Pendle's Rise, Fall, and Future: A Deep Dive into Protocol Mechanics, Market Narratives, and Investment Strategies

TechFlow Selected TechFlow Selected

Pendle's Rise, Fall, and Future: A Deep Dive into Protocol Mechanics, Market Narratives, and Investment Strategies

This article will provide a systematic analysis of Pendle's mechanisms and examine how Pendle rapidly captures market demand.

Written by: @charlotte_zqh

This research report is supported by international crypto media and Tier-1 investor @RomeoKuok.

1. Pendle 101: Separating Principal from Yield

1.1 Yield-Bearing Asset Separation

Pendle is a decentralized finance protocol that enables users to tokenize future yield and sell it. In practice, the protocol first wraps yield-bearing tokens into SY Tokens (Standardized Yield Tokens), which are ERC-5115 compliant and capable of encapsulating most types of yield-generating assets. These SY tokens are then split into two components: PT (Principal Token) and YT (Yield Token), representing the principal and yield portions of the underlying asset, respectively.

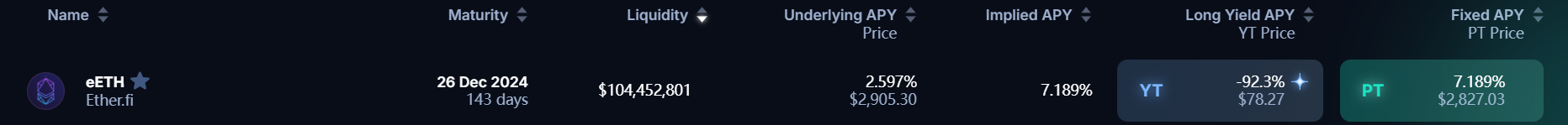

PT functions like a zero-coupon bond, allowing users to purchase at a discount and redeem at face value upon maturity. The return is embedded in the difference between purchase price and redemption amount. Holding PT to maturity yields a fixed return—for example, buying PT-cDAI at $0.90 and redeeming for 1 DAI at maturity delivers an 11.1% return ((1 - 0.9)/0.9). Purchasing PT is a short-yield strategy, reflecting the belief that future yields on the asset will decline below the current implied rate. This fixed return suits risk-averse investors. However, this differs from outright shorting and is more accurately described as a capital preservation strategy.

YT holders receive all accrued yield during the holding period—the right to future income from the principal. If yield accrues continuously, YT holders can claim earnings in real time; if settled at maturity, they must wait until expiry. Once all yield has been withdrawn, the YT becomes worthless. Buying YT is a long-yield bet—anticipating rising future returns such that total yield exceeds the purchase price. YTs offer leveraged exposure to yield without requiring full principal investment. However, if yields fall sharply, YTs may lose value entirely. Thus, compared to PTs, YTs are high-risk, high-reward instruments.

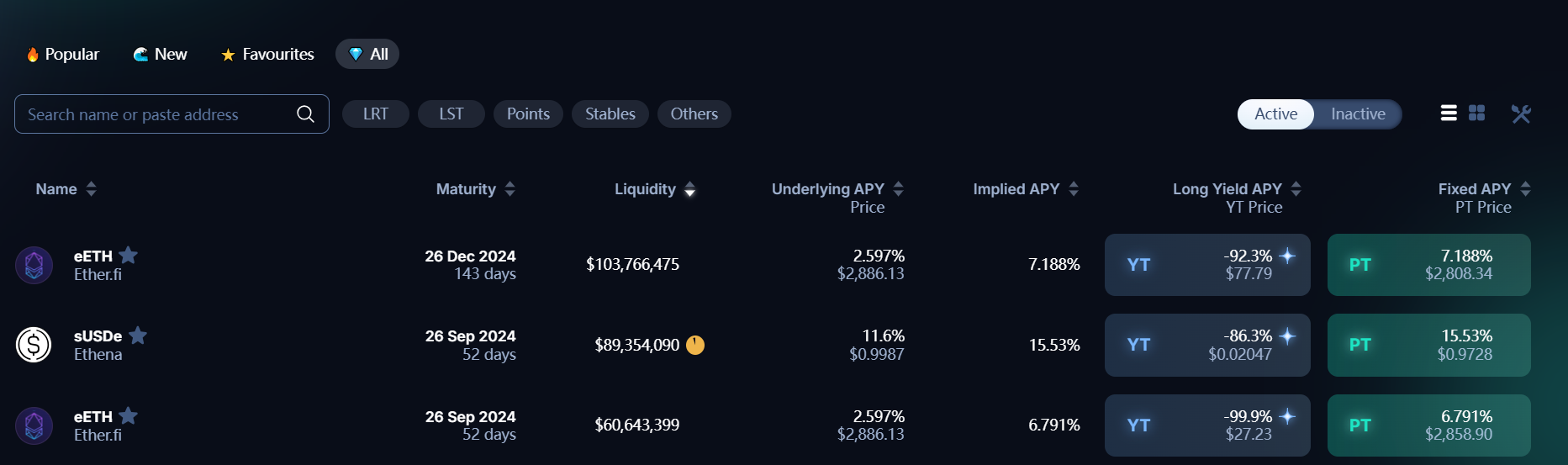

Pendle provides tools for both going long and short on yield, enabling users to choose strategies based on yield expectations. Consequently, yield metrics are central to participation. Pendle displays several APY indicators to reflect market conditions:

-

Underlying APY: The actual yield of the asset, calculated as a 7-day moving average, helping users estimate future yield trends.

-

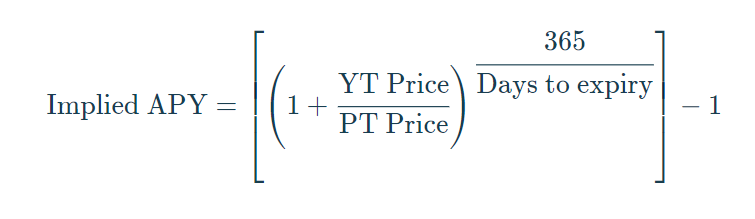

Implied APY: The market’s consensus expectation of future APY, reflected in the pricing of YT and PT. It is calculated using the following formula:

-

Fixed APY: Specific to PT, this is the fixed return earned by holding PT to maturity. Numerically equal to Implied APY.

-

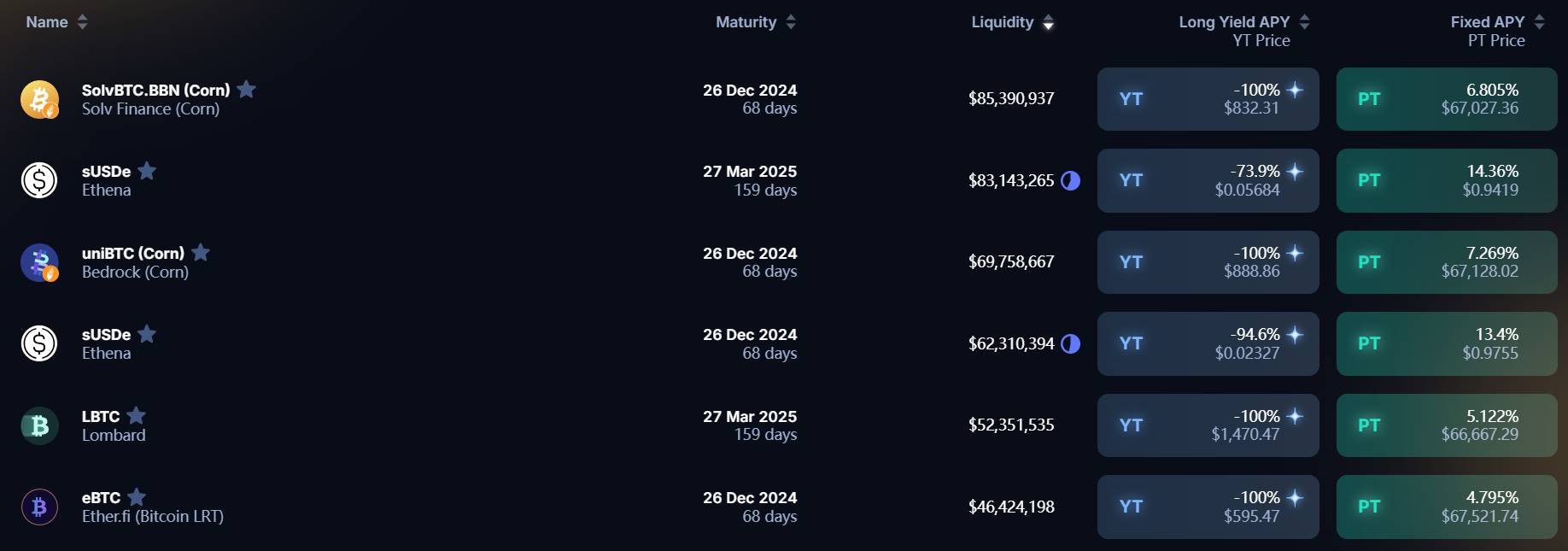

Long Yield APY: Specific to YT, this reflects the annualized return from purchasing YT at current prices. However, this figure constantly fluctuates due to changes in the underlying asset's yield (and can even be negative if the YT price exceeds expected future yield). Notably, many YTs derive potential returns from upcoming airdrops or points with uncertain valuation, leading many Long Yield APY values to show as -100%.

