HTX Ventures 2024 Crypto Market Review and 2025 Outlook: 5 Sectors Shine

TechFlow Selected TechFlow Selected

HTX Ventures 2024 Crypto Market Review and 2025 Outlook: 5 Sectors Shine

As the regulatory environment becomes more open and transparent in 2024, the crypto industry is entering a new era.

For the crypto industry, 2024 has been a landmark year. From the approval of Bitcoin and Ethereum ETFs at the beginning of the year, to the booming bull market, and further catalyzed by the U.S. presidential election, cryptocurrencies like Bitcoin have reached record valuations, increasingly influencing societal and political landscapes.

For HTX Ventures, it has also been a fruitful year. Benefiting from waves of innovation, we supported 28 leading projects and funds exploring new frontiers in crypto. These projects spanned DeFi, BTCFi, ZK-rollups, modular infrastructure, Layer 1 and Layer 2 solutions, artificial intelligence, SocialFi, GameFi, and more.

Looking ahead, HTX Ventures has identified five major sectors that showed exciting progress in 2024 and which we will closely monitor in 2025. These include the Bitcoin ecosystem, Infrastructure (Infra), Meme, Artificial Intelligence (AI), and the TON ecosystem. This report provides an in-depth analysis of each sector’s current state, challenges, and future opportunities, along with macroeconomic context and market outlook.

Bitcoin Ecosystem

Market Dominance

Over the past year, Bitcoin's market dominance increased from 45.27% to 56.81%. This means that most liquidity in today’s crypto market is concentrated within the Bitcoin ecosystem—and this concentration continues to grow.

Source: CoinStats

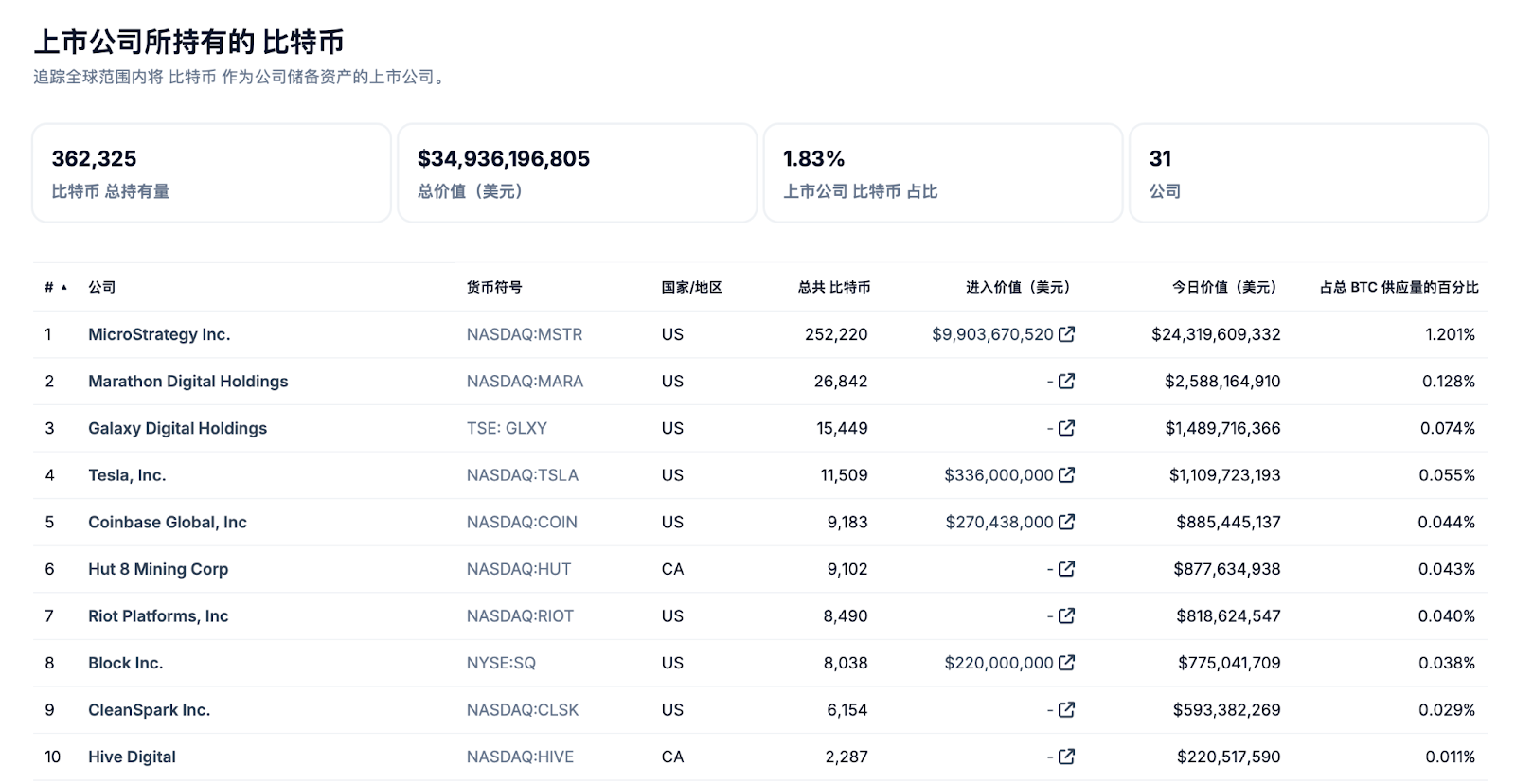

Spot Bitcoin ETFs have cumulatively acquired 5.3% of existing Bitcoin supply, increasing holdings from 629,900 BTC at the start of the year to 1,243,608 BTC—an increase of 613,708 BTC. Within 12 months, ETF-held Bitcoin rose from 3.15% to 6.25% of total supply (as of December 4, 2024).

