2024 Web3 Gaming Retrospective: Constant Innovation, Yet Still Absent in a Bull Market?

TechFlow Selected TechFlow Selected

2024 Web3 Gaming Retrospective: Constant Innovation, Yet Still Absent in a Bull Market?

This report provides an in-depth analysis of the underlying reasons for Web3 gaming's underperformance during the 2024 bull market.

Author: Stella

In 2024, the Web3 gaming industry presented a complex landscape—marked by significant progress alongside persistent challenges. While daily active users surged over 300%, and traditional game companies began concrete moves into the space, market performance told a different story: the sector’s market cap grew only 60.5%, significantly underperforming meme coins and AI-related sectors. As Bitcoin reached new all-time highs and various crypto verticals flourished, a critical question emerged: "Has Web3 gaming missed its best opportunity in this bull cycle?"

Beneath these surface-level metrics, however, 2024 marked a pivotal transformation for the industry, transitioning from pure speculation toward maturity. This report analyzes how Web3 gaming evolved throughout the 2024 market cycle, examining key indicators, technological advancements, and strategic shifts. From infrastructure development to user engagement models, we explore how the industry is building sustainable growth while tackling barriers to mainstream adoption.

Note: Unless otherwise specified, all data in this report is current as of December 15, 2024. Data sources include Footprint Analytics and CoinMarketCap.

Key Annual Metrics Overview

-

Market Cap: Reached $31.8 billion, up 60.5%;

-

Trading Volume: $5.2 billion, up 18.5%

-

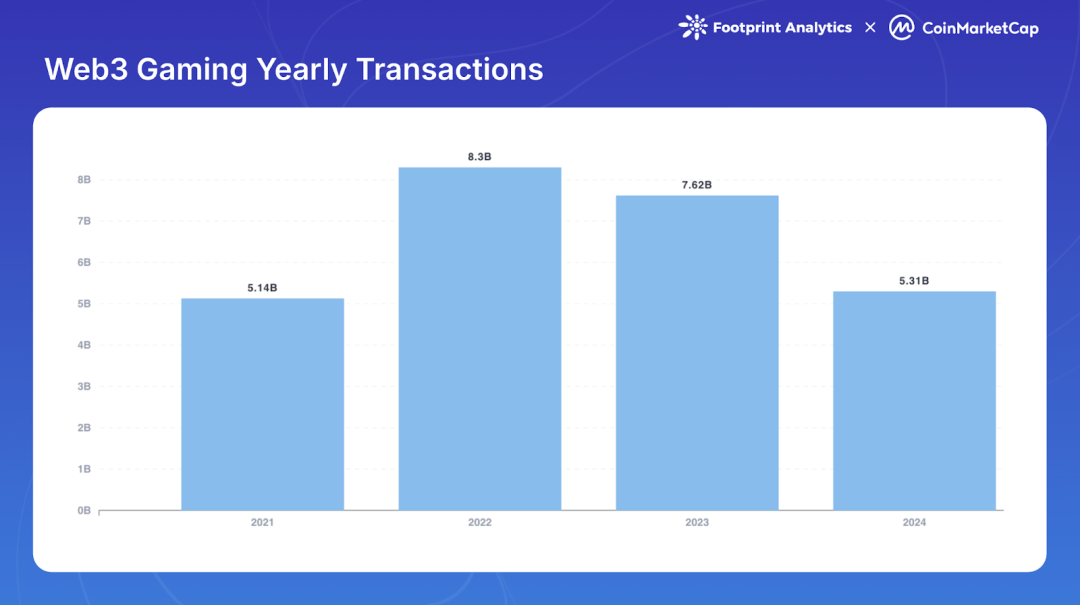

Number of Transactions: 5.3 billion, down 30.3%

-

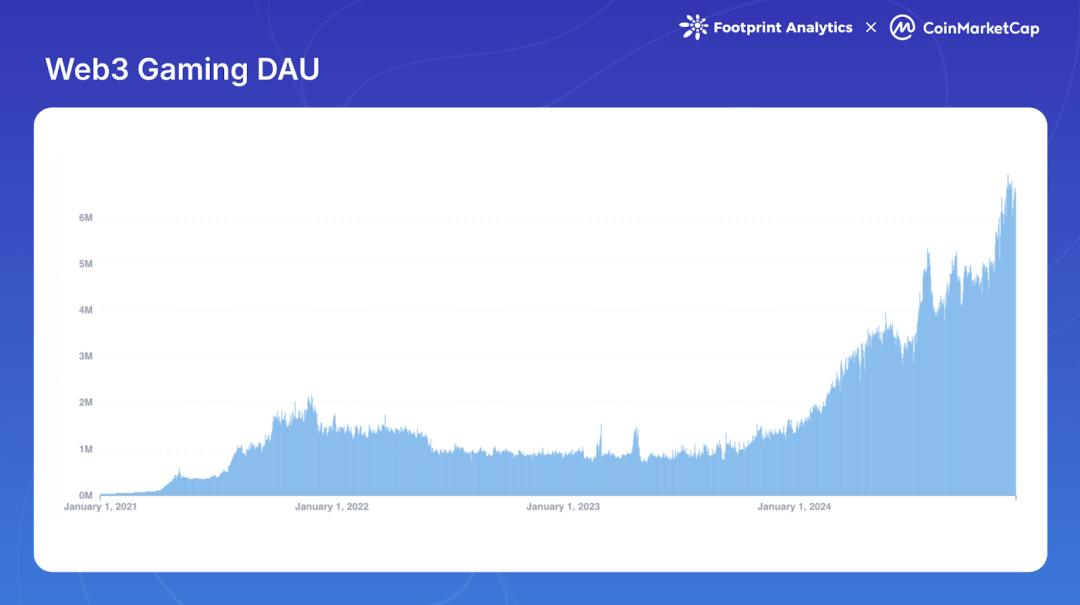

Daily Active Users (DAU): Peaked at 6.6 million by year-end, up 308.6% from start of year;

-

Active Games: Out of 3,602 total games, 1,361 remained active (37.8%);

-

Annual Funding: 220 funding events totaling $910 million;

-

Leading Blockchains:

-

Trading Volume Share: BNB Chain (23.1%), Ethereum (17.6%), Blast (9.2%);

-

Transaction Count Share: WAX (33.6%), Aptos (11.6%), Ronin (6.1%);

-

Daily Active Users: opBNB (2.2M), Ronin (1.1M), Nebula (458K) — average for December.