All four yield metrics appear simultaneously on the Pendle Market interface. When Underlying APY > Implied APY, holding the asset directly generates higher returns than holding PT, suggesting a long-yield strategy—buy YT, sell PT. Conversely, when Underlying APY < Implied APY, the opposite strategy may apply. However, these calculations do not factor in future airdrop expectations, so the strategies are only valid for pure interest-rate-exchange assets.

1.2 Pendle AMM: Enabling Trading Across Asset Types

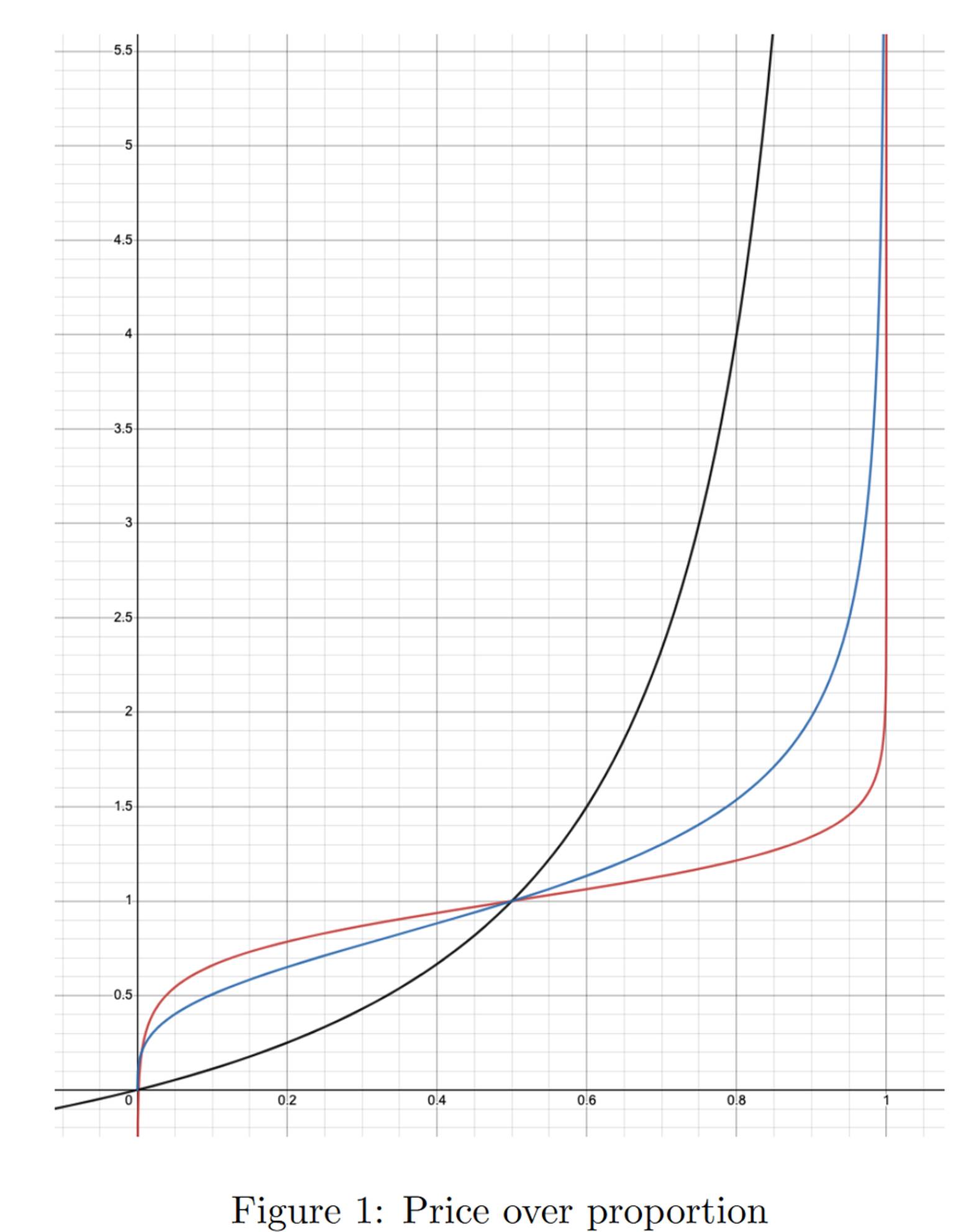

The Pendle AMM facilitates trading among SY, PT, and YT tokens. According to the Pendle whitepaper, Version 2 improved its AMM mechanism by adopting insights from Notional Finance, enhancing capital efficiency and reducing slippage. The chart below illustrates three AMM models used in fixed-income protocols: the x-axis shows the proportion of PT in the pool, and the y-axis represents the implied interest rate. Pendle currently uses the red-curve model, while the black curve represents V1 and the blue curve other fixed-income protocols.

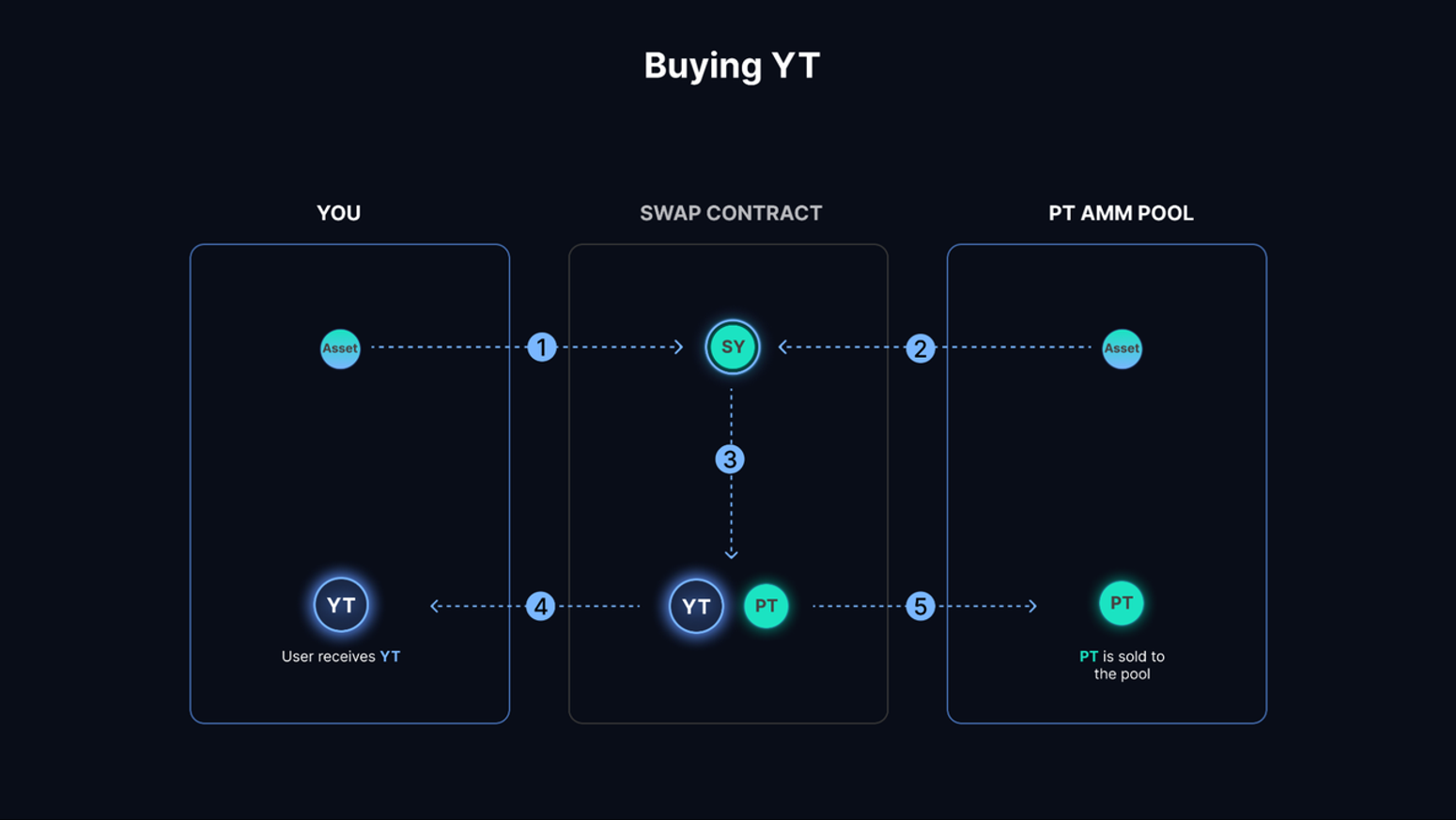

In practice, Pendle V2 employs PT-SY pools (e.g., PT-stETH and SY-stETH), significantly reducing LP impermanent loss (analyzed further below). Since SY = PT + YT, flash swaps enable YT exchange. For instance, suppose a user wants to buy YT-stETH worth 1 ETH, equivalent to N units of YT-stETH. The contract borrows N-1 SY-stETH from the pool, converts the user’s ETH into SY-stETH (by first swapping ETH to stETH via Kyberswap, then wrapping it into SY-stETH within Pendle), combines all N SY-stETH, splits them into PT and YT, delivers N YT to the user, and returns N PT to the pool. Effectively, the pool performs a swap of N-1 SY for N PT.

