Asian markets open with across-the-board gains in risk assets: US stocks rebound, cryptocurrencies surge

TechFlow Selected TechFlow Selected

Asian markets open with across-the-board gains in risk assets: US stocks rebound, cryptocurrencies surge

Minsheng Securities analysis believes this will not become a turning point event for the market.

Author: Ye Zhen, Wall Street Insights

On Monday morning in Asian markets, risk assets rebounded across the board, reversing the pessimistic sentiment from last Friday as investors returned to assets such as stocks, oil, and cryptocurrencies. Gold also continued its upward trend.

-

Following the opening of Asian markets on Monday, U.S. stock index futures rose, with S&P 500 futures climbing nearly 1%;

-

Asia-Pacific stock markets showed divergence, with Australia's S&P/ASX 200 index down 0.3% and Hong Kong's Hang Seng Index futures falling 0.5%. Japanese markets were closed for a holiday;

-

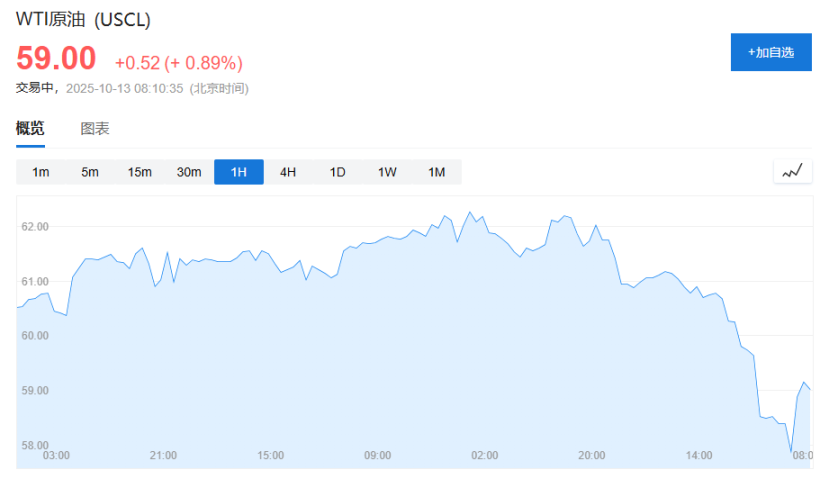

Oil prices rebounded by over 1%;

-

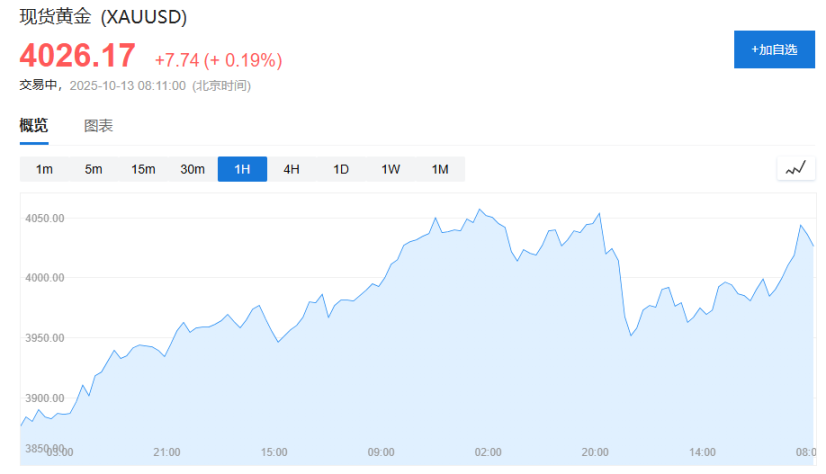

Spot gold rose 0.7% to $4,045 per ounce;

-

Cryptocurrencies rallied, with Bitcoin reclaiming levels above $115,000;

According to Global Times, on the 12th, a spokesperson for China's Ministry of Commerce answered questions regarding recent Chinese economic and trade policy measures. In response to the U.S. threat to impose 100% tariffs on China and implement export controls on all critical software, citing "China’s export controls on rare earths and related items," the spokesperson stated: Threatening with high tariffs at every turn is not the right way to engage with China.

The Ministry of Commerce said that China's position on tariff wars has been consistent—we do not want a fight, but we are not afraid either. China urges the U.S. to correct its erroneous actions promptly, follow the important consensus reached by the two heads of state during their phone call, safeguard the hard-won outcomes of consultations, continue to leverage the China-U.S. economic and trade consultation mechanism, resolve each other's concerns through dialogue based on mutual respect and equal negotiation, properly manage differences, and maintain stable, healthy, and sustainable development of China-U.S. economic and trade relations. If the U.S. insists on its current path, China will resolutely take corresponding measures to protect its legitimate rights and interests.

In response, Minsheng Securities analysis believes that, considering Trump’s restrained tone during his weekend press conference and China’s rational response, the fundamental tone between the two sides remains unchanged and this incident will not become a turning point for the market.

Risk Assets Rebound, Gold Extends Gains

At the start of Asian trading, prices across various asset classes generally improved. At time of writing, S&P 500 futures were up more than 1%.

In commodities, WTI crude oil rose 0.9% to $59 per barrel.

Safe-haven gold extended its gains, with spot gold rising 0.19% to $4,026.17 per ounce at time of writing.

Foreign exchange markets remained relatively stable, with the Bloomberg Dollar Spot Index largely unchanged. The yen weakened 0.5% against the dollar to 151.93. Offshore renminbi exchange rates were flat.

However, Asia-Pacific stock markets showed divergence. Australia's S&P/ASX 200 index declined 0.3%, while Hong Kong's Hang Seng Index futures dropped 0.5%. Japanese markets remained closed for a holiday.

After experiencing a historic large-scale liquidation, the cryptocurrency market saw a strong rebound over the weekend. According to CoinGecko data, as of October 12, Bitcoin rose 4.2% in 24 hours, trading around $115,180; Ethereum surged 10.8% to $4,143.

Other major tokens also posted broad gains, with Solana up 6.3% and Dogecoin surging 7.6%. Total cryptocurrency market capitalization recovered to $3.85 trillion, nearly 10% higher than the two-day low.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News