Big companies are jumping on the Bitcoin bandwagon, but Asian firms hold less than 1% of the coins

TechFlow Selected TechFlow Selected

Big companies are jumping on the Bitcoin bandwagon, but Asian firms hold less than 1% of the coins

Asian companies' investment in Bitcoin is still in its early stages

Author: Tiger Research Reports

Translation: TechFlow

Executive Summary

-

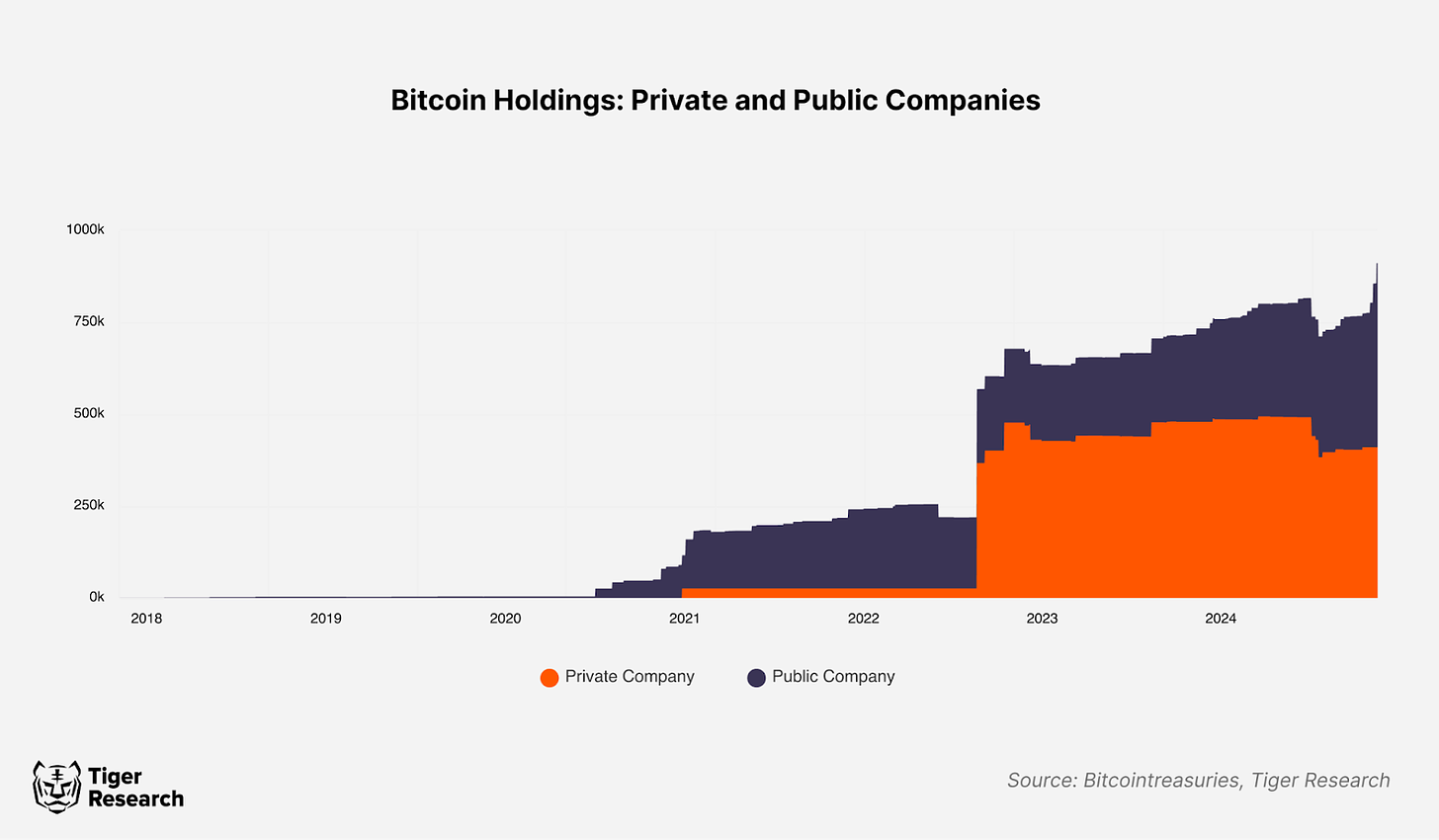

The trend of corporate Bitcoin investment is expanding: Since the U.S. Securities and Exchange Commission (SEC) approved spot Bitcoin ETFs, corporate investment strategies have gradually heated up. This trend is not limited to Western markets and is now extending into Asia.

-

Why companies are choosing Bitcoin: Bitcoin has demonstrated significant appeal in diversifying asset allocation, improving capital management efficiency, and enhancing corporate value.

-

Participation and development prospects in Asian markets: Corporate Bitcoin investment in Asia is still in its early stages, but successful cases like Metaplanet indicate substantial market expansion potential. However, regulatory uncertainty and lack of institutional support remain major obstacles.

1. Introduction

This year, the U.S. Securities and Exchange Commission (SEC) approved spot Bitcoin ETFs—a milestone event marking the institutionalization of crypto assets. Since then, an increasing number of companies have begun incorporating Bitcoin into their investment strategies. For example, MicroStrategy has made Bitcoin one of its key financial assets. This trend is rapidly spreading from Western to Asian markets, gradually becoming a global phenomenon. This report analyzes the primary strategies driving corporate Bitcoin adoption and the underlying influencing factors.

2. The Surge in Corporate Bitcoin Investment

As Bitcoin's value gains broader recognition, its attractiveness continues to grow. At the national level, some governments have started discussing Bitcoin investments. For instance, El Salvador has taken proactive steps by continuously purchasing Bitcoin. In the United States, discussions around President-elect Trump’s plan to establish a Bitcoin reserve have become a focal point. Additionally, Poland and Suriname are exploring the possibility of treating Bitcoin as a strategic asset.

