In-depth Analysis of Polymarket, SX Bet, Pred X, and Azuro Prediction Markets

TechFlow Selected TechFlow Selected

In-depth Analysis of Polymarket, SX Bet, Pred X, and Azuro Prediction Markets

Nothing is smarter than the market, and no information system can be more efficient than a free market.

Author: Trustless Labs

Prediction markets are open markets that use financial incentives to forecast specific outcomes. These markets are trading platforms built for betting on the results of various events. Market prices can reflect the public's perception of the probability of an event occurring.

A typical prediction market contract trades between 0% and 100%. The most common form is binary options markets, which settle at either 0% or 100% upon expiration. Users can also sell their positions before the event concludes, exiting according to prevailing market prices.

Through prediction markets, we can extract the collective future expectations about an event from the value demonstrated by participants who bet on it. Traders with differing beliefs express their confidence in potential outcomes through trading contracts, and the market price of these contracts is considered a consolidated belief.

The history of prediction markets is long—almost as old as human gambling itself—and their connection with politics seems ancient: during the Middle Ages, people actively placed bets on papal elections within the Catholic Church.

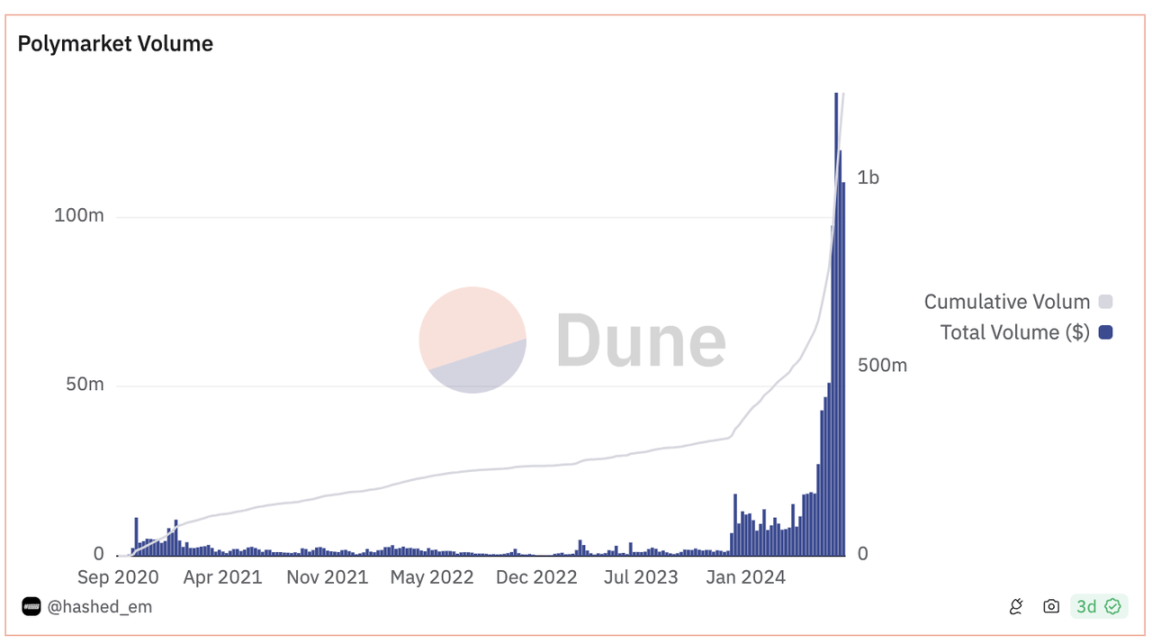

As the U.S. presidential election approaches, interest in political betting has surged in July, driven by events such as Trump’s assassination attempt, Biden’s withdrawal, and the Democratic Party replacing him with Harris as the nominee. This has brought significant attention to prediction markets, particularly Polymarket.

