Key macro events last week: Trump's tariff policy, DeepResearch launch, and changes in Asia's crypto policies

TechFlow Selected TechFlow Selected

Key macro events last week: Trump's tariff policy, DeepResearch launch, and changes in Asia's crypto policies

Stay informed, stay vigilant.

Author: Alea Research

Compiled by: TechFlow

It's been a hectic week, and the market hasn't yet recovered from the volatility at the beginning of the year and the impact of President Trump's term. The cryptocurrency market has just experienced the largest 24-hour liquidation in history, with over $2.3 billion liquidated and more than $188 billion wiped out from market capitalization.

Currently, U.S. stock index futures are sharply lower across the board. The market may overreact again at the opening, as it did last week—plunging initially before potentially recovering gradually—but the exact trajectory remains to be seen.

Unlike traditional financial markets, the cryptocurrency market operates 24/7, and has already felt the significant impact of Trump's tariff threats. Bitcoin briefly dropped to $92,000 before rebounding to $95,600, where it currently stabilizes. Ethereum, on the other hand, completely erased its gains on the ETH/BTC chart, plunging over 18% at one point before only slightly recovering to just under $2,600. There were even rumors that a trading firm was forced into liquidation due to Ethereum's collapse.

With the market downturn now center stage, today’s focus will be on tariffs—the primary cause behind this market crash—and some other important news overshadowed by Trump’s heated weekend rhetoric.

Stay informed, stay vigilant.

Tariff Situation

The market reacted negatively to Saturday’s announcement, as the tariffs took effect just one day after being announced. However, similar to last week’s DeepSeek incident, while traditional financial markets have not fully digested the news, the crypto market continued to decline over the weekend.

The market had previously assumed that Trump’s tariff talk was mostly bluster—merely negotiation leverage rather than immediate policy without consultation with relevant leaders and diplomats. What caught the market off guard was Trump targeting America’s allies and closest nations instead of primarily focusing on China—a surprising strategy that intensified market panic.

China is being hit with a 10% tariff, along with the cancellation of a previous policy allowing small packages to enter the U.S. duty-free. This change affects consumer e-commerce involving apparel and durable goods, and the actual tariff burden exceeds the standard 10% rate.

Meanwhile, the U.S. has imposed a direct 25% tariff on its two largest trade partners—Canada and Mexico—while exempting energy products at a 10% rate. This decision is particularly critical because energy constitutes Canada’s primary export to the U.S. Excluding energy, Canada actually runs a trade deficit with the U.S. Even before the tariffs, some Canadian food exporters had planned to relocate their headquarters to the U.S. to reduce costs and streamline operations; the new tariffs will only accelerate this trend and make such decisions easier for businesses.

Trump’s swift imposition of tariffs on these countries highlights two key points:

-

Trump genuinely views tariffs as a significant source of revenue, possibly even as a supplement to other forms of taxation.

-

Trump is more willing than expected to endure short-term economic pain in pursuit of what he believes are long-term benefits.

Today, President Trump will meet with leaders from Canada and Mexico, which could bring greater clarity to the current tariff situation, whether positive or negative. Imports from China, Canada, and Mexico together account for nearly half of all U.S. imports, meaning there is limited room for further tariff increases on other countries without risking diminishing economic returns—a scenario the market may react to.

(At time of publication, U.S. President Donald Trump agreed to delay implementation of increased tariffs on Mexico and Canada for 30 days.)

News Updates

Tariffs will undoubtedly remain a central topic in traditional financial media this week. However, beyond tariffs, there are several other important developments that could impact the cryptocurrency market but have received insufficient attention due to recent massive liquidations.

OpenAI Deep Research

To maintain competitiveness following DeepSeek’s release of its R1 reasoning model, OpenAI quickly rolled out a series of new features. First, Sam Altman announced that free ChatGPT users would gain access to OpenAI’s O3-mini model. Then, the team launched the “Operator & Agents” feature, allowing users to initiate tasks via Operator—such as purchasing goods—with Agents completing them autonomously using powerful search and reasoning capabilities. Now, the next-generation version of agents—Deep Research—has officially launched, offering users enhanced automation for complex tasks.

