Interpreting Global Cryptocurrency-Related Stocks: A New Liquidity Hub Beyond the Crypto World

TechFlow Selected TechFlow Selected

Interpreting Global Cryptocurrency-Related Stocks: A New Liquidity Hub Beyond the Crypto World

The future development of the crypto market is not just about the growth of digital currencies themselves, but lies in their immense potential to integrate with traditional finance.

Authors: JoyChen, EvanLu, Waterdrip Capital

As the global financial regulatory environment becomes increasingly clear, the cryptocurrency market is gradually transitioning from a "niche community" into the mainstream financial system. After the U.S. election, President-elect Donald Trump's victory has had a positive impact on the crypto industry, with promises of more friendly regulatory policies—including establishing a national Bitcoin reserve and encouraging expanded Bitcoin mining in the United States—boosting market confidence. In the following days, this sentiment broadly spread across capital markets, leading to widespread gains among blockchain-related stocks.

Currently, an increasing number of listed companies recognize the immense potential of blockchain technology and are actively incorporating it into their strategic planning. Many blockchain概念股 (concept stocks) have demonstrated strong growth momentum, attracting significant attention and investment. By integrating blockchain technology, these companies are driving digital transformation and value creation, gradually emerging as key players within their industries. We have closely tracked numerous stocks in this sector, observing their rising prominence in capital markets and anticipating even greater development opportunities driven by blockchain advancements:

In recent years, particularly due to regulatory tailwinds brought about by the U.S. launch of cryptocurrency-related ETFs (such as Bitcoin spot ETFs), cryptocurrencies are no longer confined to closed digital currency markets but are now deeply integrated with traditional capital markets. Grayscale, as a pioneer in this space, has established its Bitcoin Trust (GBTC) as a bridge for traditional investors to access the crypto market. Data shows that as of November 20, BlackRock’s Bitcoin spot ETF (IBIT) has reached nearly $45 billion in assets under management (AUM), maintaining almost continuous net inflows since the beginning of the year. Meanwhile, Grayscale's Bitcoin spot ETF (GBTC) manages approximately $20.3 billion in AUM, reflecting investor interest and confidence in this emerging asset class.

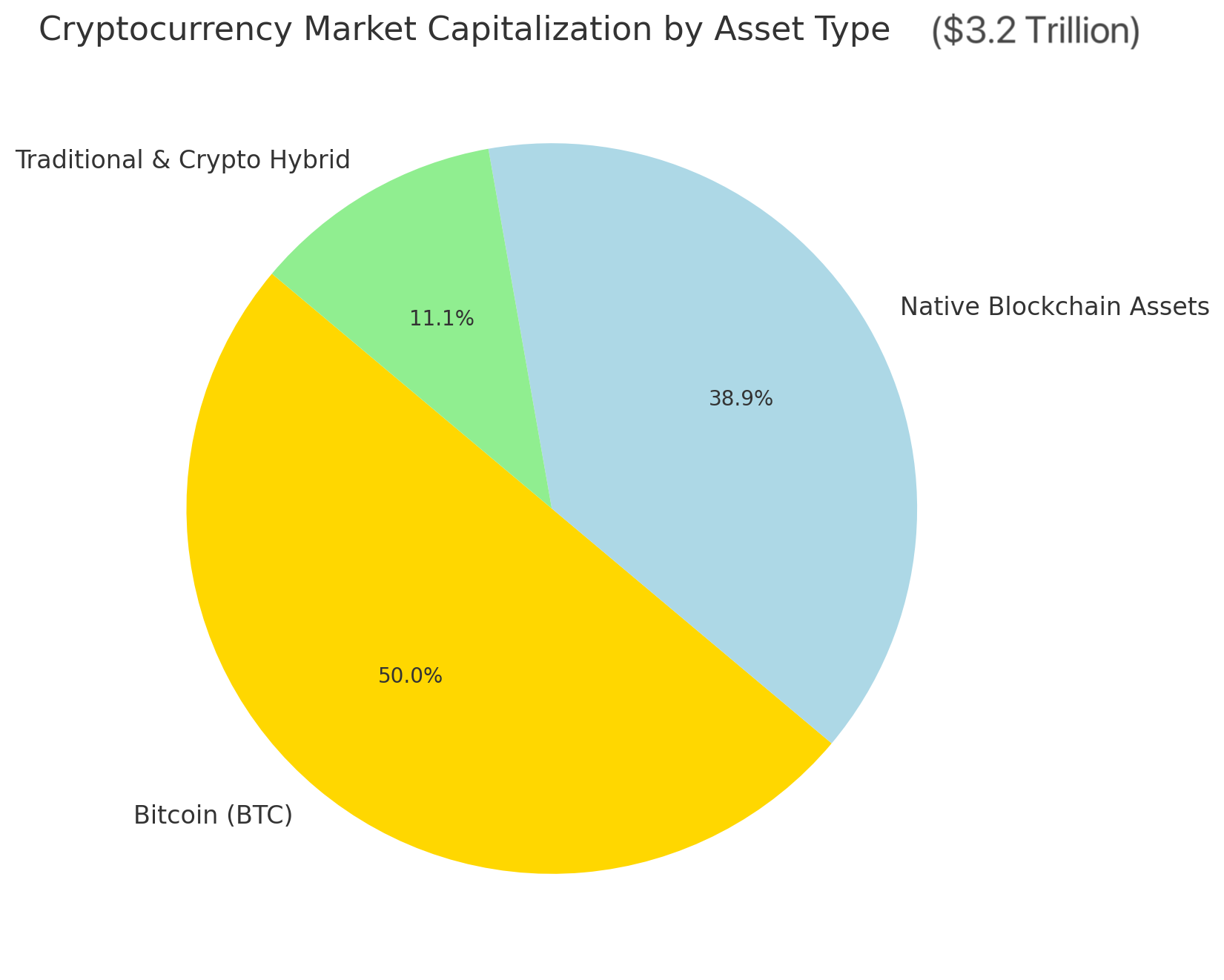

The current total market capitalization of the cryptocurrency market is around $3.2 trillion. We can categorize this into three primary segments based on asset type:

-

Bitcoin (BTC): As the core asset of the entire crypto market, Bitcoin currently has a market cap of approximately $1.9 trillion, accounting for over 50% of the total cryptocurrency market. It serves not only as a universally recognized store of value within both traditional finance and native crypto circles but also stands out among institutional investors for its inflation-resistant properties and limited supply, earning it the nickname “digital gold.” Bitcoin plays a pivotal role as a central hub in the crypto ecosystem, stabilizing the market while bridging connections between traditional assets and native on-chain assets.

