Diving into the Secondary OTC Market for Crypto: Understanding the Identities and Motivations of Buyers and Sellers

TechFlow Selected TechFlow Selected

Diving into the Secondary OTC Market for Crypto: Understanding the Identities and Motivations of Buyers and Sellers

Today, the term "secondary over-the-counter market" primarily refers to trading of locked tokens.

Author: Min Jung

Compiled by: TechFlow

Summary

-

The secondary over-the-counter (OTC) market is a space where people can trade various assets, including locked tokens, equity, or SAFTs (Simple Agreement for Future Tokens—a legal agreement commonly used in blockchain and cryptocurrency project fundraising, allowing investors to provide capital during development in exchange for future token issuance), which are difficult to trade on public exchanges. Today, the term "secondary OTC market" primarily refers to trading of locked tokens.

-

Primary sellers in the secondary OTC market include venture capital firms, crypto project teams, and foundations, typically driven by motives to secure early profits or manage sell pressure. Buyers fall into two categories: "holders" who believe in the long-term potential of tokens and are attracted by discounts, and hedgers who seek to profit from price differences through strategic financial operations.

-

As market sentiment grows increasingly bearish, the secondary OTC market is gaining more attention, with tokens often sold at significant discounts due to limited buyer interest. Nonetheless, this market plays a crucial role in managing liquidity and reducing immediate sell pressure on public exchanges, thereby contributing to a more stable and resilient crypto ecosystem.

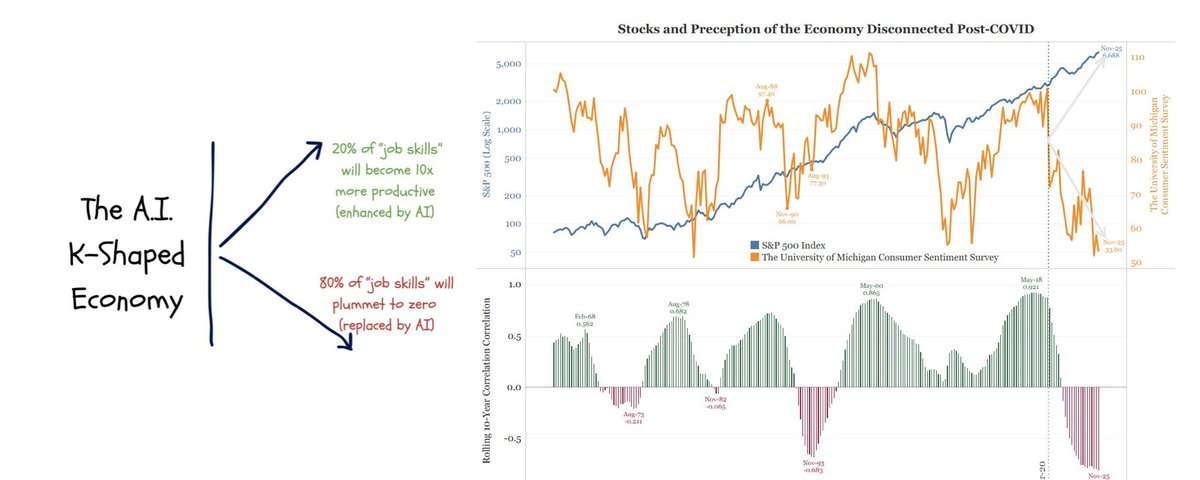

Figure 1: Current Market State, Source: imgflip

Introduction

Although largely inaccessible to most retail crypto investors, the secondary over-the-counter (OTC) market is rapidly gaining importance among industry insiders such as venture capital firms, crypto project teams, and foundations. As the dynamics of the crypto market evolve, the secondary OTC market is becoming a critical arena for managing liquidity and securing profits—especially in environments characterized by high valuations and limited liquidity. Therefore, this report will discuss: 1) what the secondary OTC market is, 2) who the participants are and their motivations, 3) perspectives on the current market state, and 4) insights from Taran, founder of STIX, an OTC platform for private crypto trading.