Polymarket: Order Book-Based Tradable Prediction Markets

Launched in 2020, Polymarket is a decentralized prediction market project founded by Shayne Coplan, backed by prominent institutions and angel investors including Polychain Capital, Founders Fund, and Vitalik Buterin.

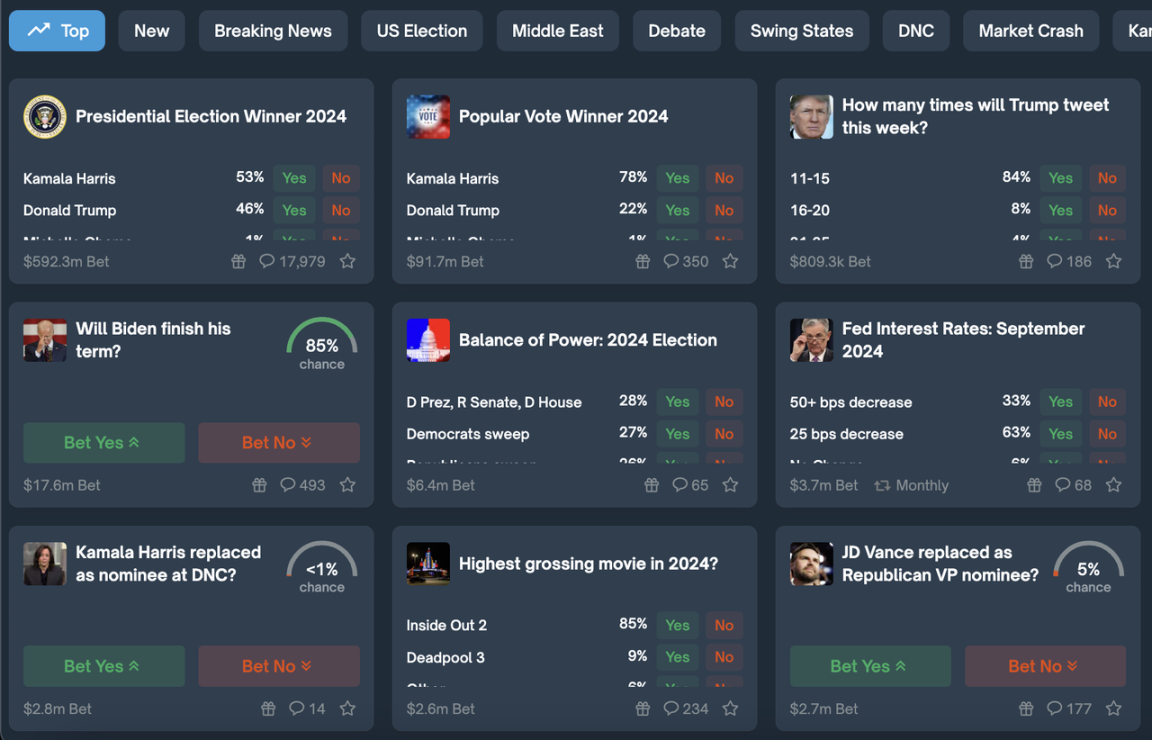

Polymarket allows users to trade on controversial global topics—such as politics, sports, and pop culture—building portfolios based on their predictions.

Unlike traditional sports betting, Polymarket enables free trading of shares while the outcome of a topic remains uncertain, allowing speculators to flexibly engage in probabilistic speculation.