-

Native On-Chain Assets: This category includes public chain tokens (e.g., Ethereum ETH), decentralized finance (DeFi)-related tokens, and utility tokens used within on-chain applications. Highly diverse and volatile, performance in this segment is primarily driven by technological upgrades and user demand. Its current market cap is about $1.4 trillion, significantly below high-growth expectations.

-

Integration of Traditional Assets with Crypto Technology: This area encompasses tokenized real-world assets (RWA), blockchain-based securitized assets, and other innovative projects. Though its current market cap is only in the tens of billions of dollars, this field is rapidly expanding alongside broader adoption of blockchain technology and deeper integration with traditional finance. Tokenizing traditional assets enhances liquidity and represents one of the key drivers of future crypto market growth. We are highly confident in this segment, believing it will drive traditional finance toward a more efficient and transparent digital transformation, unlocking vast market potential.

Why are we so bullish on the growth potential of traditional assets?

Over the past six months, Bitcoin’s asset characteristics have evolved anew, and the dominant forces in capital markets have transitioned from old incumbents to new pools of capital.

In 2024, cryptocurrency further solidified its position within traditional finance. Financial giants such as BlackRock and Grayscale launched exchange-traded products tied to Bitcoin and Ethereum, offering institutional and retail investors easier access to digital assets—further cementing ties with traditional securities.

Meanwhile, the trend of tokenizing real-world assets (RWA) is accelerating, enhancing financial market liquidity and reach. For example, Germany’s state-owned development bank KfW issued two digital bonds totaling €150 million via blockchain technology in 2024, settled using distributed ledger technology (DLT). French tech manufacturer Metavisio issued corporate bonds using tokenization to fund a new manufacturing facility in India—demonstrating how traditional institutions are leveraging blockchain to improve operational efficiency. Many financial institutions have already begun integrating crypto technologies into their business models.

Today, a self-reinforcing capital cycle centered on Bitcoin—with ETFs and stock markets serving as primary channels for capital inflow and U.S.-listed firms like MSTR acting as conduits—is actively absorbing dollar liquidity and gaining momentum.

The convergence of traditional finance and blockchain will generate far more investment opportunities than native on-chain assets alone. This trend reflects growing market emphasis on stability and practical use cases. With deep infrastructure and mature mechanisms, traditional finance holds enormous untapped potential when combined with blockchain technology. In response, Waterdrip Capital, especially through its Pacific Waterdrip Digital Asset Fund, will continue focusing on innovative integrations between traditional finance and the crypto industry to identify cross-sector investment opportunities.

This research report analyzes the growth patterns of blockchain concept stocks, particularly how they integrate with on-chain assets, aiming to uncover additional innovative investment opportunities. For instance, MSTR’s issuance strategy exemplifies a typical path where companies raise USD-denominated capital via convertible bonds or equity offerings to acquire on-chain assets. Recently, MSTR’s share price surged along with Bitcoin, and its 2027-dated convertible bond yields hit a three-year high, enabling its stock performance to surpass that of traditional tech stocks.

From these perspectives, it becomes evident that the future of the crypto market lies not just in the expansion of digital currencies themselves, but in their transformative integration with traditional finance. From regulatory tailwinds to structural shifts, blockchain concept stocks sit at the epicenter of this megatrend, capturing global investor attention.

