Asia's Cryptocurrency Tax Landscape: From Tax-Free Havens to High-Tax Regions, A Comprehensive Overview of National Tax Policies

TechFlow Selected TechFlow Selected

Asia's Cryptocurrency Tax Landscape: From Tax-Free Havens to High-Tax Regions, A Comprehensive Overview of National Tax Policies

To achieve success in cryptocurrency tax policy, balanced policies must be established.

Author: Tiger Research

Translation: TechFlow

TL;DR

-

Tax policies across countries vary widely, including tax exemptions, progressive taxation, flat rates, transitional schemes, and transaction-based taxation—reflecting different economic strategies and policy priorities in each jurisdiction.

-

Governments aim to increase fiscal revenue through taxation, while investors worry that high tax burdens could undermine profitability. This tension has led capital to flow toward overseas exchanges.

-

To achieve success in cryptocurrency taxation, balanced policies must be established—not only focusing on tax revenue but also promoting healthy market development.

1. Cryptocurrency Trading and Taxation

Since the emergence of the cryptocurrency market, taxation of trading activities has remained a contentious issue. The core conflict lies in differing perspectives between governments and investors: governments seek to boost fiscal revenue through taxation, whereas investors fear excessive tax burdens may reduce investment returns.

Nevertheless, taxation is a cornerstone of modern economies—not only a key source of government revenue but also a critical mechanism for driving market development. In the context of cryptocurrency markets, tax policy is expected to play three primary roles:

First, taxation can help establish a standardized market. Taking stock markets as an example, levying taxes on transactions or profits often signifies official recognition of assets, thereby providing a stable foundation for market activity.

Second, taxation enhances investor protection. For instance, the U.S. passed the Consumer Financial Protection Act in 2010, establishing the Consumer Financial Protection Bureau (CFPB) to safeguard investor rights. In Web3 markets, appropriate tax policies and regulation can restrict arbitrary product launches and misleading advertising, reducing fraud and protecting investors' legitimate interests.

Third, tax policy can accelerate integration between cryptocurrencies and traditional financial systems by clarifying their legal status. Such integration helps improve market stability and strengthen investor confidence.

However, due to the unique nature of cryptocurrency markets, simply borrowing from stock market practices cannot fully realize these positive effects. As the crypto market rapidly expands, many existing tax regimes have been criticized as "predatory" value extraction mechanisms, intensifying tensions between governments and investors.

Against this backdrop, this report analyzes cryptocurrency tax policies in major Asian countries and examines how effectively these three objectives—market standardization, investor protection, and system integration—are being implemented. Through multi-faceted analysis, it aims to provide both policymakers and investors with a more comprehensive perspective.