Polymarket's real-time trending markets

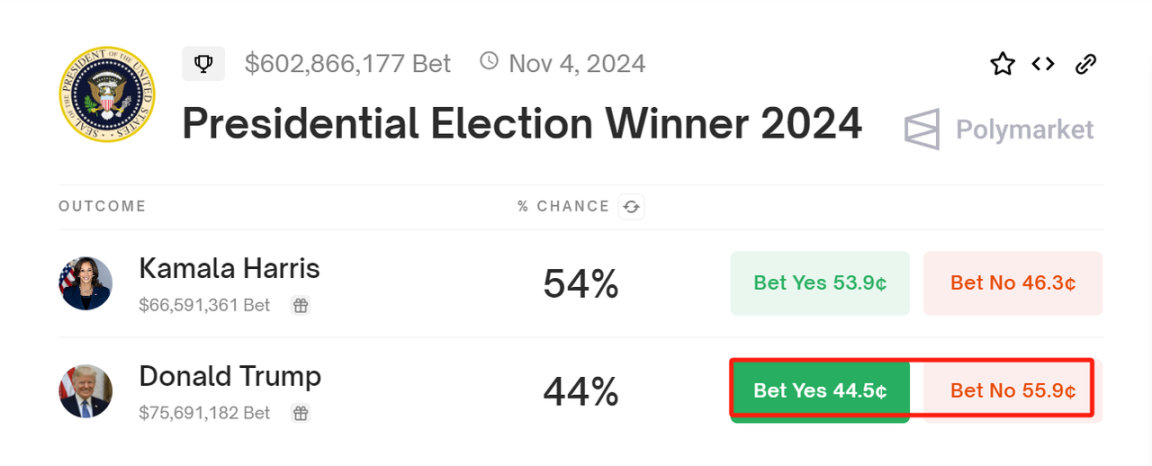

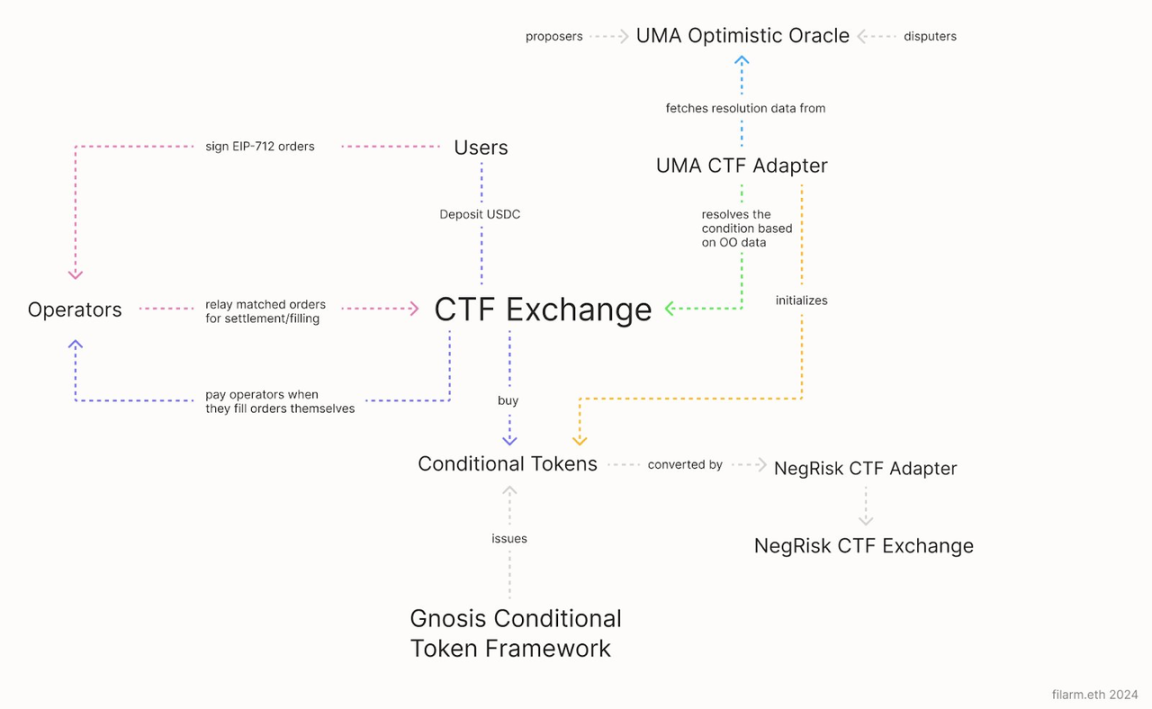

Polymarket uses Gnosis’ Conditional Tokens Framework (CTF). For every $1 worth of ERC20 tokens like USDC deposited as collateral, two conditional tokens are minted, representing opposing outcomes ("yes" or "no") of an event. Multi-outcome markets aggregate multiple binary markets.

