Hashed 2025 Investment Outlook: Leading Blockchain Application Globalization with Asia at the Core

TechFlow Selected TechFlow Selected

Hashed 2025 Investment Outlook: Leading Blockchain Application Globalization with Asia at the Core

Asia will play a central role in this transformation, thanks to its highly digitalized societies, rapidly developing economies, and openness to new technologies.

Author: HASHED

Translation: TechFlow

Hashed has established and strictly enforces internal policies and procedures designed to identify and effectively manage conflicts of interest related to investment activities. This content is for informational purposes only and does not constitute legal, business, investment, or tax advice. Additionally, any securities or digital assets mentioned are for illustrative purposes only and do not represent investment advice or an offer to provide investment advisory services.

Simon Kim's Introduction: Hashed’s 2025 Investment Thesis and Outlook on U.S. Crypto Policy

We are currently at a pivotal moment where technological innovation intersects with policy transformation. I am pleased to introduce our two key reports: Hashed’s 2025 Investment Thesis: Blockchain Globalization with an Asian Core, and the special report A Second Trump Term in 2025: The Future of U.S. Crypto Industry Policy.

The blockchain industry is approaching a turning point—infrastructure is maturing, institutional participation is increasing, and unprecedented opportunities are emerging. Our investment outlook for 2025 is grounded in years of observing cycles of technological innovation, industry challenges, and market maturity across global markets.

In recent years, several major trends have validated our strategic direction: blockchain infrastructure has become more stable and reliable, stablecoin ecosystems continue to expand, and high-performance networks are delivering on their promises of usability and efficiency. These developments, combined with growing institutional investment and the expansion of the global digital economy, are paving the way for large-scale adoption of blockchain technology.

We structure our investment thesis into three parts:

-

Review of 2024 Investment Thesis: Providing transparent insights into industry growth and market dynamics through real data analysis.

-

Vision and Strategic Focus: Clarifying our focus on high-growth markets and emerging opportunities.

-

Priority Investment Areas: Outlining how our investment team aims to build a more inclusive and efficient blockchain ecosystem.

Additionally, the Hashed Open Research team has analyzed potential U.S. crypto asset policy directions under a second Trump administration in 2025. This report explores critical issues such as stablecoin legislation and industry regulation—policy shifts that could reshape the global market landscape. In an increasingly interconnected global blockchain environment, understanding these policy trajectories is essential for industry development.

Through these two reports, we aim to offer partners unique perspectives to better understand the potential impact of policy changes on market dynamics and investment opportunities. We believe this integrated view combining market insights with policy analysis will serve as a vital reference for strategic decision-making in 2025 and beyond.

We sincerely invite you to read both reports and welcome your feedback and suggestions.

Hashed’s 2025 Investment Thesis: Asia at the Core, Leading Blockchain Globalization

Hashed remains committed to advancing blockchain into its golden age—a phase of mass adoption driven by real-world applications and global participation. We believe Asia, with its highly digitized societies, rapidly developing economies, and openness to new technologies, will play a central role in this transformation. From stablecoins becoming pillars of financial systems to scalable blockchain technologies maturing, the entire ecosystem is now ready for real-world deployment. We predict 2025 will mark the beginning of large-scale blockchain adoption, led by Asia, driving globally fairer and more transparent distributed ledger technology.

Part One: 2024 Investment Thesis – Data Tells the Real Story

We revisit our 2024 investment thesis through data analysis, assessing alignment between actual market performance and expectations. By reviewing key trends, major developments, and lessons learned, we gain deeper insight into the latest dynamics of the Web3 industry.

Key Area 2024 #1: Infrastructure for Mass Adoption of Blockchain

In 2024, blockchain infrastructure matured further, focusing on scalability and user experience. Progress in stablecoins and scalability solutions demonstrated that specialized technologies are significantly improving application efficiency and user engagement. While some expectations were not fully realized or took different forms, the overall trend is clear: 2024 was a pivotal year for blockchain moving toward mass adoption.

Our hypothesis about 2024 written at the end of 2023:

-

Specialized stablecoins will enter niche markets (e.g., B2B payments), challenging the dominance of USDT and USDC by offering targeted services.

