L3 Economic Dilemma: Profitability is unattainable unless monthly transaction volume exceeds 50 million

TechFlow Selected TechFlow Selected

L3 Economic Dilemma: Profitability is unattainable unless monthly transaction volume exceeds 50 million

If we could fundamentally change the design and operation of L3, it could unlock new revenues, new markets, and major structural advantages.

Author: Syndicate

Compiled by: TechFlow

As discussed in a previous article, L3s face real challenges around economic sustainability.

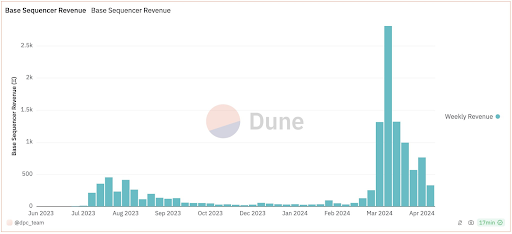

While Base earned over $30 million in revenue from sequencer fees alone in Q1 2024, what works for a handful of L2s (like Base, Arbitrum, OP Mainnet, and Polygon) does not scale to L3s. Why?

Currently, L3s are gaining popularity due to their ability to drastically reduce costs for users and developers—unlocking possibilities for new fully on-chain applications, games, and experiences. Much like cloud computing reduced the cost and time of building web applications by thousands of times, L3s may do the same for Web3, enabling new networked worlds to be built at thousands of times the speed and cost efficiency. At least, that’s the theory.

However, reducing costs by thousands of times also presents significant economic challenges for L3s: such low fees mean they cannot rely on sequencer revenue as a primary income source unless they achieve L2-level transaction volumes—which is unfeasible for nearly all L3s. Moreover, achieving thousand-fold cost reductions requires L3 operating costs to drop another 10x to 100x from today’s levels. This will demand a fundamental transformation in L3 infrastructure, not just incremental improvements.

This creates a serious economic dilemma for L3s. How can they hope to solve it?

L3 Break-Even Analysis

Through our collaboration with emerging L3 ecosystems, the Syndicate team has observed L3s attempting to address this challenge by increasing network fees to generate profits (or at least attempt to break even) from their sequencers. So far, these efforts have not yielded profitability.

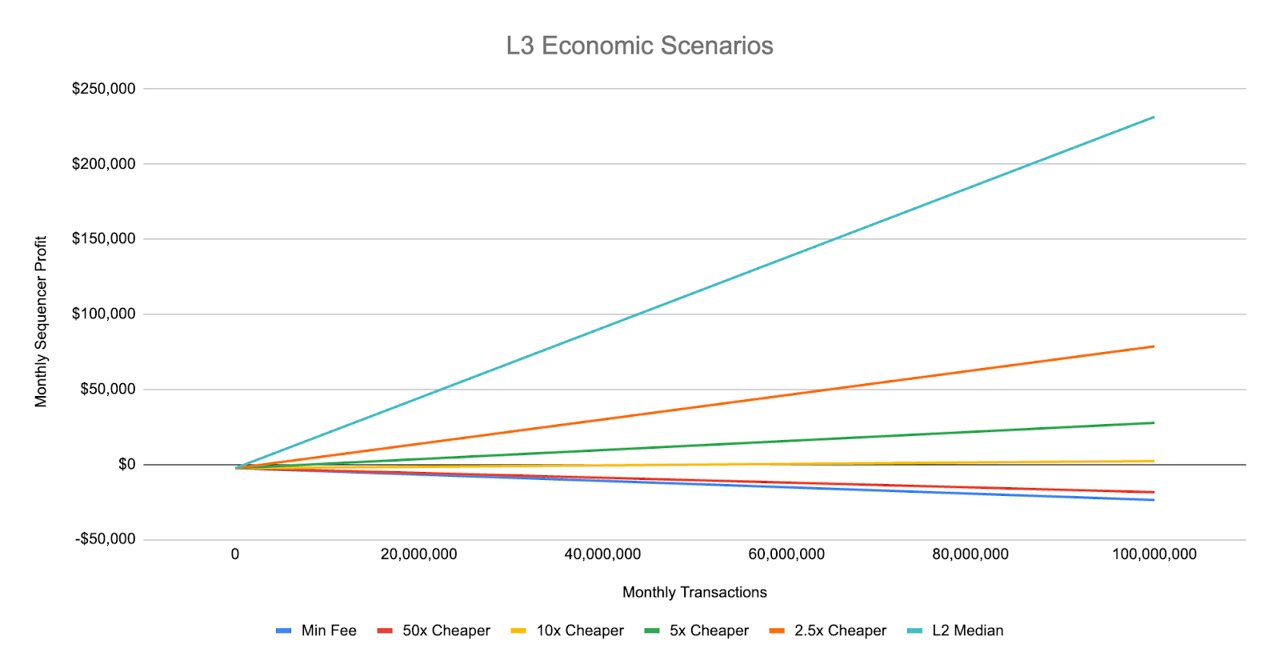

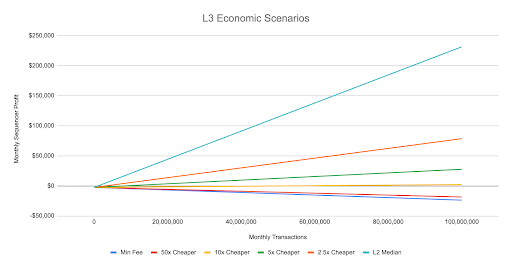

A few months ago, we conducted economic scenario modeling for L3s—analyzing various levels of on-chain activity and fee structures relative to L2s—to understand their paths to break-even and profitability. The results were sobering.