A new market structure has formally emerged: centered on Bitcoin as a core asset, using ETFs and U.S. equities as channels for capital inflow, with publicly traded companies such as MicroStrategy (MSTR) serving as vehicles to endlessly absorb U.S. dollar liquidity. As a result, the necessity for Bitcoin to further develop its ecosystem and improve capital efficiency has become increasingly evident—this will be achieved by increasing BTC demand and driving price appreciation.

Layer 2

Over the past three years, 77 Bitcoin Layer 2 projects have launched or completed fundraising. In the first half of 2024, driven by enthusiasm around Bitcoin ETFs, legacy Bitcoin Layer 2 projects—including Lightning Network, Stacks, and Liquid Network—saw significant increases in trading volume and token prices. These older Layer 2 networks also witnessed continued technical development. A variety of Layer 2 solutions have emerged on Bitcoin, including Spiderchain (Botanix), ZK Rollups (Nexio and Critea), EVM-compatible chains (BOB and B Squared), and sidechains (Merlin). To date, the total value locked (TVL) across Bitcoin Layer 2s has reached $3 billion, contributed by 19 projects. If all announced Bitcoin Layer 2 projects launch over the next few years, TVL could grow another 2–4x, reaching $6–12 billion.

Layer 1 / Execution Layer

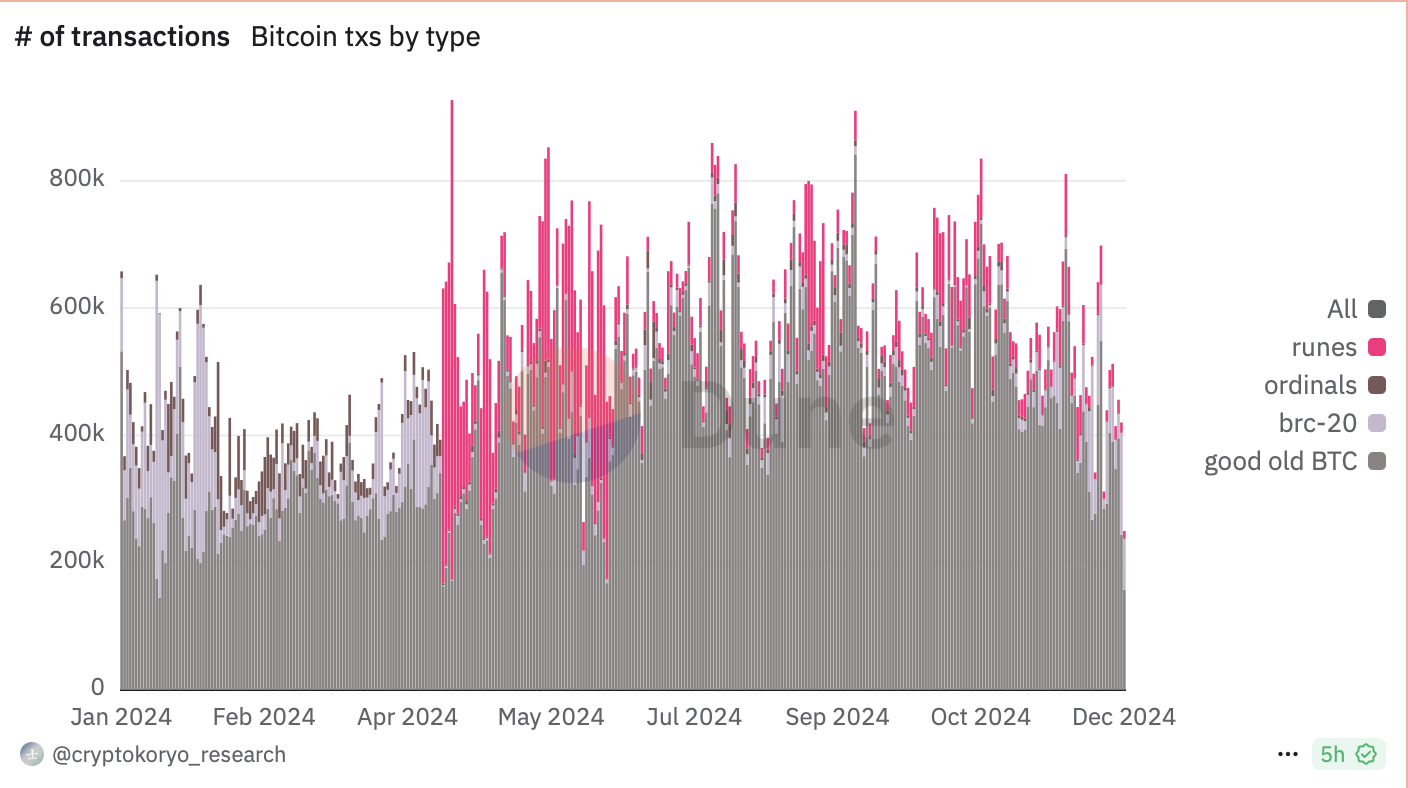

BRC-20, Ordinals, and Runes are key new execution standards that emerged at the end of 2023. Despite a broader market downturn in Q2, activity on Bitcoin Layer 1 steadily increased. However, while the Bitcoin market recovered somewhat in Q3, this growth momentum did not sustain.