2024 Review:

-

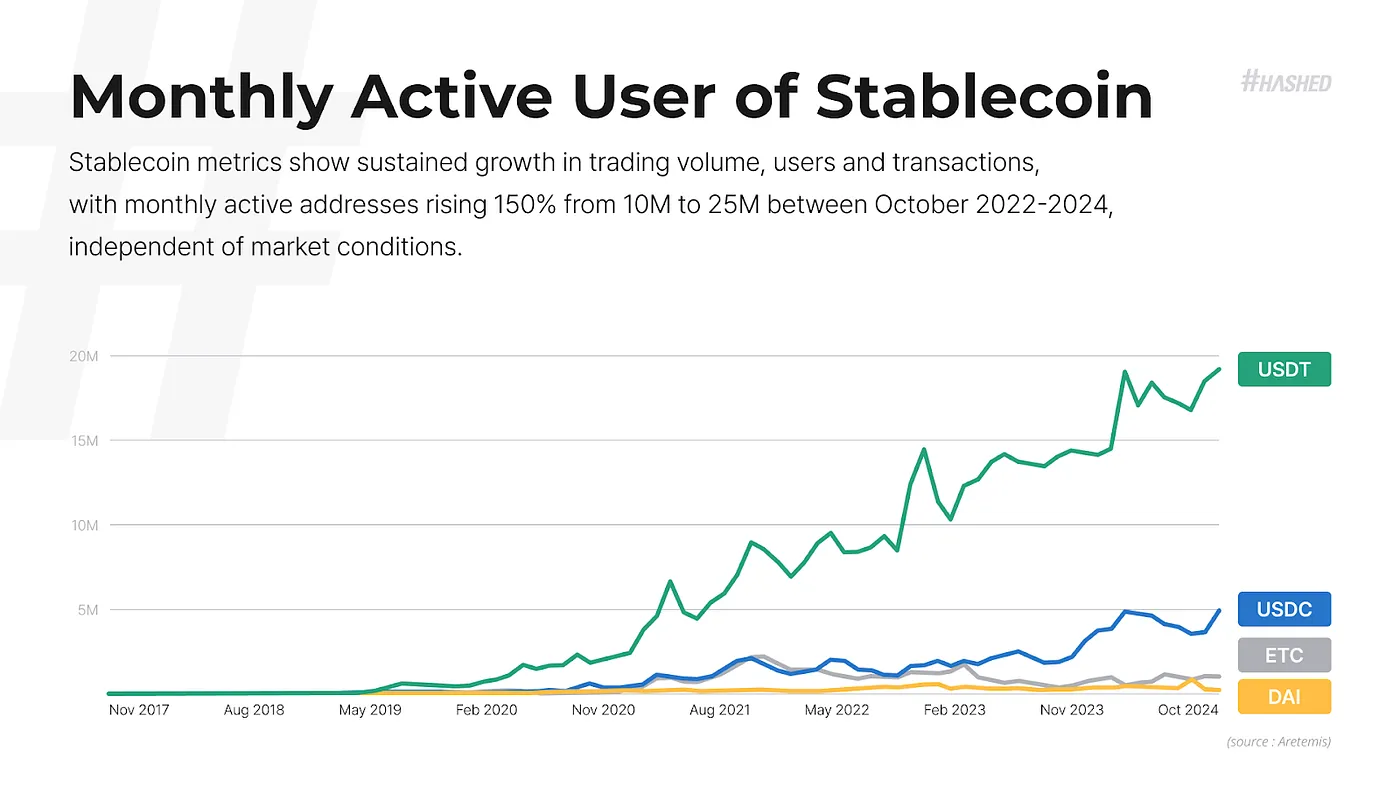

Stablecoin transaction volume, user count, and number of transactions grew significantly. Monthly active addresses increased from 10 million in 2022 to 25 million in 2024—an increase of 150%. This growth was independent of market volatility, demonstrating strong underlying demand.

Our hypothesis about 2024 written at the end of 2023:

-

Layer 3 Rollups will solve computational scaling for high-performance decentralized applications, particularly optimizing user experience in gaming and social scenarios.

2024 Review:

-

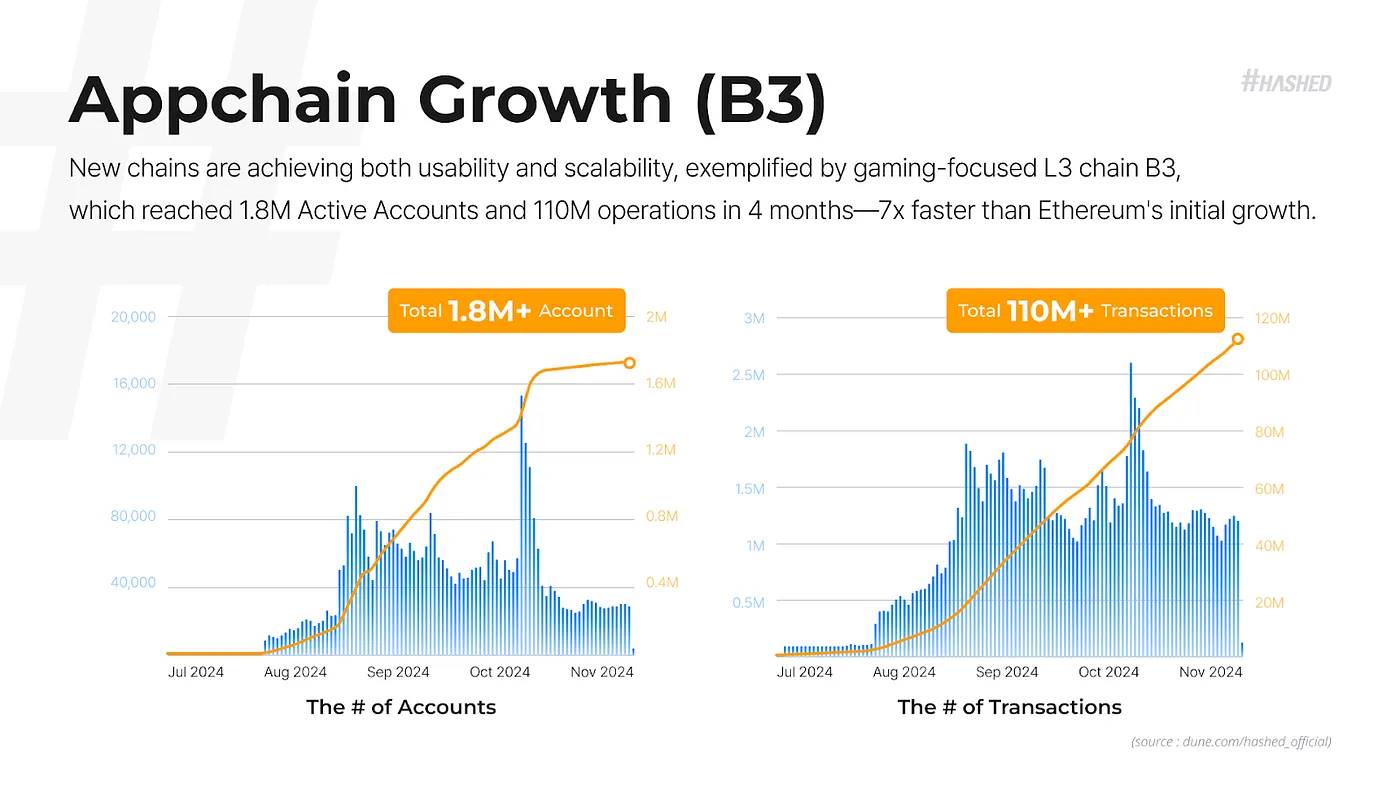

New blockchains achieved breakthroughs in usability and scalability. For example, B3, a Layer 3 chain focused on gaming, reached 1.8 million active accounts and 110 million operations within just four months—seven times faster than Ethereum’s early growth rate.