2. Comparative Analysis of Cryptocurrency Tax Policies in Major Asian Markets

Source: X

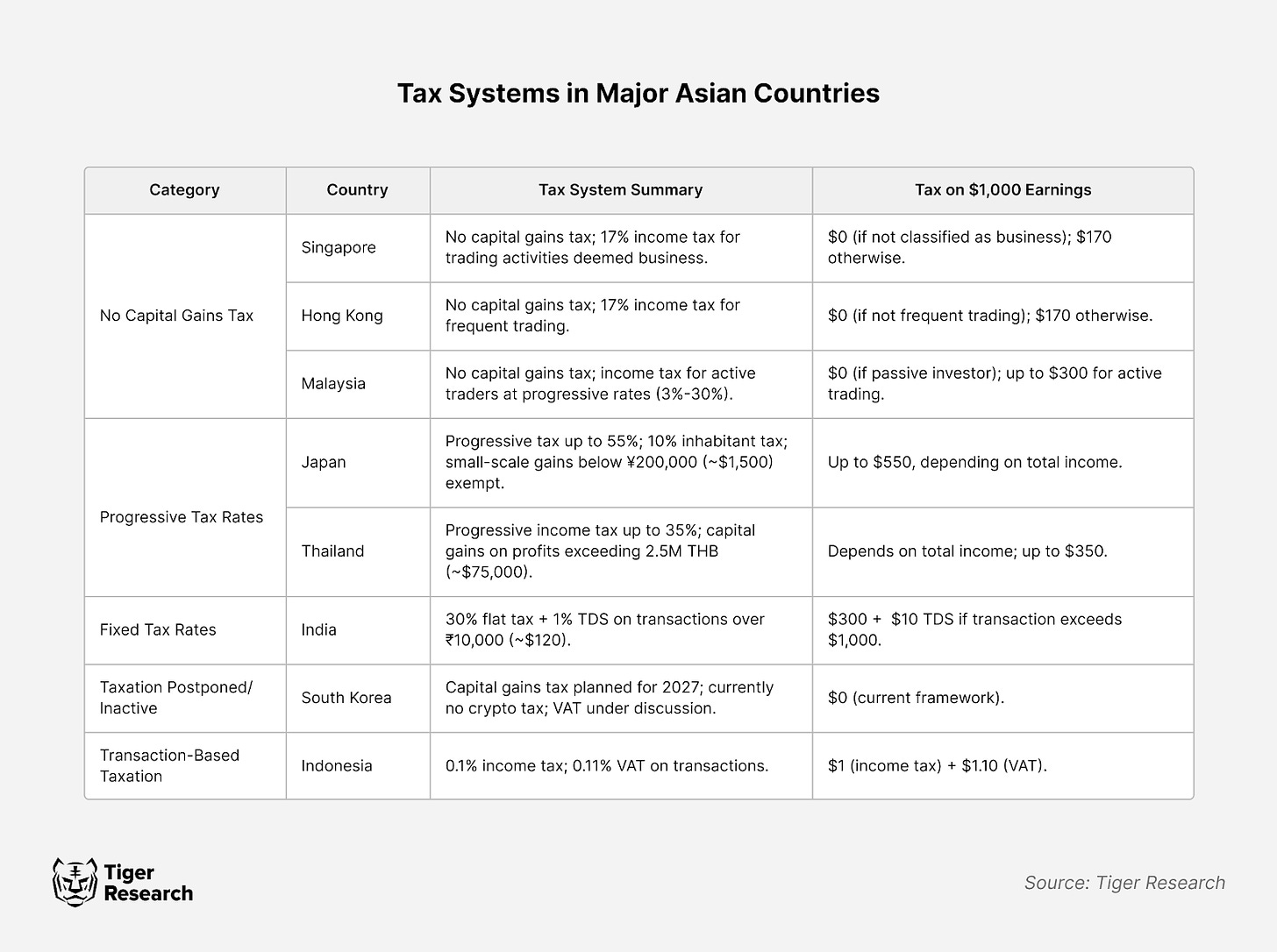

Analysis of cryptocurrency tax policies in major Asian countries reveals five distinct policy models, reflecting differences in economic structures and policy priorities.

For example, Singapore exempts capital gains from taxation and only imposes a 17% income tax on cryptocurrency earnings deemed commercial income. This flexible approach not only reduces the tax burden on investors but also reinforces Singapore’s position as a global cryptocurrency hub. Similarly, Hong Kong is exploring tax exemption policies for investment gains by hedge funds and family offices—a move aimed at attracting institutional investors.

In contrast, Japan adopts a markedly different high-tax model, imposing up to 55% tax on cryptocurrency trading to curb speculative behavior. However, amid evolving market conditions, Japan is now considering proposals to reduce the rate to 20%, signaling a potential shift in its tax strategy—one that may increasingly prioritize long-term market development.

2.1. Tax-Exempt Jurisdictions: Singapore, Hong Kong, Malaysia

Singapore, Hong Kong, and Malaysia—key financial centers in Asia—exempt capital gains from cryptocurrency investments. This policy aligns with their longstanding economic strategies.

Their tax-exempt frameworks extend established practices from traditional finance. By maintaining low tax rates (such as no capital gains tax on stock investments), they have historically attracted substantial international capital. Extending this principle to cryptocurrency reflects policy consistency and adherence to core economic principles.

This strategy has already yielded significant results. For instance, Singapore became Asia's largest cryptocurrency trading hub in 2021. With investment gains free from taxation, the country has drawn large numbers of active investors, fueling rapid market growth.

