Interpreting the CKB Account Abstraction Ecosystem: The Cornerstone of BTC Mass Adoption

TechFlow Selected TechFlow Selected

Interpreting the CKB Account Abstraction Ecosystem: The Cornerstone of BTC Mass Adoption

An overview of Nervos (CKB)'s native Account Abstraction (AA) implementation and related ecosystem development.

Author: Wuyue, Geeker Web3

Editor: Faust

Since the Account Abstraction (AA) narrative gained traction in the Ethereum community in 2022, the concept has become popular across the Web3 ecosystem. It represents a design philosophy for account systems, aiming to establish higher-level standards and enhance account functionality. However, on mainstream blockchains like Ethereum, the flexibility and universality of account systems are severely limited by fixed rules, such as:

-

Your account must already hold ETH or other Gas Tokens to initiate transactions—an obvious barrier for new users;

-

EVM-based public chains support only a single account system, forcing users from other chains or Web2 to adopt new tools and entry points.

The once-popular EIP-4337 proposal in the Ethereum community was believed to address these issues, but due to constraints around its technical model, legacy burdens, ecosystem maturity, and developer understanding, EIP-4337’s solution resembles patchwork rather than a fundamental fix. Meanwhile, EIP-3074, which attempts to add new opcodes to the EVM, is considered potentially insecure, introducing new risks while solving old ones—making its feasibility highly controversial.

Due to various factors, Ethereum’s founding team did not fully consider the account system at mainnet launch, leaving behind significant technical debt—including the separation between EOA and contract accounts, lack of gasless transactions, and absence of support for multiple cryptographic primitives. These historical limitations have clearly hindered Ethereum's AA roadmap. In fact, Ethereum’s AA approach doesn’t elevate its account system beyond newer blockchains; it merely closes the gap. If a blockchain thoroughly considers account design from day one, it can avoid Ethereum’s detours altogether.

Unlike EVM-based chains, Nervos deeply considered account architecture from inception. After thorough research, we believe Nervos’ account system aligns more closely with the foundational and essential principles of AA. Its UTXO-inspired cell model and OmniLock—which supports multiple verification methods—are inherently aligned with AA goals from the start, free of legacy constraints, and natively compatible with account systems from BTC, ETH, Solana, and beyond.

Moreover, for the recently booming BTCFi space—which brings DeFi use cases to native Bitcoin assets—it’s crucial to deliver seamless experiences for Bitcoin holders. This requires compatibility with mainstream Bitcoin wallets and infrastructure. CKB’s native AA solution naturally achieves this, creating ideal conditions for mass BTCFi adoption.

Below, we’ll analyze Nervos’ account abstraction system from multiple perspectives: design philosophy, system architecture, applications, and ecosystem.

Bitcoin UTXO vs. Nervos’ Cell Model

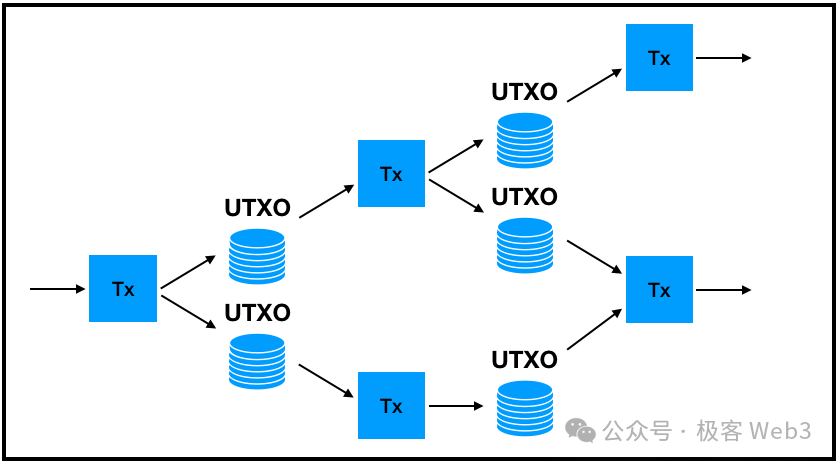

Most people know that UTXO-based blockchains do not rely on an “account–balance” data structure. Instead, they use a unique format. Specifically, UTXOs can be melted down or minted like gold—each transaction destroys old UTXOs and creates new ones. Furthermore, UTXO data isn’t stored under a centralized address but is scattered within the transactions that generated them, requiring access to past block records to retrieve.

It’s no exaggeration to say that Bitcoin pioneered a storage paradigm distinct from traditional Web2 “account–information” models. This approach addresses state explosion, inefficient data read/write operations, and ambiguous ownership. With the UTXO model, asset data storage and ownership boundaries are clear, enabling better parallelization and concurrency support, facilitating features like storage leasing, and avoiding many pitfalls of traditional account systems.

