Situation reverses—could the Eastern liquidity upswing be arriving?

TechFlow Selected TechFlow Selected

Situation reverses—could the Eastern liquidity upswing be arriving?

See what institutions that have consistently been bullish on China have to say.

Author: Sean Tan, Primitive Ventures

Translation: TechFlow

As a multi-strategy, asset-agnostic investment firm, our philosophy goes beyond simply identifying opportunities. We focus on building investment frameworks capable of anticipating and adapting to future market shifts—constantly seeking the optimal balance between risk and return. What fascinates us most are often opportunities misunderstood or overlooked by the majority of market participants. Drawing from a decade of experience in foreign exchange and cross-border markets, we’ve found that shifts in liquidity or sudden external shocks are frequently the best catalysts.

These major events typically force market participants to rapidly rebalance their portfolios under tight time pressure. When large volumes of capital rush to reposition simultaneously, significant volatility ensues. As macro investors, one of our key skills is understanding the interplay between liquidity flows across Eastern and Western markets, onshore and offshore markets, regulated systems, and underground financial channels.

Investing in China

Our move into “investing in China” has been long and arduous. We first began positioning at the end of 2023, shortly after China reopened but when market performance remained disappointing. We then increased exposure during the first quarter of 2024. The rationale was straightforward: Chinese equities were trading at a staggering 60–70% discount compared to their U.S. peers. Widespread narratives labeled the market as “oversold beyond repair” or even “uninvestable.” Yet, from a purely fundamental perspective, a basket of blue-chip Chinese stocks exhibited solid double-digit growth. However, the primary constraint for the Chinese market at that time was—liquidity.

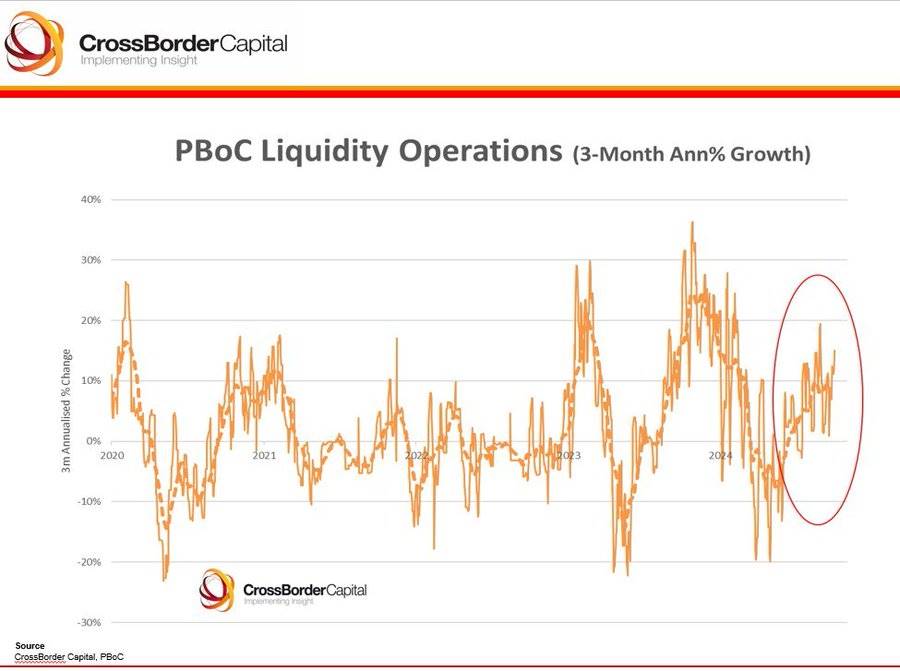

That changed last week. In an unusual move, China’s Politburo convened an ad hoc meeting directly addressing current economic challenges. Departing from its usual incremental approach, this session unveiled a unified strategic action plan led by the central bank and chaired personally by national leadership. This sent a clear signal: The government is preparing for large-scale liquidity injections and direct market intervention.

Key highlights from the meeting:

-

Unusual timing of the Politburo meeting: While the Politburo meets monthly, economic agendas are typically reserved for April, July, and year-end meetings. For the first time, an unscheduled September session publicly addressed economic issues, coordinated with aggressive monetary policy updates from the central bank.

-

Urgency around economic challenges: The tone conveyed a strong sense of urgency, urging officials to face the current environment soberly, acknowledge difficulties, and take responsibility for resolving them.