Key Area 2024 #2: Consumer-Facing Products Maturing

As payment channels and infrastructure continue to improve, we remain optimistic about AI-blockchain convergence, transparent intellectual property management ecosystems, and the rise of fully on-chain economies. These trends are not just our observations—they reflect shared recognition among institutions and individual users in the industry. Social data further confirms the validity of this direction, strengthening our confidence in future development.

Our hypothesis about 2024 written at the end of 2023:

-

The integration of AI and blockchain will enhance smart contract functionality, data privacy protection, and drive the development of decentralized AI ecosystems, improving decision-making and ownership management.

2024 Review:

-

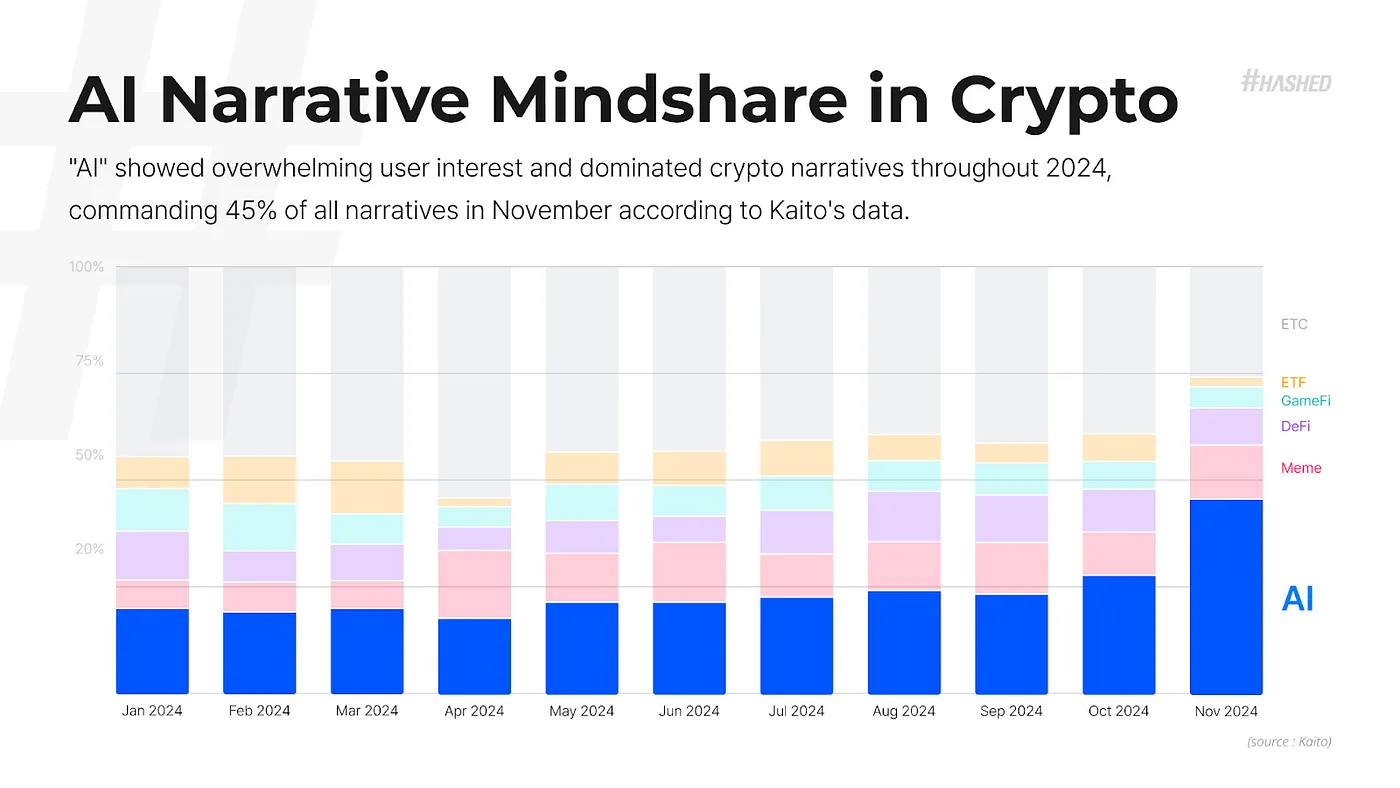

In 2024, “AI” became a hot topic among users. According to Kaito data, narratives related to AI accounted for 45% of discussions in November, making it the dominant trend in the crypto space.

