Multicoin: 7 Factors to Consider When Evaluating the Blockchain Collectibles Market (BECM)

TechFlow Selected TechFlow Selected

Multicoin: 7 Factors to Consider When Evaluating the Blockchain Collectibles Market (BECM)

Brand-based BECMs are more attractive to venture capital than time-based BECMs.

Authors: Vishal Kankani & Eli Qian

Translation: TechFlow

The collectibles market is booming. Today, over one-third of Americans identify as collectors, and by 2024, the collectibles market reached nearly $500 billion. The collectibles industry is thriving—and blockchain is entering the space.

An increasing number of collectors are actually traders whose sole purpose is to buy and sell billions of dollars worth of collectibles—from rare whiskey to luxury watches to handbags—for profit. While online marketplaces have typically evolved from digital classified ads to general stores to vertical markets, they haven’t yet evolved to serve these traders in the most efficient way possible.

To make flipping as efficient as possible, collectibles markets need 1) instant settlement, 2) physical custody, and 3) authentication. Currently, leading collectibles platforms like Bring a Trailer, StockX, and Chrono24 do not offer all three. Cash settlement isn't viable; instead, physical settlement is the default, with settlement times measured in days or weeks. For larger collectibles such as cars, physical storage quickly becomes an issue (where do you store 20 cars for flipping?). For smaller items, often traded via niche markets like Facebook groups, fraud remains a persistent challenge. All these factors make trading collectibles extremely inefficient in today’s market.

We see a significant opportunity to create a new market design tailored specifically for collectibles traders—what we call “Blockchain-Enabled Collectibles Markets” (BECMs). These markets enable instant transactions through cash settlement, reducing settlement time from weeks to seconds using stablecoins, while leveraging NFTs as digital representations of physical assets held by trusted custodians or authenticators.

BECMs have the potential to reshape the multi-billion-dollar collectibles market by enabling: 1) unified markets with increased liquidity (compared to today’s fragmented gray markets), 2) elimination of personal physical storage needs, encouraging more trading activity, 3) greater trust through verified authentication, and 4) financialization of collecting via lending, which was previously impossible. We believe these efficiencies will significantly expand the total addressable market (TAM) for collectibles, as more traders, liquidity, inventory, and markets come online.

However, while BECMs can technically be built for any collectible category, not all BECMs will be equally viable. The remainder of this article focuses on the traits that make a BECM attractive from an investment standpoint. We break down seven key characteristics across three design axes: financial, real-world, and emotional.

Financial Axis

Lack of Vertical Trading Venues

Currently, most collectibles lack dedicated markets or exchanges to centralize liquidity and facilitate transparent price discovery. Instead, they trade across many different platforms—WhatsApp chats, Facebook groups, auction houses, etc.—fragmenting liquidity. This means there's a large opportunity to serve underserved collectible markets; however, if existing market structures were already efficient, BECMs would struggle to compete. Such markets hold less appeal for venture investors.

Based on our initial assessment of the collectibles landscape, wine and spirits, handbags, and watches present the greatest potential for improvement. These categories primarily trade in gray markets, suffer from poor liquidity and opaque pricing, and are ripe for disruption.

Appropriate Price Point

For a collectible category to be investable, its items should be affordable enough that collectors can fully own them outright. Partial ownership may work for financial investments, but owning half a luxury handbag defeats the purpose of collecting. Moreover, ultra-high-priced collectibles reduce the overall buyer pool, lowering liquidity. For example, no one flips million-dollar Ferraris due to lack of 24/7 demand overlap.

On the other hand, prices must be high enough to confer social status, exclusivity, and emotional satisfaction. If something is too cheap and accessible to everyone, it fails to attract emotionally and status-driven buyers, thereby weakening market liquidity. Additionally, the price point should be sufficient to incentivize market makers to spend time researching the category. If items are too inexpensive, they must trade far more frequently to justify unit economics. Yet low-cost collectibles often fail to generate the status appeal needed to form liquid markets.