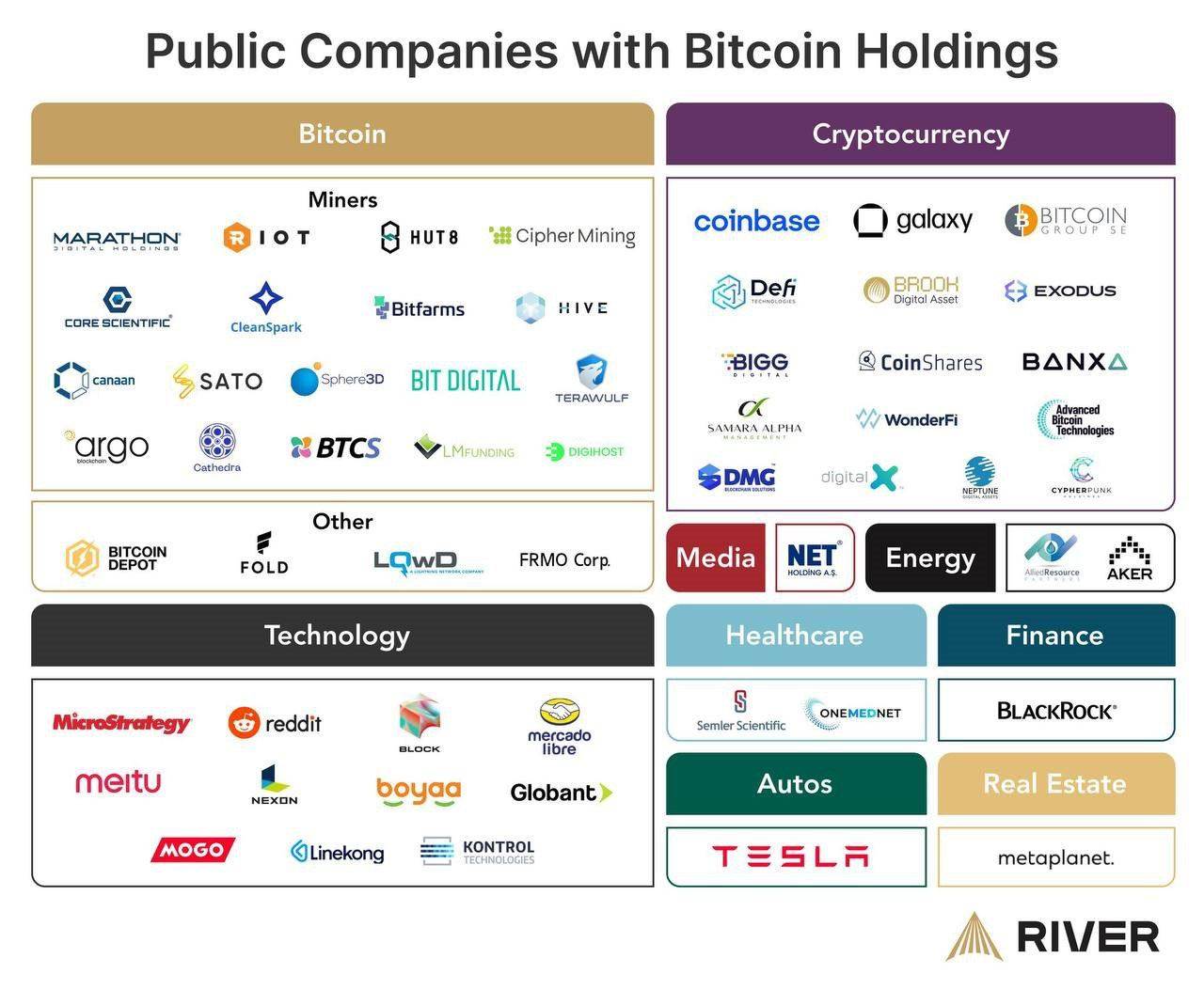

We broadly classify current blockchain concept stocks into the following categories:

I. Asset-Driven Concepts:

These companies adopt strategies positioning Bitcoin as a primary reserve asset. MicroStrategy first implemented this approach in 2020, quickly drawing market attention. This year, other firms such as Japanese investment firm MetaPlanet and Hong Kong-listed gaming company Boyaa Interactive have followed suit, steadily increasing their Bitcoin holdings. MetaPlanet announced it would adopt MicroStrategy’s key performance indicator—the “Bitcoin Yield” (BTC Yield)—reporting a BTC Yield of 41.7% in Q3 and a remarkable 116.4% in Q4 (as of October 25).

Top 30 publicly traded companies globally holding Bitcoin as corporate reserves

*Source: coingecko

Specifically, companies like MicroStrategy use the “Bitcoin Yield” metric—a calculation based on diluted shares outstanding that measures the amount of Bitcoin held per share, excluding Bitcoin price fluctuations—to offer investors a new lens for evaluating corporate value and investment decisions. This focuses on balancing Bitcoin accumulation against equity dilution resulting from issuing common stock or convertible instruments. To date, MicroStrategy’s Bitcoin investment yield stands at 41.8%, indicating successful growth in holdings without excessive shareholder dilution.

However, despite MicroStrategy’s notable success in Bitcoin investing, its debt structure remains a market concern. The company reportedly carries $4.25 billion in outstanding debt, raised through multiple rounds of convertible bond issuances, some bearing interest payments. Analysts worry that if Bitcoin prices drop sharply, MicroStrategy may be forced to sell part of its Bitcoin holdings to repay debts. However, others argue that thanks to its stable legacy software business and low interest rates, operating cash flows are sufficient to cover interest expenses, making a forced sale unlikely even during major Bitcoin downturns. Additionally, with a current market cap of $43 billion, debt constitutes a small portion of its capital structure, further reducing liquidation risk.

While many investors applaud the company’s steadfast Bitcoin investment strategy—believing it will deliver substantial returns—others express concerns over its high leverage and exposure to market volatility. Given the extreme volatility of crypto markets, any adverse movement could significantly affect asset values. Moreover, the premium valuation relative to net asset value raises questions about sustainability—a focal point for market scrutiny. A stock correction could impair financing capabilities, potentially affecting future Bitcoin purchase plans.

1. MicroStrategy (MSTR)

Business Intelligence Software Company

Founded in 1989, MicroStrategy initially focused on business intelligence and enterprise solutions. However, starting in 2020, the company transformed into the world’s first publicly traded firm to hold Bitcoin (BTC) as a treasury reserve, fundamentally altering its business model and market positioning. Founder Michael Saylor played a crucial role in this shift, evolving from an early Bitcoin skeptic to a staunch advocate.

Since 2020, MicroStrategy has continuously purchased Bitcoin using internal funds and debt financing. To date, it holds approximately 279,420 BTC, valued at nearly $23 billion—about 1% of Bitcoin’s total supply. Its most recent acquisition occurred between October 31 and November 10, 2023, purchasing 27,200 BTC at an average price of $74,463. The average cost basis is $39,266 per BTC, while the current price hovers around $90,000, giving MicroStrategy unrealized gains approaching 2.5x.

Although MicroStrategy faced a paper loss of about $1 billion during the 2022 bear market, it never sold any Bitcoin and instead continued accumulating. Since 2023, Bitcoin’s strong rally has propelled MSTR’s share price upward, delivering a year-to-date return of 26.4% and cumulative returns exceeding 100%. MicroStrategy now operates what can be described as a “BTC-based recursive leverage model,” raising capital via bond issuance to buy more Bitcoin. While this generates high returns, it also carries risks—especially during periods of severe Bitcoin price swings. Analysis suggests liquidation risk only arises if Bitcoin falls below $15,000; given today’s ~$90,000 price, this scenario is extremely unlikely. Furthermore, the company maintains low leverage and strong demand for its bonds, reinforcing financial resilience.