However, aside from El Salvador, most countries’ Bitcoin investment initiatives remain at the stage of policy discussion or campaign promises, with actual implementation still distant. The U.S. has not directly invested in Bitcoin but holds some BTC recovered from criminal activities. Moreover, due to Bitcoin’s high price volatility, many central banks still prefer gold as a more stable reserve asset.

Government action on Bitcoin remains slow and limited, while corporate participation is accelerating. Companies such as MicroStrategy, Semler Scientific, and Tesla have already made bold investments in Bitcoin—standing in stark contrast to the cautious stance adopted by most governments.

3. Three Key Reasons Why Corporations Are Focusing on Bitcoin

Investing in Bitcoin is no longer just a trend—it is increasingly becoming a core financial strategy for corporations. Due to its unique characteristics, Bitcoin has captured corporate attention, primarily for the following three reasons:

3.1. Achieving Asset Diversification

Traditionally, corporate financial assets are typically allocated toward stable options such as cash and government bonds. These assets ensure liquidity and help mitigate risk, but they offer low returns, often failing to outpace inflation, which may lead to erosion of real asset value.

Source: Michael Saylor X

Bitcoin, as an emerging alternative asset, effectively addresses these shortcomings. With high return potential and risk diversification capabilities, it offers corporations a new option for asset allocation. Over the past five years, Bitcoin has significantly outperformed traditional assets such as the S&P 500 index, gold, and bonds—even surpassing high-risk, high-return junk bonds. This demonstrates that Bitcoin is not merely an alternative but also a crucial tool in corporate financial strategy.

3.2. Enhancing Asset Management Efficiency

Another key reason Bitcoin attracts corporations is its efficient asset management features. Bitcoin enables 24/7 trading, providing businesses with great flexibility to adjust their asset allocations at any time. Furthermore, compared to traditional financial institutions, Bitcoin offers faster and more convenient liquidation without being constrained by banking hours or cumbersome procedures.