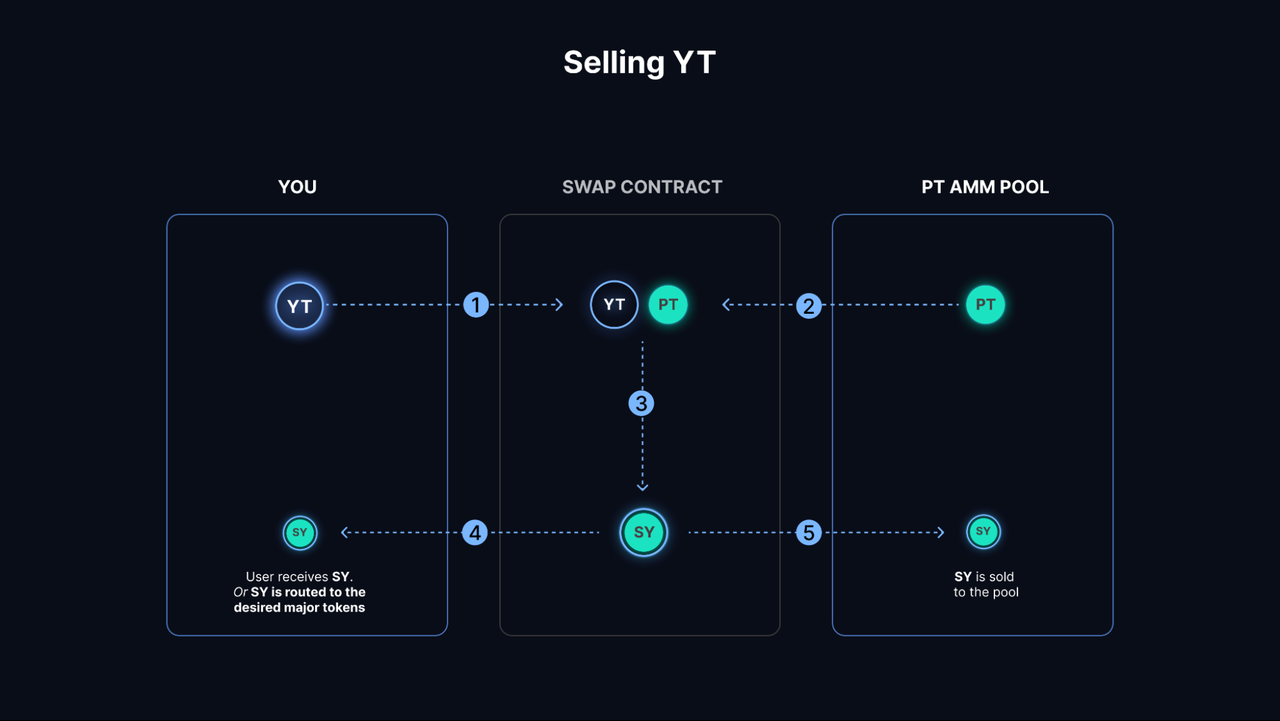

Selling YT follows the reverse process. To sell N YT (valued at 1 SY), the contract borrows N PT from the pool, merges them with one SY to form N SY, gives one SY to the user, and returns N-1 SY to the pool—effectively converting N PT into N-1 SY within the pool.

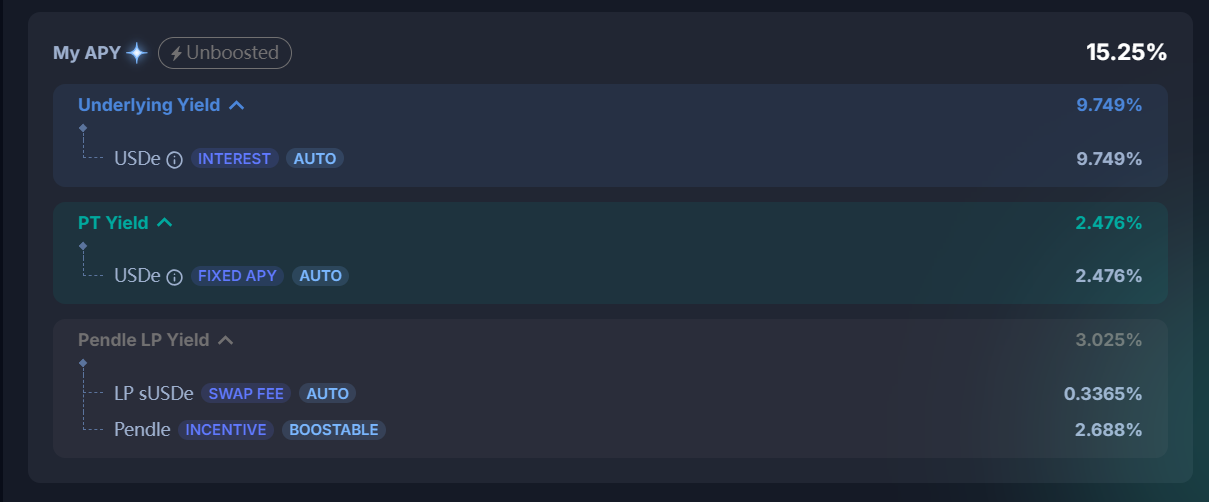

Like other AMMs, Pendle requires liquidity providers (LPs) to deposit funds into pools. However, because one PT equals one SY at maturity, there is no impermanent loss for LPs at expiry. When providing liquidity, users deposit SY and PT tokens, automatically capturing native yield from these assets. Additionally, LPs earn transaction fees and PENDLE-based liquidity mining rewards, totaling four sources of income:

-

PT Fixed Yield: Return from holding PT

-

Underlying Yield: Yield generated by the SY asset

-

Swap Fees: 20% of trading fees

-

PENDLE Token Incentives

2. Tokenomics: How Does Revenue Drive Token Price?

2.1 Economic Mechanism: Creating a Flywheel Effect

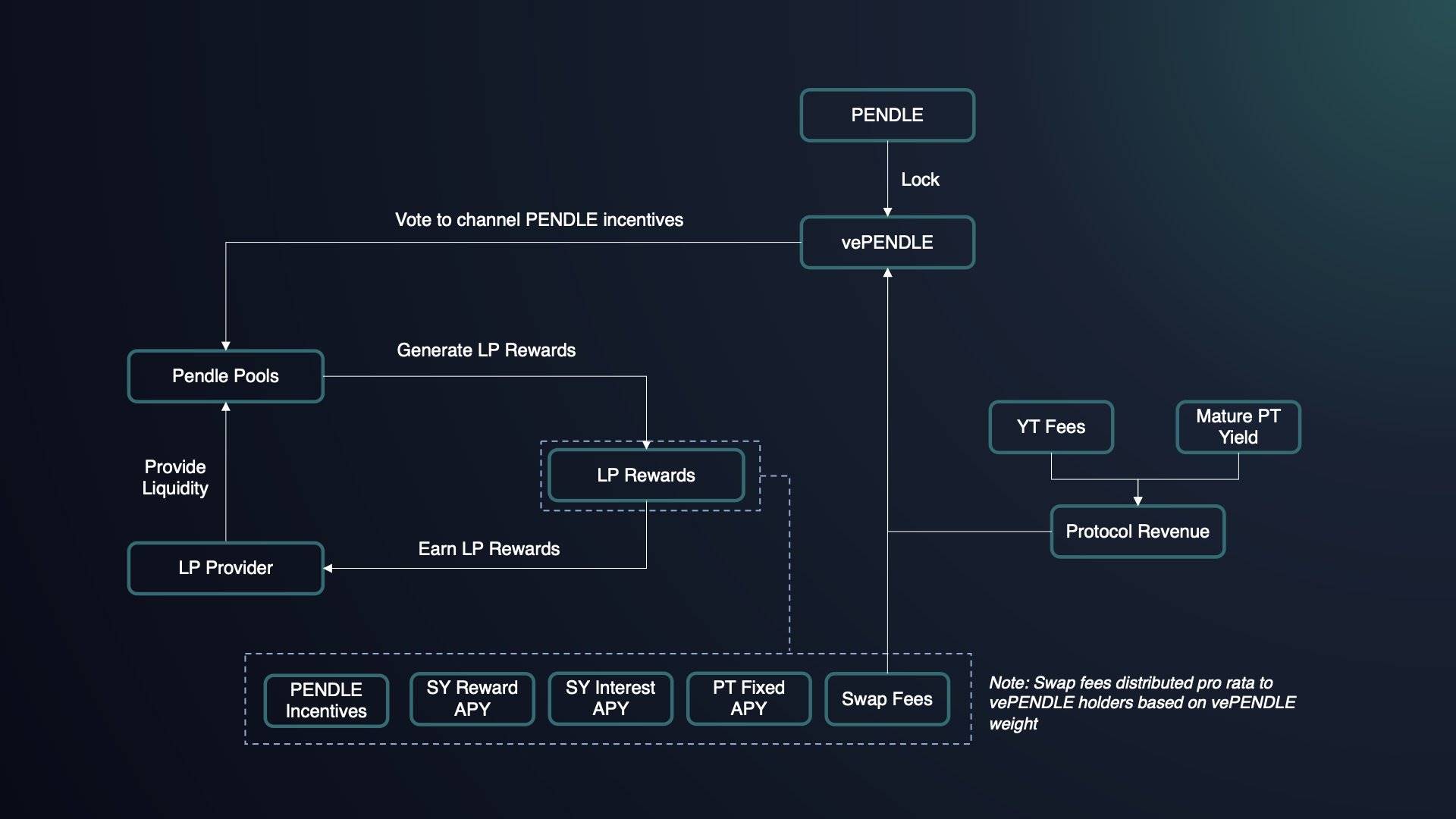

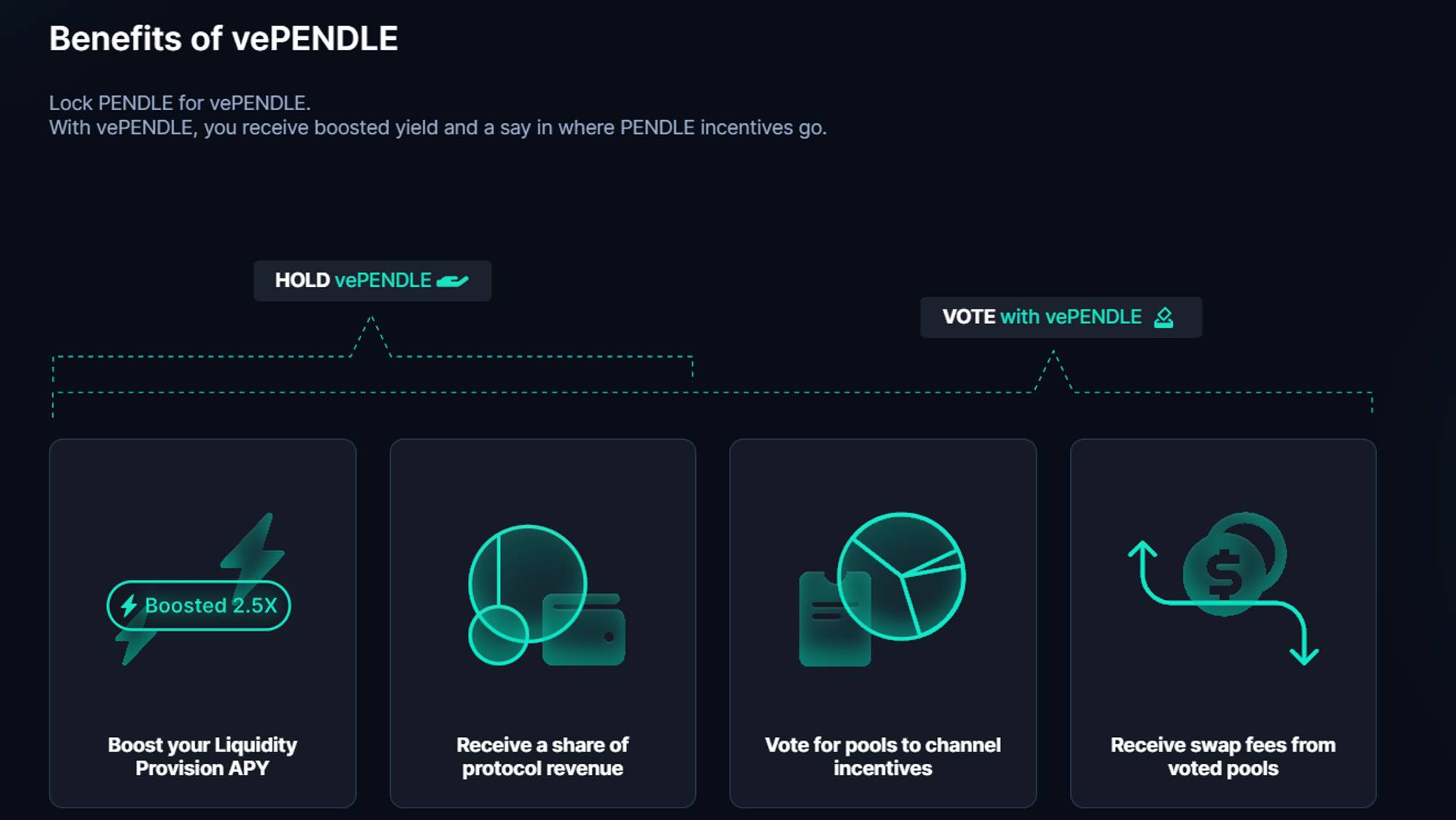

The core of PENDLE’s tokenomics lies in locking tokens to obtain vePENDLE, which grants access to protocol revenue sharing and governance rights. Similar to Curve’s veCRV model, users lock PENDLE to receive vePENDLE, with longer lock-up periods yielding more vePENDLE. Lock durations range from 1 week to 2 years.

Holding vePENDLE offers several benefits:

-

Boosted Rewards: LP earnings can be boosted up to 2.5x

-

Voting Power: Vote on allocation of PENDLE incentives across different pools

-

Revenue Sharing: vePENDLE holders receive:

-

80% of trading fees from voted pools: Only those who vote qualify for fee shares from selected pools

-

3% of all YT-generated yield

-

A portion of PT yield: From unredeemed PTs—e.g., when users fail to redeem PTs at maturity, the protocol eventually reclaims the assets

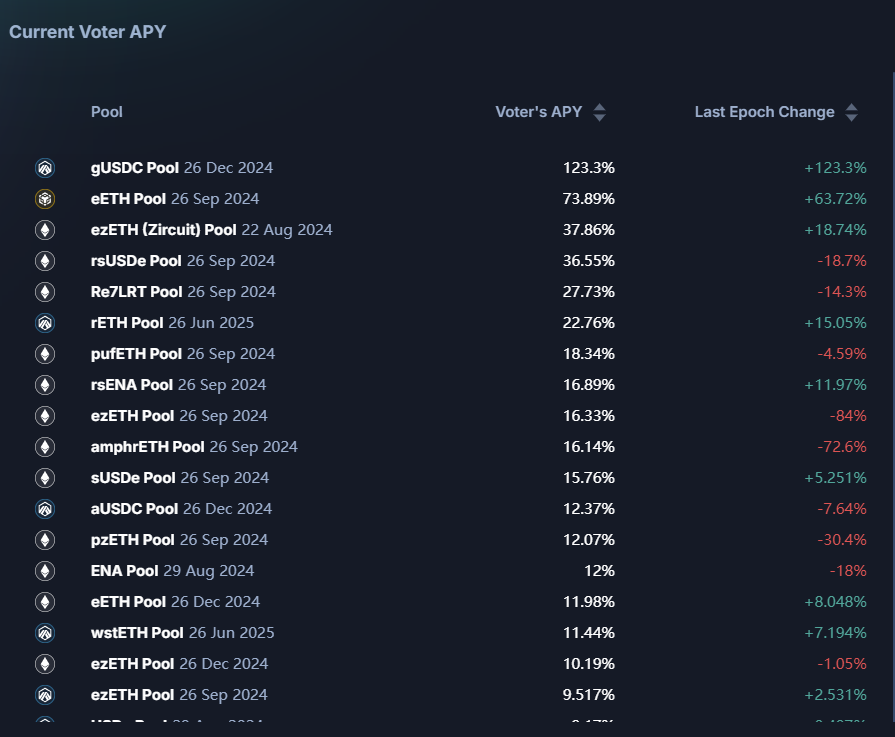

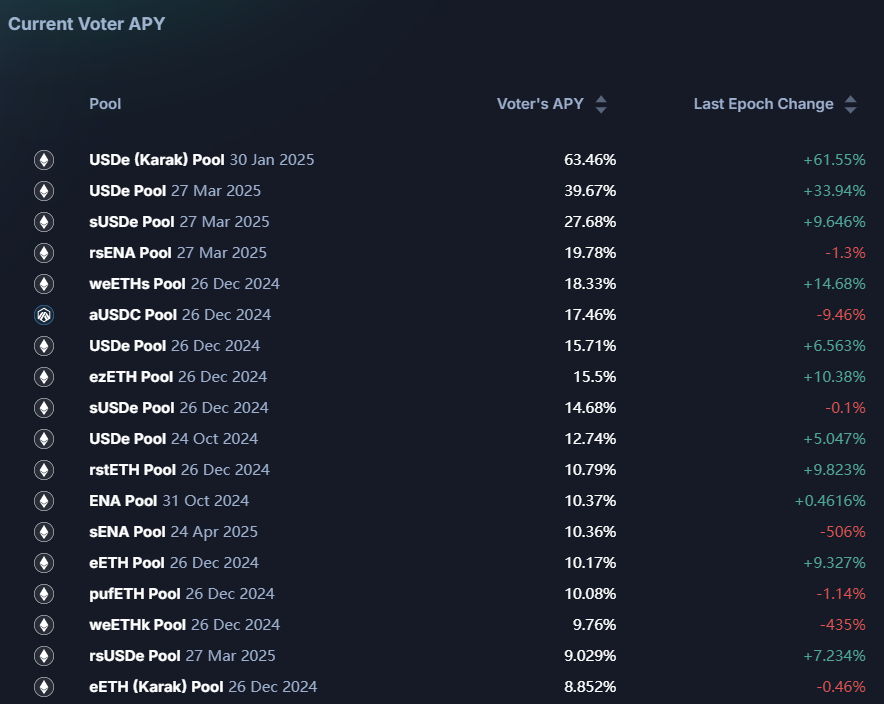

In terms of yield calculation, Total APY for vePENDLE holders = Base APY + Voter’s APY. Base APY comes from YT and PT returns, while Voter’s APY stems from trading fee shares in specific pools—and constitutes the majority of total yield. Currently, Base APY is around 2%, whereas Voter’s APY can exceed 30%.

