Trump vs. JPMorgan for Power: Why Are Bitcoin and MSTR Taking the Blame?

TechFlow Selected TechFlow Selected

Trump vs. JPMorgan for Power: Why Are Bitcoin and MSTR Taking the Blame?

This is not just a financial story, nor is it just a political story.

Author: Maryland HODL (BitBonds = Structural Innovation)

Translation: TechFlow

The Covert Battle for Monetary Power: The Head-On Clash Between the Old Order and the New Architecture

A struggle for monetary power is unfolding before our eyes—but almost no one truly understands what's at stake. What follows is my highly speculative interpretation of this phenomenon.

——@FoundInBlocks

In recent months, a pattern has gradually emerged across politics, markets, and media. Disconnected headlines are suddenly linking together, market anomalies no longer appear random, and institutional behavior has become unusually aggressive. Beneath the surface, deeper forces seem to be brewing.

This is not a typical cyclical fluctuation in monetary policy.

This is not a conventional partisan conflict.

Nor is it simply “market volatility.”

We are witnessing a direct confrontation between two opposing monetary systems:

The old order……centered around JPMorgan, Wall Street, and the Federal Reserve.

The new order……centered around the Treasury, stablecoins, and a digital architecture built on Bitcoin.

This conflict is no longer theoretical. It is real, accelerating, and for the first time in decades, visible to the public eye.

What follows attempts to map out the true battlefield……a battlefield most analysts cannot see because they continue to interpret a world breaking free from its constraints through the lens of 1970–2010 frameworks.

JPMorgan Steps Out of the Shadows

Most people think of JPMorgan as just a bank. This is a misconception.

JPMorgan is the operational arm of the global financial system……it is the entity closest to the core mechanisms of the Federal Reserve, influencing dollar settlements worldwide and serving as the primary executor of the traditional monetary architecture.

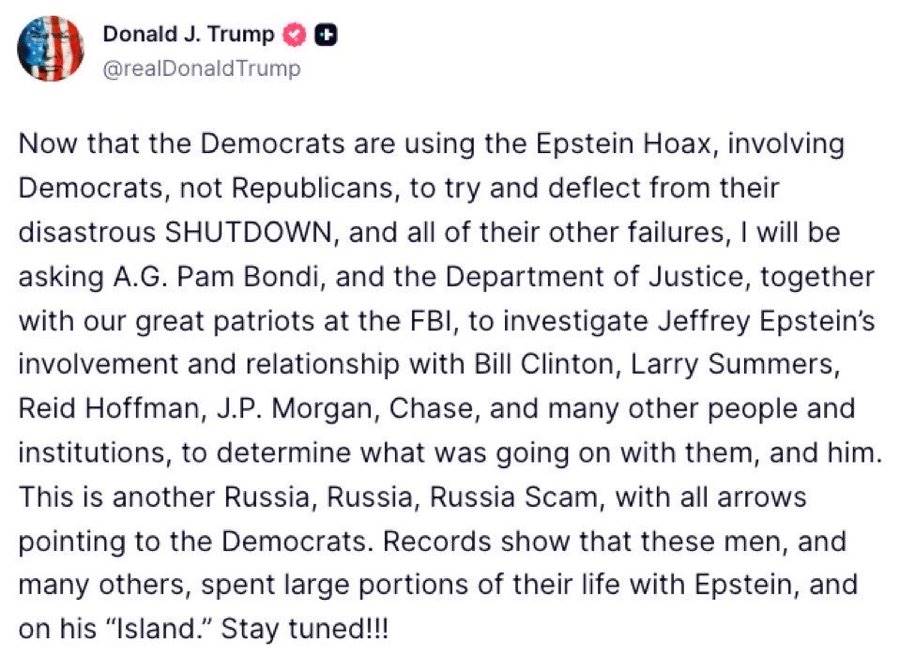

Thus, when Trump posted about the Epstein network and explicitly named JPMorgan—not just individuals—it was not rhetorical exaggeration. He directly inserted the system’s most central institution into the narrative framework.

Meanwhile:

-

JPMorgan has been a key driver behind the aggressive shorting pressure on Strategy (MSTR), precisely at a moment when Bitcoin’s macro narrative threatens traditional monetary interests.