What Is the Secondary OTC Market?

The secondary over-the-counter (OTC) market is a private trading space where buyers and sellers directly negotiate and execute trades involving assets such as tokens, equity, or investment contracts like SAFTs (Simple Agreements for Future Tokens), all conducted outside public exchanges. Most assets listed on the secondary OTC market cannot be traded on conventional exchanges like Binance or OKX for various reasons. Because many crypto project tokens are locked, the secondary OTC market provides investors and teams with a way to sell these assets before they become freely tradable (unlocked). Today, the term “secondary OTC market” primarily refers to trading of locked tokens, especially those related to TGE (Token Generation Event) or even pre-TGE projects. This article will focus specifically on locked token trading for TGE projects.

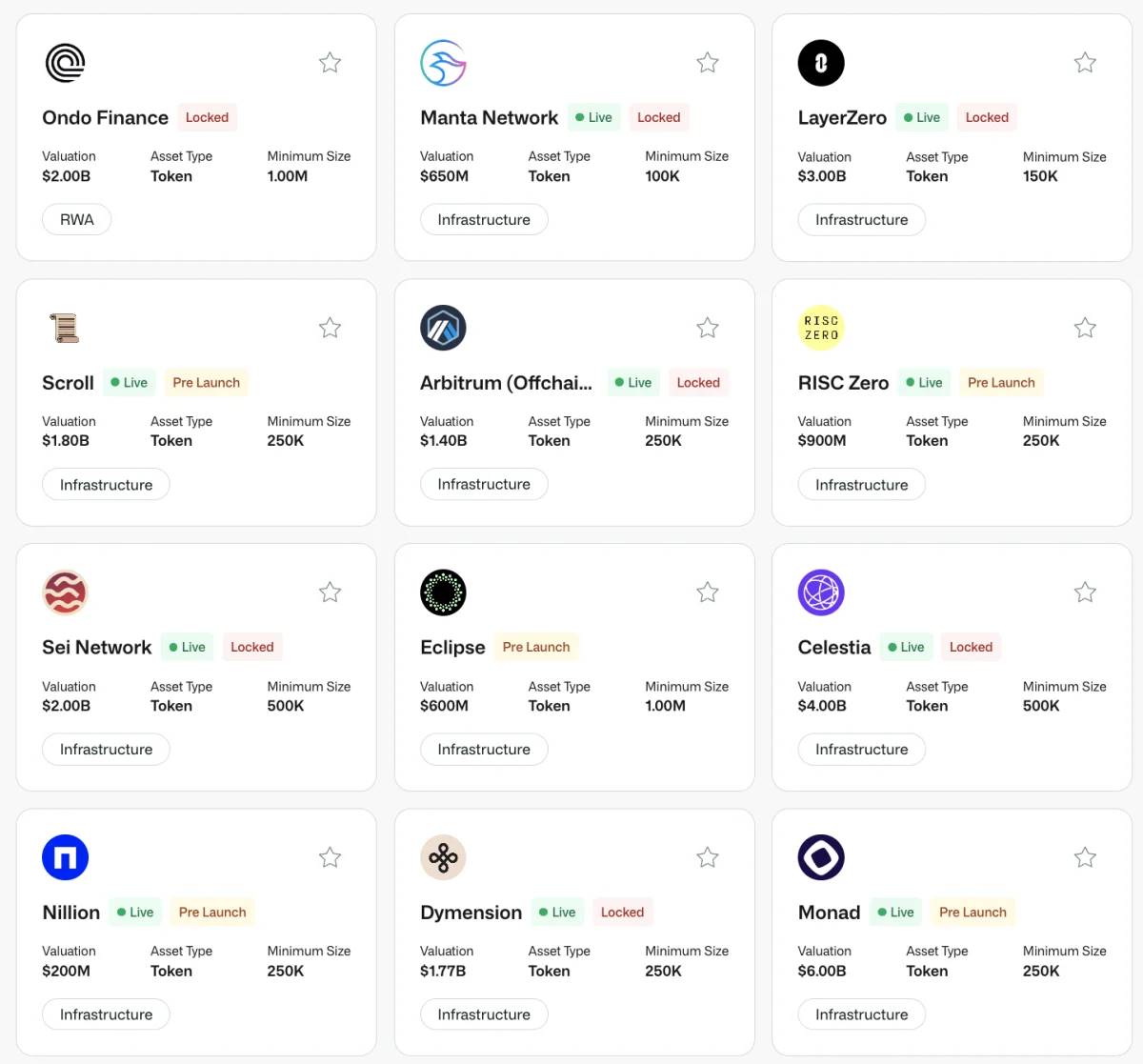

Figure 2: State of the Secondary OTC Market, Source: STIX

Why Is It Becoming an Active Market?

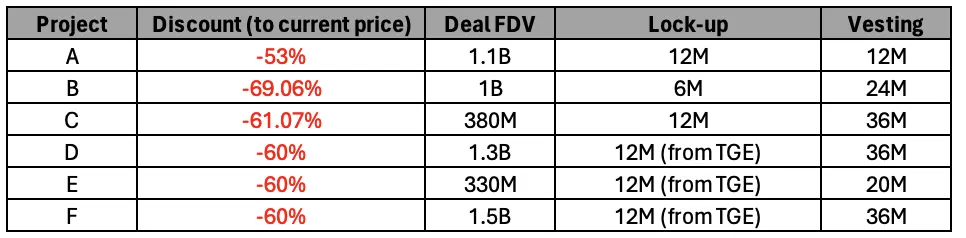

The main driver behind the flourishing of the secondary OTC market is stakeholders’ strong motivation to sell their holdings. Currently, many top 20 tokens are trading at nearly 50% discount with one-year lockups, while some tokens from projects outside the top 100 are selling at up to 70% discount. For example, a token priced at $1 on exchanges like Binance might only sell for $0.30 on platforms like STIX, with a one-year lockup and additional two-year monthly vesting.

This trend aligns with recent market conditions marked by high FDV (Fully Diluted Valuation), low liquidity, and negative sentiment toward VC-held tokens. As discussed in the article “FDV Is a MEME,” a large number of new projects have emerged without corresponding participants or liquidity to support such massive supply. Consequently, as more tokens unlock, prices naturally decline. Moreover, many tokens contribute little actual value to the market and are often overvalued relative to their real user base and utility. Recognizing this, teams and VCs that initially invested in these projects choose to sell now and lock in profits rather than risk selling later at lower prices.