Market Performance Analysis

Market Capitalization Trends

The Web3 gaming sector achieved strong growth in 2024 but lagged behind other crypto sectors. According to Footprint Analytics, the market cap of gaming tokens reached $31.8 billion by year-end—an increase of 60.5% compared to the previous year. Although the sector hit an intra-year high of $47.4 billion in March, it still fell far short of the all-time peak of $114.1 billion recorded in November 2021.

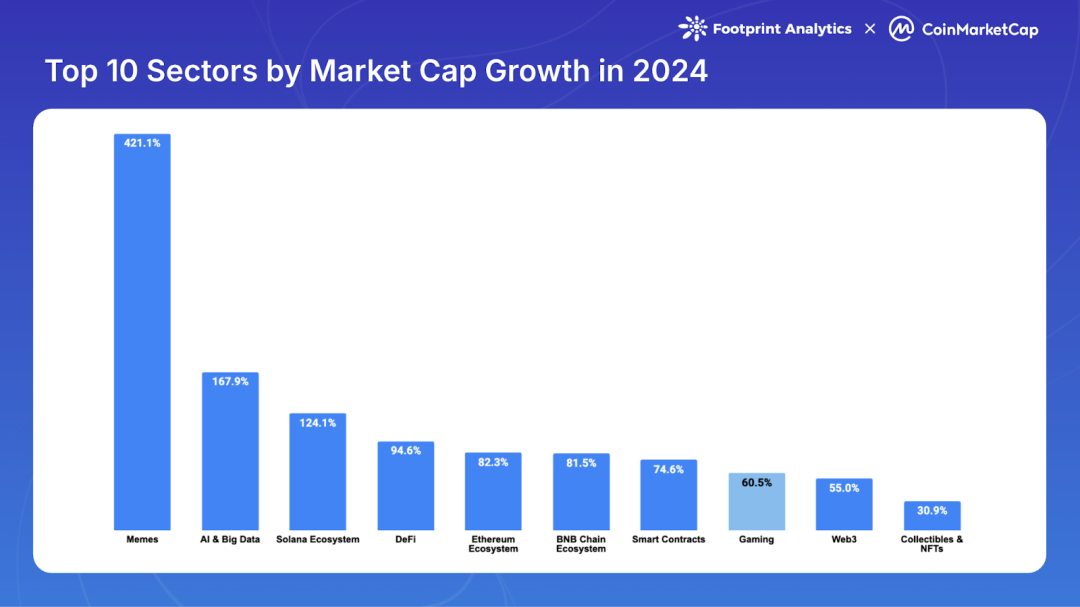

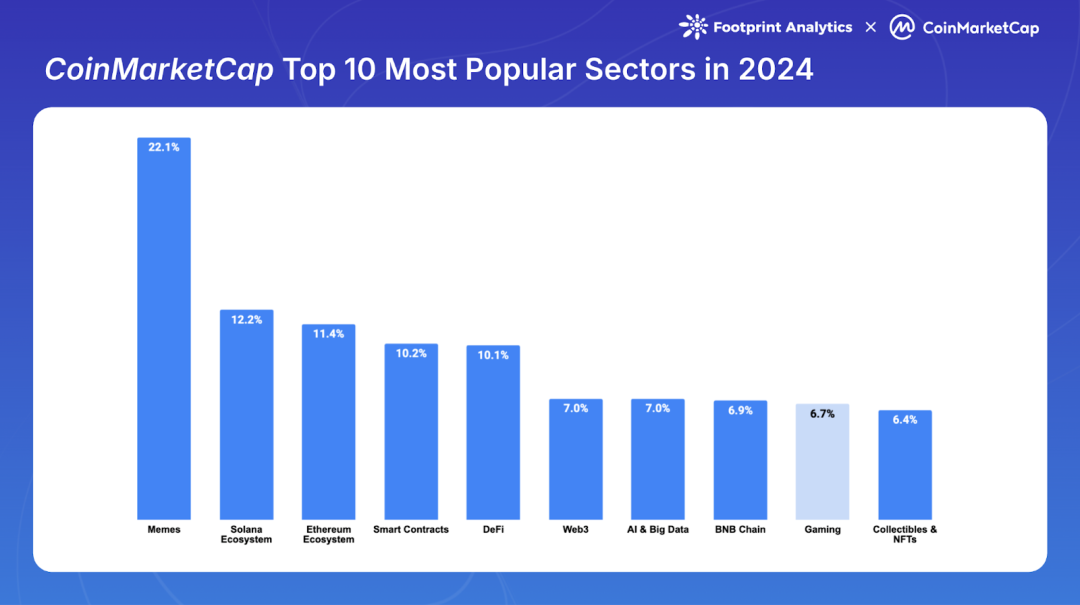

Despite robust overall crypto market performance in the second half of 2024—especially driven by Bitcoin's surge in the final two months—gaming tokens underperformed relative to other sectors. Data from CoinMarketCap shows that Web3 gaming ranked eighth out of the top ten sectors in terms of market cap growth, significantly trailing leaders such as meme coins (421.1%), AI & Big Data (168.0%), and Solana ecosystem projects (124.1%).