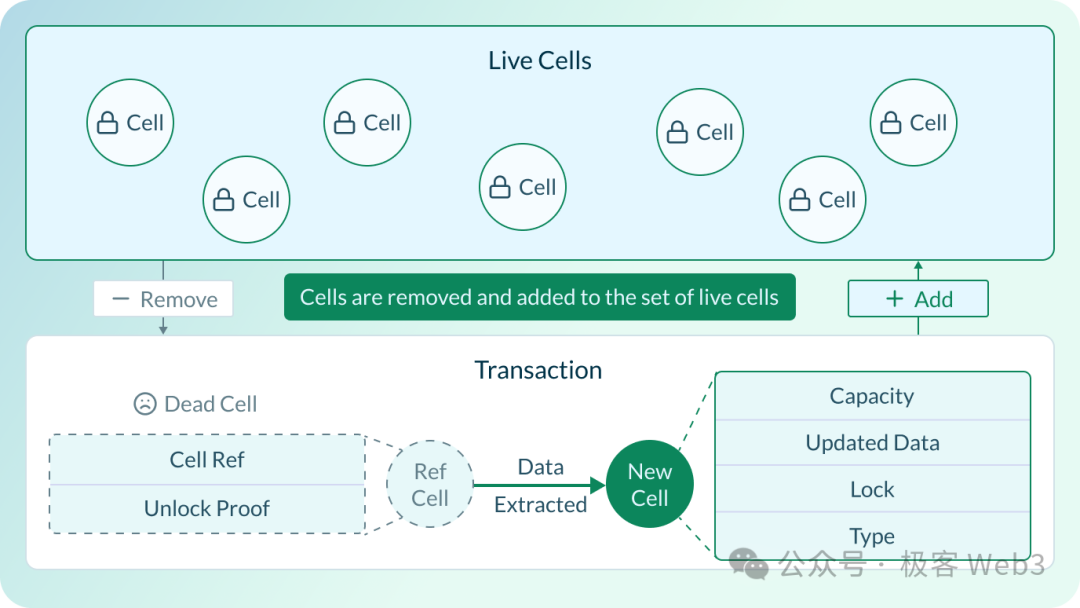

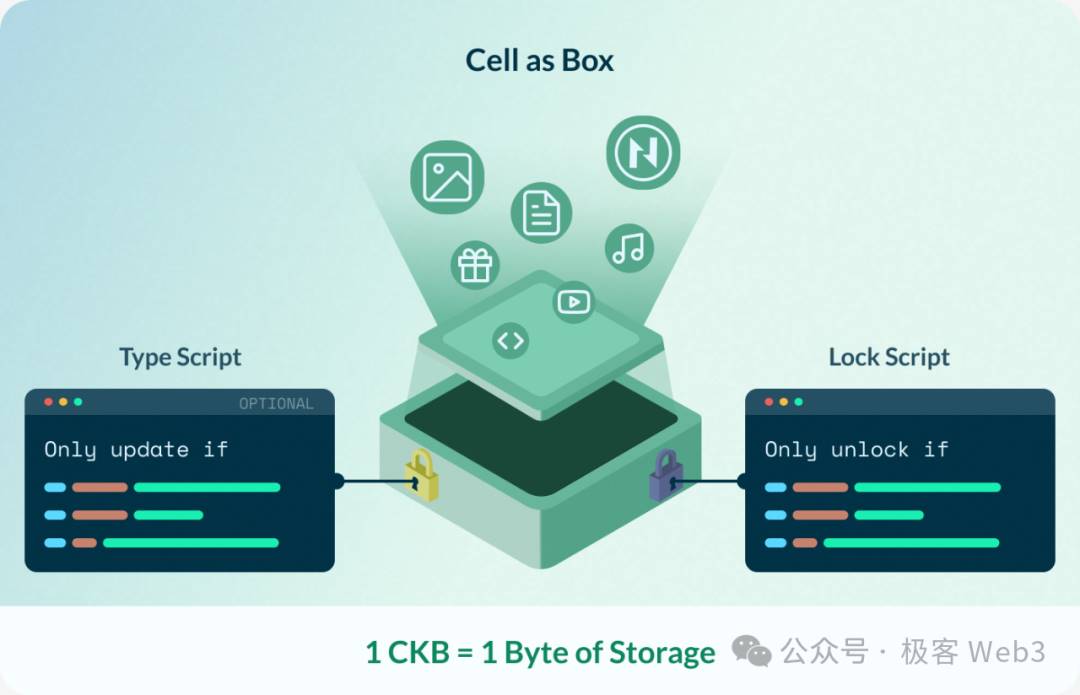

Nervos’ account system was designed from the outset to incorporate the strengths of Bitcoin’s UTXO model. The Cell model is essentially an upgraded version of Bitcoin’s UTXO, offering Turing-complete programmability. Moreover, both CKB and other assets are treated as first-class citizens—unlike EVM chains that distinguish native tokens from ERC-20s.

The operation of CKB’s Cells mirrors that of Bitcoin UTXOs: both are driven by “lock scripts” and “unlock scripts.” Each UTXO/Cell comes with a “lock script” upon creation—like a password lock—and the “unlock script” acts as the key. As long as you provide the correct key, you can control the associated UTXO/Cell.

However, unlike Bitcoin UTXO, the Cell model introduces a “TypeScript” field atop the lock script. If the LockScript serves as an authenticator determining who can modify the Cell, then TypeScript functions as the smart contract attached to the Cell, where code for DEXs or lending protocols can be deployed.