-

Expansion of counter-cyclical fiscal policy: The meeting emphasized the need for stronger counter-cyclical fiscal and monetary measures, ensuring sufficient fiscal spending. We now await a series of upcoming fiscal stimulus announcements.

-

Support for capital markets: The government affirmed the importance of capital markets, signaling stability through large-scale liquidity injections.

-

Cut reserve requirement ratio (RRR) by 50 basis points, injecting 1 trillion RMB in long-term liquidity, with potential for another 25–50 bps cut ahead.

-

Reduced the 7-day reverse repo rate by 20 bps from 1.7% to 1.5%.

-

The PBOC will provide 500 billion RMB to purchase equities, strengthening market stabilization efforts.

-

This clearly signals the start of a liquidity injection and intervention cycle. Western/global markets quickly picked up on this message, interpreting it skillfully as monetary easing. And just like that—the catalyst arrived. Markets erupted. The world suddenly woke up to the strength of China’s underlying fundamentals, and we finally harvested the delayed returns from our contrarian bet.

While it remains to be seen whether these measures will truly revive the sluggish economy, the upcoming “Singles’ Day” shopping festival (China’s equivalent of Black Friday) will serve as an early litmus test for consumer demand and retail spending—directly reflecting the health of domestic consumption recovery.

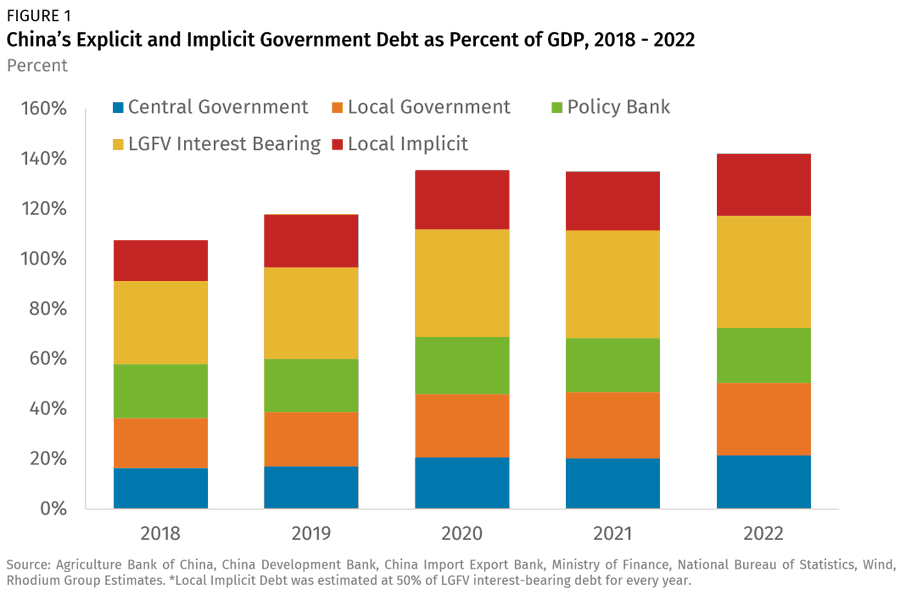

It’s important to note, however, that China’s debt structure differs significantly from that of the United States. In China, local governments bear most of the debt burden and rely heavily on land sales for revenue. This unique setup adds complexity, making local economic trends a critical factor in assessing the broader trajectory of recovery.

Implications for Cryptocurrencies

At Primitive, we strive to view the landscape through the widest possible lens. As cryptocurrencies enter the mainstream investment cycle and more institutions begin meaningful allocations, we observe increasing convergence among the profiles of capital allocators making these decisions.

Unlike previous cycles, we aren’t witnessing a surge of retail investors directly buying crypto assets with fiat—such as the 2017 ICO frenzy or the 2021 NFT craze. Back then, new users would deposit fiat directly into exchanges, convert it into stablecoins or Ethereum, and dive into various speculative activities. In 2021, we saw funds flowing directly from Coinbase to OpenSea, while MoonPay surged in popularity due to massive demand for fiat-to-NFT purchases.

