One Year of the Trump Administration: Transformation in the U.S. Crypto Industry

TechFlow Selected TechFlow Selected

One Year of the Trump Administration: Transformation in the U.S. Crypto Industry

Over the past year, the direction of U.S. cryptocurrency policy has been clear: integrating the cryptocurrency industry into the formal financial system. However, this process has not been seamless or frictionless.

Author: Tiger Research

In 2025, the U.S. government is advancing a pro-cryptocurrency policy with a clear objective: enabling the existing crypto industry to operate under the same regulatory framework as traditional finance.

Key Takeaways

-

The United States aims to integrate cryptocurrency into its existing financial infrastructure, rather than simply absorbing the entire industry.

-

Over the past year, Congress, the SEC, and the CFTC have progressively incorporated crypto through new and adjusted regulations.

-

Despite inter-agency tensions, the U.S. continues refining its regulatory framework while supporting industry growth.

1. The U.S. Absorption of the Crypto Industry

Following President Trump's re-election, the administration launched a series of aggressive pro-crypto policies—marking a sharp departure from previous stances, under which the crypto industry was primarily seen as a target for regulation and control. The U.S. has now entered an unimaginable phase, integrating the crypto sector into its established system at an almost unilateral pace.

The shifting positions of the SEC and CFTC, along with traditional financial institutions increasingly entering crypto-related businesses, signal broad structural transformation.

Notably, all this has occurred within just one year since President Trump’s re-election. What specific changes have taken place in U.S. regulation and policy so far?

2. One Year of Shifting U.S. Crypto Stance

In 2025, the arrival of the Trump administration marked a major turning point for U.S. crypto policy. The executive branch, Congress, and regulatory agencies have acted in concert, focusing on reducing market uncertainty and integrating crypto into existing financial infrastructure.

2.1. Securities and Exchange Commission (SEC)

Previously, the SEC primarily relied on enforcement actions to address crypto-related activities. In high-profile cases involving Ripple, Coinbase, Binance, and Kraken’s staking services, the SEC filed lawsuits without providing clear standards on token legal status or permissible activities—often applying interpretations retroactively. This forced crypto companies to focus more on managing regulatory risk than business expansion.

This stance began shifting after the resignation of Chair Gary Gensler, who held a conservative view toward the crypto industry. Under Paul Atkins’ leadership, the SEC has adopted a more open approach, actively building foundational rules to bring the crypto industry into the regulatory fold, rather than relying solely on litigation.

A key example is the announcement of the “Crypto Project,” through which the SEC signaled its intent to establish clear criteria defining which tokens qualify as securities and which do not. Once directionless, the agency is now reshaping itself into a more inclusive regulator.