If a developer wants to implement an AMM-style liquidity pool on CKB, they simply write the contract code into the TypeScript of a dedicated Cell and store the pool’s state data (e.g., balances of various assets) in the Cell’s Data field. Users then interact directly with the code in TypeScript.

This design extends Bitcoin’s UTXO model into richer application scenarios, offering far stronger programmability. Since CKB uses the RISC-V virtual machine, programs written in multiple programming languages can be supported, enabling far more complex logic than Bitcoin.

Regarding the Cell’s lock script (LockScript), it directly relates to our core topic: Account Abstraction. One major goal of AA is enabling flexible identity verification methods on-chain. For UTXO-based systems, achieving this requires enhancements to the LockScript—the identity verifier. To this end, CKB introduced OmniLock, a specialized script supporting multiple authentication schemes.

Next, let’s explore the specific design of OmniLock.

OmniLock and Account Abstraction

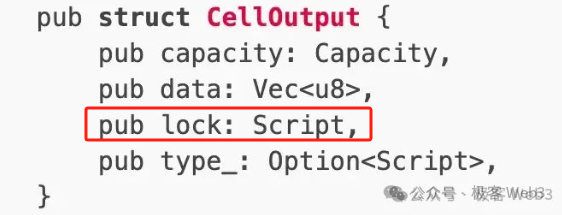

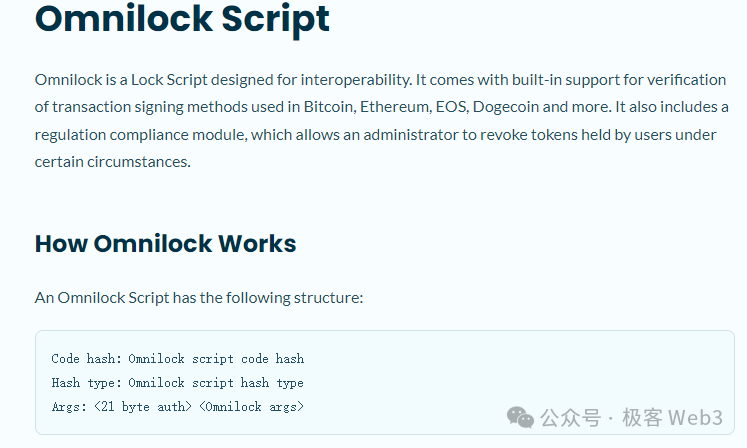

As previously mentioned, both CKB’s Cells and Bitcoin’s UTXOs define usage rights via lock scripts. The LockScript determines who can modify the Cell, serving as an identity authenticator. To support multiple authentication methods, CKB provides OmniLock—a universal lock script capable of accommodating various signature algorithms and verification mechanisms.

OmniLock modularizes different verification logics—by setting different parameters, various verification algorithms can be flexibly configured. Users can directly operate CKB assets using BTC, ETH, or even WebAuthn accounts, wallets, or authentication methods.

So how exactly does OmniLock work and get used? Put simply, OmniLock is a piece of code officially deployed by Nervos on the CKB chain, stored in a specific Cell and reusable by others—similar to “system contracts” on EVM chains. Any Cell wishing to use OmniLock can reference it in its own lock script.

Next, let’s understand the working principle of lock scripts and OmniLock through pseudocode.

A CKB lock script contains three fields: Code hash, hash type, and Args. Since Code hash and hash type are less relevant here, we won’t elaborate. Instead, we’ll focus on the Args field, which enables different verification algorithms defined in OmniLock through flexible configuration.

The content of the Args field consists of two parts. The first is "auth," dedicated to identity verification, 21 bytes long, containing a 1-byte flag identifier and 20 bytes of authentication data. The auth field includes a pre-set public key hash—only the owner of the corresponding private key can pass authentication and gain permission to modify the Cell.

The flag in auth acts as an identifier to select different authentication methods. These methods include not only cryptographic signature verification but also integrated processes—for example, a flag value of 0x01 indicates Ethereum external message authentication. Beyond Ethereum, OmniLock supports Bitcoin, Dogecoin, Tron, multi-sig, and many other message verification formats.

The second part of Args is called Omnilock args—it functions like a switch, allowing selection among predefined OmniLock modes, such as admin mode (e.g., USDT freeze capability), anyone-can-pay mode for microtransactions (e.g., small donations), or timelock mode. In short, adjusting Omnilock args enables different pre-coded functionalities within OmniLock.

In summary, by configuring different parameters in the Auth and Omnilock args fields of a Cell’s lock script, users can choose identity verification methods from various chains or platforms, introducing diverse authentication options to CKB. Of course, beyond the preset methods in OmniLock, developers can also define their own authentication schemes.