This underperformance extended to community interest as well. On CoinMarketCap’s list of most-watched categories, Web3 gaming captured only 6.7% of total views among the top ten sectors, ranking ninth—overshadowed by meme coin-related projects throughout the year.

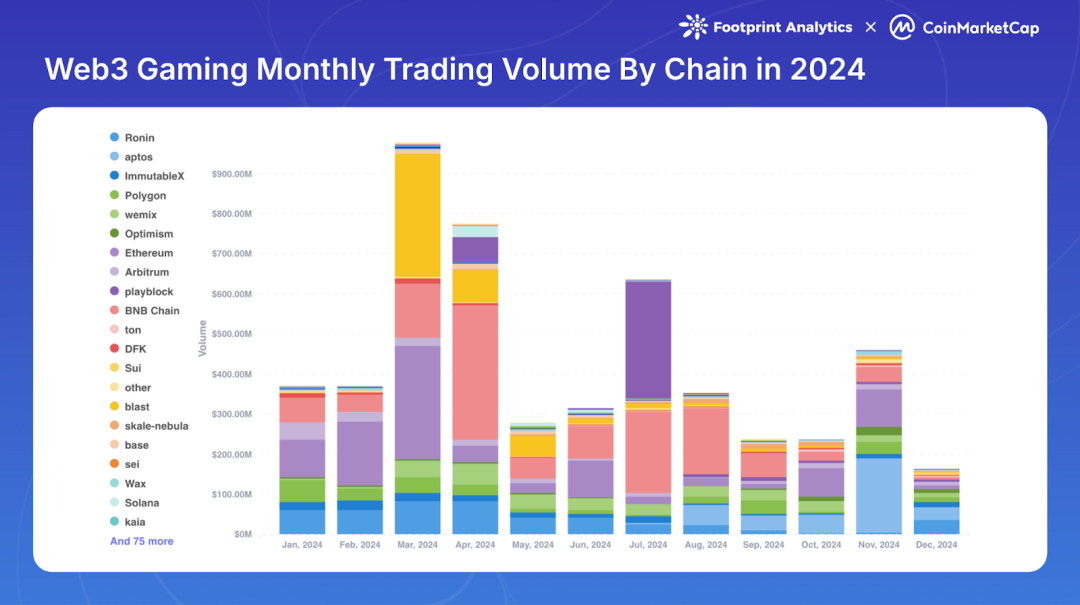

Trading Volume Analysis

Web3 gaming showed mixed results on key metrics in 2024—trading volume increased, but transaction count continued to decline.

Volume Trends

Total trading volume for Web3 gaming reached $5.2 billion in 2024, up 18.5% from 2023. This reversed the downward trend seen since 2021, though volumes remain drastically below prior cycle peaks. The 2024 figure represents just 6.2% of the 2021 peak ($84.1 billion) and 15.1% of 2022’s volume ($34.5 billion).

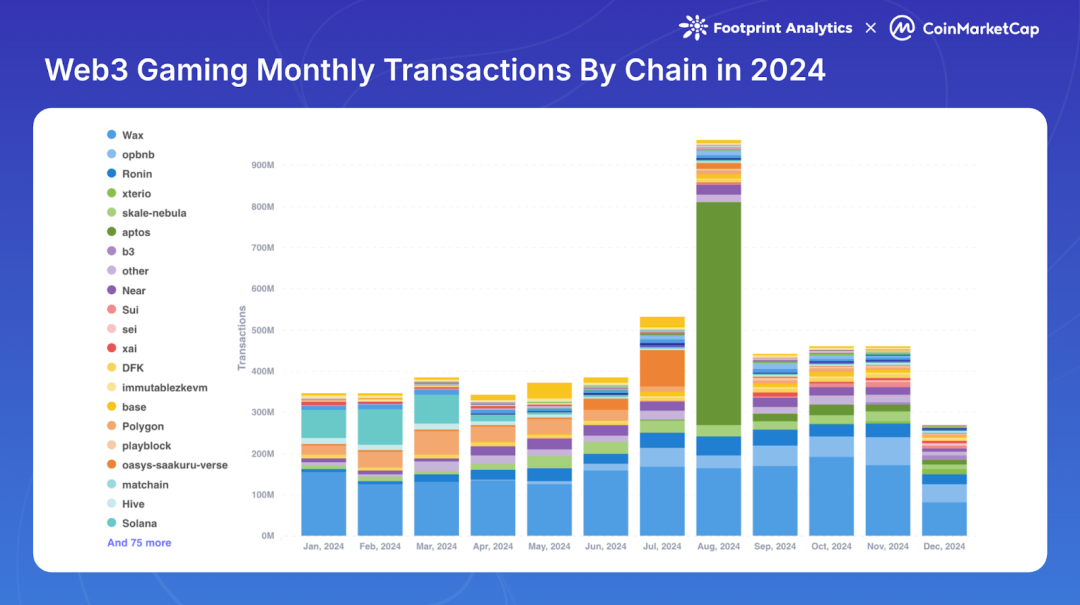

Transaction Count Trends

Total transactions amounted to 5.3 billion in 2024, a 30.3% decrease from the previous year. While this level is comparable to 2021’s 5.1 billion transactions, it fails to reverse the declining trend that began in 2022.