However, tax exemption policies face challenges. First, markets may overheat due to speculation; second, direct tax revenues for the government may decline. To address these issues, these jurisdictions employ alternative measures—generating indirect tax revenue through the expansion of financial services, and ensuring market stability via strict oversight of exchanges and financial institutions.

2.2. Progressive Tax Regimes: Japan and Thailand

Japan and Thailand apply high progressive tax rates to cryptocurrency trading profits. This approach reflects a broader social objective: redistributing wealth by taxing high-income individuals at higher rates. In Japan, the top marginal rate reaches 55%, consistent with taxation on traditional financial assets.

Yet high tax rates bring notable drawbacks. Most prominently, “capital flight” occurs when investors relocate assets to tax-friendly regions such as Singapore, Hong Kong, or Dubai. Additionally, heavy tax burdens may dampen market vitality and hinder growth. These concerns have drawn regulatory attention and may prompt future policy adjustments.

2.3. Flat-Rate Taxation: India

Source: ISH News YouTube

India applies a flat 30% tax rate on cryptocurrency trading profits. Unlike the progressive systems seen in traditional financial markets, this policy prioritizes administrative efficiency and market transparency.

Several outcomes stem from this design. First, the simple structure reduces compliance burdens for taxpayers and tax authorities alike. Second, applying a uniform rate across all transactions minimizes incentives for splitting trades or engaging in tax avoidance.

Nonetheless, flat-rate taxation has clear limitations. For small investors, even minimal gains are taxed at 30%, increasing investment costs. Moreover, applying the same rate regardless of income level raises fairness concerns. The Indian government has acknowledged these issues and is exploring reforms—such as lowering rates for small transactions or offering tax breaks for long-term holders—to preserve simplicity while fostering balanced market development.

2.4. Transitional Policy: South Korea

Source: Kyunghyang Shinmun

South Korea has adopted a cautious stance on cryptocurrency taxation, reflecting the sector’s inherent uncertainty. For example, the planned Financial Investment Income Tax, initially set for implementation in 2021, was delayed until 2025, with cryptocurrency taxation postponed further to 2027.

This transitional policy offers clear advantages. It allows the market space and time to evolve organically, while giving regulators a window to observe policy outcomes elsewhere—including in Japan and Singapore—and track global regulatory trends. By learning from others’ experiences, South Korea aims to build a more robust tax framework.

Still, this approach carries risks. In the absence of clear tax rules, market participants face uncertainty, which could encourage speculative excess. Furthermore, inadequate regulatory infrastructure may weaken investor protections, potentially undermining long-term market health.

2.5. Transaction-Based Taxation: Indonesia

Indonesia has introduced a unique transaction-based tax system, standing in sharp contrast to other Asian nations. Implemented in May 2022, it levies a 0.1% income tax and a 0.11% value-added tax (VAT) on every transaction—an integral part of Indonesia’s financial market modernization efforts.

This transaction-based model simplifies tax procedures through low, flat rates and encourages use of licensed exchanges, enhancing market transparency. Since rollout, trading volume on regulated platforms has increased significantly, demonstrating the policy’s positive impact.

However, the system has shortcomings. Like India, the flat rate disproportionately affects small traders. Frequent traders face accumulating tax costs, raising concerns about declining market liquidity.

To address these issues, the Indonesian government plans to refine the policy based on market feedback. Potential adjustments include reduced rates for small-value transactions and tax incentives for long-term investors—aimed at preserving the benefits of transaction-based taxation while mitigating its downsides.

3.Conflict Between Investors and Governments

Despite diverse approaches, conflict between governments and investors remains a common challenge in cryptocurrency taxation. This tension stems not just from tax levels, but from fundamentally different understandings of digital assets.

Governments often view cryptocurrency profits as a new revenue stream—especially important amid widening fiscal deficits caused by the pandemic. Rapid growth in the crypto market presents an opportunity for stable income. For example, Japan’s 55% progressive rate and India’s 30% flat rate highlight governmental emphasis on crypto taxation.