If an L3 is 10x (or more) cheaper than today’s L2s, it will never become profitable unless its monthly transaction volume exceeds 50 million. This equates to over 50% of Base’s activity or 75% of Arbitrum’s.

Base and Arbitrum—the two most active Ethereum L2s—typically see between 50 million and 100 million transactions per month. But these are the largest players. In the past 30 days, Zora saw 3.8 million transactions, Mode saw 3.8 million, and Redstone saw 1.1 million.

To break even, an L3 with 5 million monthly transactions would need to set its fees no lower than 3x below current L2 levels. This is a major challenge, especially if the L3 primarily competes on low fees. Being only 3x cheaper than L2s is far from sufficient to attract user and developer adoption. Therefore, L3s must differentiate themselves from L2s in other ways, such as scalability, customizability, and community ownership.

In the past 30 days, only two L3s exceeded 5 million monthly transactions, both focused on gaming: Xai (275 million transactions) and Proof of Play Apex (69 million transactions). Xai’s network fees are nearly 200x lower than L2s, suggesting it may be operating at a loss. In contrast, Proof of Play Apex charges 15x higher fees than L2s, indicating potential profitability—depending on who pays them.

But given all this, what is the path forward for L3s—and L2s—for achieving sustainability and long-term value?

The Current Case for Supporting L3s

Today, L3s can be viewed as an “operating cost” or “cost center” aimed at bootstrapping the development of a new network so it becomes valuable over time. Additionally, by running sequencers, setting network fees, and using custom gas tokens, L3s provide operators with new economic tools to dynamically manage their ecosystem—including users, developers, apps, and partners—through targeted gas subsidies and incentives.

For example, consider a fully on-chain game on an L2 paying transaction fees for every on-chain action. To improve user experience, developers might want to sponsor many (or all) transactions on behalf of users—an expense that grows rapidly as the game scales. Even with low gas fees on popular L2s today, if a game has 50,000 daily active users (DAU) and each player averages 100 on-chain actions per day, the total sponsored gas cost exceeds $10,000 per day (nearly $5 million annually). For many L2s, this number could rise to $25–50 million per year! Building on their own L3 reduces these variable costs to near zero, making many new mainstream social, gaming, and consumer applications—i.e., on-chain apps—economically viable.

“Fully on-chain” is also a key selling point for some games and applications. For instance, Skyoneer is a fully on-chain game residing on Gold, its L3 dedicated to strategy games. Pirates Nation is another fully on-chain game, built on the Proof of Play Apex L3, which states: “When a game is on-chain, it means we’re not running any servers. We can’t shut it down; it will exist forever… On-chain gaming guarantees permanence, interoperability, and composability.” Here, low costs aren’t the direct selling point, but they are a necessary enabler for these other benefits.

Ultra-low fees also unlock new use cases users wouldn’t otherwise engage in. Consider how Ham Chain recently enabled new tipping and microtransaction experiences on its L3 by drastically lowering per-transaction costs.

Thus, the primary economic benefit of L3s lies not in revenue generation, but in the value they provide to applications built atop them. By dramatically reducing transaction costs, L3s make possible new applications and business models that would be economically unfeasible on more expensive L1 or L2 networks, while allowing apps to retain more value at lower cost.

Future Economic Opportunities for L3s

While L3s today may be seen as cost centers or negligible revenue sources, our team has a clearer vision of how they can become increasingly sustainable and valuable in the future. New models are emerging that will profoundly reshape L3 economics—for both developers and users.

The most obvious example is priority fees. As more applications, users, and transactions migrate to L3s, we may see priority fee markets emerge within popular L3s in gaming, social, and finance. Of course, such markets will only open when L3 activity grows to the point where block space is no longer as abundant as it is today on Ethereum L1 and popular L2s like Base.

Yet one even more innovative model we’re already beginning to see is using native gas or staking tokens on L3s. For example, Degen Chain uses $DEGEN as its native gas token, creating additional utility for $DEGEN. New L3s under development plan not only to use their own custom gas tokens but also custom staking mechanisms to help secure or co-operate the network, thereby enhancing token utility. By leveraging native tokens—not just focusing on value creation via sequencer profits—many L3s are exploring ways to generate value through their tokenomics. In some cases, like Degen, this represents a larger value driver and opportunity than sequencer profits.

Bigger economic breakthroughs lie ahead. Our team has deeply explored L3 development and its challenges related to growth and long-term sustainability. Through this work, we’ve uncovered major issues (and opportunities) tied to how L3s are designed and operated—factors that ultimately limit their economic autonomy and potential today. However, if you can fundamentally change how L3s are designed and operated, you can unlock new revenue streams, new markets, and major structural advantages. This means that in the near future, L3s won’t just be 1,000x cheaper—they’ll also gain access to entirely new revenue and value-generation opportunities previously impossible. We look forward to sharing our research and work in this area in the coming weeks.

Looking Ahead

As L3s continue to evolve, we’ll see many new experiments in value creation and capture—from the perspective of chain operators, developers, and users alike.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News