The two conditional tokens fluctuate independently based on market demand and can be freely traded via order books. Alternatively, users can hold until resolution, where those holding the winning token receive the full $1 payout.

Since both tokens trade independently in a market similar to a CEX, their combined price may deviate from $1, creating arbitrage opportunities. Market makers step in to correct this spread. Before resolution, users can always redeem one “yes” and one “no” token together for $1 through the smart contract.

Polymarket’s prediction market consists of several key components:

-

Market Topics – Each Polymarket prediction focuses on a single theme or event. While users can propose new markets via Polymarket’s Discord, due to complexities in phrasing, Polymarket retains discretion over which markets get listed.

-

Oracles – Determining event outcomes typically requires human input. Polymarket uses UMA’s Optimistic Oracle, allowing anyone to submit a result. If no challenge arises during the dispute period, the result is accepted. In rare disputes, UMA token holders vote to resolve the outcome.

-

Conditional Tokens – As described, depositing $1 mints one “yes” and one “no” token. At settlement, the holder of the correct outcome receives $1. These tokens trade freely, with prices indicating implied probabilities. Polymarket uses Gnosis’ CTF built on the ERC1155 standard.

-

Order Book Market – Polymarket employs a hybrid on-chain order book model, similar to dYdX v3. Users sign orders off-chain; operators match trades, and final settlement occurs on-chain via non-custodial smart contracts, enabling atomic swaps between binary tokens and collateral assets. Operators do not control the $1 collateral.

-

Liquidity Providers – Unlike fixed-odds sportsbooks, Polymarket allows continuous trading of conditional tokens before resolution. Pricing is driven by supply and demand, potentially causing deviations (sum ≠ $1). Anyone can provide liquidity via limit orders, profiting from bid-ask spreads, with additional USDC incentives offered by Polymarket.

Polymarket system architecture

Source: https://dune.com/blog/polymarkets-rise-a-new-era-in-prediction-markets

Polymarket has not announced any token issuance plans nor an active user points program. Nonetheless, it has distributed over $3 million in USDC so far this year through its liquidity rewards program, aimed at boosting overall platform liquidity depth. Currently, top-volume markets pay liquidity providers around 600 USDC daily.

SX Bet: Single-Bet Prediction Platform

SX Bet is an Ethereum-based sports betting platform launched in 2019, now operating on SX Chain—an Arbitrum Orbit Rollup.

SX Bet primarily supports sports-related betting markets, focusing on winners of major tennis, football, baseball, and basketball events. Recently, it has expanded into Crypto, Degen Crypto, and Politics, featuring bets on mainstream crypto asset prices, on-chain meme coins, and U.S. election outcomes.

Unlike Polymarket, SX Bet follows traditional sports betting models, supporting only single bets that cannot be traded before the event resolves.

SX Bet innovates by introducing combo betting—users predict outcomes across a series of events, winning only if all are correct. Payouts for successful combo bets are often massive, effectively acting as leverage in prediction markets. SX Bet itself becomes the counterparty to these trades.

These combo bets resemble lotteries, sometimes offering returns up to 10,000x, and the resulting success stories often go viral—a hallmark of traditional sports prediction markets.

Clearly, Polymarket and other prediction markets based on the “dual-token” conditional framework cannot support combo betting. It would be impossible for a contract to mint a unique conditional token for every possible combination and ensure sufficient liquidity for each. Binary markets have limited odds structures, potentially reducing appeal to users.