Key Area 2024 #3: Convergence of Traditional Finance and Blockchain

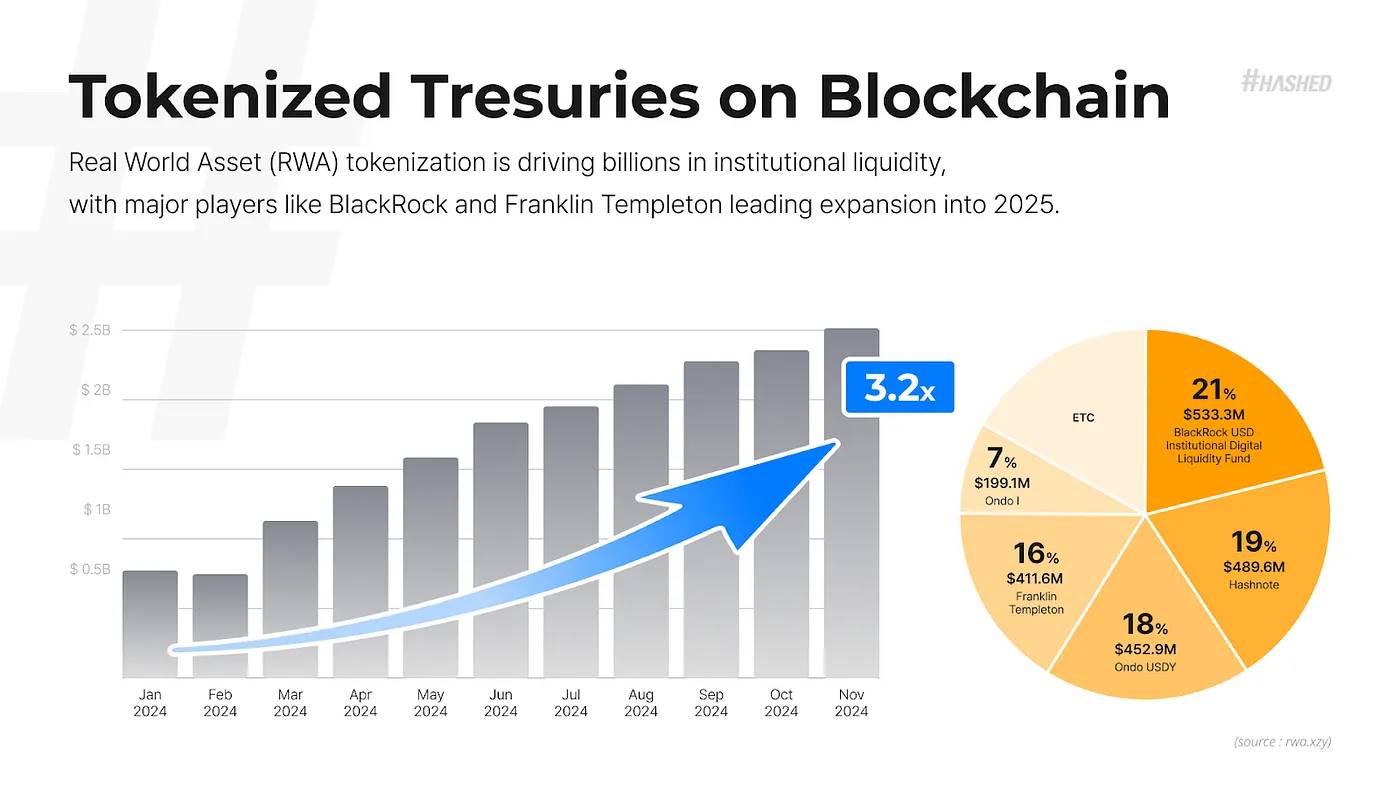

In 2024, tokenization of real-world assets (RWAs) and advancements in new Bitcoin token standards (such as Ordinals and BRC-20) accelerated the integration of traditional finance with blockchain. RWAs attracted billions in institutional capital, with giants like BlackRock and Franklin Templeton leading the charge. Meanwhile, Bitcoin unlocked DeFi-like functionalities through new token standards, accounting for approximately 60% of network activity and reinforcing its role beyond being a store of value.

Our hypothesis about 2024 written at the end of 2023:

-

Tokenization of real-world and security assets will serve as a bridge between traditional finance and blockchain, with emphasis on compliance and infrastructure development.

2024 Review:

-

RWA tokenization attracted billions in institutional liquidity. Institutions like BlackRock and Franklin Templeton are accelerating this trend, with plans extending into 2025.

Our hypothesis about 2024 written at the end of 2023:

-

Bitcoin’s Ordinals and BRC-20 standards will expand functionality via data inscription and tokenization, creating DeFi-like opportunities.

2024 Review:

-

Since 2023, new standards like Ordinals and Runes have driven significant growth in Bitcoin network activity, now accounting for around 60% of total transaction volume.

Part Two: Asia — Where Belief Meets Opportunity

Beyond the noise and hype, we examine why Asia continues to lead in Web3 innovation. From user base to developer ecosystem, Asia’s unique advantages position it as the core region for blockchain development—an opportunity too significant to overlook.

Hashed firmly believes the blockchain golden age will not be limited to a small elite in developed nations but will be a global opportunity—especially empowering Asia’s vast user base as primary participants. They will engage in diverse economic and non-economic activities on a fair and transparent global distributed ledger. Based on this vision, we have consistently prioritized Asian consumer markets and made early-stage investments accordingly.