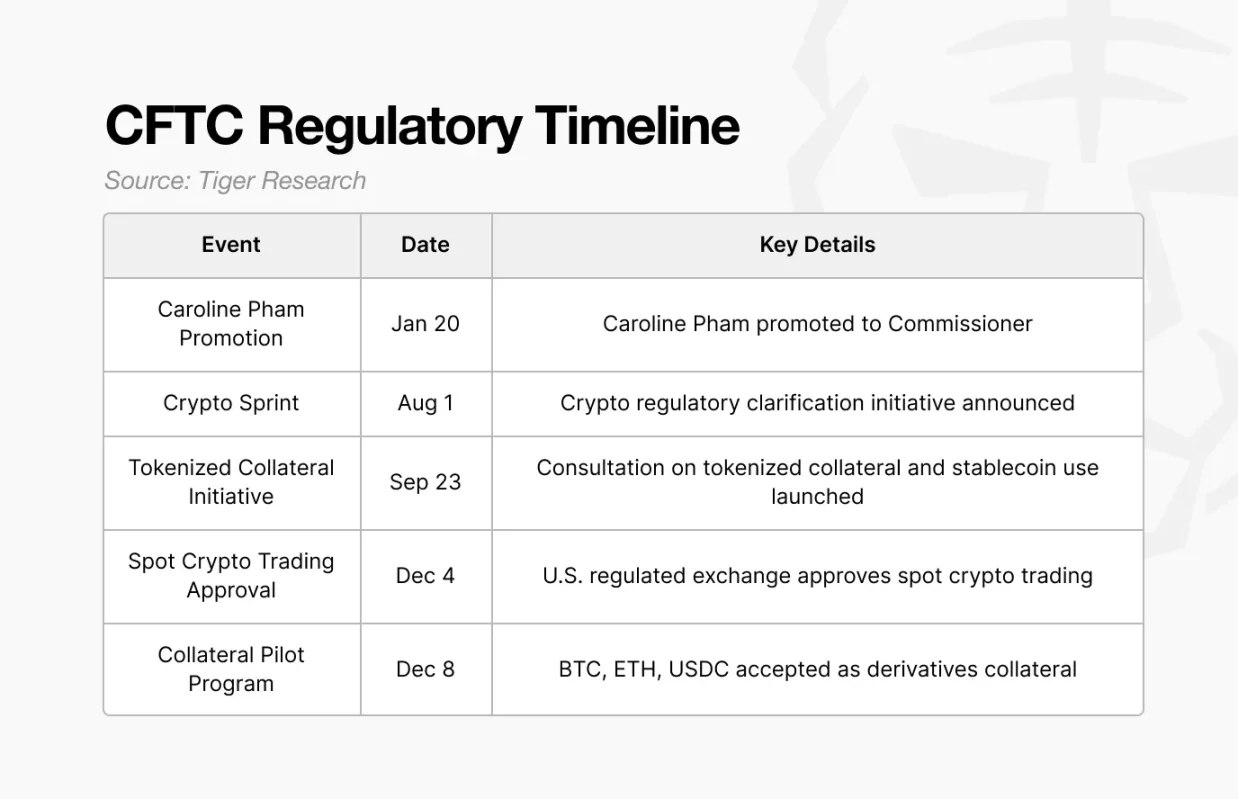

2.2. Commodity Futures Trading Commission (CFTC)

Source: Tiger Research

Historically, the CFTC’s involvement in crypto was largely limited to derivatives markets. This year, however, it took a more proactive stance, formally recognizing Bitcoin and Ethereum as commodities and endorsing their use by traditional institutions.

The “Digital Asset Collateral Pilot Program” is a key initiative. Under this program, Bitcoin, Ethereum, and USDC are now permitted as collateral for derivatives trading. The CFTC applies haircut ratios and risk management standards, treating these assets similarly to traditional collateral.

This shift indicates that the CFTC no longer views crypto assets purely as speculative instruments, but increasingly recognizes them as stable collateral assets comparable to traditional financial assets.