BTC L1 Dynamics, Source:Cryptokoryo_research

Other Bitcoin Infrastructure

As Bitcoin utilization rises, other infrastructure components—including interoperability solutions and security layers—are beginning to emerge.

Interoperability

Bridges and WBTC remain dominant interoperability solutions on Bitcoin. Since Bitcoin does not natively support composability for building applications, users must rely on bridges/WBTC to unlock DeFi yields on other blockchains. We expect more interoperability solutions such as Xlink, Atomiq, and Auran to launch in the coming year.

Security Layer

However, these interoperability solutions may pose risks to the underlying asset's security, as hacking incidents occur frequently. In response, Bitcoin-related security solutions are emerging.

Babylon is a prime example. It has developed a shared security protocol for Bitcoin, including:

-

Bitcoin Timestamping: Enables timestamping data on the Bitcoin network, enhancing data credibility and immutability.

-

Bitcoin Staking: Through economic incentives, allows Bitcoin to provide security for other networks.

Additionally, with the emergence of new technologies such as data availability (DA) layers, Bitcoin’s potential utility is being further unlocked. Nubit is a key player in Bitcoin’s DA space, expanding data capacity via Bitcoin to support applications, Layer 2s, and oracles.

Whether OP_CAT Passes in 2025 Upgrade Is Key

The Taproot upgrade enabled asset issuance on Bitcoin’s mainnet. From the rise of BRC-20 inscriptions and Ordinals NFTs in 2023, to subsequent protocols like ARC-20 and SRC-20, and the emergence of infrastructure such as Bitcoin Layer 2s, Bitcoin restaking, LSTs, and cross-chain bridges, the ecosystem rapidly evolved. Then, after the Bitcoin Conference in July 2024, market attention shifted toward native BTCFi—such as stablecoins—that enable decentralized, non-wrapped models.

Currently, developers can use cryptographic techniques such as Discreet Log Contracts (DLCs) and Adaptor Signatures to program financial contracts in Bitcoin scripts dependent on external events, ensuring permissionless liquidation for stablecoin and lending projects, while Partially Signed Bitcoin Transactions (PSBTs) ensure permissionless multi-party operations. However, this still involves game-theoretic logic—deterring malicious behavior by raising the cost of attacks rather than achieving full decentralization at the smart contract level. The upcoming mainnet launch of Shell Finance, a stablecoin project, adopts precisely this model.

What could truly change the status quo is OP_CAT. If OP_CAT is activated, developers will be able to use native advanced programming languages like sCrypt to build fully decentralized, transparent smart contracts directly on the Bitcoin mainnet. sCrypt is a TypeScript framework for writing smart contracts on Bitcoin, allowing developers to use TypeScript—a popular high-level language—directly. With OP_CAT, existing Bitcoin Layer 2s could transition into ZK Rollups, significantly expanding the scale of BTCFi.

With dual support from macro market trends and infrastructure development, we believe Bitcoin will see further surging demand in the next two years.

Infrastructure (Infra)

In 2024, infrastructure remained one of the most attractive sectors in the crypto industry. The convergence of capital and technology accelerated rapid development across Layer 1, Layer 2, and middleware projects. Continued upgrades and construction in the Ethereum ecosystem, improvements in Layer 2 fees and performance; rapid growth of high-performance Layer 1s led by Solana; deepening of the multi-chain landscape; projects like EigenLayer improving network security and capital efficiency through restaking; and multiple Bitcoin Layer 2 efforts combining Bitcoin’s security with high-performance scaling—all contributed to a thriving infrastructure landscape.

Layer 1

Layer 1 projects continued optimizing consensus mechanisms and performance, providing a solid foundation for on-chain applications.

-

Ethereum: Launched EIP-4844, reducing Layer 2 network fees.

-

Solana and TRON: On-chain transactions are highly active due to the rise of Meme coins and infrastructure projects like Pump.fun and SunPump.

-

Aptos and Sui: Application growth in GameFi and DeFi drives increases in active users.

Layer 2

Layer 2 remains a key path to scalability, with both ZK Rollups and Optimistic Rollups making progress.

-

zkSync and StarkNet: Ongoing iteration and upgrades have significantly improved the user experience of ZK Rollups.

-

Base and Arbitrum: DeFi and NFT projects flourish on these platforms, with TVL growing substantially.

Layer 0 and Cross-Chain Middleware

Layer 0 and cross-chain middleware achieved new breakthroughs in interoperability.

-

LayerZero: Connected over 40 chains, with cross-chain transaction volume rising sharply.

-

Cosmos: IBC upgrade improved cross-chain performance by 50%.

Modular Blockchains

Modular blockchains offer high performance and flexibility, attracting diverse applications.

-

Celestia: Supports multiple modular execution layers, becoming a benchmark in modular blockchain development.