Pred X: AI-Powered Topic Generation for Prediction Markets

Pred X is a prediction market initially built on the Sei blockchain, covering politics, cryptocurrency price forecasts, and trending events. Currently, the platform supports USDC betting across multiple blockchains including Base, Linea, Sei, and Bitlayer, and offers a Telegram mini-app named PredXFun (@PredxFantasyBot). This app provides two modes: a game mode where users predict event probabilities to earn points, and a real mode linked to wallets for actual betting on official site topics.

While Polymarket relies on user-submitted proposals via Discord to generate topics, Pred X uses Aimelia AI to crawl the internet for trending news and market sentiment, automatically generating and pushing prediction topics to its website, where users organically form trading markets.

Despite multi-chain support, Pred X is not fully decentralized. Outcome prices are determined by centralized order books, although trade execution and market mechanics follow smart contract rules.

Objectively speaking, Pred X remains less mature than other prediction markets. Its order book depth and trading volumes are far below those of Polymarket and Sx Bet. A proper prediction market should allow users to freely trade outcome tokens before resolution. Unfortunately, Pred X does not allow users to place their own orders. Without market makers in most markets, users cannot actually trade freely. Additionally, documentation lacks clarity on how consistency across multi-chain topic contracts is ensured, or how sufficient liquidity for outcome tokens is maintained across chains. In Telegram’s “real mode,” betting prices for the same topic differ from those on the main site.

These issues raise doubts about Pred X’s practical usability and reliability. Overall, the product currently feels more like a prototype.