For investors, MicroStrategy functions as a leveraged proxy to Bitcoin. Under steady upward price expectations, the stock holds considerable upside. However, long-term risks associated with debt expansion must be monitored. Over the next 1–2 years, MSTR remains a compelling watchlist item—particularly for those bullish on Bitcoin’s long-term outlook—as a high-risk, high-reward investment vehicle.

2. Semler Scientific (SMLR)

Semler Scientific is a medical technology company whose innovative strategy includes holding Bitcoin as a primary reserve asset. In November 2024, the company disclosed acquiring 47 additional BTC, bringing its total holdings to 1,058 BTC at a total investment cost of ~$71 million. Part of the funding came from operating cash flow, signaling Semler’s intent to strengthen its balance sheet via Bitcoin, positioning itself as a pioneer in asset management innovation.

Nonetheless, Semler’s core business remains centered on its QuantaFlo device, designed for diagnosing cardiovascular disease. However, its Bitcoin strategy extends beyond mere treasury reserves. In Q3 2024, the company reported $1.1 million in unrealized gains from its Bitcoin holdings—providing a financial hedge amid a 17% YoY revenue decline.

Despite a current market cap of just $345 million—far below MicroStrategy’s scale—Semler’s adoption of Bitcoin as a reserve asset has earned it the moniker “mini-MicroStrategy” among investors.

3. Boyaa Interactive

Boyaa Interactive is a Hong Kong-listed gaming company and one of China’s top developers and operators in the casual games sector. Since late last year, it has begun exploring the crypto space, aiming to fully transform into a Web3-focused public company. Through large-scale purchases of Bitcoin and Ethereum, investments in multiple Web3 ecosystem projects, and signing a subscription agreement with Pacific Waterdrip Digital Asset Fund under Waterdrip Capital for strategic collaboration in Web3 game development and Bitcoin ecosystem initiatives, Boyaa is reshaping its identity. The company stated: “The purchase and holding of cryptocurrencies are important steps in our Web3 business development and layout, and a key component of our asset allocation strategy.” As per its latest announcement, Boyaa holds 2,641 BTC and 15,445 ETH, with total costs of ~$143 million and $42.6 million respectively.

Notably, recent crypto market strength led to significant price increases in both Bitcoin and Ethereum. Based on closing prices on the 12th, Boyaa realized unrealized gains of nearly $90.22 million on Bitcoin and ~$7.95 million on Ethereum—totaling close to $100 million.

Rising crypto prices have heightened investor interest in related concept stocks. In the Hong Kong market, for example, as of November 12, Bluehole Interactive surged 41.18%, New Huo Tech Holdings rose 27.40%, and OKX Blockchain Group increased 11.65%, showcasing robust performance among blockchain-linked firms. The Hong Kong blockchain market remains in early stages, but the policy environment continues improving, with recent supportive regulations encouraging innovation and creating favorable conditions for growth. Some companies benefit from asset-driven effects linked to crypto price movements, while also actively exploring real-world applications of blockchain in gaming, finance, and the metaverse. Future market expansion will depend on successful technology deployment and ecosystem maturation, providing clearer direction and confidence for investors.

Boyaa’s current crypto holdings are valued at approximately HK$2.2 billion—surpassing its current market capitalization. In Q2 2024, the company reported revenues of ~CN¥104.8 million ($14.6 million), up 5.8% YoY, with web and mobile games contributing CN¥29 million and CN¥69 million respectively, and digital asset appreciation adding CN¥6.74 million (~$940k). In its earnings release, Boyaa attributed revenue growth to “digital asset appreciation gains from our cryptocurrency holdings.”

The company plans to increase its crypto holdings by up to $100 million over the next 12 months. Additionally, Boyaa has assembled a dedicated team focused on Web3 game development and underlying infrastructure R&D. Benefiting from substantial gains in digital assets, its Q1 profit grew 1,130% YoY, pushing its stock price to nearly 3.6x its年初 level—an emblematic example of an asset-driven blockchain concept stock. Going forward, Boyaa’s performance will remain sensitive to crypto market volatility, with its share price likely continuing to track asset value appreciation.

II. Mining Concepts

Mining-related blockchain stocks have drawn significant market attention in recent years, benefiting not only from direct cryptocurrency earnings but also increasingly participating in adjacent high-growth sectors such as artificial intelligence (AI) and high-performance computing (HPC). With AI’s rapid development, demand for computational power is soaring, providing fresh support for mining stock valuations. Particularly as power contracts, data centers, and supporting infrastructure become scarce, mining companies can generate additional revenue by supplying compute infrastructure for AI workloads.

However, not all mining firms are well-suited to meet AI data center requirements. Mining operations prioritize cheap electricity, often locating in areas with lower, short-term unstable power pricing to maximize profits. Conversely, AI data centers emphasize power stability, are less sensitive to electricity price changes, and prefer long-term reliable supply. Therefore, existing mining power systems and facilities aren’t always suitable for direct conversion into AI-ready infrastructure.

Mining concept stocks can be categorized as follows:

-

Mining Companies with Mature AI/HPC Operations: These firms operate in both mining and possess developed AI or HPC businesses, often backed by tech leaders like NVIDIA. Examples include WULF, APLD, and CIFR, which not only mine cryptocurrencies but also build AI compute platforms and engage in AI inference, effectively merging mining and AI compute demands, thereby attracting greater market interest.

-

Mining-Focused Firms with Large Coin Reserves: These companies concentrate on mining while accumulating large amounts of Bitcoin and other cryptocurrencies. CleanSpark (CLSK) is a representative example, with coin holdings representing 17.5% of its market cap. Similarly, Riot Platforms (RIOT) holds reserves equivalent to 21% of its market cap. These firms aim to profit from future price appreciation.