Source: GMB Labs

From investors’ perspectives, however, high tax rates are seen as barriers to market development. Higher taxes compared to traditional financial products, combined with compounding costs from frequent trading, suppress investment enthusiasm. Capital flight thus becomes a pressing issue—many investors transfer assets to offshore platforms like Binance or relocate to tax-exempt jurisdictions such as Singapore and Hong Kong. This suggests that government attempts to raise revenue may backfire.

Moreover, some governments focus narrowly on taxation while neglecting supportive market-building policies, exacerbating the divide. Investors often perceive such approaches as short-sighted and overly restrictive.

Therefore, finding a new balance between governments and investors is crucial. Resolving this issue requires more than adjusting tax rates—it demands innovative policies that promote healthy market growth while securing reasonable tax revenue. Achieving this balance will be a key challenge for governments worldwide in the coming years.

4. National Market Revitalization Policies and Activation Strategies

Cryptocurrency taxation can either stimulate or hinder market development. Some countries use tax policy to institutionalize and innovate within the market, while others experience stagnation and talent outflows due to high taxes and complex regulations.

Singapore exemplifies successful market activation. By exempting capital gains tax, it provides systemic support to blockchain firms and fosters innovation through regulatory sandboxes. This comprehensive strategy has cemented Singapore’s leadership in Asia’s cryptocurrency landscape.

Hong Kong also pursues proactive market development. While maintaining tax exemptions for individual investors, it has expanded licensing for digital asset management firms. Starting in 2024, qualified institutional investors will be allowed to trade cryptocurrency ETFs—further broadening market participation.

In contrast, high tax rates and complex systems in certain countries hinder market growth. Many investors move assets overseas due to excessive tax burdens, leading to brain drain and weakening long-term competitiveness in digital finance.

Thus, successful cryptocurrency tax policies must strike a balance between revenue generation and market development. Governments should look beyond short-term tax goals and focus on building a healthy, sustainable market ecosystem. Going forward, continuous policy refinement based on market feedback will be essential to achieving this balance.

5. Conclusion

Taxing cryptocurrency is an inevitable phase in the evolution of digital asset markets. Yet whether tax policies can truly stabilize markets warrants careful evaluation. While some argue transaction taxes curb speculation and reduce volatility, historical evidence shows such outcomes are often unattainable.

A classic case is Sweden in 1986. When the government doubled its financial transaction tax from 50 to 100 basis points (1 basis point = 0.01%), much of the equity trading migrated to the UK. Specifically, 60% of trading volume for Sweden’s 11 major stocks shifted to London—demonstrating how poorly designed tax policies can harm domestic markets.

Hence, both governments and investors must carefully assess the real-world impacts of tax policies. Governments should move beyond mere revenue collection and instead focus on cultivating a healthy, sustainable market environment. For investors, the introduction of tax rules can represent an opportunity for greater market formalization—leading to more stable and mature investment conditions.

In the end, the success of cryptocurrency tax policy hinges on whether governments and market participants can find common ground. It is not merely about adjusting tax rates, but a fundamental challenge shaping the long-term trajectory of digital asset markets.

Disclaimer

This report is compiled based on materials believed to be reliable. However, we make no express or implied representations regarding the accuracy, completeness, or suitability of the information. We assume no liability for any losses arising from the use of this report or its contents. Conclusions and recommendations reflect information available at the time of preparation and may change without notice. All views, forecasts, and objectives expressed herein are subject to change and may differ from those of other individuals or organizations.

This document is for informational purposes only and should not be construed as legal, business, investment, or tax advice. Any reference to securities or digital assets is for illustrative purposes only and does not constitute investment advice or an offer to provide investment services. This material is not directed at investors or potential investors.

Terms of Use

Tiger Research permits fair use of its reports. Under the principle of "fair use," content may be used for public interest purposes without harming its commercial value, provided prior permission is not required. However, when citing Tiger Research reports, users must: 1) clearly credit "Tiger Research" as the source, and 2) include the Tiger Research logo (black/white). Repackaging and republication require separate negotiation. Unauthorized use may result in legal action.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News