Nervos Account Abstraction Ecosystem: CCC, Mobit, and JoyID

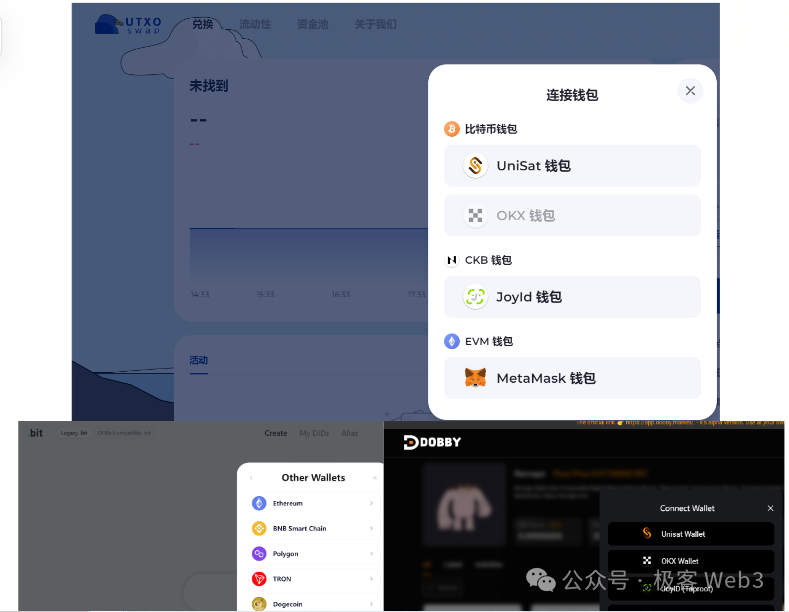

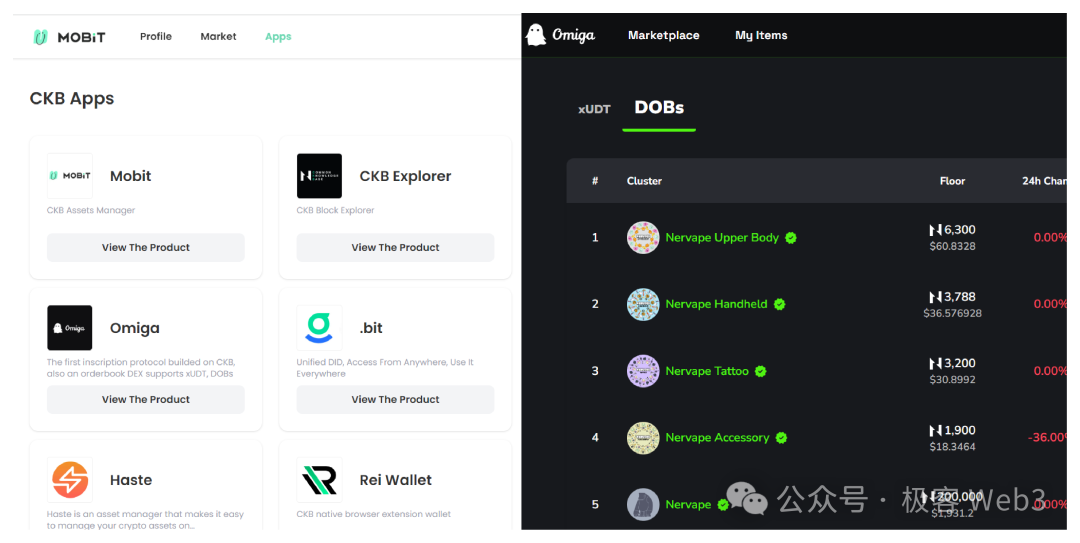

As discussed above, OmniLock forms the foundation of Nervos’ account abstraction. Wallets based on OmniLock—such as Mobit, .bit, Omiga, and middleware like CCC (Common Chains Connector)—together constitute Nervos’ rich BTCFi account abstraction ecosystem. Additionally, there’s Did.id, a DID platform offering security, privacy protection, and identity management, and Dobby, a decentralized DOBs asset trading platform.

The advantages of AA bring great convenience to BTCFi applications, allowing CKB-based projects to directly support BTC wallet interactions and lowering user barriers. In the following section, we’ll examine concrete examples to explore CKB’s AA ecosystem.

Common Chains Connector (CCC)

Let’s start with CCC—a wallet connector middleware that provides cross-chain operability between various wallets and dApps on CKB.