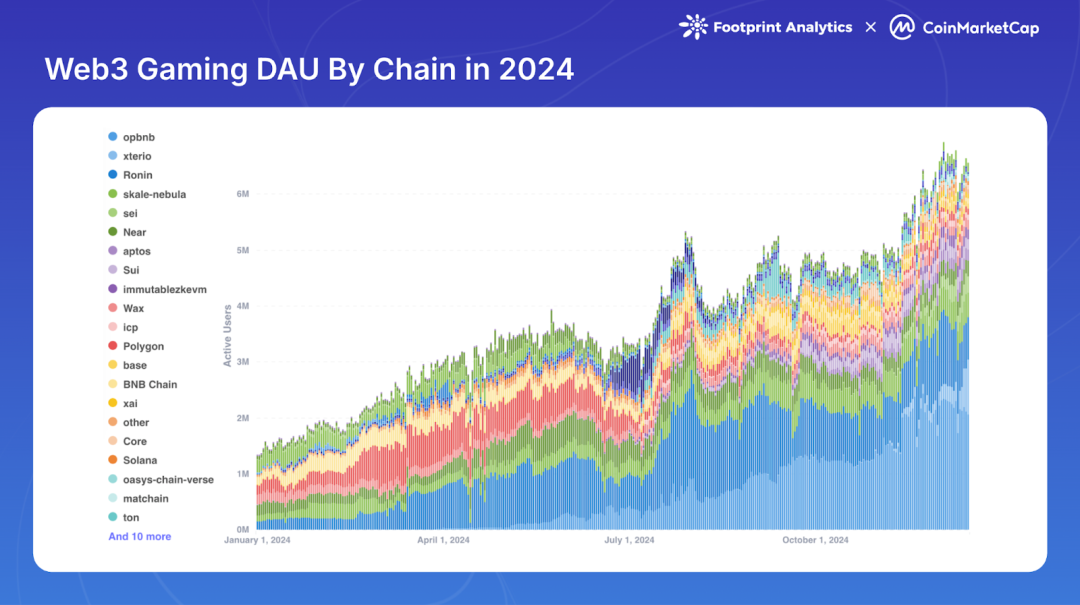

User Engagement

Daily active users (DAU) saw substantial growth in 2024, rising from an average of 1.6 million in January to 6.6 million in December—an increase of 308.6%. This surpassed the previous cycle’s peak of 1.8 million DAU set in November 2021. Although some bot activity may be included in these figures, the upward trajectory reflects meaningful user engagement within the sector.

Ecosystem Development

Blockchain Competition and Evolution

Performance Across Major Blockchains

In 2024, leadership among blockchains supporting Web3 gaming shifted significantly, with different chains excelling across transaction volume, transaction count, and user participation.

Transaction Volume Distribution

BNB Chain maintained dominance in trading volume with $1.2 billion (23.1% market share), followed by Ethereum at $920 million (17.6%). Blast and Ronin held 9.2% and 9.0% shares respectively.

Transaction Count by Chain

Despite an overall 30.3% decline in transaction count across the sector, certain blockchains performed strongly. WAX led with 1.8 billion transactions (33.6% of total). Aptos rose rapidly due to Tapos, a Telegram-based “tap-to-earn” game, recording 620 million transactions (11.6%), including 540 million in August alone. Ronin and opBNB each recorded around 320 million transactions.

Users by Chain

Chain-level user engagement grew significantly, especially in the second half of 2024. opBNB emerged as a leader in user activity, averaging 2.2 million DAU in December—surpassing long-time leader Ronin (1.1 million). Nebula, a Layer 2 built on SKALE, ranked third with 458K average DAU. NEAR, Sui, and Sei entered the top ten in DAU rankings, reflecting an expanding competitive landscape and users’ willingness to adopt newer platforms.

The diversification of chain usage signals increasing ecosystem maturity, as different blockchains find niches tailored to specific game types and user preferences. Leading networks are no longer just providing base-layer infrastructure—they’re evolving into comprehensive platforms for game developers. Initiatives like Arbitrum Foundation’s $2 billion ARB Game Catalyst Program, Starknet Foundation’s 50 million STRK token distribution, and major grant programs from Sui and Xai demonstrate how chains are using strategic incentives to attract and retain high-quality game projects.

Infrastructure Improvements

Scalability Enhancements

Blockchain processing capacity has improved dramatically, with current networks handling over 50 times more transactions per second than four years ago. This leap was enabled by the rise of Ethereum Layer 2 and Layer 3 solutions—including Immutable zkEVM, Avalanche L1-based chains, Oasys, SKALE, and Arbitrum Orbit game-specific chains—as well as high-throughput blockchains like Solana, Sui, and Aptos.

Game-dedicated chains also made major strides. In June 2024, Ronin announced its Layer 2 plan, Ronin zkEVM, allowing developers to deploy their own zkEVM chains. Immutable zkEVM took a strategic step toward greater accessibility by removing deployment whitelists and enabling permissionless deployments. Additionally, Avalanche completed its most significant upgrade since mainnet launch—"Avalanche9000"—which focused on lowering barriers for customized L1 creation and improving interoperability.

Gas Fee Reductions

Ethereum’s March 2024 "Dencun" upgrade (also known as "Proto-Danksharding" or EIP-4844) was a landmark event, dramatically reducing costs on L2 networks. The impact was profound: gas fees dropped from several dollars to mere cents or less—eliminating one of the biggest friction points for blockchain game developers and players alike.

Improved Cross-Chain Interoperability

Chainlink’s Cross-Chain Interoperability Protocol (CCIP) saw notable adoption in 2024, enabling developers to build games that interact with assets across multiple chains. This advancement greatly enhanced in-game item interoperability.