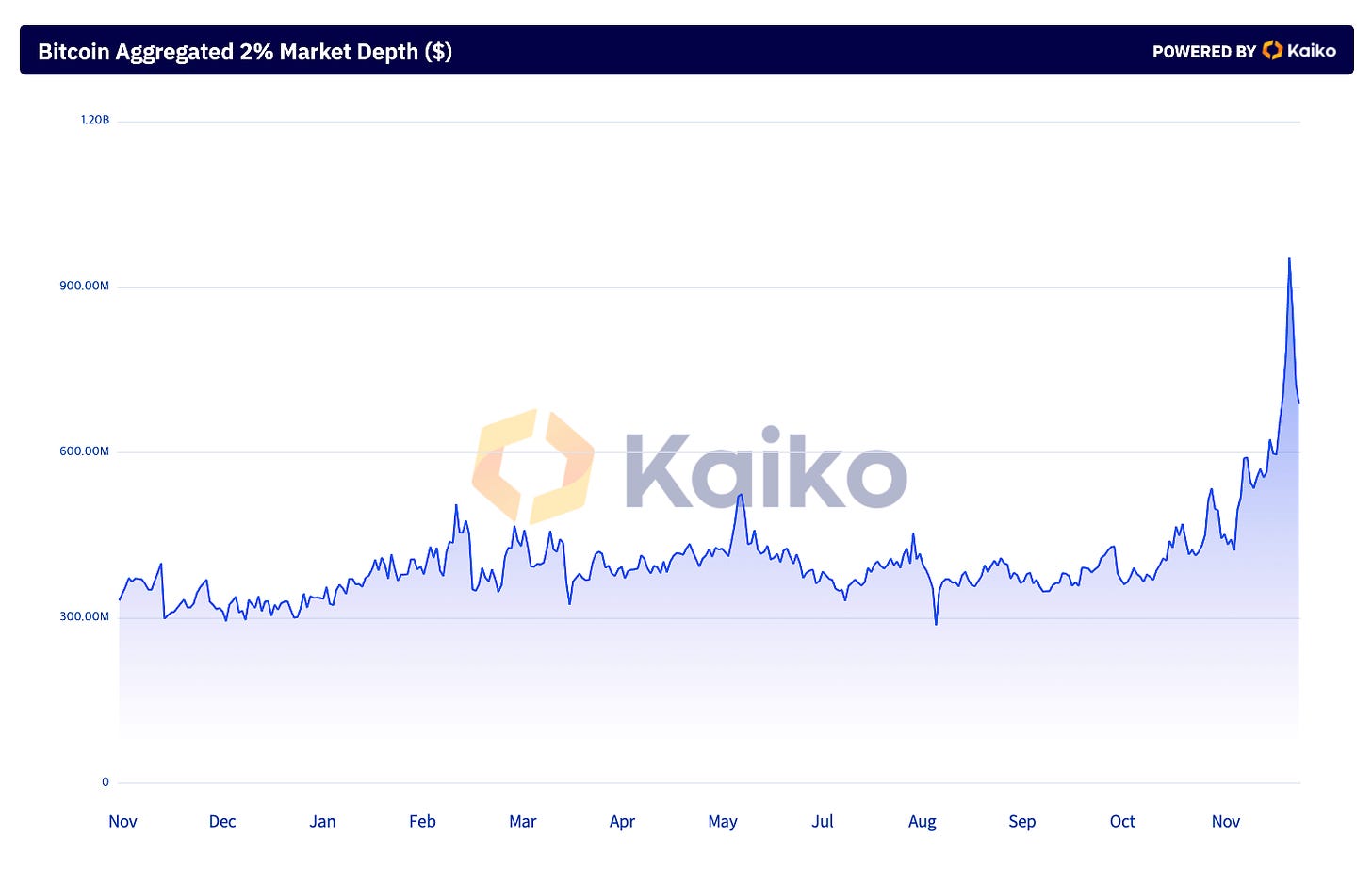

Source: Kaiko

Although corporations remain concerned about potential price impact when liquidating Bitcoin holdings, this issue is gradually easing as market depth increases. According to Kaiko data, Bitcoin’s "2% market depth" (the total value of buy and sell orders within ±2% of the current market price) has steadily increased over the past year, reaching an average daily depth of approximately $4 million. This indicates continuous improvement in Bitcoin’s market liquidity and stability, creating a more favorable environment for corporate usage.