Figure 3: Trades in the Current Market, Source: Presto Research

Who Are the Buyers and Sellers, and What Are Their Motivations?

Sellers and Their Motivations

Teams

Even at discounts of 50–70%, project teams often remain profitable. Many of these teams consist of small groups (typically 20–30 people) who built their projects within just 2–3 years. Despite relatively short development cycles and limited initial investment, these projects are often valued at $3 billion FDV or higher. In the Web2 world, it’s rare to see such a small team create a company worth $1.5 billion in such a short time. Under these circumstances, many projects are tempted to sell their tokens at a discount, recognizing the opportunity to secure profits now rather than risk seeing their value drop in the future.

Venture Capital Firms

VC firms face a similar situation. Recent market conditions have led to rapid and significant valuation increases, with seed rounds often occurring just six months after pre-seed rounds—and at triple the valuation. In some cases, VCs conduct multiple funding rounds simultaneously, assigning different valuations to the same point in time. As a result, unless they invested in the latest round before TGE, many VCs still find themselves in a significantly profitable position—even accounting for a 50% discount in the secondary market. This environment incentivizes VCs to sell and lock in returns. Additionally, under current market conditions, limited partners (LPs) of VC funds are beginning to pay closer attention to DPI (Distributions to Paid-In Capital), further motivating VCs to realize returns and reinforcing the trend of selling in the secondary OTC market.