-

Reports indicate delivery delays when clients attempted to transfer their Strategy shares out of JPMorgan, suggesting custodial stress……a phenomenon that typically only arises when internal operational mechanisms are under extreme strain.

(Source: https://x.com/EMPD_BTC/status/1991886467694776531?s=20)

JPMorgan occupies a strategic core within the Federal Reserve ecosystem, both structurally and politically. Undermining its position is equivalent to weakening the entire old monetary system itself.

None of this is normal.

And all of it is part of the same story.

The Government’s Silent Shift: Returning Monetary Power to the Treasury

While media focuses on surface-level culture wars, the real strategic agenda revolves around money.

The government is quietly working to return core monetary issuance authority back to the U.S. Treasury……through:

-

Treasury-integrated stablecoins

-

Programmable settlement rails

-

Bitcoin reserves as long-duration collateral

This shift is not a minor adjustment to the existing system, but a direct replacement of its core power center.

Currently, the Fed and commercial banks—led by JPMorgan—nearly monopolize the creation and distribution of all dollars. If the Treasury and stablecoins become the central hub for issuance and settlement, the banking system will lose authority, profits, and control.

JPMorgan knows this perfectly well.

They fully understand the real significance of stablecoins.

They also know exactly what happens if the Treasury becomes the issuer of programmable dollars.

That’s why they are fighting back……not through press conferences, but through market mechanisms:

-

Derivatives pressure

-

Liquidity bottlenecks

-

Narrative suppression

-

Custodial delays

-

And political influence

This is not a policy debate. It’s a fight for survival.

Bitcoin: The Unexpected Battlefield

Bitcoin is not the target……it is the terrain of the battle.

The government wants to quietly accumulate strategically before making any overt move toward a Treasury-led digital settlement system. Prematurely announcing such plans would trigger massive market reactions (gamma squeeze), propel Bitcoin into “escape velocity,” and make accumulation prohibitively expensive and uncontrollable.

The problem is that the old system is using gold-like suppression tactics to dampen Bitcoin’s signal:

-

Flooding with paper derivatives

-

Massive synthetic shorting

-

Perception warfare

-

Liquidity raids at key technical levels

-

Custodial bottlenecks at major prime brokers

JPMorgan has mastered these techniques in the gold market for years—and now they’re being deployed against Bitcoin.

This isn’t because Bitcoin directly threatens bank profits……but because Bitcoin strengthens the Treasury’s future monetary architecture while undermining the Fed’s position.

The government faces a difficult strategic choice:

-

Allow JPMorgan to continue suppressing Bitcoin, preserving the ability to accumulate at low prices.

-

Make a strategic announcement that pushes Bitcoin higher, but risks losing the chance to quietly position before political consensus is reached.

This is why the government remains publicly silent on Bitcoin.

Not because they don’t understand Bitcoin……but because they understand it too well.

Clashing on Fragile Ground

The entire backdrop of this struggle is a monetary system over sixty years old, characterized by:

-

Financialization

-

Structural leverage

-

Artificially low interest rates

-

Asset-first growth models

-

Reserve concentration

-

Institutional cartelization

Historical correlations are collapsing everywhere because the system is no longer coherent. Traditional finance (TradFi) commentators who view this as a normal economic cycle fail to realize that the cycle itself is disintegrating.

The system is breaking.

The underlying structure is unstable.

Interests are diverging.

And both sides—the old order represented by JPMorgan and the emerging order driven by the Treasury—are fighting on the same fragile infrastructure. Any miscalculation could trigger cascading instability.

This explains why current actions appear so erratic, uncoordinated, and urgent.

Strategy: The Bridge Under Direct Attack

Now we introduce a critical layer most commentators have overlooked.

Strategy (MSTR) is not just another corporate Bitcoin holder. It has become a conversion mechanism——a bridge connecting traditional institutional capital with the emerging Bitcoin-Treasury monetary architecture.

MSTR’s structure, its leveraged Bitcoin strategy, and its preferred stock products effectively convert fiat, credit, and fiscal assets into long-term Bitcoin exposure. In doing so, MSTR has become the de facto entry point for institutions and retail investors unable or unwilling to hold spot Bitcoin directly, while offering an escape from yield compression under Yield Curve Control (YCC).