-

Diversified Composite Businesses: These companies combine crypto mining and coin accumulation with ventures in AI inference and AI data center construction. Marathon Digital (MARA) exemplifies this group, with coin holdings equaling 33% of its market cap. Diversification helps mitigate single-sector risks while boosting overall profitability.

As AI demand grows, HPC and AI compute services will increasingly converge with blockchain mining, potentially elevating mining company valuations. In the future, miners may evolve from mere “digital gold diggers” into critical infrastructure providers powering AI advancement. While challenging, many mining firms are accelerating investments in AI compute and data centers to secure a foothold in this emerging domain.

1. MARA Holdings (MARA)

One of North America’s largest enterprise-run Bitcoin mining companies, founded in 2010 and listed in 2011. MARA specializes in cryptocurrency mining, focusing on generating digital assets within the blockchain ecosystem. Using proprietary infrastructure and intelligent mining software, it provides hosted mining solutions, primarily for Bitcoin. Like Riot, MARA experienced a 12.6% stock decline followed by further drops, yet saw rapid share price appreciation over the past year.

According to October data, MARA achieved 32.43 EH/s in hash rate, becoming the first publicly traded miner to reach this scale. With the activation of a new 152 MW power capacity, hash rate is expected to grow by ~10 EH/s. MARA recently acquired two data centers in Ohio and is building a third site, adding 152 MW of mining power, scheduled for full operation by end-2025. CFO Salman Khan noted the acquisition cost was ~$270,000 per MW, expecting these deployments to help achieve a 50 EH/s target by 2024.

Additionally, on November 18, MARA announced the issuance of $700 million in convertible preferred notes maturing in 2030. Proceeds will fund Bitcoin purchases, repurchase 2026-maturing convertible notes, and expand existing operations. Up to $200 million will go toward note buybacks, with the remainder allocated to buying more Bitcoin and general corporate purposes—including working capital, strategic acquisitions, asset expansion, and debt repayment. This move underscores MARA’s strong long-term bullish stance on Bitcoin.

2. Core Scientific (CORZ)

Blockchain Infrastructure and Cryptocurrency Mining Services

Founded in 2017, Core Scientific Inc. operates in two main segments: equipment sales and hosting services, plus self-operated Bitcoin mining farms. Revenue comes from consumer-based contracts and hosting services, while its digital asset mining division earns income from operating computing devices that process transactions on blockchain networks and participate in mining pools, receiving cryptocurrency rewards.

Recently, Microsoft (MSFT.US) announced it would spend nearly $10 billion from 2023 to 2030 leasing servers from AI startup CoreWeave. CoreWeave has signed a 120-megawatt (MW) high-performance compute hosting agreement with Bitcoin mining giant Core Scientific. After several expansions, CoreWeave now hosts a total of 502 MW of GPU capacity in Core Scientific’s data centers. Since securing multi-billion-dollar contracts with CoreWeave, Core Scientific’s stock has surged nearly 300% cumulatively.

The 12-year hosting contract is projected to generate $8.7 billion in total revenue for Core Scientific. Meanwhile, although its Bitcoin mining hash rate remains stable, its network share has declined from 3.27% in January to 2.54% in September.

Overall, Core Scientific perfectly captures the synergy between AI and Bitcoin—especially in AI data centers—securing major contracts and actively acquiring new clients, demonstrating strong growth potential. Despite declining Bitcoin mining market share, progress in AI data centers provides solid support for sustainable long-term growth, suggesting further upside potential.

3. Riot Platforms (RIOT)

Based in Colorado, Riot Platforms focuses on blockchain infrastructure development, support, and cryptocurrency mining. Previously, it invested in several blockchain startups, including Canadian exchange Coinsquare, but has since refocused entirely on mining operations.

Riot’s stock has been highly volatile, dropping 15.8% during Bitcoin price declines. Nevertheless, it gained over 130% in the past year.

Despite recent market tailwinds driving a 66% weekly surge, Riot’s fundamentals remain weak. Its Q3 2024 earnings revealed $84.8 million in total revenue, with $67.5 million from Bitcoin mining, but a net loss of $154.4 million, or $0.54 per share—far worse than the expected $0.18 loss. Q2 losses were $84.4 million, compared to $27.4 million in the same period last year. Overall, losses are widening. While short-term stock gains align with broader market trends, long-term sustainability remains questionable.

4. CleanSpark (CLSK)

Green Energy Cryptocurrency Mining

CleanSpark specializes in Bitcoin mining powered by renewable energy. In Q2 2024, its revenue rose to $104.1 million, up $58.6 million (129%) from $45.5 million a year earlier. However, for the three months ended June 30, 2024, it reported a net loss of $236.2 million, or $1.03 per share, compared to a $14.1 million loss ($0.12/share) in the prior year. Notably, despite a broad market rally in early November, CleanSpark (CLSK) did not benefit due to a temporary trading halt. The founder explained the suspension resulted from miscalculations in equity subscription ratios during an acquisition. The company also announced completion of its acquisition of GRIID, targeting a total mining capacity of 400 megawatts (MW) in the coming years. CleanSpark holds a substantial amount of Bitcoin and other digital currencies, with coin reserves representing 17.5% of its market cap—indicating a significant portion of its valuation is backed by Bitcoin holdings.

From a stock performance perspective, CleanSpark is a leading green-energy miner, whose sustainable mining strategy and relatively low energy costs give it long-term potential. Its acquisition of GRIID and expansion of mining capacity reflect proactive efforts to gain market share and competitiveness. However, despite strong revenue growth, large losses mean investor focus on profitability and cash flow will heavily influence future stock movements. CLSK’s share price may experience significant volatility due to Bitcoin price swings and fluctuating energy costs.

