Understanding the Fluid Mechanism: How to Mitigate Liquidity Crises During Large-Scale Liquidation Events?

TechFlow Selected TechFlow Selected

Understanding the Fluid Mechanism: How to Mitigate Liquidity Crises During Large-Scale Liquidation Events?

Fluid is currently the only lending market capable of proactively preventing liquidity crises.

Author: DMH

Translation: TechFlow

(Original image from DMH, translated by TechFlow)

Summary

-

Fluid performed exceptionally during the largest liquidation event in history, successfully completing liquidations and saving users millions of dollars.

-

Fluid is currently the only lending market capable of proactively addressing liquidity crises.

-

The design of Fluid DEX further enhances the security and user experience of the Fluid lending market.

Background

Last week witnessed the largest-scale liquidation event in market history, and once again Fluid demonstrated its robust stability. During this event, Fluid successfully completed liquidations with the highest liquidation threshold in the market (Liquidation Threshold, up to 97%) and the lowest liquidation penalty (Liquidation Penalty, as low as 0.1%).

What are the main threats faced by lending markets during a liquidation event?

-

Bad debt arising from failure to liquidate in time.

-

Assets requiring liquidation reach 100% utilization, making liquidation impossible.

During last August's market crash, ETH plummeted 16% within just four minutes. I previously analyzed in detail how Fluid’s efficient liquidation mechanism helped users recover millions of dollars in losses.

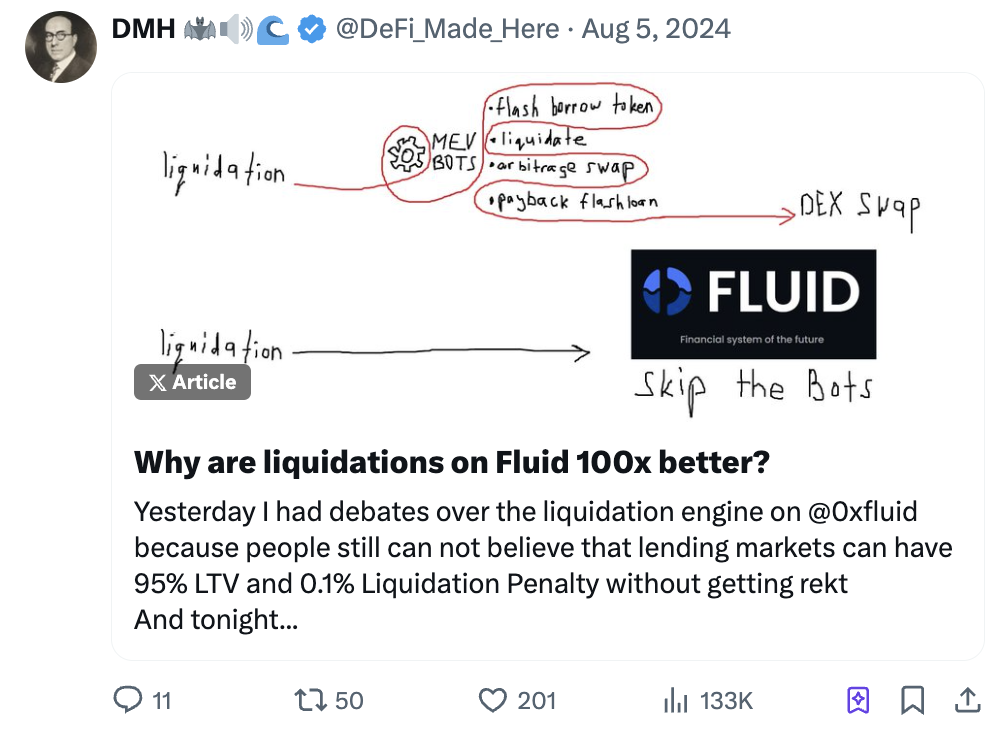

However, like other lending markets that rehypothecate assets, Fluid previously lacked a comprehensive security mechanism for liquidity crises. To better illustrate this, it's important to understand the basic liquidation process: liquidators must seize collateral and repay debt to complete a liquidation. If the collateral needing liquidation has already been fully borrowed out, liquidation cannot proceed, resulting in bad debt for the protocol.

How does the introduction of Fluid DEX change the current situation?