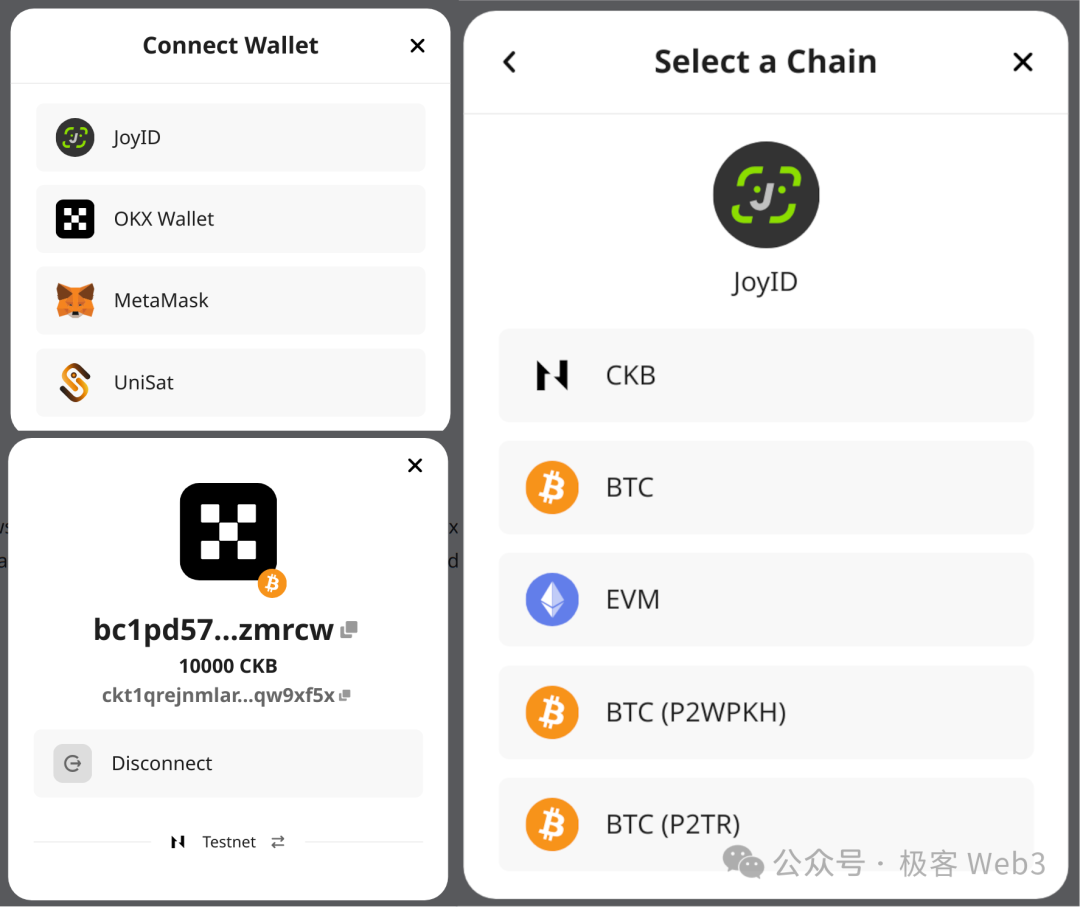

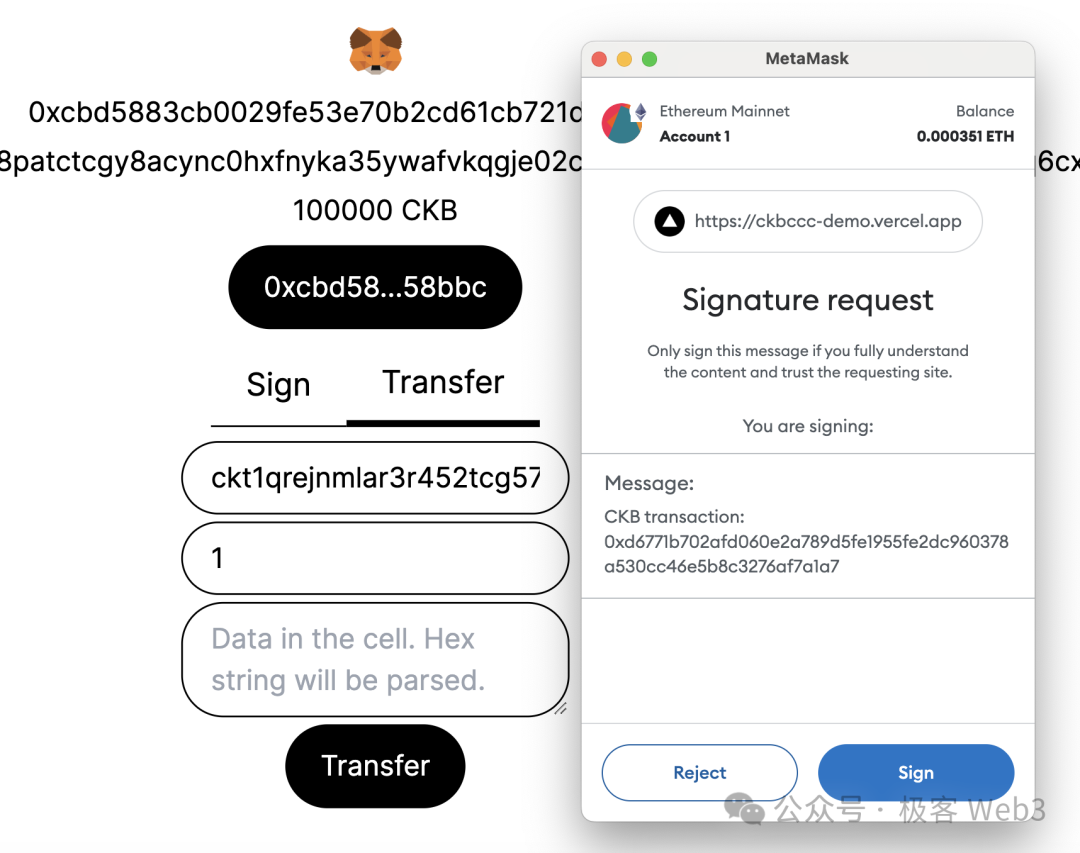

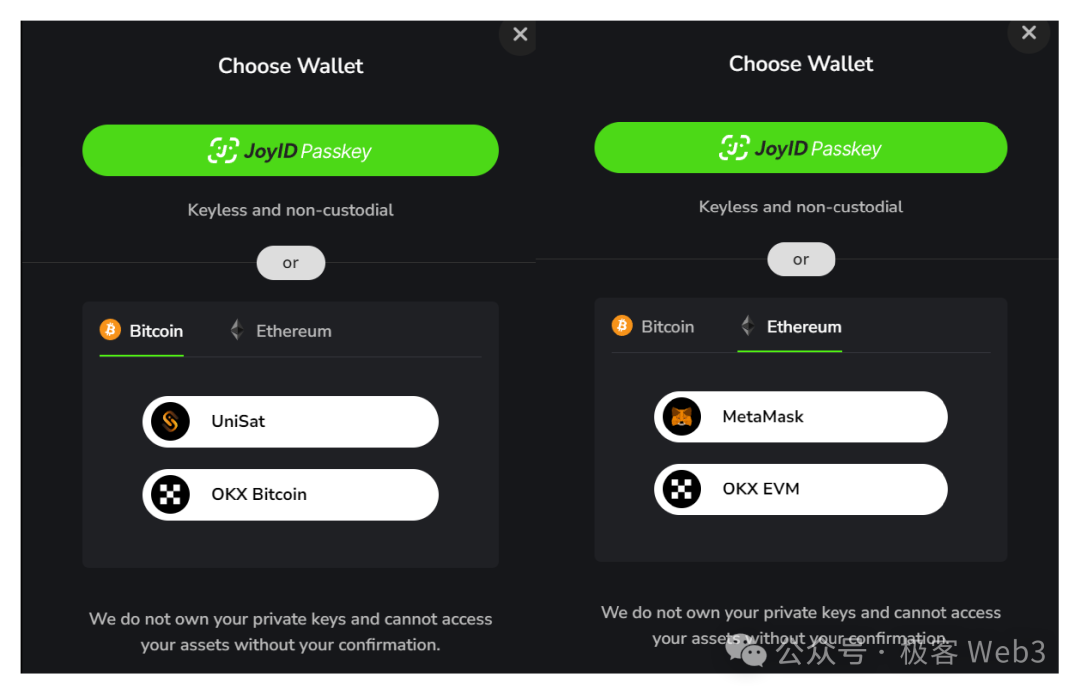

The image below shows CCC’s connection interface. Using MetaMask as an example, if you have an Ethereum account, here’s how you can control your corresponding account on CKB.

When conducting a CKB transaction via CCC, the demo invokes MetaMask’s personal_sign method to sign a message—not directly submitted to the chain.

The signed message contains hexadecimal codes representing the CKB transaction. Once signed by MetaMask, this message is submitted to the Nervos CKB chain and verified via mechanisms like OmniLock.

As previously noted, Nervos natively supports Ethereum message formats—CKB was built from the ground up to integrate with other chain ecosystems. For users, this means accessing the CKB ecosystem through familiar tools and interfaces;

For developers, Nervos defines the OmniLock standard at the base layer and abstracts multi-chain wallet implementation details through CCC, significantly reducing development complexity. This allows app developers to focus on business logic without getting bogged down in low-level intricacies.