Do not confuse OpenAI’s Deep Research with Google Gemini’s similarly named feature. OpenAI’s Deep Research builds upon today’s leading large language model (LLM) technology, aiming to provide users with a highly skilled and knowledgeable agent capable of performing across multiple white-collar domains. These areas span broadly from finance to data analysis, holding immense potential.

Notably, Sam Altman stated that Deep Research is already capable of handling tasks representing a “single-digit percentage” of economic value within the global economy, primarily in white-collar work. This further supports the view that white-collar jobs will be disrupted by AI earlier than manual labor. This development also underscores how LLM companies must build competitive moats through user interfaces (UI), not just models alone. The launch of Operator and now Deep Research represent major steps in this direction, while the response from other companies remains to be seen.

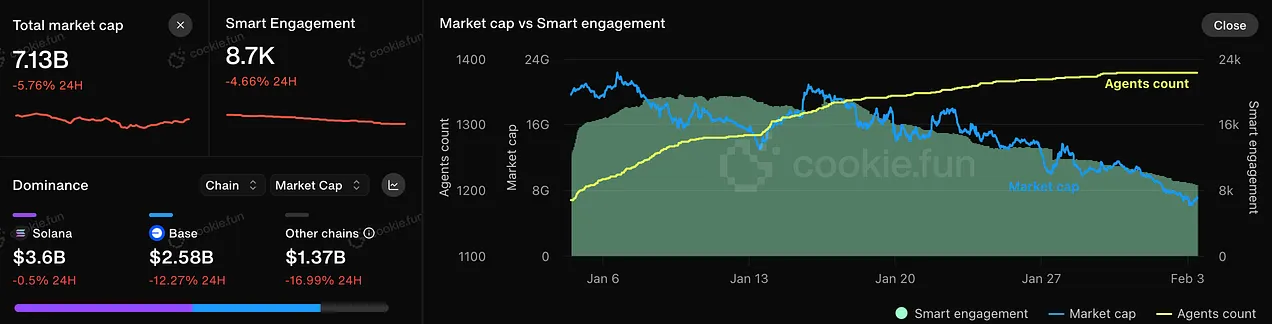

For the cryptocurrency space, this is undoubtedly positive news for the AI agent industry—even though Deep Research adoption is still in early stages. Considering the current total market cap of the AI agent sector stands at just $7.13 billion, down from a previous peak of $22 billion, this progress is particularly significant. Regardless of how the tariff situation unfolds, Deep Research could have profound implications for AI technology, financial markets, and even the crypto space.

India Crypto Developments

While less impactful than other news, this topic could still carry weight. Reports indicate that India, the world’s third-largest real economy (fifth by nominal GDP), is reviewing its existing cryptocurrency policies—or more accurately, the lack thereof. In the short term, this could negatively affect the crypto market. Rumors suggest the Indian government might impose a tax as high as 70% on undisclosed cryptocurrency gains, which would deliver a negative shock if implemented.

However, Ajay Seth, Secretary of Economic Affairs, said the government plans to re-examine the regulatory framework for cryptocurrencies. This move appears driven more by necessity than genuine enthusiasm for embracing crypto. In contrast, smaller nations like El Salvador and the Czech Republic have already shown more favorable attitudes toward cryptocurrencies. Among major global economies, India is undoubtedly one of the most pivotal players likely to adjust its crypto policy stance.

Additionally, occasional rumors surface about China potentially allowing cryptocurrency ownership or relaxing trading restrictions, though these typically lack substance. If China were to truly ease restrictions, it would significantly benefit the crypto market—but such a scenario currently seems unlikely. In comparison, India adjusting its crypto policy framework represents a more realistic and meaningful positive development.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News