The adoption of standardized digital asset formats, particularly ERC-721 and ERC-1155, became even more widespread. These standards ensure NFTs can be recognized and used across various games and platforms, simplifying asset transfers and interactions.

2024 also saw the rise of decentralized platforms supporting cross-chain gaming. Portal, Fractal ID, and Web3Games provided essential infrastructure for seamless asset movement and interaction between different blockchain ecosystems.

Project Development

2024 was a pivotal year for Web3 gaming. Beyond traditional studios entering the space, the ecosystem welcomed several major game launches. Highly anticipated titles such as Off The Grid and MapleStory Universe entered early access, while Illuvium officially launched. Pirate Nation successfully executed its token generation event (TGE), featuring a successful "play-to-airdrop" campaign.

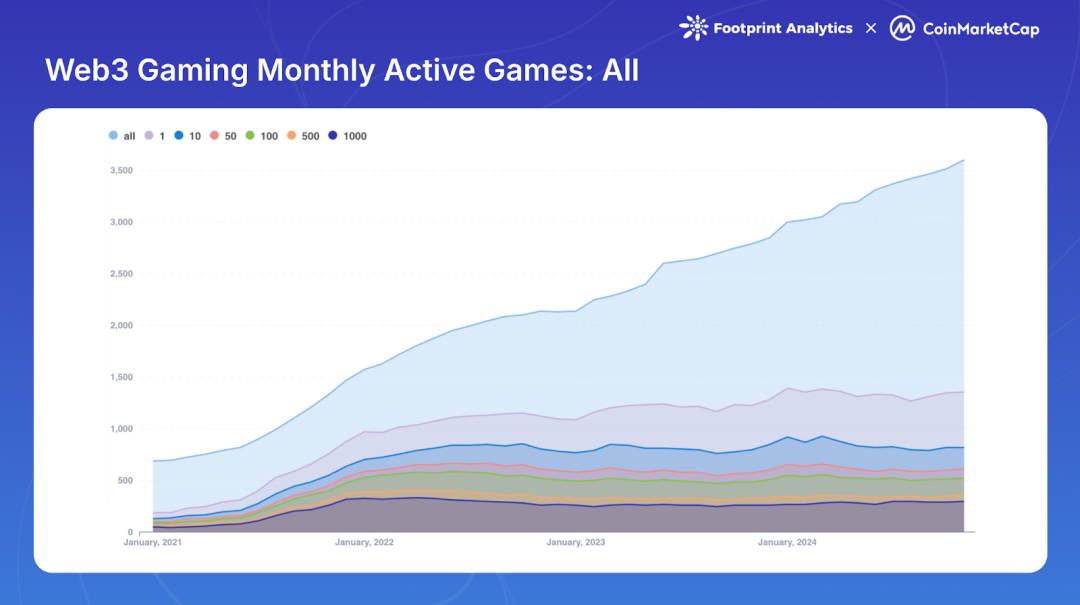

Analysis of Active Games

As of November 30, 2024, the total number of blockchain games reached 3,602—up from 2,997 in January. However, active game metrics revealed challenging trends. Only 1,361 games (37.8%) remained actively engaged on-chain, meaning 2,241 games (62.2%) were inactive. Moreover, despite overall growth in total games, the number of active games declined slightly from 1,387 in January.

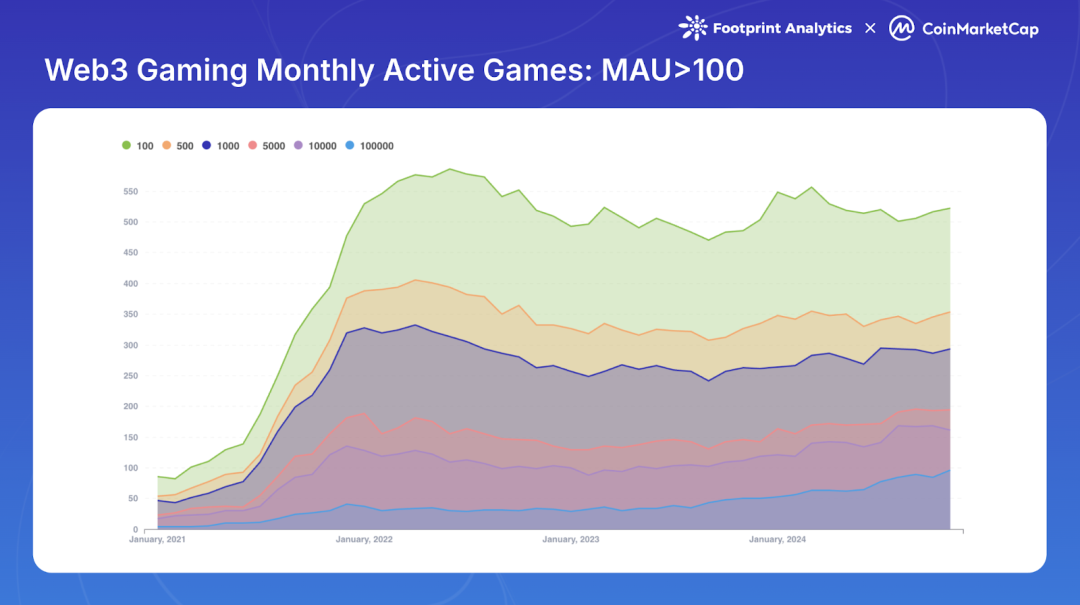

A deeper look at user engagement reveals further market concentration. The number of games with over 100K monthly active users (MAU) decreased from 586 in June 2022 to 522 by end of 2024. In November 2024, 161 games (4.5% of total) achieved over 10K MAU, with 96 (2.7%) surpassing 100K MAU.