Mobit

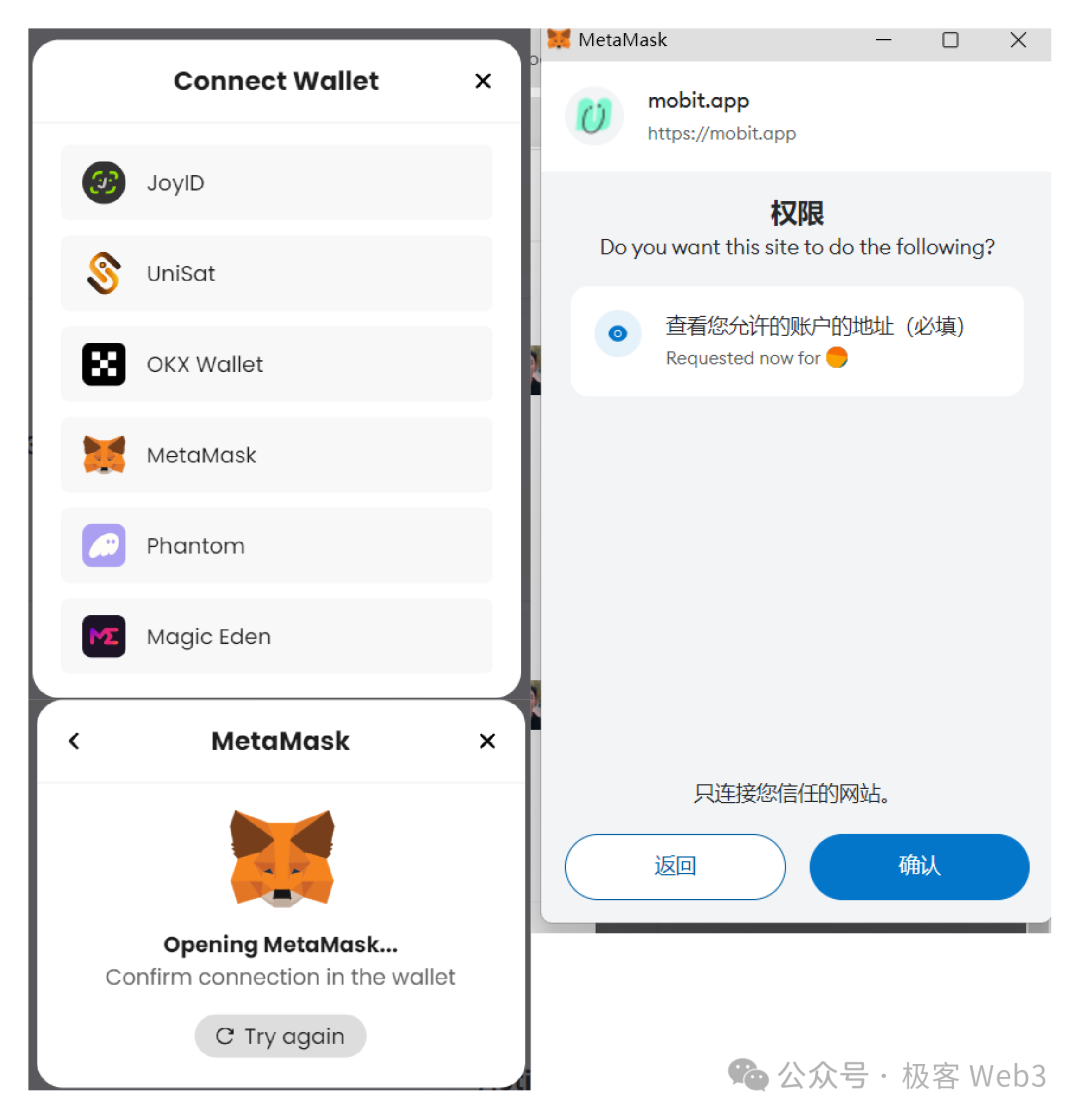

Mobit is a DID and asset management platform built on Nervos. If we use an analogy, Mobit is like a gateway into the Nervos ecosystem—with a very low threshold. With Mobit, users need almost no prior knowledge—just simple operations allow interaction with the Nervos ecosystem using accounts from other blockchains.

The image below shows Mobit’s connection interface. Currently, Mobit supports account systems from multiple major blockchains, and this list continues to grow.

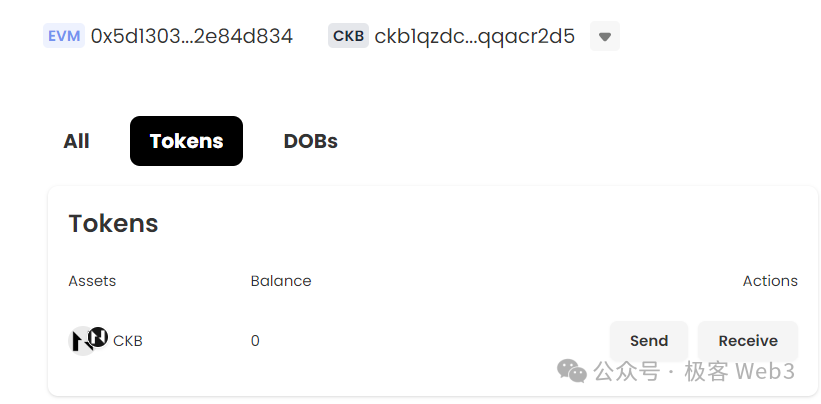

Again taking MetaMask as an example, after connecting, the interface displays both the user’s EVM and CKB addresses, along with tokens and DOBs assets held on CKB.

Let’s talk about DOBs—they’re unique to the Nervos ecosystem, similar to NFTs but fundamentally different. First, DOBs store all data on-chain, making them “fully on-chain NFTs,” whereas many Ethereum NFTs don’t store full data on-chain;

Second, each DOB can have a Chatbot that interacts with owners. As different owners follow varied nurturing paths, each DOB develops more distinct individuality compared to traditional NFTs.

Omiga is the DOBs marketplace in the Nervos ecosystem. Users can jump directly into it from the Apps section in Mobit.

Omiga also leverages Nervos’ account abstraction capabilities.

With simple operations and comprehensive features, Mobit enhances BTCFi interactivity. At its core, BTCFi aims to bring diverse DeFi experiences to native Bitcoin assets. Compatibility with mainstream Bitcoin wallets will be a critical factor for BTCFi infrastructure—and CKB is already prepared.

Adoption of WebAuthn

WebAuthn is a web standard co-developed by the World Wide Web Consortium (W3C) and the FIDO (Fast IDentity Online) Alliance, aiming to enhance authentication security, simplify login processes, and reduce reliance on traditional passwords or private keys.

Mainstream desktop or mobile operating systems like iOS and Android include built-in key management software that uses local secure modules or cloud storage to store keys and perform signatures. Current WebAuthn implementations typically support P-256, P-384, and P-521 curves. Since Nervos’ OmniLock supports custom cryptographic primitives, it can accommodate these as well.

Here are some WebAuthn-supported clients:

-

Apple KeyChain:

-

Security Enclave: Apple devices use Secure Enclave to handle critical cryptographic operations, including private key storage and signing.

-

iOS and macOS: Apple systems can use Keychain APIs for authentication and signing, or leverage Face ID or Touch ID for user verification.