This means:

If the government envisions a future where a Treasury-backed digital dollar coexists with Bitcoin reserves, then MSTR is the key corporate conduit for achieving that transition.

JPMorgan knows this perfectly well.

Therefore, when JPMorgan:

-

Facilitates large-scale shorting,

-

Creates delivery delays,

-

Pressures MSTR’s liquidity,

-

And amplifies negative market narratives, it is not merely attacking Michael Saylor (MSTR’s founder). It is attacking the very conversion bridge that makes the government’s long-term accumulation strategy feasible.

There’s even a plausible scenario—still highly speculative, yet increasingly logical—that the U.S. government might eventually intervene with a strategic investment in MSTR. As recently suggested by (@joshmandell6), this could take the form of:

-

Injecting U.S. Treasuries in exchange for ownership stakes in MSTR,

-

Thereby explicitly supporting MSTR’s preferred stock instrument and enhancing its credit standing.

Such a move would carry political and financial risks, but it would also send an unmistakable signal to the world: The United States is defending a critical node in its emerging monetary architecture.

And the mere possibility of this is enough to explain the intensity of JPMorgan’s attacks on MSTR.

The Critical Window: Control Over the Federal Reserve Board

The timeline is tightening.

As @caitlinlong recently pointed out: Trump needs to gain actual control over the governance of the Federal Reserve before Jerome Powell steps down. However, the current situation is unfavorable……he trails by roughly three to four votes on the board.

Multiple critical junctures are converging simultaneously:

-

Lisa Cook’s Supreme Court challenge, which could drag on for months, delaying key reforms.

-

February 2025 Federal Reserve Board votes, which could solidify an adversarial governance structure for years to come.

-

The upcoming midterm elections, where poor Republican performance would weaken the government’s ability to rebalance monetary power.

This is why current economic momentum is crucial, rather than waiting six more months.

This is why the Treasury’s issuance strategy is changing.

This is why stablecoin regulation has suddenly become pivotal.

This is why Bitcoin price suppression matters.

And this is why the battle over MSTR is not a minor issue, but a structural one.

If the government loses congressional support, Trump will become a “lame duck” president……unable to reshape the monetary system, trapped instead by the very institutions he sought to bypass. By 2028, this window will close entirely.

The urgency is real. The pressure is immense.

The Broader Strategic Landscape

When you step back and look at the big picture, the pattern becomes unmistakably clear:

-

JPMorgan is waging a defensive war, trying to preserve its status as the global node of the Fed-bank-centric system.

-

The government is executing a stealthy transformation, returning monetary dominance to the Treasury via stablecoins and Bitcoin reserves.

-

Bitcoin has become the proxy battlefield—its price suppressed to protect the old system, while quiet accumulation empowers the new.

-

Strategy (MSTR) is the conversion bridge, an institutional gateway threatening JPMorgan’s control over capital flows.

-

Fed governance is the key bottleneck, and political timing is the greatest constraint.

All of this unfolds on unstable ground, where any misstep could trigger unpredictable systemic consequences.

This is not just a financial story, nor merely a political one.

This is a civilization-scale monetary transformation. And for the first time in sixty years, this conflict is no longer hidden behind closed doors.

Trump’s Gamble

The government’s strategy is becoming clearer:

-

Let JPMorgan overextend itself on price suppression.

-

Quietly accumulate Bitcoin.

-

Protect and possibly further strengthen Strategy (MSTR) as the conversion bridge.

-

Quickly reshape the governance of the Federal Reserve.

-

Position the Treasury as the issuer of digital dollars.

-

Wait for the right geopolitical moment (possibly the “Mar-a-Lago Accord”) to unveil this new architecture.

This is not mild reform. It is a complete overturning of the 1913 monetary order……monetary power will shift from financial institutions back to political ones.

If this gamble succeeds, the U.S. will enter a new monetary era built on transparency, digital rails, and a hybrid Bitcoin-collateral framework.

If it fails, the old system will tighten its grip, and the window for change may not reopen for a generation.

Regardless of the outcome, the war has already begun.

Bitcoin is no longer just an asset……it has become the fault line between two competing futures.

Yet what neither side fully recognizes is that both will ultimately lose to absolute scarcity and mathematical truth.

As these two giants battle for control, prepare for surprises, and stay safe.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News