Pendle’s ve model has also given rise to bribe platforms such as Penpie and Equilibria, mirroring the relationship between Convex and Curve. However, unlike Curve—where project teams have strong incentives to bribe voters to maintain deep liquidity for stablecoin pegs—there is less fundamental need for LSD or LRT projects to influence Pendle’s liquidity depth. Therefore, the primary motivation for participating in bribery comes from Pendle’s own LPs. Bribe platforms optimize two aspects: 1) Pendle LPs can earn enhanced yields without purchasing or locking PENDLE; 2) PENDLE holders gain liquid derivatives like ePENDLE/mPENDLE while still qualifying for vePENDLE rewards. As this article focuses solely on Pendle, we will not expand further on the broader bribe ecosystem here.

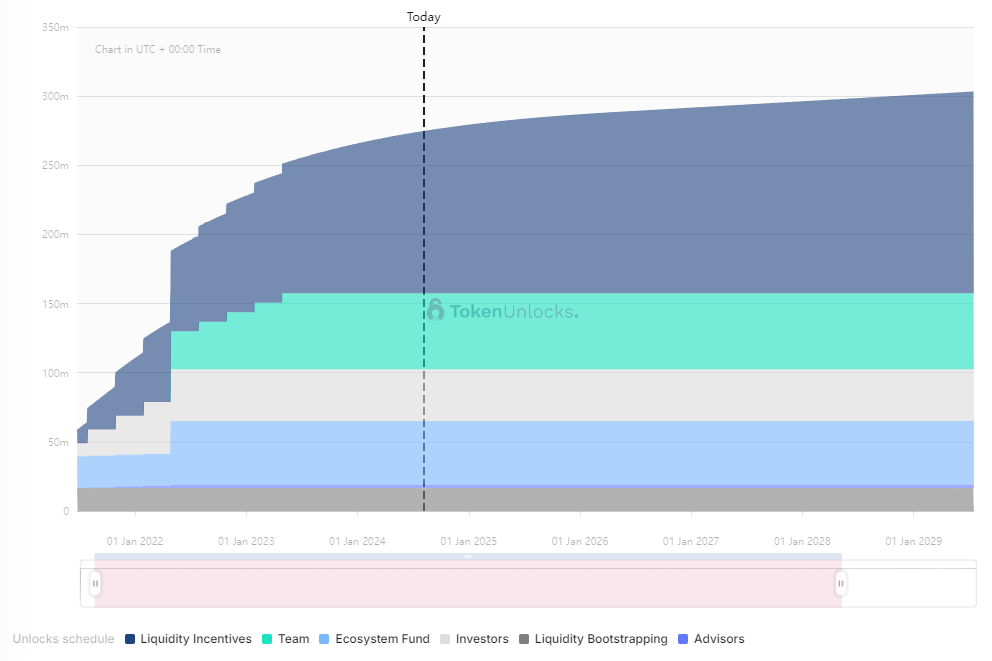

2.2 Token Distribution and Supply: No Major Future Unlocks

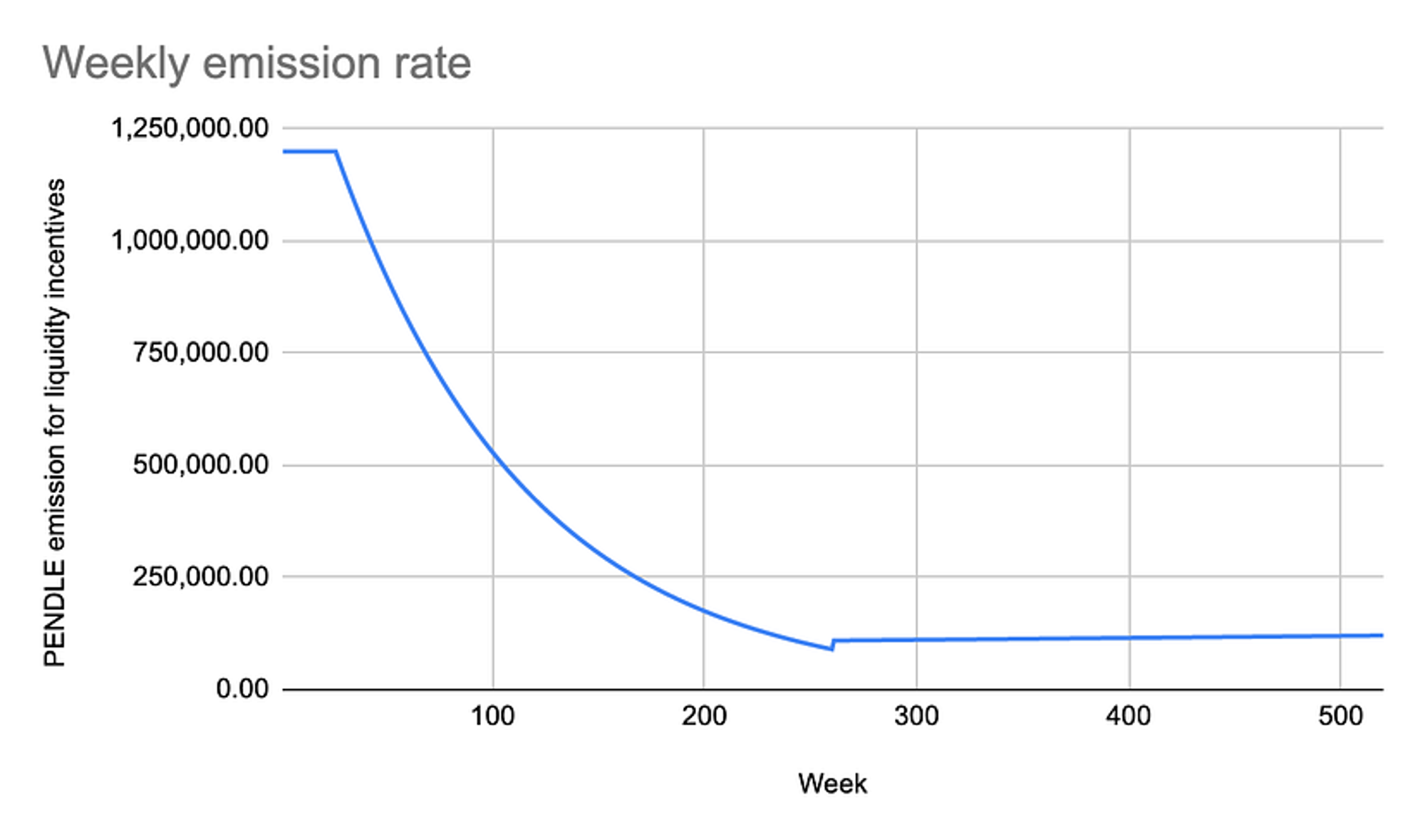

PENDLE was launched in April 2021 with a hybrid inflationary model and uncapped supply. For the first 26 weeks, it offered a fixed weekly reward of 1.2 million PENDLE. From week 27 to week 260, emissions decay weekly by 1%. After week 261, inflation stabilizes at 2% annually to sustain incentives.

According to Token Unlock data, initial allocations were made to team, ecosystem, investors, and advisors—all of which have now fully unlocked. Excluding OTC trades, there are no significant future unlocks expected. Daily inflation now comes only from liquidity mining, with approximately 34.1k PENDLE emitted per day. At the August 5 price of $2, daily sell pressure amounts to just $68.2k—relatively low.

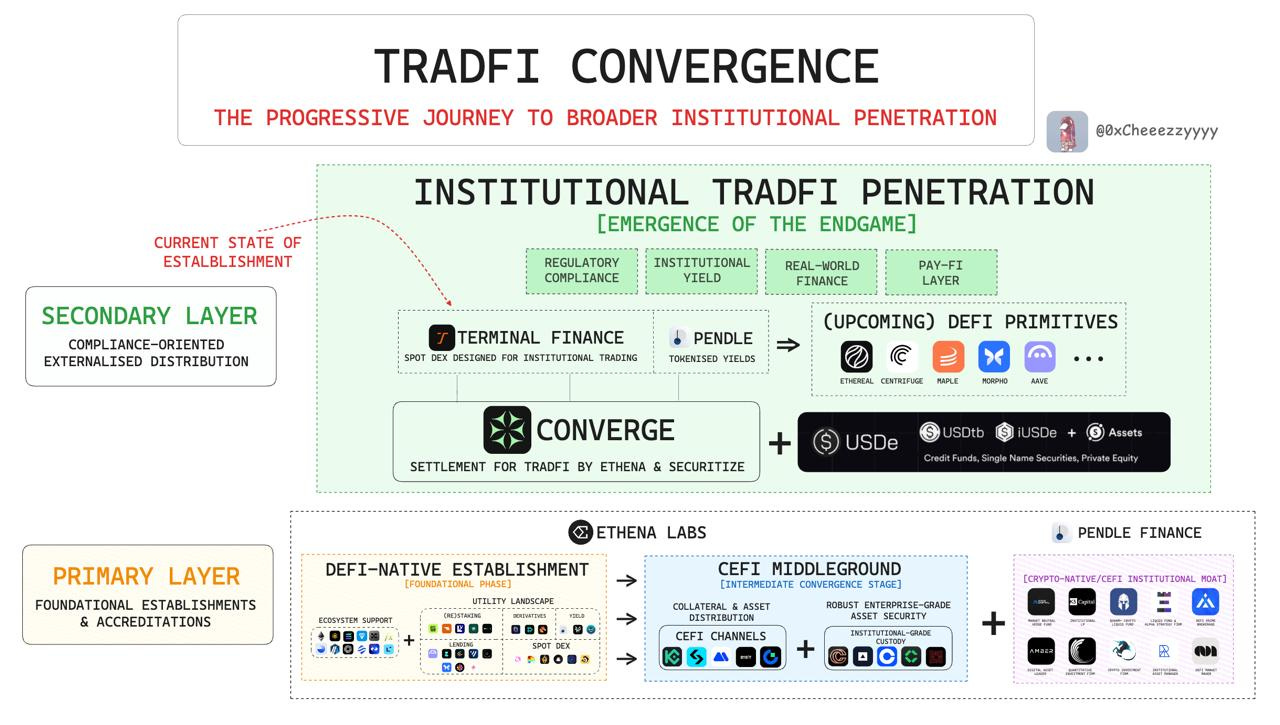

3. Use Case Evolution: Stable Income, Rate Trading, and Points Leverage

Pendle’s development can be divided into three phases:

-

Founded in 2021 during DeFi Summer, but DeFi was still in infrastructure-building mode—dominated by DEXs, stablecoins, and lending protocols. As a rate-swap product, Pendle received little attention.