-

Windows Hello:

-

TPM (Trusted Platform Module): Windows devices can use TPM via Windows Hello for key generation and signing.

-

Biometric Authentication: Windows Hello supports fingerprint and facial recognition for identity verification.

-

Android Keystore: Android devices utilize hardware security modules for key storage and signing, authenticated via biometrics like fingerprints or facial recognition.

-

Ubisoft Security Keys: Hardware security keys like YubiKey support secure authentication and signing via USB or NFC.

JoyID, a wallet in the CKB ecosystem, is an application built using WebAuthn technology. With JoyID, users can authenticate via biometrics (e.g., fingerprint or facial recognition), enabling seamless and highly secure login and identity management.

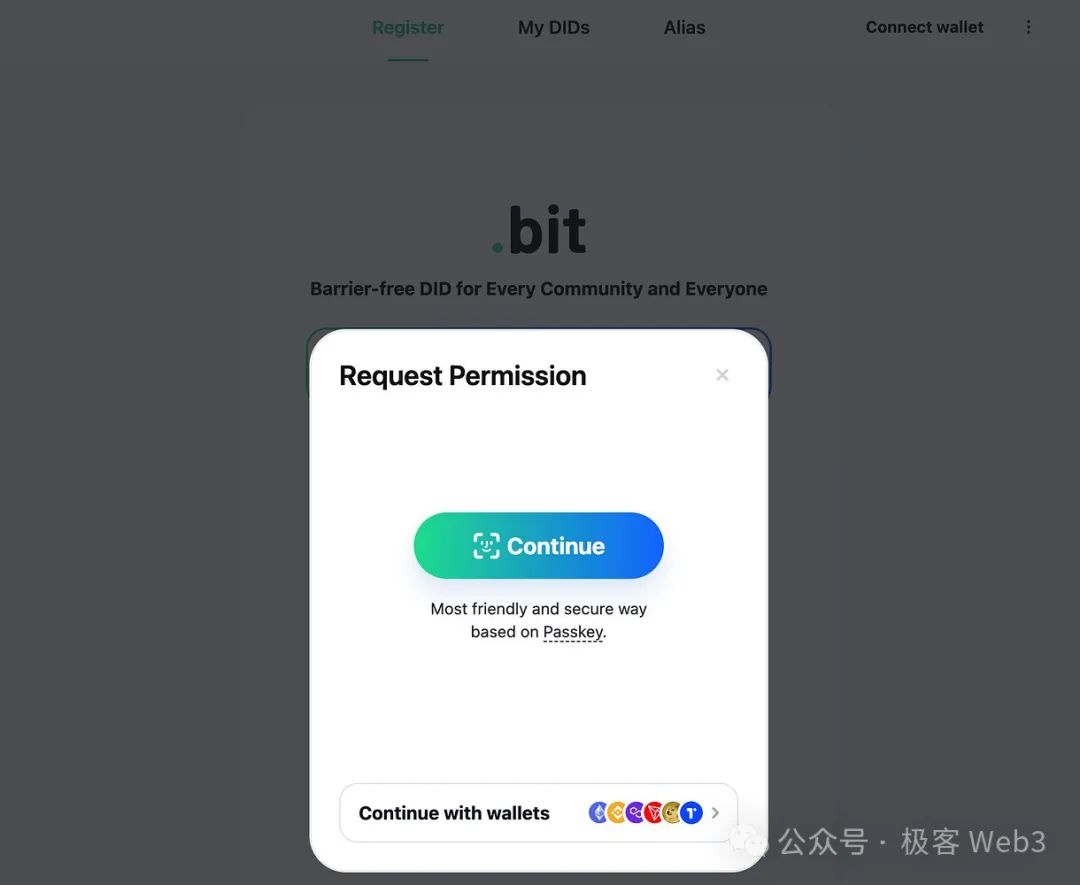

.bit in the Nervos ecosystem also uses Apple’s WebAuthn implementation to enable blockchain login and usage.

From the above examples, we see that CKB’s AA solution natively supports other chains and Web2 users. For the vast Web2 audience, WebAuthn support is crucial—it eliminates the burden of managing private keys and seed phrases, drastically lowering the entry barrier. Blockchains that act early in this direction will gain significant long-term advantages.

Conclusion

Ethereum’s existing AA solutions are largely superficial fixes due to historical baggage, unable to resolve root issues. In contrast, Nervos fully considered account system design from mainnet inception, providing OmniLock to support arbitrary identity verification methods.

Nervos’ Cell model is essentially an enhanced version of Bitcoin’s UTXO. Its lock scripts support multiple signature algorithms, and OmniLock—functioning like a system contract—can be directly invoked by any Cell’s lock script, delivering a Web2-grade experience for developers and users alike;

The current Nervos account abstraction ecosystem already includes products like CCC, Mobit, and JoyID, forming a relatively complete suite;

BTCFi fundamentally enriches native Bitcoin assets with diverse DeFi experiences. Compatibility with mainstream Bitcoin wallets is a key consideration for BTCFi infrastructure. As a core component of the BTCFi ecosystem, CKB adopts an inclusive approach, creating essential conditions for mass adoption on both developer and user fronts.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News