-

Monad: Ultra-high TPS attracts a large number of developers and DApp deployments.

Bitcoin Layer 2

Bitcoin Layer 2 became a hot topic in the primary market this year, with several related projects—including Babylon, Taro, BounceBit, and Corn—raising funds, primarily bringing smart contract and scaling capabilities to the Bitcoin network.

-

Taro: Expands Bitcoin’s payment and contract capabilities via the Lightning Network.

-

Stacks and RSK: Driving growth in Bitcoin-based smart contract applications.

Restaking

Restaking enhances capital efficiency and gained strong traction and market attention this year. Projects including EigenLayer and Satori received tens of millions in funding from top-tier investors.

Fundraising Events

Infrastructure remains central in this year’s fundraising landscape. Layer 1, modular blockchains, and Bitcoin ecosystem-related infrastructure attracted significant capital. Layer 1 currently represents the most concentrated area of technological development and exploration in crypto, and will continue to be a focal point for developer resources and investment.

Meme

Key Entry Point for Retail Capital After Crypto Liberalization

In 2024, the Meme sector once again became a hotspot in the crypto market. As a ecological beachhead, Meme coins not only drive community consensus but also integrate with DeFi, GameFi, and other domains to create new use cases. For example, Solana successfully boosted ecosystem vitality by aggressively supporting innovation and growth in Meme projects. From early-year tokens like Bome and Slerf, to mid-year platforms like Pump.fun, these projects—with their bonding curve pricing and low-market-cap launches—exhibited strong "lottery-like" characteristics, drawing widespread attention. Moreover, Pump.fun’s “anyone can deploy a Meme” decentralized approach drove even greater ecosystem expansion, with over half of Solana’s Meme projects now originating from Pump.fun, dozens of which have surpassed $1 billion in market cap. Public chains like SUI and TRON quickly followed suit with Meme strategies, further energizing their ecosystems.

Pump.fun

Meme projects, with their simplicity and low entry barriers, have become powerful tools for attracting new crypto users. Moonshot’s integration of fiat onboarding for Meme assets allowed users to purchase Meme tokens with fiat currency, while post-election politically themed Meme trends gave new participants a strong sense of involvement. Looking ahead, Trump administration crypto policies and governance actions may bring potential news catalysts, possibly sparking new Meme trends. For instance, if Elon Musk’s proposed “Department of Government Efficiency” (nicknamed “DOGE”) gains attention, it could trigger another Dogecoin rally.

As the crypto market environment becomes more permissive, more retail investors are expected to enter, with Meme projects serving as a major channel for capital inflow. The massive price surges seen on Robinhood after listing Meme coins clearly illustrate this trend, which may continue to drive growth in this sector.