This user concentration indicates a maturing market where successful games capture larger audiences—a trend influenced by intense competition, rapid iteration, and the emergence of "winner-takes-more" dynamics within the ecosystem.

Innovation Landscape

Cross-Platform Gaming Trends

Mobile gaming, emphasizing accessibility and seamless UX, solidified its position in 2024 as the dominant platform for Web3 games. The mobile-first approach has reshaped how developers design blockchain games—prioritizing intuitive interfaces and simplified onboarding. Among newly launched Web3 games in 2024, mobile titles accounted for 29.4%.

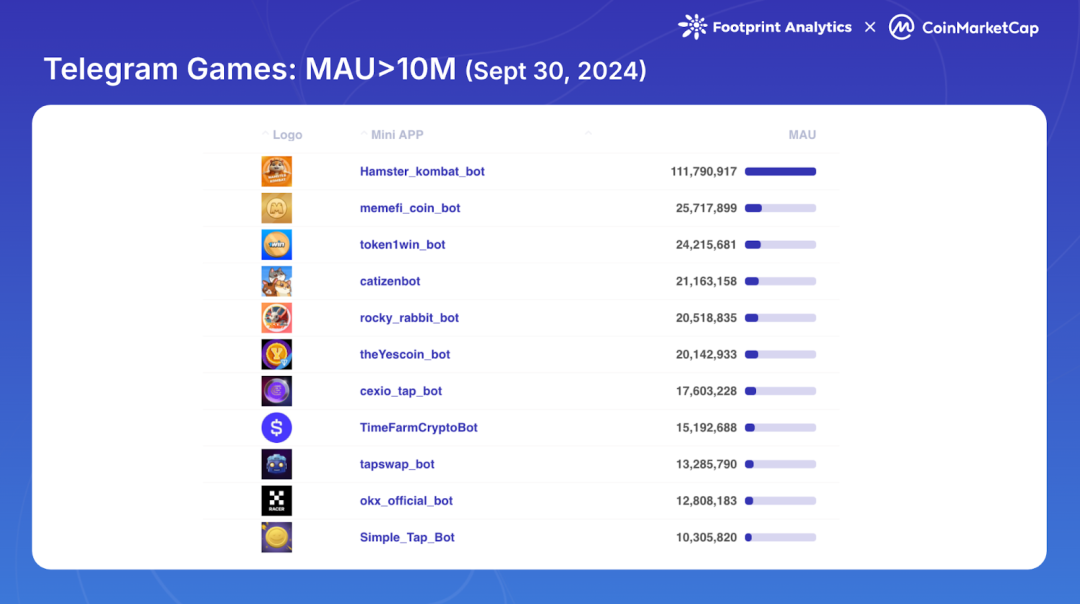

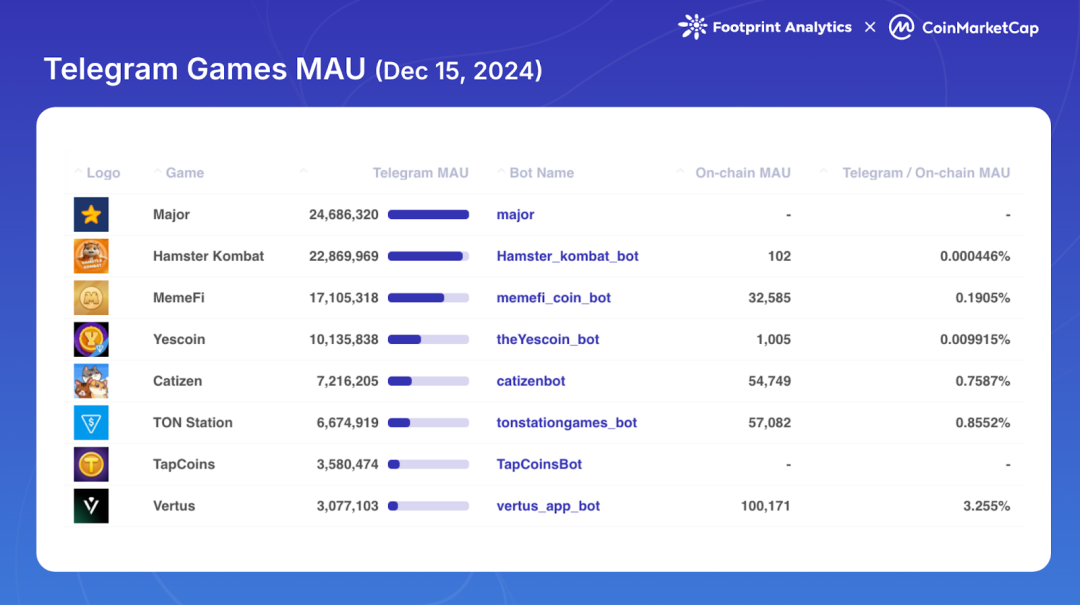

Social platforms, particularly Telegram, emerged as powerful catalysts for Web3 gaming adoption, representing 20.9% of new releases. Telegram’s success stems from its massive user base, frictionless in-app experience, and ability to bypass traditional app store restrictions. Its influence peaked in Q3 2024 when 11 games exceeded 10 million MAU. Notably, TON successfully converted much of this user base into on-chain participants, creating spillover effects across Web3 gaming, meme coins, and DeFi. This success prompted other blockchains—including Aptos, Sui, and Core—to race for Telegram traffic by launching or supporting Telegram-based games.

Similarly, Line announced plans in December 2024 to launch 20 mini dApps, signaling growing interest from mainstream messaging platforms in integrating blockchain gaming.