5. TeraWulf (WULF)

Green Energy Cryptocurrency Mining

As operational risks decrease and margins improve, energy firms are becoming increasingly influential in the crypto industry. TeraWulf, a crypto subsidiary of Beowulf Mining Plc, recently disclosed in regulatory filings its expectation to reach 800 MW of mining capacity by 2025—accounting for 10% of Bitcoin’s current network computing power. TeraWulf focuses on sustainable mining solutions, particularly utilizing hydropower and solar energy, and is also developing AI data centers.

Recently, TeraWulf increased the total size of its 2.75% convertible bonds to $425 million, with $118 million earmarked for share buybacks. The financing includes an over-allotment option allowing initial purchasers to add $75 million within 13 days of issuance. The new bonds mature in 2030, with proceeds used for buybacks and general corporate purposes.

TeraWulf stated it will prioritize share repurchases and continue organic growth in high-performance computing and AI, as well as pursue potential strategic acquisitions. Following the announcement, TeraWulf’s stock rose nearly 30% since last Friday, outperforming Bitcoin and other mining peers. Recently, miners have turned to convertible bonds and Bitcoin-backed loans to prepare for declining hash price pressures post-Bitcoin halving.

Overall, TeraWulf’s positioning in green energy and AI mining demonstrates strong growth potential. In the short term, it may benefit from market enthusiasm for sustainable and AI-integrated mining. However, given the volatility of the mining sector and macroeconomic conditions, long-term performance requires ongoing evaluation. Current stock gains contain speculative elements, but its sustainable strategy offers genuine growth prospects.

6. Cipher Mining (CIFR)

Bitcoin Mining Company

Cipher Mining focuses on developing and operating Bitcoin mining data centers in the U.S., aiming to strengthen Bitcoin network infrastructure.

Recently, Cipher Mining announced an expanded credit partnership with Coinbase, establishing a $35 million term loan. According to its November 1 financial disclosure, the company increased its existing credit line from $10 million to $15 million and added a new $35 million term loan.

Additionally, as demand for AI technologies rises in the crypto market, Cipher Mining’s AI business valuation has improved. However, compared to peers like CORZ, APLD, and WULF, its stock has lagged in performance. While its infrastructure investments in Bitcoin mining have yielded results, slower progress in AI integration may affect near-term stock performance.

7. Iris Energy (IREN)

Renewable Energy-Powered Bitcoin Mining

Iris Energy focuses on Bitcoin mining using green energy—especially hydropower—globally. Its core competitive advantage lies in environmentally sustainable mining operations, differentiating it from competitors. Compared to coal and oil, IREN’s clean energy approach reduces carbon emissions and lowers operating costs. The company operates multiple green-powered mining facilities, particularly in regions rich in renewable energy such as Canada and the U.S.

IREN has also experimented with cloud computing services, though this segment remains less defined than its core mining business. While cloud compute can reduce hardware barriers and offer flexible returns, its revenue model and market acceptance are still nascent, lacking clear profitability versus traditional mining. Thus, IREN’s cloud efforts remain exploratory, immature, and difficult to justify with high valuations.

In monetizing energy assets, IREN lags behind competitors like CIFR (Cipher Mining) and WULF (Stronghold Digital Mining), which have made strides in integrating traditional and green energy resources, gaining stronger market competitiveness. While IREN’s green mining edge is undeniable, its slower monetization pace limits short-term capital generation.

8. Hut 8 (HUT)

Hut 8, headquartered in Canada, is one of North America’s largest innovative digital asset miners, operating large-scale energy infrastructure with a commitment to eco-friendly practices.

In 2023, Hut 8 generated $121.21 million in annual revenue, up 47.53% YoY. For the quarter ending September 30, 2024, revenue reached $43.74 million, up 101.52% YoY. This brings trailing twelve-month revenue to $194.02 million, representing a 209.07% annual growth rate.

Per its Q3 report, Hut 8 accelerated development and commercialization of its digital infrastructure platform, with all metrics pointing to strong growth and sustained business momentum.

9. Bitfarms (BITF)

Based in Canada, Bitfarms specializes in developing and operating Bitcoin mining farms, continually expanding its scale. The company recently announced a $33.2 million incremental investment to upgrade 18,853 Antminer T21 units originally ordered from Bitmain to the newer S21 Pro models. According to its Q3 financial report, Bitfarms revised its procurement agreement with Bitmain, with deliveries expected between December 2024 and January 2025. Analysis from TheMinerMag indicates that adopting next-gen miners has significantly reduced costs: from $40.6 per PH/s in Q1 to $35.5 in Q2, and down to $29.3 in the latest quarter.

Overall, Bitfarms’ strategy of upgrading equipment and optimizing procurement lowers costs and improves mining efficiency, revealing strong growth potential. This approach enhances profitability and strengthens its competitive standing in the fiercely contested crypto mining landscape. With further cost reductions, Bitfarms is poised to maintain an edge, especially if Bitcoin prices rebound or demand increases.

10. HIVE Digital Technologies (HIVE)

Cryptocurrency Mining Company, HPC Business

Hive Digital recently announced the acquisition of 6,500 Canaan Avalon A1566 Bitcoin miners, aiming to boost total hash rate to 1.2 EH/s—demonstrating continued commitment to crypto mining. However, since late last year, Hive has clearly shifted focus toward high-performance computing (HPC). The company believes HPC offers higher margins and technical moats, enabling more sustainable revenue growth. Consequently, Hive has repurposed 38,000 Nvidia data center GPUs previously used for Ethereum and other crypto mining into on-demand GPU cloud services, marking a new chapter in AI and HPC.

This strategic pivot aligns with industry trends. Similar to Hut 8, Hive redirected resources after Ethereum’s transition from PoW to PoS. Today, Hive’s HPC and AI business generates 15x more revenue than Bitcoin mining, amid surging GPU compute demand. Goldman Sachs reports highlight the bright outlook for GPU cloud services. Fortune Business Insights forecasts the North American GPU services market will grow at a 34% CAGR through 2030. With rising AI project demands—large language models like ChatGPT still in early stages—nearly every enterprise needs massive GPU compute power.