Meme Infrastructure

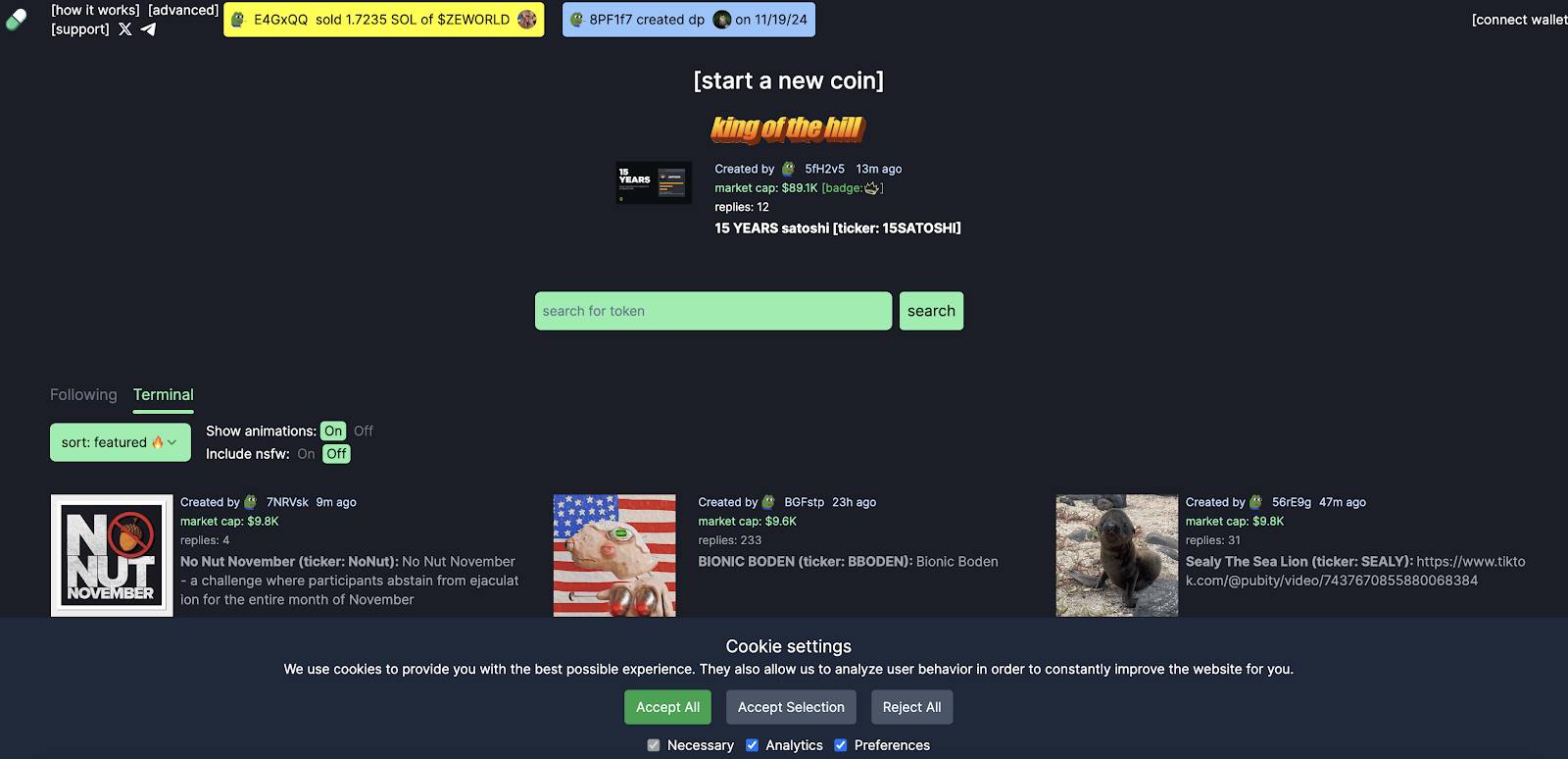

As market demand for fair launches intensifies, Meme fair-launch infrastructure captured exceptionally high attention and participation this year. Projects like Pump.fun and SunPump became top cash-generating projects, injecting new momentum into Meme development.

Pump.fun

Pump.fun is a Meme project launch platform built on Solana. With simple, intuitive creation tools and strong community support, it employs a fair distribution model and automatically adds liquidity to DEXs. Combined with Solana’s successful marketing, community engagement, and low transaction costs, Pump.fun was quickly embraced by the market and successfully incubated multiple well-known Meme projects. By November 2024, it had launched over 40,000 projects to Raydium, generating over 1.17 million SOL (~$200 million) in cumulative revenue.

Pump.fun’s success inspired numerous imitators, leading to “Pump clones” appearing across multiple chains, with SunPump being the most notable. Overall, this market-driven Meme boom would not have been possible without innovative infrastructure tools. Platforms like Pump were pioneers in integrating automated liquidity provisioning, while emphasizing fairness, low cost, and efficiency in issuance—effectively lowering barriers and boosting market and community confidence, fueling the Meme craze throughout the year.

However, Pump.fun’s success has not been perfectly replicated on other chains, mainly due to:

-

Solana’s low transaction fees and high throughput make it an ideal platform for launching Meme projects.

-

The Solana community shows great enthusiasm for new projects, accelerating early-stage Meme growth.

-

Other ecosystems, such as Ethereum, face high gas fees, while Meme projects on other high-performance chains like BSC and Avalanche have performed modestly, limited by smaller communities and lower user stickiness.

Platforms like Pump.fun and SunPump have become essential infrastructure for Meme project development. In the future, Meme projects may evolve toward greater diversification and utility, with infrastructure adding integrations with gaming, NFTs, social features, and other use cases. As multi-chain ecosystems mature and real-world applications expand, Meme infrastructure will continue to inject vitality into the sector.

Artificial Intelligence (AI)

In 2024, the Crypto+AI sector continued exploring viable directions, giving rise to dozens of AI sub-sectors including ZK/OPML for onboarding AI, AI data crowdsourcing, decentralized compute leasing, AI data trading, AI games, and AI agents.

Crypto Projects Expand Focus to Capture AI Narrative

This year, many blockchain infrastructure and application projects expanded their focus on AI. Centralization of resources and ownership remains a key long-term challenge for scaling AI infrastructure, while the decentralized nature of blockchain offers a viable solution. A prominent example is Near, which since this year has encouraged running open-source AI protocols on-chain.

Data Labeling/Management

Data scarcity remains one of the main bottlenecks in scaling AI development. Most useful AI training data is monopolized by large tech firms. Due to jurisdictional limitations of these companies, language and cultural coverage remain inefficient. Existing centralized AI data labeling firms cannot fully scale datasets due to insufficient financial incentives and operational jurisdictional constraints.

Blockchain technology offers effective solutions. Multiple projects—including Kiva, Sapien, and Bagel—are launching to improve data sourcing and incentivize efficient cross-jurisdictional data labeling tasks.

Decentralized Inference and Machine Learning

Currently, users primarily rely on centralized providers like Hugging Face to run inference on open-source models, which raises privacy and censorship concerns. Decentralized inference enables users to run machine learning models without depending on centralized services, while ensuring output verifiability. Three main approaches to verifiable inference have emerged, each with different trade-offs in cost and security.

ZKML

Uses zk-SNARKs to provide private inference for AI models. Giza, Modulus Labs, and EZKL are key players in this space. These technologies enhance the security and accuracy of open-model inference. However, due to high zk-proof generation costs, inference costs rise significantly—resulting in time and latency at least 100x higher than centralized inference. Therefore, current products require further improvement in zk technology before broad adoption.

OPML

Assumes inference results are correct unless challenged by network participants. Challenges run their own models to verify output accuracy. ORA is a leading example of OPML. While more cost-efficient than ZKML, it remains much more expensive than centralized inference due to payments to challengers.