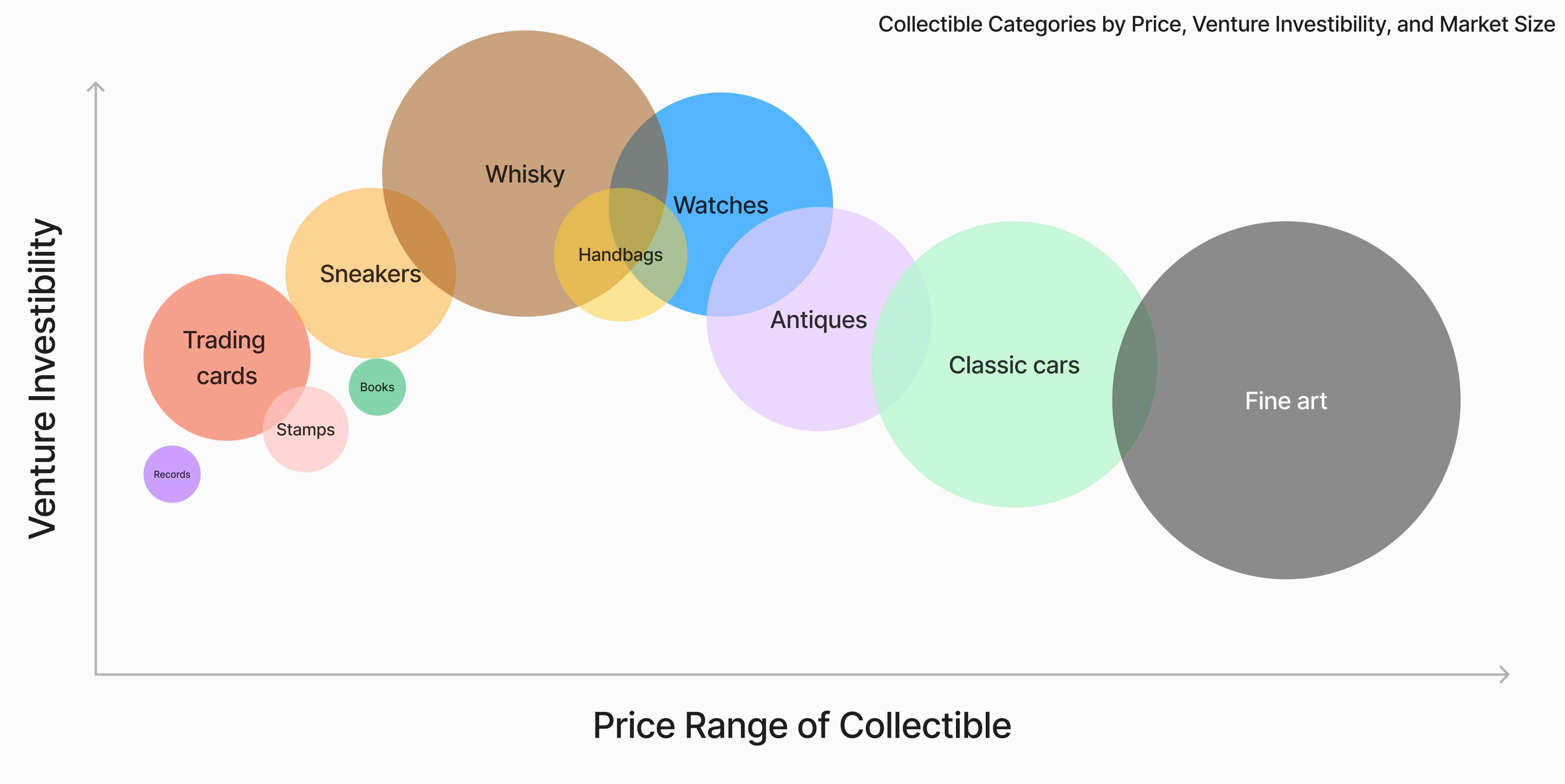

We believe the ideal price range for an investable BECM lies roughly between $1,000 and $100,000. This makes sneakers, watches, handbags, and antiques ideal candidates for BECMs. Art and cars are too expensive for most people, while records and stamps may be too low-priced to justify BECM infrastructure.

Figure: Venture investability is our subjective assessment; bubble size corresponds to market size. Sources include records, trading cards, stamps, rare books, sneakers, whiskey, handbags, watches, antiques, art, and classic cars

Perceived as a Store of Value

Collectors are status-seeking buyers. They are the "diamond hands." Their presence is crucial for maintaining healthy price floors in collectibles markets. It signals that a collectible isn't just a passing trend but has lasting cultural relevance. A collectible becomes a store of value when enough people believe it will remain culturally relevant over long periods. Such items appeal across generations and tend to be resistant to technological shifts.