3.3. Increasing Corporate Value

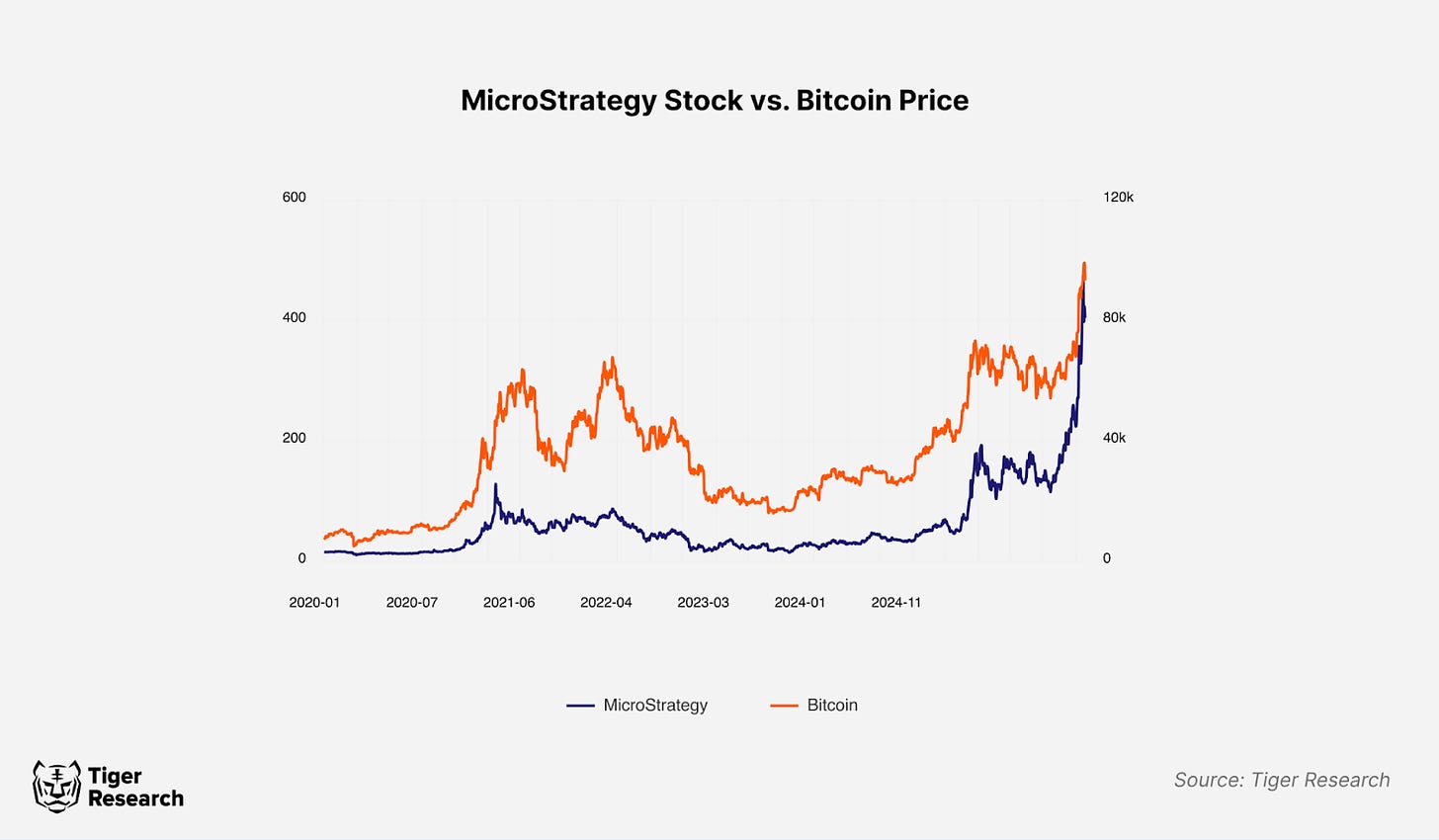

Holding Bitcoin is not only a financial decision—it can also significantly enhance corporate value and stock prices. For example, both MicroStrategy and Metaplanet experienced sharp stock price increases after announcing Bitcoin acquisitions. This strategy serves not only as an effective marketing tool within the digital asset industry but also provides companies with a pathway to capitalize on growth opportunities in this sector.