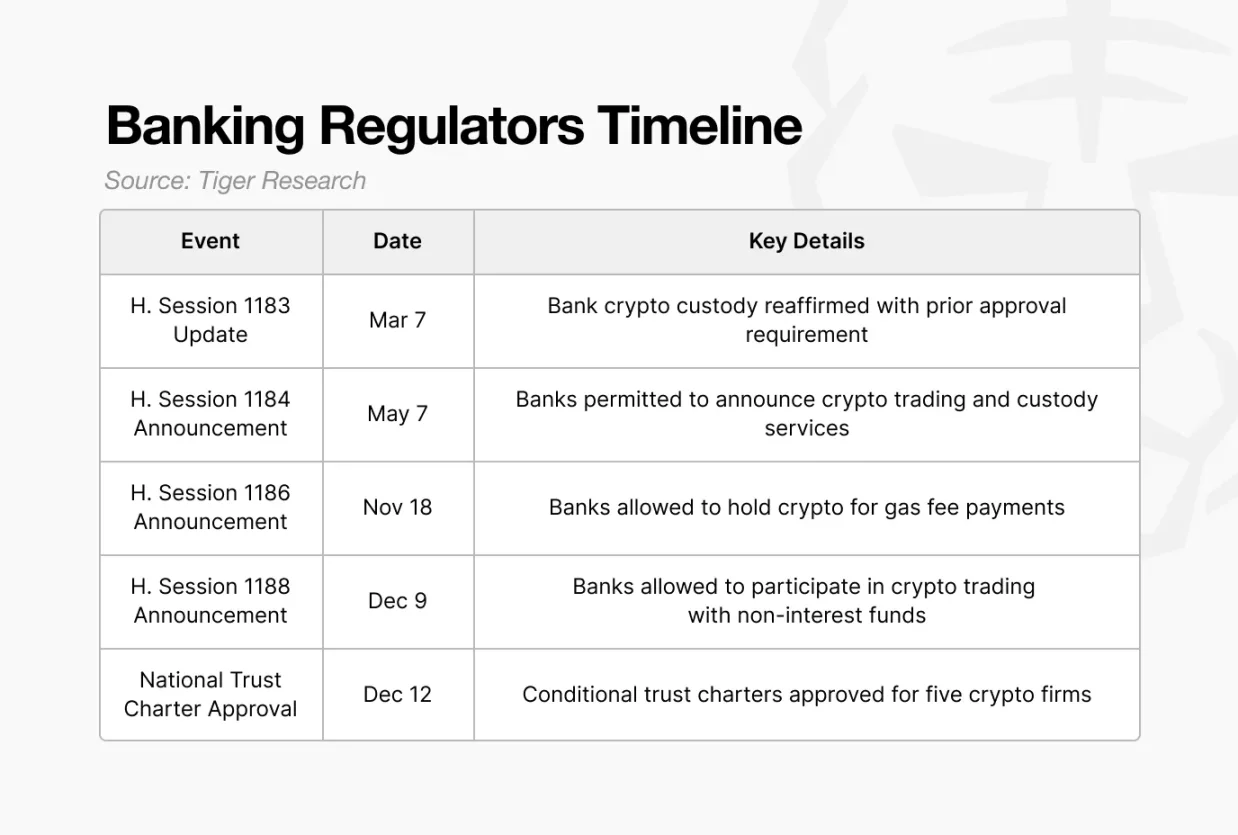

2.3. Office of the Comptroller of the Currency (OCC)

Source: Tiger Research

Previously, the OCC kept its distance from the crypto industry. Crypto firms had to apply for licenses state by state, making access to the federal banking system difficult. Their expansion was constrained, structurally disconnected from traditional finance, forcing most to operate outside the regulated system.

That approach has now changed. The OCC has chosen to bring crypto companies into the existing bank regulatory framework instead of excluding them from the financial system. It has issued a series of interpretive letters—official documents clarifying whether specific financial activities are permitted—gradually expanding the scope of allowable operations to include crypto asset custody, trading, and even on-chain transaction fee payments via bank payment rails.

This evolution culminated in December when the OCC conditionally granted national trust bank charters to major players like Circle and Ripple. This move is significant as it grants these crypto firms equal standing with traditional financial institutions. Operating under a single federal regulator, they can now conduct nationwide operations and directly process transfers—previously requiring intermediary banks—just like traditional banks.