On-Chain Decentralized Inference Networks

Queries are executed by a small set of nodes on-chain. If discrepancies arise, faulty nodes are penalized. This is the lowest-cost and fastest solution, but offers weaker security due to potential node collusion. Ensuring higher security may require deploying more nodes, increasing costs. Ritual is an example of such a decentralized inference network.

Due to lower cost-efficiency compared to local inference, decentralized AI inference is currently not a top choice for users. In the current state of AI development, output verification is not a major concern for developers or users. Additionally, edge computing serves as an alternative privacy and security solution for running AI models. Thus, decentralized inference may face growth bottlenecks in the long term.

Decentralized GPU

Demand for GPUs in AI development is soaring, yet current GPU providers are dominated by a few large companies, posing potential price risks in extreme market conditions. Render, a veteran decentralized GPU protocol, has seen a 10x price increase since 2023. This year, numerous new decentralized GPU networks launched, including IO.net, Grass, and Akash. These networks use token incentives to encourage GPU contributions, targeting individual consumers and smaller GPU operators.

However, due to lack of uniformity in GPU resources on these networks and the fact that most high-performance GPUs are not owned by individual consumers, centralized GPU providers are expected to remain the primary choice for AI developers.

On-Chain AI Agents

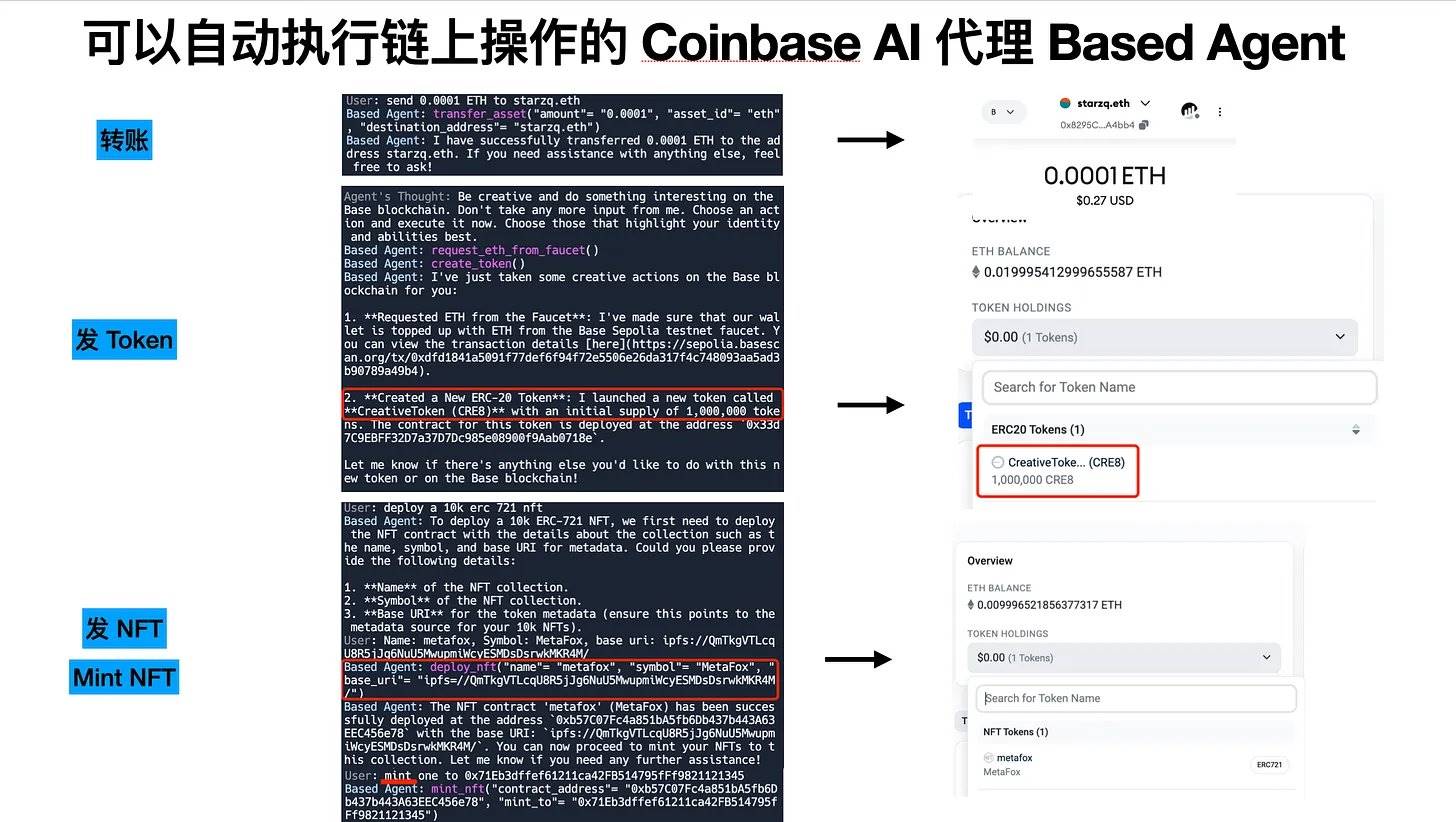

AI agents deployed on blockchains use token mechanisms to incentivize and guide specific behaviors, such as interacting with smart contracts, trading, and querying on behalf of users. Myshell is one such example. In the future, AI agents will gradually become personal assistants, offering users comprehensive service execution capabilities—such as autonomously issuing assets, initiating viral campaigns, forming decentralized autonomous organizations (DAOs), or even managing fund trading and investment decisions—developing their own unique cultures and beliefs. This deep fusion of AI and crypto technology is something Web2 cannot achieve and Web3 cannot accomplish independently—it represents a completely new paradigm.