4. Growing Bitcoin Investment by Asian Enterprises

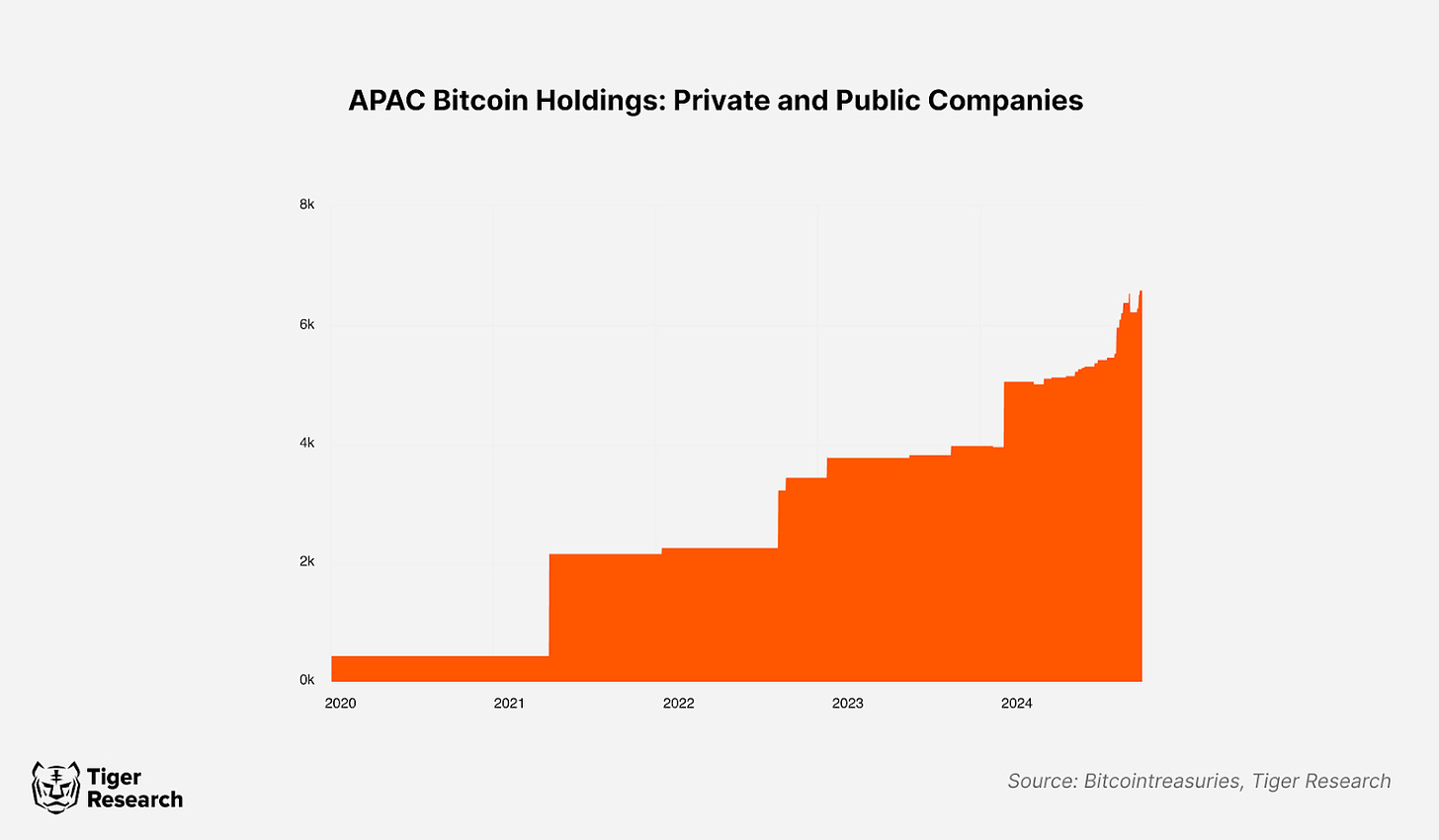

While Asian corporate Bitcoin investment is still in its infancy, holdings are gradually increasing. For example, China’s Meitu, Japan’s Metaplanet, and Thailand’s Brooker Group have all treated Bitcoin as a strategic financial asset. Nexon has also conducted large-scale Bitcoin purchases. Notably, Metaplanet has been particularly active, acquiring 1,142 bitcoins over the past six months.