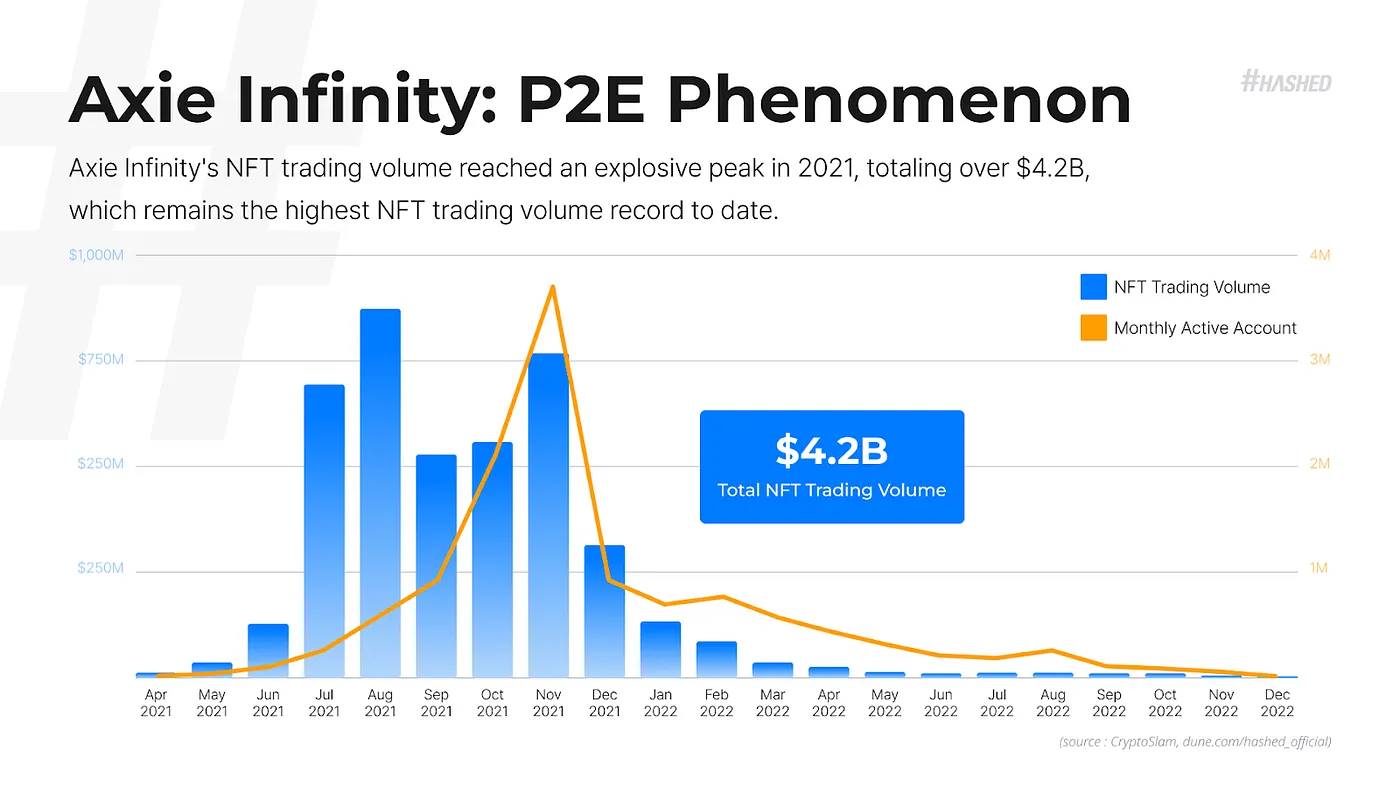

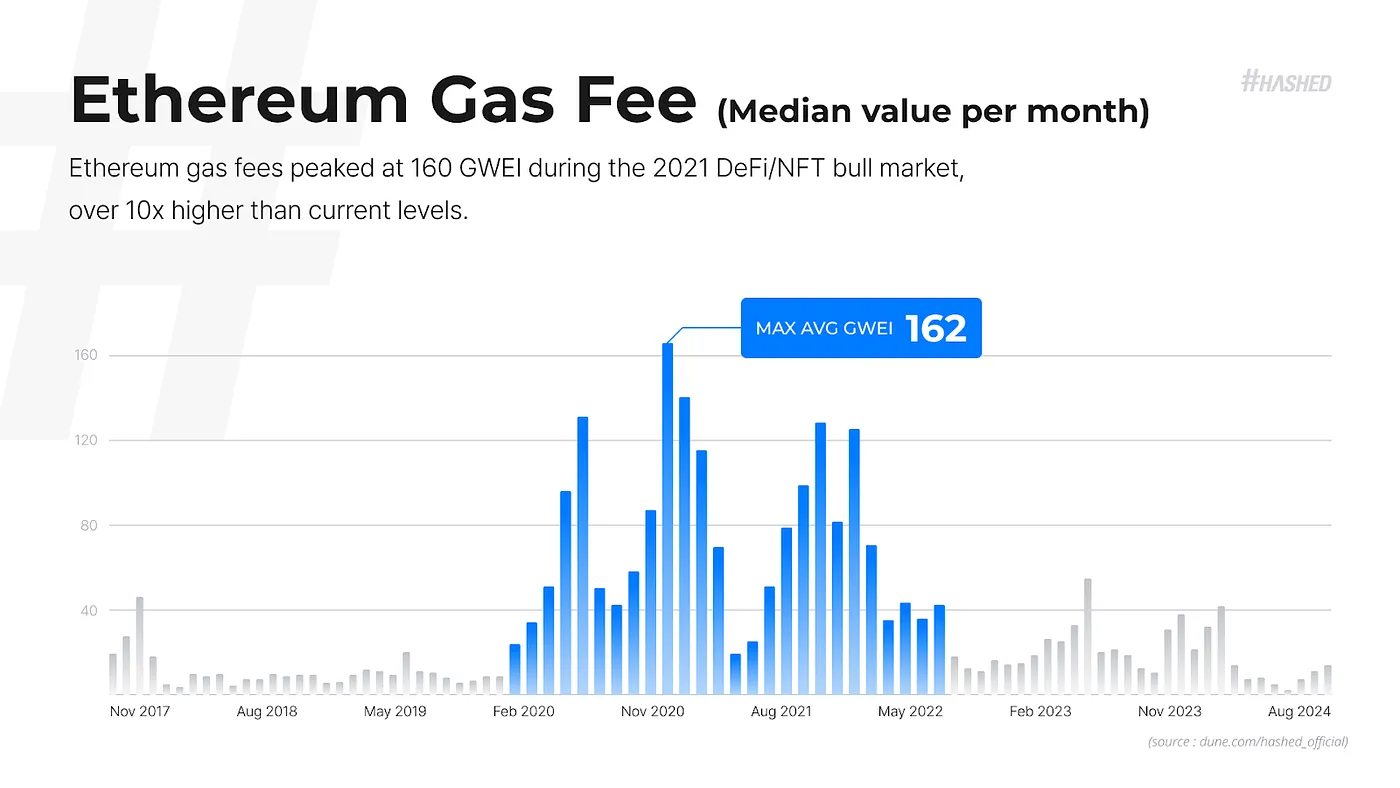

In 2021, we seemed to stand at the threshold of blockchain’s golden age. Bitcoin hit record highs, Ethereum’s DeFi and NFT ecosystems flourished, and market capitalization surged rapidly. The rise of altcoins signaled a classic bull market. By August 2021, users from emerging Asian markets flooded into blockchain. Though lacking crypto expertise, they showed immense enthusiasm for the technology. P2E (play-to-earn) games like Axie Infinity captured global attention, and dreams of mass adoption felt within reach. However, soaring transaction fees and network congestion soon turned Ethereum into a luxury, while other high-throughput “Ethereum killers” exposed fundamental chain-level flaws. Growth among Asian users eventually plateaued, shifting the narrative from frenzy to sobriety.