In this cycle, traditional finance holds stronger appeal than native crypto ecosystems. Futures open interest at the Chicago Mercantile Exchange (CME) has already surpassed Binance, and CME is preparing to launch spot products. U.S. institutional investors remain barred from trading on overseas venues—even via prime brokers. Meanwhile, ETFs are poised to become underutilized high-quality collateral, while credit within the crypto ecosystem itself has dried up. Indeed, when Bitcoin dropped to $53,000 in early September due to seasonal selling, our market positioning was primarily based on two macro views:

-

We are in an environment of loose liquidity

-

The crypto cycle is part of a larger macroeconomic cycle

These two principles have become core tenets guiding our investment decisions.

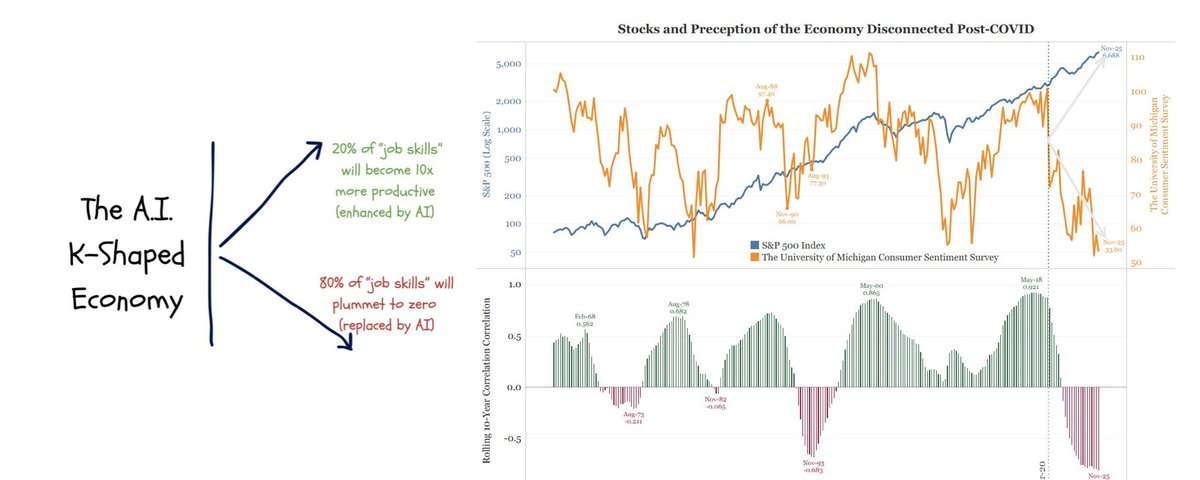

In the early stages of this cycle, the crypto spot market suffered a double blow—from tech/AI stock selloffs and zero-day options. The former had a more pronounced wealth effect on retail investors, while the latter offered thrill-seeking traders a more exciting “gambler’s paradise” than the relatively calm crypto market. Zero-day options, introduced less than two years ago by the Chicago Board Options Exchange (CBOE), now dominate equity markets—accounting for over 50% of S&P 500 option trading volume.

With both the U.S. and China entering monetary easing cycles, global liquidity is rising. Combined with the upcoming U.S. election and signs of slowing momentum in tech stocks, we expect some risk appetite to shift toward crypto. Seasonal factors in Q4 may influence how investors rebalance portfolios ahead of 2025—especially given public endorsements like BlackRock CEO Larry Fink calling Bitcoin a valuable low-correlation asset. Such statements will undoubtedly attract further attention from institutional allocators.

Outlook Ahead

Looking ahead, we are closely watching Chinese savers, who maintain a world-class savings rate of 34%. Most of these funds remain parked in bank deposits, withdrawn from both the stagnant property market and an equity market that has underperformed for nearly five years. The key question is whether these savings will be reallocated into risk assets—and how such a shift might be triggered.

We’re also monitoring whether coordinated policy actions this week can achieve the targeted 5% GDP growth, reignite capital inflows into China’s domestic markets, stimulate retail consumption, and boost risk appetite toward financial assets. These dynamics will shape the economic outlook for 2025—and could even influence the outcome of the U.S. presidential election on November 5.

Whether in traditional or crypto markets, we find return distributions to be highly concentrated. This means it's extremely difficult to generate meaningful alpha—whether picking niche stocks or alternative tokens. Therefore, at Primitive, we adopt a different strategy. Our core principle is “follow the liquidity.” Specifically, when designing trading strategies, we focus primarily on tracking and leveraging shifts in market liquidity.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News