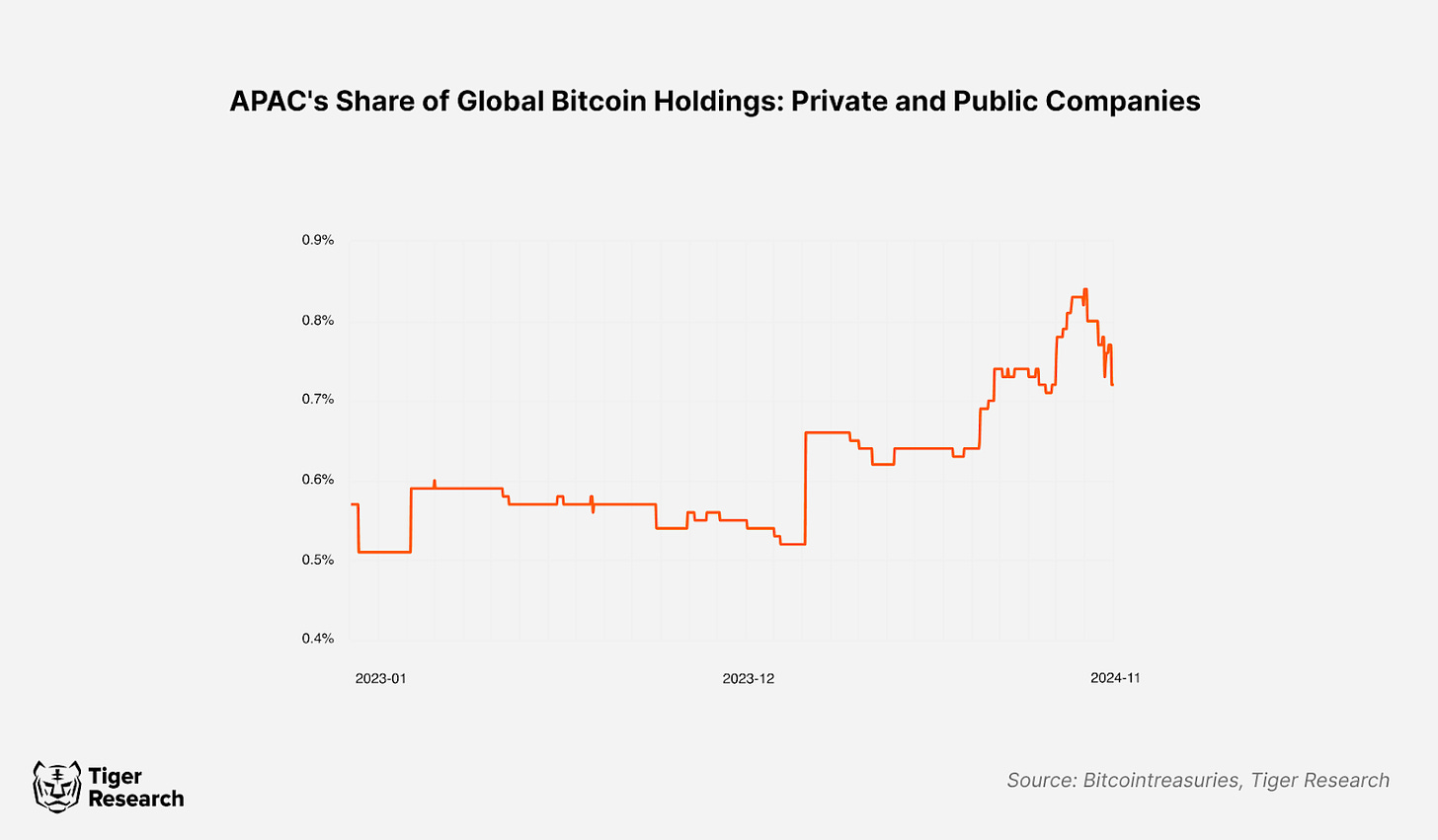

Nevertheless, overall participation by Asian firms in the Bitcoin market remains low. Statistics show that the total amount of Bitcoin held by Asian companies accounts for less than 1% of the global total, primarily due to regulatory restrictions in many countries. For example, in South Korea, corporations cannot open accounts on cryptocurrency exchanges and face numerous barriers when attempting to invest in overseas Bitcoin ETFs or launch crypto-related funds. As a result, these companies have almost no formal channels through which to invest in Bitcoin.

Despite these regulatory challenges, the potential for Asian corporate participation in the Bitcoin market remains promising. Some companies are investing via overseas subsidiaries to circumvent local regulations. Meanwhile, countries like Japan have made progress in relaxing relevant policies. Leading examples such as Metaplanet are attracting growing market attention. These positive developments may pave the way for broader Asian corporate engagement in the Bitcoin market in the future.

5. Conclusion

Bitcoin investment is gradually becoming a popular financial strategy among corporations. However, its price volatility remains a significant challenge, especially under external influences such as international politics. The 2022 market crash clearly exposed the potential risks associated with corporate Bitcoin holdings. Therefore, companies should proceed with caution when investing in Bitcoin and prudently combine it with safer assets to reduce overall risk.

Moreover, for Bitcoin to further develop within corporate portfolios, clear institutional frameworks must be established. Currently, there is a lack of definitive guidance on the holding and accounting treatment of crypto assets, leaving companies confused during implementation. Once these uncertainties are resolved, Bitcoin could play a more important role in corporate asset diversification.

Disclaimer

This report is prepared based on information believed to be reliable. However, we make no express or implied representations or warranties regarding the accuracy, completeness, or suitability of the information contained herein. We assume no responsibility for any loss arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and may change at any time without notice. All projects, forecasts, targets, and opinions mentioned in this report are subject to change and may differ from those of other organizations or individuals.

This document is for informational purposes only and does not constitute legal, business, investment, or tax advice. The securities or digital assets referenced in this article are provided solely as examples and do not constitute investment advice or an offer to provide investment advisory services. This material is not specifically directed to investors or potential investors.

Terms of Use

Tiger Research permits fair use of its reports. The principle of “fair use” allows specific content of the report to be used for public interest purposes, provided that its commercial value is not impaired. If the use falls within the scope of fair use, prior permission is not required. However, when citing Tiger Research reports, the following requirements must be met: 1) Clearly indicate “Tiger Research” as the source; 2) Include the Tiger Research logo (black or white). Any adaptation or republication of the report content requires separate negotiation. Unauthorized use may result in legal liability.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News