-

Toward the end of 2022, Ethereum’s transition to PoS established staking yield as crypto’s native interest rate. A wave of Liquid Staking Derivatives (LSDs) emerged, making yield a focal point and creating abundant yield-bearing assets—Pendle found its product-market fit (PMF). With few competitors in the niche, Pendle became a small-cap play on the LSD narrative. Its listing on Binance further elevated its valuation ceiling.

-

From late 2023 to early 2024, EigenLayer introduced restaking, spawning numerous Liquid Restaking Token (LRT) projects—all announcing points programs and anticipated airdrops. This ignited a points race, resulting in: (1) more yield-bearing assets, expanding Pendle’s path to grow TVL; (2) crucially, Pendle captured the intersection of principal-yield separation and points leverage, finding a new PMF. The following sections detail how Pendle plays a role in the points race and empowers the PENDLE token.

In summary, beyond being an LP or vePENDLE holder, Pendle’s main use cases today fall into three categories: conservative wealth management, yield speculation, and points leverage.

3.1 Conservative Wealth Management

This primarily involves PT assets. By holding PT, users receive a fixed amount of the underlying asset at maturity, with the fixed rate locked in at purchase. Users don’t need to monitor APR fluctuations. This function offers stable, low-risk, low-return outcomes. During the points-trading era, it further enhanced user returns: take eETH, for example—users forego eETH’s points accrual in exchange for higher fixed yield. Hence, PT yield (7.189%) now far exceeds eETH’s base yield (2.597%), offering a tool for users seeking higher fixed ETH-denominated income. Some users skeptical of future LRT token performance may buy PT cheaply during market FOMO-driven spikes in YT prices—a de facto short position on LRT tokens.

3.2 Yield / Return Expectation Trading

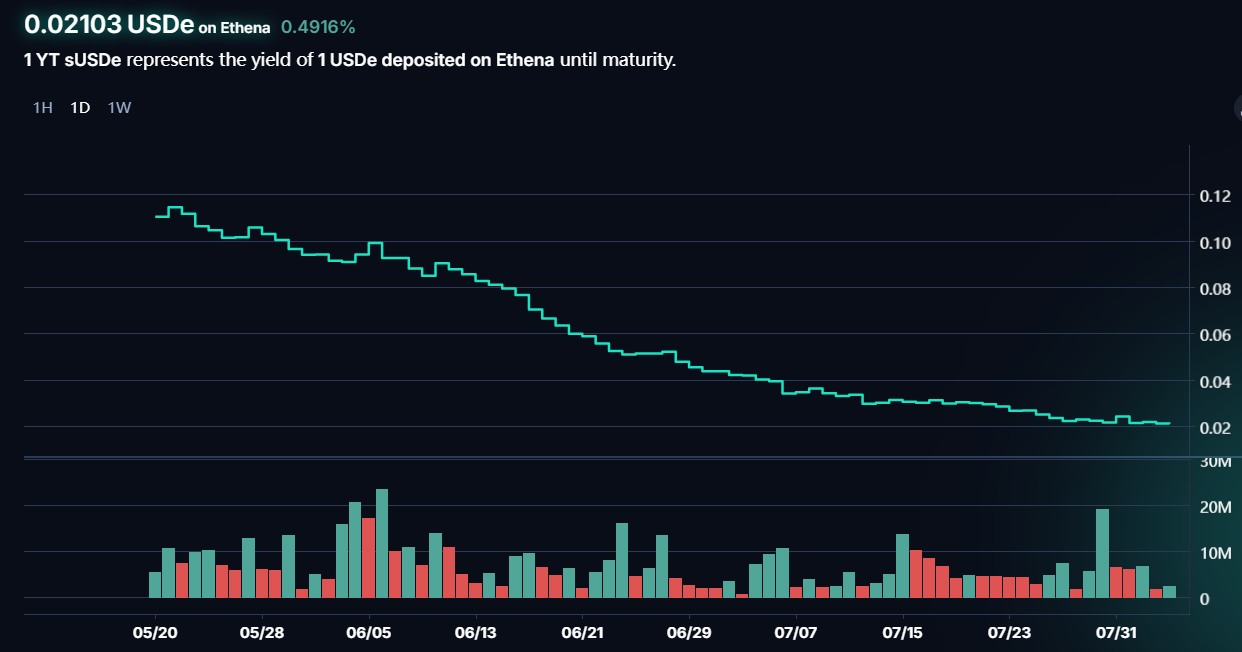

Users trade YT tokens to speculate on rising or falling yields. When expecting a significant yield increase, they buy YT and sell later when price rises. This strategy works best with volatile yield assets—for example, sUSDe, the staking receipt for Ethena’s synthetic dollar. Its yield mainly derives from ETH funding rates: higher funding rates mean higher yields. Since funding rates depend on market sentiment, sUSDe yield fluctuates accordingly. Trading YT-sUSDe allows quick profits from volatility. Moreover, with points eligibility attached, YT trading also incorporates changing airdrop expectations. For instance, buying YT-USDe early before ENA’s launch and selling after market FOMO sets in could generate substantial gains. However, this strategy carries high risk. Recently, YT-sUSDe prices have declined repeatedly—partly because shorter holding periods reduce accumulated points, and partly due to falling ENA prices, lowering market expectations for airdrop value. Early buyers may face significant losses.

3.3 Points Leverage and Trading

The most impactful innovation for Pendle in this cycle has been its integration with points trading, offering users highly leveraged exposure to points and potential airdrops. We focus on this feature and aim to answer the following questions:

(1) Which projects are suitable for Pendle’s points trading?

Points have become the dominant form of airdrop distribution, acquired through interaction, volume farming, or deposits. Deposit-based accumulation has become the most effective method. With the rise of LRT protocols, Bitcoin Layer 2s, and staking platforms, the “TVL war” has dominated 2024. Some protocols directly lock assets—e.g., BTC Layer 2s lock BTC and inscriptions; Blast locks ETH directly. Others issue liquid tokens as deposit receipts, granting points over time. Pendle’s principal-yield separation mechanism fits well with the latter category—those requiring an underlying asset as a medium for points accumulation.

(2) Where has Pendle achieved PMF with points trading?

Pendle achieves PMF in two key areas: points leverage and early airdrop pricing/trading. TVL wars favor whales; retail users lack sufficient ETH to meaningfully participate. Pendle allows direct purchase of YT to gain points rights—no principal required. This enables 10x–50x points leverage on LRTs and Ethena-like projects. Second, Pendle creates the earliest market for pricing points. Trading YTs is effectively trading market expectations around future airdrops and token valuations. This breaks down into two scenarios: ① For tokens not yet TGE’d, airdrop rules are often unclear, so YT pricing reflects both expectations about possible tokens and their early valuation; ② For already-launched tokens with clear market prices, uncertainty remains about how many tokens each point will redeem. If redemption rules are known—i.e., the number of tokens receivable at expiry—the YT acts like an option, priced based on expectations of the token’s value at maturity.

(3) How does points trading affect Pendle’s revenue and token price?

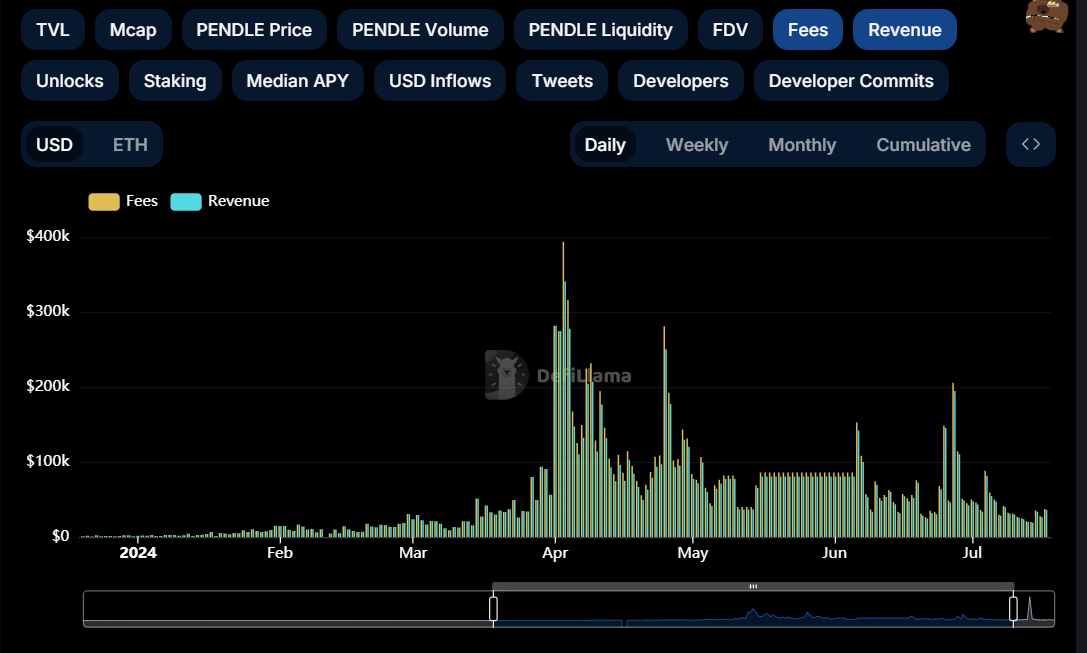

As previously analyzed, points trading introduces speculative demand driven by evolving airdrop expectations—more volatile and dynamic than yield alone. This drives higher trading volumes and fee income. Simultaneously, broader asset adoption increases Pendle’s TVL.