Art is a prime example. Humans have enjoyed art for thousands of years, and it's reasonable to assume they will continue doing so for millennia. Vinyl records are more ambiguous—they’re popular among older generations, but whether post-iPod generations will continue valuing them remains to be seen.

Real-World Axis

Storage Challenges

Collectibles that require significant physical space or are prone to degradation are prime candidates for BECMs and thus represent strong investable categories. Most individuals struggle to store delicate items like wine or art long-term without proper environmental controls (humidity, temperature, light, etc.). Even if you could magically solve these issues, spatial constraints become immediate—storing more than 50 paintings or 100 wine bottles at home is impractical for most. And even if space weren’t an issue, insurance complications arise.

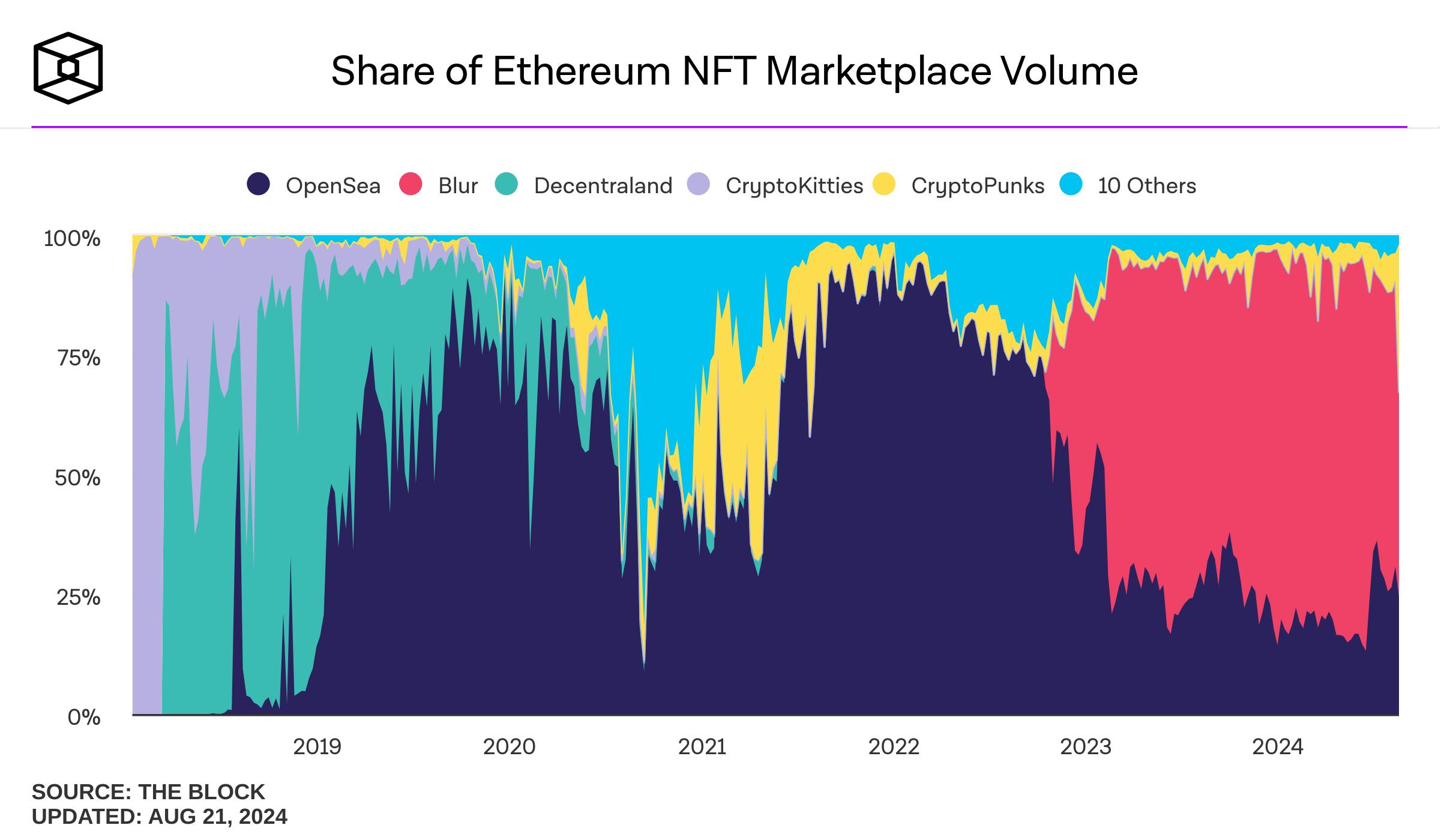

If storing a collectible category is trivial, building a BECM might still be profitable, but barriers to entry will be much lower, leading to fiercer competition, fragmented liquidity, and weaker pricing power. NFTs exemplify this category: they’re immune to environmental factors, occupy no physical space, and their transparent provenance on-chain makes fraud nearly impossible—making it difficult to build a defensible NFT marketplace.