Console gaming remains relatively untapped in Web3, with major manufacturers like Microsoft and Sony maintaining cautious stances. However, new approaches are emerging to bridge this gap. Developers like Gunzilla Games with Off The Grid are separating core gameplay from blockchain features to meet expectations of traditional console gaming. Meanwhile, blockchain platforms are developing dedicated Web3 gaming handhelds—such as Sui’s SuiPlay0X1 and Solana’s Play Solana Gen1 (PSG1)—potentially creating a new category of specialized hardware.

Traditional Game Studios Enter the Space

2024 marked a turning point in how traditional game companies view blockchain gaming, shifting from experimental steps to strategic positioning.

Ubisoft launched Champions Tactics: Grimoria Chronicles in October on Oasys Layer 2 HOME Verse. The tactical RPG integrates NFT-based features while preserving traditional gameplay elements.

Square Enix strengthened its blockchain presence through strategic investments and partnerships. In addition to investing in platforms Elixir Games and HyperPlay, the company announced it would bring its Symbiogenesis title to HyperPlay.

Sony Group’s involvement signaled a major move into blockchain gaming, both through investment and infrastructure. Alongside a $10 million investment in double jump.tokyo Inc.’s Series D round, Sony unveiled Soneium—a Layer 2 network designed to connect Web3 innovation with consumer applications in gaming and entertainment.

AI Integration in Game Development

As artificial intelligence transformed industries in 2024, Web3 gaming emerged as a key beneficiary of AI innovation, unlocking new possibilities for development and player experience.

AI has revolutionized in-game interactions and content generation. Studios are leveraging AI to create more sophisticated non-player characters (NPCs) that adapt to player behavior and generate personalized quests based on individual play history and preferences. This personalization enhances engagement by making experiences more relevant and immersive.

On the development side, AI has dramatically streamlined creative workflows. Developers now use AI tools to auto-generate environments and assets, significantly reducing production time and cost. This empowers smaller teams to compete with large studios in delivering high-quality content.

AI also strengthens operational aspects of Web3 games. It automates testing processes and monitors on-chain transactions for fraud or cheating—critical in games with complex economic systems. Furthermore, AI algorithms help optimize game economies and token models, addressing one of the toughest challenges in Web3 game design.