From an investment standpoint, Hive’s transformation lays a solid foundation for future growth. While still active in Bitcoin mining, rapid HPC and AI development allows Hive to reduce reliance on mining, opening diversified, high-margin revenue streams.

III. Infrastructure and Solution Providers

Mining hardware/blockchain infrastructure concept stocks refer to publicly traded companies specializing in Bitcoin mining hardware, blockchain infrastructure development, and related technical services. These firms profit by designing, manufacturing, and selling specialized mining equipment (e.g., ASIC miners), offering cloud mining services, and operating hardware infrastructure essential for blockchain networks. Mining hardware makers form the backbone of blockchain infrastructure by supplying the physical equipment needed for cryptocurrency mining. ASIC (Application-Specific Integrated Circuit) miners are the most common type, purpose-built for crypto mining. Revenue for these manufacturers comes primarily from two sources: mining equipment sales and mining hosting/cloud mining services.

Mining equipment prices are influenced by various factors, including crypto market volatility, production costs, and supply chain stability. For instance, rising Bitcoin prices increase miner profitability, boosting demand for mining gear and lifting revenues. Beyond hardware, blockchain infrastructure also includes mining pools, data centers, and cloud service platforms that provide computational support.

For investors, mining hardware and infrastructure firms offer high growth potential, especially during bull markets. Demand for mining equipment correlates positively with Bitcoin prices. However, these stocks carry high volatility, exposed to market sentiment, technological innovation, and regulatory changes. Investing in them requires not only optimism about crypto’s future but also awareness of inherent uncertainties.

1. Canan (CAN)

Research and Development of Blockchain Hardware Products

Founded in 2013, Canan released the world’s first ASIC-based blockchain computing device that year, ushering the industry into the ASIC era and accumulating extensive chip mass-production experience. In 2016, its 16nm product rollout marked Canan as the first mainland Chinese company in advanced process nodes. From 2018 onward, Canan achieved global firsts in self-developed 7nm chips and mass-produced the RISC-V-based edge AI computing chip K210.

Since inception, Canan has emerged as a major player in blockchain hardware, leveraging its leadership in ASIC mining tech and in-house chip design. Compared to peers, CAN and BTDR—companies capable of using self-made miners to boost mining profits—have additional upside potential. Despite the previous bear market, Canan maintained strong miner sales, with future volumes expected to grow significantly amid Bitcoin’s recovery.

A key upside driver is miner pricing: if prices rise—due to unexpected demand or constrained supply—this could trigger a "double-Davis effect"—simultaneous P/E and earnings expansion—elevating valuations. CAN recently secured two major institutional orders, including HIVE’s purchase of 6,500 Avalon A1566 miners, which will boost sales and revenue, signaling strong market validation. From a fundamental and market expectation standpoint, current stock levels don’t fully reflect its future potential. If the Bitcoin market recovers and miner prices stabilize or rise, Canan’s sales and profits could see substantial growth, driving higher valuations.

2. Bitdeer (BTDR)

Cloud Mining Services and Mining Hardware Manufacturing

Bitdeer provides global cryptocurrency computing power, allowing users to lease resources for Bitcoin mining. It offers shared computing solutions, including cloud mining and computing markets, along with one-stop mining machine hosting services covering deployment, maintenance, and management to support efficient mining operations.

Recently, Bitdeer launched its next-generation water-cooled miner SEALMINER A2, the second model in the SEALMINER series. Equipped with Bitdeer’s self-developed second-gen chip SEAL02, A2 delivers significant improvements in energy efficiency, performance, and stability over the A1 series. Available in air-cooled (SEALMINER A2) and water-cooled (SEALMINER A2 Hydro) versions, the A2 series meets diverse mining environment needs. Both models use advanced cooling tech to optimize power consumption and computing performance, ensuring stable operation under heavy loads. Test data shows A2 achieves 16.5 J/TH efficiency and 226 TH/s hashrate—slightly below market-leading models like Bitmain and MicroBT’s 13.5 J/TH. The company confirmed A2 has entered mass production, with plans to add 3.4 EH/s of capacity by early 2025. Bitdeer also plans to complete tape-out design of the SEAL03 chip in Q4, targeting 10 J/TH efficiency.

Overall, Bitdeer is at a critical juncture of innovation and growth, especially in water-cooled mining and computing sharing. As a cloud mining platform, it offers computing leasing and hosting—not just traditional hardware sales. Unlike conventional manufacturers, cloud mining and hosting platforms enjoy greater capital and resource flexibility, scaling market share by offering on-demand compute to various investor sizes. While overall crypto trends affect Bitdeer, its diversified and innovative business model may provide relative stability during market turbulence.

3. BitFuFu (FUFU)

Cloud Mining Services and Digital Asset Management Services

Backed by Bitmain, BitFuFu is a Bitcoin and cloud mining company providing global users access to mining without purchasing hardware. According to its latest Q3 financial report, BitFuFu holds ~$104 million in digital assets, equivalent to 1,600 BTC. Of this, 340 BTC belong to the company, while the rest are customer assets from cloud mining and hosting services. BitFuFu is thus not only a mining service provider but also a significant Bitcoin asset manager.

Additionally, BitFuFu signed a two-year credit agreement with Antpool (a Bitmain subsidiary), with a maximum loan limit of $100 million. This strengthens cooperation with Antpool and enhances financial flexibility. Amid crypto market fluctuations, more mining firms (e.g., MARA, CleanSpark) are turning to Bitcoin-collateralized loans to flexibly leverage their holdings for business expansion.

From an investment view, BitFuFu benefits from Bitmain and Antpool’s backing, granting unique advantages in hardware supply and computing resources—ensuring access to efficient, stable mining equipment and optimized farm and pool operations. This gives BitFuFu a clear technological and resource edge in cloud mining, helping attract more users and capital.