Figure: Ethereum NFT marketplace volume, source: The Block

We believe collectibles like wine, whiskey, and cars face the biggest storage challenges, meaning their collectors stand to benefit the most from BECMs. Wine and whiskey are highly sensitive to environment, requiring specialized vaults with controlled temperature, humidity, and lighting (our investment in Baxus addresses this). Cars require large garages—most people can’t store more than 3 or 4 at home. Trading cards, sneakers, watches, and handbags are relatively easy to store; collectors can still benefit from outsourced storage, but marginal gains are smaller.

Trust Issues Exist

In addition to solving physical custody, BECMs must also solve authenticity to attract investors.

Today, collectors face serious trust problems; buyers and sellers in chat groups rely on community endorsements and anonymous moderators to vet counterparties. Fraud is rampant across nearly every collectible category, making it hard for participants to feel 100% confident in their purchases. Establishing market standards and trusted authenticators is essential for attracting collector, alternative asset investor, and speculator liquidity.

There are two approaches to authentication:

1. Internal Authentication: Requires deep domain expertise and is operationally complex. If the market misidentifies an item, it may be liable for compensation. However, this can become a strong moat, especially for hard-to-authenticate items. Internally authenticated markets must manage potential conflicts of interest and maintain oversight to preserve buyer trust.

2. Outsourced Authentication: Simpler, but reduces the margin the market can capture. More reasonable when the category is easier to authenticate. A key benefit is natural separation between the marketplace and authenticator, mitigating conflicts of interest.

If a BECM can establish trust and offer refund guarantees, it can build competitive moats that make it venture-backable. Categories like watches, handbags, and wine are rife with counterfeits. BECMs have a strong opportunity to increase trust and attract new collectors who’ve avoided the space due to fraud concerns.

Emotional Axis

Provenance Based on Time or Brand

In collectibles, provenance defines how an item gains value. For collectibles, this is usually based on time or brand.

Time-based provenance means assets appreciate due to age and historical context. Rare books are a classic example. Items with time-based provenance typically only trade in secondary markets—there’s no central issuer, and assets are often unique or extremely limited. This can constrain secondary market activity, as collectors don’t need continuous capital for new releases, and die-hard holders suppress available supply. The Constitution DAO is a perfect example—the Constitution copy they bid on hasn’t re-entered the secondary market. Other time-provenance collectibles include antiques, art, cars, and firearms.

Brand-based provenance occurs when brands build reputations over time, causing the market to view their products as valuable. Watches are the quintessential brand-provenance collectible. Top luxury watchmakers—Rolex, Patek Philippe, Richard Mille, and Audemars Piguet—control nearly half of the luxury watch market due to brand strength. Brand-based collectibles have centralized, profit-driven issuers releasing new items regularly. Unlike time-provenance items, these encourage secondary market activity, as collectors need funds for new releases and turn to secondaries to sell.

Therefore, brand-based BECMs are more venture-attractive than time-based ones.

Passionate Collector Base Exists

Venture investors want to see strong emotional attachment to a collectible—it’s a precursor to having diamond-handed holders. Without them, organic liquidity is hard to achieve. A BECM with a weak community will struggle to attract volume and lose investment appeal.

The best signal of a passionate community is enthusiasm bordering on debate. We want to see car collectors argue about the greatest supercar ever made, or handbag lovers defend their favorite underrated brand. Passionate collectors will be active across corners of the internet—subreddits, forums, and group chats.

The Cambrian Era of Collecting

The future of BECMs isn’t limited to watches, handbags, and wine. Hundreds of other investable categories await.

The opportunity with BECMs lies in opening new markets for diverse collectibles and improving access to novel alternative investments.

We’ve long been interested in how crypto touches the real world, making an early investment in Helium back in 2019, which pioneered what’s now known as DePIN. Our early involvement in DePIN taught us valuable lessons, and here we share some insights into the market opportunity for DePIN applications.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News