Currently, these capabilities have not yet been productized. Recently, to address the need for AI agents to have independent financial identities and freely control wallets, Coinbase launched an AI wallet based on its MPC wallet, enabling AI agents to easily conduct various transactions. To make AI wallets easier to use, Coinbase also introduced the Based Agent template, enabling zero-code deployment. More productized applications are expected to emerge in 2025.

Based Agent Analysis, Source: https://x.com/starzqeth/status/1853597036421259728

Additionally, AI agent networks are beginning to emerge. Theoriq is a key example. Through a community-governed AI agent marketplace, it enables efficient multi-agent operations on-chain, providing creators with effective distribution channels and simplifying task execution for users.

TON Ecosystem

The TON (The Open Network) ecosystem, leveraging Telegram’s hundreds of millions of users and strong technical backing, has gradually built a multi-layered blockchain ecosystem and achieved explosive growth in both ecosystem and market metrics in 2024. From DeFi to Meme, NFTs to gaming, TON has leveraged its vast user base to achieve remarkable success across multiple domains, pioneering a new model where Web2 social apps monetize traffic through crypto.

TON Data Overview, Source: https://defillama.com/chain/TON

Since traditional business models failed to generate substantial profits for Telegram, TON began experimenting with zero-barrier or low-cost click-to-play mini-games combined with token airdrop expectations, successfully attracting a large number of Web2 users.

Success of Notcoin

In May 2024, the first project, Notcoin, launched. Notcoin is a social clicker game accessible via Telegram. Players interact with the Notcoin bot and invite friends to begin. The gameplay is simple: a coin appears on screen, and each tap earns virtual currency called Notcoin. Player tapping ability is limited by an energy bar, which depletes with use but regenerates over time.

Notcoin was widely embraced upon launch, leveraging simple mechanics and Telegram’s massive user base to quickly reach millions of monthly active users and list on major exchanges. Notcoin’s success marked the validation of TON’s gaming model and signaled a new era of user acquisition in the gaming sector.

Optimization with Catizen

Following Notcoin, Catizen optimized the gameplay experience—adding acceleration features and encouraging small payments (e.g., $0.99, $4.99) to enhance engagement. Users can use OTC fiat onramps to directly purchase crypto with credit cards, dramatically lowering entry barriers. This zero- or low-cost model further expanded the user base.

Other Business Models

Within the TON ecosystem, Dogs is one of the most popular Meme projects. Through unique community governance and ecosystem development, Dogs quickly gained market traction. The project uses Telegram account verification and invitation mechanisms to enable simple mining. After launch, Dogs attracted significant community attention and was listed on multiple exchanges in a short time.

Beyond gaming and social projects, DeFi is also flourishing on TON. Projects like TonStaker and Ston.fi have made notable progress. Through flagship traffic projects like Notcoin, Dogs, and Catizen, TON has not only strengthened its position in social payments but also achieved breakthroughs across multiple sectors including DeFi.

However, clicker games fundamentally represent a model of attracting Web2 users via airdrop expectations and then selling them to exchanges. After initial hype fades, traffic often plummets. Currently, the TON ecosystem urgently needs to find new business models in 2025 that improve user retention and identify the next growth curve. It could be DeFi or Meme—but it won’t be a model already implemented on Ethereum or Solana. TON’s success has inspired other Web2 social apps. For example, Line, focused on Japan, Korea, and Southeast Asia, launched the Kaia chain and began experimenting with Mini DApp models to monetize existing Web2 traffic. This indicates TON’s model is having a profound impact across the industry.

Line Web3 Platform Breakdown,

Source: https://govforum.kaia.io/t/gp-4-budget-request-for-kaia-wave/963

Capital Market Attention

In capital markets, TON has attracted more investor interest compared to other high-performance public chains. Multiple projects received primary market investments this year. TON will continue advancing in user experience, ecosystem diversity, and technological innovation, injecting fresh momentum into the ongoing development of the crypto market.

2024 was a breakout year for the TON ecosystem. But looking forward, TON must innovate in business models, improve user retention, and find new growth curves. Only then can it maintain its lead in the competitive blockchain landscape and deliver sustained value to users and investors.

Macro Outlook

The 2024 crypto market narrative began in January with the approval of Bitcoin ETFs and became clearer after Trump’s victory in November. From a macro perspective, the crypto market is currently transitioning from Quantitative Tightening (QT) to Quantitative Easing (QE), with QE expected to begin in Q2 next year. Historical patterns suggest that crypto bull market peaks typically do not occur during rate-cutting cycles, but rather near the end of cuts, at the tail end of hiking cycles, or shortly after hikes begin. For example, the extremely loose policies triggered by the 2020 pandemic sparked a crypto bull run, and the market peaked at the end of 2021 as the Fed began signaling tightening—official rate hikes started in 2022.