The impact on PENDLE is even clearer. vePENDLE holders earn primarily from trading fee shares. Without sufficient volatility and speculative activity, trading volume dries up, and vePENDLE yields plummet. In July 2023, vePENDLE’s total APY was only ~2%. Despite Pendle riding the LSD hype, its token price failed to benefit from operations. Points trading changed this: today, multiple pools offer vePENDLE APY above 15%, with some LST-related pools exceeding 30%.

(4) How do related projects’ performances affect Pendle?

Two major risks loom over Pendle: airdrop distributions from core assets (LRTs and Ethena); and sustained price declines in flagship project tokens. Airdrop fulfillment reduces speculative demand. Although points programs may continue over multiple rounds, combined with falling token prices, market confidence erodes. Fewer users opt to deposit, and associated trading volumes shrink dramatically. Currently, both Pendle’s TVL and trading volume have fallen sharply—mirrored in its token price.

4. Data Analysis: TVL and Volume Are Pendle’s KPIs

We believe Pendle’s operational data falls into two buckets: stock and flow. Stock is represented by TVL, along with structural composition, pool maturity dates, and rollover ratios—indicators affecting sustainability. Flow refers to trading volume, including volume itself, fees, and breakdowns—directly influencing token utility.

4.1 TVL and Related Metrics

ETH-denominated TVL grew rapidly after mid-January 2024, closely tracking PENDLE’s price. Peak TVL exceeded 1.8M ETH. Sharp drawdowns occurred on June 28 and July 25, primarily due to mass pool maturities and insufficient reinvestment, causing rapid TVL erosion. Current TVL stands at ~1M ETH—nearly 50% below peak—with no sign of stabilization.

Specifically, on June 27, 2024, multiple LRT pools—including Ether.Fi’s eETH, Renzo’s ezETH, Puffer’s pufETH, Kelp’s rsETH, and Swell’s rswETH—matured. Users withdrew principal. While alternative pools exist, renewal rates remain low. TVL has not recovered, confirming earlier analysis: as LRT projects launch tokens with weak price performance, user appetite for further investment wanes. This cycle has seen limited innovation in the Ethereum ecosystem, and ETH price outlook remains dim. Reduced demand for ETH-based yield products directly impacts Pendle’s revenue. Thus, Pendle is tightly coupled with Ethereum’s fortunes.

Regarding TVL composition, Pendle’s total TVL is $2.43B. Eleven pools exceed $10M TVL. The largest, SolvBTC.BBN, accounts for only 3.51%—indicating a healthy, diversified structure without overreliance on single pools. The next major expiry date is December 26, 2024, suggesting relatively stable TVL in the near term.

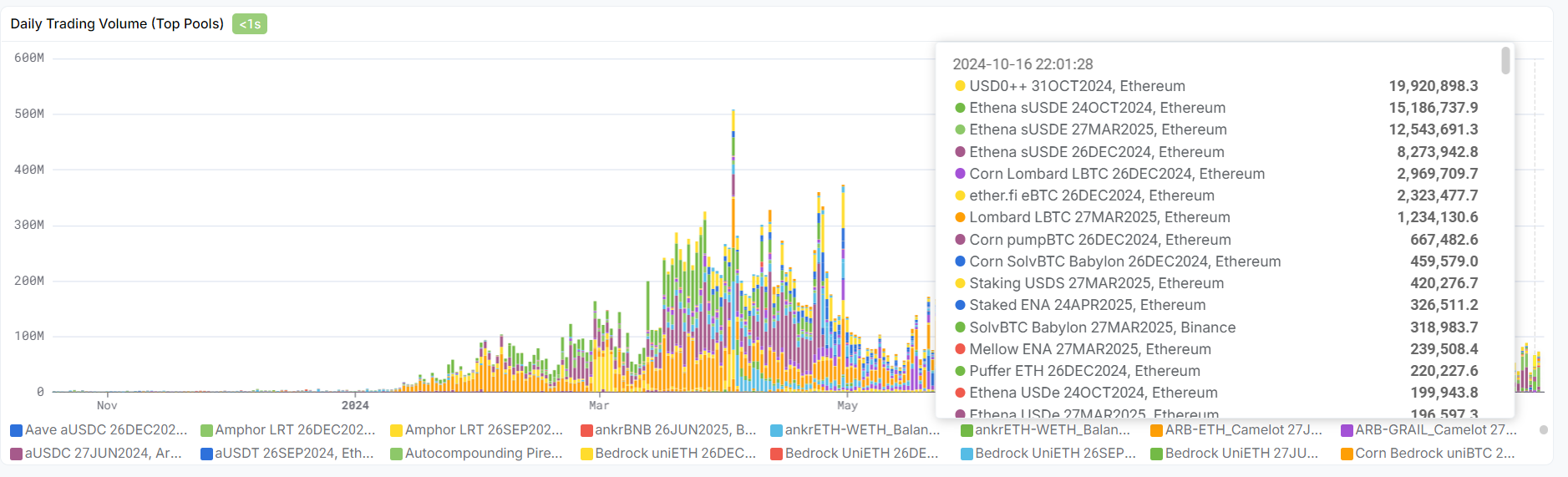

After the restaking wave subsided, Pendle smoothly pivoted to BTCfi and stablecoins like USDe/USD0. Though business momentum and market sentiment lag behind Q1 levels, TVL has stabilized without collapse. However, as major Ethereum LRT protocols launch tokens and EIGEN begins trading, the restaking narrative loses steam—also dampening speculation around BTC staking. This is evident in declining trading volumes on Pendle. The next potential shock could come from Babylon or other BTC restaking launches. Once BTC restaking ends, can Pendle find new use cases?

4.2 Trading Volume and Composition

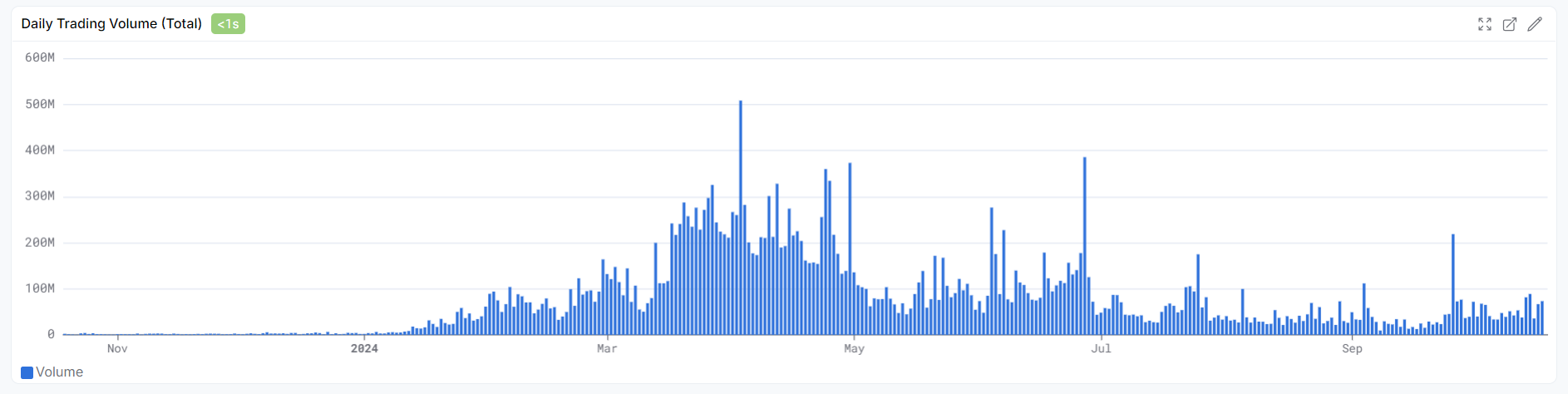

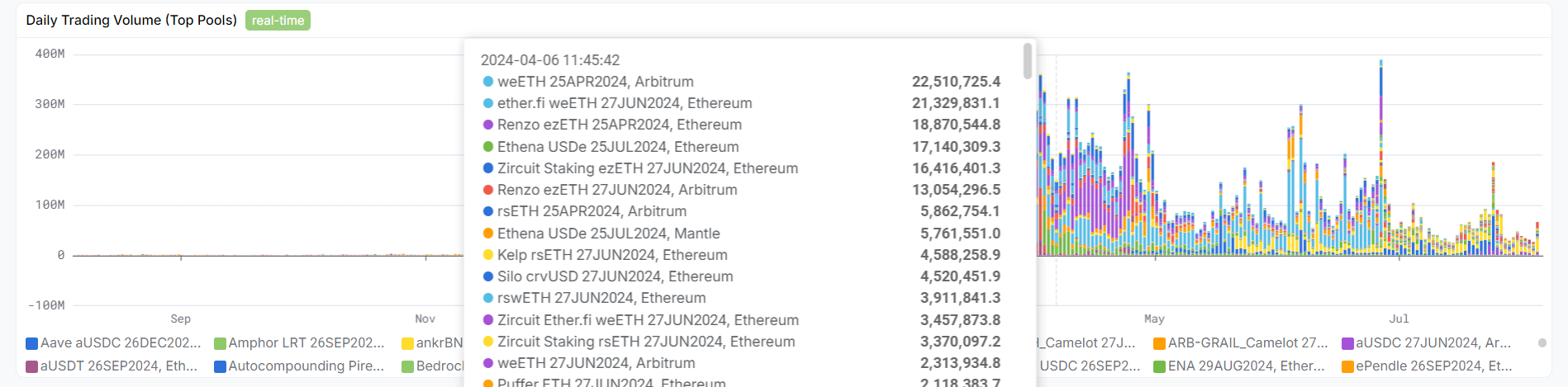

Pendle AMM volume surged after January 2024, peaking around April. Following Eigenlayer’s token announcement and fading airdrop hopes from LRTs like Ether.fi, volume declined noticeably and now sits at year-to-date lows.