Reality fell short of expectations. The surge in activity brought sharply rising transaction costs and network congestion, transforming Ethereum from a public resource into a luxury good. Meanwhile, so-called “Ethereum killers,” despite advertising high throughput, frequently suffered from chain-level instability. The initial influx of Asian users appeared promising but ultimately stagnated. Before institutional adoption, macroeconomic headwinds and repeated market turmoil dampened retail-driven growth. This wave eventually ended, leaving behind the story of the last cycle as we know it.

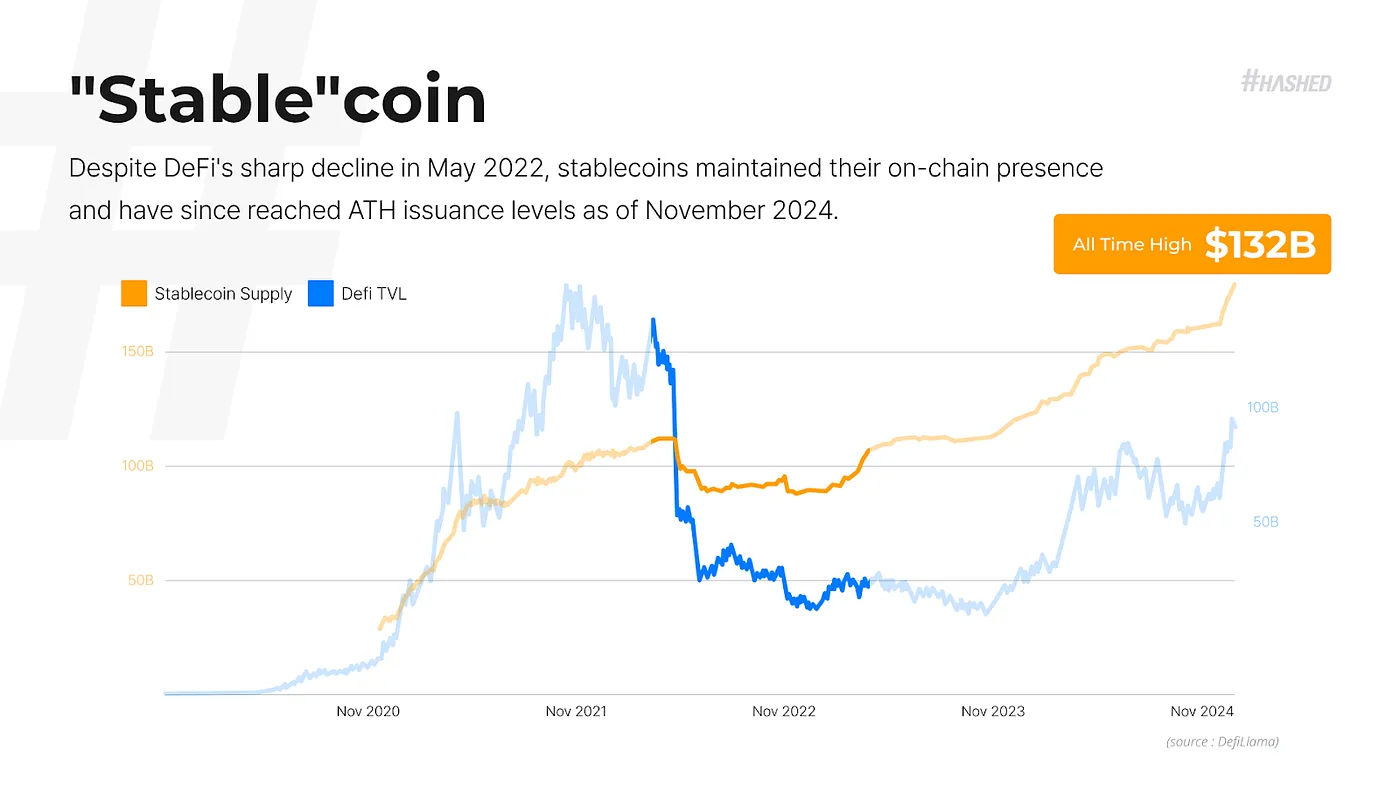

During the subsequent year-long crypto winter—a period marked by plunging market indicators and sustained bearish sentiment—one thing remained remarkably “stable”: stablecoins. Ironically, in an industry championing decentralization, the most popular instruments were fiat-backed stablecoins. Even amid rising interest rates and decoupling from broader market trends, stablecoin usage remained robust. This phenomenon emerged because, despite slow and costly development of financial and information infrastructure on-chain, users continued relying on stablecoins for practical value transfer. This suggests that Bitcoin’s original vision of on-chain value transfer is gradually maturing through integration with fiat currencies.

