling narrative around AI and America’s upstream-downstream monopoly in the sector. Markets assigned exceptionally high valuations to U.S. AI stocks, reflecting optimism about AI-driven economic growth. However, DeepSeek is now reversing this trend. Its biggest impacts are twofold: First, on cost—greatly reducing computational requirements, sharply curtailing growth potential for upstream compute providers like NVIDIA. Second, through open-sourcing, breaking U.S. dominance over downstream AI algorithms, thus depressing valuations of algorithm providers like OpenAI. This disruption has only just begun. How the U.S. AI sector responds will be crucial, but in the short term, U.S. AI stock valuations are already retreating while Chinese tech stocks are rebounding.

For a long time, the U.S. suppressed Chinese corporate valuations through media narratives, keeping them artificially low. Now, benefiting from the grand narrative of DeepSeek enabling China’s manufacturing upgrade, coupled with the Trump administration’s relatively softer stance on China-related issues—reducing geopolitical risks—valuations of both Chinese and U.S. firms are rebalancing. According to CICC reports, the recent rise in Hong Kong stocks has mainly benefited from southbound capital inflows (from mainland China) and passive overseas capital, while active overseas funds—restricted by Trump’s investment bans on Chinese companies—have shown little change. Nevertheless, liquidity monitoring remains important, as many indirect methods exist to capture gains from Chinese corporate valuation rebounds—such as investing in closely linked markets like Singapore. Capital flow changes can be easily identified via the Hong Kong dollar exchange rate. Since HKD operates under a currency board system pegged to USD within a range of 7.75–7.85, approaching 7.75 indicates stronger foreign investor appetite for Hong Kong stocks.

A second noteworthy point is the development of a U.S. sovereign wealth fund. Sovereign wealth funds serve as valuable supplements to government finances, especially for trade surplus nations holding large amounts of dollars. Among the world’s top ten sovereign wealth funds, three are Chinese, four Middle Eastern, and two Singaporean. The largest is Norway’s Government Pension Fund Global, with total assets around $1.55 trillion. Due to constitutional constraints limiting federal taxation to direct taxes, establishing a sovereign fund in the U.S. is inherently difficult. With limited revenue sources and ongoing fiscal deficits, creating such a fund seems challenging. Yet Trump reportedly instructed the Treasury to establish a trillion-dollar sovereign fund—potentially a measure to alleviate fiscal strain. But key questions remain: Where will the money come from, and what will it invest in?

According to statements by new Treasury Secretary Bessent, the idea involves revaluing U.S. gold reserves to provide $750 billion in liquidity for the fund. Under Title 31, Section 5117 of the U.S. Code, the official value of the U.S. government’s 8,133 metric tons of gold remains fixed at $42.22 per ounce. At current market prices (~$2,920/oz), this implies an unrealized gain of $750 billion. Amending the law would unlock this liquidity—a clever move. However, if implemented, the dollars used for investment or debt relief would come from gold sales, inevitably affecting gold price trends.

As for investment targets, the author believes the fund will likely focus on bringing production capacity back to the U.S. Thus, its impact on Bitcoin may be limited. Previous analyses explained that in the short to medium term, Bitcoin serves as a fallback asset for the U.S. economy—based on sufficient U.S. pricing power over this asset. However, since the economy hasn’t yet entered visible recession, this isn’t currently a central policy priority, but rather an important tool to navigate reform-induced turbulence.

Finally, on tariffs: tariff risks have been well contained. Current evidence suggests tariffs are more of a negotiating chip than a necessary choice for Trump—evident in the relatively restrained rate of China tariffs imposed. This restraint reflects consideration of how high tariffs could fuel domestic inflation. The author is more curious about potential tariffs on Europe and what returns the U.S. might extract. However, there are concerns about the EU’s ability to rebuild independence. Exploiting Europe to regain strength may be America’s first step in this great power contest. Regarding inflation, although CPI has risen for several consecutive months, overall levels remain manageable. Combined with Trump’s moderate tariff approach, current inflation risks do not appear severe.

Lastly, the dollar’s trajectory is a critical issue requiring continuous monitoring. Indeed, debate over whether the dollar will strengthen or weaken under Trump’s new term persists. Statements by key figures significantly influence markets. For example, Stephen Moore, Trump’s newly appointed economic advisor and chief economist at the White House Economic Council, stated that the U.S. needs a weaker dollar to boost exports and promote domestic reindustrialization. After sparking market panic, Treasury Secretary Bessent reassured markets on February 7, affirming that the U.S. will continue its “strong dollar” policy, though noting the RMB is somewhat undervalued.

This presents an interesting dynamic. What are the implications of a strong versus weak dollar for the U.S.? A strong dollar has two main effects. First, on asset prices: as the dollar appreciates, dollar-denominated assets perform better—benefiting U.S. Treasuries and global U.S. equities, increasing market willingness to buy U.S. debt. Second, on industry: stronger dollar purchasing power lowers costs for U.S. multinational corporations but undermines competitiveness of domestic industrial goods in global markets, hindering reindustrialization. The effects of a weak dollar are the opposite. Considering Trump’s overall policy vision—enhancing great power competitiveness through industrial return and increased production capacity—a weak dollar policy seems aligned. However, a problem arises: a weak dollar leads to depreciation of dollar-denominated assets. Given the fragility of the current U.S. economy and its financing pressures, too rapid a shift toward a weak dollar could prevent the U.S. from surviving the reform-induced pain period.

A representative event illustrating this pressure occurred on February 25, when Buffett’s annual shareholder letter explicitly criticized the U.S. fiscal deficit—amplifying market concerns. We know that for a long time, Buffett’s portfolio strategy has involved selling overvalued U.S. risk assets, increasing cash reserves invested in short-term U.S. Treasuries, and allocating to Japan’s five major trading companies—a form of carry trade, though no need to elaborate here. The point is, Buffett’s views carry significant weight. Capital overweighted in dollars shares a common concern: the real purchasing power of the dollar, i.e., fears of dollar depreciation. Hence, rapidly entering a depreciation phase would bring immense pressure.

Nonetheless, both China and the U.S. will likely choose to trade space for time to gradually reduce debt. The dollar is expected to follow a pattern of strengthening before weakening. Movements in dollar-denominated assets will align accordingly. Cryptocurrencies are among the assets affected by this tide.

Finally, the author’s view on the crypto market: uncertainty remains high. Individual investors might consider a barbell strategy to enhance portfolio antifragility—allocating to blue-chip cryptocurrencies or low-risk DeFi yields on one end, and small positions in high-volatility assets on dips on the other. Given the confluence of multiple adverse factors, short-term price pressure is evident. Yet no clear structural risks are visible. Therefore, if panic-driven overselling causes excessive drawdowns, selective accumulation could be a reasonable approach.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News