Foundations

The motivations of foundations participating in the secondary OTC market may differ slightly. While some foundations may recognize their token’s high valuation and seek to sell quickly, others may take a more strategic approach. A common strategy is to sell unlocked tokens to investors at a discount, coupled with a one-year lockup. This method reduces immediate sell pressure on public markets while still allowing the foundation to raise necessary operational funds. In many cases, this type of transaction can be seen as a more proactive or “bullish” use of the secondary OTC market, as it balances the need for operational funding with the goal of maintaining market stability.

Buyers and Their Motivations

Holders

The first category of buyers in the secondary OTC market consists of those who believe in the long-term potential of the token. These individuals, often called “holders” (hodlers), are committed to the project’s success and are willing to buy tokens at a 50% discount with the intention of holding them for several years. For these buyers, the opportunity to purchase tokens at a steep discount is highly attractive, as they plan to maintain their investment in the project over the long term, expecting the token’s value to rise as the project develops. The high discount offers them an excellent entry point, enabling them to accumulate more tokens at a lower cost.

Hedgers

The second category of buyers seeks to profit from these transactions. Known as hedgers, they use perpetual swaps and other financial instruments to lock in profits from discounted tokens. By purchasing tokens at a 50% discount and shorting them, they can lock in returns equivalent to the discount. Additionally, if funding rates are positive, they can earn funding fees, further boosting their returns. This approach allows hedgers to exploit price differences between the secondary OTC market and public markets, making it a profitable strategy for those skilled in financial risk management.

Why Can’t Sellers Become Hedgers?

Although it might seem logical for sellers (such as VCs and project teams) to hedge their positions like buyers instead of selling at steep discounts, several factors make this impractical, including regulatory barriers and liquidity constraints.

On the regulatory front, VCs often face strict rules limiting their participation in certain financial activities—such as shorting tokens—which are essential components of effective hedging strategies. Beyond these regulatory limitations, hedging itself requires substantial capital to avoid liquidation risk. Sellers must post significant collateral, often exceeding the value of the tokens they aim to hedge, because while downside risk is limited, upside potential is theoretically infinite. This creates a financially prohibitive scenario for hedging, especially considering that most VCs and project teams hold their wealth in illiquid tokens rather than cash. Furthermore, hedging isn’t as simple as it appears. Numerous complex factors must be considered, such as counterparty risk—for example, the potential for platform failure or bankruptcy (as seen with FTX)—and risks associated with funding fees, which could suddenly turn negative, further complicating the strategy and potentially leading to unexpected losses.

Some Thoughts

What Does the Current Market Condition Imply?

Currently, the secondary OTC market reflects a more bearish sentiment than public exchanges—even at discounts up to 70%, it is difficult to find buyers. This contrasts sharply with public exchanges, where investors are usually compensated for shorting tokens via positive funding rates. While understanding the intentions of secondary market participants is crucial, this trend likely reflects cautious attitudes among market insiders responding to current conditions.

Figure 4: Most Tokens Have Positive 1-Year Cumulative Funding Rates, Source: Coinglass

The Role of the Secondary OTC Market

Despite bearish market sentiment, it’s important to recognize that activity in the secondary market isn’t entirely negative. In fact, an active secondary market is vital to the overall health of the crypto ecosystem. By facilitating the transfer of tokens between sellers and buyers, the secondary market enables profit-taking outside traditional trading venues. This process helps mitigate the impact of large token unlocks—events historically viewed as bearish due to increased sell pressure. By enabling these trades to occur off-exchange, the secondary market reduces immediate sell pressure on retail investors when tokens unlock. This shift contributes to a more stable and resilient market, preventing token unlocks from inevitably causing sharp price declines and supporting a healthier, more balanced market environment.