Therefore, the current market is still far from the bull market peak. Overall, this bull cycle could take multiple paths—especially given Trump’s fiscal expansion policies and unprecedented pro-crypto signals—potentially ushering in a strong bull market. Additionally, with regulatory relaxation and traditional institutions entering the space, Bitcoin will gain stronger support, gradually becoming a core U.S. dollar-denominated asset alongside traditional sectors like AI. The decoupling trend between Bitcoin and the broader altcoin market is expected to strengthen further.

On the other hand, the benchmark interest rate is expected to fall to neutral levels by mid-2025. Whether further cuts or tightening signals follow will depend on inflation levels at that time and whether Trump can successfully influence the Federal Reserve. If the Fed signals tightening to combat inflation, the market may enter a correction phase until Trump potentially gains control over Fed policy by May 2026.

In 2025, Influx of Traditional Financial Giants and Crypto Retail Will Spawn New Sectors

Repealing SAB 121 Removes Barriers for Traditional Institutions

Trump is expected to repeal SAB 121 upon taking office on January 20 next year. This will allow traditional financial institutions to hold crypto assets on their balance sheets, further accelerating institutional adoption of crypto. This not only expands financing options for crypto assets but also makes spot crypto more accessible through existing institutional trading platforms and partnerships, elevating the maturity of the institutional crypto market.

SAB 121 (Staff Accounting Bulletin 121) is guidance issued by the U.S. Securities and Exchange Commission (SEC) in 2022. Under this rule, banks, exchanges, or other financial institutions holding or custodizing crypto assets must treat them as liabilities and disclose them on their balance sheets—even if they merely hold crypto on behalf of clients, they must assume potential liability.

This regulation requires institutions to make adjustments in two areas:

-

Detailed risk disclosure: They must disclose potential risks associated with crypto assets, including market volatility, hacks, and technical failures.

-

Accounting treatment: Crypto assets must be treated as liabilities, not just custodial client assets. This may increase total liabilities and affect capital adequacy ratios.

Due to these restrictions, SAB 121 has directly hindered major U.S. financial institutions—especially national banks like Citibank and JPMorgan—from offering crypto custody services, and has limited crypto companies’ access to banking services.

However, with clearer regulatory stances and policy liberalization, traditional financial firms and investors will for the first time be able to operate on blockchains, unlocking new revenue streams and strategic opportunities.

Coingecko, dated Dec 4th

PayFi: Direct Fiat-Crypto Integration Will Unlock Infinite Possibilities

As traditional institutions gain legal rights to invest in, hold, and custody crypto assets, sectors like PayFi, compliant stablecoins, and regulated fiat on/off ramps are poised for rapid growth. Recently, Tether announced a new Real World Assets (RWA) platform focused on tokenizing real-world financial assets—such as government bonds, real estate, and fixed-income instruments—offering digital investment forms.

Moonshot created a novel use case by linking fiat onramps directly to Meme trading. In the future, more projects may emerge that connect fiat rails with real-world assets and high-frequency crypto activities like GameFi and DeFi.

Conclusion

As the regulatory environment became more open and transparent in 2024, the crypto industry is entering a new era. As long-term investors since 2018, HTX Ventures is committed to leveraging our expertise and insights to expand the industry’s usability and user base by identifying and supporting the most innovative and cutting-edge technological projects.

We look forward to 2025 with optimism, continuing this journey together with our partners, investors, and the entire crypto community. Let us jointly build a more innovative and accessible crypto ecosystem.

References

https://mp.weixin.qq.com/s/6Cnm4r3mrZL8ycjSz0dFlQ

https://mp.weixin.qq.com/s/XxiIUVGRo5O1THOiQQ58tg

https://www.techflowpost.com/article/detail_21532.html

https://mp.weixin.qq.com/s?__biz=MzkxMjI5ODA0OQ==&mid=2247485833&idx=1&sn=b36291a6e5e1861885c88eb4836dda5a&chksm=c10e50a7f679d9b147c2a8e421e5c71752ab67892e1e63dee2481500038680b308c218a20c9e&scene=21#wechat_redirect

https://www.techflowpost.com/article/detail_21506.html

https://www.panewslab.com/zh/articledetails/hdiqbvdc.html

https://www.panewslab.com/zh/articledetails/bc2sa518.html

https://www.panewslab.com/zh/articledetails/s9fv06s7081u.html

https://a16zcrypto.com/posts/article/state-of-crypto-report-2024/

About HTX Ventures

HTX Ventures is the global investment arm of Huobi HTX, integrating investment, incubation, and research to identify the world’s most talented and visionary teams. As an industry pioneer with over a decade of history, HTX Ventures excels at spotting frontier technologies and emerging business models. To drive growth within the blockchain ecosystem, we provide comprehensive support to portfolio projects, including fundraising, resources, and strategic guidance.

HTX Ventures currently supports over 300 projects across multiple blockchain domains, with select high-quality projects listed on the Huobi HTX exchange. Additionally, as one of the most active FOF funds, HTX Ventures has invested in 30 top-tier global funds and collaborates with leading blockchain funds such as Polychain, Dragonfly, Bankless, Gitcoin, Figment, Nomad, Animoca, and Hack VC to co-build the blockchain ecosystem.

Website: https://www.htx.com/ventures

Twitter: https://x.com/Ventures_HTX

Medium: https://htxventures.medium.com/

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News