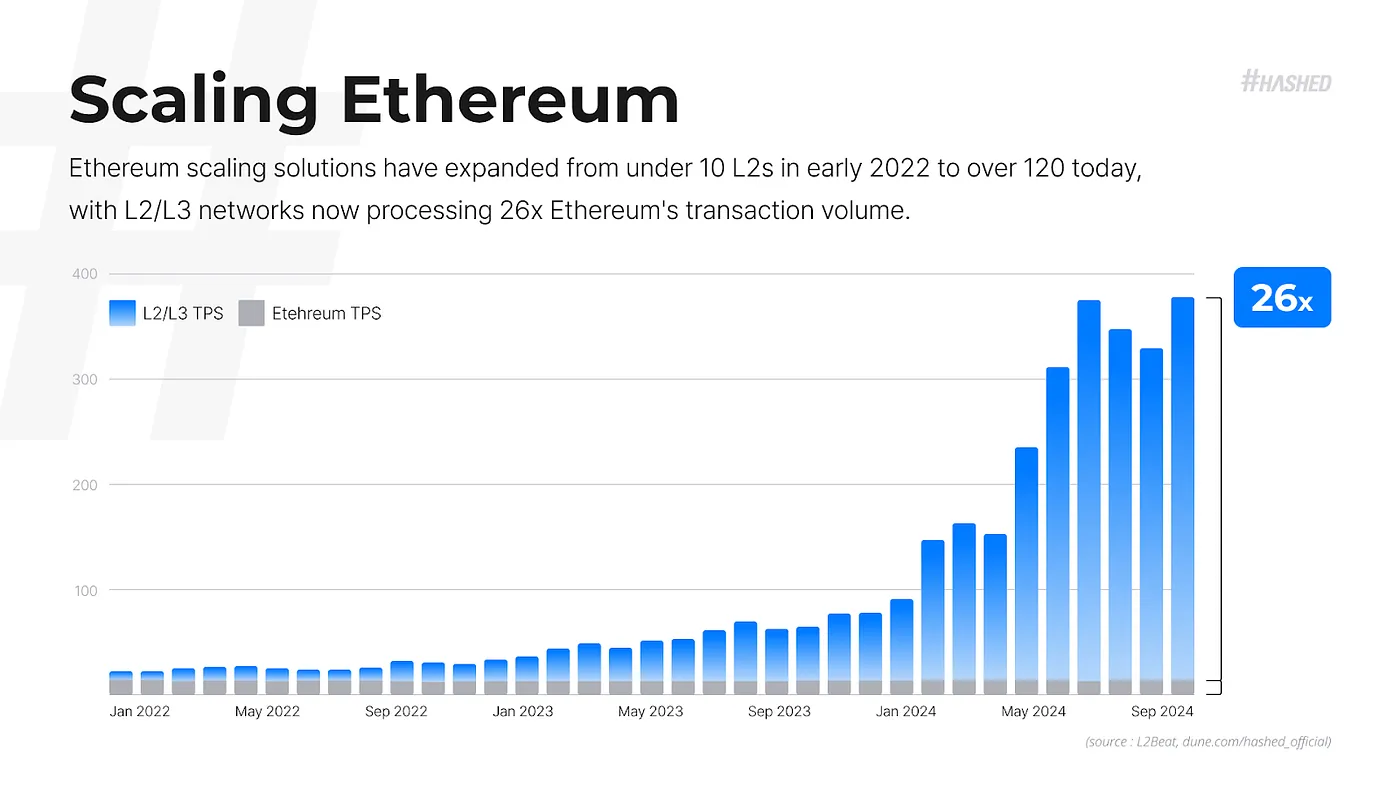

During this period, as stablecoin fundamentals strengthened, a new generation of high-performance blockchain competitors emerged. These platforms struck a balance between integrity, decentralization, utility, and commercial viability. Having survived the bear market stress test, surviving blockchain networks became more resilient. Meanwhile, Ethereum’s dominance across key metrics began to fragment, with increasing activity shifting to L2 solutions (as Ethereum was originally designed) and fast-growing monolithic blockchain ecosystems. Unlike the previous cycle constrained by high fees, today’s blockchain ecosystem offers a more accessible environment for mainstream users, enabling broader participation.

This shift coincided with the deepening use of stablecoin payment networks as a core financial pillar and the formal establishment of high-performance blockchains as ecosystem-level infrastructure. On the institutional front, the approval of major cryptocurrency ETFs opened the door for institutional capital and accelerated integration with mainstream finance. Unlike the previous speculative frenzy, institutional interest this time is more serious, with increasing numbers of enterprises exploring blockchain applications in infrastructure and consumer-facing solutions.

In this revival, Asia stands out. Ordinary users are returning to a market equipped with stronger infrastructure, diversified use cases, and more efficient value transfer mechanisms. At the same time, major governments and corporations in regions such as the Middle East, Japan, Hong Kong, and Southeast Asia are taking blockchain seriously—marking a shift from speculative curiosity to strategic positioning. Asia’s advantage stems from a unique combination: high mobile device penetration, a tech-savvy population, and a rapidly evolving digital economy. Moreover, cultural preferences for gamification and collective participation align perfectly with new consumer-facing blockchain applications.

We believe this is not merely a repetition of the past cycle, but a transformative phase laying the foundation for a globally distributed ledger capable of supporting mass adoption. With its vast, young, and digitally native population, Asia holds a distinct advantage in leading this transformation. Fueled by openness to innovation and vibrant consumer markets, Asia will remain a core driver of blockchain’s future, accelerating the world’s transition toward decentralized systems.

Part Three: 2025 Key Actions

Based on market signals and ecosystem dynamics, our investment team conducted in-depth analysis of future trends. We identified key value drivers and growth vectors that will shape the next wave of Web3 adoption.

Redefining Money: Stablecoins Integrating into Traditional Markets

Author: Simon Kim

In Q2 2024, stablecoin transaction volume surpassed Visa for the first time, signaling their expansion beyond crypto exchanges and DeFi into B2C and B2B financial domains. In South Korea, stablecoins now account for 10% of trade settlements, reflecting a shift from gray-market status to regulated financial infrastructure.

Behind this trend lies the integration of stablecoins into traditional financial institutions’ payment systems to improve efficiency, reduce costs, and accelerate cross-border transactions. Even SWIFT is exploring integrating stablecoins into existing payment infrastructure, indicating a global shift toward real-time settlement in payment systems.

Beyond payments, stablecoins are unlocking new opportunities in lending markets. By leveraging interest rate differentials between high- and low-rate countries, stablecoins serve as reliable collateral, facilitating cross-border capital flows and enhancing global financial efficiency. Simultaneously, they expand access to financial services for the unbanked.

These trends create substantial investment opportunities in blockchain infrastructure and application development. While technical scalability and security improvements remain urgent priorities, long-term market growth will increasingly depend on regulatory adaptation and institutional framework development.

The Infinite Creator: How Autonomous Digital Entities Are Disrupting Attention-Driven Social Media

Author: Ryan Kim

Despite Web3 social platforms yet to surpass traditional giants like X.com (formerly Twitter) or TikTok, a revolution led by autonomous digital creators is brewing. These intelligent agents can generate endless streams of high-quality content around the clock, breaking through the limitations of human creativity.