In terms of volume composition, first-half 2024 activity was dominated by Renzo and Ether.fi assets. Today, most volume comes from Ethena and USD0. BTCfi contributes limited volume. Since trading volume directly determines fees and vePENDLE yields, it serves as a more immediate driver than TVL.

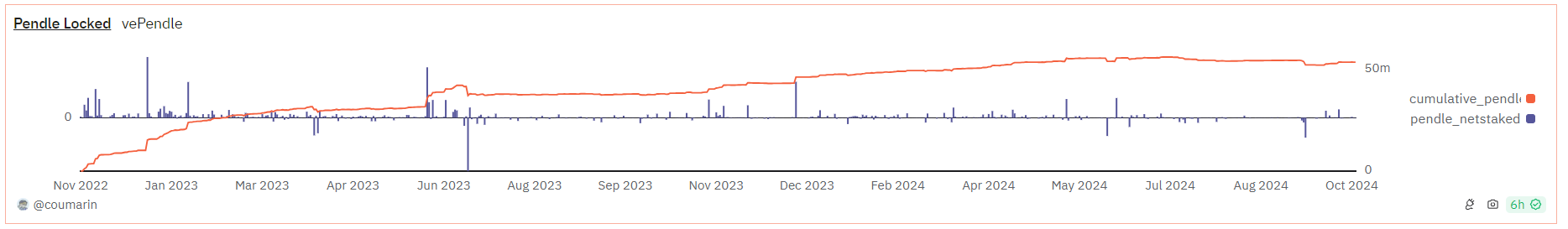

4.3 Token Locking Ratio

The locked PENDLE ratio directly affects supply-demand dynamics. With daily emissions relatively stable, the more PENDLE locked as vePENDLE, the stronger the positive pressure on price. Trends in PENDLE locking mirror broader business and price movements. Since November 2023, locked amounts rose rapidly—from 38M to a peak of 55M. After reaching 54M in April 2024, growth slowed, and net outflows of vePENDLE began. This aligns with prior analysis: as TVL and volume decline, vePENDLE yields fall, reducing incentive to lock. While no massive outflow has occurred yet—partly due to lock-up constraints making this metric lag behind TVL, volume, and price—and top pools still offer decent returns, slowing the exodus—it remains clear that both operational and vePENDLE growth metrics indicate short-term pain. Pendle has yet to identify a new growth vector post-restaking and post-points-frenzy to continue its previous success story.

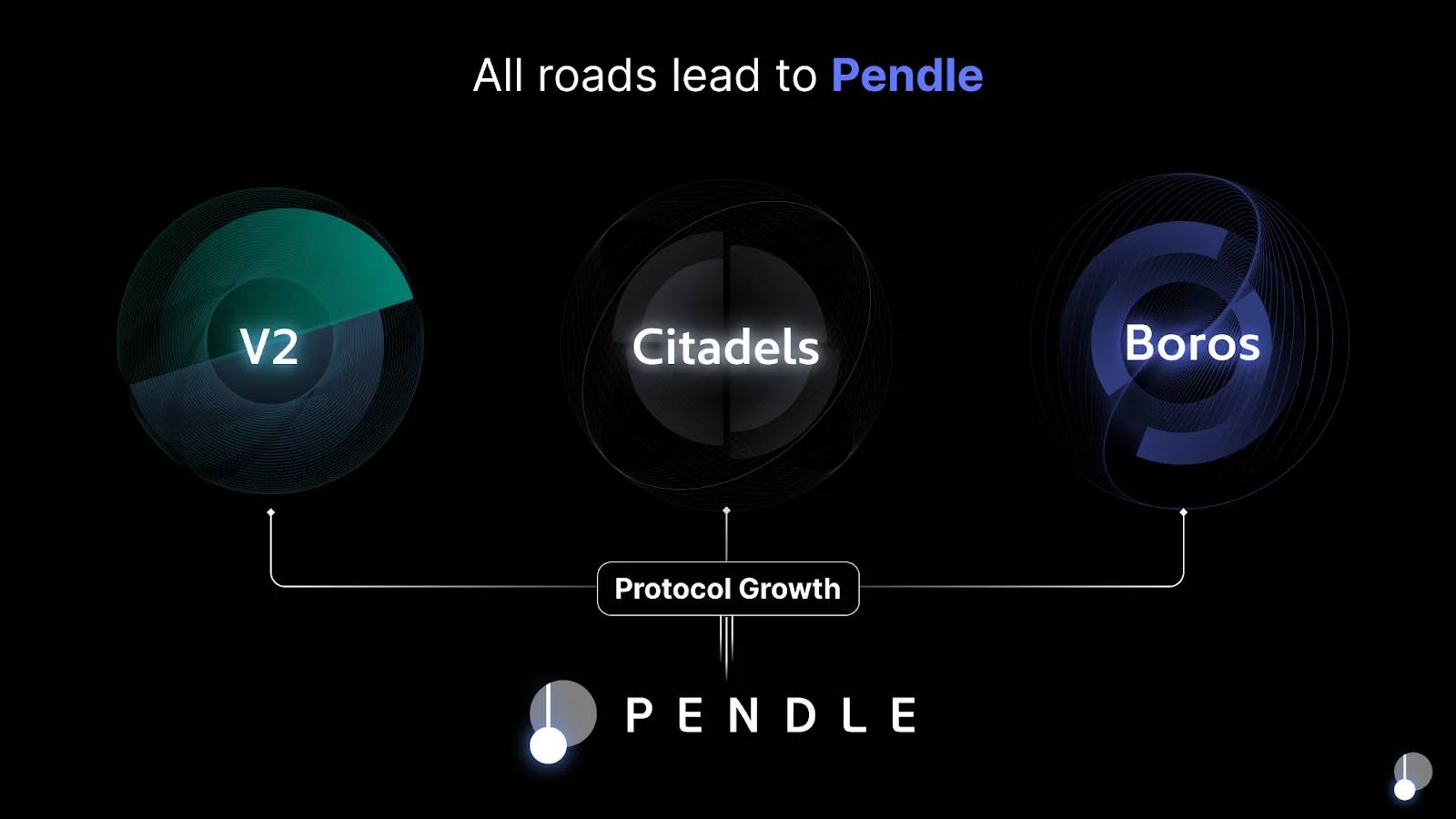

5. Conclusion: Pendle Needs New Use Cases Beyond Restaking

In summary, Pendle succeeded by identifying a clear PMF—and more importantly, by directly linking business revenue to token value through a tangible mechanism: packaging YT as a points-trading vehicle increased AMM volume and boosted vePENDLE income.

Since peaking at $7.50, Pendle has not reversed its downtrend. There’s no denying Pendle is a strong DeFi product, combining yield generation with speculative appeal to serve diverse investor risk profiles. Yet, ETH-denominated TVL shows no recovery, and underperformance from restaking projects and Ethena has dampened future airdrop expectations. Demand for Pendle is waning, and PENDLE’s price is searching for a new floor. To reignite growth, Pendle must either repackage its offerings or expand into new ecosystems like Solana to boost TVL and volume.

Another identity Pendle once held was “Ethereum Beta”—but this is shifting. During the restaking era, Pendle served as a key yield product for Ethereum and its derivatives—even Ethena’s USDe yield tied directly to ETH funding rates. If market confidence in Ethereum falters and ETH price stagnates, Pendle struggles too. Importantly, unlike meme-based Ethereum beta plays like PEPE, PENDLE has a direct transmission mechanism: weak ETH price → reduced ETH-based yield demand / cooling restaking sector → lower usage of Pendle → declining protocol revenue → falling PENDLE price. However, with Bitcoin staking assets now surpassing Ethereum on Pendle, this linkage may weaken.

Finally, key fundamentals to watch:

-

Monitor progress of points programs from LRTs, Ethena, USD0, and similar stablecoin projects. The end of “points season” could further reduce Pendle’s revenue.

-

Track changes in Pendle’s TVL and trading volume. If multiple pools expire simultaneously, anticipate sharp TVL drops—and consider trimming PENDLE positions preemptively.

-

Stay updated on product developments: launch of Pendle V3, new pools and strategies, and potential expansion into new blockchain ecosystems.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News