Q&A with Taran, Founder of STIX

Who Are You, and What Is STIX?

I’m Taran, founder of STIX, an OTC platform for private crypto trading. Founded in early 2023, STIX aims to provide a structured solution for those looking to conduct secondary trading in the crypto space. Our primary sellers are team members, early investors, and treasuries wishing to offload concentrated, locked token positions. Main buyers include whales, family offices, and hedge funds.

How Do You View the Development of the Secondary OTC Market Within the Broader Crypto Ecosystem?

The recent pullback in newly launched tokens shows that these protocols surged in price earlier in 2024 mainly due to their low float (demand outstripping supply). However, once the market turned risk-averse in Q2, these tokens suffered major setbacks, with many dropping over 75%. Many of these tokens experienced large ongoing unlocks, with tokens immediately dumped onto the market, further exacerbating price impact. Examples include Arbitrum, Starknet, Worldcoin, Wormhole, etc.

In Q1 and Q2, the same assets were traded in bulk OTC deals, primarily by early investors looking to de-risk and rotate into more liquid assets (like BTC, ETH, etc.), at discounts ranging from 70–80% off peak prices. Data suggests most tokens were overvalued by at least 5x and continued to trend downward upon introduction of new circulating supply.

Our push in 2024 for OTC price transparency (see here) aimed to highlight the importance of the OTC market. Buyers get multiple opportunities to acquire distressed positions, while sellers can conduct OTC trades without market impact.

There’s also a third party involved in these trades: the project team. Teams may decide for various reasons to block OTC trades (see here).

The importance of the secondary market lies in:

-

Removing motivated sellers from your cap table, preventing them from selling on order books

-

Introducing new, motivated holders with higher cost basis

-

Raising the average cost basis of private holders

-

Future supply control (e.g., introducing new vesting schedules)

-

Ensuring no backroom deals and full visibility into OTC trades

What Are the Key Trends or Topics in the Secondary OTC Market Today?

Two main trends:

-

For protocols that haven't been overfunded, treasuries now want to build cash reserves. We’ve supported multiple protocol treasuries in structured OTC raises, where buyers purchase at favorable prices (with installment unlocking over time), and treasuries gain cash reserves. This allows treasuries to diversify, reduce risk, and give teams sufficient runway to navigate competition.

-

Smart trading firms see clear arbitrage opportunities: buying favorably in OTC markets and managing hedges on exchanges, often earning funding fees. This funding fee/OTC arbitrage exists across hundreds of tokens and represents a very profitable market-neutral strategy for sophisticated trading firms.

Do You Think the Buyer's Market Trend Will Continue? What Are Your Short-Term and Long-Term Views?

-

I don’t think funding fee/OTC arbitrage for most tokens will end soon, as their unlock periods still span 2–3 years, and most tokens continue to have positive funding fees.

-

The secondary market is clearly cyclical: in 2023, the vast majority of OTC volume was for unlaunched assets, mainly due to well-funded protocols not yet live. Now that most of these protocols have launched, the market has shifted toward trading locked token blocks—transactions that are generally less risky since spot/perpetual markets are mostly established and abundant data is available for analysis.

-

With continuous monthly unlocks, sellers also have opportunities to keep managing risk on exchanges and aren’t necessarily forced into OTC trades. However, assets still facing cliff unlocks (like Ethena, LayerZero, IO.net, Aethir, etc.) continue to offer buyers chances to find the best deals.

-

If tokens rally in September and October, many sellers will contact STIX hoping to exit, as they’ve realized that de-risking is always wise. Many sellers who didn’t want OTC trades in Q1 now hope to exit at better prices than in Q2/Q3. However, I don’t think buyers are optimistic about these premiums—that’s why I believe the buyer’s market will persist into 2025.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News