Azuro: Liquidity Pool-Supported Betting Protocol

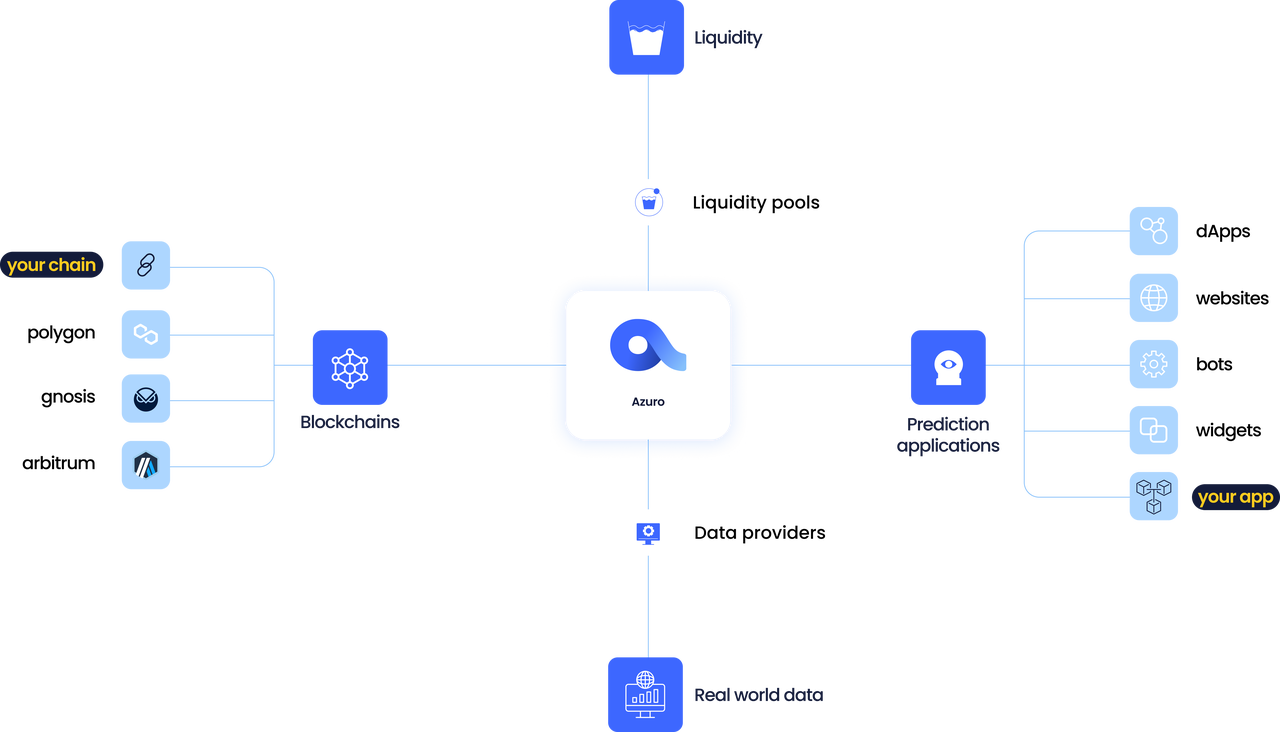

Azuro is not a prediction market itself but a foundational protocol for building on-chain prediction markets. This permissionless infrastructure includes on-chain smart contracts and web components, enabling multiple prediction market applications to be built atop Azuro. All Azuro-based betting platforms can be found on its website.

Azuro only supports single bets and does not allow tradable “yes/no” tokens like Polymarket. Payouts occur only after results are finalized.