Overall, as the Bitcoin market recovers and cloud mining demand grows, BitFuFu is well-positioned to capitalize on this trend. Compared to traditional mining firms, cloud mining enables lower-cost participation—ideal for users without hardware resources.

IV. Exchange Concepts:

1. Coinbase (COIN)

Cryptocurrency Trading Platform, Digital Currency Transaction and Custody Services

Founded in 2012 and listed on Nasdaq in 2021, Coinbase is the first and only legally compliant publicly traded crypto exchange in the U.S. This status makes it the largest crypto exchange by volume in the country and a top choice for institutions seeking regulated custody solutions. Coinbase co-launched USDC, a dollar-pegged stablecoin, with Circle, and has expanded into staking and custody services. It is also a core holding of ARK Invest’s Cathie Wood, who has repeatedly expressed strong confidence in the company.

Coinbase’s stock price closely tracks Bitcoin. Its historical peak on November 8, 2021, coincided almost exactly with Bitcoin’s all-time high on November 10. Its lowest point in late 2022 also aligned with Bitcoin’s bottom. From a high of $368.9 in 2021 to a low of $40.61, Coinbase suffered an 89% drawdown—more volatile than Bitcoin’s 78% decline—highlighting its leveraged exposure to the crypto market.

In the past six months, Coinbase’s stock movements have largely reflected regulatory pressure and Bitcoin ETF approval developments. Initially seen as a major catalyst in 2023, ETF approvals later sparked concerns about business model cannibalization, causing temporary pullbacks. Nonetheless, post-election dynamics created tailwinds.

With Trump’s victory, pro-crypto policy expectations strengthened market confidence, sending COIN soaring. After briefly dipping to $185 post-election, the stock climbed to ~$329. In the relatively closed U.S. compliant crypto market, growing retail demand for Bitcoin positions Coinbase for sustained benefits. As a leader in regulated exchanges, Coinbase boasts solid fundamentals and gains disproportionate advantages during favorable policy shifts. Looking ahead, as more retail investors enter the market, Coinbase is poised to capture significant traffic inflows.

2. Bakkt Holdings (BKKT)

Bakkt is a leading crypto platform offering compliant custody and trading services for institutional investors. Licensed by the New York State Department of Financial Services (NYDFS) for crypto custody, Bakkt has earned trust—especially among institutional clients—amid security breaches at other custodians.

Originally founded by Intercontinental Exchange (ICE), Bakkt later spun off as an independent public company, symbolizing the convergence of traditional finance and crypto economy. Recently, Bakkt’s stock surged significantly after news that Trump’s media and tech group (DJT) plans to acquire the company outright. According to the Financial Times, DJT is in advanced talks to buy Bakkt, a deal that would advance Trump’s crypto ambitions and provide Bakkt with funding and growth opportunities.

On the announcement day, Bakkt’s stock jumped 162%, rising another 15% in after-hours trading. DJT’s shares also climbed ~16.7%. Prior to the deal, Bakkt’s market cap was slightly above $150 million, based on recent financials and market conditions. Despite disappointing revenue (just $328,000 in the three months ended September 30, with a $27,000 operating loss).

From an investment perspective, Bakkt holds great potential but faces challenges. First, its compliance and institutional focus offer unique strengths amid growing institutional adoption. Second, its recent surge stems mainly from acquisition speculation. Such a deal could bring capital and resources, accelerating development. However, Bakkt’s poor profitability and uncertain growth in custody and trading services require careful consideration. Investors must assess business sustainability and competitive intensity.

V. Payment Concepts:

Block (SQ)

Founded in 2009 as Square, Block is a payment services provider. As early as 2014, Square began accepting Bitcoin as payment. From 2018 onward, it remained active in the Bitcoin space. Starting in 2020, Block began large-scale Bitcoin purchases for its payment business and as corporate treasury reserves. In Q3 of FY2024, Block reported total net revenue of $5.976 billion, up 6% from $5.617 billion a year ago. Excluding Bitcoin-related income, net revenue reached $3.55 billion, up 11% YoY. Net profit turned positive at $281 million, reversing a $93.5 million loss last year, representing a 402.1% YoY improvement.

Square’s strong application foundation, healthy asset reserves, and stable operating cash flows make it one of the more grounded concept stocks. Driven by Trump’s pro-Bitcoin policy certainty, Square’s stock rose 24% over the past two weeks.

Another payment concept worth watching is PayPal. As a global payments giant, PayPal offers digital payment services to merchants and consumers worldwide. It has shown growing interest in blockchain, notably launching PayPal USD (PYUSD) in 2023—a dollar-backed stablecoin on Ethereum, central to its digital payment and blockchain integration strategy. PayPal also made its first blockchain investment using PYUSD, supporting Mesh, a firm specializing in digital asset transfers and embedded finance.

In contrast, Block’s blockchain focus centers more narrowly on Bitcoin, integrating it into payments and corporate treasury.

Conclusion:

Demand for blockchain concept stocks is growing rapidly—potentially surpassing even traditional tech stocks and cryptocurrencies themselves. As blockchain evolves beyond initial crypto applications to broader industry solutions, demand for related technologies and infrastructure is surging. Compared to traditional tech stocks, blockchain concepts offer greater growth potential, driven not only by continuous innovation but also by the global financial system’s digital and decentralized transformation.

With advancing blockchain maturity and improving regulatory clarity, the outlook for blockchain concept stocks is becoming increasingly promising. As governments worldwide clarify crypto regulations, blockchain enterprises are poised for explosive growth on compliant foundations. We anticipate more traditional industries adopting blockchain, further fueling innovation and demand. Waterdrip Capital remains optimistic about the long-term potential of the blockchain sector, closely monitoring relevant companies and technological progress, and actively engaging in opportunities. In the coming years, blockchain concept stocks are likely to become one of the most attractive investment themes in global capital markets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News