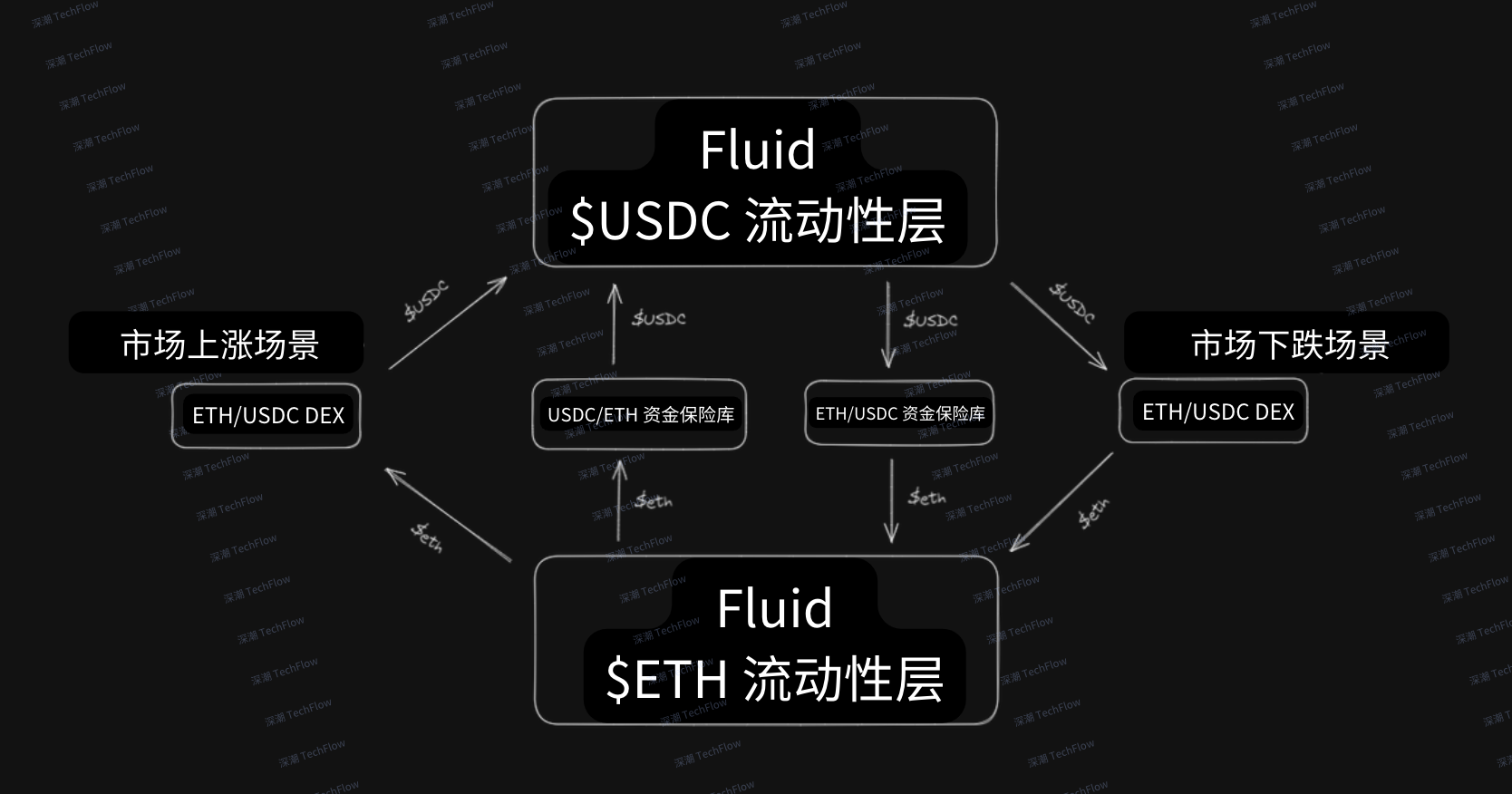

In the event of a sudden market crash, ETH in the market will be sold for USDC. In such cases, liquidity providers (LPs) on decentralized exchange (DEX) protocols receive ETH while providing USDC to traders. This process effectively increases ETH liquidity within the protocol and further boosts overall ETH liquidity across the entire Fluid system, thereby preventing liquidity crises.

Conversely, when the market is trending upward, liquidations tend to involve positions with USDC as collateral and ETH as debt. In this environment, more USDC flows into the Fluid system while ETH flows out. This dynamic increases USDC liquidity, making the liquidation process more efficient and seamless.

Fluid is currently the only lending market capable of proactively preventing liquidity crises. In contrast, other lending markets can only respond to liquidity issues through passive measures (for example, increasing borrowing APR when asset utilization rises). However, such passive approaches often prove ineffective during sudden market crashes.

The Fluid lending market was initially powered by Fluid DEX, and now Fluid DEX reciprocates by ensuring ample liquidity is always available during liquidations, giving the Fluid lending market a significant advantage. This synergy dramatically improves capital market efficiency, increasing it tenfold.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News