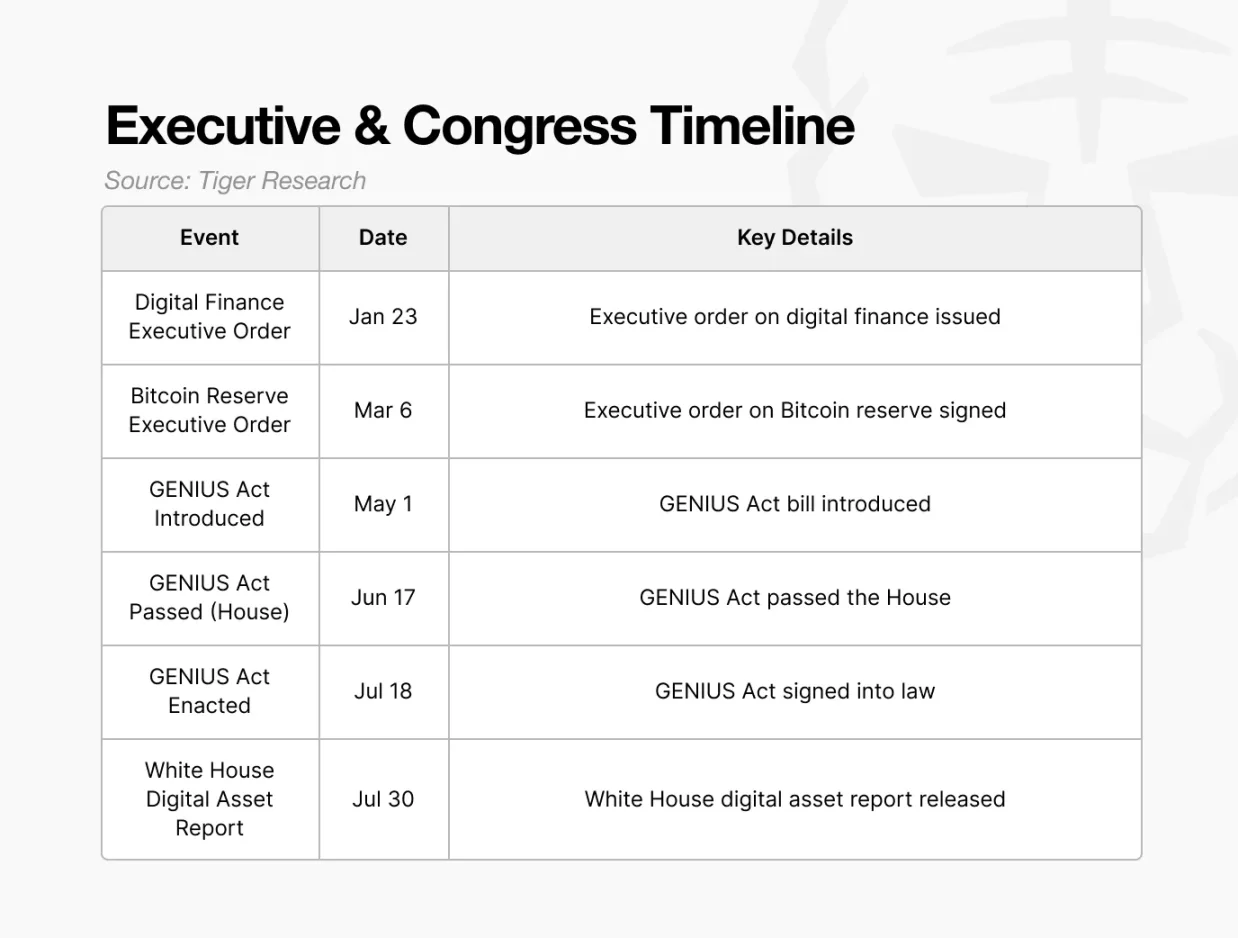

2.4. Legislation and Executive Orders

Source: Tiger Research

In the past, although the U.S. began discussing stablecoin legislation as early as 2022, repeated delays created a regulatory vacuum. With no clear standards on reserve composition, regulatory authority, or issuance requirements, investors could not reliably verify whether issuers held sufficient reserves—raising concerns about reserve transparency for some issuers.

The GENIUS Act addresses these issues by clearly defining stablecoin issuance requirements and reserve standards. It mandates that issuers hold 100% reserves backing outstanding tokens, prohibits rehypothecation of reserve assets, and consolidates regulatory authority under federal financial regulators.

As a result, stablecoins have now become legally recognized digital dollars with guaranteed payment capacity.

3. Direction Set: Competition and Checks Continue

Over the past year, the direction of U.S. crypto policy has become unmistakably clear: integrating the crypto industry into the formal financial system. Yet this process has not been seamless or frictionless.

Domestic disagreements persist within the U.S. government. The debate over the privacy mixer service Tornado Cash serves as a prime example: the executive branch aggressively enforces bans citing illicit fund flows, while the SEC chair publicly warns against over-suppressing privacy. This shows that consensus on crypto within the U.S. government remains incomplete.

However, these divisions do not equate to policy instability—they reflect inherent features of the U.S. decision-making system. Agencies with different mandates interpret issues from their own perspectives, sometimes voicing public dissent, moving forward through mutual checks and persuasion. The tension between strict enforcement and innovation protection may cause short-term friction, but in the long run helps refine regulatory standards with greater precision.

The key is that such tensions haven’t stalled progress. Even amid debate, the U.S. continues advancing on multiple fronts: rulemaking at the SEC, infrastructure integration at the CFTC, institutional absorption at the OCC, and legislative standard-setting in Congress. It does not wait for full consensus, but allows competition and coordination to proceed in parallel, driving the system forward continuously.

In the end, the U.S. has neither fully deregulated crypto nor attempted to suppress its development. Instead, it has simultaneously reshaped regulation, leadership, and market infrastructure. By transforming internal debate and tension into momentum, the U.S. has chosen a strategic path to draw the global center of the crypto industry toward itself.

The past year has been pivotal precisely because this direction has moved beyond declarations, becoming concrete policy and execution.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News