Azuro’s role in the ecosystem

Source: https://gem.azuro.org/hub

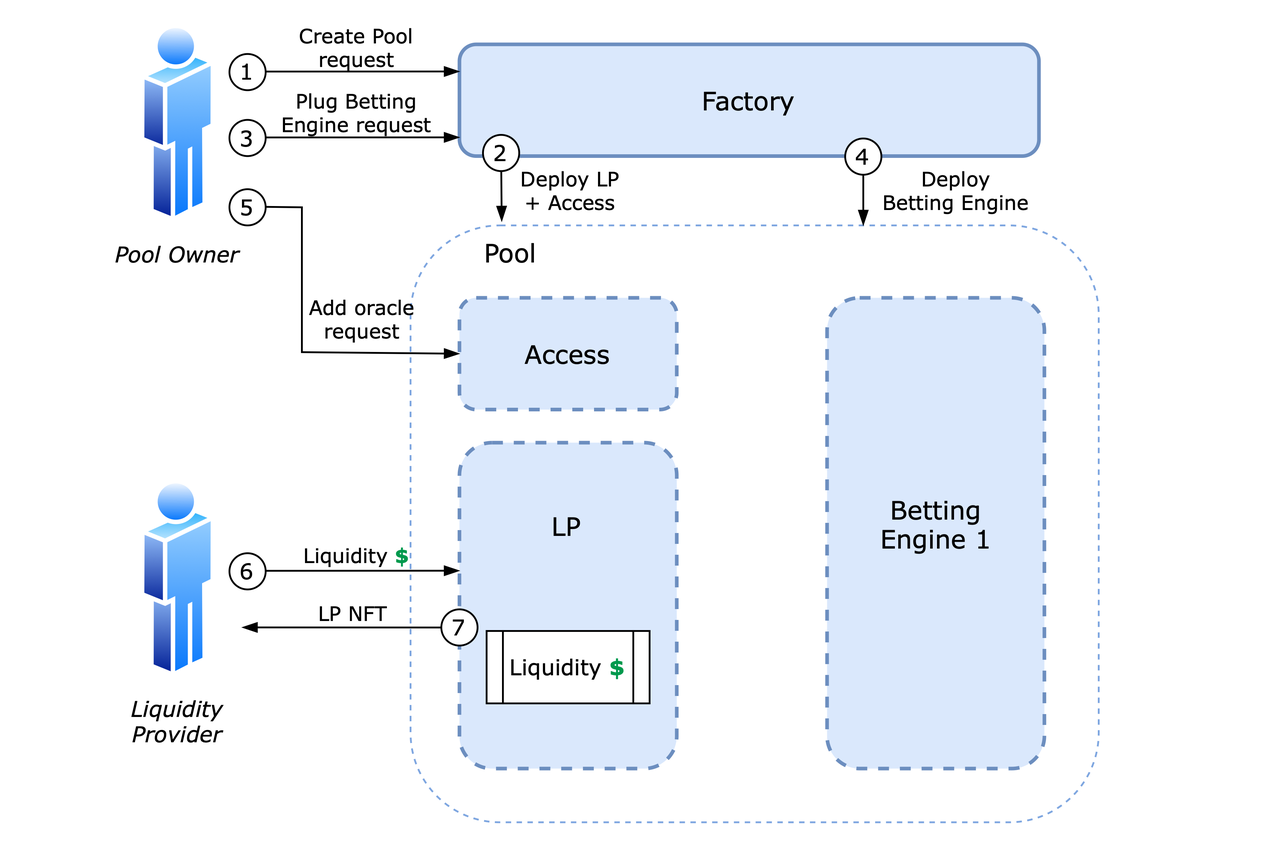

Azuro’s system is centered around liquidity pools. Anyone can deploy their own pool by interacting with Azuro’s factory contract. One pool can host multiple betting platforms, each supporting numerous events under various prediction themes.

In dual-split models like Polymarket, liquidity is fragmented across individual prediction events. Azuro introduces a “liquidity tree” concept—multiple events under one theme, or even across themes and platforms, share a single liquidity pool.

The liquidity tree establishes a hierarchical structure, defining liquidity boundaries for different possible outcomes—e.g., various score possibilities in a soccer match.

This pooled capital ensures the platform can act as the counterparty to bets at any time, paying out potential winnings (a loss for LPs). If bettors lose collectively, LPs profit. A single liquidity tree supports multiple prediction themes simultaneously, bearing profits or losses as the counterparty.

Each event’s odds on Azuro are calculated based on the ratio of funds wagered on that outcome versus the total liquidity allocated to the broader prediction category. Initial odds are set by designated data providers, who also seed initial liquidity. Data providers can adjust odds during the betting window, with solvency guaranteed by the initial liquidity.

Azuro liquidity factory system design

Azuro liquidity factory system design

Source: https://gem.azuro.org/contracts/factory

Azuro also supports multiple dApp implementations. Betting platforms can set their own fee-sharing models, giving bettors choice. Liquidity pool creators can define their own revenue split. A portion of all pool profits flows into Azuro’s DAO. Azuro has issued its native token, $AZUR.

Conclusion

The philosophy behind prediction markets is fascinating. Participants, driven by profit motives, treat free markets as humanity’s most efficient information aggregation system, using them to forecast real-world events. These forecasts often prove surprisingly accurate. In today’s society, where recommendation algorithms monopolize information, prediction markets offer a powerful mechanism to uncover truth and surface diverse opinions—as demonstrated by Polymarket’s political predictions.

Many crypto users were first introduced to prediction markets during the last U.S. presidential election via FTX’s Trump vs. Biden index. Combined with SBF’s strong market-making capabilities, users could even trade with high leverage—an exciting, albeit centralized, experience.

Cryptocurrencies have significantly reduced transaction friction in prediction markets, enabling better, more efficient market mechanisms. Concepts like smart contracts and AMMs have brought permissionless access and improved liquidity to prediction markets. Moreover, many AI AgentFi projects now view prediction markets as battlefields for harnessing collective intelligence and refining model performance.

However, clear limitations remain: Polymarket, while enabling free trading of conditional tokens, struggles to support flexible betting mechanics and lacks high-return prospects, diminishing appeal for casual players. Meanwhile, Azuro’s liquidity pool model, though innovative, remains relatively complex and lacks post-bet tradability.

Rather than pure technical innovation, the current surge in popularity of prediction markets reflects another wave of mass adoption in crypto culture—a triumph of free-market ideals. In an era where algorithmic authority increasingly monopolizes information, this is especially valuable. After all, nothing is smarter than the market, and no information system is more efficient than a free market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News