Investment Landscape

Overview of Annual Funding Events

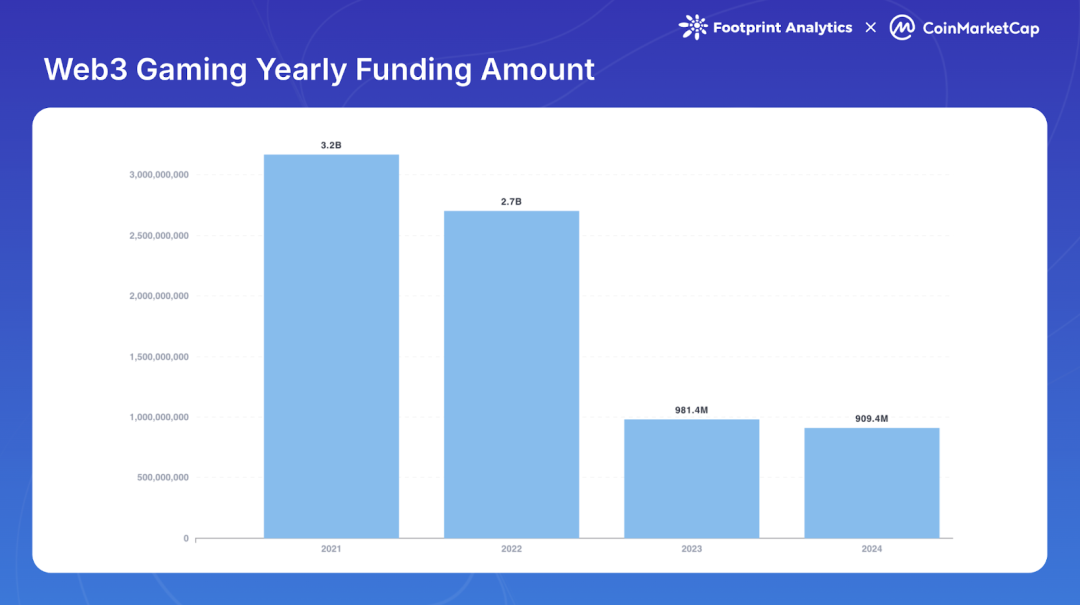

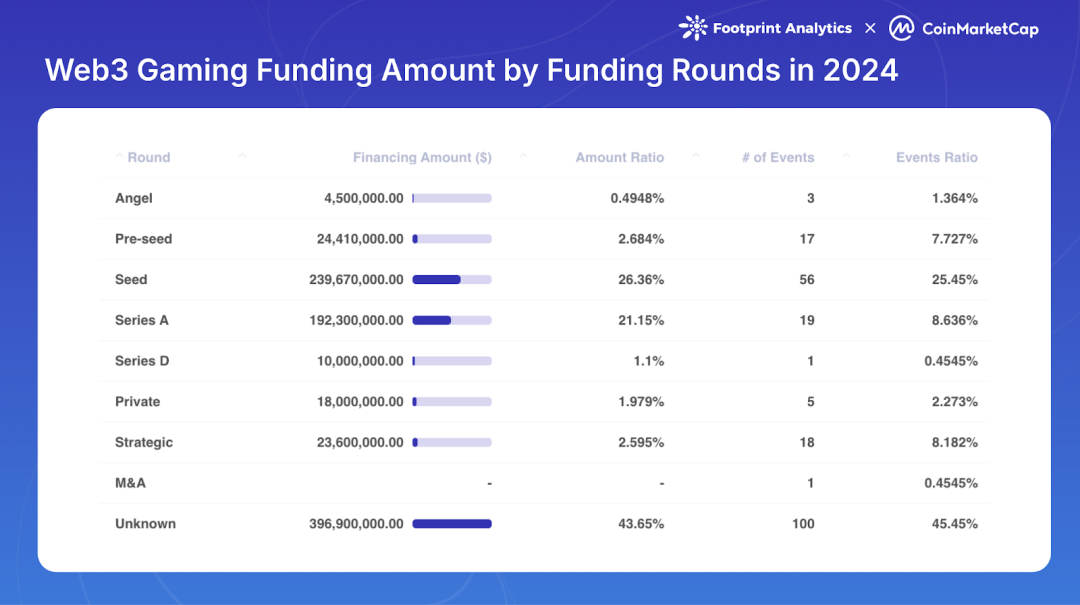

Web3 gaming raised $910 million in 2024 through 220 funding rounds. While total capital was down 7.3% from 2023 and far below the boom years of 2021–2022 ($3.2B and $2.7B respectively), the number of deals increased 48.7% year-over-year—indicating sustained investor interest despite smaller average deal sizes.

The year showed a clear bias toward early-stage investments: 76 early-stage deals (34.6% of total) versus only 20 Series A or later rounds (9.1%). This suggests that while new projects continue to secure initial funding, many ventures from the 2021–2022 boom face difficulties raising follow-on capital.

Among investors, Animoca Brands remained the most active, completing 38 deals—an increase of 192.3% from 2023—and participating in 17.3% of all 2024 funding events. Spartan Group and Big Brain Holdings followed with 22 and 15 investments respectively. The top ten investors collectively participated in 152 deals.

Major Funding Rounds

Seven projects raised over $20 million in single rounds during 2024. Azra Games led with a $42.7 million Series A, aiming to bring console-quality gaming experiences to mobile.

In cumulative fundraising, Monkey Tilt raised $51 million across two rounds as a hybrid “gaming-entertainment-gambling” platform. Gunzilla Games secured four funding rounds from prominent backers including VanEck, Coinbase Ventures, Delphi Ventures, and Avalanche’s Blizzard Fund—demonstrating strong investor confidence.

Strategic Investment Trends

As the industry matures beyond the 2021–2022 hype phase, focus has shifted toward fewer but higher-quality projects, with investors becoming more selective.

Funding increasingly targets game infrastructure and development tools—not just finished games. Notable examples include NPC Labs, which raised $18 million in seed funding to build Web3 games on Base, and Alliance Games, which secured $5 million in Series A funding for its AI-driven decentralized infrastructure. This reflects growing investor interest in foundational technologies capable of supporting multiple games and platforms.

Platforms and multi-chain development attracted significant attention, especially projects building cross-chain gaming ecosystems. Seeds Labs raised $12 million for its flagship title Bladerite on Solana, while B3 launched its Open Gaming Layer—highlighting investor appetite for expanded cross-chain capabilities.

Additionally, new game genres gained notable traction in 2024, particularly Telegram-based games and gambling-focused projects—despite ongoing regulatory uncertainty.

Industry Evolution and Future Outlook

In 2024, the Web3 gaming industry underwent a significant evolution in game design. The previously dominant "play-to-earn" model gave way to more sustainable approaches. Telegram-based "tap-to-earn" games demonstrated unprecedented user acquisition potential, while strategies like Pirate Nation and Pixels' "play-to-airdrop" introduced novel engagement mechanics. Meanwhile, mature projects adopted "play-and-earn" models, prioritizing gameplay over financial incentives.

Nonetheless, the sector continues to face persistent challenges. Technical barriers remain significant, particularly in achieving seamless blockchain integration without compromising gameplay quality. Regulatory uncertainty, especially regarding gambling mechanics and token classification, continues to affect development decisions.

Most critically, sustaining on-chain engagement has become a fundamental challenge. This is evident in the performance of Telegram games: Hamster Kombat’s MAU dropped from over 100 million in September to 22.9 million by mid-December, with only 0.0004% of users participating in on-chain gaming activities. While other Telegram games show higher conversion rates, most still fall below 1%. Importantly, these metrics specifically reflect on-chain activity—since most Telegram games keep core gameplay off-chain, users may instead be active in meme coins or DeFi. This highlights the ongoing difficulty of converting platform users into active blockchain gamers.

Outlook for 2025: Reclaiming Relevance

As Web3 gaming seeks to reestablish its position within the broader crypto landscape, several key trends emerge as potential catalysts for transformation:

Social Platform Integration stands as the most promising path to mainstream relevance. The explosive success of Telegram games demonstrates the power of meeting users where they already are—with platforms like Line and TikTok poised to follow. This approach could finally solve the sector’s long-standing user acquisition problem by leveraging existing social networks rather than building communities from scratch.

AI Integration will evolve from a marketing feature into a core driver of innovation. Beyond enhancing development and NPC interactions, AI may address fundamental challenges in economic design and user retention—areas where Web3 games have traditionally struggled to match conventional gaming experiences.

Growth Through Integration may ultimately determine the sector’s relevance. Success may not come from competing directly with traditional games or other crypto verticals, but from seamlessly blending with them. This means focusing on how blockchain enhances—rather than defines—the gaming experience, developing more sophisticated tokenomics, and placing user experience above crypto-native features.

In conclusion, the role of Web3 gaming in the crypto ecosystem may not be about dominance, but about integration. By thoughtfully connecting traditional gaming, social platforms, and blockchain technology, Web3 gaming is positioned to deliver genuine innovation. This evolution won’t just help the industry break free from being “just another crypto vertical”—it may well make it a defining force in shaping the future of gaming.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News