Looking back at social media evolution—from Facebook’s friend networks to TikTok’s algorithmic recommendations—platforms have continuously evolved to capture user attention. The next stage will be dominated by intelligent entities that, through integration with smart contracts, convert user attention into real economic value. This mechanism can redistribute profits to token holders, building a self-reinforcing attention economy.

This model transforms Web3 social from a traditional speculation-based model into a genuine economic engine, making creativity and attention integral components of a value ecosystem—and potentially challenging the dominance of current centralized platforms.

A New Paradigm for AI: Decentralized Intelligence

Author: Baek Kim

Today, centralized computing systems face bottlenecks. Opaque governance, data monopolies, and escalating privacy concerns demand disruption. Decentralized intelligence offers a new solution—distributing power, ownership, and participation across decentralized networks.

Key features of this model include:

-

Data Sovereignty: Users maintain full control over their own data.

-

Collaborative Governance: Distributed decision-making avoids single points of failure.

-

Transparent Incentives: Ensures fair rewards for all participants.

By shifting from closed proprietary systems to open, decentralized frameworks, this new model redefines how computing resources are managed—enhancing trust and efficiency, embedding accountability into the core of digital ecosystems, and democratizing innovation.

The Data Gold Rush: Unlocking a $20 Trillion Opportunity Hidden in High-Quality Data

Author: Jun Park

Every technological leap has been fueled by breakthroughs in accessing scarce, critical resources:

-

In the early 2010s, model scarcity was resolved by architectural advances like AlexNet and CNN.

-

In the late 2010s, computational bottlenecks eased with the emergence of large-scale foundation models.

-

Today, the key to the next breakthrough lies in high-quality data—an underutilized resource that will become the fuel for future innovation.

Traditional systems often hoard data within closed, proprietary silos, leaving vast data resources untapped. Blockchain technology offers a new way to unlock this hidden value:

-

Ownership and Provenance Tracking: Ensures data contributors retain control and receive proper attribution.

-

Privacy-Preserving Access: Enables secure use of sensitive datasets without compromising privacy.

-

Aligned Incentive Mechanisms: Rewards data sharing through transparent economic models.

For example, Zettablock provides domain-specific solutions via a decentralized data layer, while Story Protocol focuses on provenance tracking for creative assets. These blockchain-powered frameworks demonstrate how industries can be empowered. By unlocking access to private data, blockchain-based ecosystems can not only fuel innovation but also deliver customized solutions across a $20 trillion global market—from finance to healthcare and beyond.

Empowering Everyday Users: Consumer-Centric Applications Driving Mass Blockchain Adoption

Author: Edward Tan

The next wave of blockchain growth will be driven by consumer-centric applications that make crypto as seamless and intuitive as traditional apps. Just as crypto gaming attracted millions of users, on-chain consumer services are poised to become the gateway for blockchain to enter the mainstream.

By reimagining familiar user workflows and integrating efficiency and transparency, blockchain applications can transform everyday interactions. For instance, Modhaus tokenizes fan spending behavior in entertainment, turning ordinary transactions into personalized experiences that enable direct interaction between fans and artists. Similarly, mobile-first interfaces for DeFi protocols can simplify user actions, allowing average consumers to easily access tools like decentralized exchanges (DEXs) and money markets—lowering barriers to entry.

To break the monopoly of centralized giants over everyday users, blockchain teams must prioritize accessibility and onboarding experience. By designing applications aligned with users’ lifestyles, blockchain-based consumer products can drive mass adoption and build sustainable consumer ecosystems.

Social On-Chain: Integrating Messaging Platforms with Decentralized Ecosystems

Author: SJ Baek

Telegram, with its 900 million monthly active users, and its blockchain TON, exemplify the massive potential of mature social platforms to drive mass Web3 adoption. Growth has been fueled primarily by clicker and hyper-casual games like Notcoin, which have drawn tens of millions of users into on-chain interactions. Similarly, Line and Kakao, with over 200 million monthly active users, are attracting developers through the Kaia platform to build projects in social, gaming, decentralized finance (DeFi), and real-world assets (RWA), bringing more users into the Web3 ecosystem.

Compared to WeChat’s centralized ecosystem, Telegram and TON’s open application ecosystem is still in its early stages. It features rapid user growth but lower engagement and retention. However, proven vertical application areas—such as niche social platforms, mid-to-hardcore gaming, short video content, and social finance—offer significant potential for boosting on-chain user growth and revenue, while also extending user lifecycle.

As an open platform, Telegram and TON have relatively small operational teams, resulting in gaps in critical infrastructure such as social data platforms, app distribution channels, and technical support. To address these shortcomings and enhance scalability, a middleware layer—supported by dedicated teams or established applications—is needed to fill these gaps and propel ecosystem development forward.

Transforming Trading: Revitalizing High-Growth Assets and Legacy Systems

Author: Dan Park

Blockchain-powered markets are transforming high-growth assets and traditional industries by building efficient, transparent platforms that address long-standing unmet needs and systemic inefficiencies.

-

High-Growth Assets: As demand for emerging resources surges, blockchain markets are providing trading venues. For example, GAIB facilitates trading of computing resources to meet growing demand in decentralized AI and cloud computing. Markets for unconventional assets—such as urban air rights—are also unlocking liquidity. These assets typically trade frequently but exist in fragmented markets; blockchain simplifies transactions and opens doors for broader participation and innovation.

-

Modernizing Legacy Infrastructure: Traditional industries are being modernized through blockchain. Tokenization systems streamline processes and increase transparency. For instance, multiple platforms are optimizing USD-pegged stablecoin ecosystems or introducing real-time data sharing for stock and commodity trading networks. These enhancements boost global trade efficiency and enable broader access to markets historically difficult to enter.

These blockchain markets are more than just transaction mediums—they are vital engines driving long-term product-market fit (PMF) for blockchain technology. By transforming how industries operate, these platforms open doors to new opportunities for more people and inject new vitality into legacy systems.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News